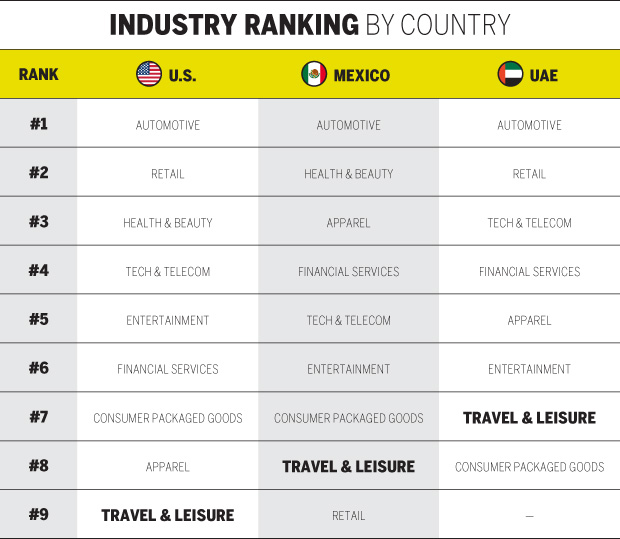

The travel & leisure industry produces the least-intimate brand relationships compared to eight other industries that were studied as part of the 2015 Brand Intimacy Report. It ranks ninth out of nine in the United States and ranked second to last in both the UAE and Mexico. What has happened to this category that, at one point, filled consumers with wonder and excitement? Why is it unsuccessful at building strong bonds and creating ultimate brand relationships?

The top travel brand in the U.S., British Airways, ranked 70th overall out of 200 brands. Compare this to the top automotive brand, BMW, which ranked second, or the top entertainment brand, Disney, which ranked sixth.

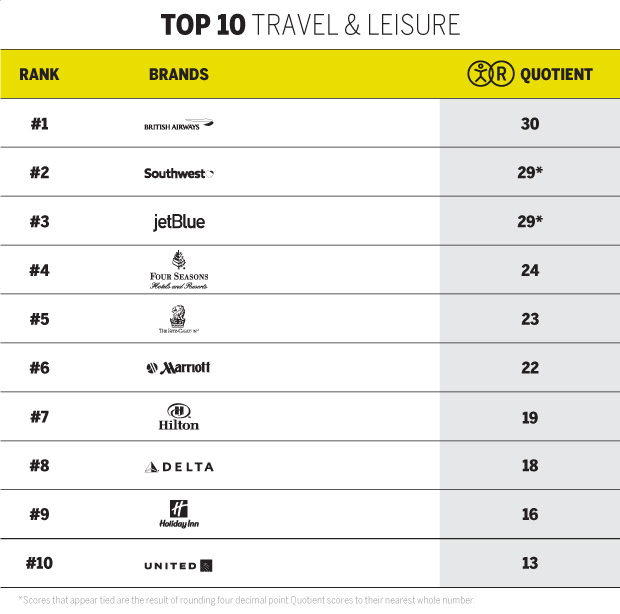

Travel & Leisure has an average Brand Intimacy Quotient of 21, approximately 12 points below the collective average across all our nine industries. The top three brands are airlines, with British Airways ranking first and Jet Blue in third, with the highest rate of fusing at 6 percent. American Airlines emerged in 11th place. Marriott is the most intimate brand for 45–64-year-olds, whereas Southwest is highest among 18–34-year olds.

While airline and hotel businesses are quite different, we hypothesize four potential reasons why this industry, despite its great potential to build intimacy, is falling short.

Disintermediation of Purchase

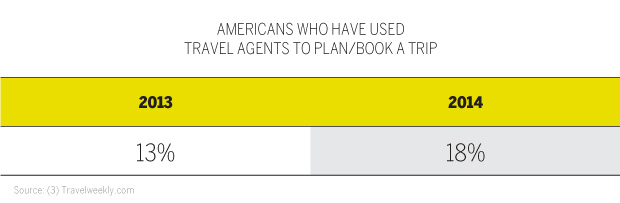

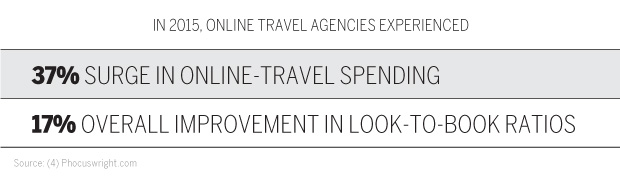

When shopping online for flights, 75 percent of consumers say they use online travel agencies, while 54 percent use the supplier website.1 More consumers are booking trips using both traditional travel agents and online travel aggregator sites, bypassing the direct airline and hotel brand purchase experience. While the brand-specific sites may be designed to engage a consumer while highlighting benefits, unique qualities of the brand, and specific promotions, travel agents and online sites neutralize the experience and commoditize the way brands are depicted and detailed. It has been found that people who booked their previous trip using a price comparison site are the least likely to be influenced by a company’s reputation.² This suggests that the way consumers are procuring and purchasing travel may be the root cause for the decreasing significance of brand relationships.

Disintermediation of Dialogue

The power of social media and online recommendations has clearly proliferated, and travel is one of the categories that generates the most dialogue. Sites like TripAdvisor are dedicated to showcasing the recommendations and opinions of everyday consumers; these are widely respected and act as a source of influence for travelers. In fact, in 2015, 37 percent of travel customers said that review websites had “very much influence” on their choices. This is up from 27 percent in 2014.5

One gets the sense that travel brands are cut out of the conversation that is taking place. The social channels for airlines and hotels tend to be seen as places for customer service complaints rather than credible sources of information and reviews which only adds to the frustration.

Diminished Usage and Changing Habits

Travel has changed. People are taking about 20 percent fewer leisure trips this year compared to 2014. More are taking just one trip, and fewer people are taking multiple trips.6 Trips with an air component have also dropped, from 39 percent in 2014 to 30 percent in 2015.7

Reasons for this decline might include financial considerations, a lack of free time to travel, a lack of interest in traveling, or simply personal obligations. For many, travel has always been a “special occasion” event, something to look forward to and carefully plan; however, today, people book more last-minute trips, and travel more spontaneously. This may make them, by necessity, less brand particular.

Additionally, the continued changes to airline loyalty programs, with their complex tiering and structures,8 makes them less relevant and often punitive (hence the creation of an entire ad campaign for Capital One with “no blackout dates”). The participation of airlines in alliance programs could diminish brand sensitivity and preference. The streamlining of business travel across enterprises also has resulted in a far less enjoyable experience with fewer perks and more bureaucracy for those who must travel for work.

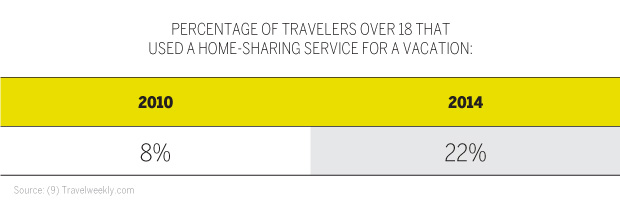

Another trend impacting the power of travel brands, particularly hotels, is homesharing. Whether driven by cost, availability or simply the desire to try something different, more travelers are using services like Airbnb and HomeAway. They may be seeking a more authentic experience, a more personal travel adventure, or just something unique.

Quality and Quantity

It is well known that air travel has become more complex with increased security demands and longer lines. In addition, Airline Quality Ratings (AQRs), which weigh on-time performance, mishandled baggage, involuntary denied boardings, and customer complaints, declined across the industry in 2014.10 For many consumers, travel is more of an ordeal than an adventure.

Quality continues to be a serious issue, especially considering that fulfillment, the Brand Intimacy archetype most aligned to performance, is what ranks highest with consumers in this category. We clearly see a disconnect between what people want and expect and what they receive. The personal touch for which this industry was once known seems to have all but disappeared. This can be evidenced in limiting the customer experience to the time spent on a flight or in the hotel room and reducing features to limit costs versus adding services to build greater intimacy and connection with the brand. Airlines are seen as nickel-and-diming customers for essentials—such as checked bags and snacks—that were, until recently, free. Hotels are similarly removing amenities including mini-bars and room service. Brands are also becoming more generic and losing differentiators that once contributed to a brand’s experience. Aiming to increase usage, they now have a mass-market appeal with little focus on any particular target market or travel segment.

Related to increasing usage, hotel operators specifically are proliferating the brands in their portfolios. The world’s ten largest hotel chains now offer a combined 113 brands at various price points, 31 of which didn’t exist a decade ago.11 It is hard to tell whom each brand is targeting as they seem less directed at any specific demographic (e.g., the budget traveler, the business traveler, the family vacationers) than in the past. In fact, this proliferation may be a result of hotels seeking more growth and signing more operating agreements rather than about identifying distinctive market segments. In the past, consumers might select a hotel they recognized, one where they felt comfortable and toward which they felt positive. Now, with more brands that fail to clearly distinguish themselves, it is harder to know what any given hotel is about, who it is meant for, and why—besides tactical reasons like location and price—anyone should select it. Therefore, it is difficult to create any real bonds with these brands because they all seem interchangeable with each other, or unfocused on their efforts. Airlines suffer a similar fate through mergers, which can result in the creation of an anonymous behemoth, and through the rise of low-budget carriers than can confuse travelers with regard to their role and their relationships with brands people already know and use.

Why Brand Intimacy?

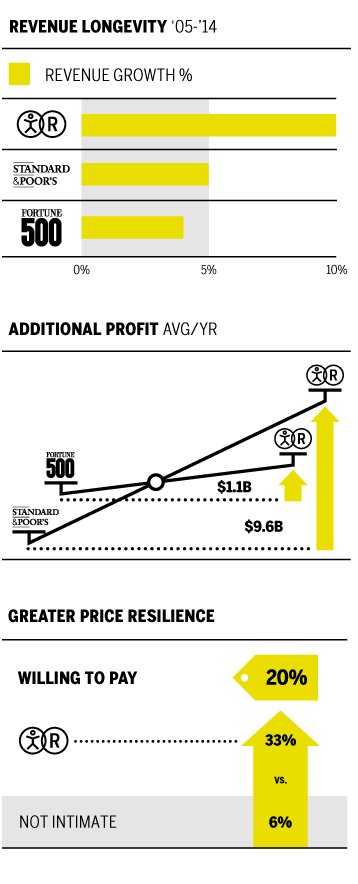

Why does a stronger Brand Intimacy Quotient matter? Intimate brands create significant business performance. The Top 10 Most Intimate Brands have outperformed established financial indices for both revenue and profit growth over the last ten years. In addition, those brands command a price premium, enjoying more financial resilience than non-intimate brands in the same industries.

Check out our Brand Intimacy Ranking Tool, built from 52,000 brand assessments.

Continued financial challenges and mergers from airlines will likely continue to have a negative impact on the bonds they form with consumers. Brand Intimacy is difficult both to achieve and to maintain. Like bonds between people, it requires sustained effort and continual nurturing.

We do firmly believe that this category, which is often about commemorating and celebrating, can regain its former luster. Technology today enables more targeted communications that can personalize the customer experience at key moments, and create the high-touch moments consumers have come to expect. Focusing on delighting the customer in big and small ways, demonstrating dialogue and inviting conversation, and finding meaningful ways to reward those consumers who have selected a particular brand can all help the category improve its ability to connect. Finding ways to create greater intimacy is the best strategy the category has to improve and grow.

To download the full Brand Intimacy 2015 Report or explore the Ranking Tool, please visit: mblm.com/brandintimacy/.

Read our detailed methodology here and review the sources cited in this article here.

To learn more about MBLM, click here.