Overview

- Media & entertainment is the #1 industry in the 2018 Brand Intimacy Study, surpassing last year’s leader, automotive

- Categorizing the industry’s brands into three groups (content producers, platforms/services, and devices) reveals that device brands are the most intimate on average

- Media & entertainment performs especially well among millennials, with an average Brand Intimacy Quotient of 50.3

- The industry also leads for percentage of users in the sharing and bonding stages of Brand Intimacy, and is #2 for the nostalgia and indulgence archetypes

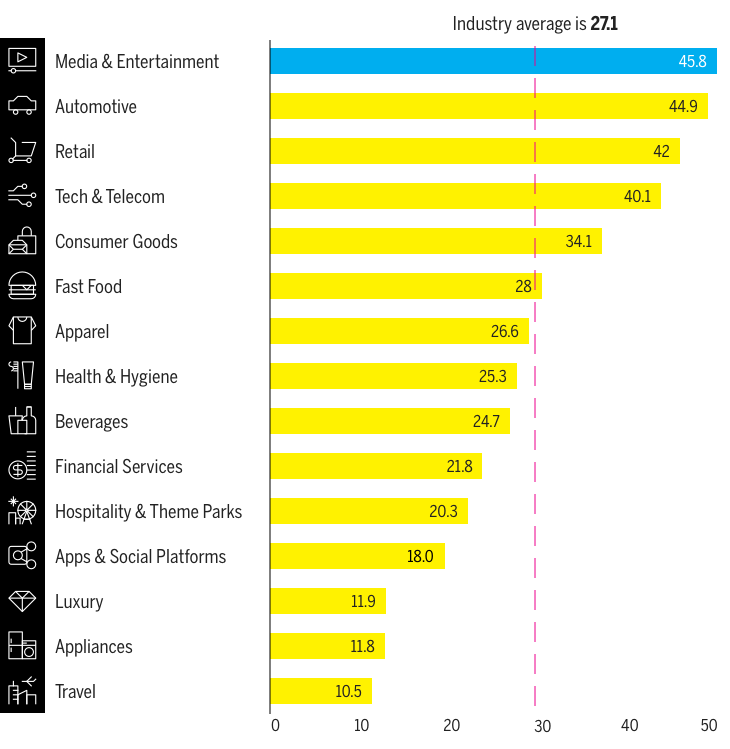

The media & entertainment industry is a rising favorite for consumers. The primary role of entertainment brands is, by definition, to entertain us, providing products, services, and experiences designed to delight and engage us. This year, the industry has done especially well at forming emotional connections with consumers. In our 2018 Brand Intimacy Study, media & entertainment was, for the first time, the top industry out of fifteen, surpassing last year’s leader, automotive, and towering over the across-industry average Brand Intimacy Quotient of 27.1 with a score of 45.8.

Brand Intimacy industry averages

In addition to having the best overall performance, media & entertainment also leads in its percentage of users in the sharing and bonding stages of Brand Intimacy, which are two out of three phases we measure in terms of the degree of emotional intensity between a person and a brand. These stages are characterized by consumers sharing knowledge with a brand (sharing) and forming an attachment to and establishing trust in a brand (bonding).

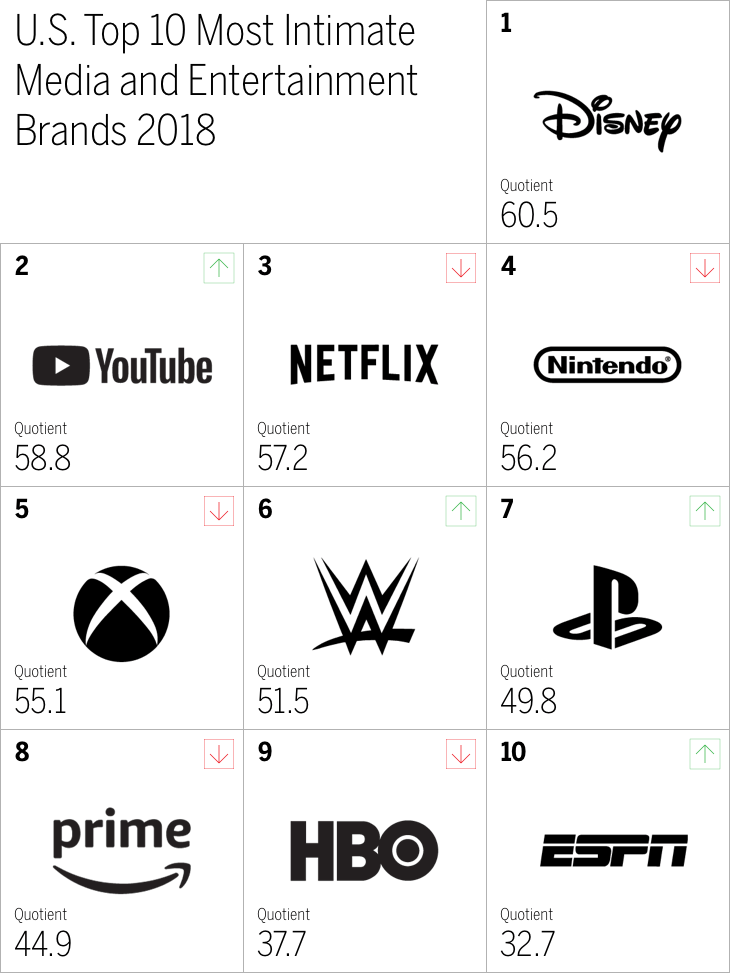

The top brands in the industry represent a diverse group, from Disney, a nearly century-old brand that generations of consumers have grown up with, to YouTube, a thirteen-year-old company that has become the latest obsession of young consumers. The top 10 list also includes TV entertainment brands (WWE, HBO, and ESPN), video game brands (Nintendo, Xbox, and PlayStation), and streaming services (Netflix and Amazon Prime) and represents a range of brands that serve different functions and appeal to different audiences. To deepen our understanding of how brands in this space have been so successful in building Brand Intimacy, we’ve created a framework that groups the top media & entertainment brands by their primary functions in the consumer’s content experience.

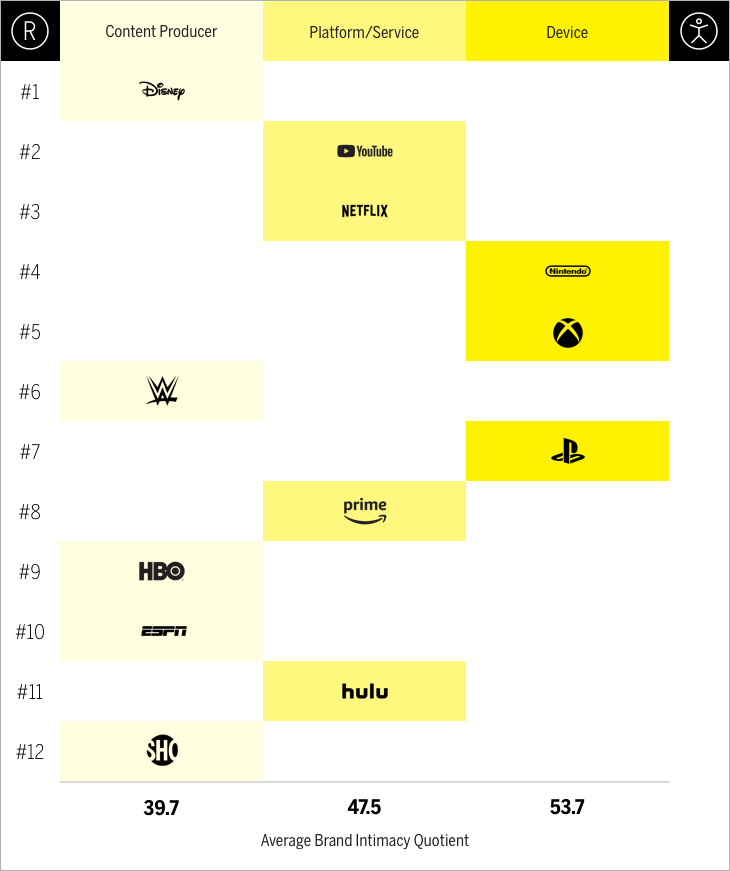

Media & entertainment brands by group

By categorizing the media & entertainment brands by their core businesses, we are able to uncover the intensity of consumer bonds. We’ve identified content producers (Disney, WWE, HBO, ESPN, and Showtime), platforms/services (YouTube, Netflix, Amazon Prime, and Hulu), and devices (Nintendo, Xbox, and PlayStation). Although it’s common these days for a media & entertainment business to be a hybrid with success across categories (e.g., Disney also has streaming apps, Netflix also creates original content, and Xbox also makes games as well as platforms for accessing games), we’ve categorized each brand by its primary business—the nature of how consumers generally perceive the brand.

Today, we will often experience a media & entertainment brand in tandem with other brands in the category across these three groups. For example, someone might watch a movie made by a content producer such as Disney through a streaming service such as Netflix on a device such as an Xbox. This way of consuming content and interacting with multiple media & entertainment brands in parallel makes the industry different from any other in our study. With this perspective in mind, we’ve conducted an analysis of the category, which has revealed some valuable insights into how consumers connect with these brands.

Millennials feel it the most

Media & entertainment is the most intimate industry overall, but what might be more impressive is its performance among millennials. The industry ranks #1 for millennials, with an average Brand Intimacy Quotient of 50.3, which is nearly seven points higher than the #2 industry, automotive (43.4). This gap is significant, especially when it is compared to the industry’s less-than-one-point lead overall. Millennials also show higher rates in the advanced stages of Brand Intimacy—that is, bonding (when an attachment is created and there is an establishment of trust between a person and a brand) and fusing (when a person and a brand are inexorably linked and co-identified with a brand). Further, millennials show higher scores than the overall total for all six Brand Intimacy archetypes, especially nostalgia.

All of this indicates that young consumers are forming more intimate bonds, deeper connections, and stronger associations with media & entertainment brands, positioning the industry for a highly intimate future. Perhaps the structure of the industry, with content producers, platforms and services, and devices existing symbiotically to allow for rich entertainment experiences, is especially effective on young users because millennials generally place high value on experiences, even more so than they do on physical products. Regardless, media & entertainment brands’ success among this age group only suggests they are more likely to maintain and expand their lead in the years to come.

Devices form the deepest bonds

Devices, on average, are the most intimate group among the three, followed by platforms/services and content producers. A possible explanation for this is the physical proximity that devices have to the user. Interacting with a physical product can make for a rich brand experience, and as we’ve seen in other industries, it can also define an experience that involves multiple brands. In a recent article, we examined how consumers interact with brands in the Smartphone Ecosystem, which consists of device manufacturers, content/information and services, access providers, and apps, and we found that users tend to attribute the benefits of apps to the devices they live on. A similar effect could be occurring in media & entertainment, causing users to view platforms/services and content as extensions of the devices used to access them.

Although there are some standout brands in the other groups (notably Disney, YouTube, and Netflix), the devices’ higher performance on average indicates that users are forming more emotional connections with the brands they physically interact with to access content. Looking outside of this industry, we can see other examples of highly intimate brands that are predominantly known for hardware/devices, such as Apple, Samsung, LG, and Microsoft. Like these brands, Nintendo, Xbox, and PlayStation all thrive by facilitating the media & entertainment experience.

A palette of positive associations

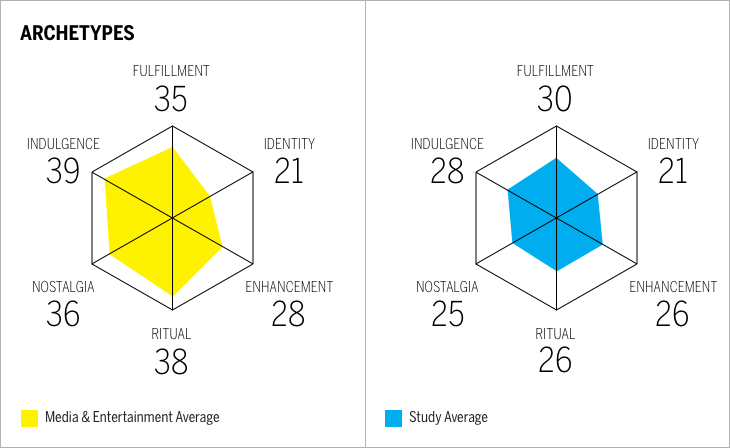

Having a variety of brands serving a variety of functions in one industry means that consumers will likely form a range of associations with the category. This versatility is reflected in media & entertainment’s strong associations with four of the six Brand Intimacy archetypes, which are patterns or markers that identify the character and nature of intimate brand relationships. Of all fifteen industries, media & entertainment is #2 for nostalgia (focusing on memories of the past and the warm feelings associated with them), #2 for indulgence (revolving around moments of pampering and gratification), #3 for ritual (ingraining a brand into a user’s daily actions to become vitally important to daily existence), and #4 for fulfillment (exceeding expectations and delivering superior service).

Brand Intimacy archetypes

By breaking down the industry by content producers, platforms/service, and devices, we can see where this broad range of associations comes from. Each group has its own set of strong markers: content producers perform well in nostalgia; platforms/services lead in ritual and fulfillment; and devices are strong in nostalgia, indulgence, fulfillment, and ritual. Being linked with a range of archetypes can drive a rich, well-rounded experience for consumers who are interacting with multiple brands at the same time. Just by watching TV, you can be nostalgic about the content you’re seeing, have a sense of ritual from using your go-to streaming service, and indulge in the experience your favorite device is providing. In this way, an entertainment experience can represent a spectrum of positive associations that drive users to form deeper connections with brands.

Indulgence plus ritual: a strong recipe for greater intimacy

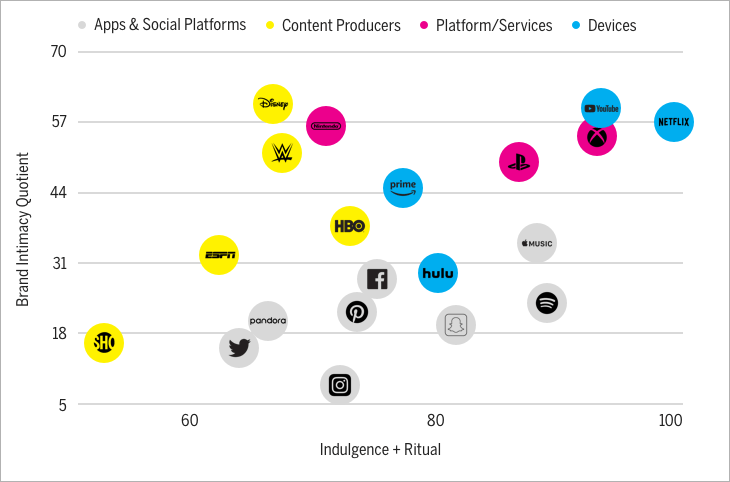

Although a range of strong archetype associations has made media & entertainment a highly intimate industry, it appears that in this industry, select archetypes are more effective than others. It should come as no surprise that the industry’s two strongest archetypes are indulgence and ritual; media & entertainment is about having a way to consistently and reliably satisfy yourself with content you enjoy. When the two archetypes are combined, they seem to serve as a formula for greater levels of Brand Intimacy.

Indulgence plus ritual vs. Brand Intimacy Quotient

The chart above shows the combined archetype scores of indulgence and ritual plotted against each brand’s Brand Intimacy Quotient. Certain apps & social platforms have been included here because they can also be considered content platforms/services and they maintain a similar relationship with these archetypes and overall Brand Intimacy. The chart indicates that the media & entertainment brands that are capable of providing both an indulgent experience and a sense of ritual are often the ones that outperform their competitors. Generally, platforms and services have high ritual scores and moderately high indulgence scores, whereas the reverse is true for devices, and although content producers have moderately high indulgence scores, they struggle to build associations with the ritual archetype, which could explain why they have lower levels of Brand Intimacy than the other groups on average.

Conclusion

Media & entertainment is home to highly intimate, standout brands, such as Disney, an international icon, and YouTube and Netflix, two of the fastest rising intimate brands, but the intimacy of this industry goes beyond the outliers at the top. U.S. consumers are connecting deeply with the brands that help them enjoy themselves, whether it’s creating meaningful content, providing a service that makes it easy to consume that content, or building a device that powers that service. The brands in this industry mean a great deal to us because they help us escape reality in one way or another and inspire strong feelings of safety, comfort, and relief. Consumers have become attached to the content that satisfies them on a daily basis and have built relationships with the brands that make those experiences possible. The main reason for the success of media & entertainment brands is that they are simply becoming better at what they do, and a large part of that overall improvement comes from content producers, platforms and services, and devices being able to work seamlessly together to provide rich entertainment experiences.

Read our detailed methodology here.

To learn more about MBLM, click here.