According to our 2017 Brand Intimacy Study, the automotive industry produces the most intimate bonds with consumers, just as it did in our previous research. The category’s ability to build intimacy should come as no surprise, as it’s responsible for some of our most significant purchases as consumers. Our cars (and motorcycles) require a substantial investment of our income, time, and trust. They act as an expression of our identity, provide immense utility, and protect us from harm. However, the category is showing some potential signs of slippage compared with last year. Auto recalls hit a record high of 53.2 million in 2016, topping the 51.1 million recalls in 2015.1 And disruption from technology has the potential to change how consumers relate to automotive brands.

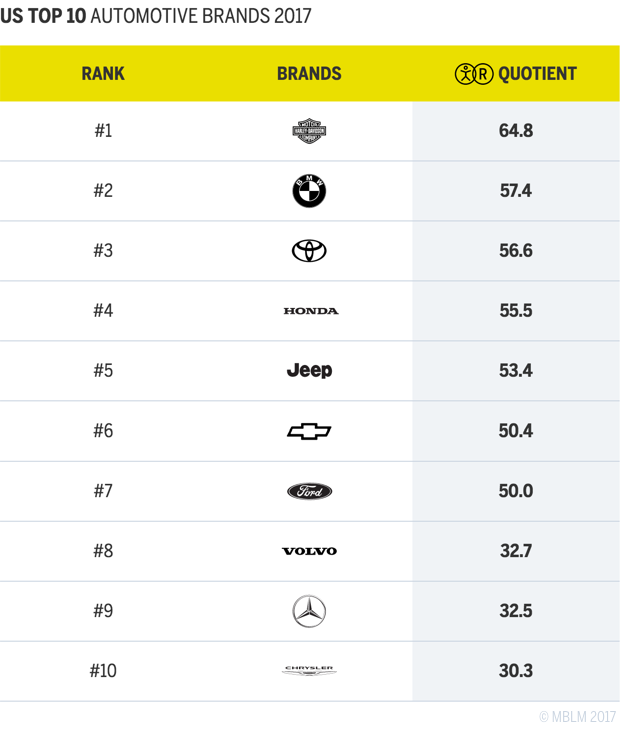

The top 10 automotive brands consist of nine car brands and one motorcycle brand, Harley-Davidson, which leads the industry. Harley jumped from #3 in our previous study to overtake BMW and Toyota this year, and, with a brand intimacy quotient of 64.8, it ranks fourth overall. Although other brands in the category have a higher percentage of intimate customers, Harley has by far the largest percentage of customers in fusing, the deepest stage of intimacy, with 14 percent (followed by Chevrolet with 9 percent).

In addition to ranking highest out of 14 other industries, automotive is also the top industry for males, those older than 35, and those with higher incomes. It is tied with retail and technology & telecommunications for the largest percentage of consumers in the fusing stage (6 percent), and has an above-average percentage of intimate consumers (34 percent). The archetype most associated with the industry is fulfillment (exceeding expectations, delivering superior service, quality, and efficacy), and it has the highest average fulfillment score of any industry (44). Among the top five fulfillment scores in the study, four of them belong to automotive brands (#1 Toyota, #2 Honda, #4 BMW, and #5 Ford).

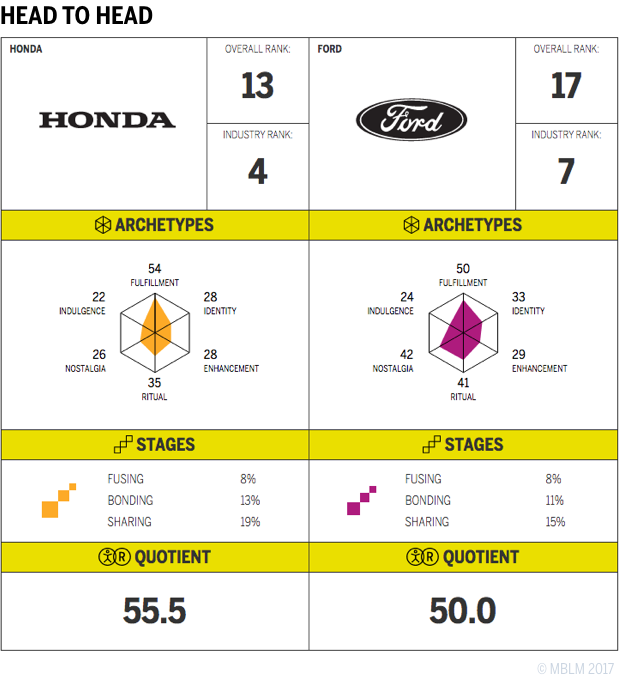

Honda and Ford are both highly intimate brands, as both are top-20 brands in the study (#13 Honda, #17 Ford). By comparing these two brands, we can see the important role that fulfillment plays in the category. Even though Ford outperforms Honda in every archetype except fulfillment, Honda is the more intimate brand, with a higher brand intimacy quotient (55.5 vs. 50.0) and more customers in nearly every stage of intimacy (tying at 6 percent for fusing customers). Honda also has a broader audience base, with a significant advantage over Ford among millennials (54.3 vs. 44.2), women (61.7 vs. 50.8), and lower-income consumers (55.9 vs. 48.0), while Ford has the advantage for higher-income consumers (62.7 vs. 54.2).

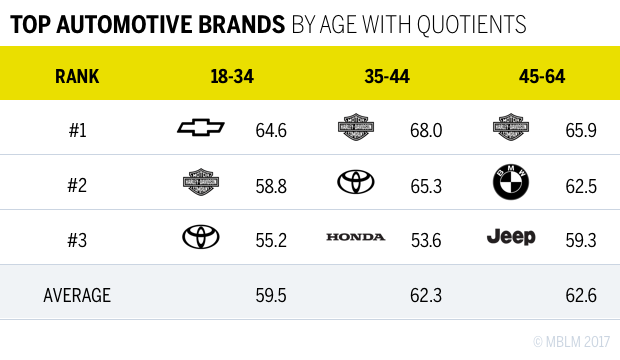

If we further examine the category based on the age of users, we see that Harley-Davidson has had success in building and maintaining intimacy across multiple generations. Although the brand appears to be slightly less popular with millennials than it is with older groups, its ability to appeal to all ages is a sign of its strength as a brand. Toyota is also successfully cultivating intimacy across multiple age groups, with more success among consumers ages 18 to 34 and 35 to 44. Notably, millennials have less intense feelings of intimacy for their top brands than the older groups. The average brand intimacy quotient for the top three automotive brands for millennials is 59.5, while the top brands of consumers ages 35 to 44 average a score of 62.3, and those of consumers over 45 average a score of 62.6. It appears that the bonds millennials are forming with their favorite automotive brands just aren’t as strong as those of their older counterparts.

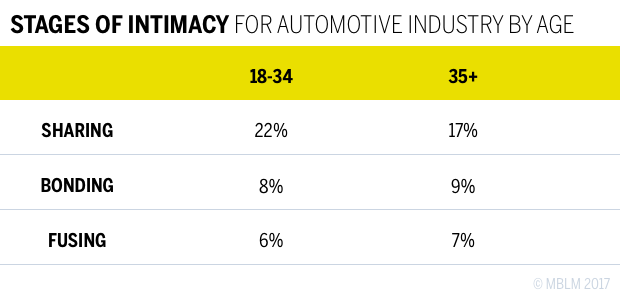

Fewer millennials are in the more intense stages (bonding and fusing) of intimacy compared with older respondents, while more millennials are in the earliest stage of intimacy—sharing (22 percent for those under 35, compared with 18 percent for those 35 and over). This supports the idea that automotive brands are struggling to form the highly intimate bonds with millennials that they’ve been able to form with older consumers. It also presents an opportunity for brands to target younger audiences and strengthen existing relationships.

These younger consumers might love their cars and bikes, but they are also looking to emerging technologies and trends that could provide them with cheaper, more convenient transportation, which impacts how they bond with brands in this category. In fact, millennials are more comfortable with fully self-driving vehicles than consumers of other generations (47 percent vs. 31 percent), and they would also be more willing to use car-sharing services if they were readily available and convenient (42 percent vs. 28 percent).2

How Ride Sharing Can Disrupt Automotive Intimacy

In just two years, the percentage of US adults using ride-sharing services has jumped from 3.4 percent in 2014 to 6.0 percent in 2016.3 Ride sharing offers consumers convenient transportation without having to buy or lease their own vehicles, and while these services currently require some consumers (i.e., the drivers) to have a car, they may have a disruptive effect on how we form bonds with automotive brands.

Although consumers might want many of the same things from a ride-sharing service that they would from their own car (e.g., safety, comfort, convenience), using these services could result in very different brand relationships between consumers and automotive brands. For example, if a consumer uses the same ride-sharing service every day, they will likely experience a variety of cars, each for a brief period of time, which decreases the likelihood that they will form bonds with any of these automotive brands. Even if a ride-sharing experience were to make a strong impression on a passenger, it would reflect positively on the ride-sharing brand or the driver, rather than on the car brand.

For many, buying a car is an identity purchase; it conveys something about the driver to the world. If consumers are given fewer reasons to purchase cars, automotive brands will have to rethink the way they distinguish themselves and build intimacy with future generations.

Millennials will be an important part of this shift from car ownership to alternative forms of transportation. They are three times more likely than older generations (Baby Boomers and Generation X) to abandon their vehicles if costs increase.4 They are also more likely to prefer living in neighborhoods that have everything within walking distance.5 This could indicate that millennials aren’t as loyal to their vehicles as previous generations are. As more transportation options emerge, like autonomous vehicles and ride sharing, younger consumers will be eager to adopt the ones that are able to provide them with lower costs and greater convenience.

Volvo is a brand that has embraced its reputation as a leader in safety and is adapting it to today’s landscape, introducing new safety technologies and renewing its entire lineup to be better positioned for autonomous driving.6 The company has boldly set the goal of having no crash fatalities or serious injuries in a new Volvo by 2020, making it clear to all potential audiences (consumers, ride-sharing companies, and drivers) that Volvo is seriously pursuing a new standard of safety. Uber has taken notice, making its first fleet of self-driving cars a fleet of custom-built Volvo XC90s.7 This is just one example of the new opportunities that will arise for automotive brands in the future.

If we take what we know about the automotive industry’s strong association with the fulfillment archetype, we can better understand how these brands form intimate bonds today—and how they can continue to form bonds tomorrow. Leading brands like BMW, Toyota, and Honda are able to create better experiences through better cars and better service, delivering high-quality products that assure customers that their money was well-spent. In the pursuit of higher quality, some car brands have even partnered with luxury brands to create specialty cars and accessories, like the limited-edition Holland & Holland Range Rover or the Mercedes-Maybach S600’s custom champagne flutes from Robbe & Berking.8

The automotive industry continues to be the strongest performing category in our study, and it will be interesting to see as the category evolves, how car brands adapt to the changing needs and priorities of their customer bases, both emerging and established.

To see this year’s study please click here.

Read our detailed methodology here and review the sources cited in this article here.

To learn more about MBLM, click here.