Overview

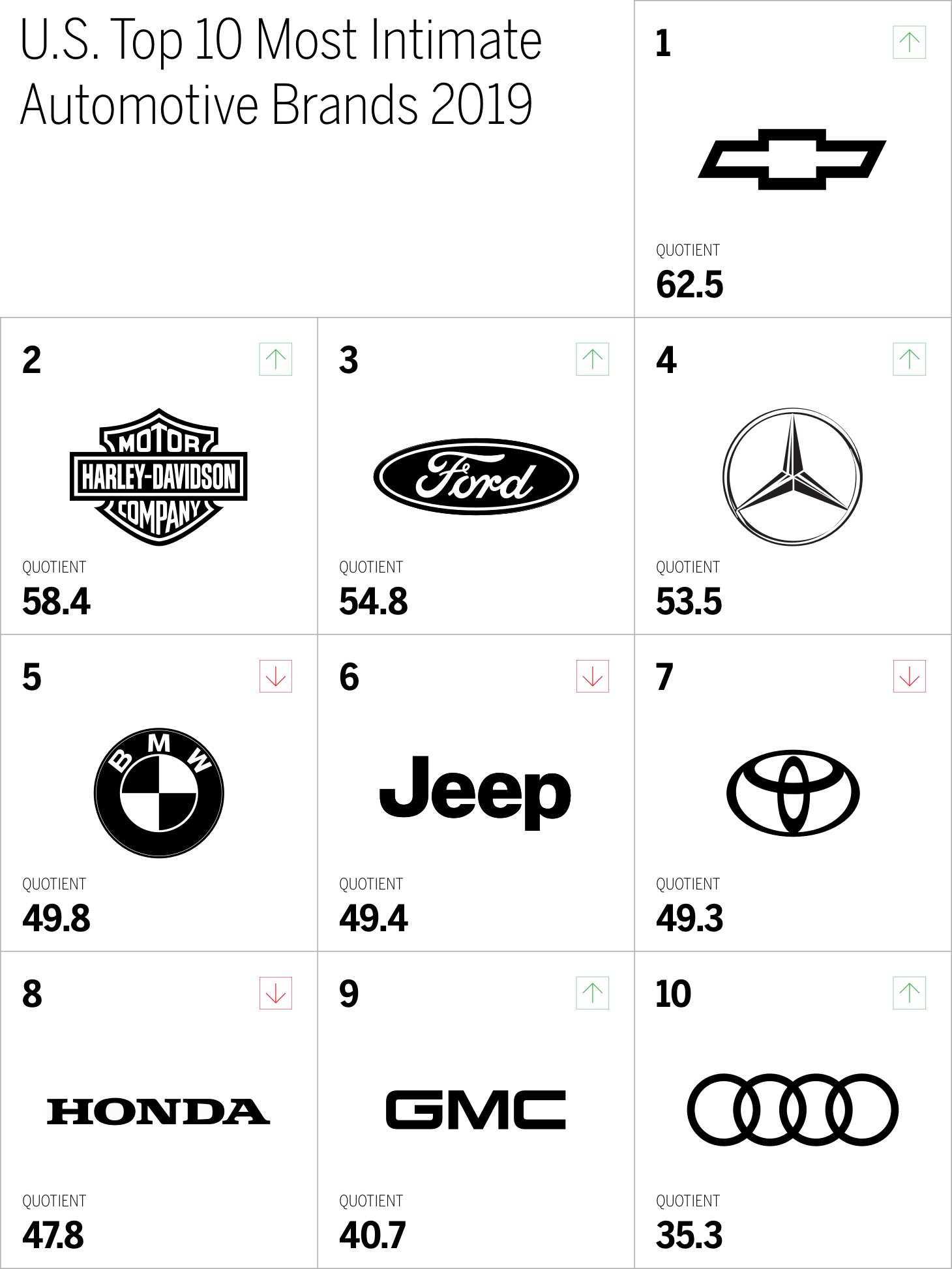

- Chevy ranks fifth overall and first in the automotive category

- Automotive is a strong-performing category, ranking second of fifteen industries

- Seven automotive brands make up the top thirty intimate brands

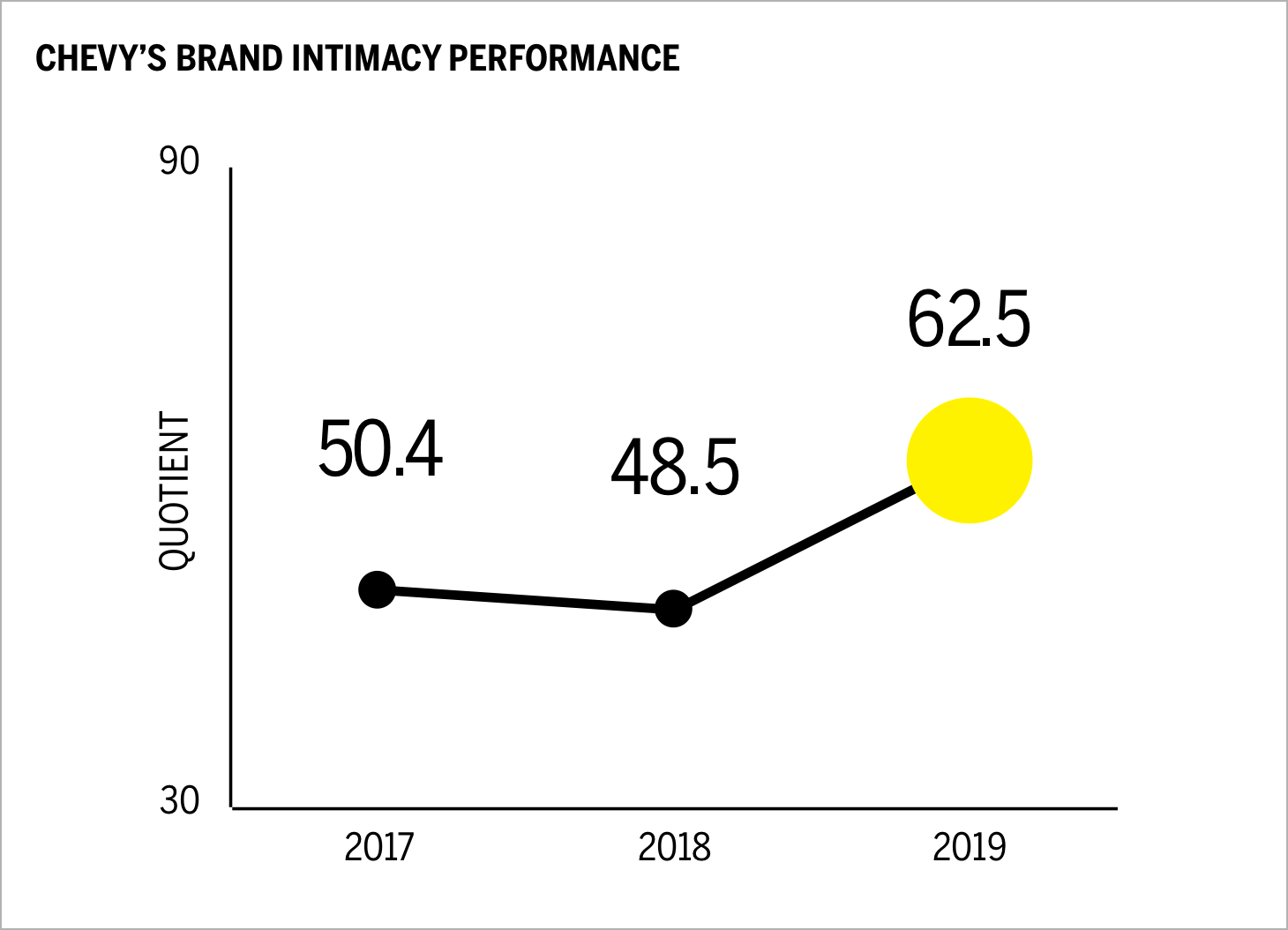

Ranking first in the industry and fifth overall is Chevrolet. This brand has jumped in performance this year with a quotient score of 62.5, up from 48.5 the previous year. Its score this year is also significantly higher than the industry average of 46.4.

This improvement is important because we know that stronger intimate brands deliver higher financial performance. Intimate brands outperform the Fortune 500 and S&P 500 annually in terms of revenue and profit. We also know that the more intimate one is with a brand, the more one is willing to pay and the less one is willing to live without it.

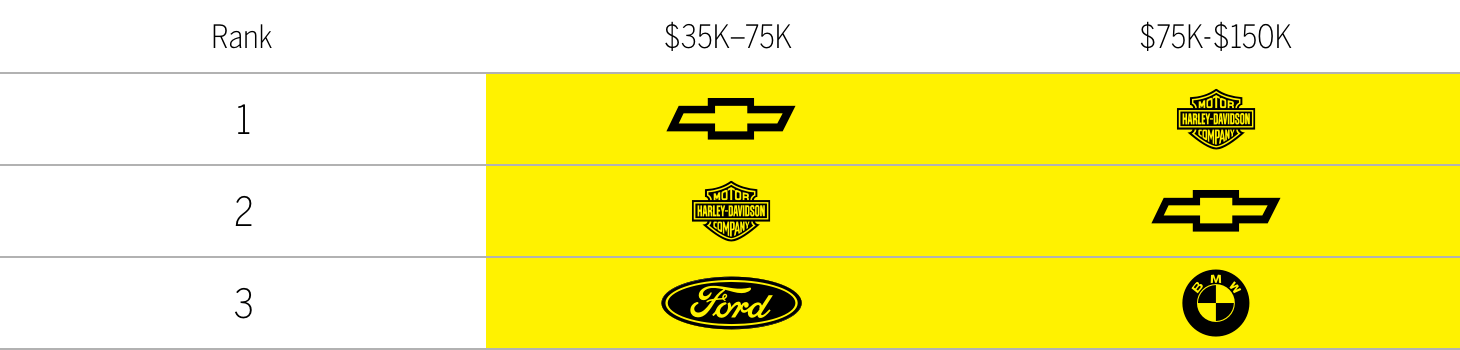

In the case of Chevy, nearly one quarter of users stated that they couldn’t live without the brand; perhaps most telling is that 16 percent were willing to pay 20 percent more for Chevy, compared with 13 percent for the industry average. Nearly half of Chevy’s users also noted that they felt an immediate emotional connection to the brand. Demographically, the brand performs better with males, and lower-income users, and at the lower-income scales and those in the 45–54 age range.

Industry performance

The automotive industry is consistently one of the top performing industries out of the fifteen surveyed. This year it ranks second, behind media and entertainment and ahead of technology and telecom. Chevy is the highest-ranked automotive brand, coming in fifth overall, and automotive accounts for seven other brands in the top thirty. The industry ranks #1 in archetype fulfillment (exceeding expectations and delivering superior service, quality, and efficacy) and identity (reflecting an aspirational image or admired values and beliefs that resonate deeply) compared with all other industries.

Given that many brands in this industry are well established with significant legacies, we see a healthy balance of users across all three stages of intimacy. Automotive is number one for sharing and bonding, the first and middle stages of Brand Intimacy, demonstrating that automotive brands excel at fostering emotional bonds with users. The category ranks second in fusing users, the most advanced stage of Brand Intimacy. Impressively, 35 percent of all automotive respondents are in some form of intimate brand relationship, the highest percentage of all industries.

Comparing the big three

American car brands are enjoying better times of late. Their portfolios have been optimized, and the cars’ quality and performance have dramatically improved from past decades when imports outperformed them in every way.

A three-way head-to-head comparison of how the Chevy, Ford, and Chrysler brands build emotional bonds reveals interesting findings. An examination of archetypes highlights that Chevy’s combination of strong performance in nostalgia (focusing on warm memories of the past) and fulfillment (exceeding expectations and delivering superior service, quality and efficacy) outperforms Ford’s. This is a powerful combination of archetypes (patterns that identify characteristics of the emotional bond). One can see how weak Chrysler’s performance is by comparison.

Most revealing is Chevy’s strength in the earliest stage (measuring the intensity and depth of emotional bonds across three stages). Chevy has almost double the number of Ford users in the early sharing stage of Brand Intimacy and nearly triple that of Chrysler. Sharing occurs when the person and the brand engage and interact: Knowledge is being shared, the person is informed on what the brand is all about, and vice versa. At this stage, attraction occurs through reciprocity and assurance.

This is significant because it resembles how younger brands perform in the early stages of their business evolution, engaging a wider pool of customers with the brand. We predict that this trend will be positive for the brand over time, as long as it continues to deepen the user–brand relationship. Notably, Ford actually performs better in the fusing stage, the most advanced and elusive stage of Brand Intimacy, which is the most difficult to achieve.

One area in which Chevy can improve is how actively it encourages customer engagement. Chevy ranked eleventh out of twelve brands in the industry regarding percentage of customers who receive communications from the brand via text, email, or app or who follow the brand on social media.

Chevy and beyond

Chevy’s recent upgraded performance points to a brand well on the road to thriving. As the company aligns its products with new audiences, it is striking the right balance between style, performance, and value. As the industry grapples with the forces of ride sharing and autonomous and environmentally-friendly vehicles, large manufacturers like Chevy must continue to build and leverage the bonds with their users to retain them as they try to transform their business and products.

Read our detailed methodology here.

Check out our annual study and rankings of intimate brands. Visit our most recent rankings of intimate famous figures—BFF. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Register for our webinar to learn patterns, insights, and findings from the Automotive industry here.