Overview:

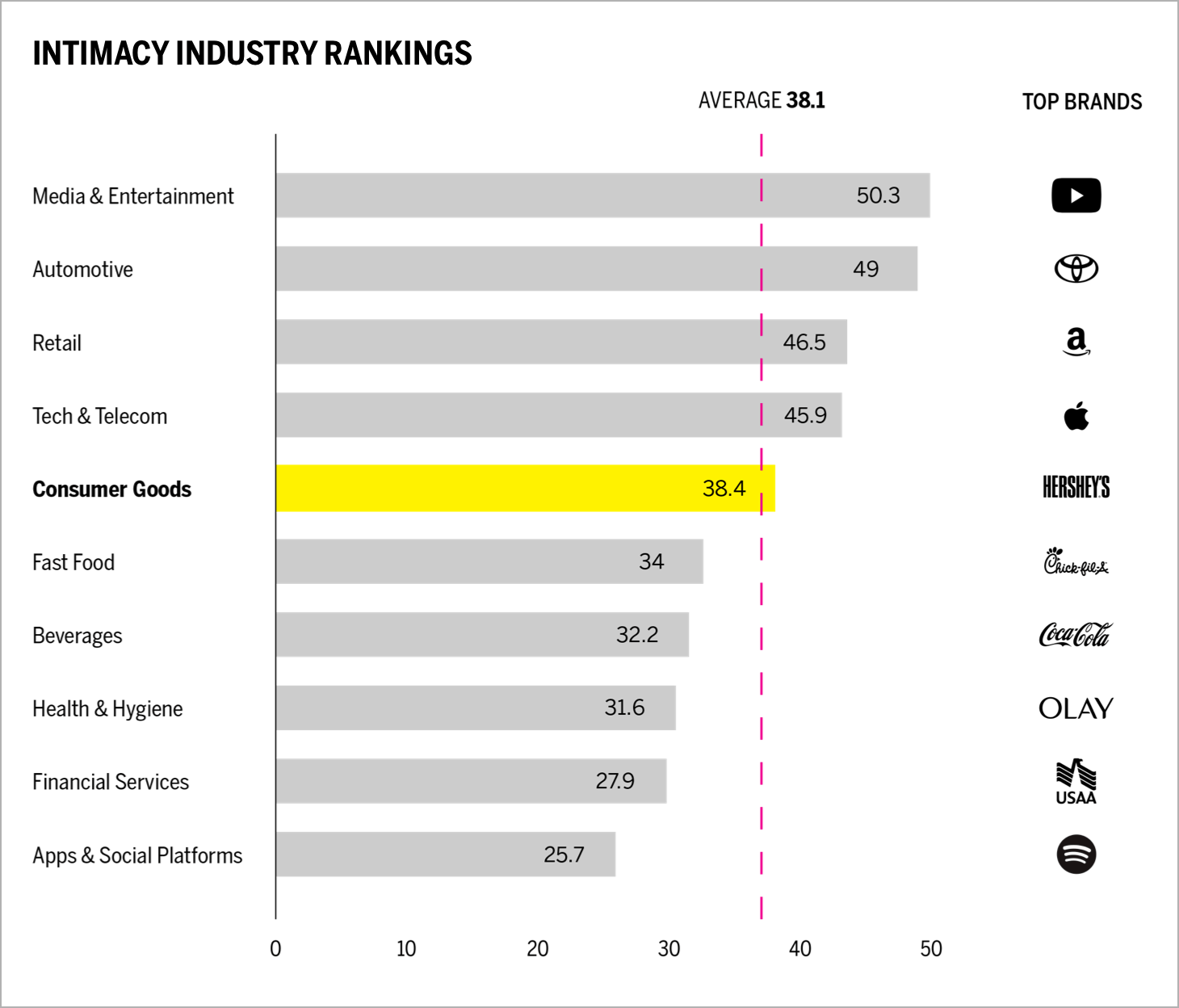

- The consumer goods industry ranks fifth in our Brand Intimacy COVID Study. To view our new study, click here.

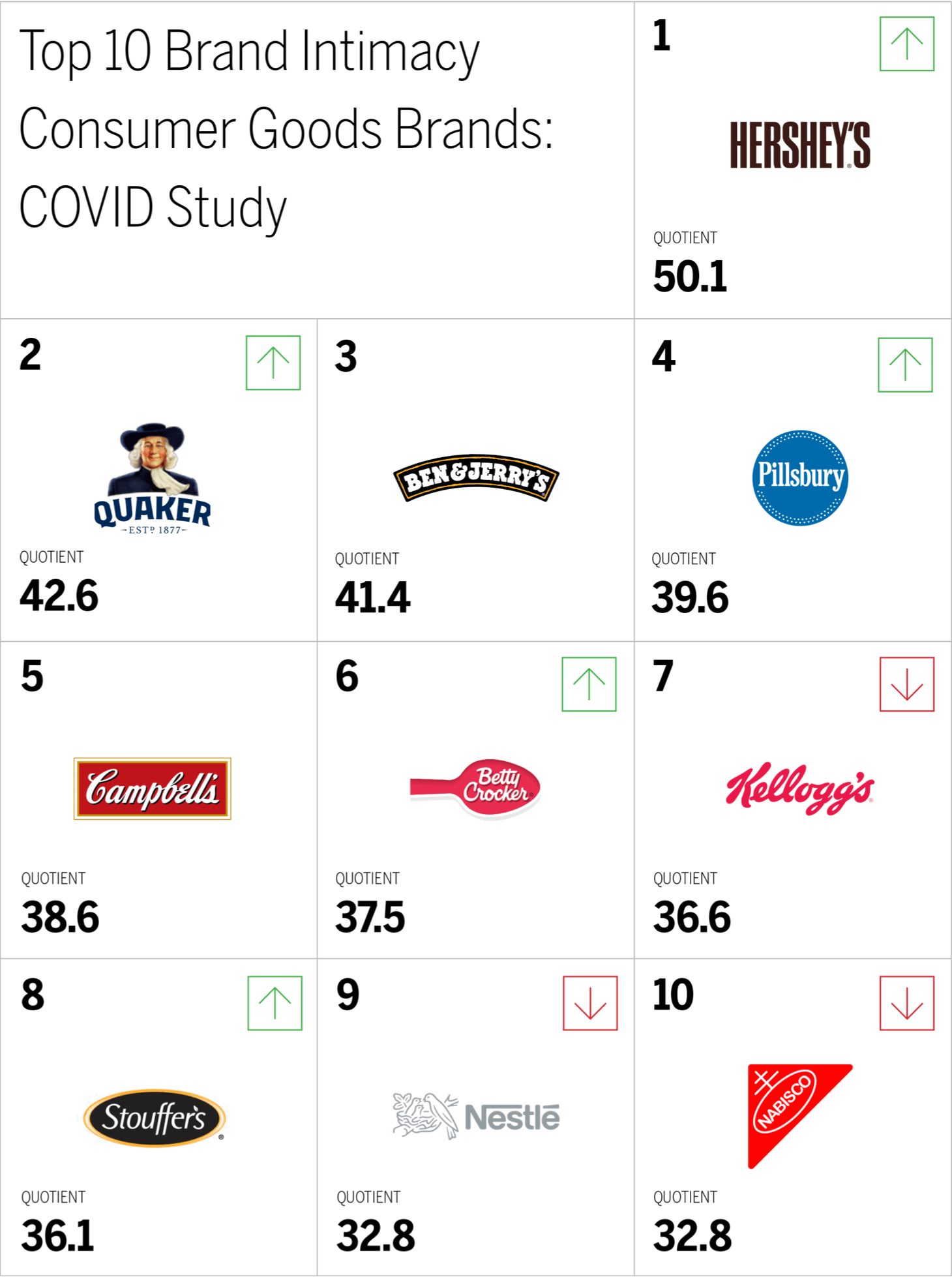

- Hershey’s is the top-ranking retail brand and has an improved Quotient Score. To see Hershey’s’ brand profile, click here.

- During COVID, consumer goods brands have ranked higher than the industry average for the indulgence and nostalgia archetypes. To read our consumer goods industry page, click here.

Introduction

As businesses and their brands face unprecedented challenges in the face of the COVID-19 pandemic, we are sharing our new insights on how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

This article is based on data and findings from our new Brand Intimacy COVID Study, conducted with 3,000 consumers in late summer 2020, revealing how leading brands are affected by the pandemic.

Brand Intimacy Performance Today

The consumer goods industry has an average Brand Intimacy Quotient of 38.4, slightly above the cross-industry average of 38.1. The industry increased its average Quotient Score by 2.4 percent.

With stay-at-home orders in place for many states over the past few months, we are separated from working, socializing, and the lives we were accustomed to. We have not been able to dine out, and grocery shopping, once taken for granted, has now become something we line up for as we maintain six feet of distance between each other. Throughout all this, consumer goods have become essential, and are a source of comfort.

Unlike many industries that have faced hard times as a result of the pandemic, consumer goods are seeing a boom. Campbell’s soup sales increased 59 percent in March from a year earlier.1 General Mills said sales grew by 45 percent in March and 32 percent in April compared with the same periods in 2019.2 This is causing increases in production and manufacturing needs. Mondelēz International (parent company of Oreos, Cadbury, and Ritz crackers, among many other brands) has hired 1,000 more workers for “front-line teams” in manufacturing, sales, and distribution to get snacks onto store shelves faster.3

Hershey’s remains in the #1 position in the industry. It is the top performer for women, those 45-64 years old, and across most income groups. Quaker moves up to second place and is number-one for those aged 35-44. Consumer preference for Pillsbury and Stouffer’s has increased, while preference for Kellogg’s and Nestlé has decreased.

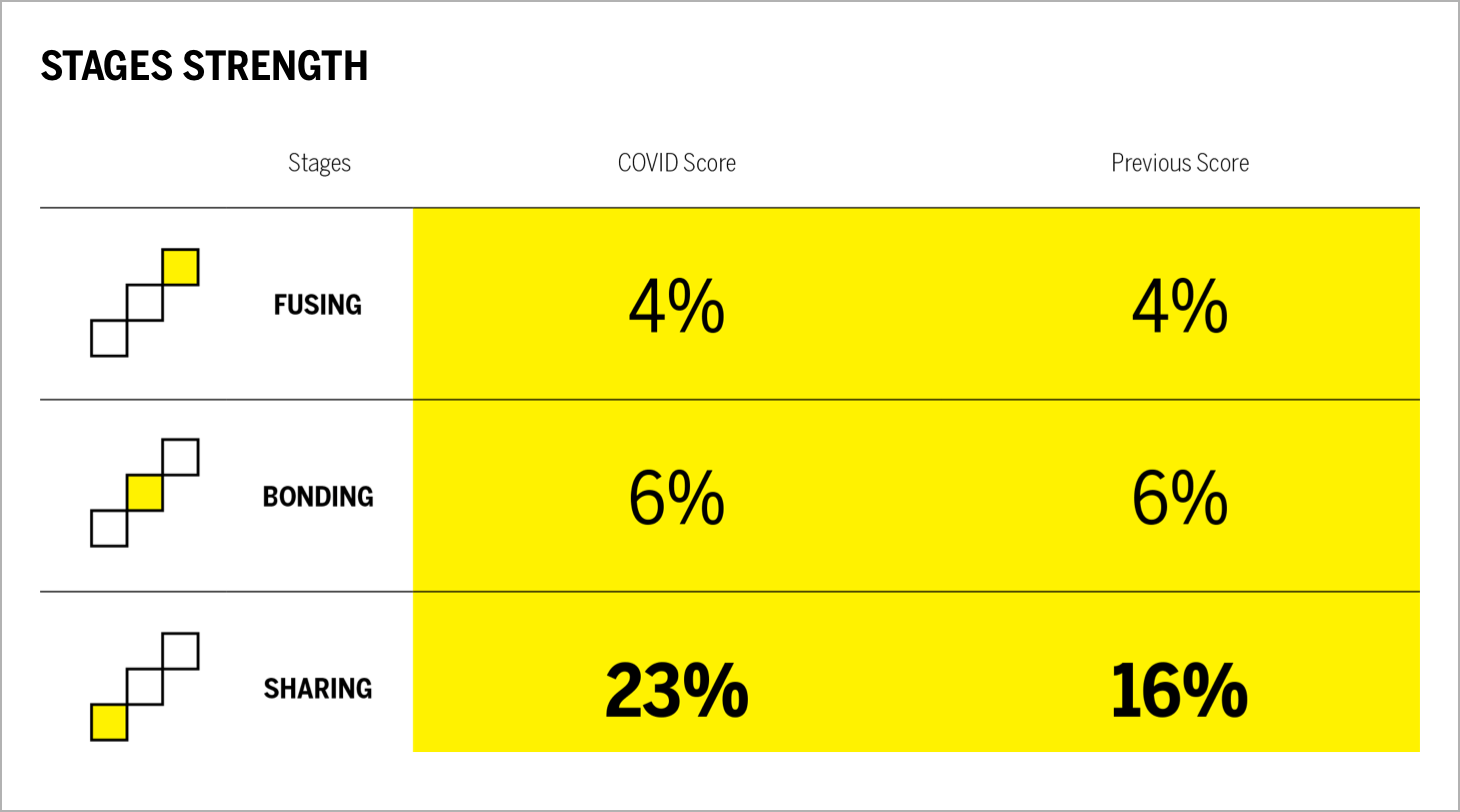

The consumer goods industry improved its performance in the earliest stage of Brand Intimacy, sharing, by 37 percent. This suggests that, during the pandemic, more consumers are emotionally connecting to consumer goods brands compared to our previous study. In fact, 22 percent more customers are in intimate relationships with consumer goods compared to our previous study. Bonding and fusing scores stayed the same.

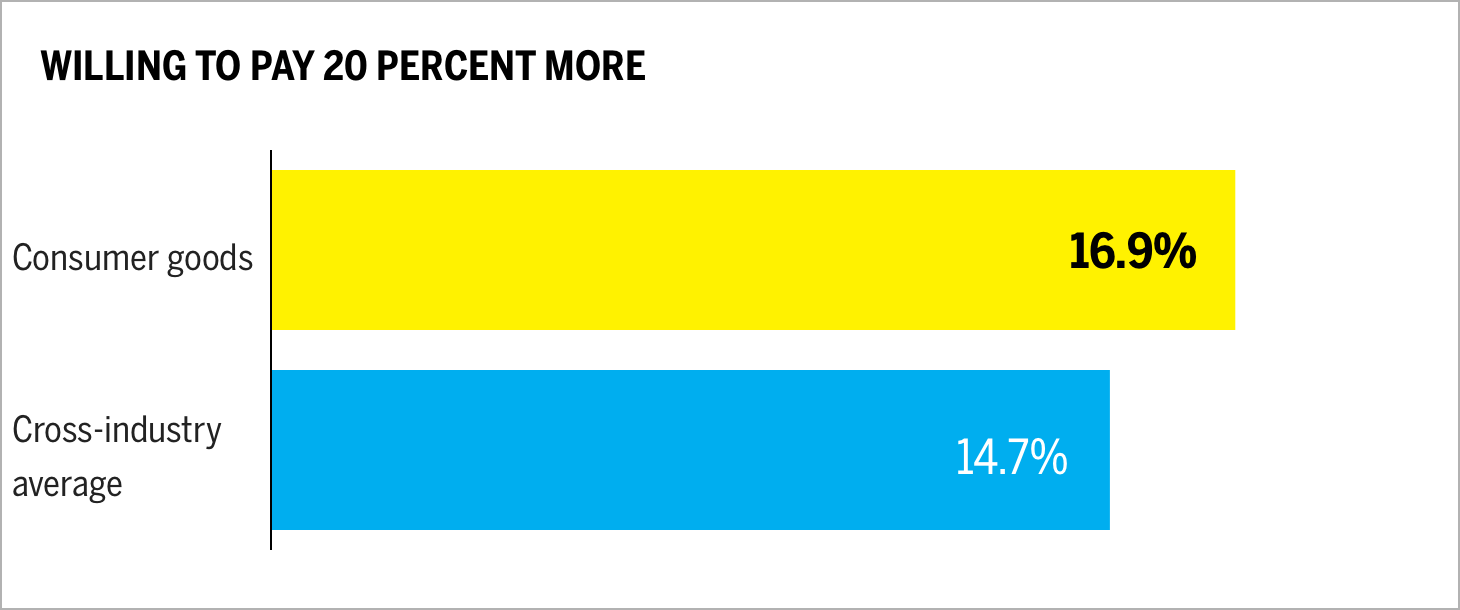

The consumer goods industry ranks 15 percent higher than the cross-industry average for consumers willing to pay 20 percent more for their products. This highlights that people value these brands highly and are willing to pay more for their favorite consumer goods.

When Brands Speak

In addition to our Brand Intimacy findings, which centers on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated during the pandemic. We’ve captured a language analysis from company websites and outbound social, focusing on 5 brands and encompassing 561,094 words.

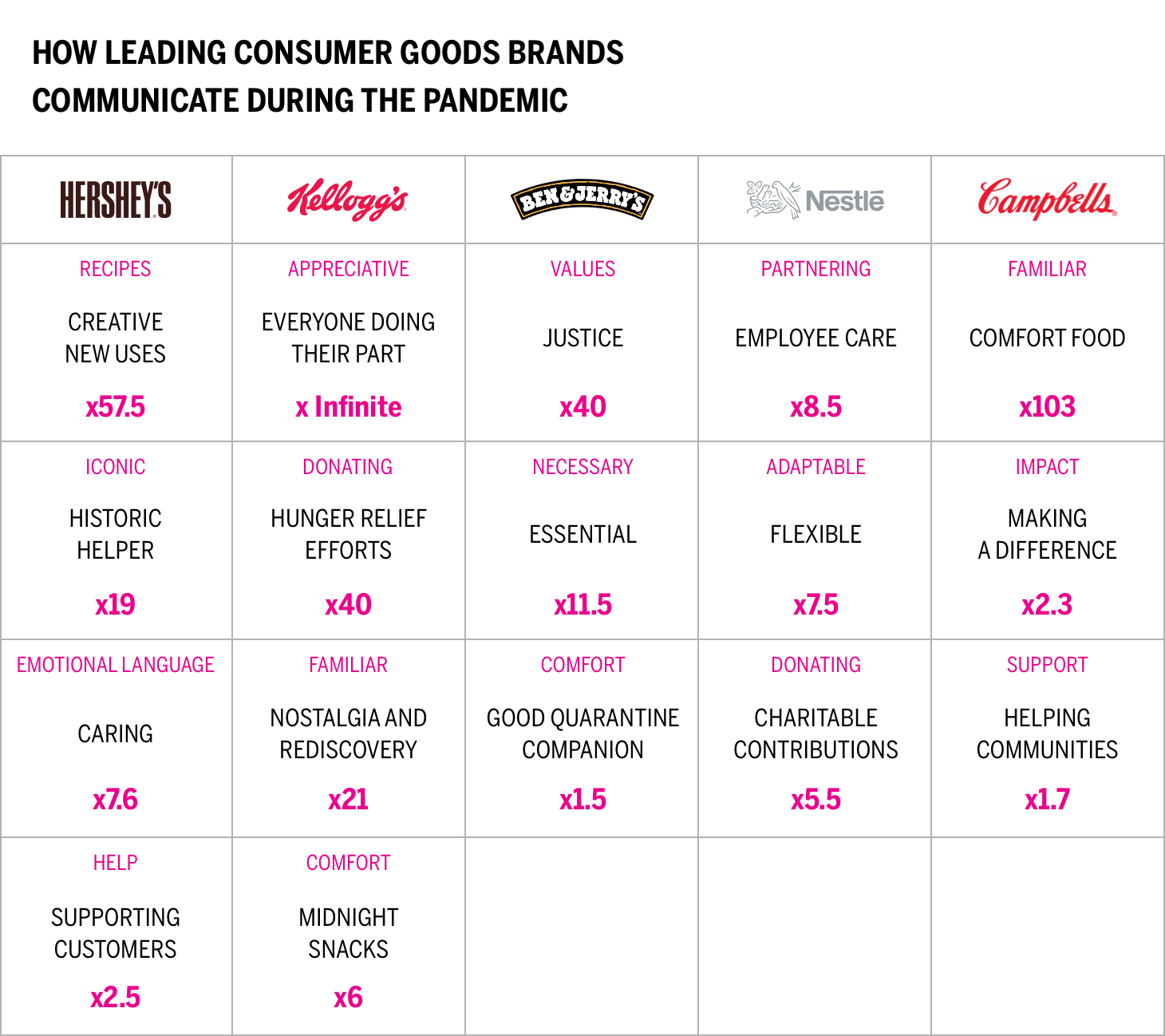

This chart presents a comparison of how leading brands are communicating about COVID on their websites and social. We are able to see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Ben & Jerry’s speaks 40 times more on justice than the competition).

Each of the five brands has elected to take a different strategy relative to COVID-19.4 Interestingly, Kellogg’s and Ben & Jerry’s both feature communications related to the coronavirus on their consumer sites, whereas Hershey’s, Campbell’s, and Nestlé have significant initiatives, but only on their corporate sites.

Hershey’s leverages its history of support, including helping Americans through the Depression and World War 2. Kellogg’s focuses on how it is thankful to all those doing their part, from its employees to other essential workers. Ben & Jerry’s has focused communication on racial and economic justice during the crisis. Nestlé mentions its stability and ability to adapt, while Campbell’s highlights its impact on communities.

Consumers tend to have more practical concerns that relate to the foods themselves, for example, new uses for Hershey’s cocoa powder or syrup and the rediscovery of Pop-Tarts and Fruit Loops. People have considered Ben & Jerry’s an essential food item and a comfort during quarantine. Nestlé’s charitable contributions and its protection of its employees are getting attention, and Campbell’s Soup is being highlighted as the ultimate comfort food.

Brands in this industry have not been as overt as others in changing their advertising or promoting how they are making a difference. Frito-Lay has been among the only ones that have created a specific media campaign.

Hershey’s has pulled spots of people interacting and focuses now on product advertising; however, these ads do not mention anything about today’s realities. Interestingly, Hershey’s has chosen a more direct way to make a statement. It has joined forces with DC Comics for limited-time superhero chocolate bars that will be given to coronavirus health-care and emergency service workers before landing on the shelves.

It is important to keep in mind that a brand’s tactics or communications are just a small signal of a brand’s intent and do not directly indicate how a brand creates greater intimacy.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is also a key principle for navigating our challenging times. The pandemic and the economic aftershocks will require brands to navigate in new and more carefully considered ways.

As we return to “normal” life, it will be interesting to see whether our consumption of, and connection to, consumer goods brands changes. Intimate consumer goods brands, those built on a foundation of emotional bonding, should find a way to reference what we have all been through together and how they have reliably comforted us through this difficult crisis.

These brands have become essential to us as we binge-watch our favorite series, as we relieve stress with a midnight snack or a quick and easy meal, which remind us of our youth and simpler times. Their ability to help see us through this crisis should foster stronger usage and more powerful bonds. Consumer goods brands should remind us what we have gone through together over the past year. While we are all eager to move forward, referencing this shared experience may well serve them in deepening intimate relationships.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.