Overview:

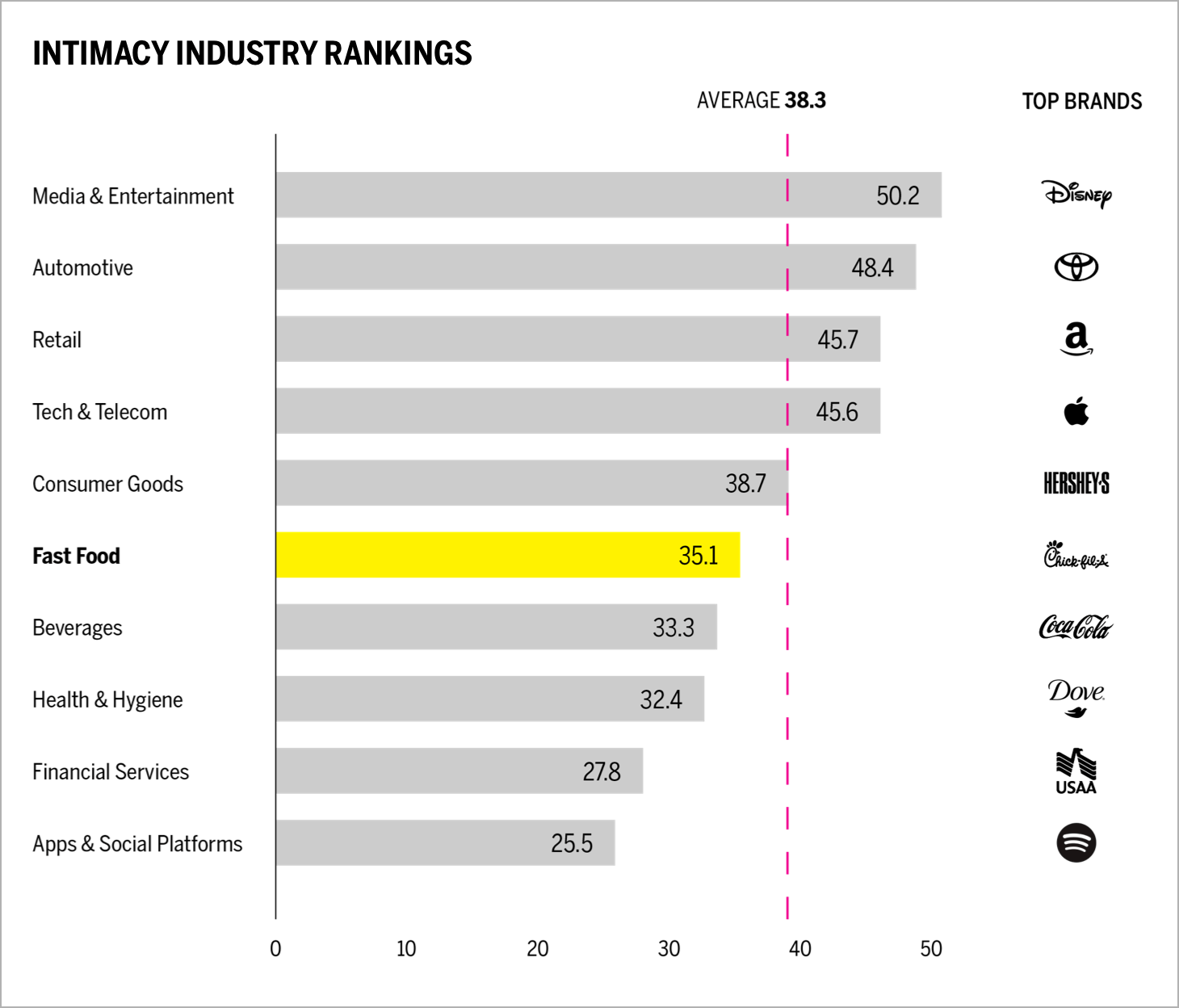

- The fast food industry ranks sixth in our 2021 Brand Intimacy COVID Study. To review our new study, click here.

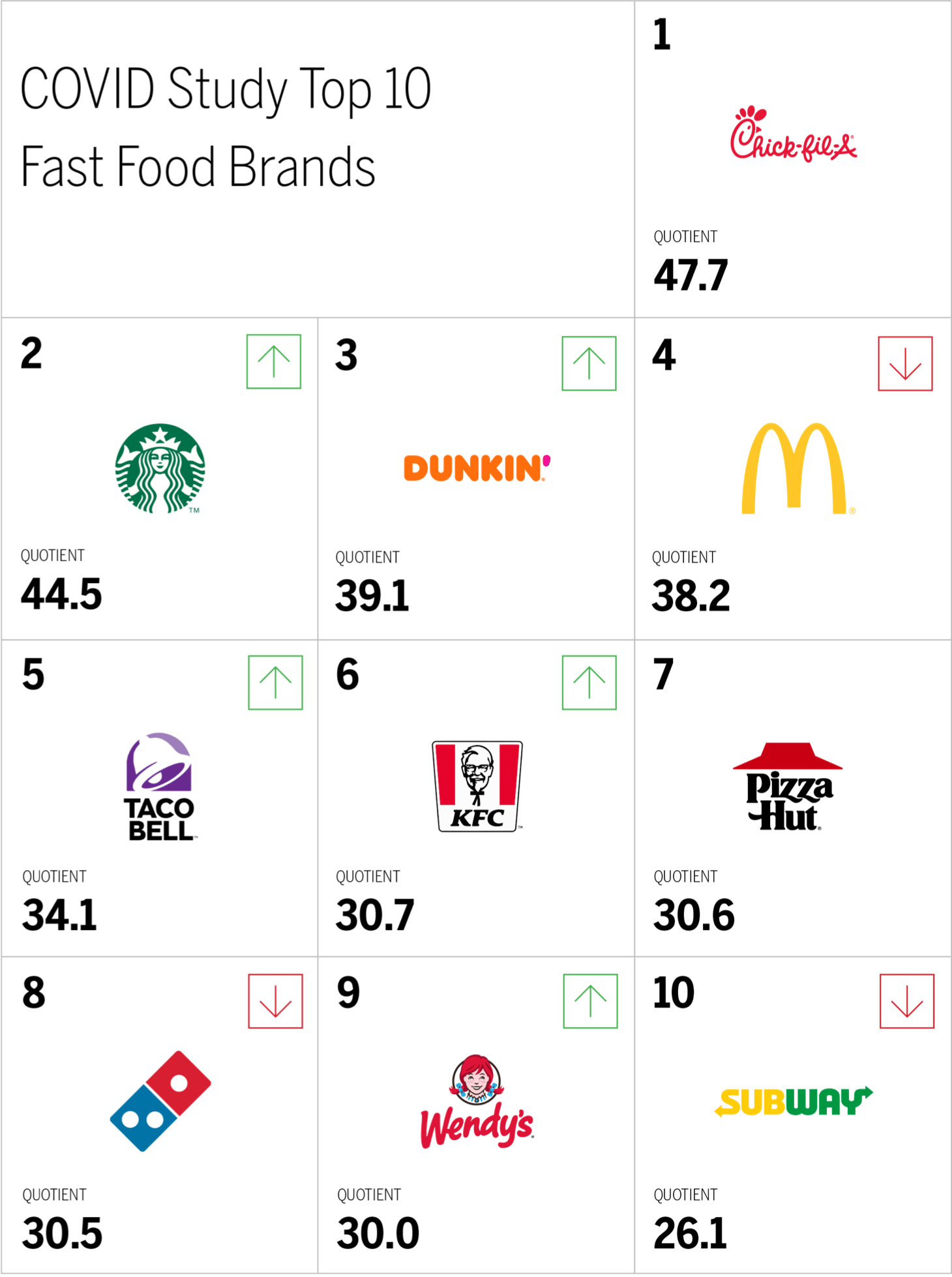

- Chick-fil-A is the top-ranking fast food brand. See Chick-fil-A’s brand profile here.

- Starbucks moves up one spot to rank second. You can view its brand profile here.

Introduction

We shared our 2020 Brand Intimacy COVID Study last year as the pandemic was affecting all our lives. We were interested in seeing its impact on the brands we all use and love. We are now sharing a follow-up study, fielded a year later when things were improving and businesses began reopening. Lately, with the rise of the Delta variant, we see the extended presence of COVID in our lives. As the world continues to deal with the pandemic, and businesses and their brands face persistent challenges, we are sharing new insights on how brands can focus, enhance, or optimize for the marketplace that we are all eager to see return to normal.

The findings from our follow-up Brand Intimacy COVID Study, conducted with 3,000 consumers in summer 2021, demonstrate how leading brand and consumer behavior has changed since a year ago.

Brand Intimacy Performance Today

The fast food industry has an average Brand Intimacy Quotient of 35.1, which is below the cross-industry average of 38.3. The industry increased its average Quotient Score by 3 percent and 32 percent of users have an increased emotional connection with fast food brands since our 2020 COVID study.

This is also reflected in market share gains. Whereas full service restaurants have had a harder time during the pandemic, fast food and quick service chains have been able to capitalize on mobile ordering and digital drive-through lanes. For the past 12 months, fast food chains dominated the restaurant market, taking in 70.2 percent of dollars spent eating out and 82.9 percent of all restaurant traffic.1

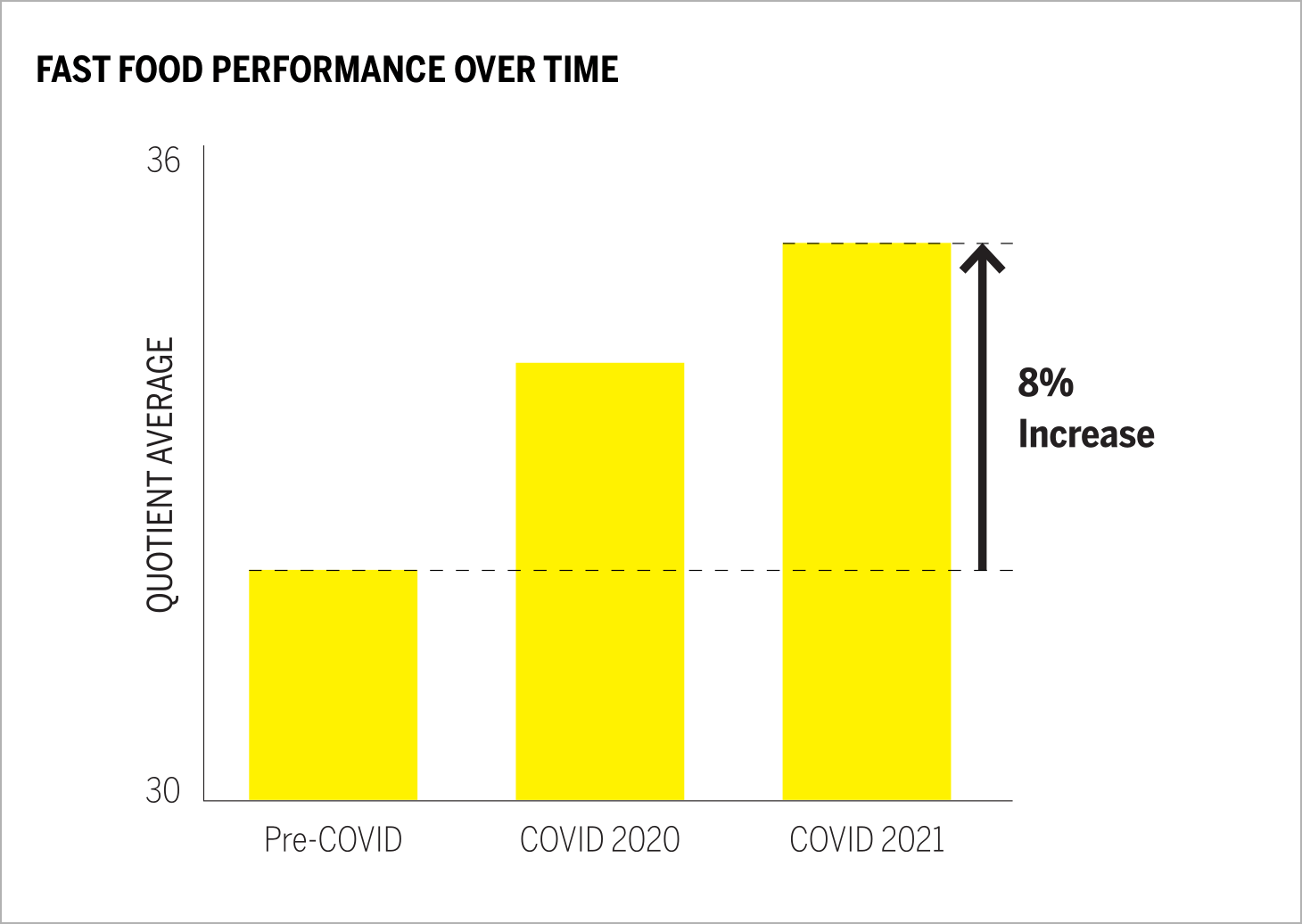

The fast food category has had to weather significant supply chain challenges over the course of the pandemic, but Brand Intimacy performance for the industry has increased by 8 percent on average since before the pandemic, mirroring the business opportunities that brands have capitalized on. Despite the hardships imposed by COVID on people and businesses, this period has actually drawn consumers closer to brands and created stronger emotional relationships.

Chick-fil-A has retained the first-place position it held in our 2020 COVID study. Starbucks has moved up to second place and Dunkin’ and Taco Bell have improved their performance, whereas McDonalds, Subway, and Dominos declined. The fast food industry performs better with men than women and better with younger consumers than older ones.

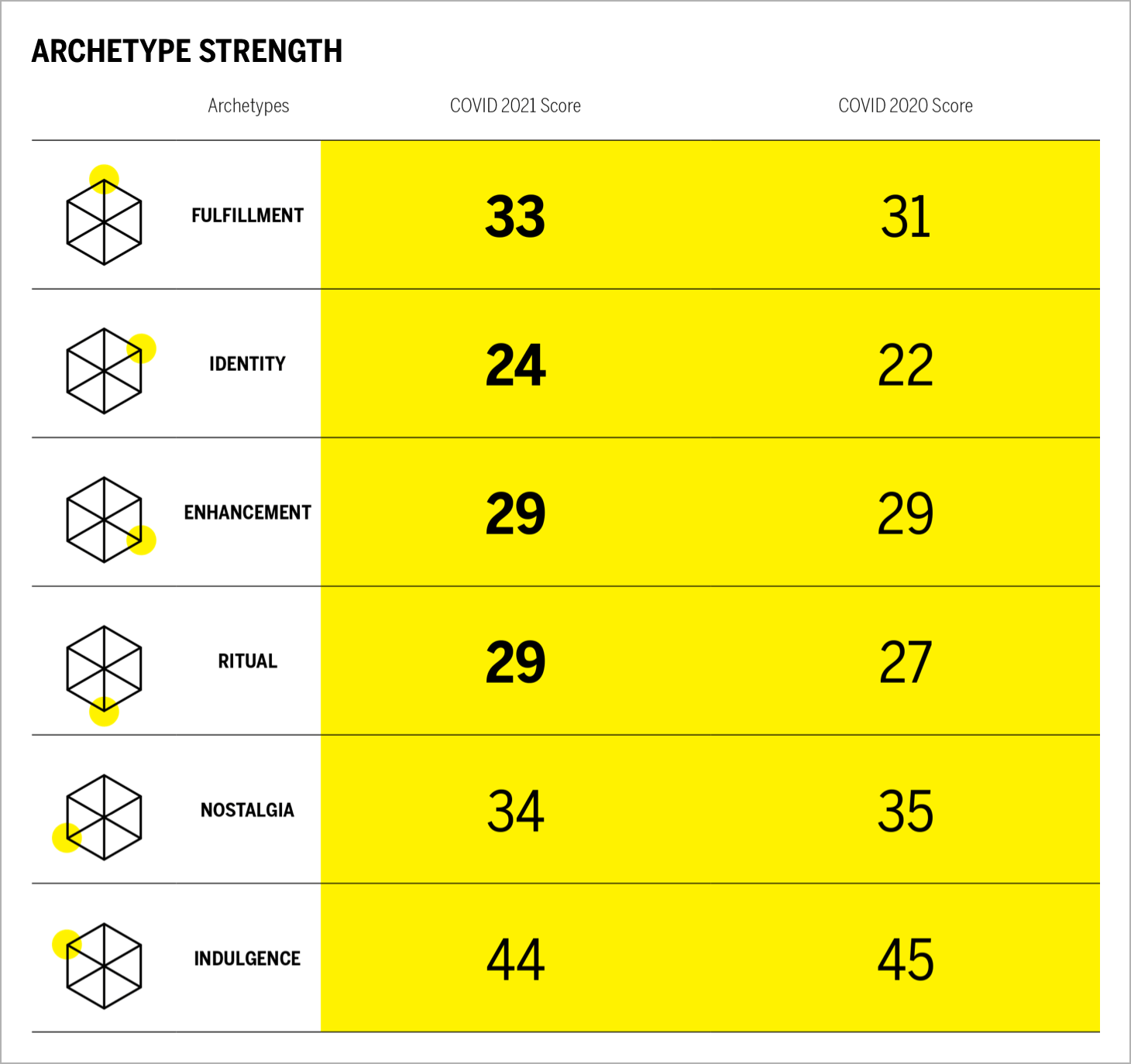

The fast food industry has improved its performance across four out of six archetypes. The industry is #1 out of all categories for indulgence, #2 for ritual, and #4 for nostalgia. These rich associations help brands in this category connect and build strong bonds with consumers.

In addition, the industry has also improved its performance in the most advanced stage of Brand Intimacy, fusing. The percent of users fusing with fast foods brands increased 14 percent since our 2020 COVID study. This demonstrates that more customers are coidentifying with these brands and establishing ultimate brand relationships.

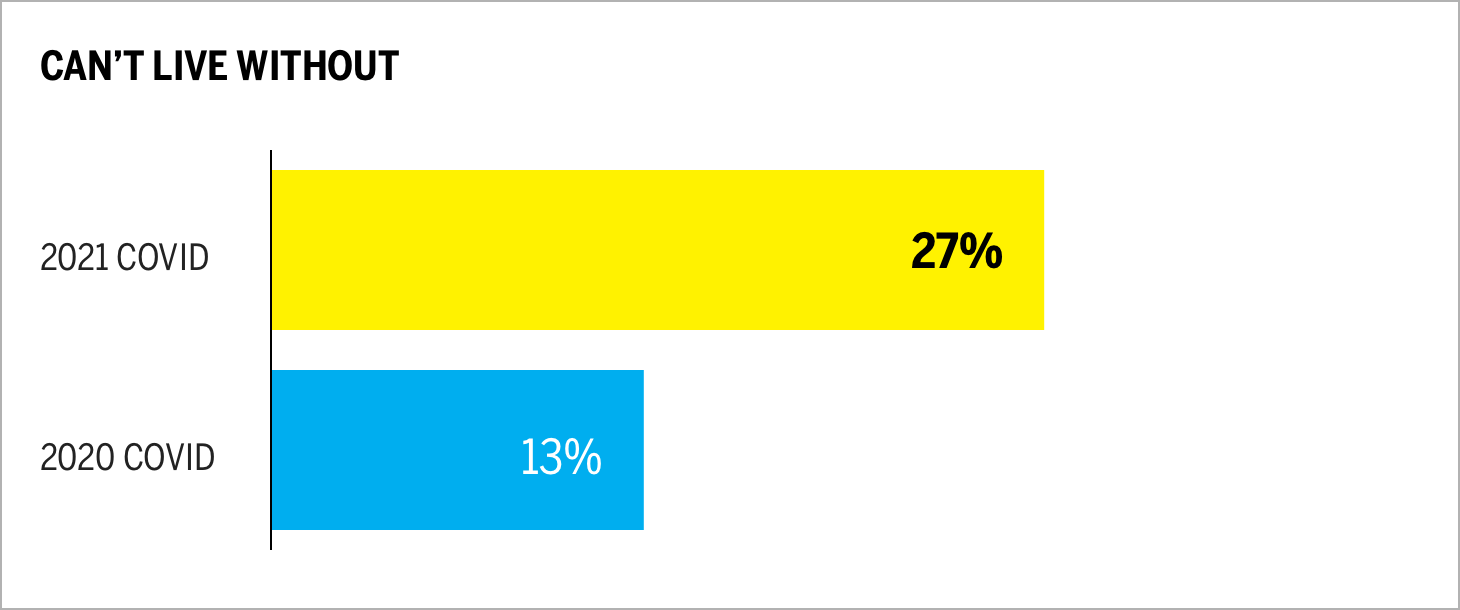

Can’t live without (a measure based on a ten-point scale that determines how essential a brand is to our lives) has risen dramatically since our 2020 study, increasing 102 percent, further highlighting consumer reliance on fast food brands.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated since the pandemic started last year. What has changed in their messaging? We have captured a language analysis from company websites and inbound social media, focusing on five brands and encompassing 1,372.300 words.

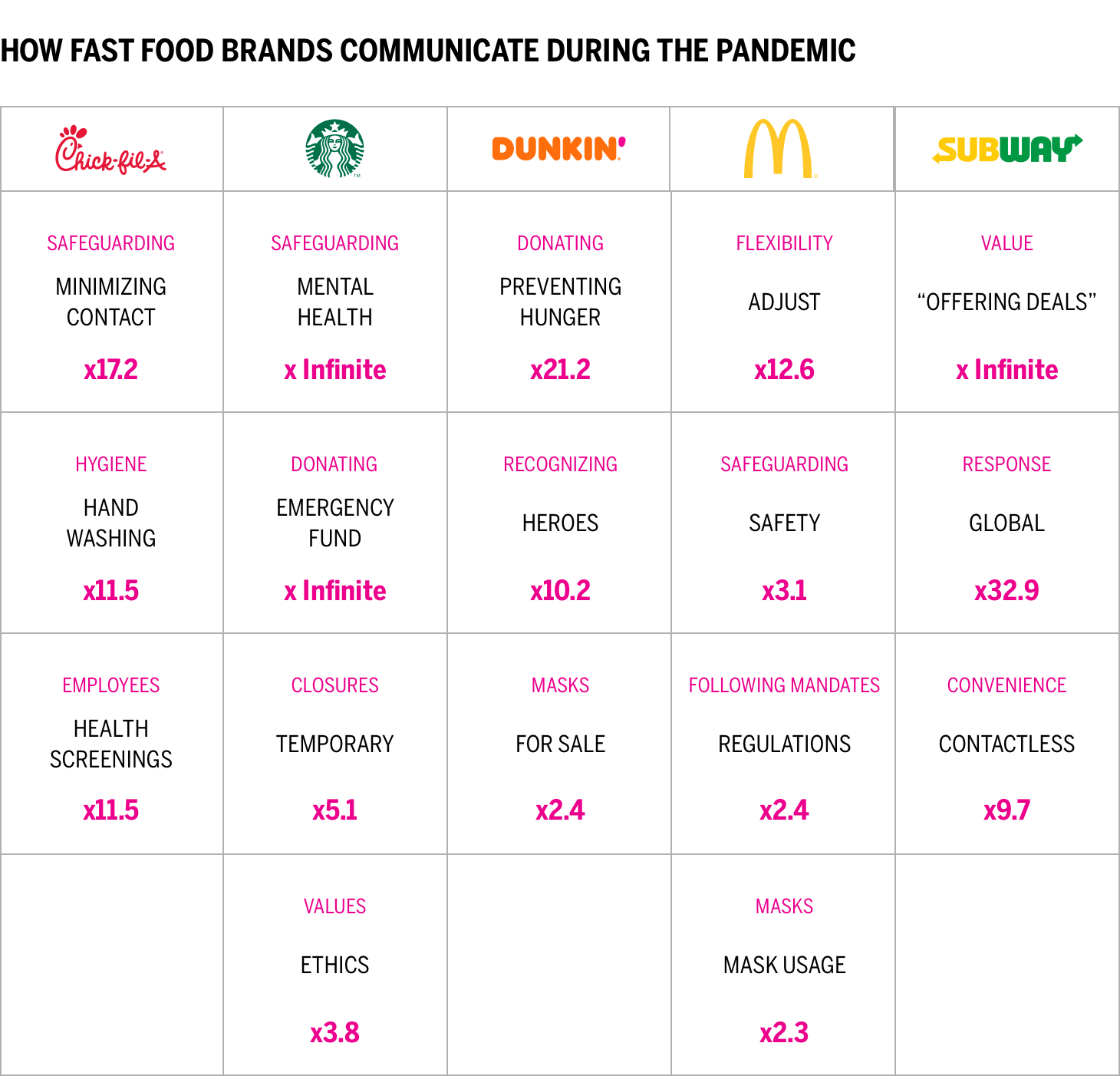

This chart presents a comparison of how leading brands are communicating about COVID on their websites. We can see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Dunkin’ speaks 21.2 times more on preventing hunger compared to competitors).

All five brands reviewed tend to highlight the importance of safety in a variety of forms. Chick-fil-A focuses on safeguarding their employees and minimizing contact, as do Subway and McDonalds. Starbucks emphasizes helping with the mental health of their employees, whereas Dunkin’ highlights masks, specifically, their new branded masks for sale. In addition, several of the brands have unique messaging and areas of focus. Starbucks details the emergency fund created for their partners in need. Dunkin’ continues to highlight the increasing rates of hunger in the United States and how it is helping, while Subway is the only brand that focuses on the affordable nature of its meals and how it is offering special deals during COVID.

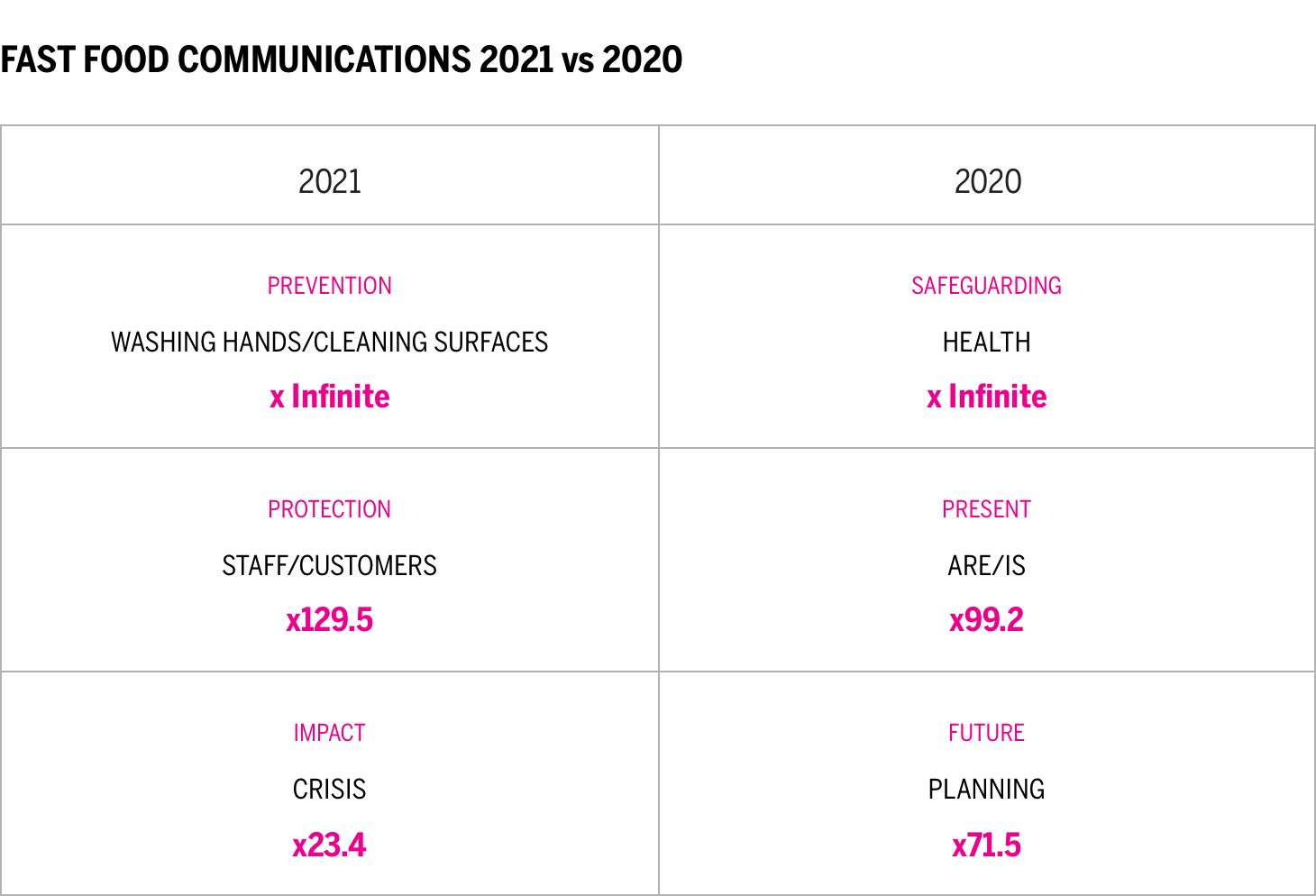

Compared to a year ago, when companies highlighted more time-related messaging (the present and planning for the future) and the overall issue of safeguarding health, messaging today focuses more on prevention, protection, and the impact of COVID.

Interestingly, in 2021 versus 2020, consumers were 8.1 times more likely to mention a shortage of supplies for fast food brands. These supply chain issues have been covered in the press, clearly a result of halted operations during the pandemic. Although happy their favorite fast food chains are open for business, customers express frustration at limited or missing items.

“So @ChickfilA is havin’ a shortage of sauces. At this point I blame Covid, because it has already taken so much from us.”

“The @ChickfilA sauce shortage of 2021 is affecting me worse than Covid did.”

“Tell me why the Starbucks Oatmilk shortage has felt longer than the pandemic.”

@Nycteris all Starbucks are out of caramel. It’s a nation-wide shortage, along with a whole bunch of other items.”

Conclusion

Our relationships with fast food brands continue to deepen, and our newest findings demonstrate that the category has become more essential to consumers. Given that Quotient Scores have increased slightly, and fusing has risen more significantly, it appears the industry is doing a good job of building bonds with those users already connected to these brands. However, sharing, the earliest stage of Brand Intimacy, has declined 14 percent. This suggests the industry needs to attract more users who are connecting emotionally with fast food brands.

In addition, the industry still ranks sixth out of ten overall in our study. There are clearly opportunities for brands to increase their performance and build stronger relationships with customers. Those with stronger digital features have advanced, offering mobile pick ups, alerts when orders are ready, and contactless delivery with tracking.

The pandemic has created a new reality, and many users are increasingly dependent on fast foods brands for comfort and convenience. Many restaurants were initially closed for extended periods in multiple states. Most have now reopened in modified forms, adapting their services, platform, and brick-and-mortar establishments to today’s circumstances. Fast food brands should be building on the foundation they have established with users during COVID to leverage the reliability, reassurance, and relief they have provided.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.