Overview:

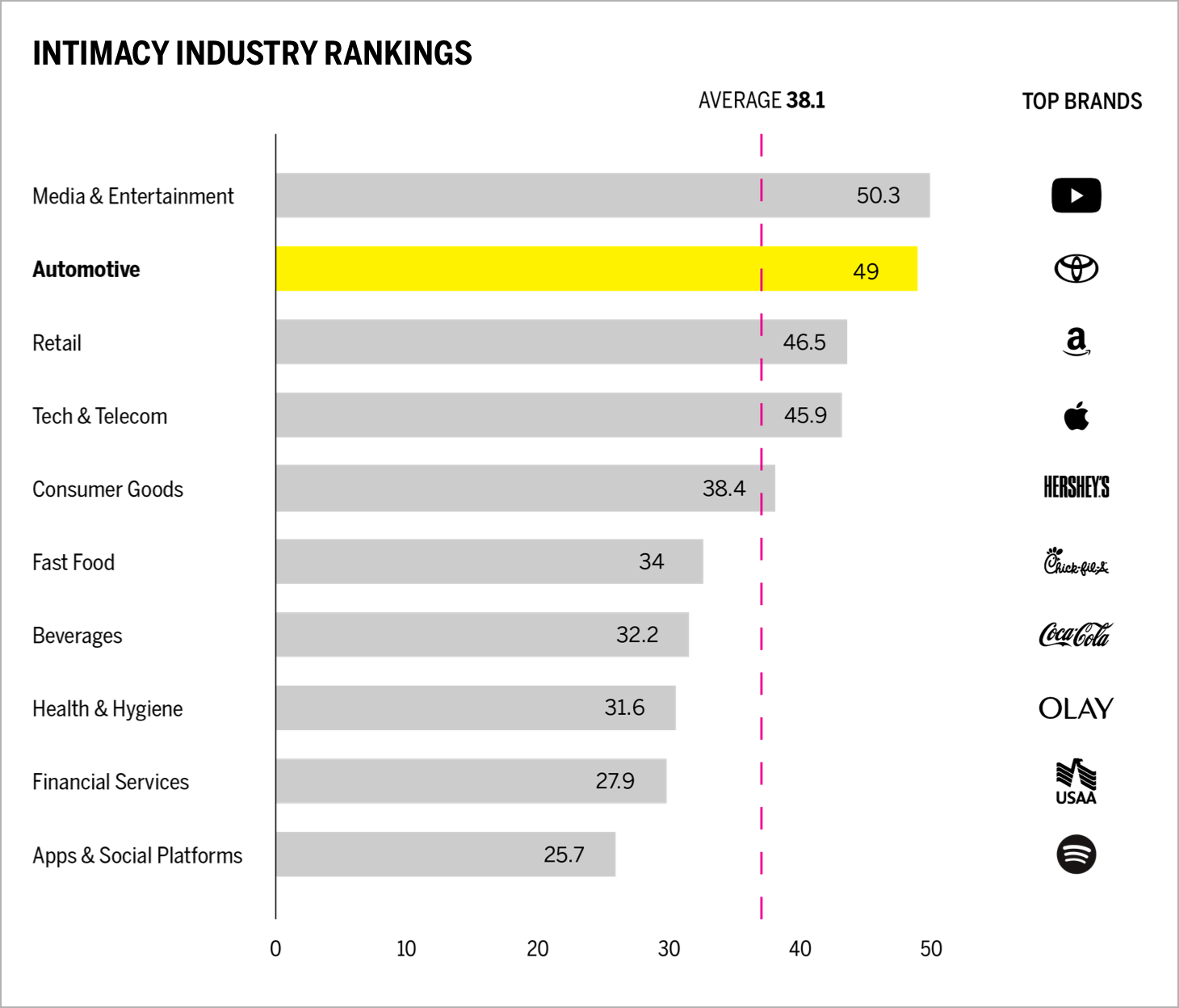

- The automotive industry ranks second in our Brand Intimacy COVID Study. To view our new study, click here.

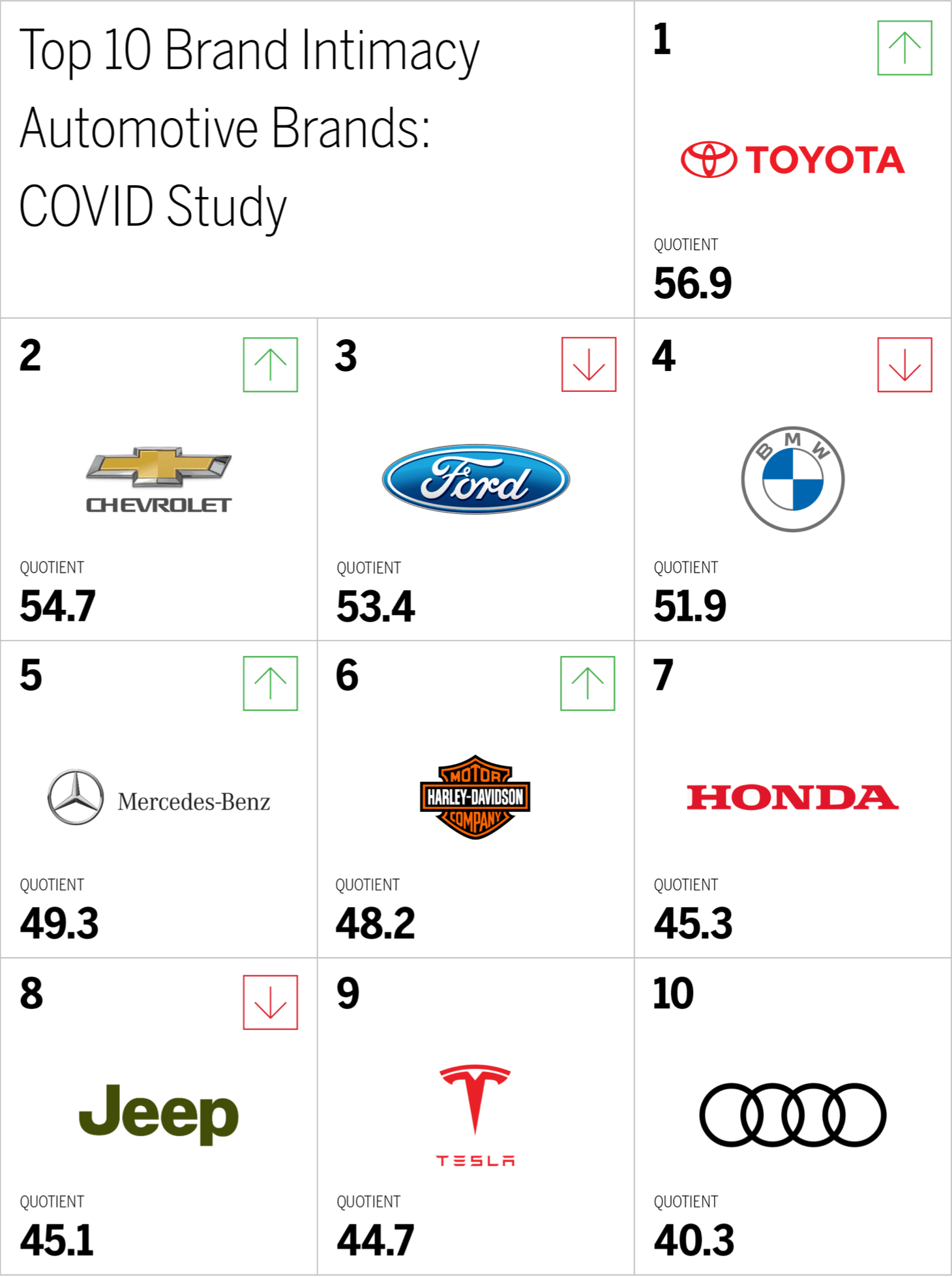

- Toyota is the top-ranking automotive brand, up from fifth place in our last study. To see Toyota’s brand profile, click here.

- During COVID, automotive brands rank higher the industry average for fulfillment, associated with performance, and identity, and linked to aspiration and shared values. To read our automotive industry page, click here.

Introduction

As businesses and their brands face unprecedented challenges in the face of the COVID pandemic, we are sharing our new insights on how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

This article is based on data and findings from our new Brand Intimacy COVID Study, conducted with 3,000 consumers in late summer 2020 revealing how leading brands are affected by the pandemic.

Brand Intimacy Performance Today

Automotive ranks second this year, behind media & entertainment. The industry’s overall performance has improved and its Quotient Score average is up 6.1 percent, compared to our previous study. This performance was surprising as we anticipated with a significant portion of the U.S. isolated at home that car use (and thereby mindshare) would diminish. The fact that the industry has improved demonstrates the indelible mark car brands maintain.

The performance of automotive brands is also good news given that industry forecasts predict sales most likely will decrease 14-22 percent among the China, United States, and European markets in 2020.1 The closure of OEM and supplier factories will likely produce 7.5 million fewer vehicles in 2020.2 At the height of the pandemic, over 90 percent of the factories in China, Europe, and North America closed. With vehicle sales declining, automakers and suppliers have laid off workers or relied on public intervention.2

Toyota ranks first in the industry, up from fifth. Ford, the previous top brand, is now in third place. Consumer preference for Mercedes-Benz and Harley-Davidson has increased, whereas preference for Jeep and BMW have decreased. Toyota’s rising performance speaks to the more utilitarian aspects of its brand that people are now connecting with. In troubling and challenging times, these value-driven brands tend to rise.

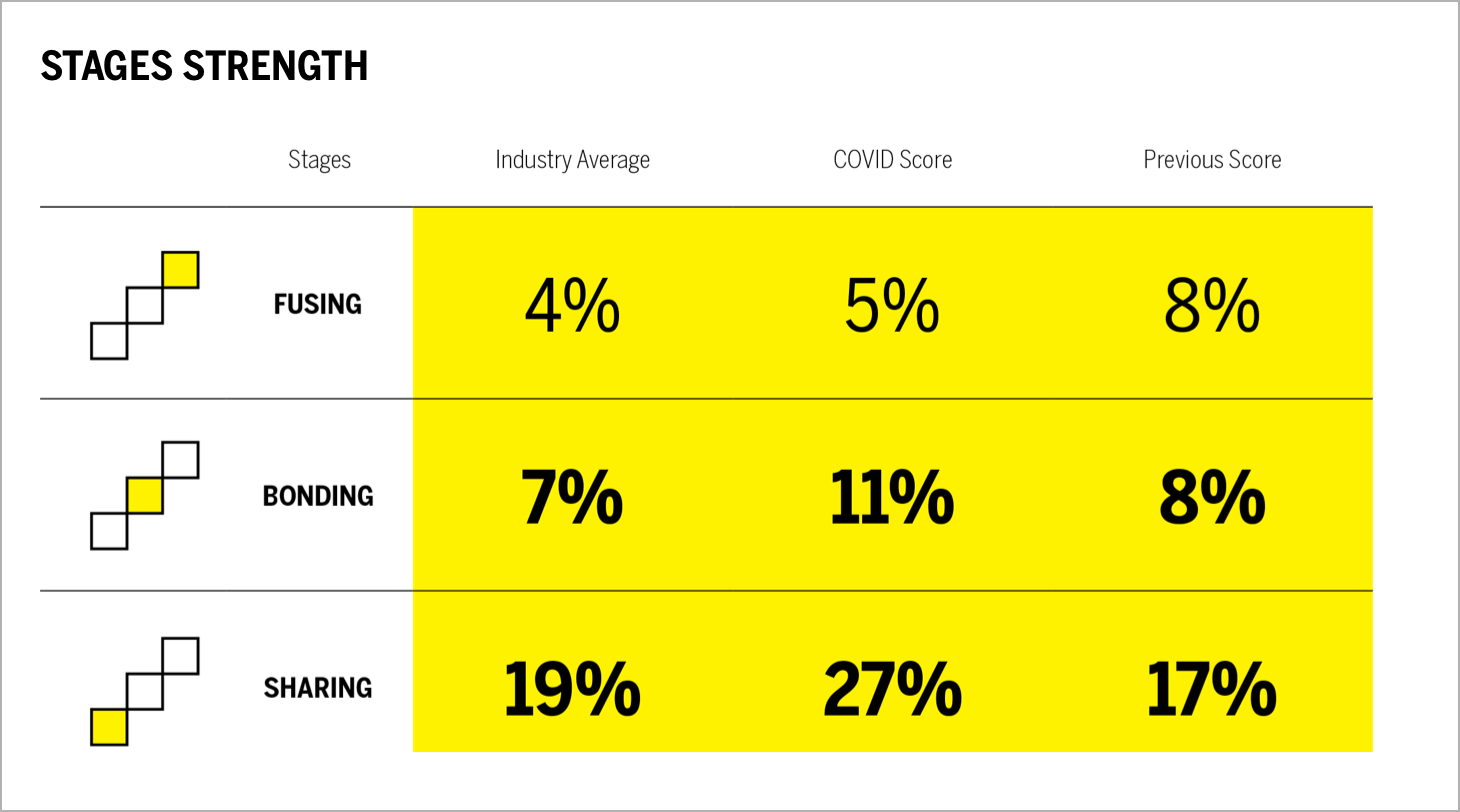

Automotive ranks first among all industries for the highest percentage of users in sharing and bonding, the earliest and middle stages of Brand Intimacy. In addition to being the top industry for these stages of Brand Intimacy compared to all 10 industries, automotive improved its own performance compared to last year in sharing and bonding. This suggests that, during the pandemic, more consumers have been emotionally connecting to automotive brands than in our previous study. In fact, the percentage of customers in some form of intimacy with automotive brands grew 32 percent.

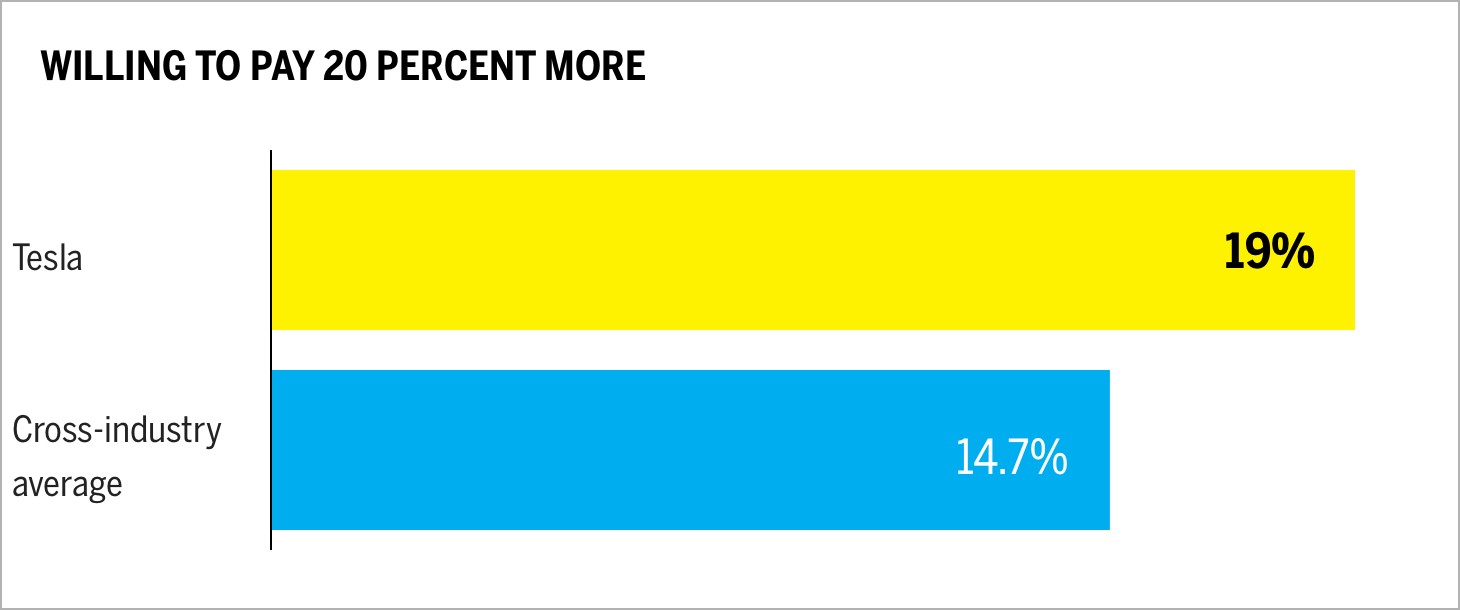

New entrant Tesla is the highest-ranked automotive brand that consumers are most willing to pay 20 percent more for. Tesla ranks 29 percent higher than the average of all brands in our study for this measure. This highlights that, when an automotive brand makes the right connection, there is opportunity for price resilience and a willingness to pay more.

This is the first year we have gathered data on the Tesla brand, and we see strong economic equity with users, likely stemming from post-purchase satisfaction and overall product performance. We will be studying how the brand fares as production numbers ramp up and the brand continues to build product with lower price points.

Toyota and Tesla are in many ways opposing brands, yet their strong performance is a good reminder that there are numerous paths to success.

When Brands Speak

In addition to our Brand Intimacy findings, which centers on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated during the pandemic. We’ve captured a language analysis from company websites and outbound social, focusing on six brands and encompassing 121,209 words.

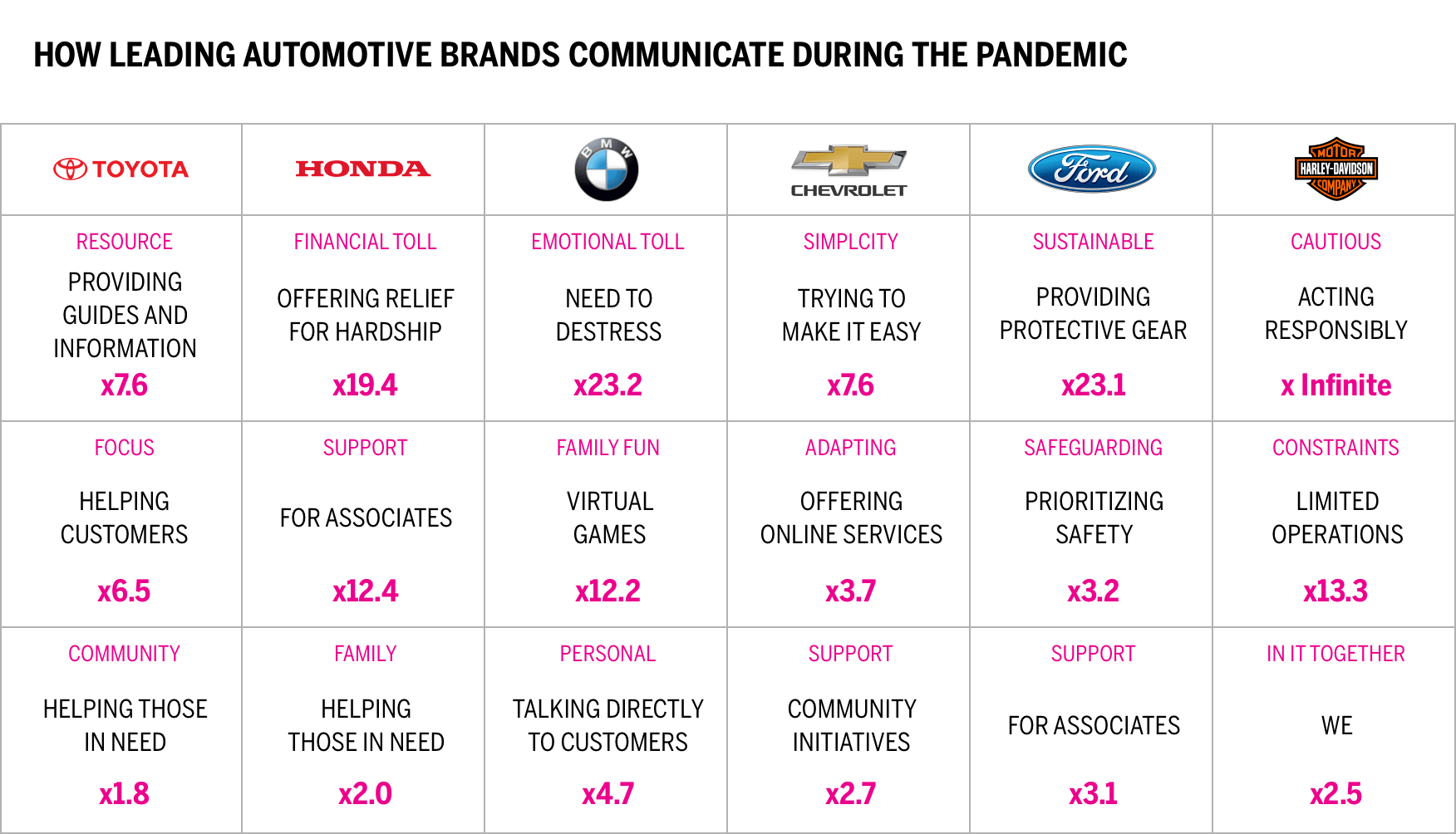

This chart presents a comparison of how six leading brands are communicating about COVID on their websites. We are able to see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g, Chevrolet speak 7.8 times more about making things easy).

Most of the automotive brands reviewed have chosen unique topics to emphasize, demonstrating different approaches to dealing with the pandemic in their marketing. Honda is the most sympathetic, addressing wanting to help those in need. BMW uses personal language, speaking directly to customers and focusing on keeping calm during the crisis and providing virtual games for children. Chevrolet is trying to be helpful, offering more services online and aiming to keep things simple and easy. Ford highlights the work it is doing creating sustainable personal protection equipment and their focusing safety for its employees and communities. Harley-Davidson acts as a friend, highlighting we are all in this together and the importance of acting responsibly. It also acknowledges current constraints in retail operations. Toyota is most aligned to Honda, focusing on ways it is helping those in need.

To demonstrate how brands have differed their communications, here are some examples of pandemic-related advertising from automotive brands. The messages align to the communications we saw on their websites and social; Toyota has a supportive spot, focused on being here for customers now and in all the better days ahead. Ford’s spot highlights its ingenuity and ability to make ventilators and respirators. Our future studies will measure which approach has reached people on a more emotional level.

It is important to keep in mind that a brand’s tactics or communications are just a small signal of a brand’s intent and do not directly indicate how a brand creates greater intimacy.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of brand intimacy and is also a key principle for navigating our challenging times. The pandemic and the economic aftershocks will require brands to navigate in new and more carefully considered ways.

Automotive continues to be a strong industry for building emotional connections and actually improving its overall performance compared to our previous study. The industry did see some atrophy: daily usage is down 21 percent and the percent of consumers who said they could not live without automotive brands has decreased 8 percent. As the United States seeks to return to “normal” life, the industry will need to rely on the strong bonds and goodwill it has established with customers to overcome supply chain and manufacturing issues. We know the automotive industry in the United States continues to be fragile. Vehicle sales in August declined close to 20 percent (YoY)3. Consumers may also identify with companies like Ford that have actively participated in pandemic programs with the government. Although sales for big ticket items have been affected, and more people are remote working/learning, these forces may be counteracted by migration out of cities to suburbs and rural areas.

We anticipate that although sales and profit may suffer in the short term, automotive brands will emerge in solid shape given their strong emotional bonds and the performance we see in our COVID study.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.