Overview

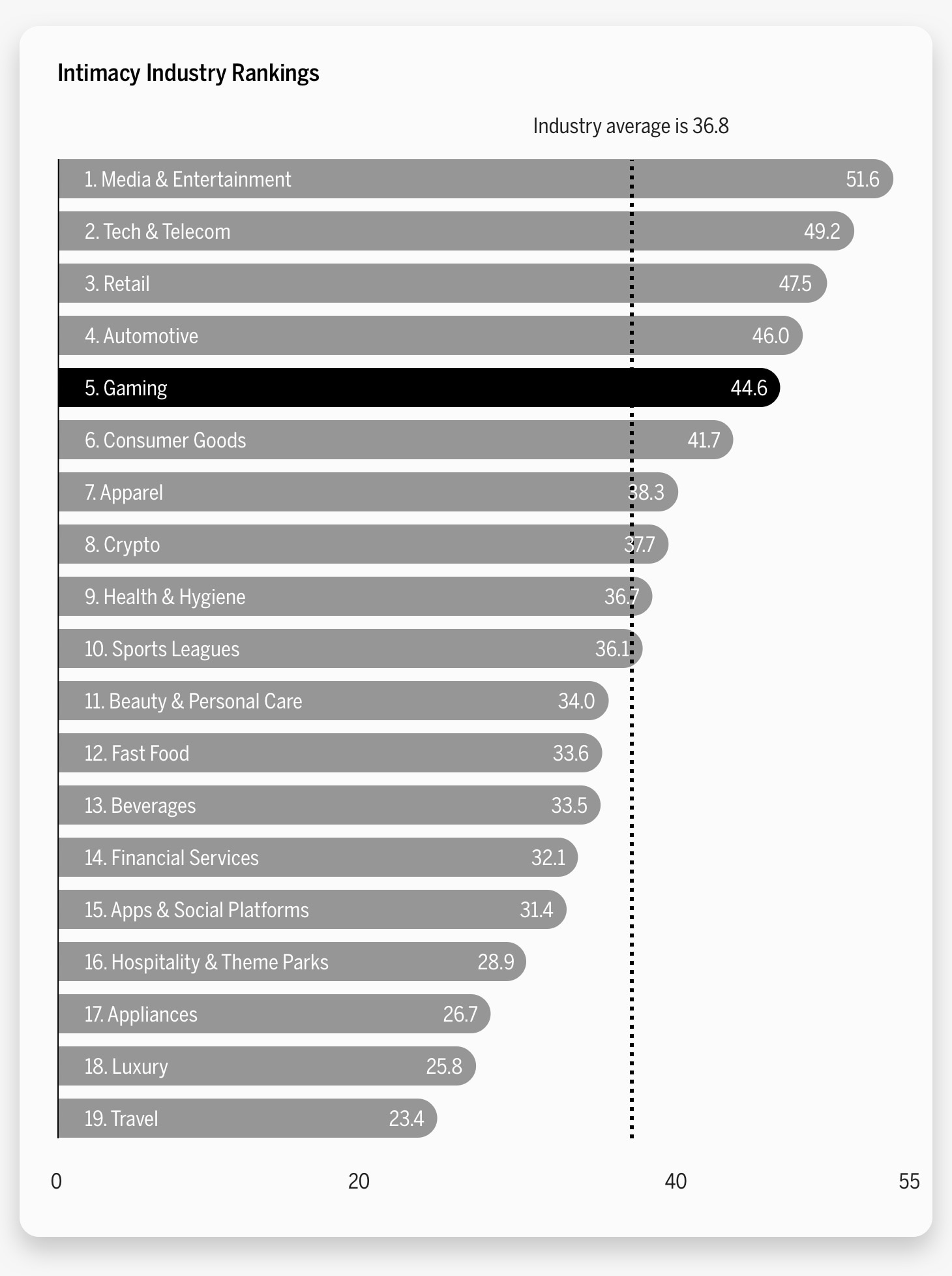

- The gaming industry ranks fifth in our 2022 Brand Intimacy Study.

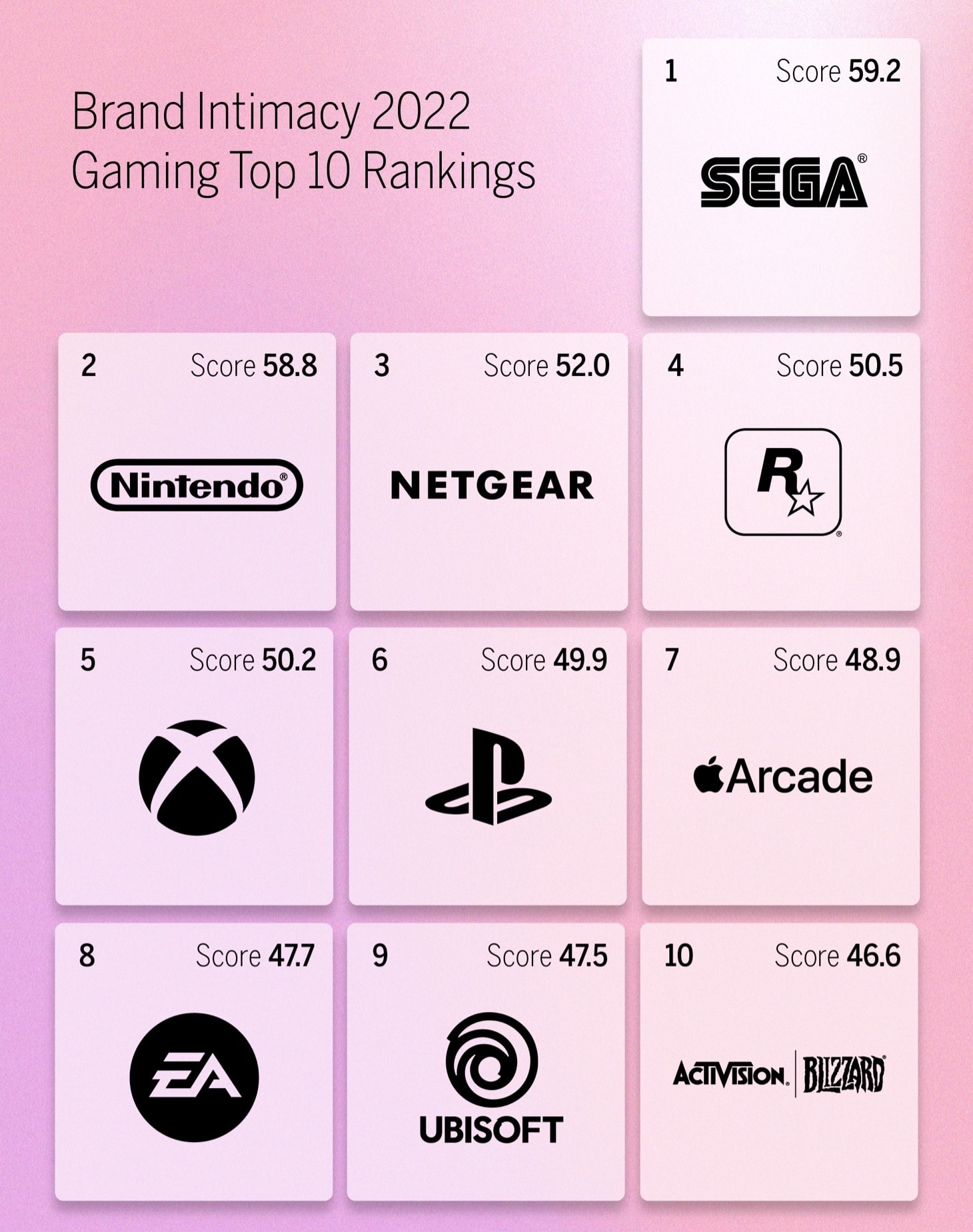

- Sega is the top-ranking gaming brand with a Quotient Score of 59.2.

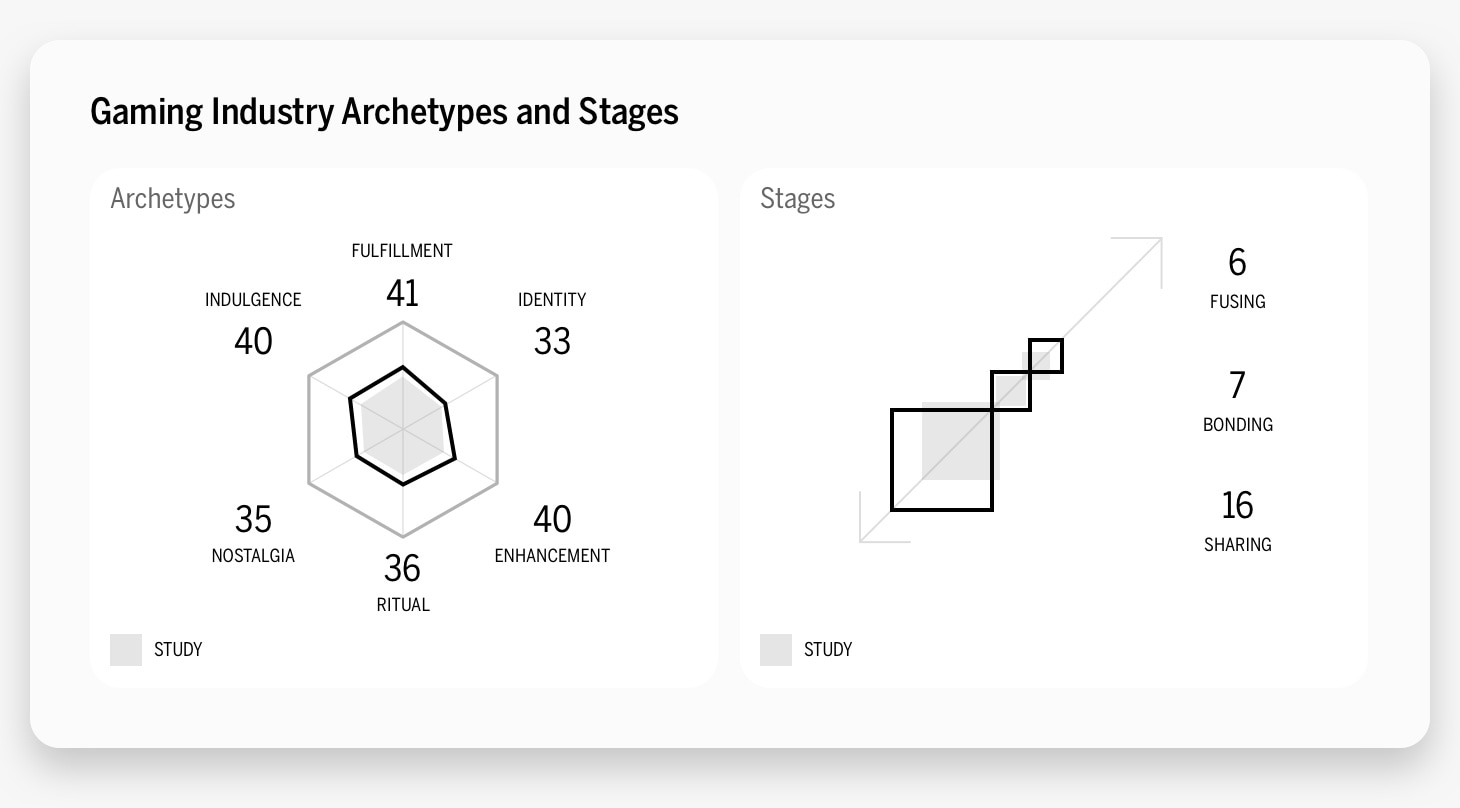

- The gaming industry’s dominant archetype is fulfillment.

Introduction

In this year’s Brand Intimacy Study, the gaming industry placed fifth with an average Brand Intimacy Quotient Score of 44.6, well above the cross-industry average of 36.8. A new entrant in our annual study, gaming was the top performing new industry in this year’s study and outperformed many older, more established industries, including financial services, fast food, and consumer goods.

Nintendo and Sega, the top-performing gaming brands, continue their long-standing competition against each other as they battle for dominance in the industry. The majority of brands in this category are known for creating video games (EA, Rockstar Games, Epic Games, etc.), and a few are more notable for their technology and hardware (Netgear and Oculus). Notably, Netgear, which produces networking hardware, does quite well in the industry coming in third and outperforming many more widely known and popular video game companies. Xbox and PlayStation, in contrast, fell below Sega, Nintendo, Netgear, and Rockstar Games despite their wild popularity and desirability.

Industry Overview

The gaming industry continues to be profitable, with US gamers spending an estimated $60.4 billion on games in 2021, a 14% increase from the previous year.1 Over the past few decades, the category of gaming has grown substantially. Many popular gaming companies, like Nintendo and Sega, can trace their beginnings back to arcade games and playing cards before evolving into computer and video games. Although the concept of computer games was originally explored in the 1950s, mainframe computer games didn’t become widely available until the 1970s with the concurrence of major technological developments in the arcade game industry. Games like Pong and Space Invaders became international successes and led into a golden age of arcade games in the late 1970s and early 1980s.

Quickly, the gaming industry evolved into an expansive catalog of ways to game, including, home consoles, handheld consoles, computer games, esports, and mobile gaming. More recently, the gaming universe has expanded into mixed, virtual, and augmented reality games. The most notable venture into virtual reality comes from Meta (previously Facebook), whose growth into the metaverse has signaled a new stage and concept of gaming.

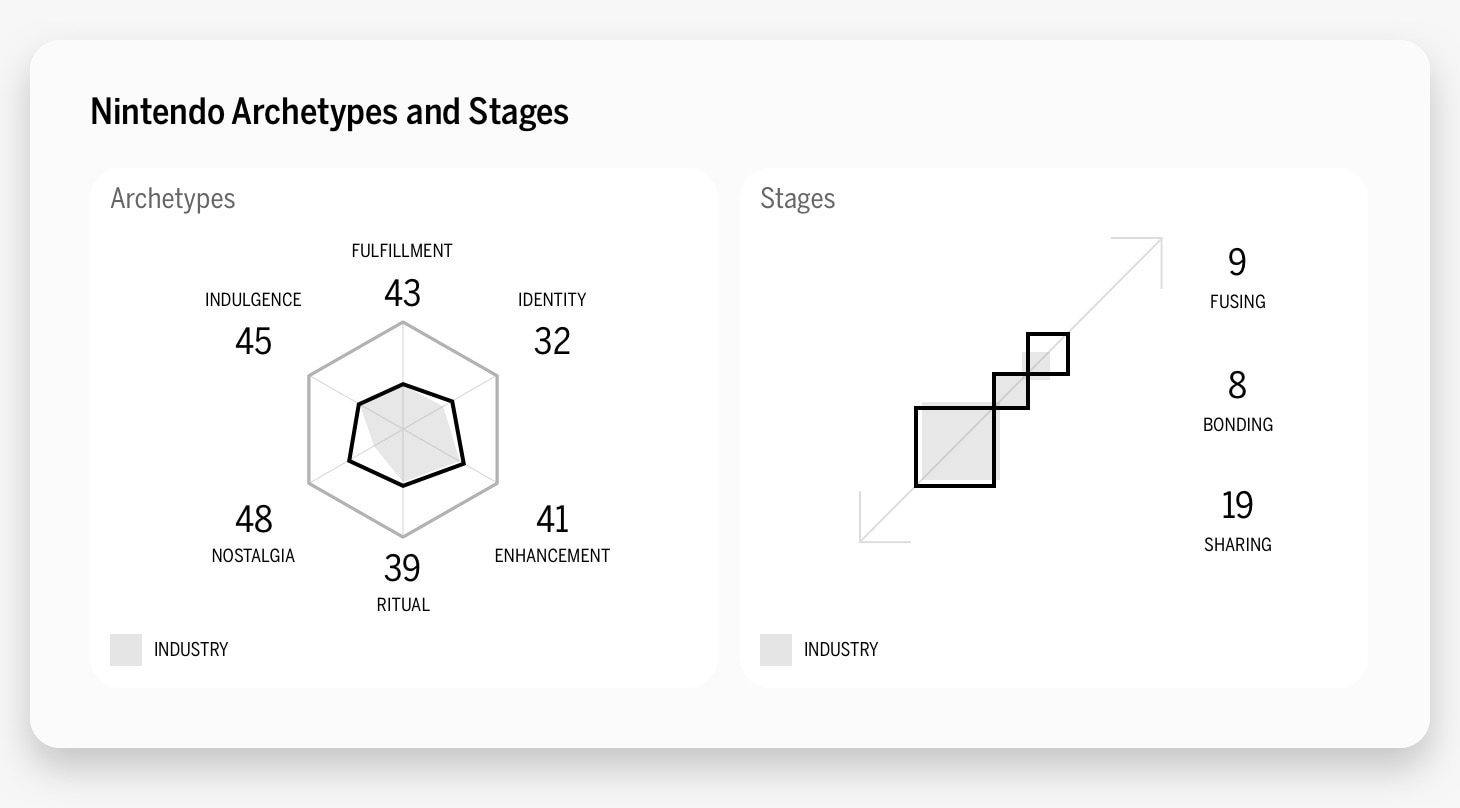

The gaming industry’s dominant archetype is fulfillment, which refers to brands exceeding expectations, delivering superior service, quality, and efficacy. Impressively, gaming ranks second out of 15 industries for the fulfillment archetype. This may be indicative of the industry’s constant growth and evolution, always releasing better, more advanced versions of familiar games and consoles. Gaming also impressively ranks second for identity, nostalgia, and indulgence. Gaming has 16% of users in the sharing stage of brand intimacy, the earliest stage; 7% in bonding, the middle stage; and 6% in fusing, the most advanced stage of Brand Intimacy. Of the consumers who write about gaming, 30% are in some stage of intimacy, outperforming the Brand Intimacy Study average of 23%. In terms of stages, the gaming industry comes in third overall for bonding and fourth for fusing.

Sega Stays Strong

By a narrow margin, Sega triumphed this year as the top-performing brand in the gaming industry, beating out its longtime competitor Nintendo.

Sega’s company origins can be traced back to the 1940s in Honolulu, Hawaii, with three businessmen who aimed to provide coin-operated amusement machines to military bases during World War II. The company, previously named Standard Games, was rebranded to Service Games following the US government outlawing slot machines in its territories. Sega, an abbreviation of Service Games, grew through the 1950s as the company expanded to include distribution in many Asian countries.2

Sega expanded significantly during the arcade industry boom, licensing popular games like Head On and Frogger. The development of game consoles and one of the best-selling video game franchises in history, Sonic the Hedgehog, positioned Sega as one of the most prolific gaming companies.

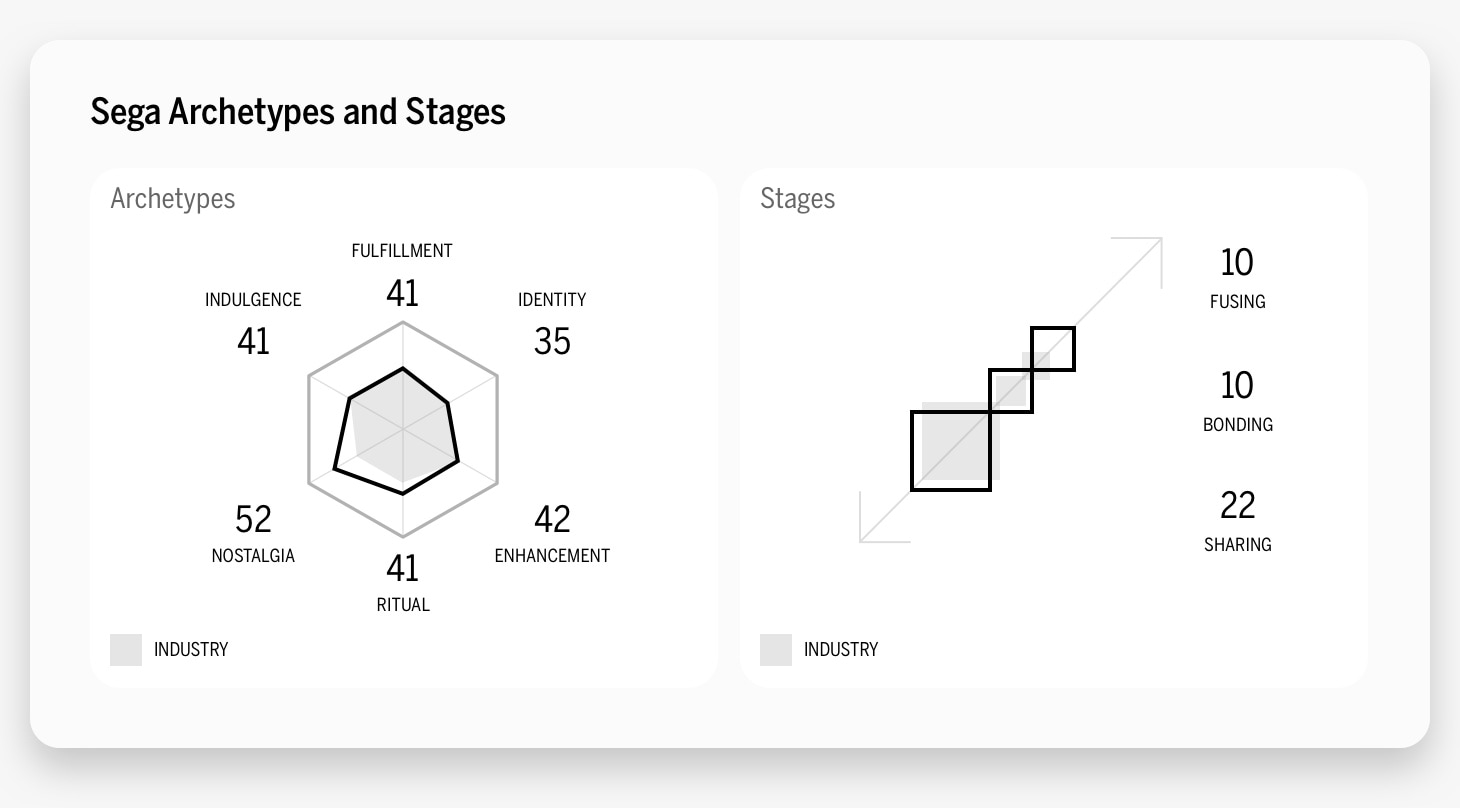

With a solid Quotient Score of 59.2, Sega comes in first in the gaming industry and ninth overall in our 2022 Brand Intimacy Study. Unlike the industry overall, Sega’s dominant archetype is nostalgia, which centers on brands focusing on memories of the past and the warm, poignant feelings associated with them. These are often brands a customer has grown up with. Sega, whose games have grown alongside a generation of gamers, is no stranger to capitalizing on themes of nostalgia. In 2018 the brand released the game Tanglewood—as only the second video game released on the Sega Genesis since 1997.3 The retro game refers back to the mid-1990s video game aesthetic, reminding longtime consumers of their childhoods and past gaming interests.

Sega also is strong across all three stages of Brand Intimacy. Sega has 22% of consumers in the sharing stage, the first stage of Brand Intimacy; 10% in bonding, the middle stage; and 10% in fusion, the most advanced stage. This suggests that Sega is able to bring new audiences in, with its strong sharing score, as well as deepen relationships with existing customers through bonding and fusing. Of the consumers who write about Sega, 41.2% are in some form of intimacy with the brand.

Nintendo as a Close Second

Nintendo, like Sega, can trace its origins back to a classic game: playing cards. Nintendo was founded in 1889 in Japan, where it produced different lines of playing cards. It released its first Western-style card deck in the early 1900s. The company finally expanded into electronics in the 1970s and entered the arcade video game market.4 The release of the Game Boy in 1989 and later consoles like the GameCube and Nintendo DS along with the massively popular Super Mario franchise positioned Nintendo as a gaming powerhouse through the 1990s and 2000s. Nintendo’s more recent ventures, including the Wii and Nintendo Switch, have seen massive success. The popularity of the Super Mario franchise even culminated in Nintendo coproducing the Super Mario Bros movie alongside Universal Pictures, which has a 2023 release date.5

With a Quotient Score of 58.8, Nintendo scores only 0.4 percent lower than Sega, coming in 11th in our overall Brand Intimacy Study. Similar to Sega, Nintendo’s dominant archetype is also nostalgia, with indulgence coming in at a close second. The age and global reach of Nintendo is likely one of the many reasons why Nintendo is the most recognized gaming brand among gamers in the United States.6 Nintendo’s Brand Intimacy scores are also strong and mirror Sega’s, with 19% of users in the sharing stage, 8% in bonding, and 9% in fusing. Of the consumers who write about Nintendo, 36.0% are in some form of intimacy with the brand.

Nintendo and Sega’s rivalry came to a head in the early 1990s with the release of the game Mortal Kombat, considered to be the most violent game at the time. As Mortal Kombat was being prepared to be released on both Sega and Nintendo game consoles, Nintendo, which previously followed rather modest content guidelines, decided to change almost all graphic visuals in the game—changing the blood from red to green and editing violent fatalities.7 The game that Sega released, on the other hand, allowed players to use a cheat code to play the fully uncensored version. As a result, the Sega version of Mortal Kombat outsold the Nintendo version five to one.8 Backlash to graphic video games helped create a rating system, and today both Sega and Nintendo produce “M for Mature” rated games for older audiences.

What Consumers Are Saying

By examining more than 1.4 billion words and phrases from social media, our 2022 Brand Intimacy Study provides us with valuable insights into how consumers feel about brands.

A common theme connecting both Nintendo and Sega is nostalgia, which shows up as one of Sega’s key words and is the dominant archetype for both brands.

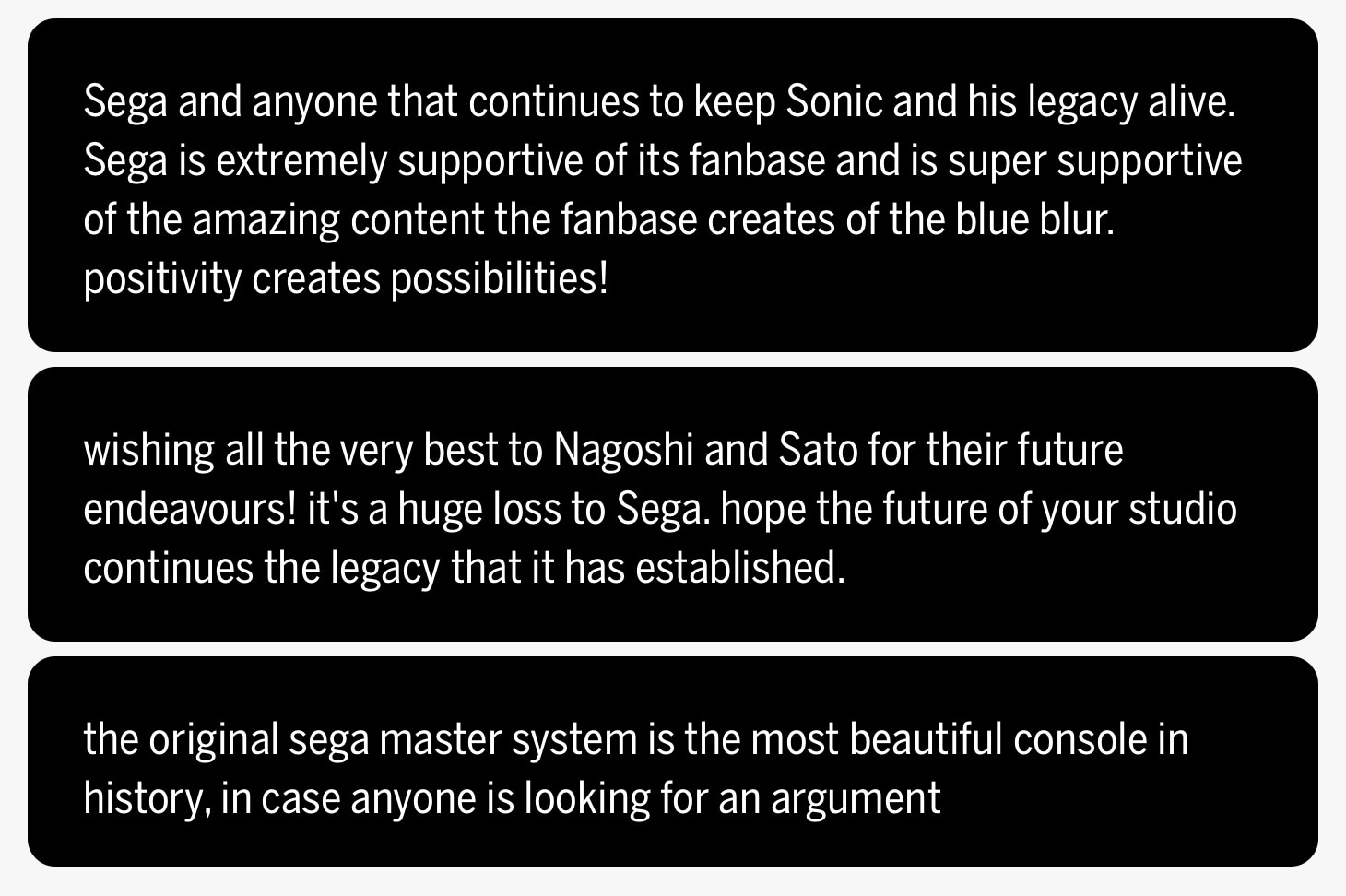

For example, Sega users often praise the brand’s lasting legacy and history.

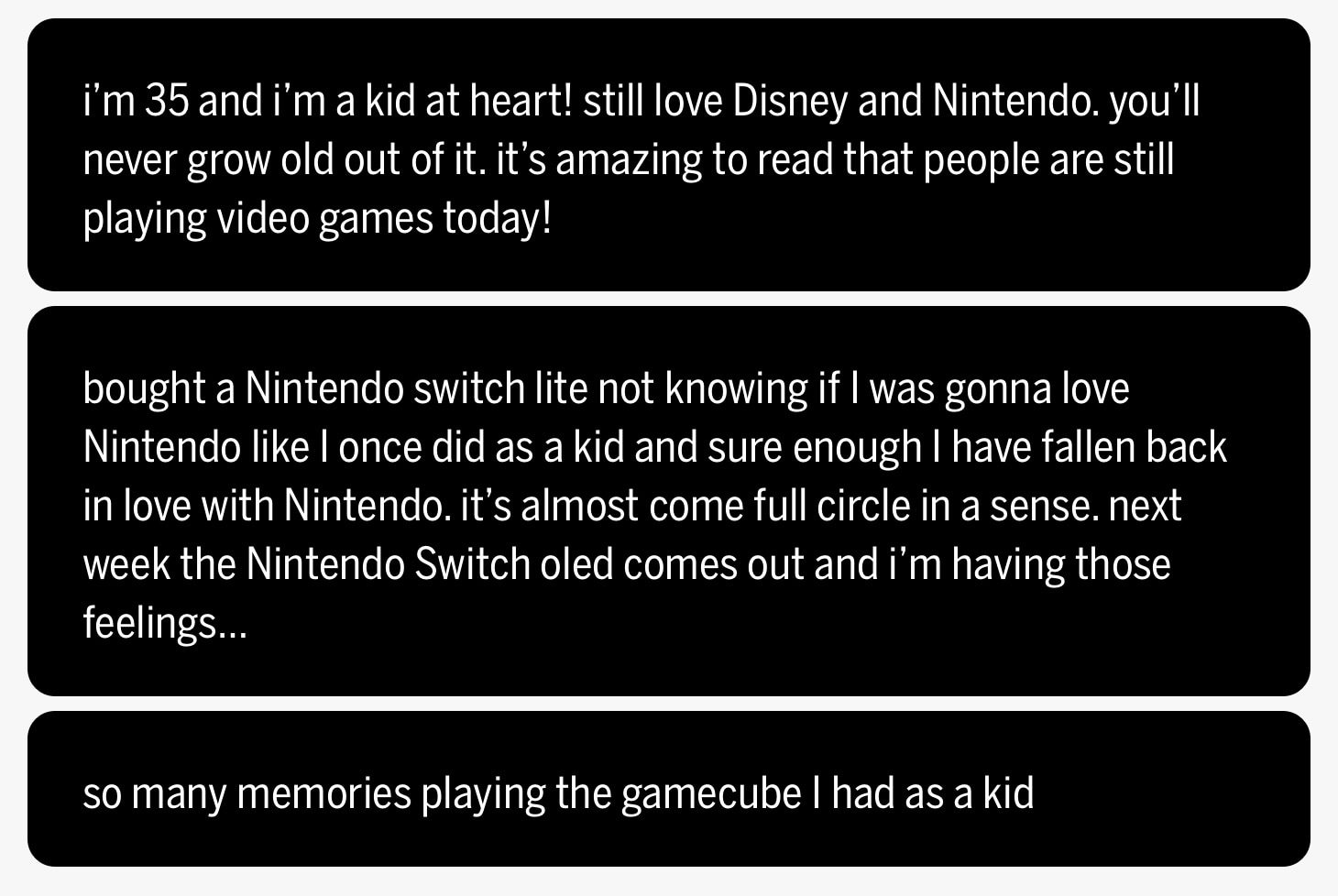

Similarly, Nintendo users frequently reference their memories and experiences with Nintendo games from their childhood.

Playing into the competition, gamers often share their opinions on the Nintendo and Sega rivalry and which brand they believe to be better. Despite Sega ranking first in the industry, users seem to more frequently cite Nintendo as the superior gaming brand.

Finally, both brands have active and loyal fan bases, who repeatedly post to support and defend their preferred gaming company.

Conclusion

As a newcomer in our annual study, the gaming industry proved itself to be a formidable force in fostering and maintaining Brand Intimacy.

The consistent growth of the gaming industry has opened the doors for many variations and different concepts of gaming to flourish. Although both top performers—Nintendo and Sega—were created decades before video games ever existed, their ability to evolve with advancing technologies and ideas kept them at the forefront of the video and arcade game market for decades.

Memorable franchises, portable gaming consoles, and games targeted at all demographics have enabled gaming companies to find success outside of what was originally thought to be a pastime for kids.

The gaming industry has, with time, also garnered much praise and criticism from activists and politicians alike. The presence of graphic violence and war in video games is frequently argued to have a negative effect on young gamers, whereas the development of esports has created a new world of competitive gaming and sportsmanship.

Overall, the gaming industry is forecasted to see massive growth in the following years, with predictions for the near future showing that the worth of the gaming industry might reach $200 billion by 2023.9 With this, the industry will likely continue innovating and advancing to further build strong bonds with its customer base.

Get an overview of Brand Intimacy here.

Read our detailed methodology here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Sources

1 “Gaming statistics.” By trust.co https://truelist.co/blog/gaming-statistics

2 “Sega Corporation.” By britannica.com https://www.britannica.com/topic/Sega-Corporation

3 “Nostalgia is gaming’s biggest trend.” By outline.com

https://theoutline.com/post/6053/tanglewood-sega-genesis-nostalgia

4 “Company history.” By nintendo.com https://www.nintendo.co.jp/corporate/en/history/index.html

5 “Super Mario Bros Movie.” By thesupermariobros.movie https://www.thesupermariobros.movie/

6 “Gaming brand recognition among gamers in the United States as of December 2016.” by Statista.com https://www.statista.com/statistics/662663/gaming-brand-awareness-usa/

7 “Mortal Kombat: Violent video game that changed the industry.” By bbc.com https://www.bbc.com/news/technology-27620071

8 Ibid.

9 “Gaming statistics.” By trust.co https://truelist.co/blog/gaming-statistics