Overview:

- The media & entertainment industry ranks first in our Brand Intimacy COVID Study. To read our new study, click here.

- YouTube is the top-ranking media & entertainment brand, up from sixth place in our last study. To see YouTube’s brand profile page, click here.

- During COVID, media & entertainment brands have ranked higher than the industry average across all archetypes except enhancement. To review our media & entertainment industry page, click here.

Introduction

As businesses and their brands face unprecedented challenges in the face of the COVID pandemic, we are sharing our new insights on how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

This article is based on data and findings from our new Brand Intimacy COVID Study, conducted with 3,000 consumers in late summer 2020, revealing how leading brands have been affected by the pandemic.

Brand Intimacy Performance Today

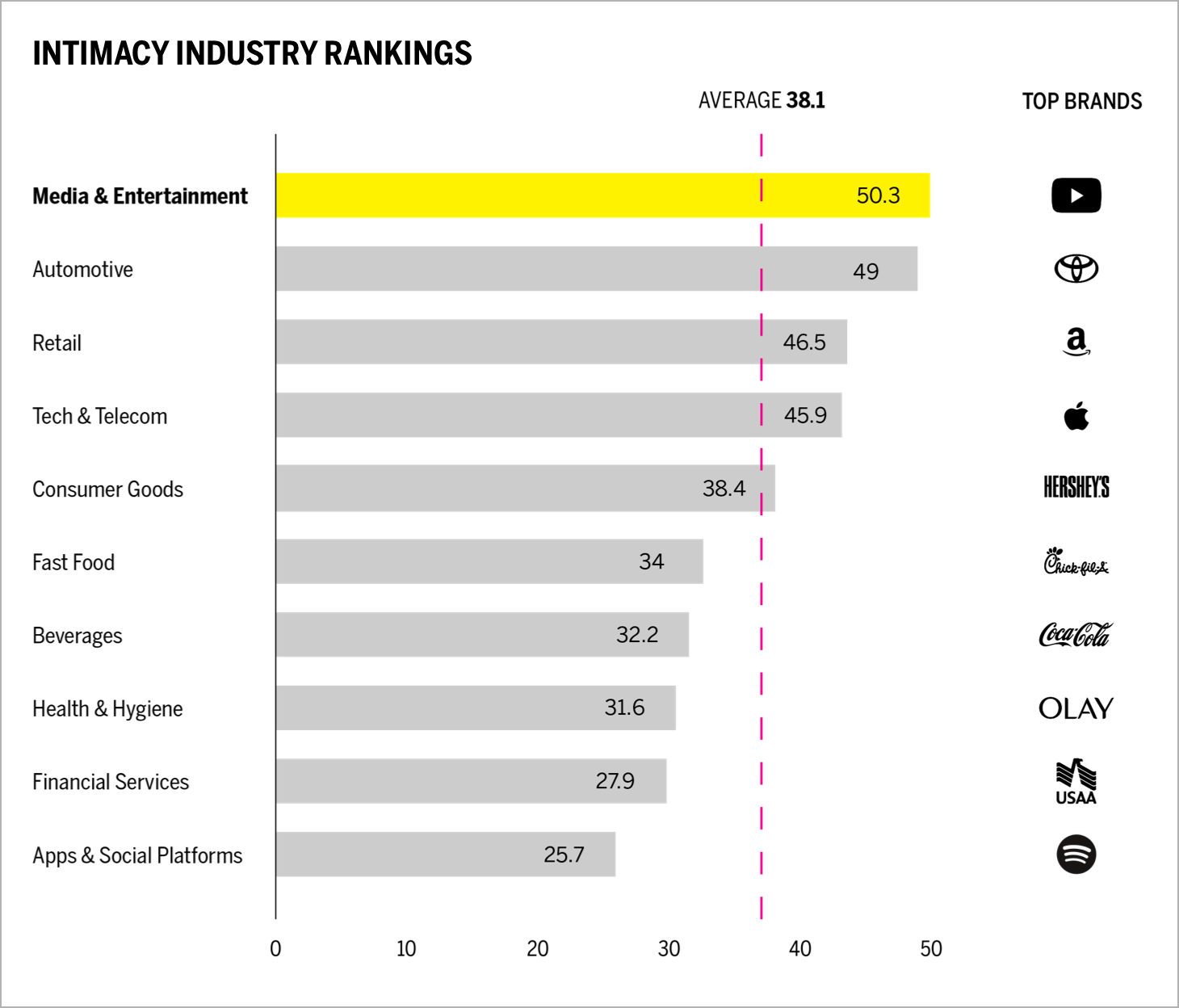

The media & entertainment industry has an average Brand Intimacy Quotient of 50.3, well above the cross-industry average of 38.1. Performance has improved, and the industry average is up 7.7 percent compared to our previous study. Media & entertainment continues to dominate. This is not surprising; we anticipated that with a significant portion of the United States isolated at home, the need for escape and enjoyment would increase.

In addition, Disney+, Apple+, HBO Max, Quibi, and NBC Peacock, to name just a few, all either launched or were hitting their stride in 2020, creating a highly competitive and rich array of options for consumers.

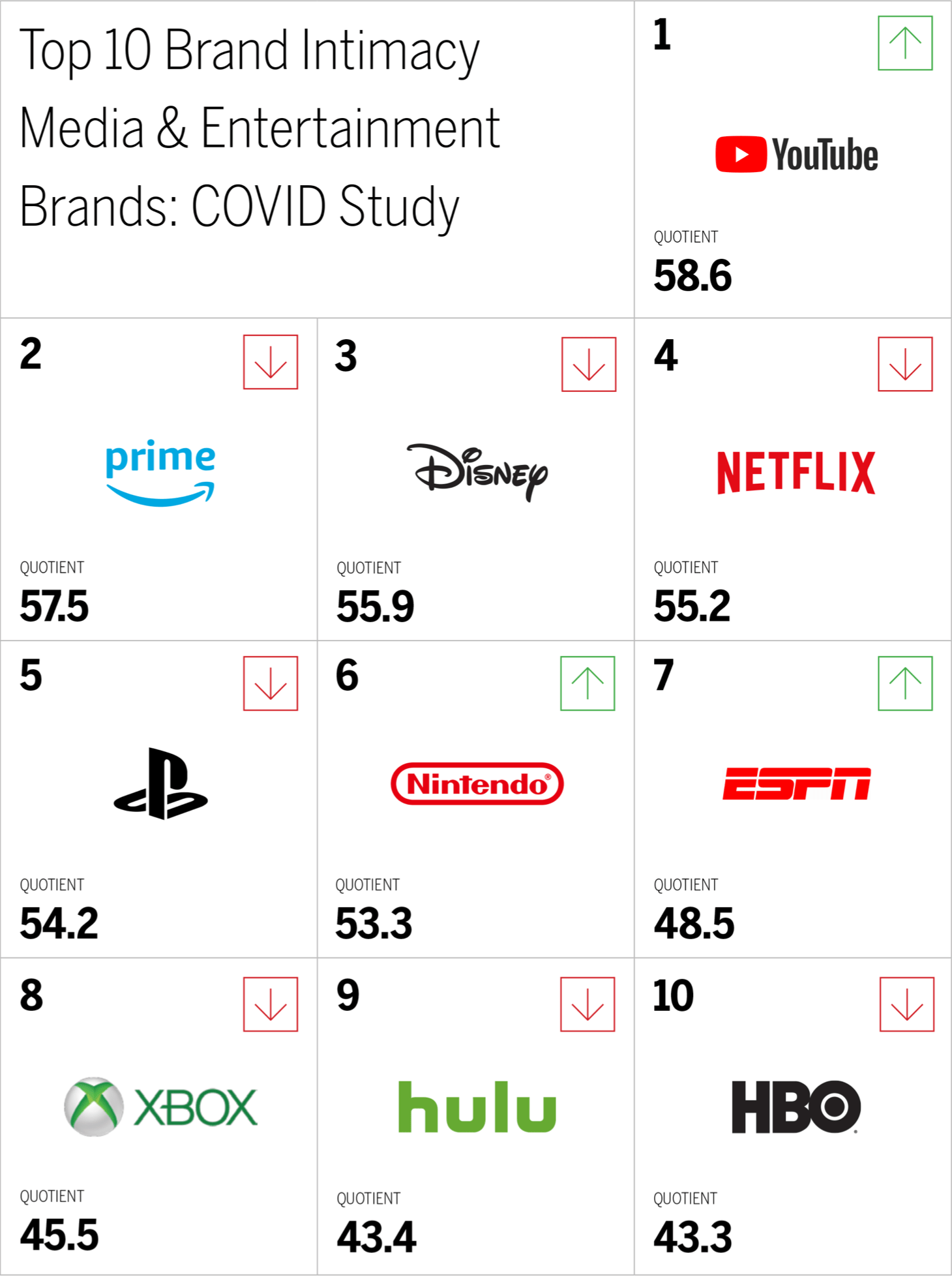

As the chart indicates, YouTube has moved into first place, whereas Amazon Prime, the prior #1, dropped to second place. Consumer preference for Nintendo and ESPN has increased, whereas preference for XBOX and HBO has decreased. YouTube’s rising performance speaks to its broad appeal, and extensive, user-generated content, an ideal match for our troubling and challenging times.

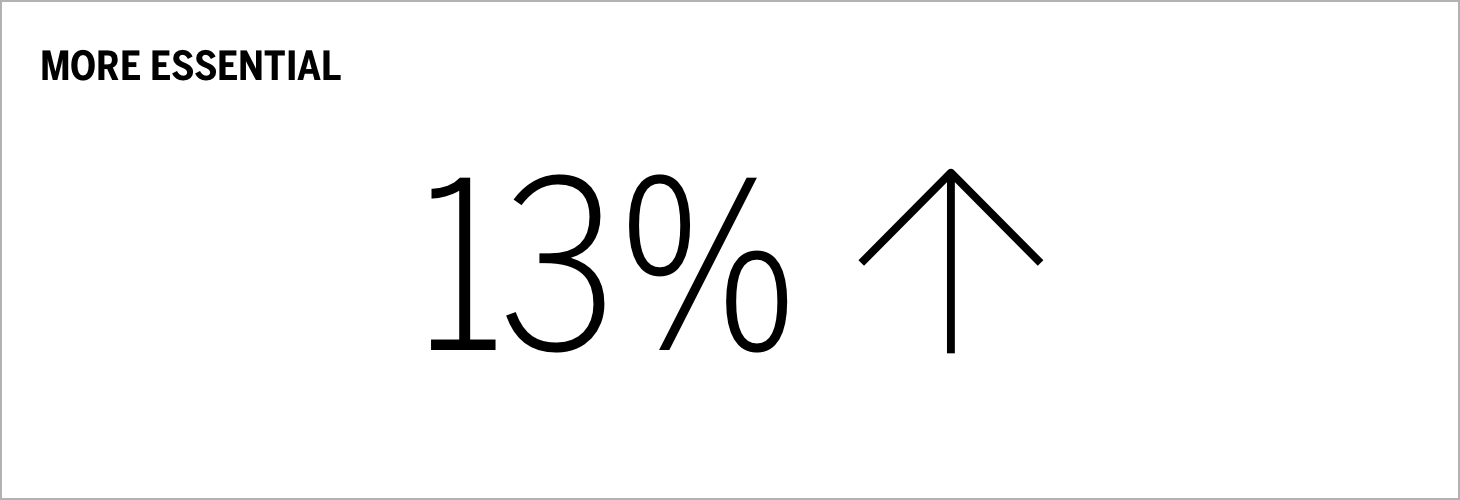

Media & entertainment has improved its score 13 percent on the “can’t live without measure”, which determines how essential a brand is to our lives. In addition, daily usage is up 7 percent. These measures show that consumers have become more attached to media & entertainment brands, are utilizing them more, and do not want to live without them.

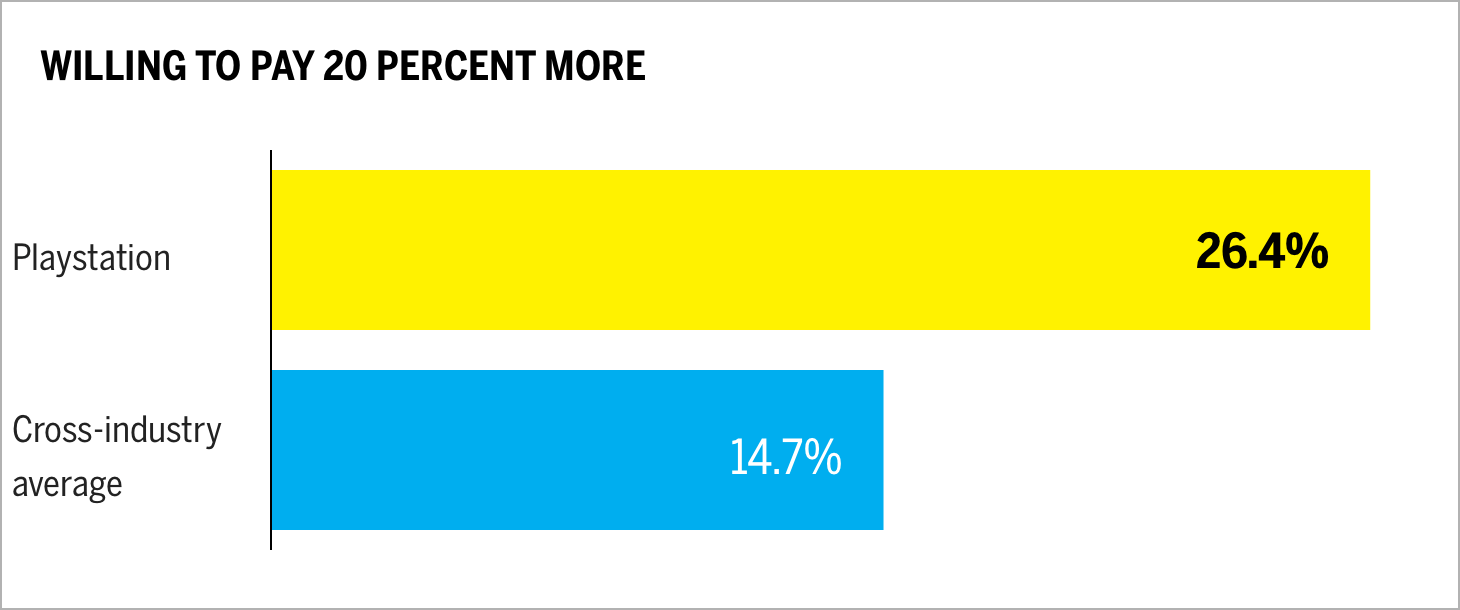

PlayStation is the highest-ranked media & entertainment brand that consumers are most willing to pay 20 percent more for. PlayStation ranks 44 percent higher than the average of all brands in our study for this measure and has improved its own performance since our last study by 9 percent. This highlights that when an intimate brand makes the right connection, there is an opportunity to leverage price resilience and consumers’ willingness to pay more.

When Brands Speak

In addition to our Brand Intimacy findings, which centers on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated during the pandemic. We have captured a language analysis from company websites and outbound social, focusing on six brands and encompassing 151,142 words.

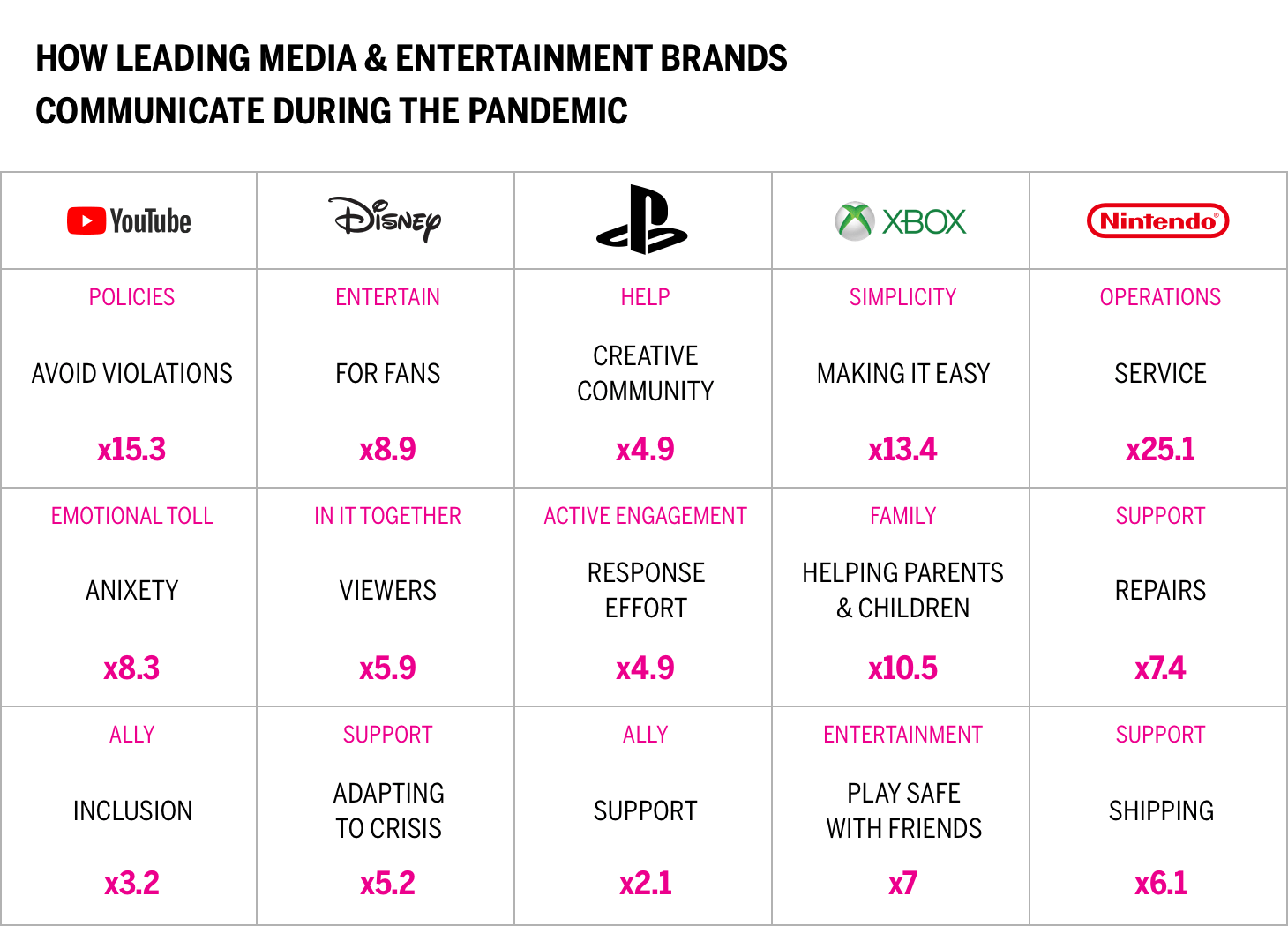

This chart presents a comparison of how five leading brands are communicating about COVID on their websites. We can see the number of appearances of key themes for each brand and the relative differences based on the other times reviewed (e.g., YouTube speaks 15.3 times more about violations than other brands).

Most of the media & entertainment brands reviewed have chosen different things to emphasize, with brands electing to take a slightly different approach when dealing with the pandemic. YouTube addresses the importance of being compliant with its rules and not violating policies related to COVID content. It also speaks to understanding the anxiety associated with the virus and how we are all in this together employing an inclusive and understanding tone. Disney also mentions the shared nature of the pandemic, and introduces special virtual and video events and activities planned for Disney fans. SONY emphasizes supporting the creative community and how it is helping fight the pandemic. Interestingly, XBOX and PlayStation take very different positions related to COVID communications. XBOX highlights how gaming is a safe family activity and also something that can be shared with friends. PlayStation instead talks more about operations and how it is helping customers during this time with repairs, customer service concerns, and shipping items to service centers.

With TV and film production halted for most of the year, we wonder how brands will fare the longer the effects of the pandemic continue. We have seen some aggressive strategies by some brands, such as Disney’s licensing of Hamilton, as way to draw audiences in. Around 2.7 million households streamed the Broadway hit, surpassing the number of people who have seen the show live over the past five years.1

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is also a key principle for navigating our challenging times. The pandemic and its economic aftershocks will require brands to navigate in new and more carefully considered ways.

Media & entertainments continue to be the strongest industry for intimate brand relationships, actually improving its overall performance compared to our previous study. In addition, the industry has fared well compared to so many others that have been decimated during these unprecedented times. Netflix has nearly doubled its number of subscribers.2 Streaming video services overall have increased (up 7 percent compared to pre-COVID rate).3 There is also some subscription fatigue, with 17 percent of subscribers saying they have already cancelled at least one service. The top reasons for canceling were high costs and expiring discounts or the end of free trials.3 Gaming also fared well, with PlayStation nearly doubling gaming sales during second-quarter 2020.4

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.