Overview

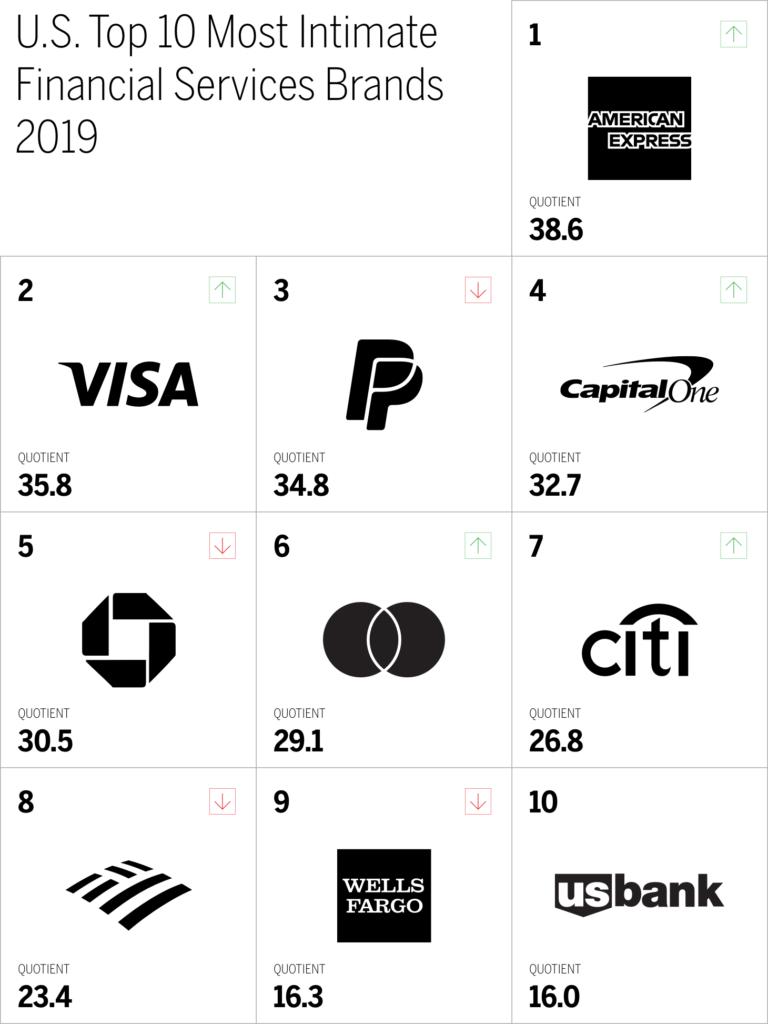

- American Express is the most intimate financial services brand in the 2019 Brand Intimacy Study, overcoming last year’s leader, PayPal

- Enhancement is the top archetype for financial services and Amex is the #1 brand for the fulfillment, identity, and indulgence archetypes

- Amex has improved its percentage of users in deepest stage of Brand Intimacy, fusing, from 3 percent in 2018 to 5 percent this year

- High-income users and women have particularly high levels of intimacy with the Amex brand

The financial services industry plays an important role in the lives of consumers, facilitating how we spend, save, and manage our money. However, the industry clearly has room to build more intimate customer bonds. It only ranks eleventh out of the fifteen industries in our 2019 Brand Intimacy Study, but since last year, its credit card brands have been on the rise and two of them are sitting at the top of its ranks: Visa at #2 and American Express at #1.

In the past year, American Express has improved its Brand Intimacy Quotient from 32.7 to 38.6, which allowed it to jump from the #3 spot to #1, overcoming PayPal and Chase. For the first time since we started our annual study, PayPal is no longer the top financial services brand. Given its iconic status in the financial services industry and its improved Brand Intimacy performance, we are focusing on Amex, detailing our top findings about the brand to better understand how it leverages emotion to connect with consumers.

A unique mix of emotions

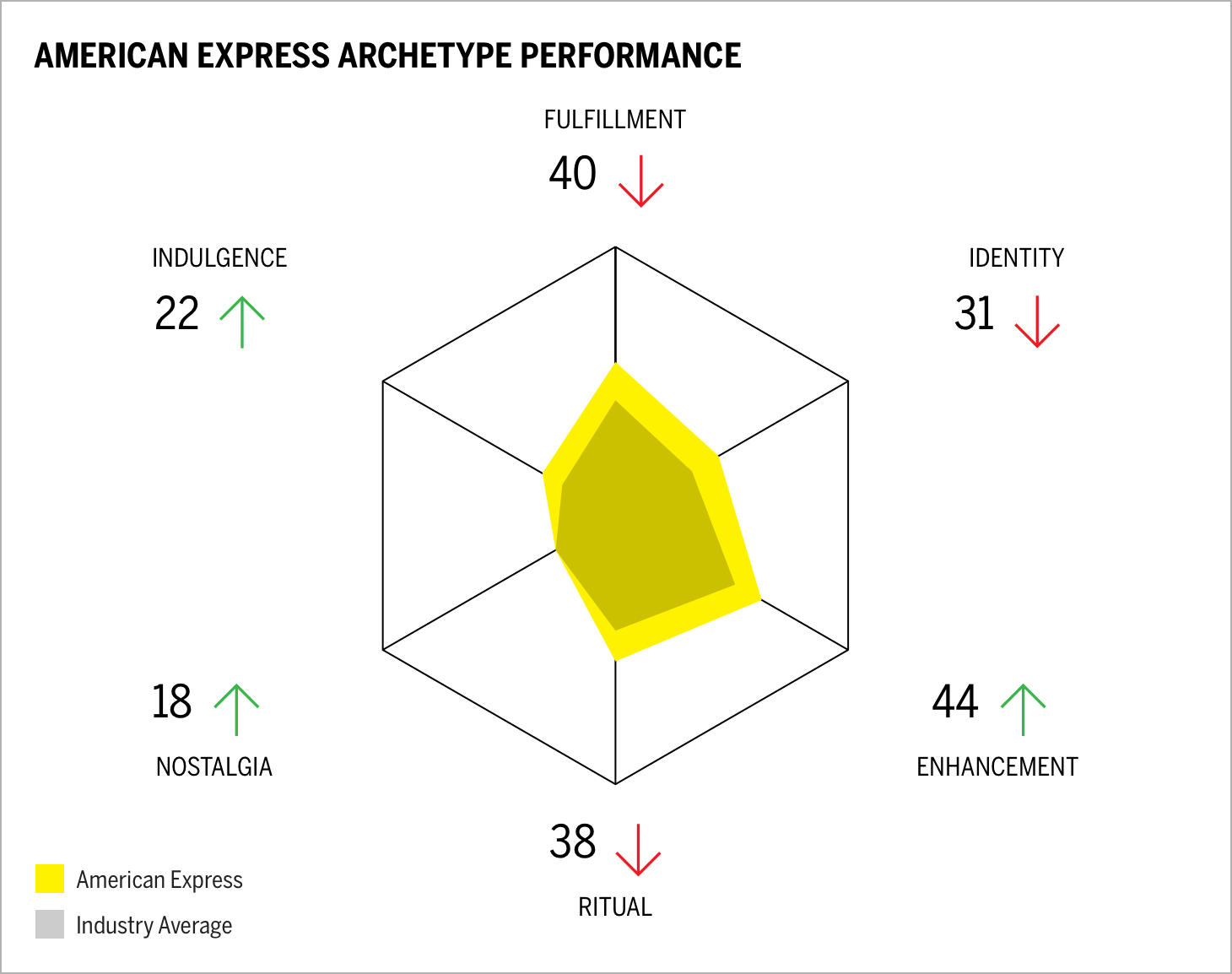

The Brand Intimacy archetypes are six patterns or markers that are consistently present among intimate brands and identify the character and nature of ultimate brand relationships. By examining how American Express performs across these archetypes compared to the rest of the industry, we can better understand how the brand is able to distinguish itself.

The American Express brand is most associated with enhancement, which is the top archetype for the industry, overtaking the ritual archetype this year. Enhancement characterizes a brand as making a customer better (smarter, more capable, and more connected) through its use. Last year, enhancement was Amex’s second most dominant archetype behind fulfillment (exceeding expectations and delivering superior service, quality, and efficacy) but has since become #1.

Where American Express is able to distinguish itself in the category, however, is in the rest of its archetype profile; it is the #1 financial services brand for fulfillment, identity (reflecting an aspirational image or admired values), and indulgence (creating a close relationship around moments of pampering and gratification). What is significant about American Express’s leadership in these archetypes is that they are the #3, #4, and #5 for the industry, respectively. This indicates that American Express has successfully associated itself with multiple characteristics that other financial services brands haven’t emphasized, allowing it to differentiate itself in the category. These three archetypes highlight the uniquely strong associations of the American Express brand: status (identity), service (fulfillment), and luxury (indulgence). No other brand in the category is able to effectively leverage these characteristics as well as Amex.

Through the fusing funnel

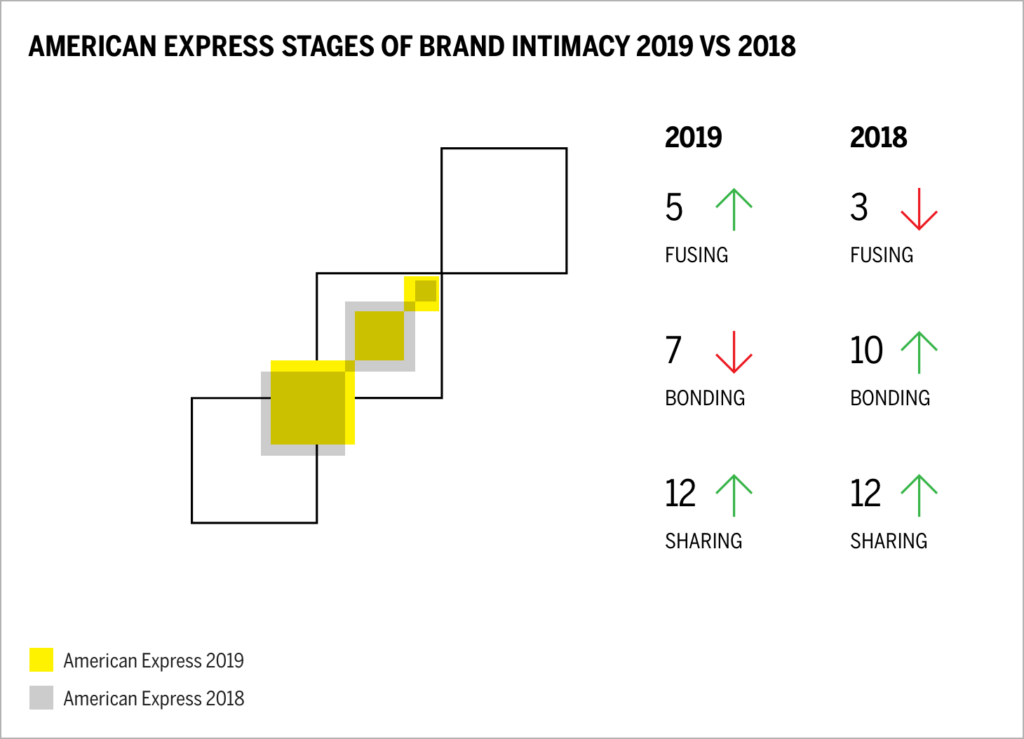

One way we can understand the depth of the bonds between American Express and its users is through the Brand Intimacy stages. These stages identify the degree of intensity in the relationship between a consumer and a brand, which increases from sharing to bonding to fusing.

If we compare American Express’s performance this year to that of 2018, we can see the percentages of users in two of its stages have changed. While the percentage of users in the sharing stage remains at 12 percent, there are fewer users in the bonding stage and more in the fusing stage. A drop in the bonding stage could be seen as troubling for the brand because this is the stage in which an attachment is formed and trust is established; however, the increase in the fusing stage from 3 percent to 5 percent indicates that some American Express users are likely moving from bonding to fusing. This would suggest that users who are already fairly intimate with the brand are becoming even closer to it and entering the fusing stage, in which they are inexorably linked and co-identified with the brand. If this is the case, Amex will need to add more users to the funnel in order to continuing building intimate bonds.

American Express’s ability to draw users in closer to the brand aligns with its increased emphasis on rewards and high-benefit card offerings. This is evidenced by the percentage of American Express users who are willing to pay a 20 percent premium for the brand’s products, which more than doubled this year, from 6 percent to 13 percent of users.

High-income intimacy and winning with women

Segmenting our data by demographics, we can see which groups have the strongest emotional connections with American Express.

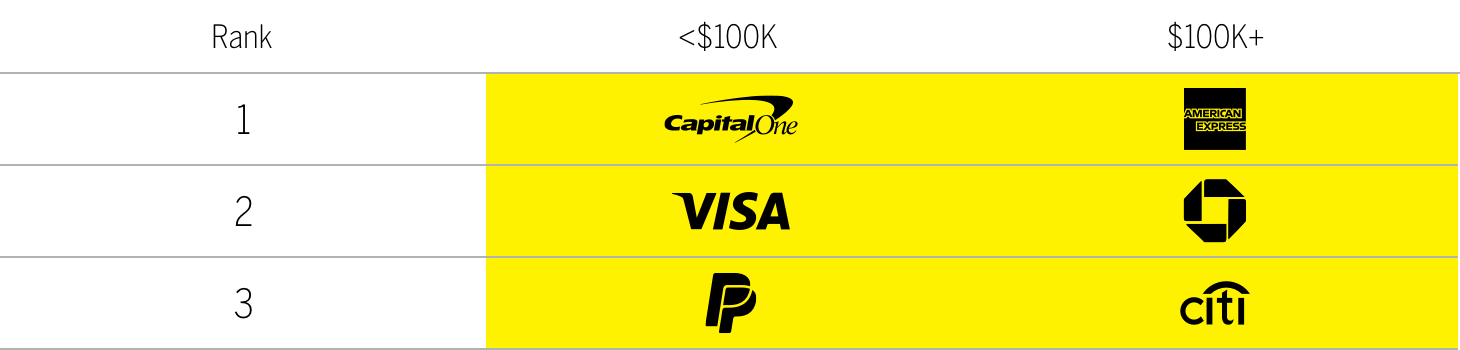

Top Financial Services Brands by Income

Not surprisingly, higher-income users are the most intimate with American Express, with an average Brand Intimacy Quotient of 49.2, which is significantly higher than the brand’s overall Quotient score of 38.6 and its average among users with incomes under $100,000 (32.1). This may be related to the brand’s aforementioned emphasis on rewards that come with the high-end cards, which have membership fees that make them more attractive among high-income users compared to lower-income users. Clearly, American Express is held in high regard by this demographic—its Quotient of 49.2 is a far cry from the #2 brand for this group, Chase, which has a score of 34.2.

Top Financial Services Brands by Gender

As for gender, women are more intimate with American Express than men are, with an average Brand Intimacy Quotient of 44.0, compared with 35.7 for men. American Express is the top brand among women, whereas men rank the brand fourth behind PayPal, Visa, and Capital One. There is also a significant gap between American Express and the #2 brand for women, Visa, which has a score of 33.2. The success of American Express among women is notable because women are less intimate with the financial services category than men on average (27.8 vs. 30.4). Amex makes efforts to support women-owned businesses; the brand partnered with the City of New York this year to create the “Shop Women-Owned” NYC campaign and release an annual “State of Women-Owned Businesses Report,” which studies annual trends of women business owners.1

Conclusion

American Express continues to foster Brand Intimacy among consumers, making it a standout brand in the financial services industry. Its ability to convey characteristics that are generally less associated with the category (identity, fulfillment, and indulgence) allows it to distinguish its brand in an industry where differentiation is a real challenge. The fact that American Express’s users appear to be funneling into the fusing stage of Brand Intimacy shows that its efforts and focus on rewards have successfully brought its clients closer to the brand. Its dominance among high-income users and women shows that the brand has established its reputation as “high end” and that it understands women despite its category falling short for this demographic. American Express’s ability to build emotional bonds with its users demonstrates the potential of Brand Intimacy, even in industries like financial services that often struggle to inspire strong positive feelings. Through differentiation, membership incentives, and powerful connections with key demographics, American Express has earned the top spot in its industry and a special place in the hearts of its users.

Read our detailed methodology here, and review the sources cited in this article here.

Check out our annual study and rankings of intimate brands. Visit our most recent rankings of intimate famous figures—BFF. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.