Overview

- Despite the popularity of apps & social platforms, the industry ranks 12th out of 15 in our 2018 Brand Intimacy Study

- The industry has below-average rates of users in all three stages of Brand Intimacy

- Trust is a key barrier that keeps users from bonding with brands in this industry, especially around issues like privacy and data collection

- Although on average, brands in the smartphone ecosystem are more intimate than those that aren’t, apps are the lowest-performing category within the ecosystem

Apps & social platforms are showing no signs of slowing down when it comes to their popularity. Over 175 billion apps were downloaded in 2017, growing over 60 percent since 2015, and consumer spending on apps has more than doubled over the same time period to reach $86 billion in 2017.1 Social platforms are enormously popular as well; 81 percent of Americans had a social media profile in 2017, and the number of social media users globally is estimated to have reached 2.46 billion.2,3 Additionally, research shows that the average person will spend more than five years of their life on social media.4

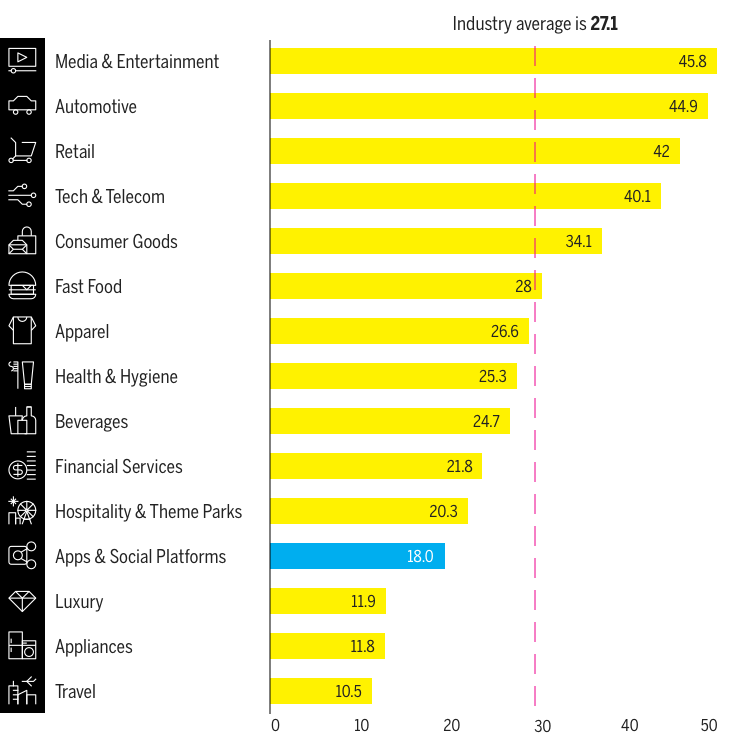

Brand Intimacy industry averages

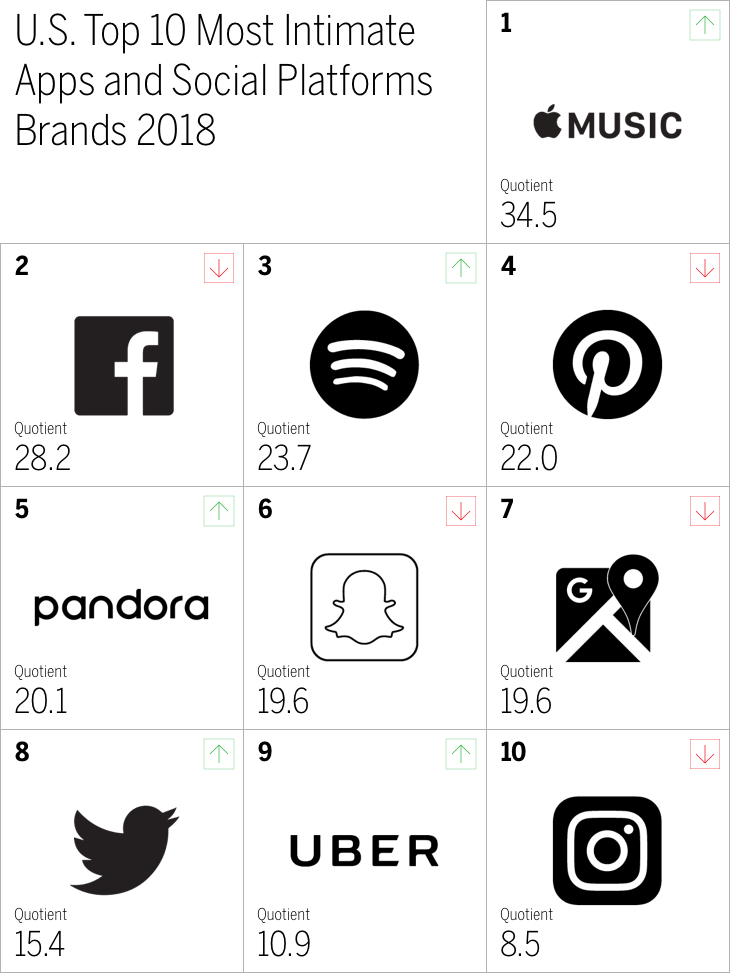

However, in our 2018 Brand Intimacy Study, the apps & social platforms industry continues to show an unimpressive performance. With an average Brand Intimacy Quotient of 18.0, apps & social platforms ranks 12th out of the 15 industries in our study.

This subpar performance is consistent with last year; the industry ranked 12th in 2017 as well. When an industry built on connection and social interaction shows persistent problems building connections with its users, it’s almost too ironic to ignore; we’ve already speculated as to why apps & social platforms struggle to build bonds in previous articles. But given the rapidly developing nature of the industry and recent events that have raised concerns among consumers, we wanted to revisit the landscape, trends and findings of apps & social platforms to understand why these brands are having difficulty creating strong emotional bonds. In this first installment of our two-part assessment of brands in this industry, we’ve identified the key barriers that inhibit apps & social platforms from building intimate brand relationships.

Three barriers to Brand Intimacy

1. Trust is a bust

The U.S. experienced a significant drop in the public’s trust of the media over the last year. The percentage of the general public that trusts the media dropped from 47 to 42 percent, and for the informed public, trust plummeted from 64 to 42 percent.5 The U.S. saw a steep decline in trust for social media and search engines specifically, dropping from 53 to 42 percent.6

This lack of trust is not without good reason; the rise of fake news had already made it easy to be skeptical about the information being shared on social platforms, and Facebook’s Cambridge Analytica controversy has raised new concerns about the collection and use of personal data. In a survey, 63 percent of Facebook users said they don’t trust the site to handle their personal data, and these sentiments aren’t uniquely directed at Facebook — 53 percent of users trust it about as much as they do other technologies (with 26 percent trusting it less).7

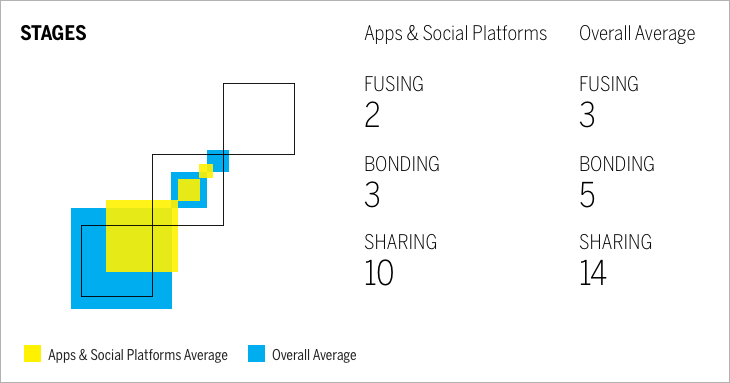

Stages of Brand Intimacy

These feelings of distrust are reflected in data from our 2018 Brand Intimacy Study. The apps & social platforms industry has a below-average percentage of users in the bonding stage, the middle stage of Brand Intimacy that is defined by an establishment of trust. A general lack of trust with the industry has made it difficult for users to bond with these brands, creating a bottleneck before the bonding stage that keeps them from forming stronger, more intimate bonds.

Luckily for this industry, trust may not be as much of an issue for younger consumers. We worked with communications infrastructure leader CommScope, which published global research on how Generation Z feels about and uses technology. A key finding of the study was that Gen Zers are not particularly concerned about sharing or having their private information shared. This is supported by data in our 2018 Brand Intimacy Study, where our youngest group of consumers (those aged 18-24) appear to be more trusting of apps & social platforms, with higher rates in the bonding stage than the average user (7 percent vs. 3 percent) as well as in fusing, the strongest stage of Brand Intimacy (4 percent vs. 2 percent). It will be interesting to see if these trends hold as consumers age and become more discerning about their data.

2. Selling influence has a price

Apps & social platforms have been popular media for advertisements for some time, but now, ad spending on these channels is increasing sharply. Social media ad spending increased by 61.5 percent between Q1 2016 and Q1 2017, and in-app ad spending is expected to nearly triple between 2016 and 2021 to a total of $201 billion.8,9 While surges in ad spending don’t guarantee a less satisfying user experience, today’s consumers generally dislike ads (especially the pop-up and auto-play ones). It seems likely that an unfavorable view of ads has affected users’ feelings of intimacy toward these brands.10

The general trend of companies and individuals increasingly using social media for marketing purposes manifests in more than just ads; there has also been a proliferation of bots and fake accounts, which wield valuable influence in social media conversations, but they also tend to be seen as false or an act of social manipulation by the users (and rightly so). Sentiments like these can easily feed social media’s trust problem. In addition, they threaten the core of what many people value about these popular platforms: their ability to connect users and foster conversation. If users start to fear that they are no longer connecting with real people through real conversations, much of the appeal of platforms like Twitter and Facebook becomes tainted. This would be especially threatening to an industry so strongly associated with the enhancement archetype, which characterizes a brand as making the user better, smarter “and more connected.

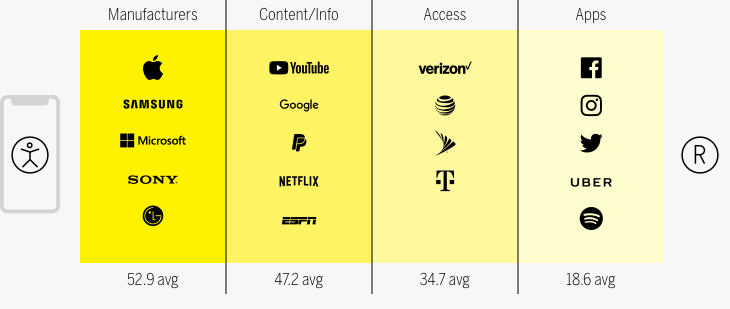

3. Getting the short end of the smartphone ecosystem

In an article last year, we noticed brands that thrive within the “smartphone ecosystem” (phone manufacturers, content/info and services, access and apps) have greater levels of Brand Intimacy on average than those outside of the ecosystem. We also observed that there is a hierarchy within this ecosystem, in which apps have the lowest average Brand Intimacy Quotient of the four categories we identified. We believe that this is due in part to users attributing the benefits of apps to the brands of their devices. Because apps and social platforms are often free and used predominantly on smartphones, they can easily be seen as utilities or extensions of the smartphone’s operating system that users feel entitled to.

The smartphone ecosystem

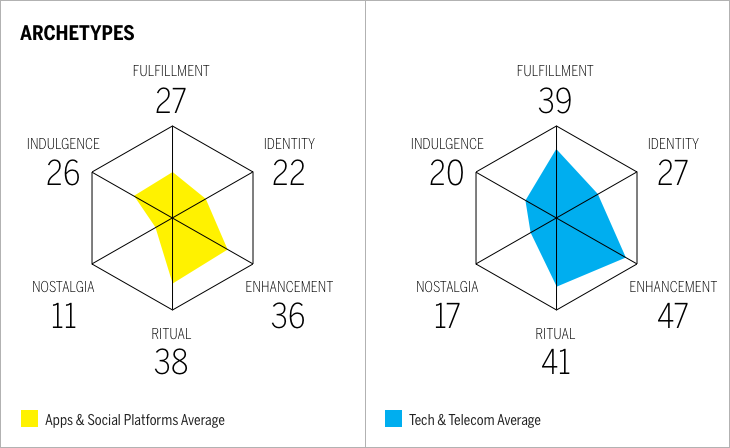

We can see in the data from the 2018 Brand Intimacy Study that technology & telecommunications, the industry that includes smartphone manufacturers, has a similar Brand Intimacy profile to that of apps & social platforms. These industries have the same two top archetypes: enhancement and ritual. Technology & telecommunications is the top industry for the enhancement archetype as well as the ritual archetype, which describes a brand as being ingrained into the user’s daily life. Apps & social platforms is second for both of these archetypes. These relatively similar archetype performances and profiles indicate that users form roughly the same kinds of bonds with the two categories, although the bonds formed with technology & telecommunications brands tend to be significantly stronger. This could indicate that while users value all brands in the smartphone ecosystem, the device’s brand stands out as the star of the show and the ultimate target of a user’s affection.

Brand Intimacy archetypes

Conclusion

While we can only expect the popularity of apps & social platforms to grow as internet and device access becomes more universal, there is a clear and present Brand Intimacy problem that seems to pervade the category, with massively adopted and frequently used brands falling noticeably short of the top brands in our study. Some of the barriers affecting the industry have been widely covered by the media in the last year (e.g., the general lack of trust, the increased need for privacy, the distrust of targeted ads, the threat of campaign interference), but apps & social platforms were struggling to build Brand Intimacy before these issues became so central to the conversation. What’s holding these brands back is bigger than a recent scandal; it’s rooted in the feelings users associate with them and how connections are formed between the user and brand.

It’s also important to keep in mind that these brands—although enormously popular—are still nascent. Maybe in ten years they’ll be viewed as more than just extensions of the smartphone ecosystem, but for now, they have yet to mature into the powerful brands you would expect to represent their massively adopted products and services. In the meantime, there are ways that these brands can overcome the challenges of their industry today.

In Part II of this article, we’ll share essential strategies that apps & social platforms can use to overcome barriers to Brand Intimacy and build stronger, more emotional bonds with their users.

Read our detailed methodology here, and review the sources cited in this article here.

To learn more about MBLM, click here.