Overview:

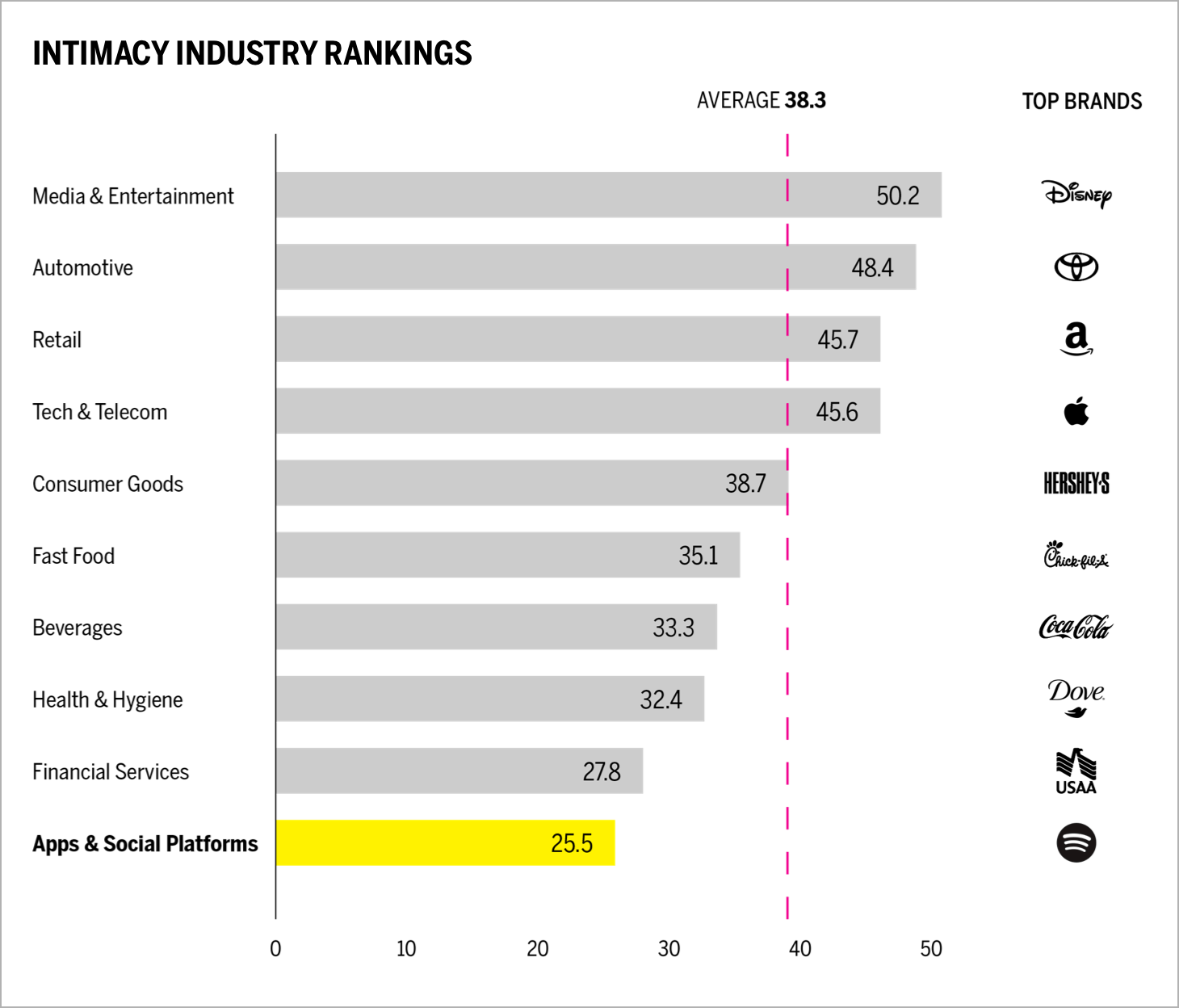

- The apps & social platforms industry ranks 10th in our 2021 Brand Intimacy COVID Study. To view our new study, click here.

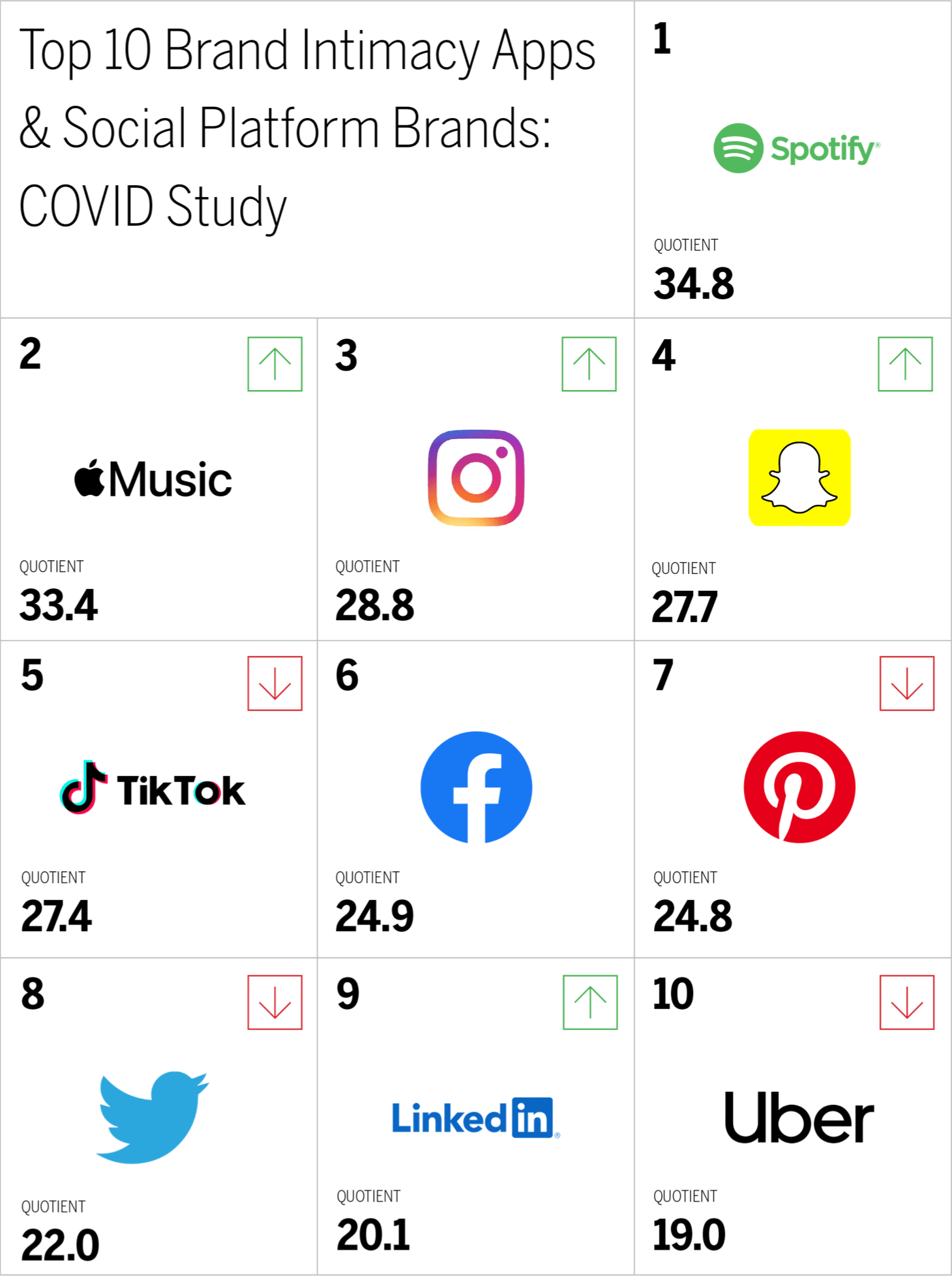

- Spotify is the top-ranking apps & social platforms brand. To see Spotify’s brand profile, click here.

- Daily usage has increased 5 percent since our 2020 COVID study. To read our apps & social platforms industry page, click here.

Introduction

We shared our 2020 Brand Intimacy COVID Study last year as the pandemic was affecting all our lives. We were interested in seeing its impact on the brands we all use and love. We are now sharing a follow-up study, fielded a year later when things were improving and businesses began reopening. Lately, with the rise of the Delta variant, we see the extended presence of COVID in our lives. As the world continues to deal with the pandemic, and businesses and their brands face persistent challenges, we are sharing new insights on how brands can focus, enhance, or optimize for the marketplace that we are all eager to see return to normal.

The findings from our follow-up Brand Intimacy COVID Study, conducted with 3,000 consumers in summer 2021, demonstrate how leading brand and consumer behavior has changed since a year ago.

Brand Intimacy Performance Today

The apps & social platforms industry has an average Brand Intimacy Quotient of 25.5, almost identical to our 2020 COVID study and well below the cross-industry average of 38.3. It ranks in last place, tenth out of ten industries.

Like most industries, the pandemic is clearly affecting business for apps & social platforms. However, growth is still predicted for 2021. Already, social media user numbers have jumped by more than thirteen percent since July last year, with the latest data showing an increase of more than half a billion users in just 12 months.1 Consumer spending on apps has hit a record $64.9 billion in the first half of 2021. This represents a 25 percent increase in spending across both the App Store and Google Play, compared to this time last year.2 However, spending has slowed, declining 13 percent, and installation growth has slowed to 1.7 percent.3

Spotify remains number one in the industry. Apple Music and Instagram have increased their performance, while Pinterest and Twitter have continued to decline. The industry performs better with men than women and with younger consumers versus older ones.

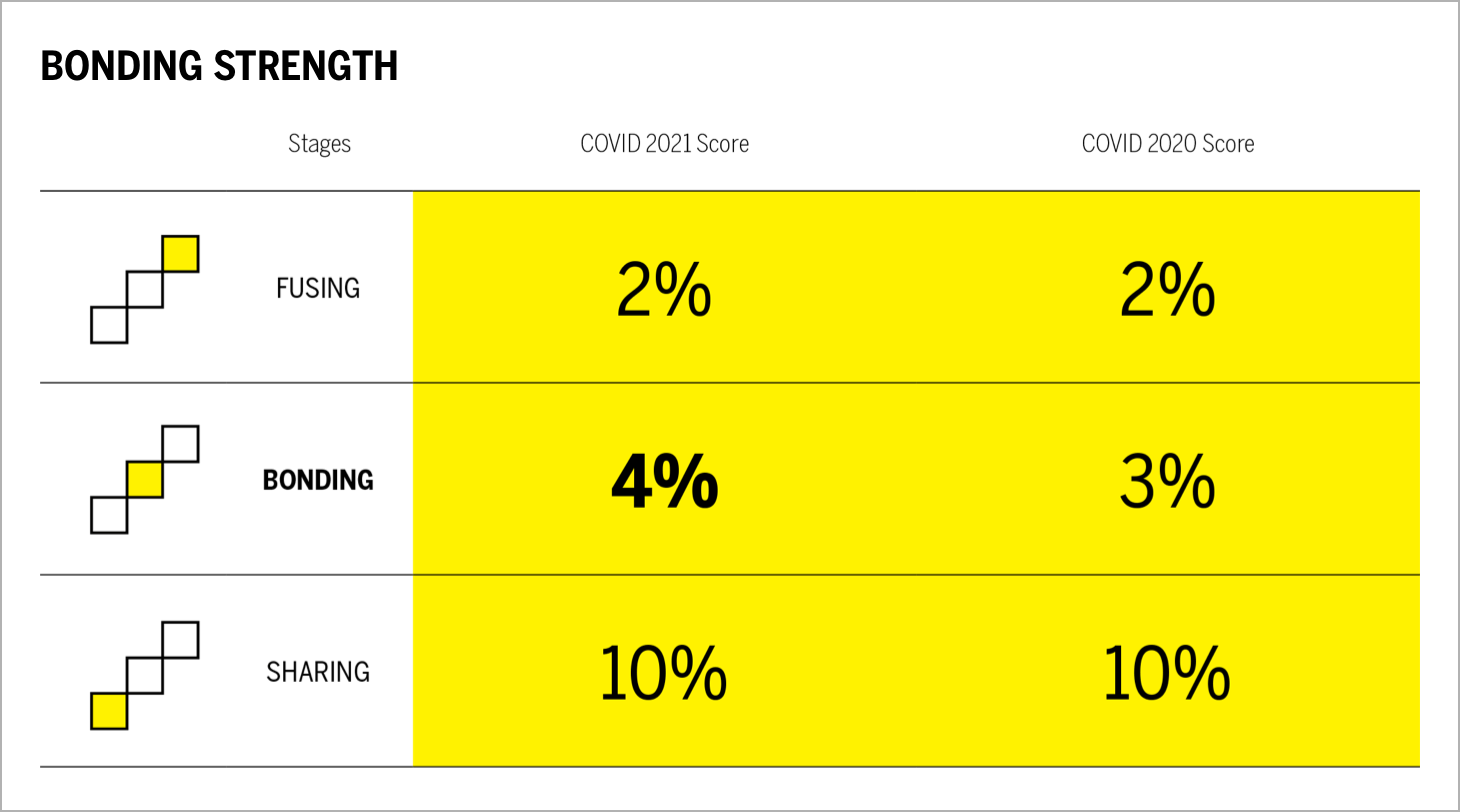

Apps & social platforms increased its bonding performance (the middle stage of Brand Intimacy) by 17 percent during the pandemic. This suggests that users were able to deepen their relationships and move into a more advanced stage of intimacy over the past year. Sharing and fusing remained the same, indicating that there is more opportunity to establish emotional connections with new users and find ways to extend connections so more users are fusing.

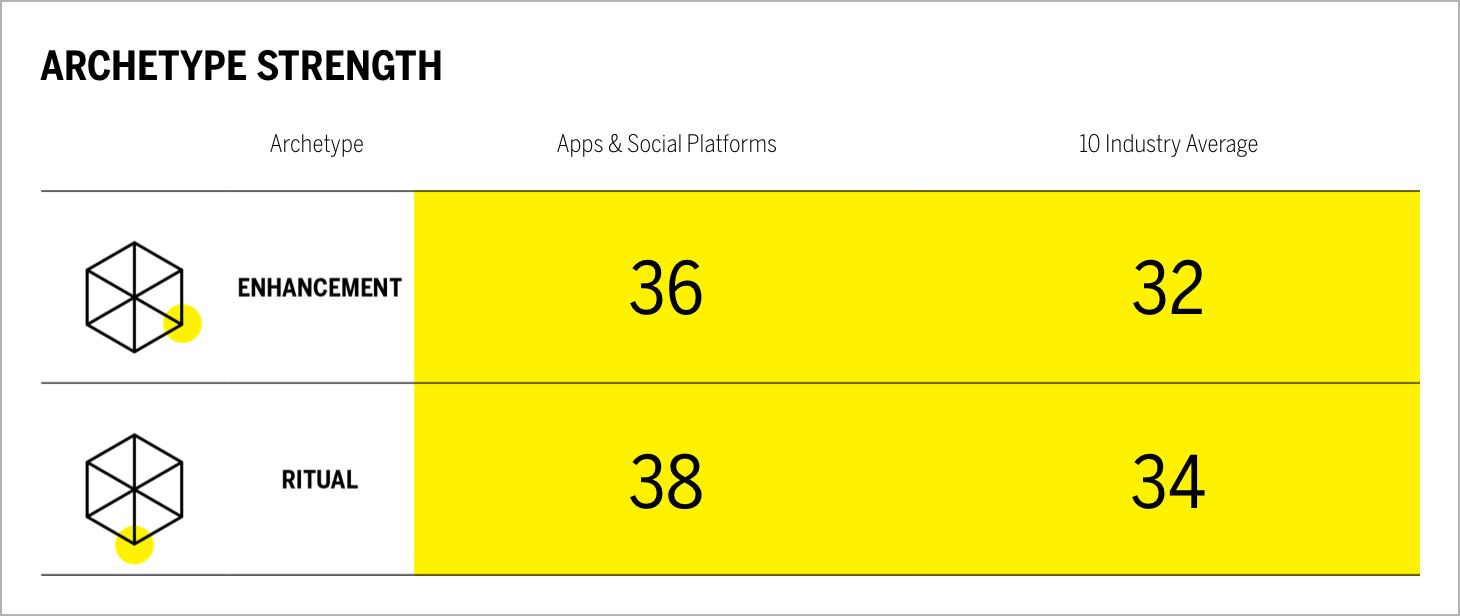

The category performs above the industry average on two key archetypes. Enhancement, where customers become better through use of the brand—smarter, more capable, and ritual, where a person ingrains a brand into his or her daily actions. This indicates that users appreciate the ability of apps and social platforms to connect and provide valuable information. The superior performance in ritual also links to a 4 percent increase in daily usage this year.

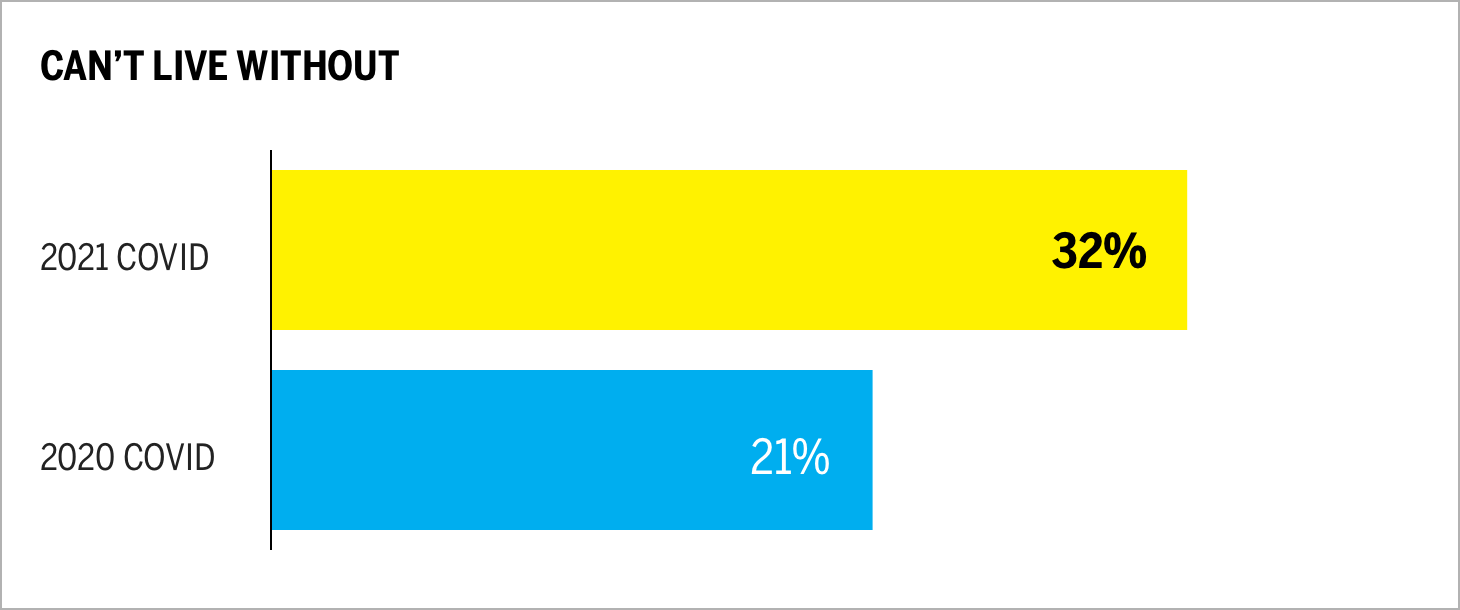

Can’t live without (a measure based on a ten-point scale that determines how essential a brand is to our lives) has increased 52 percent since our 2020 study, further highlighting consumer reliance on apps and social platform brands.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated since the pandemic started last year. What has changed in their messaging? We have captured a language analysis from company websites and outbound social, focusing on five brands and encompassing 442,417 words.

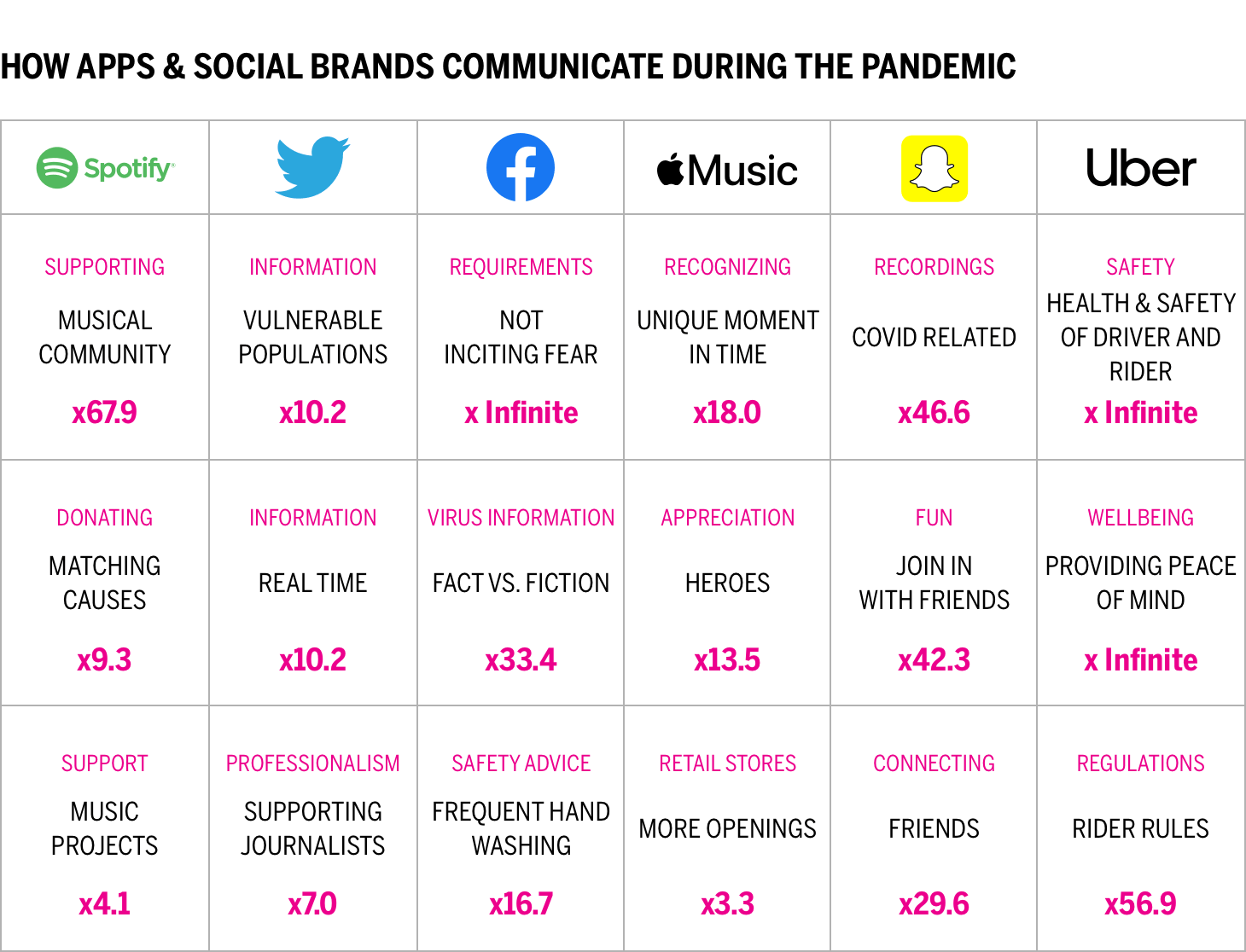

This chart presents a comparison of how leading brands are communicating about COVID on their websites and in social media. We noted the appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Spotify speaks 67.9 times more about supporting the musical community compared to its competitors).

The brands employ different strategies in terms of COVID-related messaging. Some have changed significantly since last year, whereas others are almost identical. In general, there is less COVID-specific messaging than last year, with a 32 percent reduction in these communications. Spotify’s approach is almost identical to last year, with messaging related to supporting the musical community during the pandemic. Snapchat also kept similar communications about having fun and connecting with friends. It has also added a larger focus on COVID-related recordings. Twitter continues its more academic tone. The platform still addresses appreciating journalists. However, it also emphasizes providing real-time information and communications directed toward vulnerable populations. Facebook has shifted its focus, emphasizing its requirement of not inciting fear, fighting misinformation, and presenting fact versus fiction. Apple Music has varied messaging, recognizing this unique moment in time as well as appreciation for frontline workers and everyone helping to fight COVID. Apple store openings are also mentioned. Uber is more specific, emphasizing its safety policies and expectations in vehicles for riders, as well as its best safety practices to provide peace of mind.

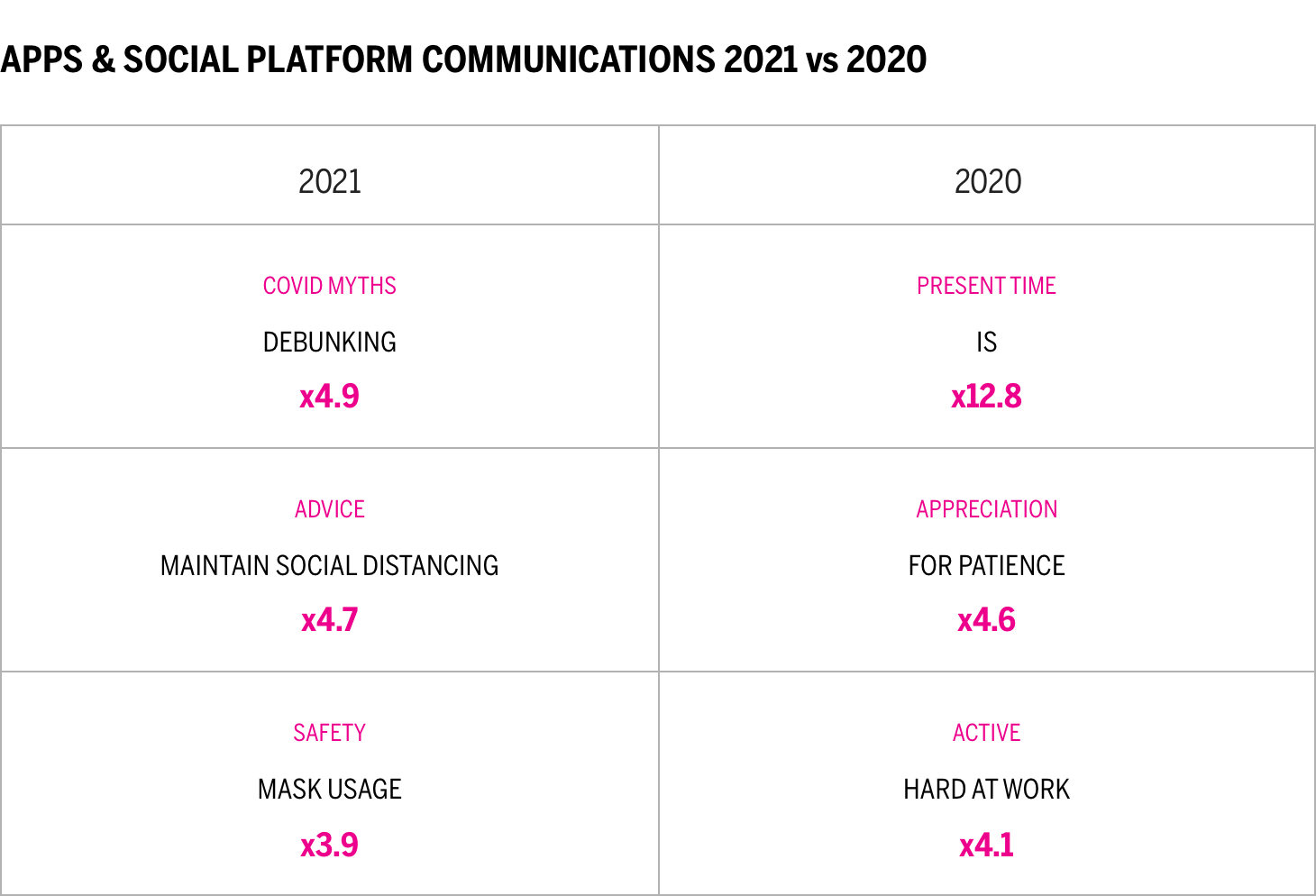

A year ago, category messaging highlighted more time-related messaging (the present), and an appreciation for user patience as platforms figured out how to navigate in a new world. This year we see more overall focus on debunking COVID misinformation, providing safety advice, and mask usage.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and a key principle for navigating these continuously challenging times. Although social media brands show some signs of improvement, the industry remains in last place, with few significant gains in performance.

Brands in this space should capitalize on the role they continue to play during the pandemic. Although misinformation, bans, and freedom of communication remain thorny and complex issues, apps and social platform brands have been connecting friends, families, and colleagues during COVID and have been a reliable, capable source of information and communication. Some brands may be divided across political lines; however, brands in this category need to highlight who they are, what they value, and how they help. They seem to be getting lost in their own platforms, and users must start to identify more specifically with the brands themselves to build emotional connections. With these increased bonds, apps and social platforms can focus on demonstrating the important role they have played during the pandemic and focus on fostering safe and meaningful connections that can blossom into newer, better social media.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.