Overview

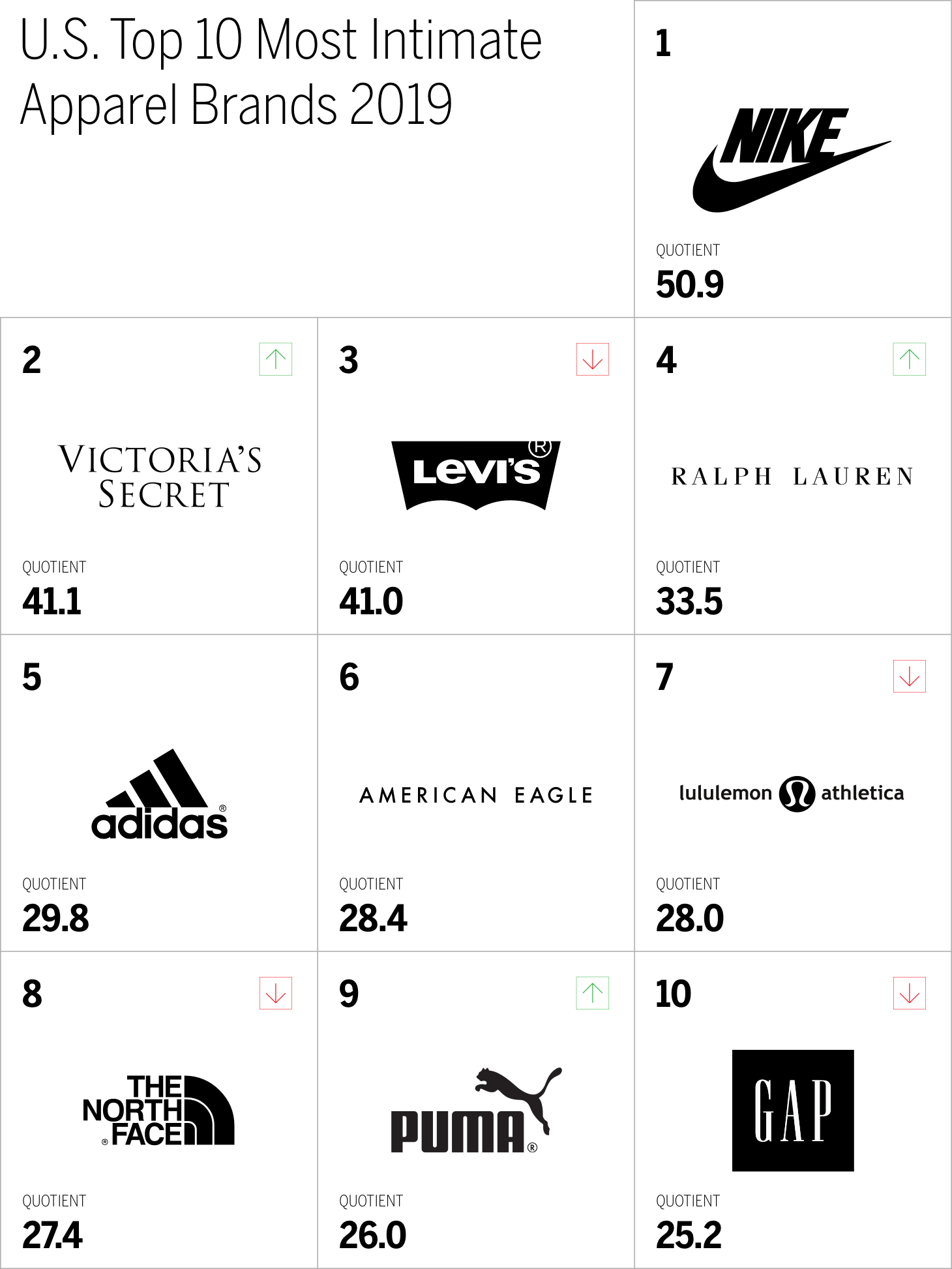

- Nike ranks first in Apparel and 15th overall

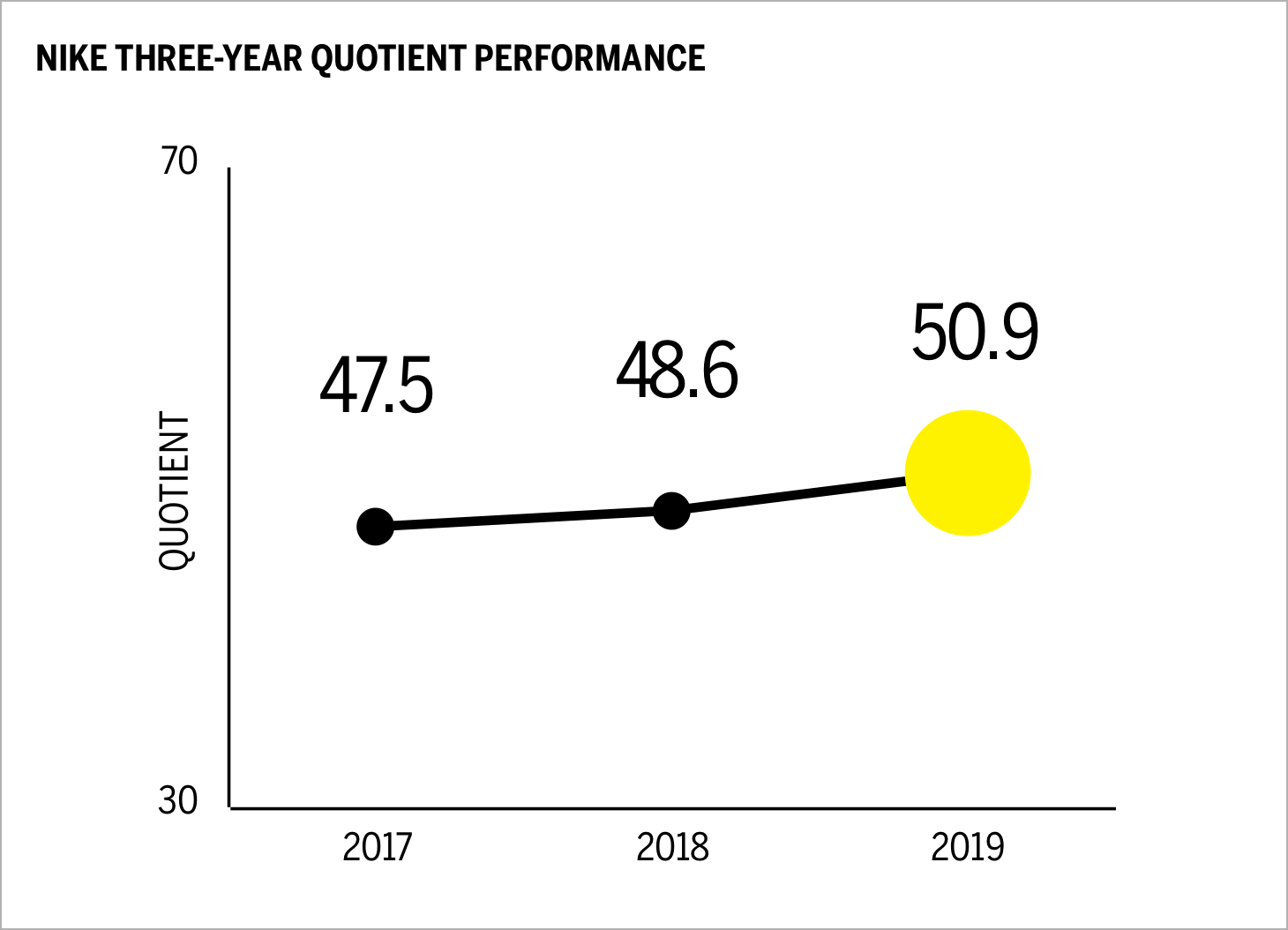

- Nike has improved its Brand Intimacy performance for the third year in a row

- The Apparel category ranks seventh of 15 industries surveyed

- Nineteen percent of Nike users say they can’t live without the brand

Introduction

Nike is the top apparel brand in 2019. It also ranks 15th overall, up from 20th in 2018. This year the category experienced considerable movement, with many brands like Levi’s, Lululemon, and The North Face dropping in the rankings. Despite this fluctuation, Nike has improved its performance year over year. The business continues to thrive as well. Nike reported revenue of $10.2 billion in Q4 2019, marking a growth of 4 percent over $9.8 billion in Q4 2018. For the full year, revenue came in at $39.1 billion in FY 2019, which was 7.5 percent higher on a year-on-year basis.1 Additionally, Nike’s women’s business has also grown by double digits in 2019.2

A Strong Showing

A look at Nike’s Brand Intimacy performance in detail reveals some interesting insights.

The brand’s Quotient score has consistently risen, indicating that the brand is continuously improving its effort to build strong emotional bonds with customers. Although these increases are small, they are steady, which is positive progress.

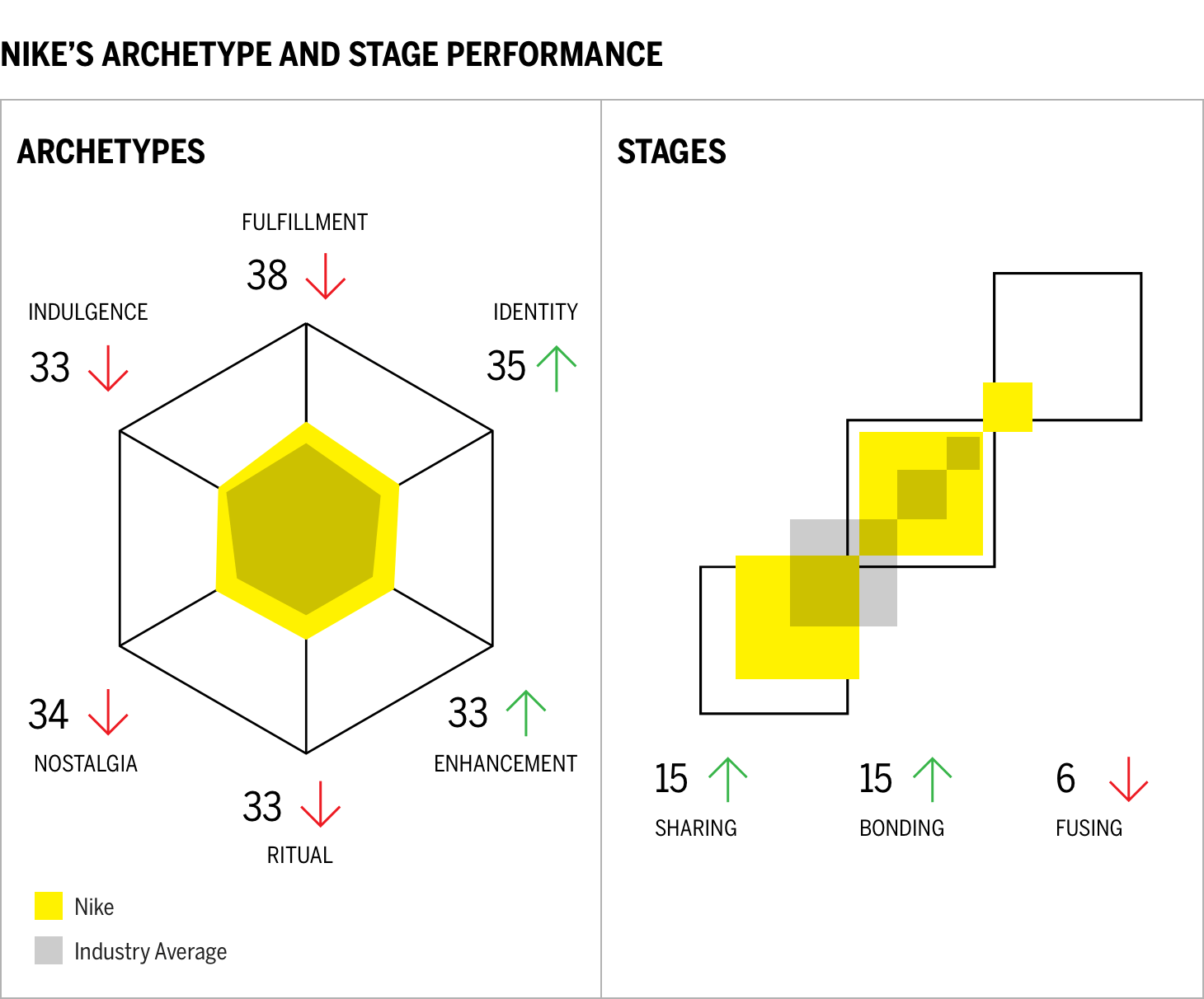

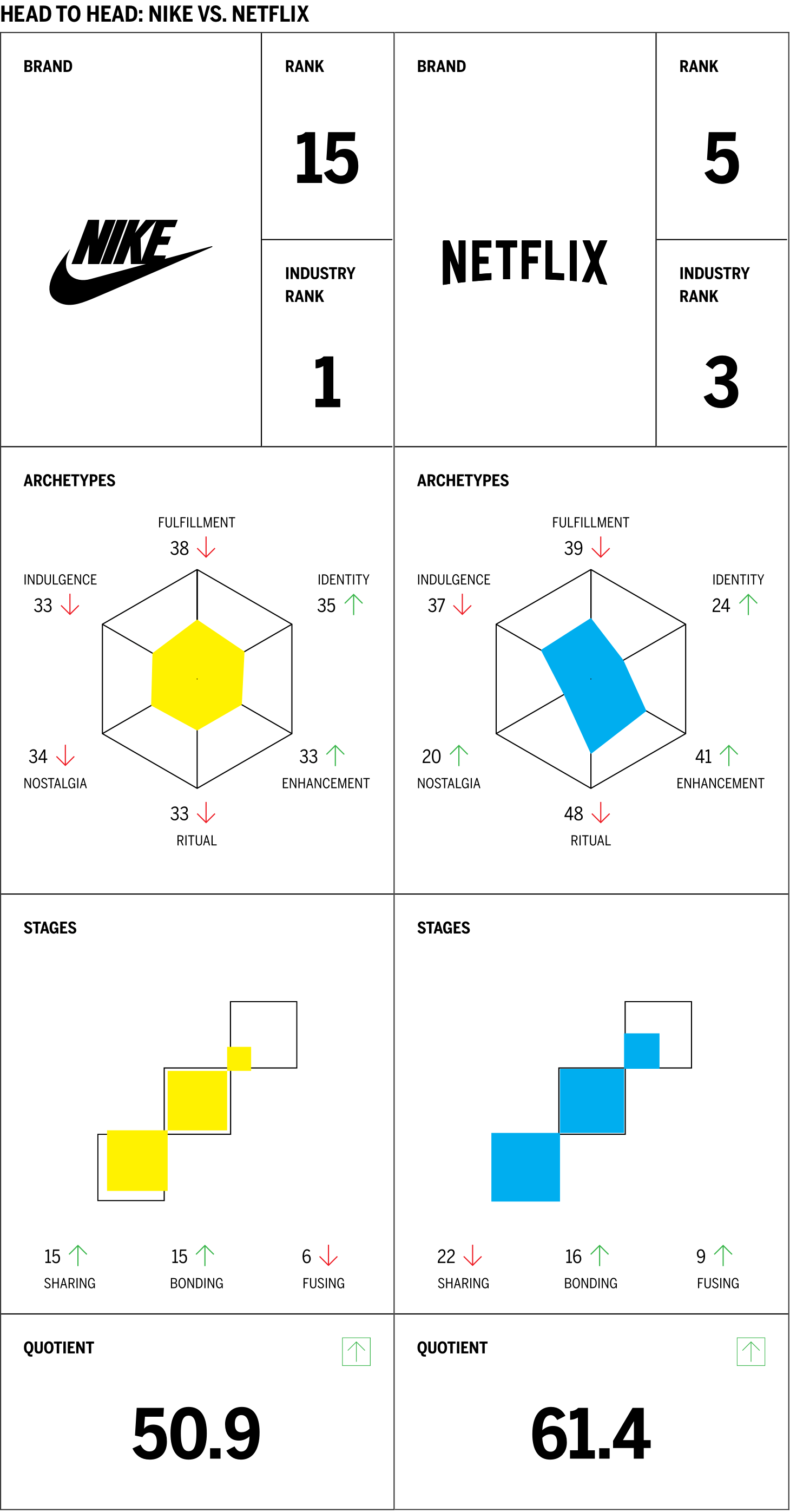

Looking at Nike’s archetypes (six patterns among intimate brands that are consistently present in part or in whole and that research has identified and later validated) is more of a mixed bag. This year, the brand showed decline in its associations with several archetypes. These include the dominant category archetype of fulfillment (exceeds expectations; delivering superior service, quality, and efficacy), ritual (a brand that is part of a daily routine), nostalgia, (a brand associated with warm memories of the past), and indulgence (creates a close relationship centered on moments of pampering and gratification that can be occasional or frequent). Note that although the brand has declined in fulfillment, it is still the #1 ranked brand in the category for this association.

Interestingly, the brand showed improvement related to identity (reflect an aspirational image or admired values and beliefs that resonate deeply), suggesting that the brand’s continued commitment to brand building initiatives is resonating. Nike has been known to take controversial stands, such as its relationship with Colin Kaepernick, and its customers seem to respect and align with these stands. Additionally, Nike’s performance in enhancement (a brand that makes me smarter and more connected) has risen. This is also interesting and may relate to Nike’s big focus on mobile as a useful way to shop rather than just a conversion tool. So far, this has led to new store concepts based on mobile features, including the members-only Nike Live store and the House of Innovation flagships, as well as the retailer’s shoe sizing technology, Nike Fit, which scans shoppers’ feet to provide them with the ideal fit in each style of shoe Nike carries.

Brand Intimacy stages measure the intensity of intimate relationships. Nike improved in sharing and bonding, the first two stages of intimacy, and declined in fusing, the ultimate stage. This demonstrates that the brand can bring new consumers into the fold and cultivate relationships with them. This year, Nike increased its percentage of intimate customers from 33 to 37 percent.

Millennial Love and Willingness to Pay More

In looking at the demographic with whom the brand most resonates, we see a diverse range of audiences. Nike ranks #1 with women, men, millennials, those in the 45–64 age range, and people with incomes between $35,000 and $100,000. Nike also significantly improved its emotional bonds with millennials: in 2018, the Brand Intimacy Quotient for millennials was 50.6; in 2019, it climbed to 65.8.

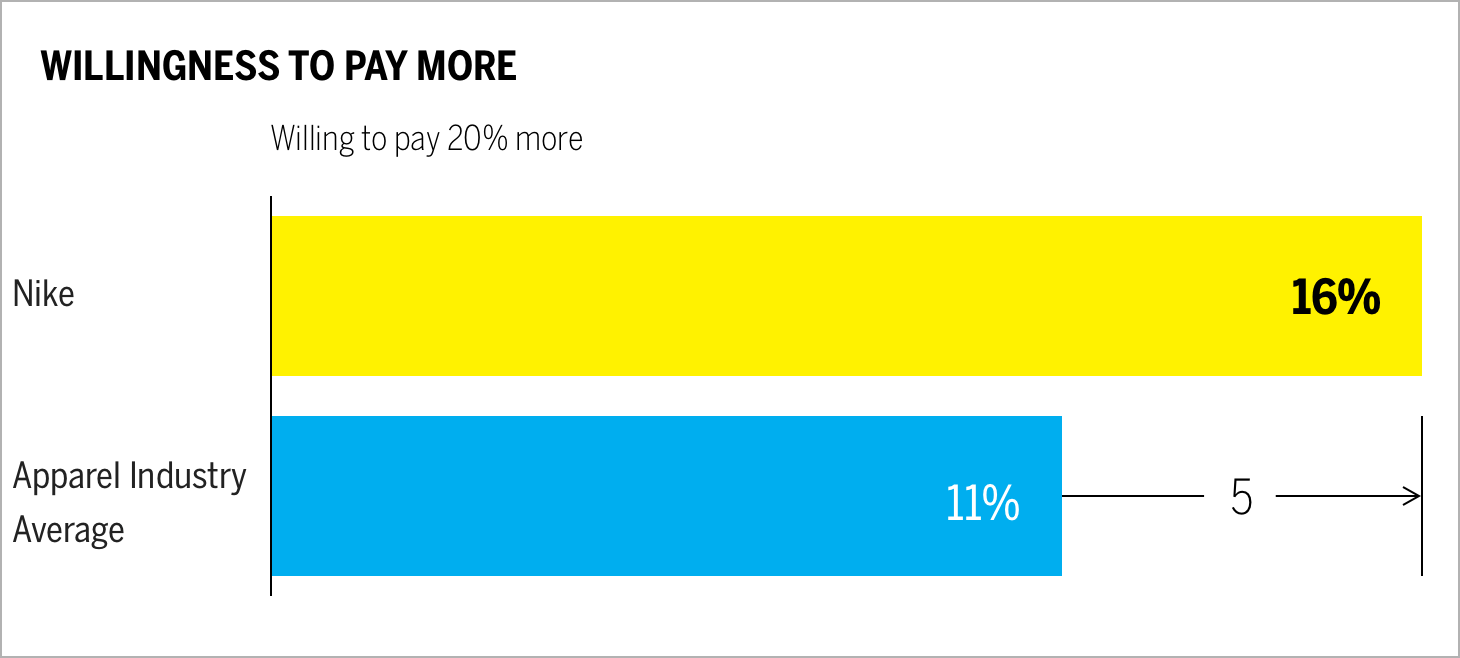

In addition to its innovative products, Nike’s mobile focus, brand campaigns, and continued support of social causes (issues of race, gender, and sexual orientation) are likely contributing to its appeal with younger consumers. What this suggests is that the brand has wide appeal and should continue to increase its funnel of users who can become intimate with the brand. This is important because we have proven that brand intimacy and business performance are correlated. Further, we can see that among intimate users, the brand has greatly improved its price resilience metrics. This means that 16 percent of Nike’s users said they would be willing to pay 20 percent more for the brand’s products, up from 9 percent in 2018 and higher than the industry average at 11 percent.

Believe in Something

Among Nike users, 58 percent stated that they felt an immediate emotional connection with the brand. Nike is clearly successful at building bonds with its consumers, bringing new consumers into the fold, and leveraging technology to deepen customer relationships. Nike also continues to champion causes that result in strong performance with the identity archetype and among millennials. Given the brand’s size, scale and spend, we wondered why it hasn’t cracked the top 10 yet. In comparing Nike to a top 10 brand, Netflix (also strong with millennials), what emerges is the power of stages.

Netflix has more users in each of the three Brand Intimacy stages and 50 percent more consumers in fusing. This means that while 37 percent of Nike’s users are in some form of intimacy with the brand, Netflix has 47 percent. To move to the top tier, Nike will have to further increase its audience base and continue to deepen the bonds of existing customers. Given the brand’s broad constituents and its firm commitment to its brand, we expect that this is likely to happen; however, given Nike’s incremental intimacy growth, it may take a few years.

Read our detailed methodology here, and review the sources cited in this article here.

Check out our annual study and rankings of intimate brands. Visit our most recent rankings of intimate famous figures—BFF. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Register for our webinar to learn patterns, insights, and findings from the Apparel industry here.