Overview:

- The media & entertainment industry ranks first in our 2021 Brand Intimacy COVID Study. To review our new study, click here.

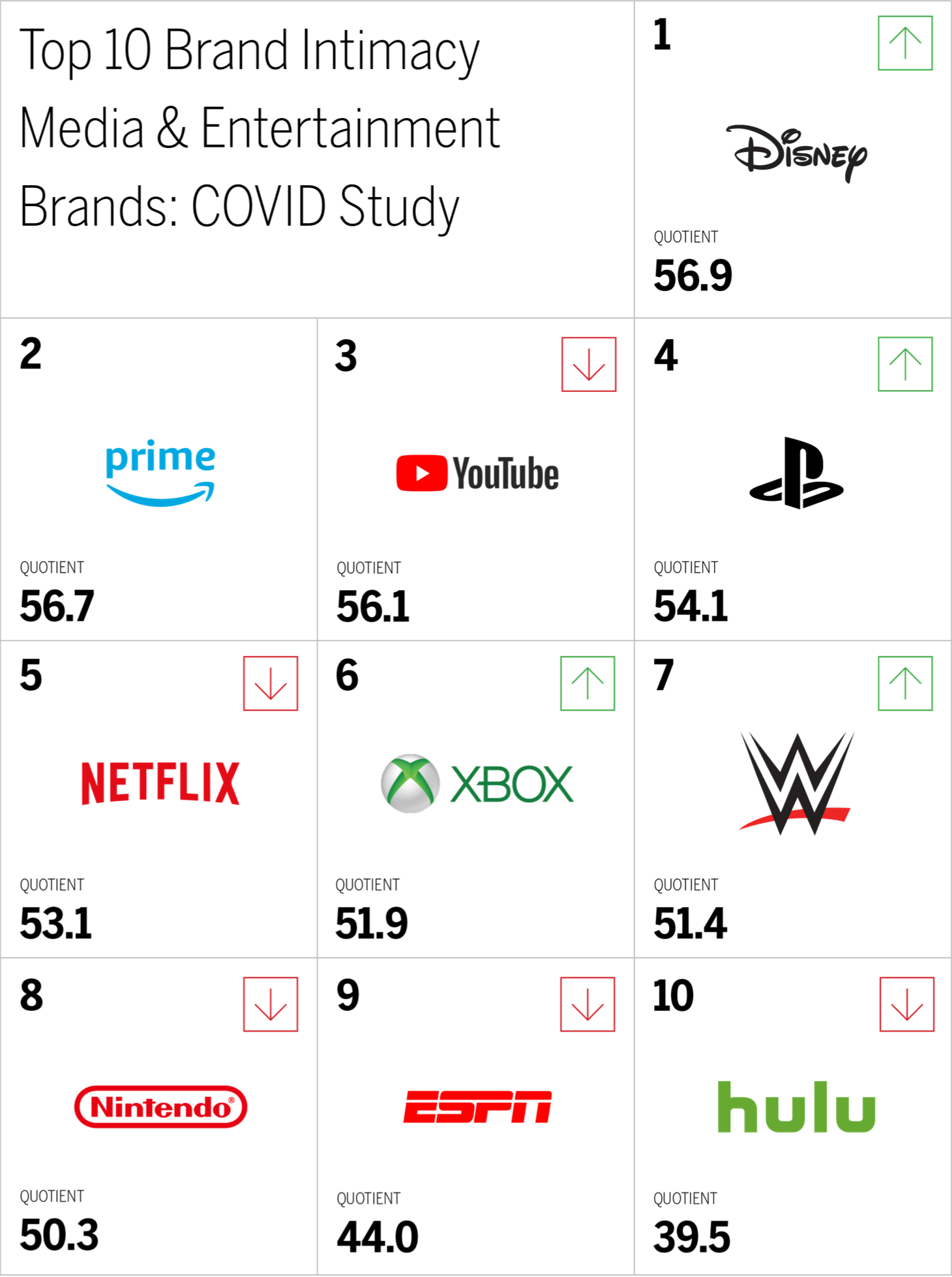

- Disney is the top-ranking media & entertainment brand, up from third place in our 2020 COVID study. To review Disney’s brand profile page, click here.

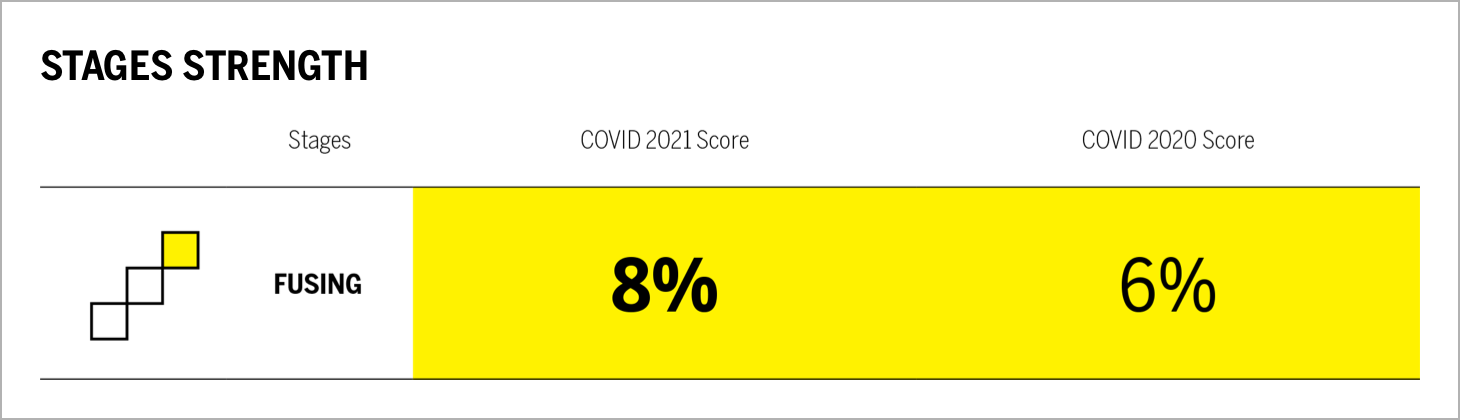

- Compared to all other industries in our study, media & entertainment ranks #1 for fusing, the most advanced stage of Brand Intimacy. To download our media & entertainment industry report, click here.

Introduction

We shared our 2020 Brand Intimacy COVID Study last year as the pandemic was affecting all our lives. We were interested in seeing its impact on the brands we all use and love. We are now sharing a follow-up study, fielded a year later when things were improving and businesses began reopening. Lately, with the rise of the Delta variant, we see the extended presence of COVID in our lives. As the world continues to deal with the pandemic, and businesses and their brands face persistent challenges, we are sharing new insights on how brands can focus, enhance, or optimize for the marketplace that we are all eager to see return to normal.

The findings from our follow-up Brand Intimacy COVID Study, conducted with 3,000 consumers in summer 2021, demonstrate how leading brand and consumer behavior has changed since a year ago.

Brand Intimacy Performance Today

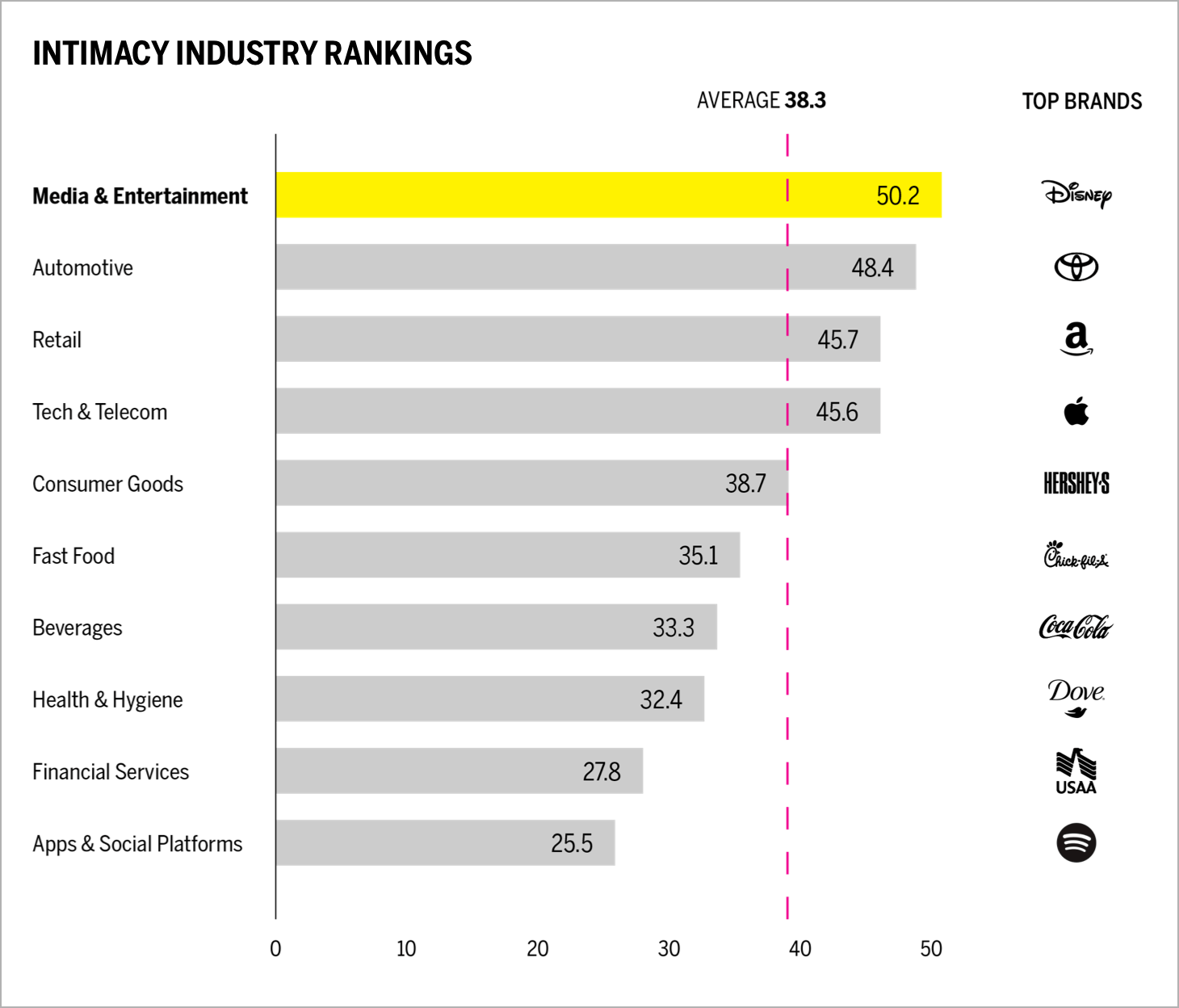

The media & entertainment industry ranks #1 out of all industries and has an average Brand Intimacy Quotient of 50.2, well above the cross-industry average of 38.3. Even as businesses opened and stay-at-home orders subsided, the category continues to lead and build strong bonds with consumers.

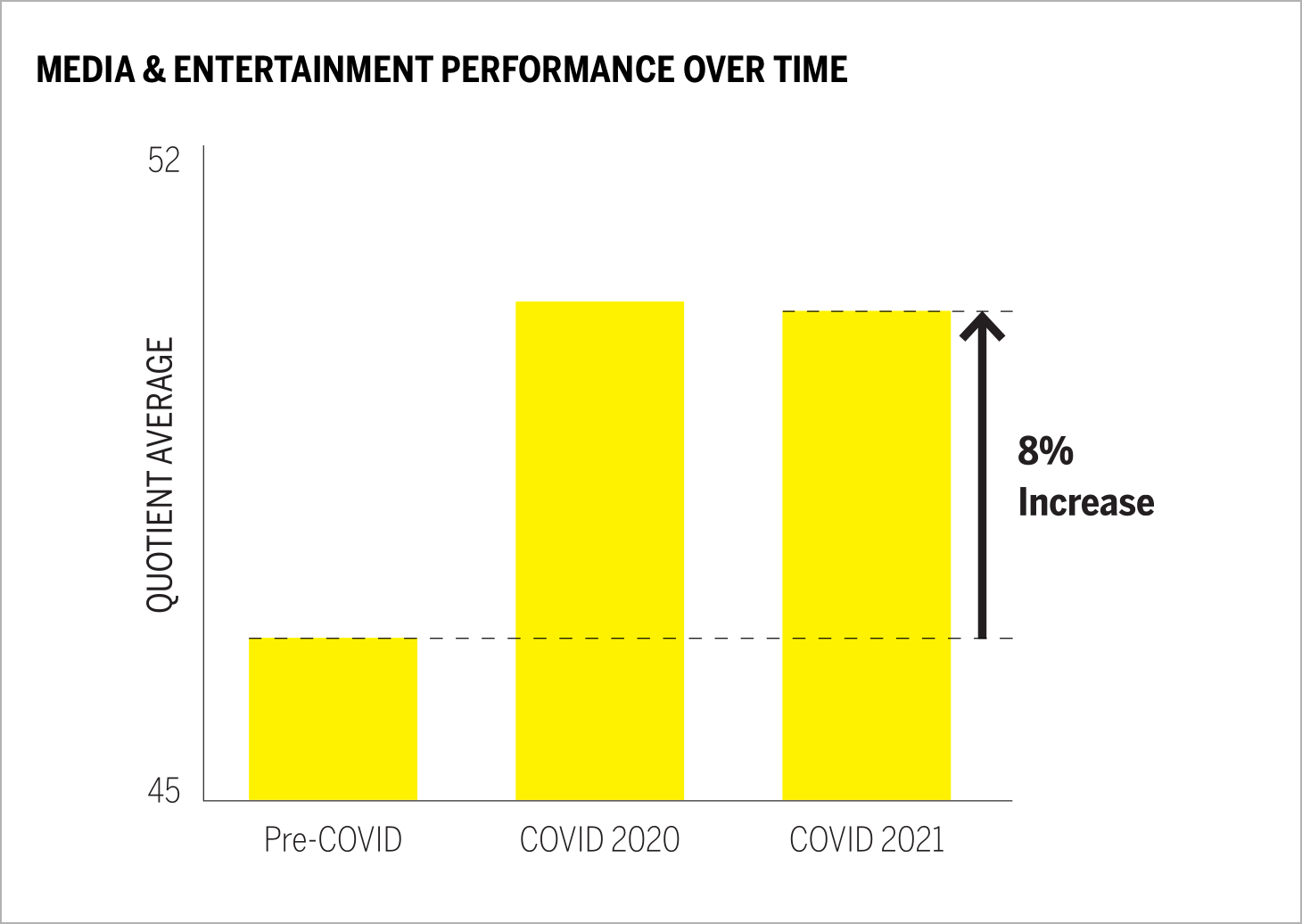

Despite the hardships imposed by COVID on people and businesses, this period has actually drawn consumers closer to media & entertainment brands and created stronger emotional relationships. Brand Intimacy performance for the category has increased by 8 percent on average since before the pandemic.

As the chart indicates, Disney has moved into first place with Amazon Prime holding steady in second place. YouTube, the previous first-place brand, has dropped to third place. PlayStation and Xbox have both improved their performance while Nintendo and ESPN have declined. Media & entertainment brands perform better with men than women and with consumers under 35 years old than those older than 35 years old.

Gaming continues to show strong performance in 2021. Xbox content and services revenue has increased by $739 million (34 percent) since last year.1 Nintendo, which dropped from sixth place to eighth place in our most recent study, shows financial decline. In 2021, Nintendo expects its revenue and net profit to decline by 9 percent and 29 percent, respectively, as it ships fewer Switch consoles as a result of the chip shortage, saturation of the market, and competition from newer consoles from Microsoft and Valve.2

The growth of streaming is less clear. Americans spent 44 percent more time streaming video in the fourth quarter of 2020 than they did a year earlier.3 What seems certain is that Americans have more streaming brands to choose from and are becoming more selective. A study in February 2021 noted that the average subscriber has dropped one service compared to October 2020.4 More specifically, Netflix expected to only add 6 million new subscribers in the first quarter of this year, which is less than half of the 15.8 million subscribers that were added in the first quarter of last year when the lockdown began.5 This may help explain why the brand dropped one spot from fourth to fifth in our 2021 COVID study.

Despite shifting growth, media & entertainment improved its performance in the most advanced stage of Brand Intimacy, fusing, by 24 percent. This means during the pandemic, more consumers were able to co-identify with media & entertainment brands and deepen their emotional connections. Sharing and bonding scores declined, suggesting newer users need to be the focus to establish continued intimate relationships with these brands.

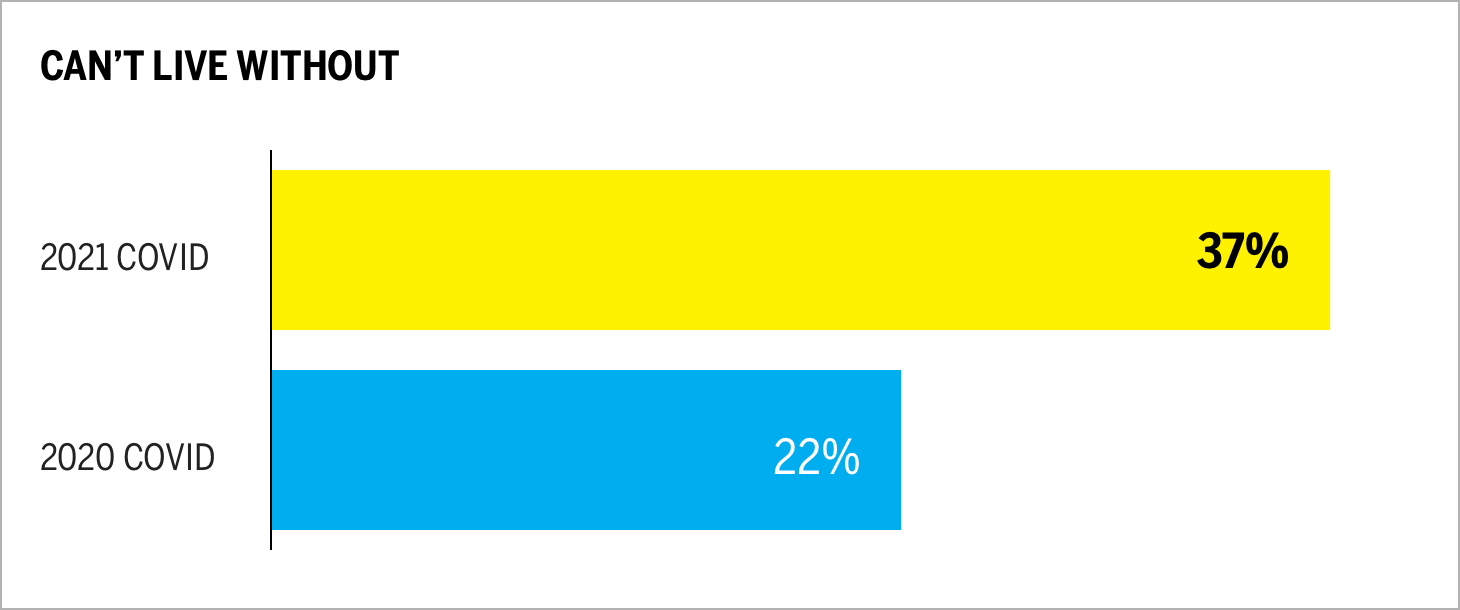

Media & entertainment has improved its score 68 percent on the “can’t live without” measure, which determines how essential a brand is to consumers’ lives. In addition, daily usage is up 7 percent. These measures demonstrate that users continue to rely on these brands.

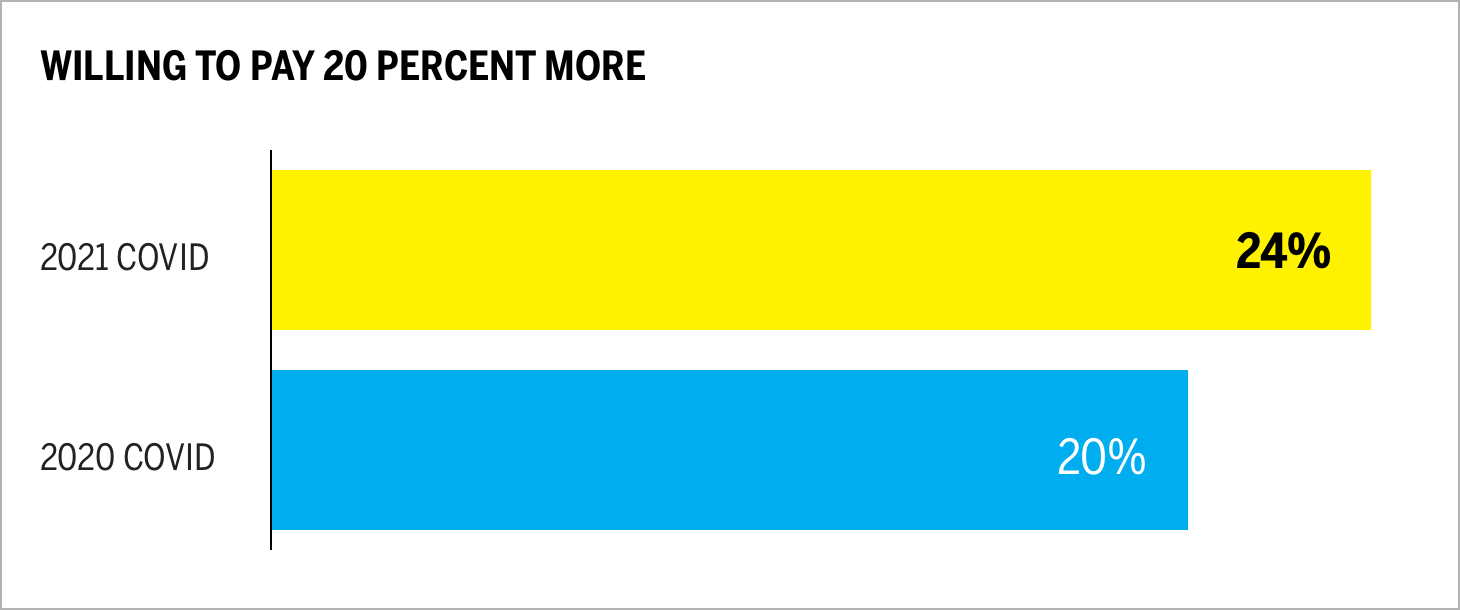

The willingness to pay 20 percent more for media & entertainment products and services has also increased by 20 percent, with Disney being the top-ranked industry brand for this measure. Nintendo, Xbox and PlayStation rank second through fourth, demonstrating the consumers’ willingness to pay more for gaming brands during the pandemic.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands have behaved and communicated since the pandemic started last year. What has changed in their messaging in a year? We have captured a language analysis from company websites and inbound social, focusing on five brands and encompassing 994,788 words.

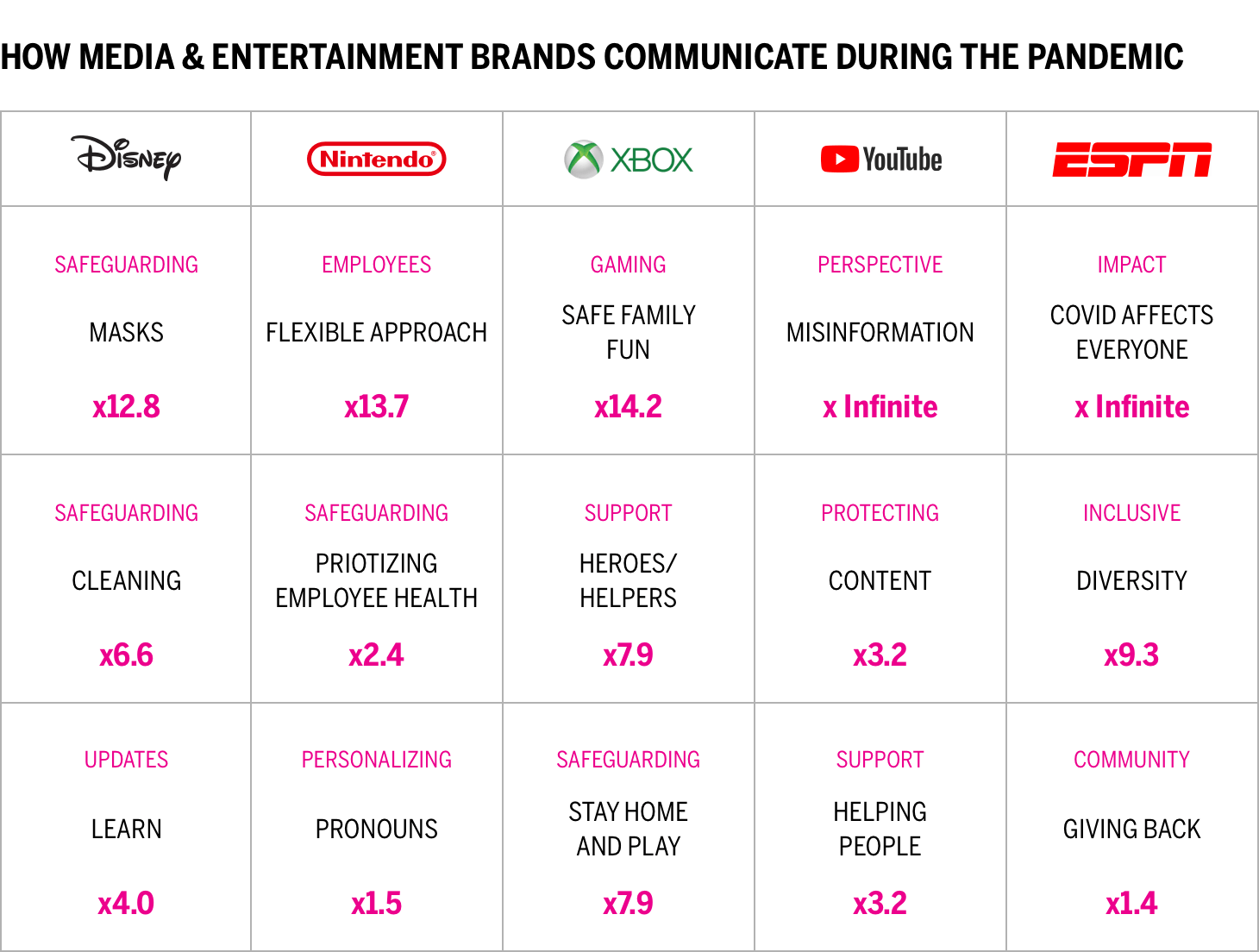

This chart presents a comparison of how five leading brands communicated about COVID on their websites. We can see the number of appearances of key themes for each brand and the relative differences based on the other times reviewed (e.g., Disney speaks 12.8 more times about masks, which is not surprising given its theme parks and physical locations).

Interestingly, each of the media & entertainment brands reviewed have chosen different areas of focus related to the continued pandemic. Disney highlighted information related to its physical destinations. This includes an emphasis on masks, stringent cleaning protocols and sharing updates on changing regulations and its impact on visitors. YouTube addressed its focus on weeding out misinformation and the importance of complying with its content requirements. The brand continues to feature how it is helping people deal with the pandemic. Interestingly, Xbox and Nintendo take very different positions related to COVID communications. Similar to last year, Xbox still highlighted how gaming is a safe family activity and something that can be shared with friends. Nintendo emphasized prioritizing employee health and being flexible with employee hours and locations. Last, ESPN talks about the effect of COVID on everyone’s lives, giving back to the community, and the importance of diversity and an inclusive culture.

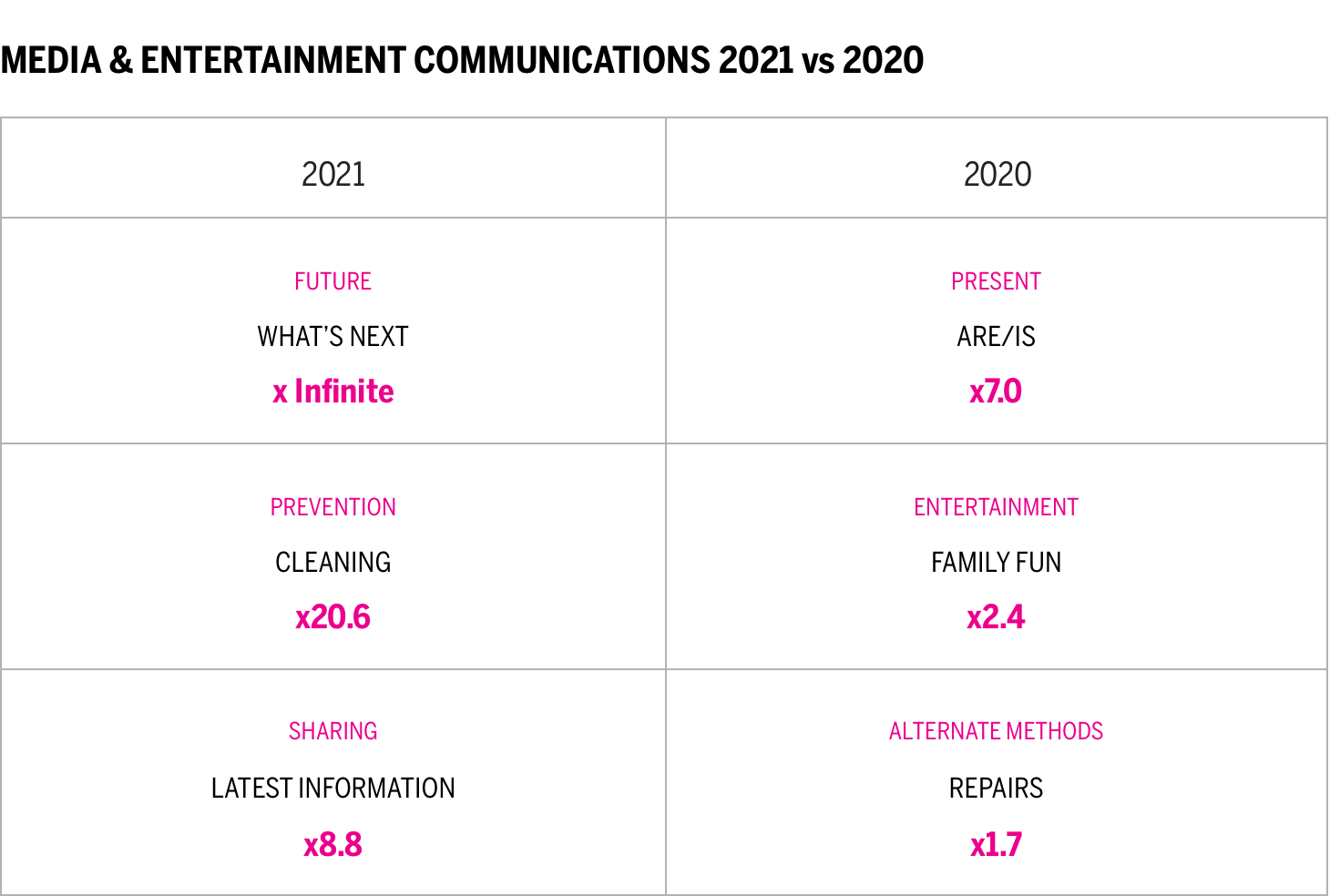

Last year, communications highlighted the present moment and how entertainment was safe family fun. There was also a tactical focus on how to get things repaired while stores were closed. This year, language had a significant future focus shift, a growing emphasis on preventative measures, and more sharing on COVID planning and protocols. In addition, there has been a 36 percent increase in the amount of pandemic communications these brands are producing compared to last year.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is a key principle for navigating our challenging times. The continued longevity of the pandemic requires media & entertainment brands to think about deepening their bonds with users, and attracting new users in carefully considered ways.

Although media & entertainment maintains its top industry position, it did show a decline in sharing and bonding percentages, suggesting fewer new users are coming into the fold to form emotional attachments with these brands. With increased competition in the gaming world and subscription service fatigue, media & entertainment brands need to prioritize relationships because less time at home and more options will result in increasingly selective users. Category brands should be building on the foundation they have by establishing member programs, encouraging dialogue, and acting less transactional and more relationship focused.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.