Overview:

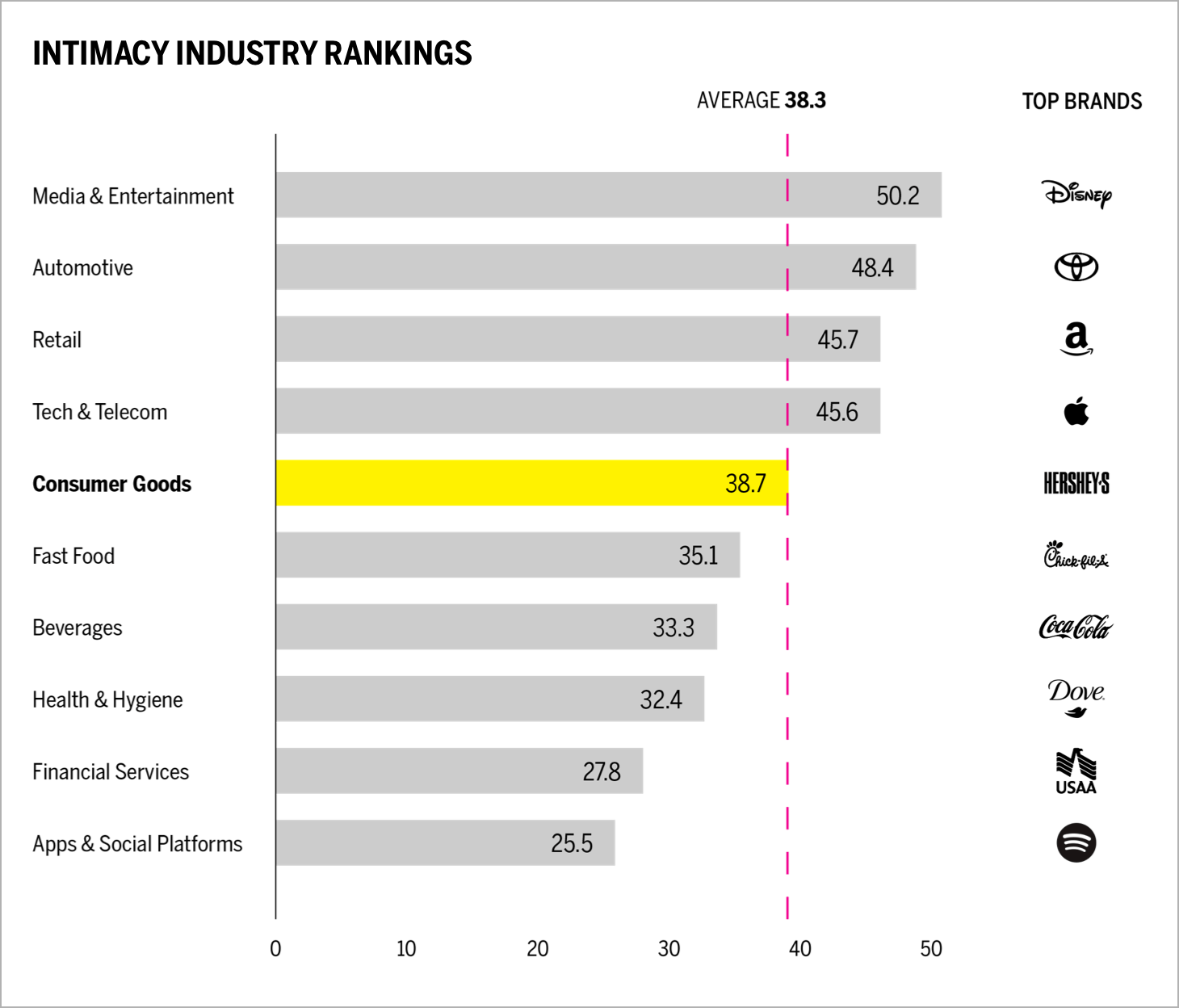

- The consumer goods industry ranks fifth in our 2021 Brand Intimacy COVID Study. To review our new study, click here.

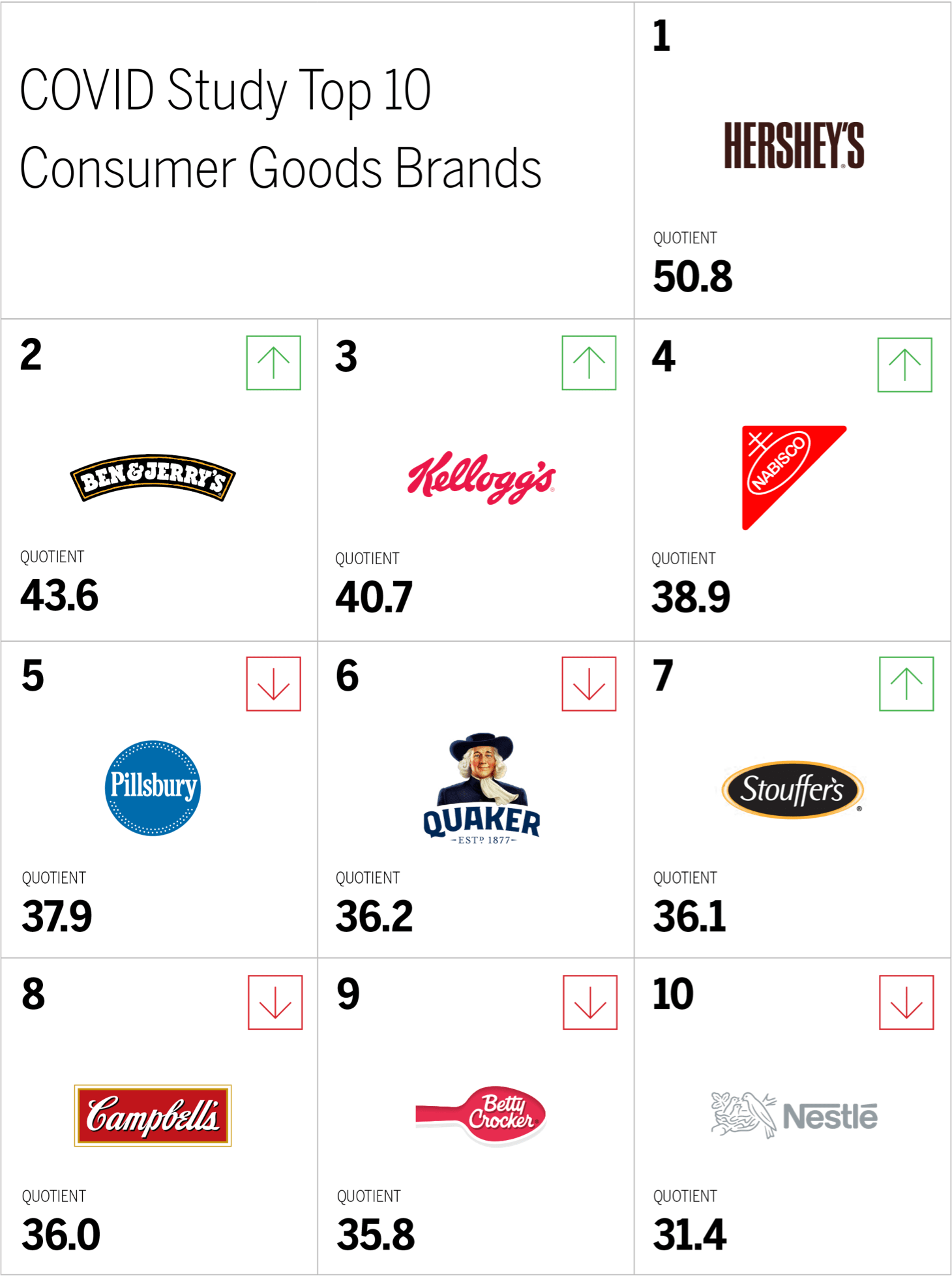

- Hershey’s the top-ranking consumer goods brand. Review Hershey’s brand profile here.

- In our 2021 COVID study, the consumer goods industry ranks #1 among all industries for the nostalgia archetype. Review the consumer goods industry page here.

Introduction

We shared our 2020 Brand Intimacy COVID Study last year as the pandemic was affecting all our lives. We were interested in seeing its impact on the brands we all use and love. We are now sharing a follow-up study, fielded a year later when things were improving and businesses began reopening. Lately, with the rise of the Delta variant, we see the extended presence of COVID in our lives. As the world continues to deal with the pandemic, and businesses and their brands face persistent challenges, we are sharing new insights on how brands can focus, enhance, or optimize for the marketplace that we are all eager to see return to normal.

The findings from our follow-up Brand Intimacy COVID Study, conducted with 3,000 consumers in summer 2021, demonstrate how leading brand and consumer behavior has changed since a year ago.

Brand Intimacy Performance Today

The consumer goods industry has an average Brand Intimacy Quotient of 38.7, slightly above the cross-industry average of 38.3.

Several consumer goods brands saw increased demand and sales last year, with more people staying at home and many restaurants closed or offering limited menus. As a result of the pandemic, consumer goods manufacturers are now seeing higher prices for materials as well as transportation challenges. For example, Campbell forecast fiscal 2021 adjusted earnings between $2.90 and $2.93 per share, compared with its prior forecast of $3.03-$3.11 per share. It expects sales to fall at least 3.0 percent, compared with the minimum 2.5 percent fall projected.1 Hershey’s, on the other hand, continues to experience growth. Consolidated net sales for the company hit $2.3 billion in the first quarter, an increase of 12.7 percent from the same period last year.2

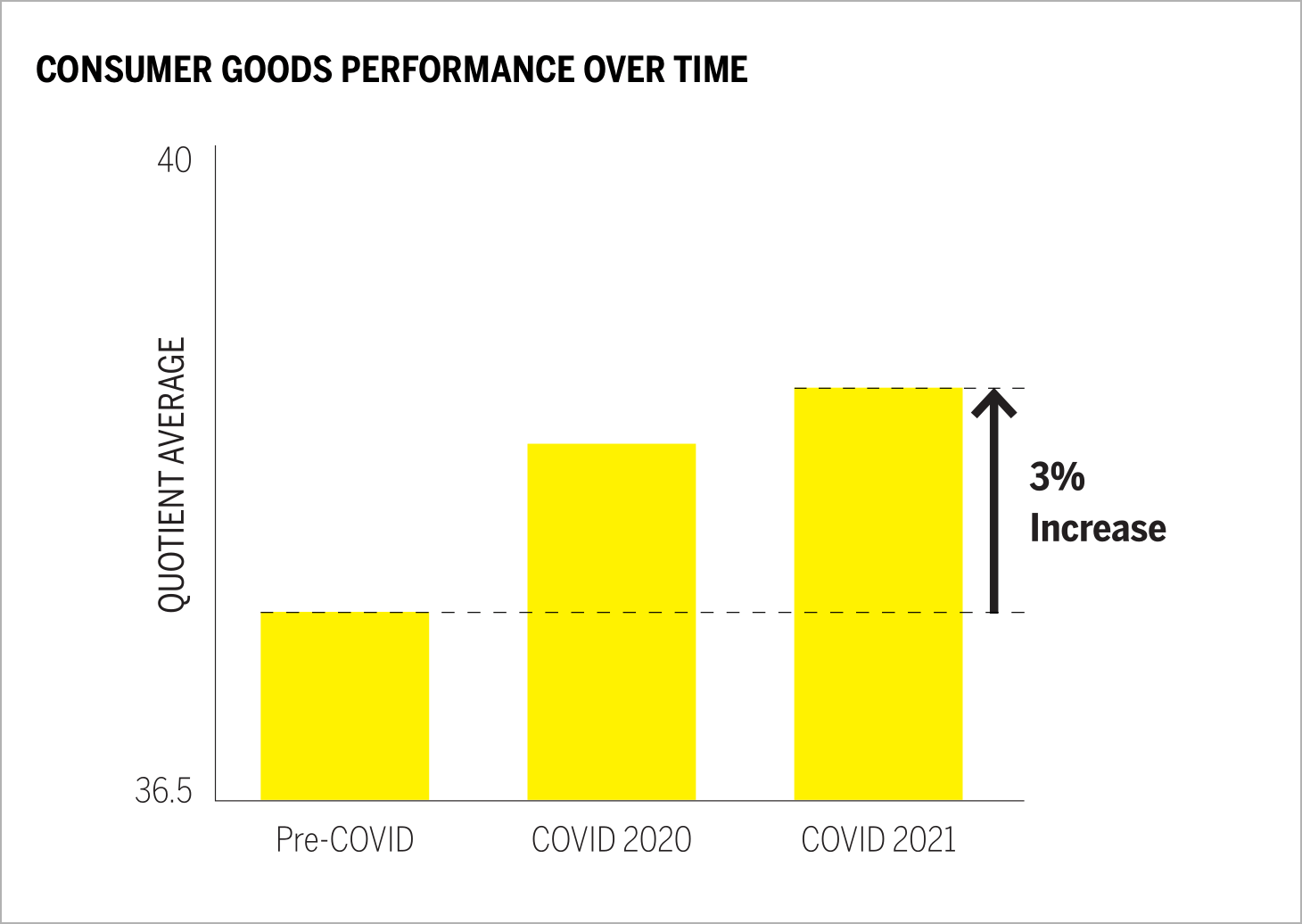

Brand Intimacy performance for the industry has increased by an average of 3 percent since before the pandemic, despite manufacturing and supply chain challenges. Despite the hardships imposed by COVID on people and businesses, this period has actually drawn consumers closer to brands and created stronger emotional relationships.

Hershey’s remains in first position in the industry, while Ben & Jerry’s moved up one place. Consumer preference for Kellogg’s and Nabisco has increased, while preference for Campbell’s and Quaker has declined. Consumer goods performs better with women than men and with consumers over 35 years old versus those under 35 years old.

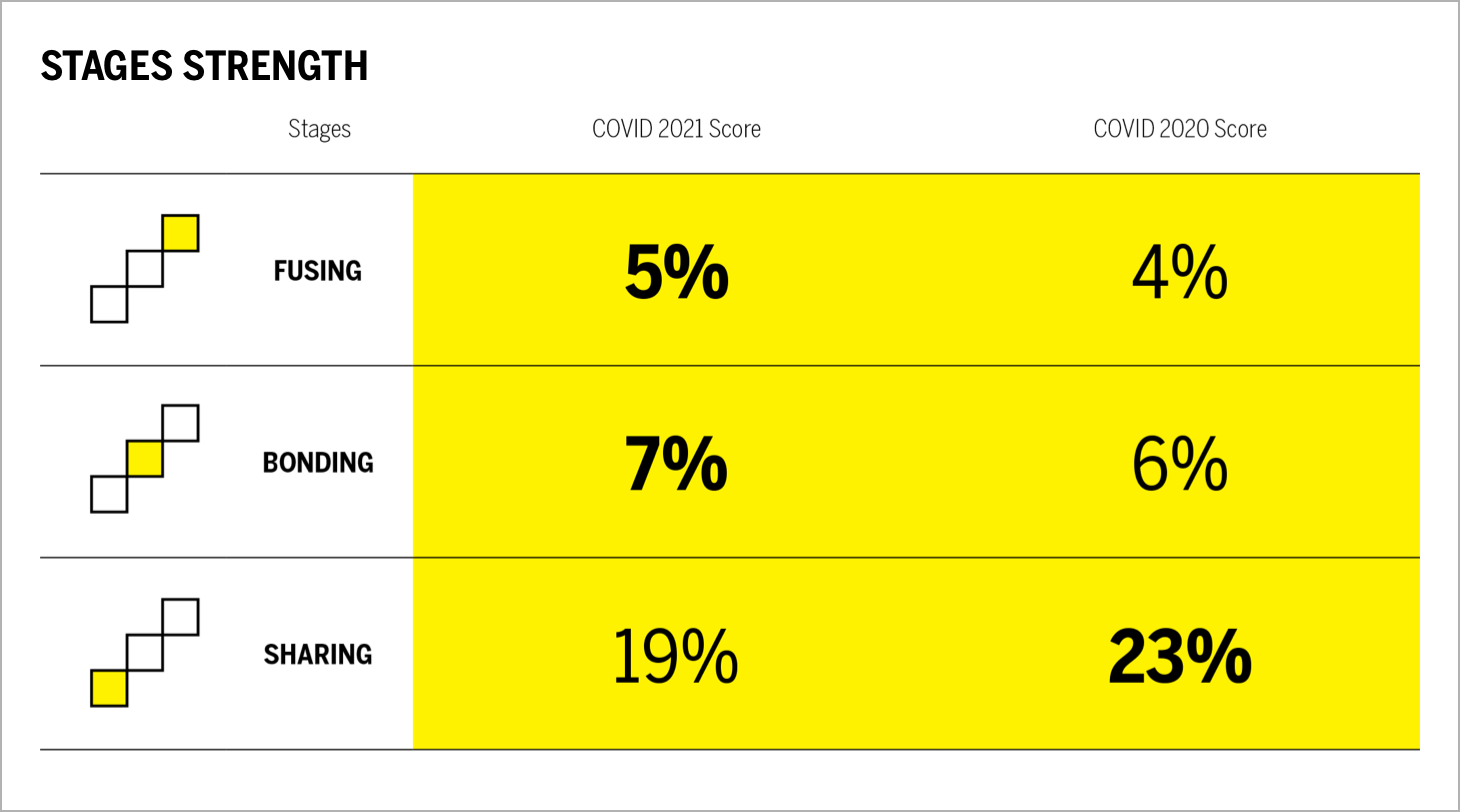

The consumer goods industry’s performance in sharing, the earliest stage of Brand Intimacy, declined by 17 percent. However, the category improved in the two more advanced stages of Brand Intimacy, bonding (17 percent increase) and fusing (25 percent increase). This suggests that once users are emotionally connected to consumer goods brands, they are able to move to more significant emotional relationships.

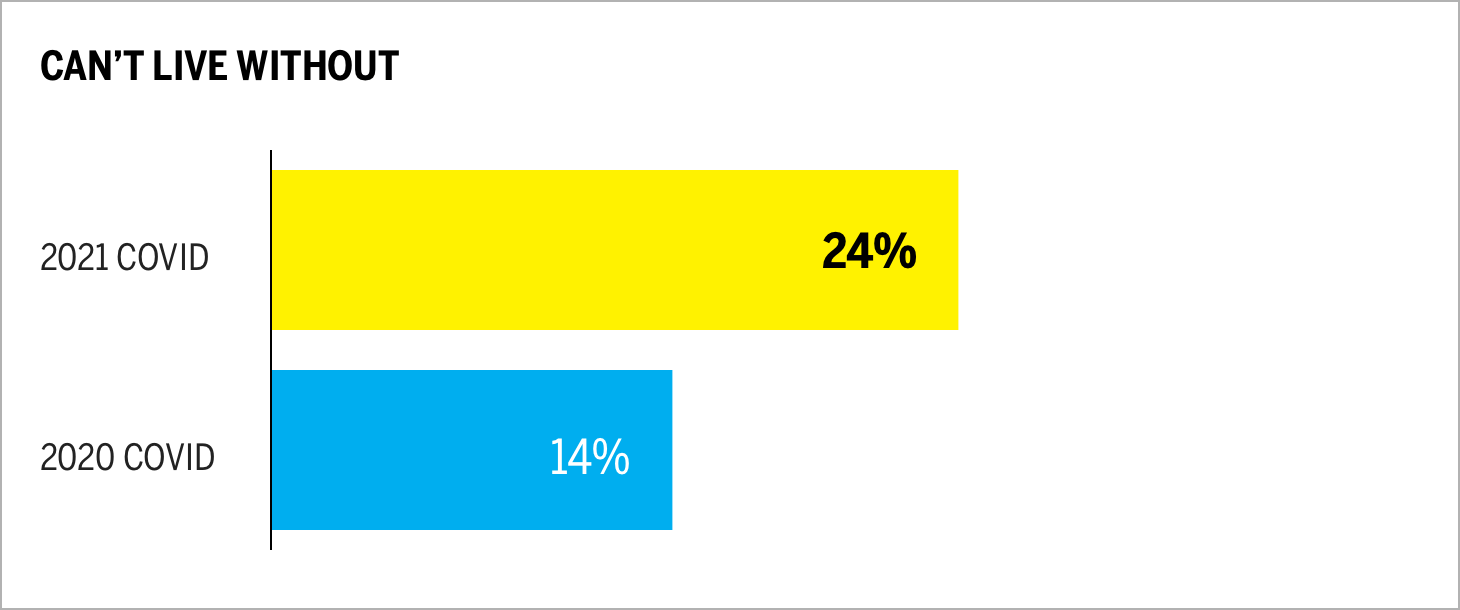

Can’t live without (is a measure based on a ten-point scale that determines how essential a brand is to our lives) has risen by 70% since our 2021 study, further highlighting reliance on consumer goods brands. Ben & Jerry’s is the number one consumer brand for can’t live without.

When Brands Speak

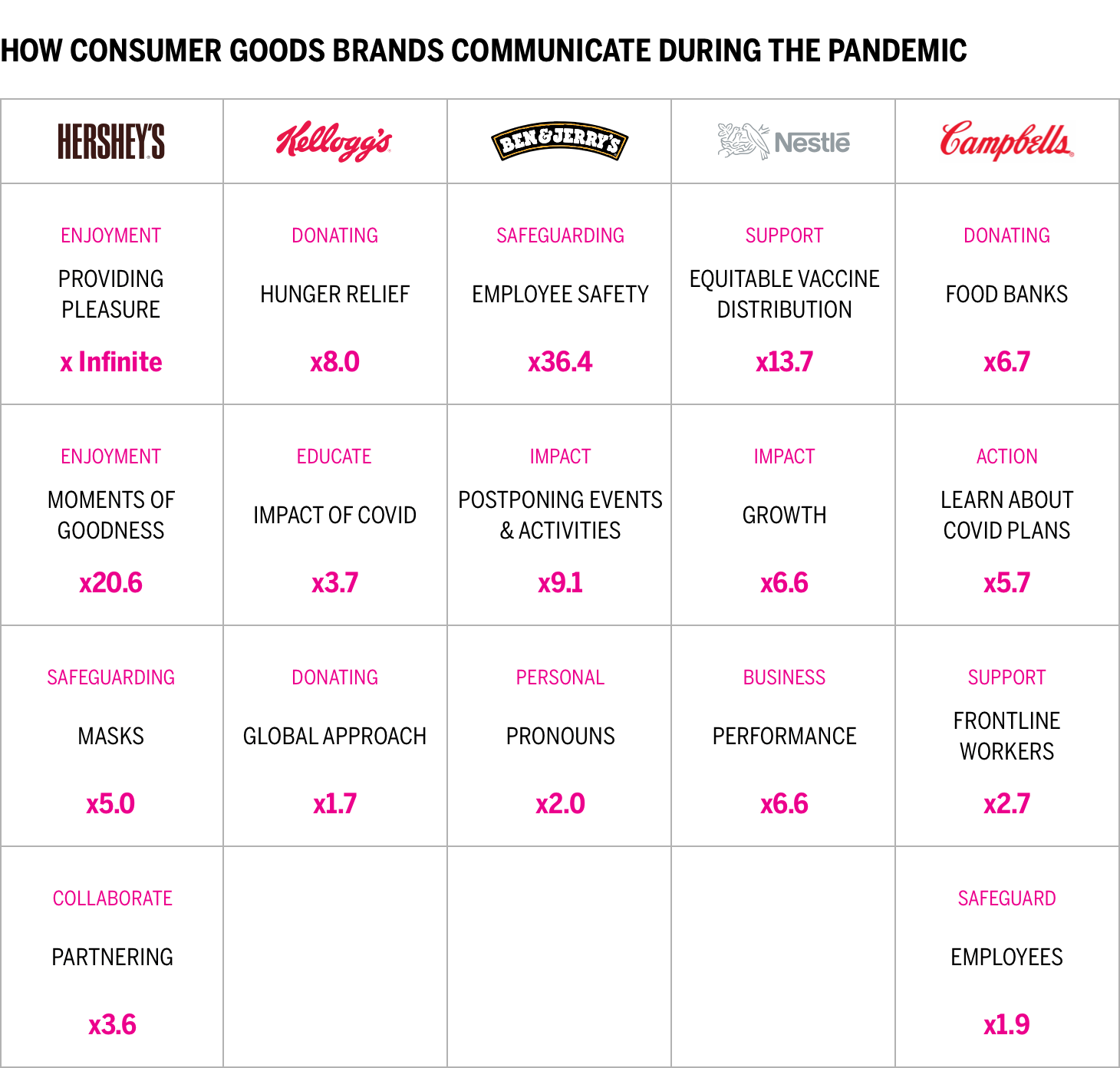

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated since the pandemic started last year. What has changed in their messaging? We have captured a language analysis from company websites and inbound social media, focusing on five brands and encompassing 1,372.300 words.

This chart presents a comparison of how leading brands are communicating about COVID on their websites. We can see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Dunkin’ speaks 21.2 times more about preventing hunger compared to competitors).

Each of the five brands we reviewed emphasizes a slightly different focus related to what COVID-related messages they are prioritizing. Hershey’s emphasizes how its products provide pleasure and moments of goodness related to safe family enjoyment. Kellogg’s leverages its global donations to hunger relief and other notable causes. Both Ben & Jerry’s and Campbell’s highlight employee safety. Ben & Jerry’s speaks in more personal tones and details the need to postpone events and activities throughout the year. Campbell’s highlights its donations to food banks and the actions they are taking related to COVID. Nestle features a business focus related to the impact of COVID and is also notable in its support of equitable vaccine distribution. In terms of tone, Hershey’s and Ben & Jerry’s have a friendlier communication style, whereas Nestle and Campbell’s appears more corporate in tone.

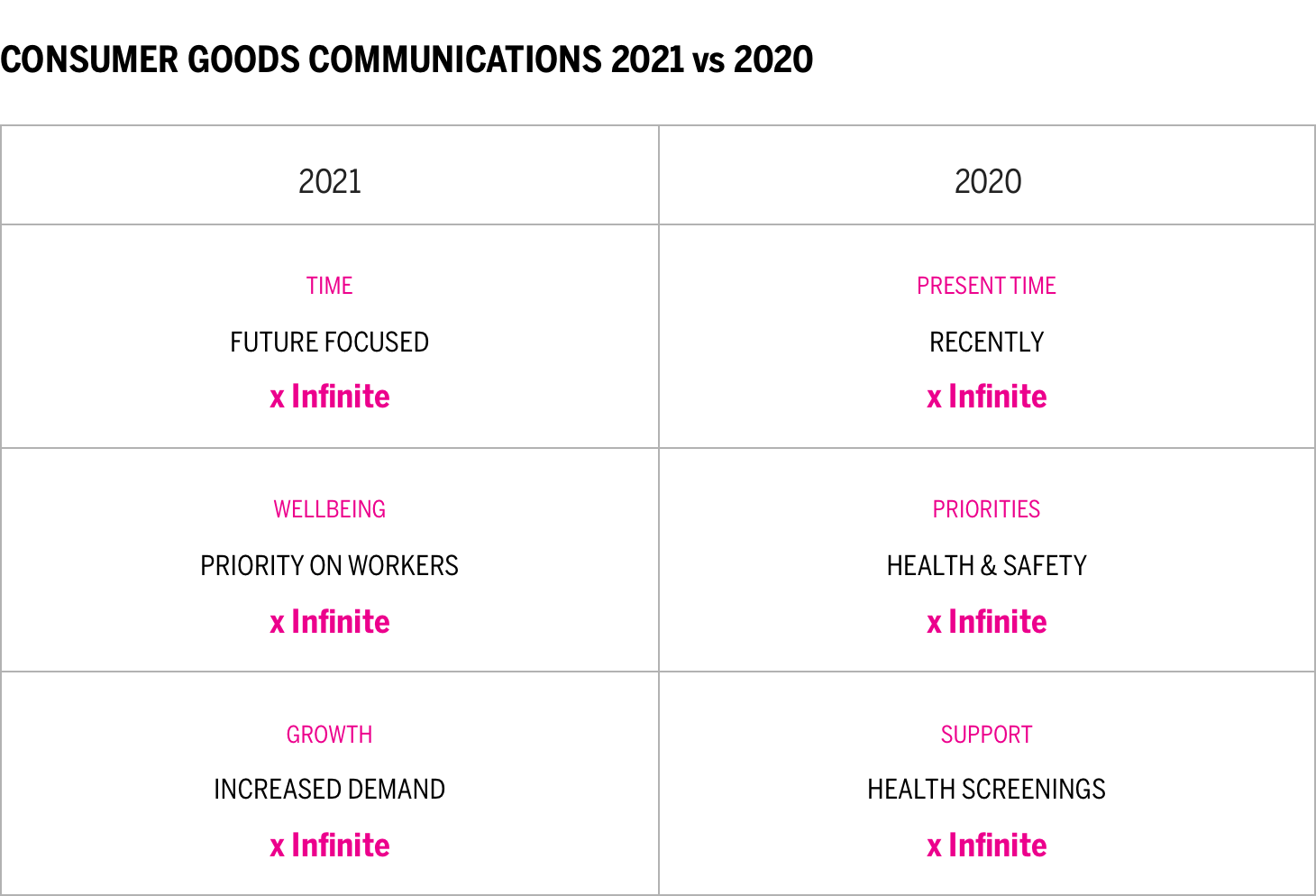

A year ago, industry communications related to COVID highlighted more time-specific messaging, prioritizing the health and safety of workers, and creating health screenings and a safe workplace. This year, communications emphasize the future, the well-being of workers, and increased demand for consumer goods products.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is also a key principle for navigating our challenging times. Consumer goods brands have been a constant companion for many of us, providing a sense of comfort in which most Americans have indulged. Nearly half of Americans have reported weight gain, averaging a 29 pound increase.3 Given the industry’s strong link with nostalgia, it may be useful for brands to highlight those associations over indulgence.

As behaviors normalize, consumer goods brands must find new ways to strengthen the bonds deepened during the pandemic and communicate a shared experience, their reliable presence, and the continued role they can play in our lives. With sharing, the earliest stage of Brand Intimacy, declining and only 31 percent of all users in an intimate relationship with category brands, it is also important to attract new consumers who can build emotional connections.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.