Overview:

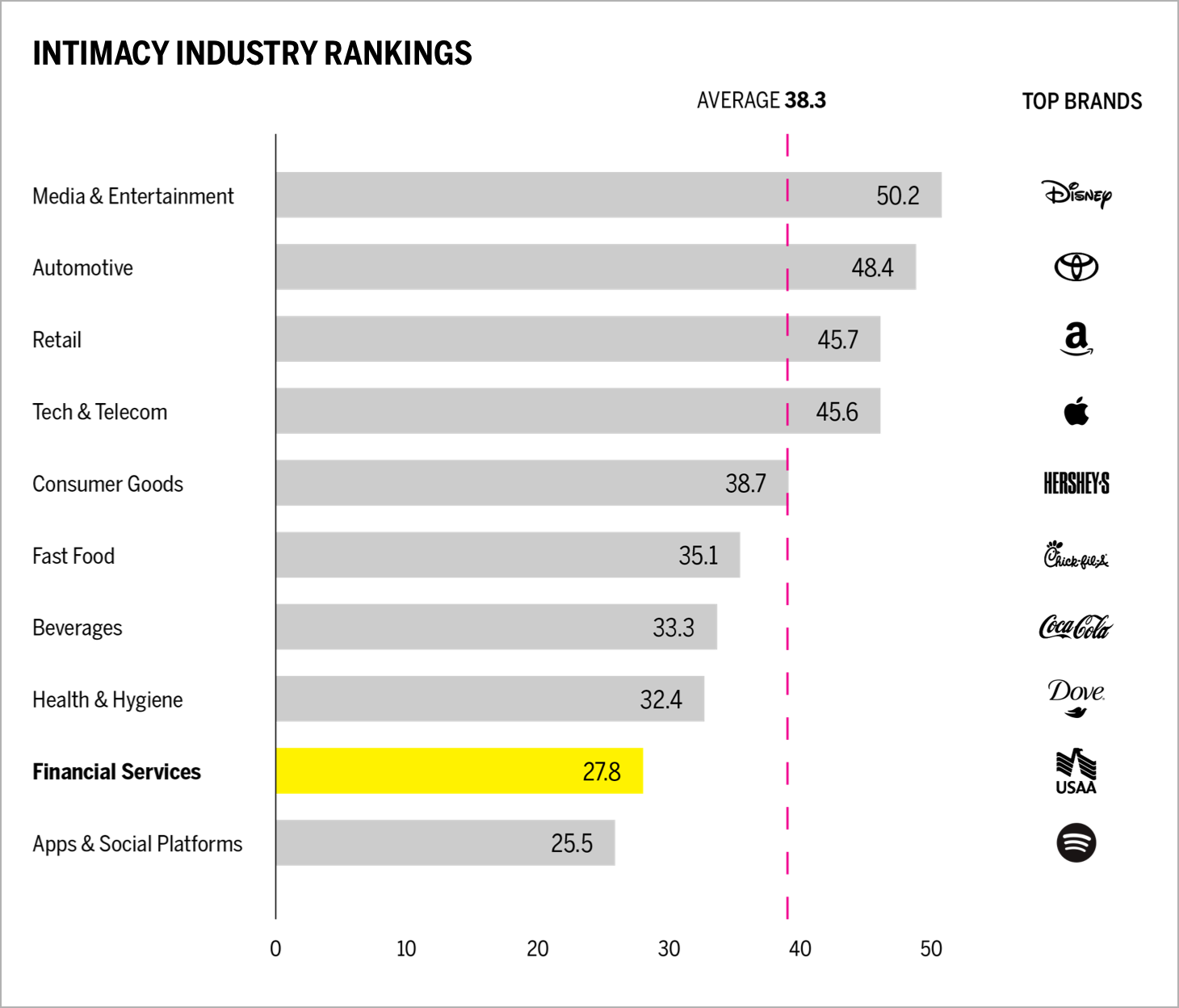

- The financial services industry ranks ninth in our 2021 Brand Intimacy COVID Study. To view our new study, click here.

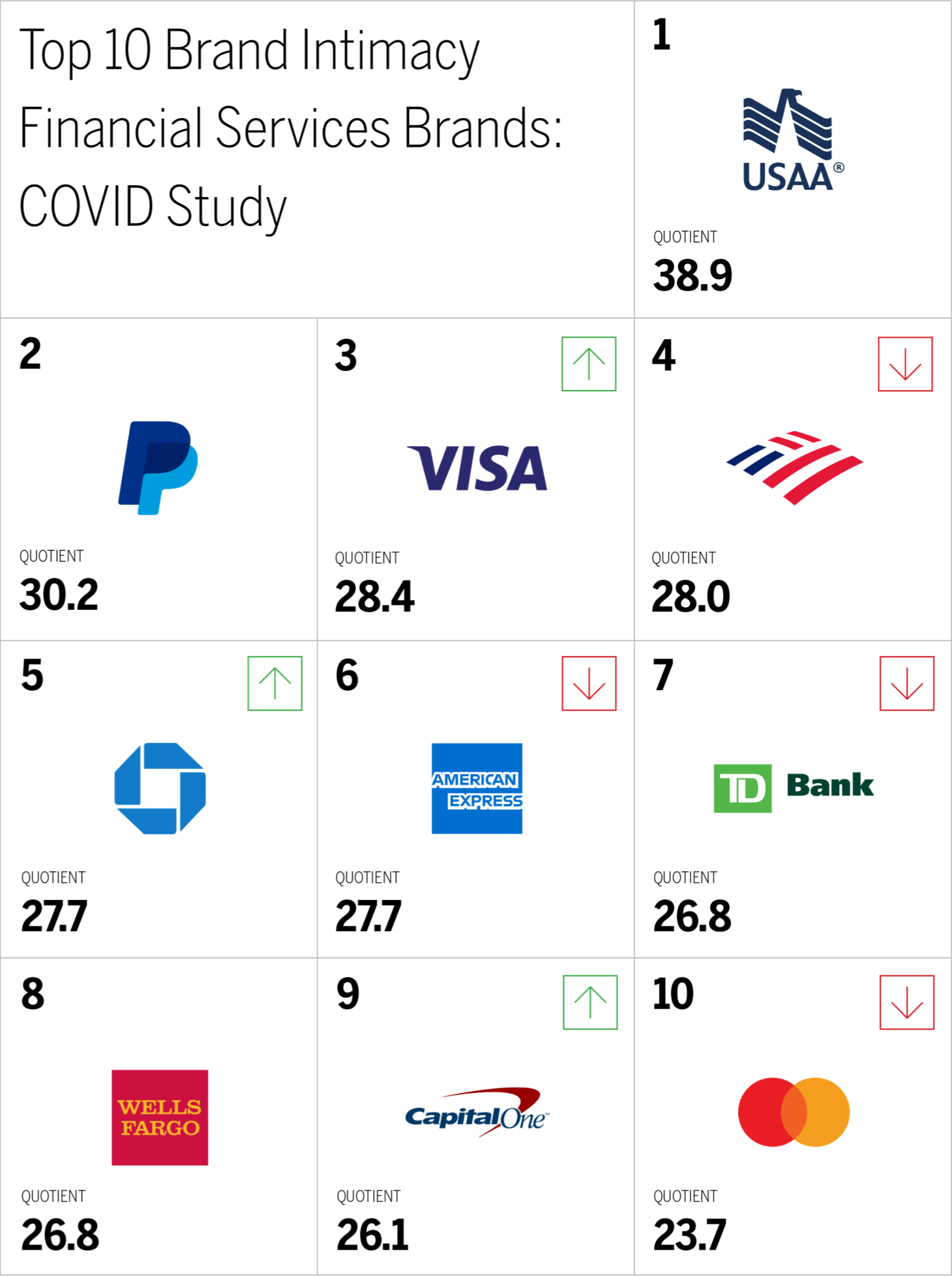

- USAA is the top-ranking financial services brand. To see USAA’s brand profile, click here.

- Bank of America is the top brand for women. To see Bank of America’s brand profile, click here.

Introduction

We shared our 2020 Brand Intimacy COVID Study last year as the pandemic was affecting all our lives. We were interested in seeing its impact on the brands we all use and love. We are now sharing a follow-up study, fielded a year later when things were improving and businesses began reopening. Lately, with the rise of the Delta variant, we see the extended presence of COVID in our lives. As the world continues to deal with the pandemic, and businesses and their brands face persistent challenges, we are sharing new insights on how brands can focus, enhance, or optimize for the marketplace that we are all eager to see return to normal.

The findings from our follow-up Brand Intimacy COVID Study, conducted with 3,000 consumers in summer 2021, demonstrate how leading brand and consumer behavior has changed since a year ago.

Brand Intimacy Performance Today

The financial services industry has an average Brand Intimacy Quotient of 27.8, almost identical to its performance in our 2020 COVID study. The industry Quotient Score is below the cross-industry average of 38.3.

The pandemic seemed to give banks a renewed sense of purpose in 2020: providing liquidity to the economy. Helped along by likeminded monetary and government policies, banks have indeed played their part in the crisis response. Going into 2021, the delayed impact of the pandemic made itself felt,1 and banks seem less clear today on their roles moving forward.

Credit cards have also been affected, with consumers applying for fewer new cards and focusing on reducing balances.2 Many temporary programs offered in 2020, like American Express’s more ways to earn rewards and bonuses and CapitalOne’s bonus rewards for streaming services, have ended.3

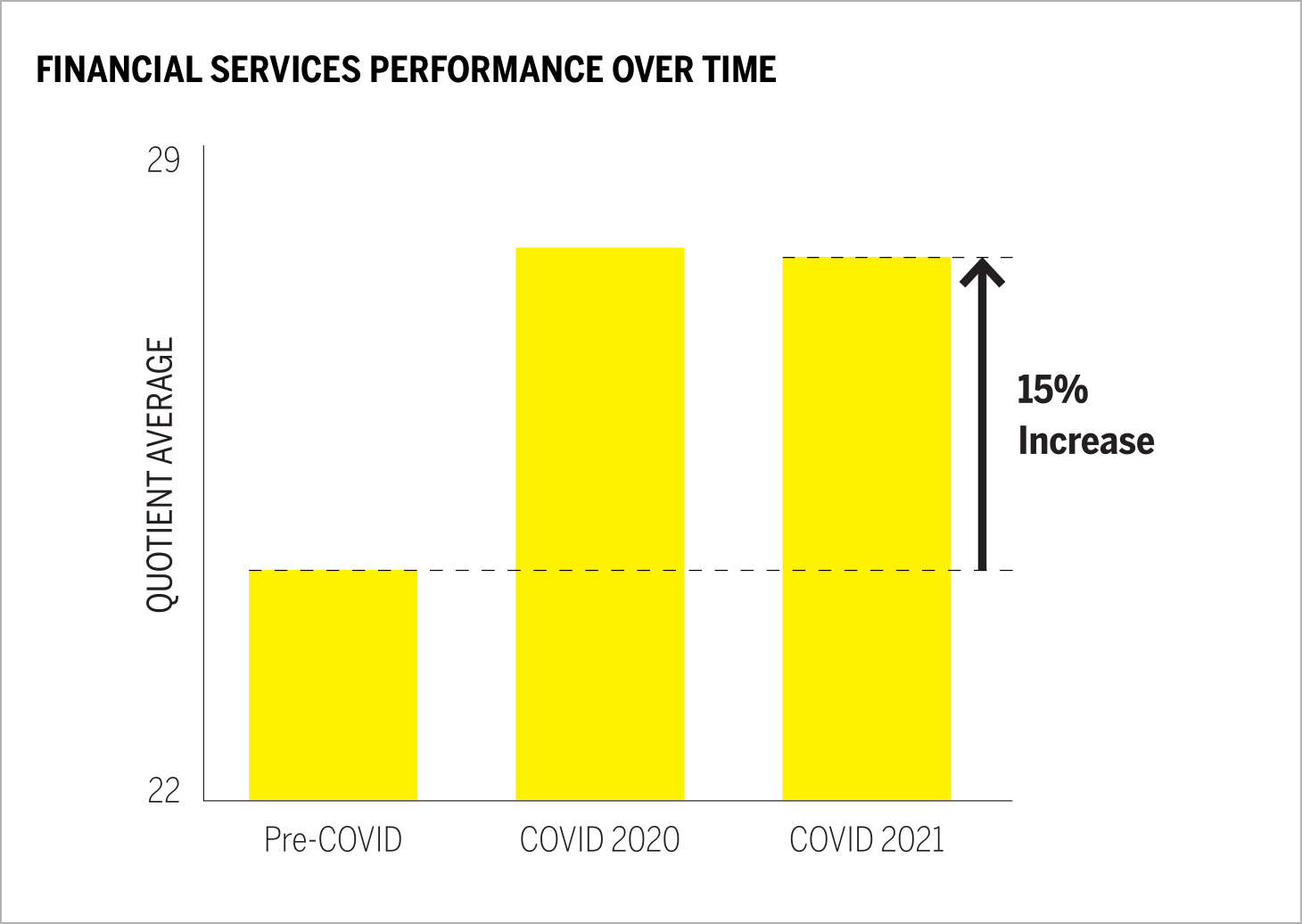

Regardless of these setbacks, the industry’s Brand Intimacy performance has increased by an average of 15 percent since before the pandemic. Despite the hardships imposed by COVID on people and businesses, this period has actually drawn consumers closer to financial services brands and created stronger emotional relationships.

USAA remains in first place, with Chase and Visa both improving their positions. Consumer preference for American Express and Bank of America has declined. Ranked industry brands perform better with men than women and with consumers over 35 years old versus those under 35. Interestingly, in our 2020 COVID study, the industry performed better with those under 35, suggesting that millennials’ overall satisfaction with the industry has declined in 2021.

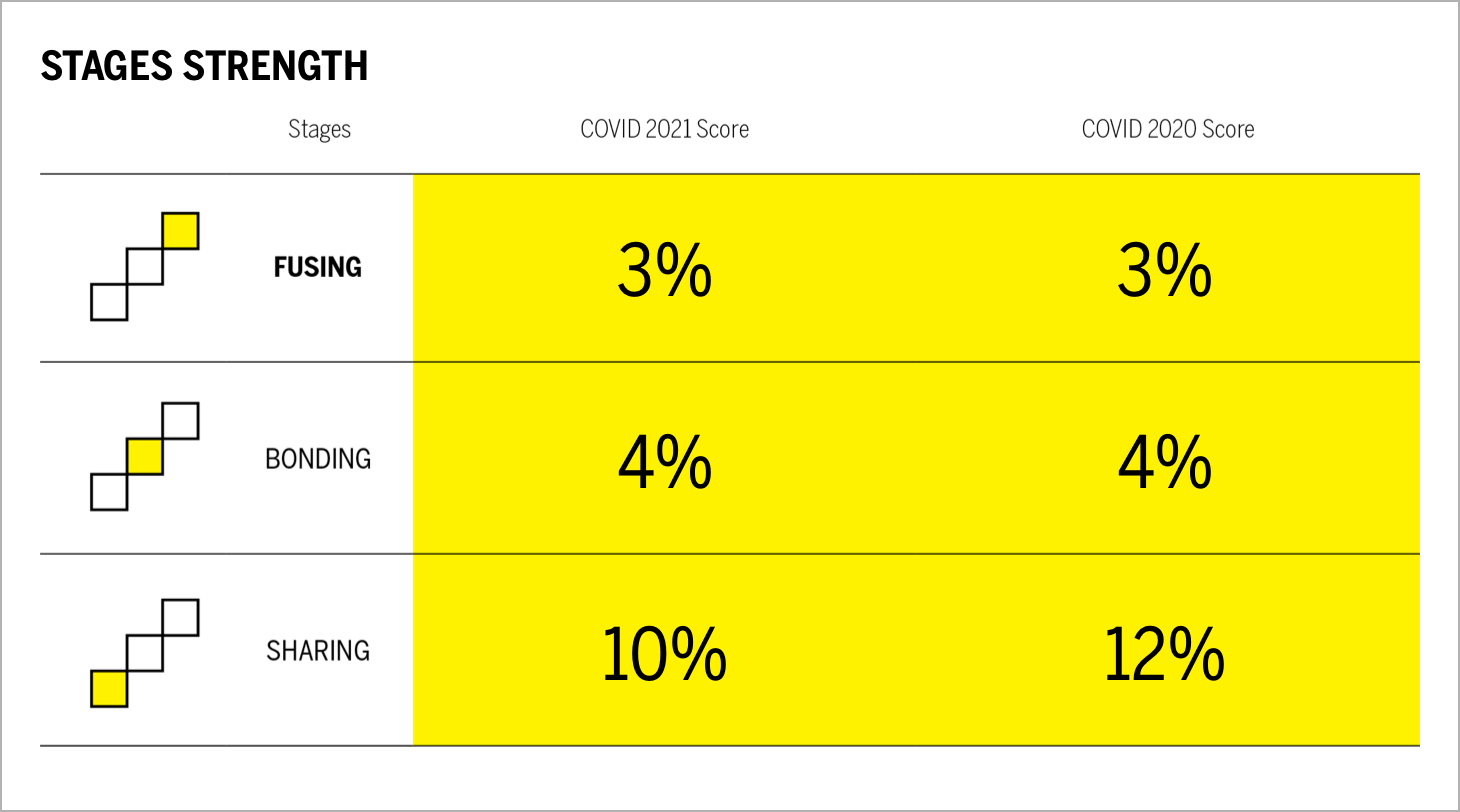

The financial services industry declined slightly in its percentage of sharing users, those in the earliest stage of Brand Intimacy. Bonding and fusing, the more advanced stages of Brand Intimacy, remained the same. This seems like a disappointment given the efforts many brands made to accommodate customers in light of the pandemic.

Although stages remained essentially the same, we see an increase associated with identity, the archetype that reflects an aspirational image or admired values and beliefs that resonate deeply. It has increased by 4 percent since our 2020 COVID study. This is notable given how many people needed financial help during the past year, when the ability to delay payments or apply to government PPP programs led some to see financial services brands in a more favorable light.

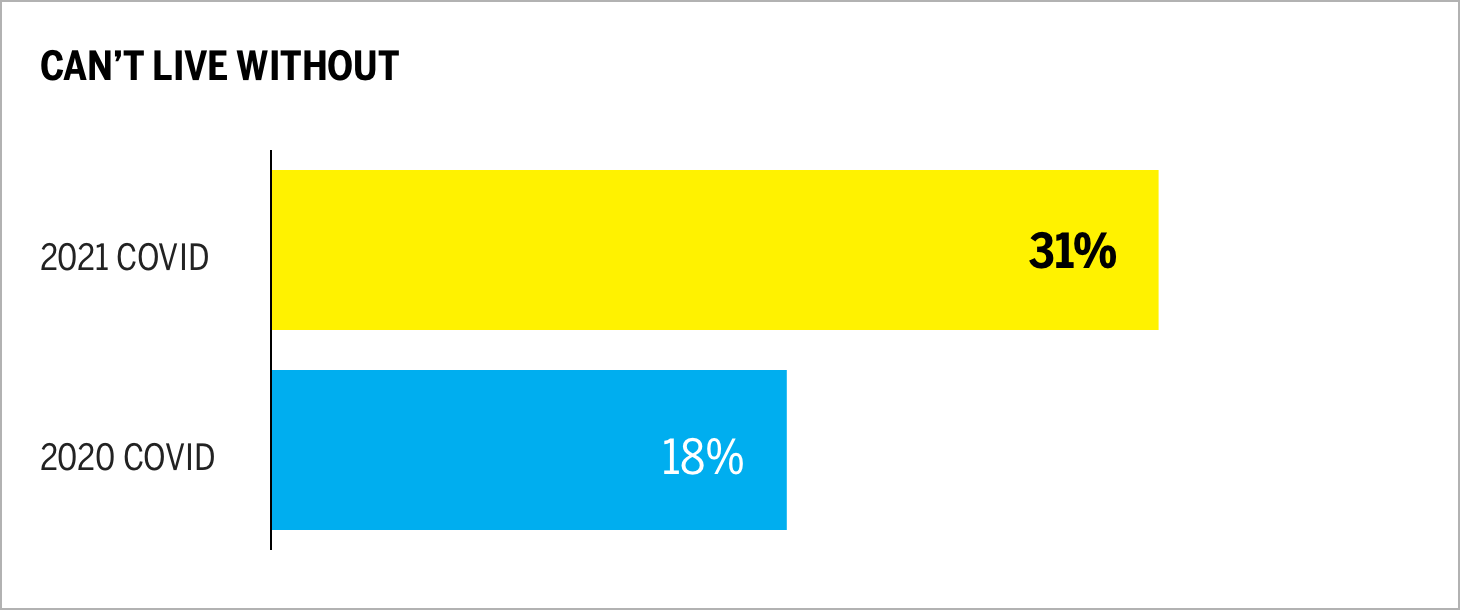

Can’t live without (a measure based on a ten-point scale that determines how essential a brand is to our lives) has increased by 80 percent, further highlighting consumer reliance on financial services brands.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated since the pandemic started last year. What has changed in their messaging? We captured a language analysis from company websites and outbound social, focusing on five brands and encompassing 385,776 words.

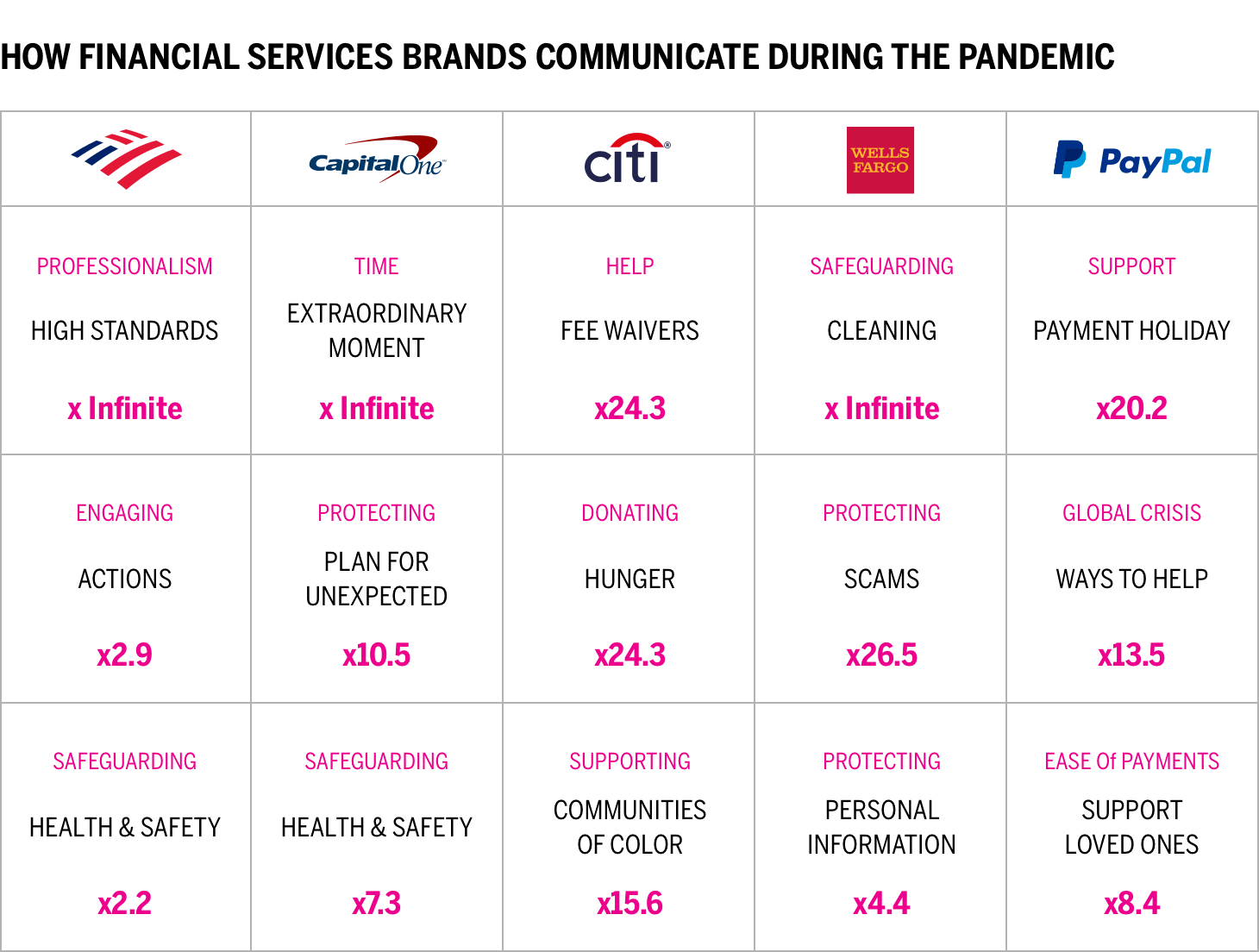

This chart presents a comparison of how leading brands are communicating about COVID on their websites and in social media. We can see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Citi speaks 24.3 times more about fee waivers during this time compared to competitors).

One of the most notable contrasts from 2020 is how much fewer COVID-related communications exist, with an 80 percent decrease compared to last year. Besides less volume, there is also less of a compassionate tone that dominated messaging last year. Citi has the most empathetic and warm tone. Its communications center around issues related to fee waivers for those facing financial hardship, donating to minimize the food shortages during the pandemic, and supporting communities of color given the disproportionate impact of COVID on these communities. Bank of America highlights how it is safeguarding the health and safety of its employees and customers. Wells Fargo also focuses on its stringent cleaning standards and how to protect oneself from scammers during the pandemic. PayPal explains its payment deferment, Payment Holiday, now only available to consumers already on a payment plan. Its content also has a promotional tone, highlighting how to send money to loved ones anywhere in the world who might need it.

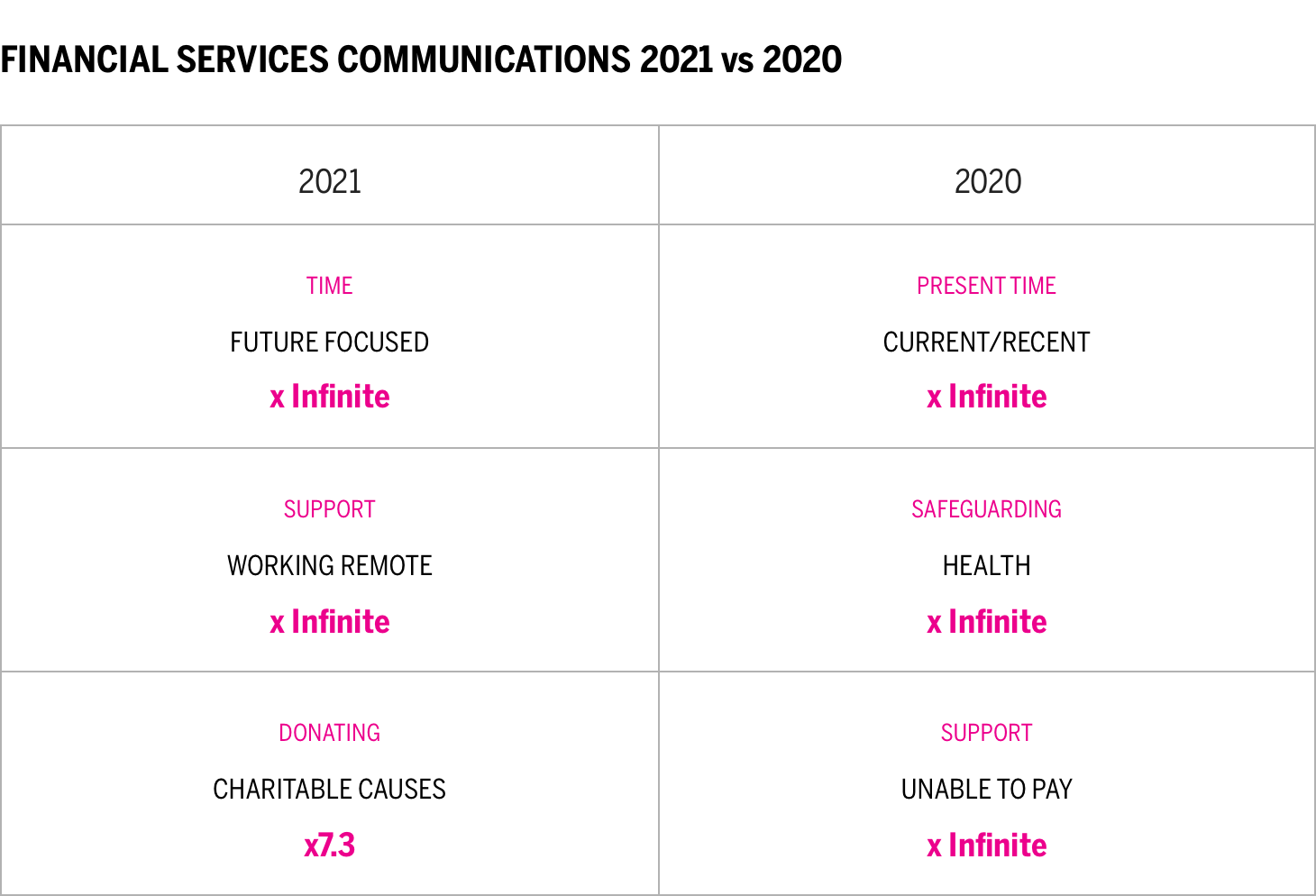

Compared to a year ago, which highlighted more time-related messaging (the present and planning for the future), the overall issue of safeguarding health and how to help customers experiencing financial hardships, messaging today has more of a future focus, supporting employees with remote working options and charitable contributions. We see this moving the dialogue forward, discussing what’s next, shifting workforce practices, and helping those less fortunate.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is also a key principle for navigating our continuously challenging times.

Brands in the financial services category, ranked ninth out of ten industries, need to shift their approach. One might hope their performance would have increased since last year given the large focus on helping customers facing financial hardship. We noted in our 2020 study that early indications pointed to the industry improving on a number of measures and better connecting with customers. However, this hope was not fully realized, given the industry Quotient Scores in 2021 are almost identical to those in 2020. Although frustration related to longer wait times, limited open branches, and bureaucratic communications likely occurred, these things do not explain the absence of goodwill the industry should have had.

What is also notable is the relative disappearance of COVID-related messaging since last year, a reduction of more than 80 percent. Financial institutions chose not to continue nurturing their relationships with customers and explaining shifting plans and advancing priorities. This is evident from the generally limited communications we reviewed on company websites.

To move up from ninth place, financial service brands must work harder to build relationships, not merely transactions. Brands that do succeed in establishing emotional connections outperform leading financial indices and enjoy longevity, greater economic equity, and increased engagement. Category brands tried to return to a world before COVID rather than referencing our shared experiences, and how these brands have been there to help us.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.