CONTEXT

The excuse of leaving your wallet at home is now a thing of the past.

Despite being around for over ten years, peer-to-peer payment services have recently increased in popularity, particularly among millennials. Mobile P2P payments in the U.S. have an estimated annual transaction volume of $28 billion, with 82 million U.S. adults making a mobile money transfer in 2016.

The role of P2P payments has evolved beyond the occasional eBay purchase or international money transfer, as users find it easier to split checks, pay bills, and keep track of money owed to friends and family through these services. Their adoption appears to be increasing rapidly when you consider that market leader Venmo transferred $1 billion in January 2016, which is ten times what it transferred in January 2014.

The landscape includes players from a variety of backgrounds, including industry pioneer PayPal, tech giant Google Wallet, more recent FinTech entrants like Venmo and Square, and social media platforms with access to enormous user bases, like Facebook and Snapchat.

CHALLENGE

To test the six P2P payment services we identified, our team went on a weeklong journey of buying doughnuts, coffee, and lunch to determine who stood out, who stumbled and who provided the best user experience.

WHO WILL WIN OUR BATTLE OF THE PAYMENT APPS?

PayPal

Market Entry:

1998

Send and transfer money at the speed of life

Venmo

Market Entry:

2009

Make and share payments

Google Wallet

Market Entry:

2011

The fast, easy, and free way to send money to friends and family

Square Cash

Market Entry:

2013

Send money for free

Snapchat

Market Entry:

2014

Send money in a snap

Facebook Messenger

Market Entry:

2015

Send money to friends securely and easily

INSIGHTS

In testing each app we uncovered four hallmarks of a superior user experience.

EASY MONEY

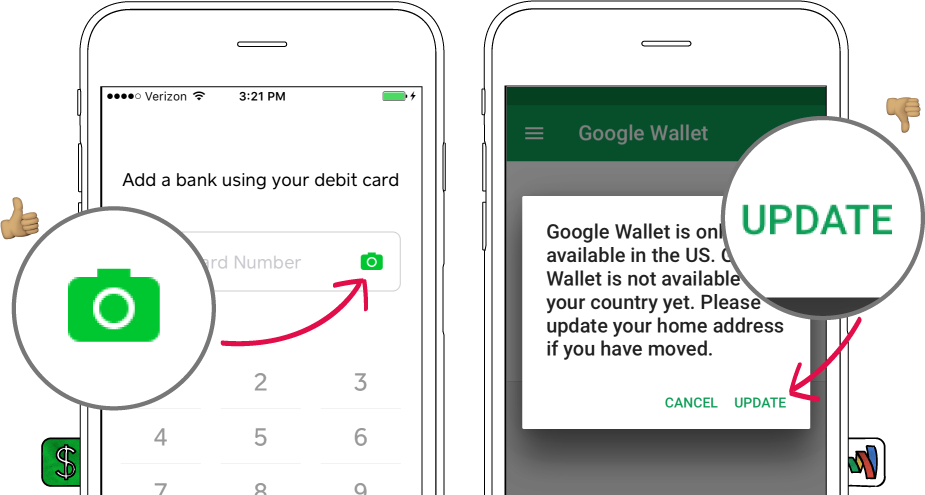

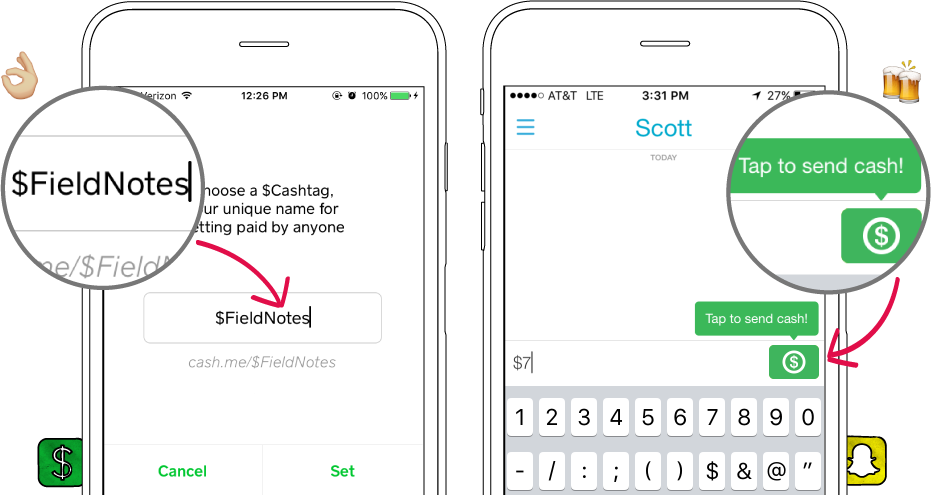

When it comes to P2P payment apps, we want an interface that’s easy to use, a seamless signup so that our friends will join, and a payment process that even our grandparents can understand. For our group of testers, Square Cash was the clear winner when it came to the signup process and user interface. Being able to add a new card via the phone camera was a huge plus that cut down on signup time and hassle. Their “$Cashtags” made it easy to find and pay anyone, even if you didn’t have their phone number or email address. If you’re away from your phone, Square Cash will let you pay and request through their website or even via email.

On the negative side, we had issues with the Google Wallet app, which had a more convoluted signup process and gave one of our participants trouble for having a Gmail account that was registered outside the U.S. It seems that being intertwined with every aspect of a person’s digital life can be liability that a newer app with a single focus doesn’t have to contend with.

IT PAYS TO BE POPULAR

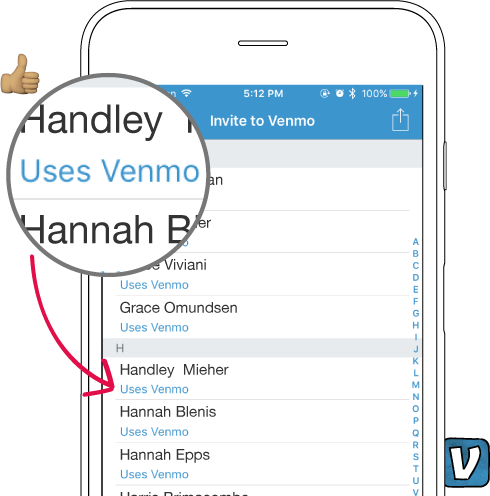

Although P2P payments have a variety of uses, most of us in the test group use them for paying back friends and splitting checks in a restaurant or bar. Even if an app charges no fee, is easy to use, and seems trustworthy, it can fail to gain ground on the competition if the user base is too small. After all, this is peer-to-peer payment and it’s only convenient if both parties are using the same app. Since no one likes to take the time to download a new app or enter their credit card information, the most convenient app is probably the one that your friends and family are already using, and for us, that was Venmo. We like Venmo for its unique social feed (even if it is overrun with “hilarious” payment descriptions), but we love it for its popularity. When was the last time you heard someone say, “Can you Google Wallet me ten bucks for lunch?”

Although nearly every one of our participants frequently uses Facebook and Snapchat, none had ever sent or received money with either of these otherwise hugely popular platforms. It was no surprise that most of their friends didn’t even know you could use them to send money. Perhaps these social media behemoths will become more proactive in marketing this hidden feature, but until then, we’ll stick with Venmo.

THE FUN FACTOR

Admittedly, “fun” isn’t the word that immediately comes to mind when dealing with P2P payment brands, but in order to distinguish themselves from the competition, several of our tested apps have made varying attempts to create an entertaining experience. Venmo is well known for its social feed and liberal use of emojis within the app community. For many, what might seem like over-sharing has become a tongue-in-cheek inside joke. Not to be outdone, Square Cash came up with the catchy concept of the “$Cashtag” that is both easy to understand and use and adds a sense of personality to the payment process. Snapchat stood out from the rest by seamlessly integrating its payment feature into the overall app experience by asking whether you would like to send money whenever you use a dollar amount in a message. Sending payments through Snapchat eliminated the rigid feeling of interacting with a financial institution. The experience was colorful, informal and completely integrated into the flow of the conversation taking place in the app.

TRUST IS A MUST

Despite frequent headlines about identify theft and yet another merchant getting hacked, we somehow felt safe using all the apps during our research. When it came down to which we trusted most, how familiar we were with the brand played a significant role. PayPal immediately earned our trust as it was a brand our team had associated with payments for years. Additionally, several of us had previously used PayPal for online transactions without issue. Interestingly, Google Wallet left us the most uneasy. Several participants found it unsettling when they signed into their Gmail account and found that Google already had their credit card information. We felt less comfortable using apps such as Facebook Messenger and Snapchat either because we were not accustomed to sending and receiving money with them or because it just felt strange to trust an app well known for questionable content with our money. One of our testers deleted each app after trying it out, suspicious that something somehow might go wrong unnoticed.

The Full Notes

Download the full Field Notes for a closer look at each brand and our handy flowchart to help you choose which app is right for you.