B2B financial services firms traditionally have not had a strong marketing focus. In fact, many today still have limited or no marketing departments. Brand in this category has historically been defined by reputation and performance. While B2B financial services firms do not promote themselves in the same ways you see with B2C financial brands in the marketplace, they do require their brands to compete and market themselves to attract and retain clients and talent. As more firms proliferate, and boutiques (and now “kiosks”) are nudging the bulge bracket players, there is a stronger need than ever to be distinctive and relevant.

Yet, almost no firms have compelling, differentiated value propositions rooted in factors that drive decision-making. Few give prospective customers a compelling and unique reason to choose them. Few create strong cross-sell opportunities with existing customers since they are often in silos and not incentivized to do so. While offices may be sophisticated and stylish, websites and collateral are dated and lacking. In an industry dedicated to maximizing value and opportunity for their clients, it’s ironic that most financial services brands underleverage their biggest asset—their brand.

“It’s ironic that most financial services brands underleverage their biggest asset—their brand.”

Before you think this is the biased perspective of a marketer, McKinsey has shown a correlation between brand strength and financial performance for B2B brands, as well as the fact that decision-makers consider a brand central, rather than marginal, to influencing their selection.1

THE HERD LANDSCAPE

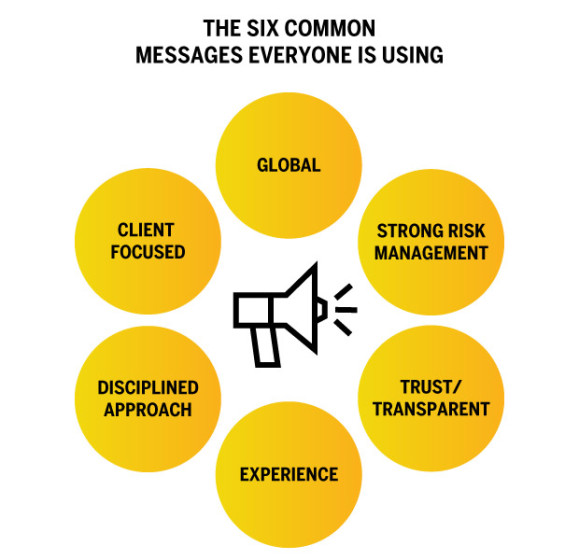

Today, by and large, what we see is a superficial, pedestrian effort to build a brand. And the result is what you’d expect: a generic and uninspired landscape. Reactive post-financial crisis words like “experienced,” “disciplined,” and “trustworthy” abound, and are often used interchangeably by firms.

Taking asset managers as an example, among the top 30 firms2, you can see the cacophony of sameness in terms of the communications they utilize:

The basic point here is, if everyone is saying the same thing, how are you able to stand out? How is a potential customer to choose from this sea of similarities? As McKinsey notes, “Given the prevalence of similar messages, this is an important checkpoint for many companies… this probably won’t move the needle when customers consider your brand.”3

“Given the prevalence of similar messages, this is an important checkpoint for many companies… this probably won’t move the needle when customers consider your brand.”

As is further noted in the Harvard Business Review, ”… then every competitor is going to have more or less the exact same strategy as you. That means that you are likely to be indistinguishable from your competitors and the only way you will make a decent return is if the industry currently happens to be highly attractive structurally.”4

In addition to sounding the same, thus making it challenging to stand out, it’s unclear if these messages are actually effective at driving decision-making. Several studies have shown a significant disconnect between the brand messages that companies provide and what motivates a customer to choose you.5 In reality, what you consider important for your brand image may have minimal influence on a prospect’s decision-making.

USING SCIENCE TO MOVE THE NEEDLE

The best way to determine what’s effective is through research. Yes, this involves some cost and time; however, learning from customers who experience your brand is important input (as well as learning from people who considered you but chose another firm). It is also critical to conduct the right kind of research. Just asking customers and listening to their answers is insufficient. “Stated importance” (what someone says is important) has been proven to be different from “derived importance” (a statistical measure that is the outcome of a regression analysis, which infers the relative importance of perceptions or attitudes based on the patterns in how people rate brands. Once data are collected, multivariate regression is applied to determine which perceptions correlate most strongly with preference, likelihood to purchase, etc.)

An example of this can be seen with research from the Financial Times on fund image. When asked to rate the importance of specific attributes when considering an asset management company to place assets with, respondents stated that “risk management” and “transparent” were very important. They ranked as the third and fourth (out of 12) most important attributes when selecting a firm. However, when we look at the attributes that drive usage (derived importance), these two attributes dropped significantly. Risk management fell to 11 and transparent to 9, clearly the lower echelon of influence.6 Thus, learning what really drives customer decision-making is key.

THE ART IN EXPRESSING WHAT IS IMPORTANT

To cut through the clutter, you need to be distinctive, effective and ownable. A barrage of messages is not a brand. Too often, we see firms throw everything but the kitchen sink at the challenge and what you get is either a lack of cohesion or more sameness. That is because your disparate messages need to connect to a larger promise or strategy.

“A barrage of messages is not a brand.”

The art of building a great brand, once you know what matters most to your customers and what your real strengths are as a company, lies in creating a more unique essence. A concise and carefully crafted value proposition will be the source from which all on-brand behaviors, expressions and communications can be developed. Design will obviously play a role here in both small and profound ways, once its anchored to a powerful value proposition.

What makes creating a good value proposition difficult is that it details the compelling promise you make to distinct target audiences, outweighing your barriers while being differentiated from competitors and supported by proof points (oh yes, you have to demonstrate/prove that you can/will deliver what you say you will).

By crafting this, competitors will not be able to combine the same proof points and create the same promise as you. There may be some similar overlaps, but you will be able to claim more of a unique space for your more proprietary brand.

CONCLUSION

There is tremendous opportunity in the B2B financial services category to develop stronger brands and experience more financial gains. Rather than be satisfied with the “Me too” message, use the art and science of branding to shape and leverage your brand. Avoid the more risk-averse, herd mentality when it comes to your brand and seek a more interesting, compelling and relevant territory. Brands who do this over the long term consistently outperform their competitors and build significant brand value. The biggest brains in finance already know how to leverage asset value. Can they now do the same for their own brand?

Review the sources cited in this article here.

To learn more about MBLM, click here.