Context

The financial services industry is undergoing an interesting transformation. FinTech is changing the way we spend, save, sell, invest and pay. In Mexico there is a clear trend of startups focused and dedicated to FinTech. First, because of the great need to develop offers of financial services focused on better benefits for users, and then for the great business opportunity it represents for entrepreneurs. According to the National Banking and Securities Commission between 2011 and 2015 the crowdfunding industry in Mexico has had an average annual growth of 495%. This figure includes Loan companies, Crowdfunding, Real Estate, and Insurers, among others. On this occasion, we will focus on person to person lending companies, with personal or project interest.

The Challenge

Given MBLM’s interest in the relationships between brands and people in this digital age and the role of millennial generation as a benchmark for technology brands, we find it interesting to evaluate these new players first-hand. In this way Field Notes is born Peer-to-Peer. We invest in four of the most outstanding P2P loan platforms in Mexico to evaluate the user experience in each of its steps. Although we will not know the performance of our investments within a few months, we can review the performance of the product and how it manages to link with us (future users), because according to this first experience and the follow-up on the part of the brand depends on whether or not they get involved and become recurring investors.

Who Will Have The Best Performance Of Peer-To-Peer Loan

Doopla

Release year: 2015

How much has loaned: $ 400,000

Range of investment: $ 25 to $ 100

Average loan: $ 3,750

Kubo

Release year: 2012

How much has loaned: $ 500,000

Range of investment: starts in $ 12.5

Average loan: $ 3,600

Prestadero

Release year: 2012

How much has loaned: $5,300,000

Investment Range: $500 to $50,000

Average Loan: $1,350

Yotepresto

Release year: 2015

How much has loaned: $ 500,000

Range of investment: starts in $ 25

Average loan: $ 7,000

INSIGHT

Before showing you the complete report (below) where you can see which of the four brands was winning, we talked about what were the main conclusions that we observed between the registration in the platform and the investment to each one.

EASY REGISTRATION

In addition to the yields, the practicality of using this type of online platform to avoid wasting time in a branch office becomes an important advantage in this sector. Although all players in this analysis offer a “simple” process, Prestadero stands out for the combination of time / requirements and in less than two hours you can already be investing your money.

The biggest asset: You can start investing in a very short time with Prestadero.

The biggest deficit: The time it can take to validate payments for Doopla and Kubo.

CONFIDENCE AND SOLIDITY

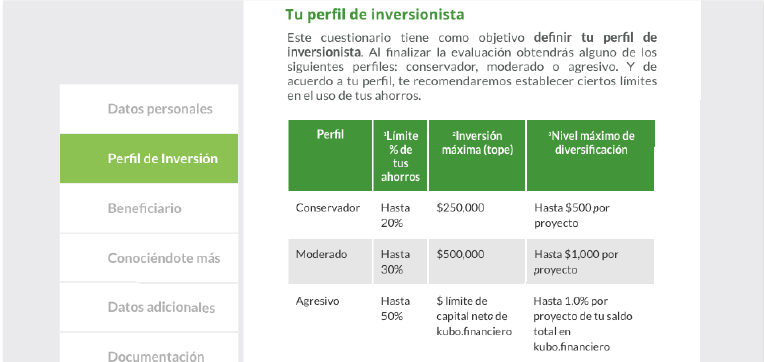

Generating confidence and security through the professionalism of the platform and the management of money is fundamental. That is why we believe that Kubo stands out from the rest. The clarity of the information guided us to better know our investor profile. It certainly helped us make informed decisions. In addition, the mentions, regulations and alliances you have speak of a professional and transparent platform.

The biggest asset: Kubo offers clear information and is backed by official regulations.

The biggest deficit: The lack of the same can affect the confidence in any brand.

ACCESSIBILITY AND SERVICE

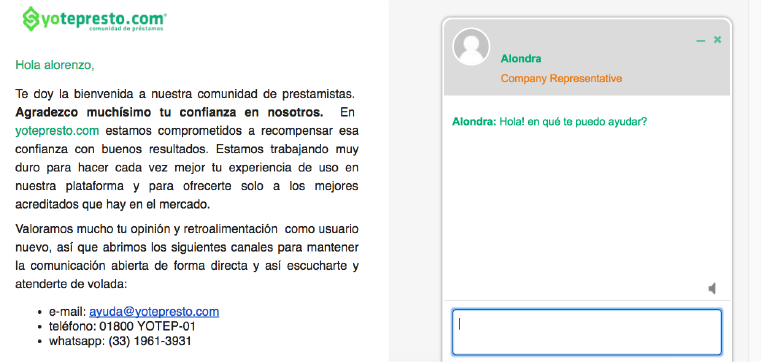

Just after finishing the registration process, in my inbox, I found a thank you and welcome email signed by Luis Rubén Chávez, CEO of Yotepresto.com. In addition, it included a quick guide with explanations of how to use the tool and tips and contact phones for feedback and doubts. They also have, permanently, an online attention chat. Undoubtedly, a platform focused on sincere and personalized attention has much advanced in the generation of intimacy with its clients, generating their confidence and therefore their tranquility.

The biggest asset: Kubo offers clear information and is backed by official regulations.

The biggest deficit: Beware of neglecting users with doubts or little attention. That can be the difference between investing in one platform or another.

COHERENCE IN THE PROPOSAL

The speech and tone of communication is one of the key tools for generating trust and transmitting security. Kubo Financial maintains a professional, empathetic, didactic speech with a human touch. The social approach is present along the platform and adds a differential against the competition.

The biggest asset: Financial Kubo adds value to your offer through a professional speech.

The biggest deficit: The absence of a clear point of view in some of the brands.