Overview:

- The health & hygiene industry ranks eighth in our Brand Intimacy COVID Study. To view our new study, click here.

- Olay is the top-ranking health & hygiene brand and has an improved Quotient Score. To see Olay’s brand profile, click here.

- During COVID, health & hygiene brands have ranked higher than the industry average for the identity and ritual archetypes. To read our health & hygiene industry page, click here.

Introduction

As businesses and their brands face unprecedented challenges in the face of the COVID pandemic, we are sharing our new insights on how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

This article is based on data and findings from our new Brand Intimacy COVID Study, conducted with 3,000 consumers in late summer 2020, revealing how leading brands have been affected by the pandemic.

Brand Intimacy Performance Today

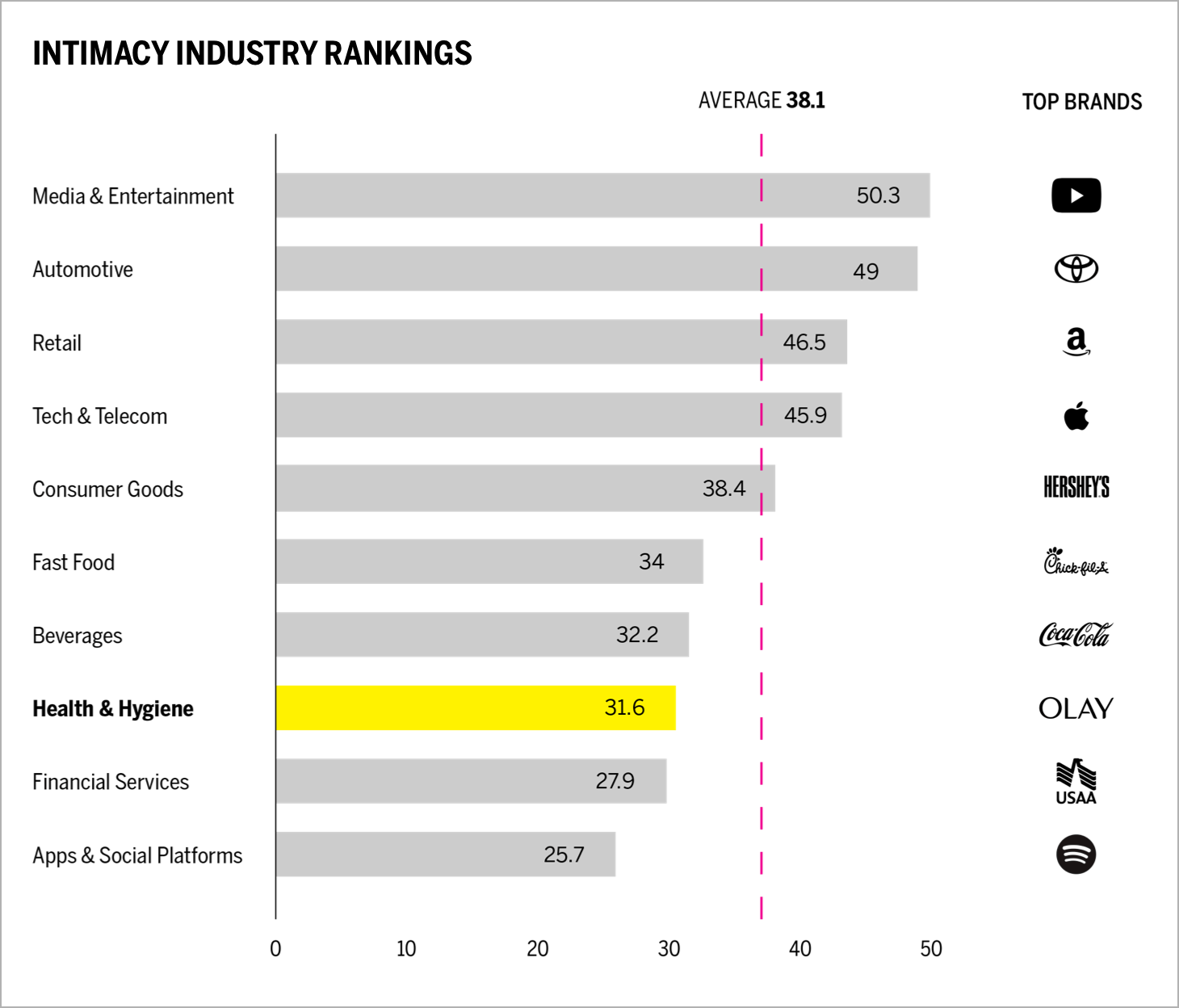

The health & hygiene industry has an average Brand Intimacy Quotient of 31.6, below the cross-industry average of 38.1. The industry increased its average Quotient Score by 5 percent.

Like many industries, the health & hygiene industry has been impacted by the pandemic. Beauty and personal care sales are predicted to decline by their steepest rate in more than 60 years.1 McKinsey estimates global beauty-industry revenues could fall 20 to 30 percent this year, and in the United States, if there is a COVID recurrence later in the year, the decline could be as much as 35 percent.2 In contrast, sales of health products and medical supplies increased significantly, particularly during the beginning of the pandemic, up 85.3 percent from the previous year.3 Specific in-demand products like hand sanitizers and wipes show an online sales increase of over 5,000 percent compared to this time last year.3 Liquid hand soap sales rose 170 percent.3

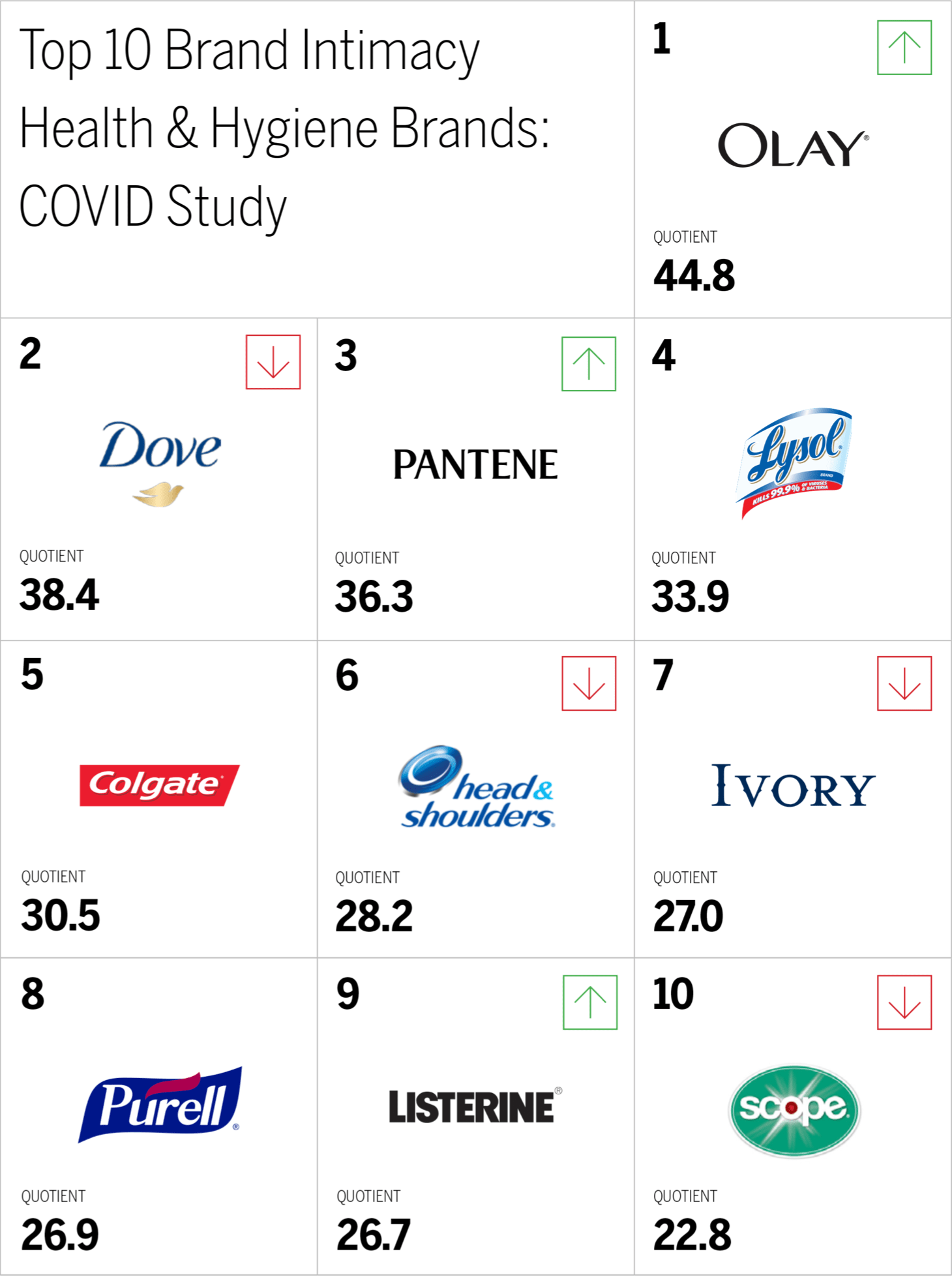

The chart indicates that Olay moves to first place, whereas Dove drops to second place. Consumer preference for Pantene has increased, whereas preference for Ivory and Head & Shoulders have decreased. New entrants Lysol and Purell ranked forth and eighth, respectively, indicating the dominant role these cleaning products played in our lives over the past eight months. The industry has become more essential to consumers during the pandemic. “Can’t live without,” a measure based on a 10-point scale that determines how essential a brand is to our lives, has increased by 6 percent.

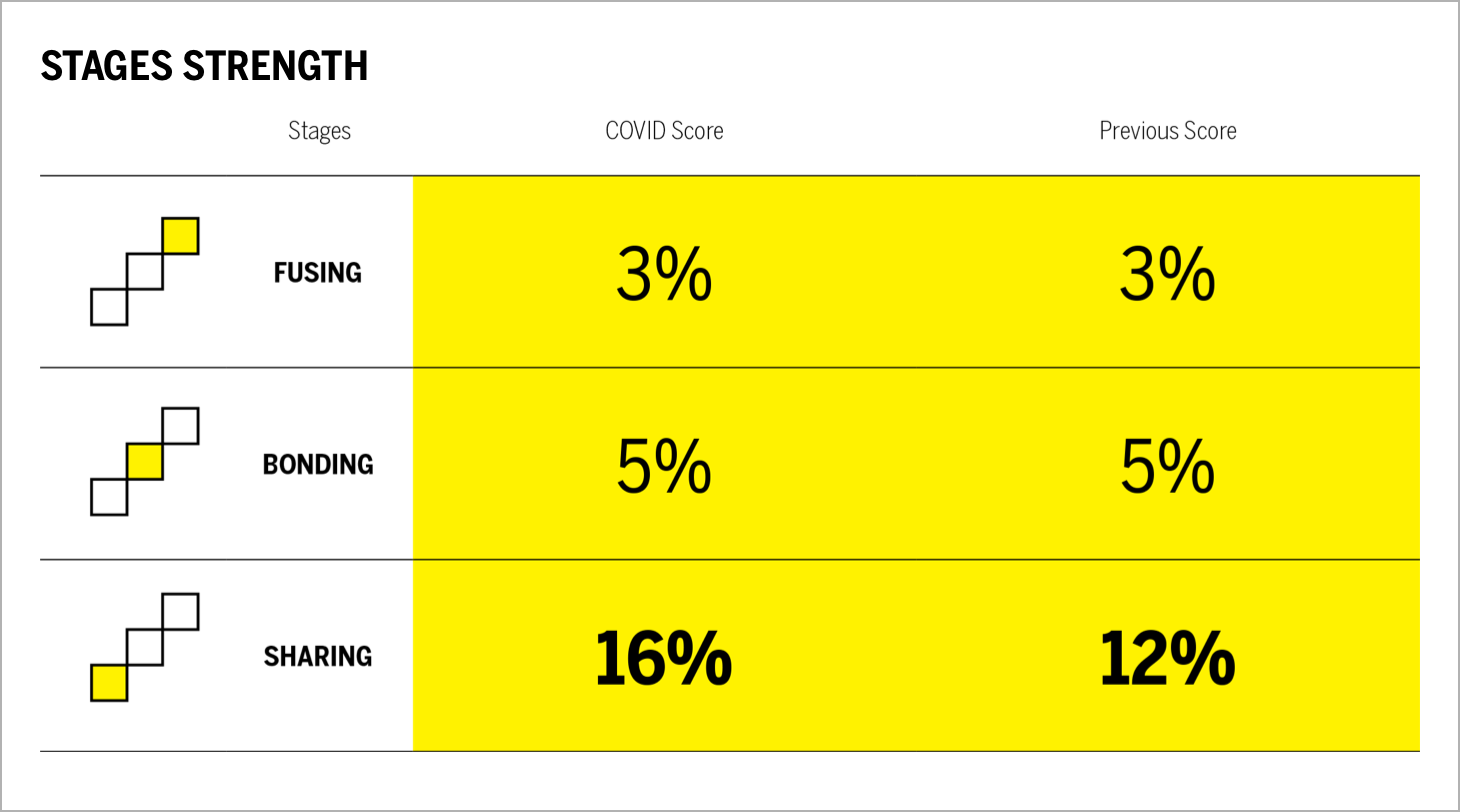

The health & hygiene industry has improved its performance in the earliest stage of Brand Intimacy, sharing, by 33 percent. This suggests that, during the pandemic, more consumers have been emotionally connecting to health & hygiene brands than in our previous study. In fact, the percentage of customers in some form of intimacy with health & hygiene has grown 23 percent. Bonding and fusing scores remain the same.

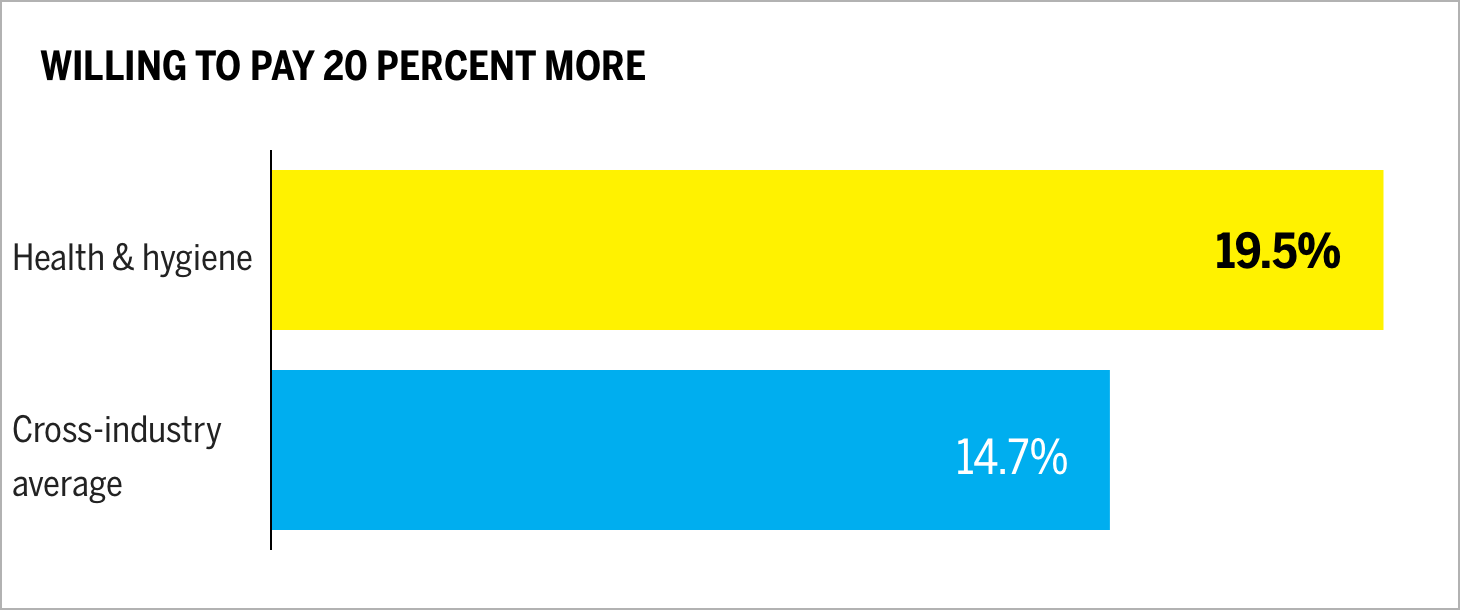

The health & hygiene industry has 19.5 percent of customers willing to pay 20 percent more for products. This is 33 percent higher than the average of all brands in our study, highlighting that the more customers value their brand relationships, the more they are willing to pay for the brands they use and love. This year, health & hygiene is the top ranked industry for consumers willing to pay 20 percent more, highlighting how important this category has been for people during the pandemic.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated during the pandemic. We have captured a language analysis from company websites and outbound social, focusing on the top two brands and encompassing 252,182 words.

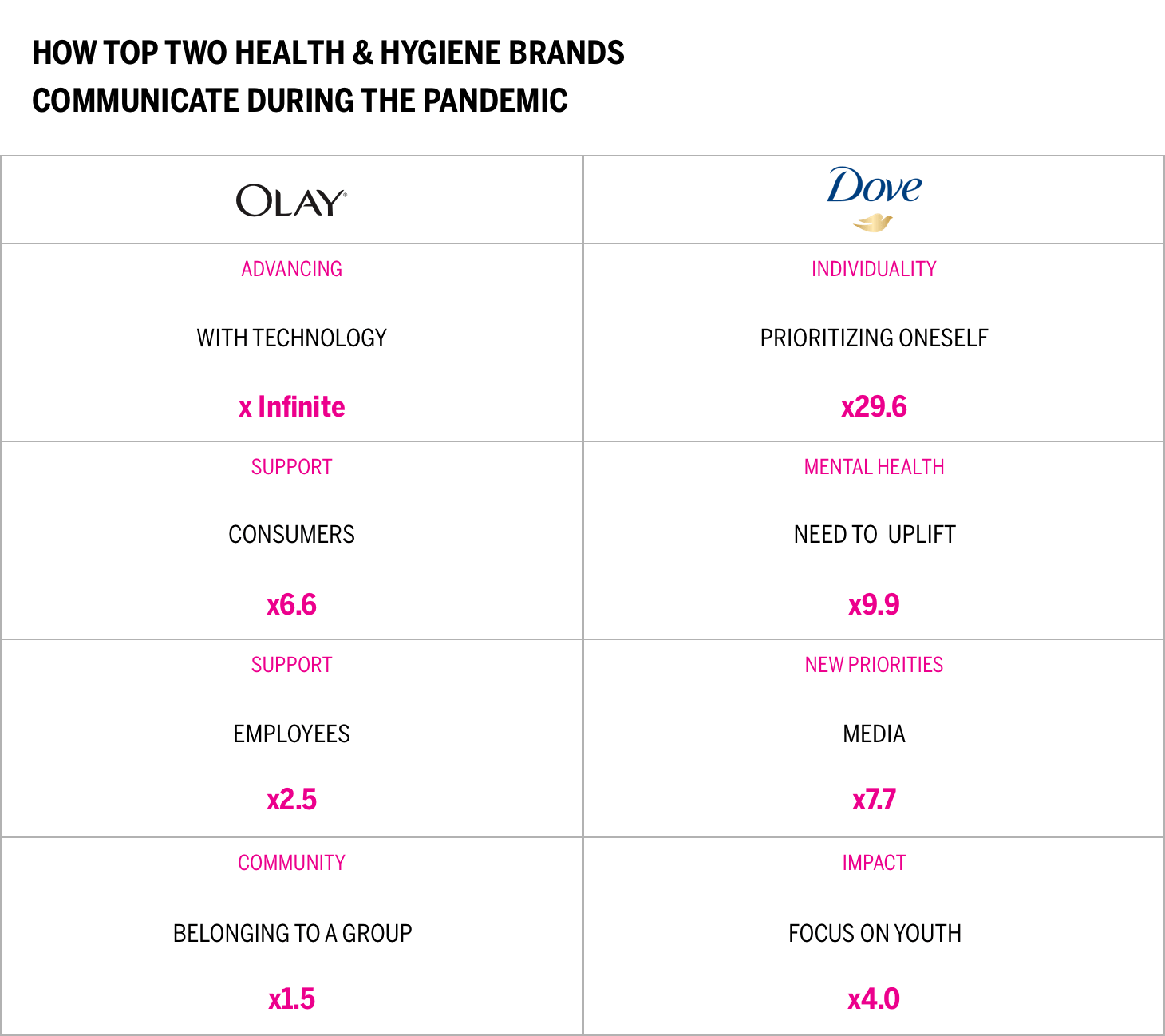

This chart presents a comparison of how our two leading brands are communicating about COVID on their websites and social. We can see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Dove speaks four times more on the effect of the pandemic on youth compared to Olay).

Olay and Dove have very different ways of speaking about COVID. Each of the five brands reviewed tends to highlight the importance of safety, the focus of safeguarding their employees, and how they are helping during the pandemic. Olay has a broad message of support that portrays consumers and employees as facing this challenging time together. Outside of the support theme, Olay also addresses how it will use technology to help operate and advance its business. Dove takes a very different approach, emphasizing the importance of the individual and maintaining a sense of wellness and positive thinking. Dove also discusses reallocating its media budget to help promote public health messages about hand washing. The brand also speaks about the youth and how to educate, build the confidence of, and support students at home.

Dove has produced several COVID-related advertising spots around the theme, “Courage is Beautiful.” Additionally, the brand is also rolling out ads to encourage hand-washing. One of its 30-second versions includes a countdown of the 20 seconds it takes to wash hands properly, with the message: “We don’t care which soap you use, we care that you care.”

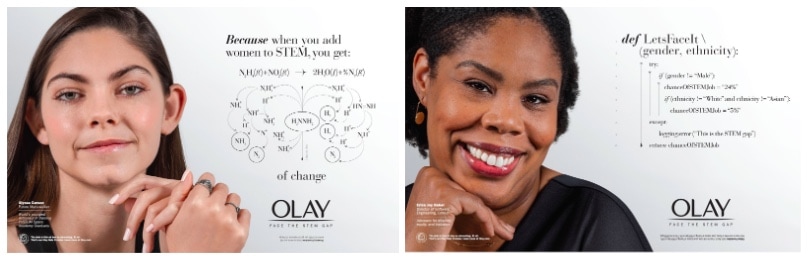

Olay does not appear to have produced COVID-related campaigns; however, earlier this year, it announced it will no longer retouch skin in photos it uses for promotional purposes. This summer, it also launched a campaign addressing the significant rate of gender disparity in the STEM professions. Olay has promised to help make a difference by supporting organizations, including the United Negro College Fund (UNCF), with funds dedicated to women scholars. Olay is dedicating $1 million in support, starting with $500,000 to the UNCF. Approximately 24 percent of STEM jobs are held by women; furthermore, women of color are estimated to represent only one out of 20 such positions.4

It is important to keep in mind that a brand’s tactics or communications are just a small signal of a brand’s intent and do not directly indicate how a brand creates greater intimacy.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is also a key principle for navigating our challenging times. The pandemic and its economic aftershocks will require brands to navigate in new and more carefully considered ways. As we return to “normal” life, it will be interesting to see whether our consumption of, and connection to, health & hygiene brands changes. Intimate brands, those built on a foundation of emotional bonding, should find a way to reference what we have all been through together and how they have reliably comforted us through this crisis. That means reflecting our collective consciousness, not going back to the world before COVID. Brands like Olay and Dove are already finding new ways to share and bond with users: celebrating our healthcare heroes or highlighting opportunities for women.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.