Overview:

- The beverages industry ranks 9th out of 15 industries for building Brand Intimacy.

- Indulgence, which is the occasional or frequent pampering and gratification of an individual, is the top archetype in the industry.

- The industry also ranks 2nd out of 15 industries for nostalgia, focusing on memories of the past and the warm, poignant feelings associated with them.

- COVID-19 is impacting how consumers purchase and bond with beverages brands. Non-alcoholic brands are seeing decline, while alcohol brands are showing an increase in sales.

As the world continues to struggle in the face of the COVID-19 pandemic, and businesses and their brands face unprecedented challenges, we are sharing our insights into how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

For context, our annual study of intimate brands, the largest of its kind, launched on Valentine’s Day 2020 with research fielded in fall 2019. Because we are all facing the new reality of COVID-19, we are offering highlights of brand performance both before and after the pandemic emerged.

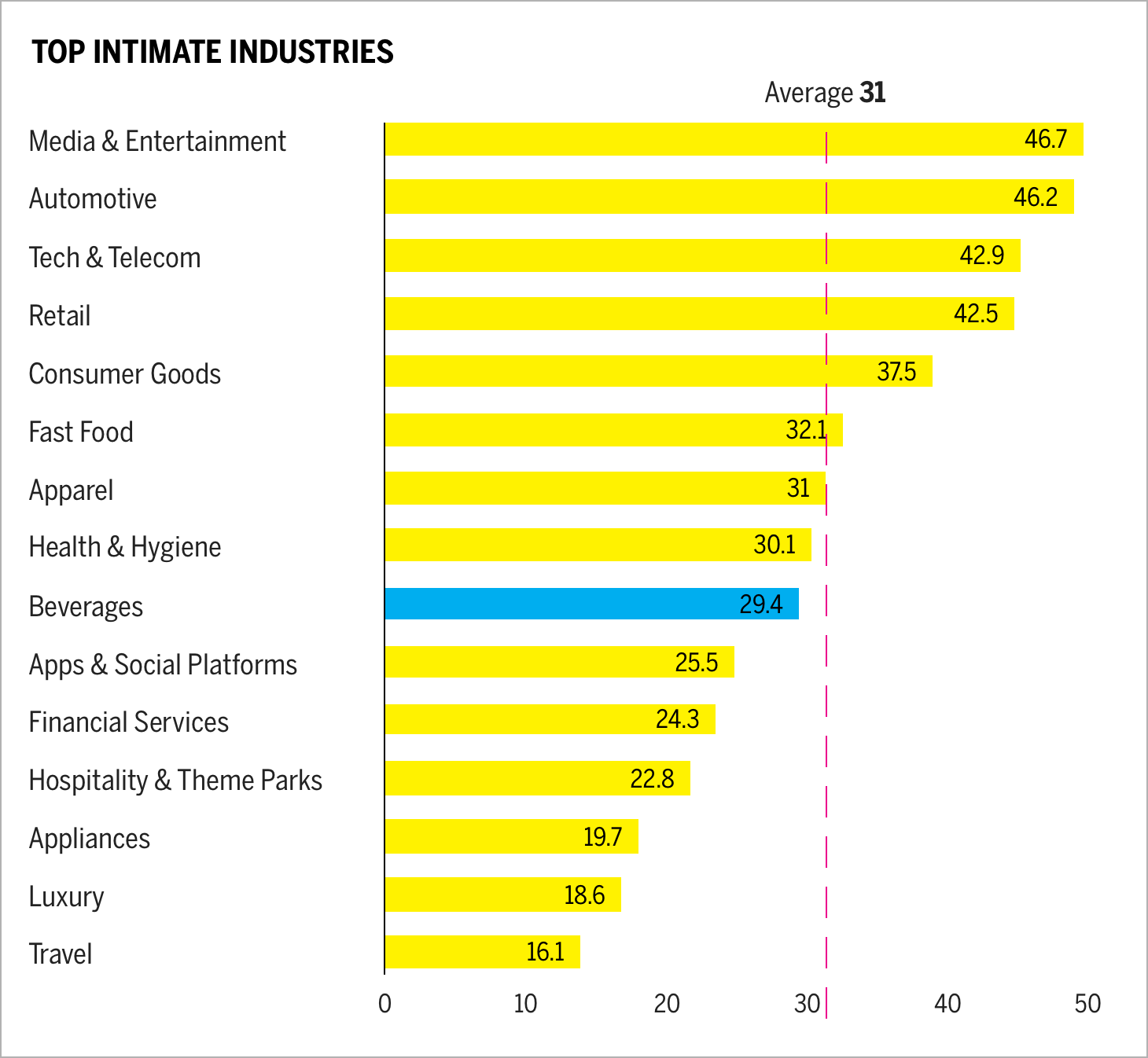

Before the crisis, beverage brands, established and ubiquitous, were maintaining the status quo while looking for new niche offerings to expand their portfolios. The beverages category has ranked 9th out of 15 industries for the last several years in our Brand Intimacy Study, although it has improved its performance in terms of quotient scores over the last two years.

With stay-at-home orders in effect over the past several months, we have not been able to dine out, and grocery shopping has become a more complex ordeal. Beverages, a source of indulgence and comfort, remain a key part of our lives, although purchasing them during the pandemic has changed.

Category Performance

The beverage industry ranked 9th out of 15 industries.

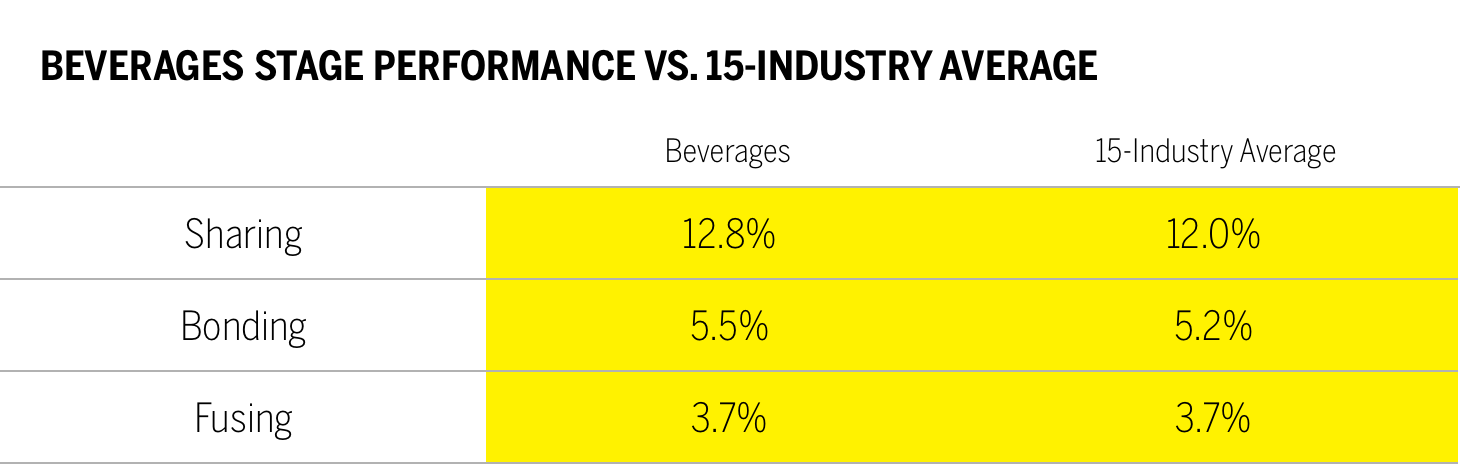

For the beverages industry, indulgence is the dominant archetype. This means creating a close relationship centered around moments of pampering and gratification that can be occasional or frequent. The category also ranks 2nd out of 15 industries for nostalgia, focusing on memories of the past and the warm, poignant feelings associated with them. These associations are particularly relevant today as consumers are indulging during COVID-19, seeking ways to cope and find comfort in brands they know and remind them of happier times. In terms of the stages of intimacy, which measure the intensity of brand relationships, beverages brands are above the 15-industry average in sharing, the earliest stage of Brand Intimacy and bonding, the middle stage centered on trust. They are slightly below average in the most advanced stage, fusing, in which the user becomes co-identified with the brand.

The beverage industry is stronger than the 15-industry average in sharing and bonding.

Beverages also perform better than average in their ability to establish immediate emotional connections, at 42.2 percent compared to the 15-industry average of 38.5 percent. The category ranks 3rd highest for consumers most willing to pay 20 percent more for their favorite brands. These measures indicate the established emotional connections between consumers and beverage brands today.

Pandemic Impact

Beverages are seeing mixed impact from the pandemic. Coke experienced negative global volumes in May, although it was a slight improvement from the 25 percent plunge they faced in April. Roughly half of the company’s revenue comes from away-from-home channels, like restaurants, movie theaters, and stadiums, which will likely continue to show decline.1 Alcohol brands appear to be on the upswing. The number of people buying alcohol to take home rose 27 percent during the week ending April 11, compared to a year ago.2 With some feeling concerns about shopping and going out, there has been a demand shift for consumers to order their alcoholic beverages for delivery, preferably online. COVID-19 has accelerated adoption of online beverage delivery services, with wine clubs such as Winc reportedly seeing a 578% increase in new member sign-ups in one week in March. Sales for marketplaces such as Minibar are up 500%.3

The Current Voice of Beverages Brands

We’ve augmented our Brand Intimacy research (fielded in November 2019) with social listening research we captured (the week of May 11). We studied a sample of our Top 20 beverages brands (Coke, Pepsi, Budweiser, Heineken, and Jack Daniel’s) regarding communications on their websites related to COVID-19 and outbound social conversations on Twitter. The analysis encompassed 519,056 words.

It is important to note that social listening data aren’t directly related to Brand Intimacy measures, although we hypothesize that the sentiment measured through the internet and social media will have an effect on future Brand Intimacy quotient scores and rankings.

Our topline findings:

Each of the brands has elected to take a slightly different approach to COVID-19. Some, like Coke, Pepsi, and Budweiser, highlight corporate initiatives. Heineken details the importance of drinking and socializing responsibly. Jack Daniel’s provides new ways to enjoy their whisky and experience their brand, from virtual tastings to virtual tours of their distilleries.

Different areas of focus among a range of top-ranked beverages brands.

This chart demonstrates a comparison of 5 of the most intimate beverages brands on the web.4 It shows how these 5 leading brands are communicating and how they are being talked about during the coronavirus pandemic. We are able to see the number of appearances of key themes for each brand and the relative differences based on the other brands reviewed (e.g., Heineken speaks 11.5 times more about drinking responsibly than its competition).

Coca Cola speaks to redirecting manufacturing, using plastic materials to create face shields. Pepsi addresses continuing to support communities in times of trouble. Budweiser highlights helping the beleaguered hospitality industry and providing emergency water to those in need. Heineken showcases their new protocols and speaks as an industry leader on the importance of drinking responsibly. Jack Daniel’s offers tips on hosting virtual events and highlights enjoying a drink at home.

Consumers tend to be more practical when posting on social media about these brands. They detail new ways to enjoy Coke and talk about whether they prefer Coke or Pepsi. They discuss enjoying their Budweiser and Jack Daniel’s and react to the Heineken commercials on drinking responsibly.

Beverage brands are trying to determine how to adjust their advertising and communications. Few have yet produced advertising specific to life during the pandemic. Pepsi’s CEO noted that 80 percent of respondents to a survey want brands to revise the tone or style of their advertising during the pandemic.5 Pepsi also had a well-publicized misstep of placing a large ad for soda on a COVID-19 testing site sign in Florida and has also pulled its #Summergram campaign of people enjoying themselves outside.6

Anheuser-Busch, parent company of Budweiser (among others), recently ran an ad of its famed clydesdales running in different parts of the country, including the Lincoln Memorial in Washington DC and the Brooklyn Bridge in New York City. The message, “Together we will run again and emerge stronger than before,” is currently one of the few commercials in the beverages industry referencing COVID-19.

Conclusion: Where Will Beverages Go?

Beverages brands continue to be a source of indulgence and enjoyment. As summer arrives, our enjoyment of Coke and Pepsi during July 4th barbecues and for cooling off on a hot day is well established. How these traditions may be modified this year are to be determined. Clearly, the sales of these beverages commercially in theaters and restaurants and at events will remain in decline. Alcohol brands are being enjoyed increasingly at home. In fact, the ordering of these brands online also highlights new channels of use and new ways to connect with consumers. Generally speaking, these brands have kept pace and remained in stock, helping maintain strong emotional connections with their users.

As we return to “normal” life, it will be interesting to see whether our consumption of beverage brands changes. Will people prefer to drink at home or resume going out and enjoying them in restaurants and bars? Similarly, will consumers continue to order their favorite alcohol beverage or curated collections online or return to the liquor store? How will our feelings about these brands evolve, as they have helped comfort us through this difficult crisis? How will beverage brands choose to market post-pandemic? Will they return to life before of parties and crowds, or reference what we’ve all been through together?

Read our detailed methodology here, and review the sources cited in this article here.

Check out our annual study and rankings of intimate brands. Visit our most recent rankings of intimate famous figures, BFF. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in our annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.