Overview:

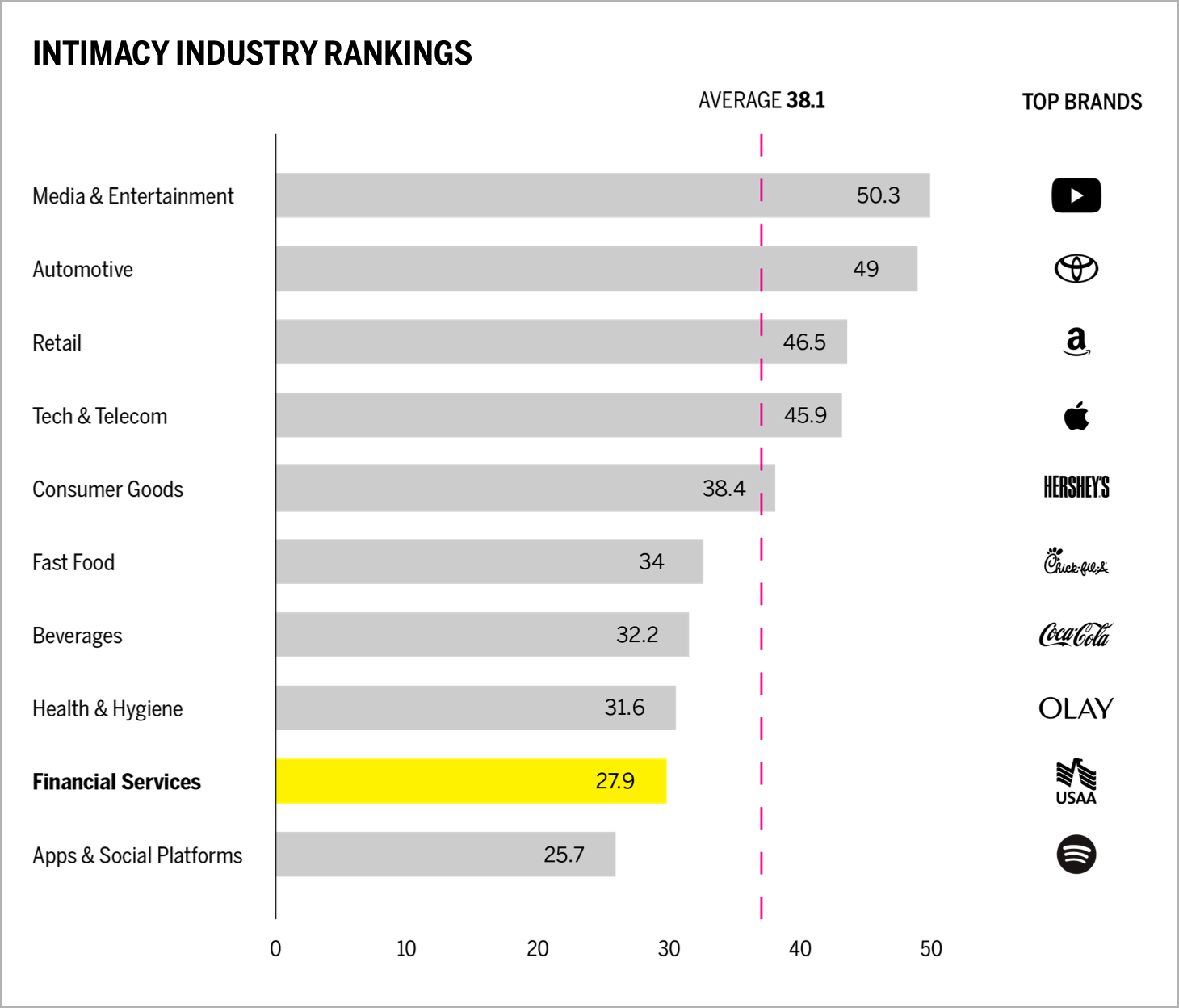

The financial services industry ranks ninth in our Brand Intimacy COVID Study. To view our new study, click here.

USAA is the top-ranking financial services brand. To see USAA’s brand profile, click here.

During COVID, financial services brands have ranked higher than the industry average for the enhancement, identity, and ritual archetypes. To read our financial services industry page, click here.

Introduction

As businesses and their brands face unprecedented challenges in the face of the COVID pandemic, we are sharing our new insights on how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

This article is based on data and findings from our new Brand Intimacy COVID Study, conducted with 3,000 consumers in late summer 2020 revealing how leading brands are affected by the pandemic.

Brand Intimacy Performance Today

The financial services industry has an average Brand Intimacy Quotient of 27.9, well below the cross-industry average of 38.1.The industry increased its average Quotient Score by 15 percent.

The pandemic is clearly affecting business for financial services. Credit cards such as American Express are limiting new customers because it is currently difficult to get an accurate picture of someone’s financial health or job security.1 Visa has noted a shift from credit card use to debit card use, citing a more pragmatic consumer psyche. Volume on Visa credit cards was down .88 percent in spring, whereas debit card values were up 12 percent.2 With travel spending down and more focus on entertainment and groceries, many are adjusting their reward perks to better meet evolving consumer needs.3 Chase Sapphire Reserve and Chase Sapphire Preferred cardholders can now redeem points for statement credits to offset purchases at grocery stores and home improvement stores; previously, these points applied to travel.4 Similarly, some American Express cardholders are now eligible for cash back if they pay for certain streaming entertainment services like Hulu or wireless phone service.5

Many banks, like Citi, Chase, and Wells Fargo, are trying to provide ways to lessen financial burdens. They have offered delays of two to three personal loan or mortgage payments and have removed payment fees where possible. Others, like Capital One, have invited customers to call them and discuss their specific situation. Chase and Bank of America have also deployed millions in new philanthropic investments to help with supporting vulnerable, hard-hit individuals who have lost their jobs or experienced reduced income.6 Wells Fargo is supporting national nonprofits in expanding virtual, cost-free coaching services to help the public adapt in these challenging times.7

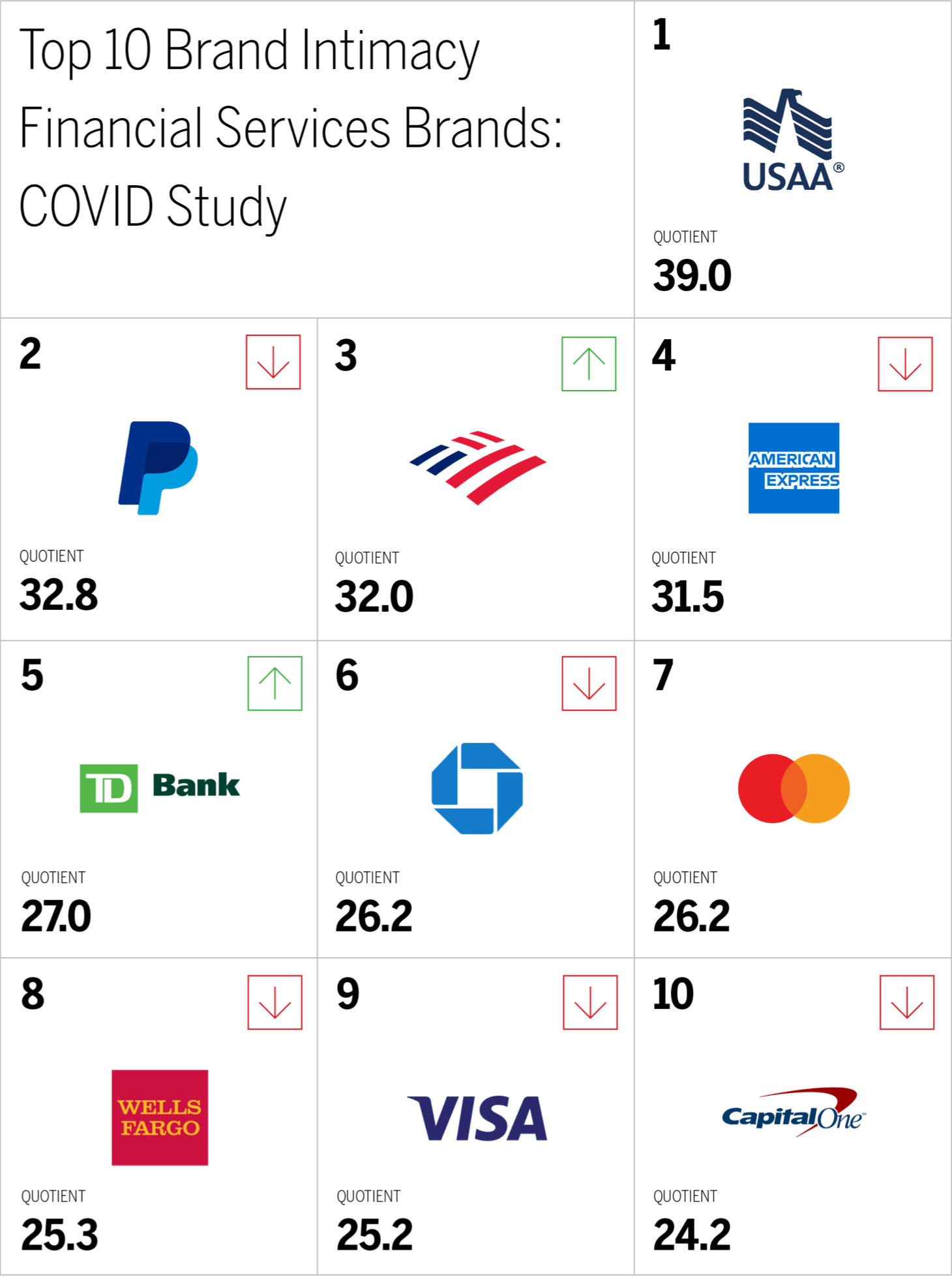

New entrant USAA lands the first place position, while PayPal drops to second place. Consumer preference for Bank of America has increased, while preference for Visa, CapitalOne and Citi has decreased. Brands in the industry perform better with men than women and with consumers under 35 years old versus those over 35.

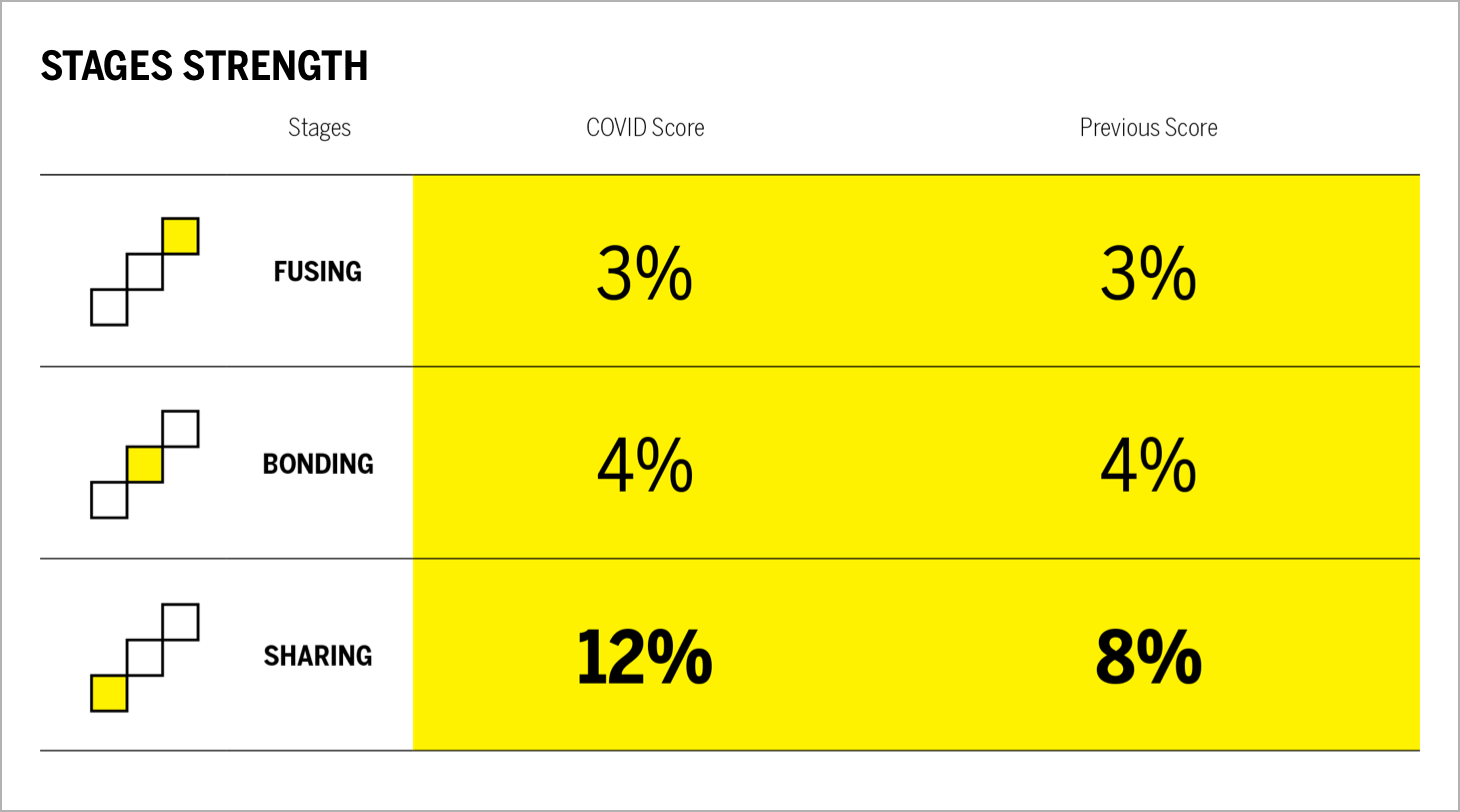

The financial services industry improved its performance in the earliest stage of Brand Intimacy, sharing by 50 percent. This suggests, during the pandemic, more consumers have been emotionally connecting to financial services brands than in our previous study. In fact, the percentage of customers in some form of intimacy with financial services brands grew 21 percent. Bonding and fusing scores remain the same.

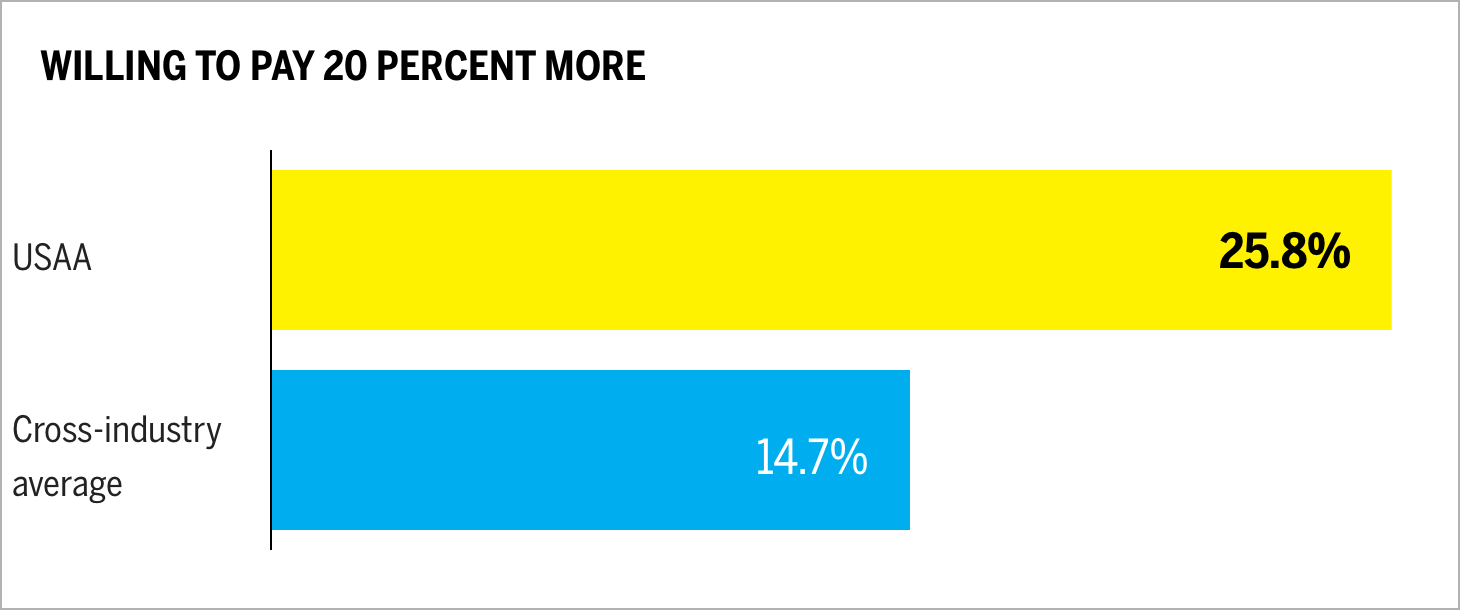

USAA, the top intimate financial services brand, has 25.8 percent of customers willing to pay 20 percent more for their products and services. This is 43 percent higher than the average of all brands in our study, highlighting that the more customers value their intimate brand relationships, the more they are willing to pay for the brands they use and love. The financial services industry also improved its overall average on consumer willingness to pay 20 percent more, rising 22 percent from our previous study.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated during the pandemic. We have captured a language analysis from company websites and outbound social, focusing on 5 brands and encompassing 640,119 words.

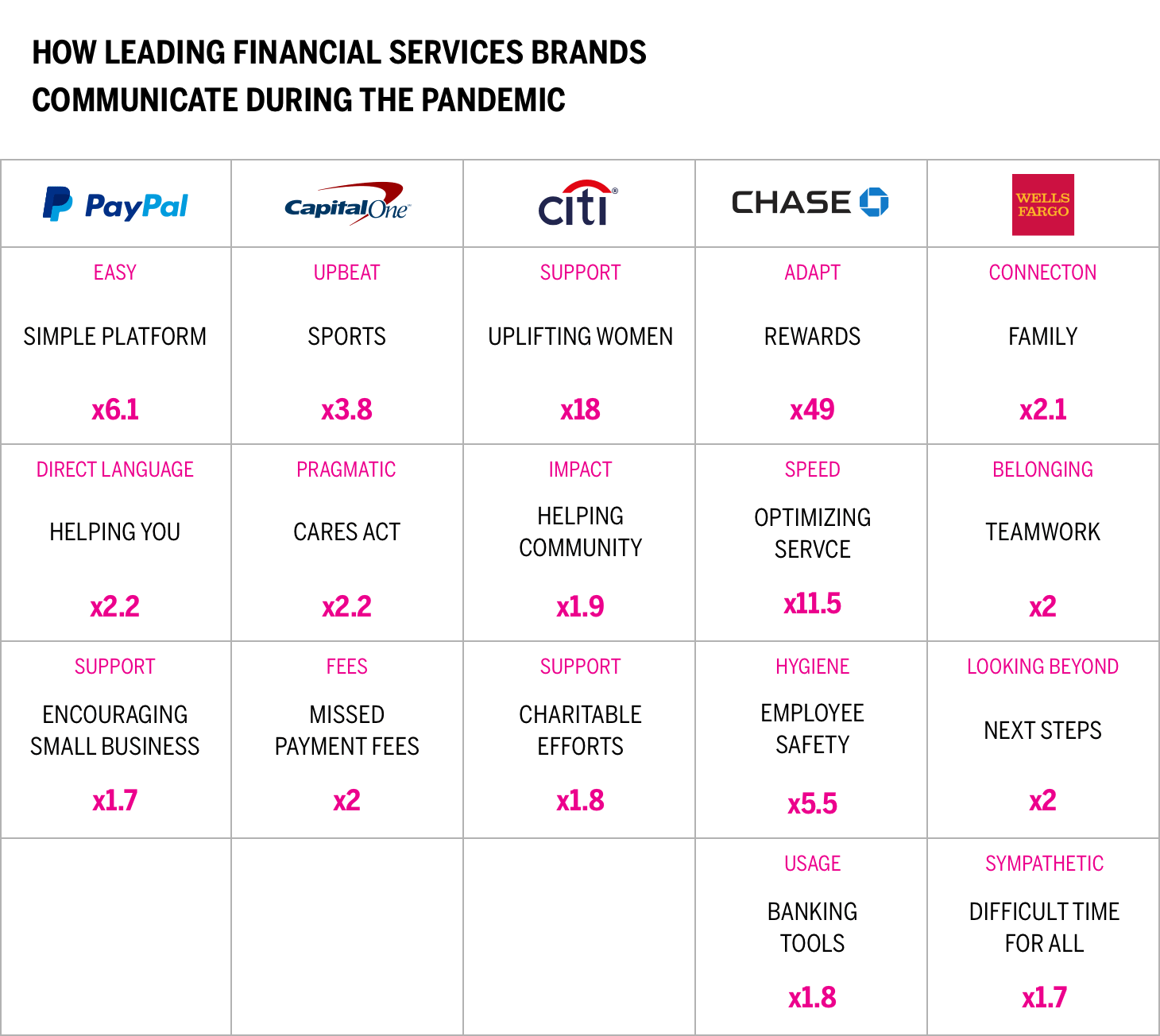

This chart presents a comparison of how leading brands are communicating about COVID on their websites and social. We are able to see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Citi speaks 18 times more about uplifting women during this time compared to competitors).

Each of the 5 brands reviewed has elected to take a slightly different approach to dealing with the pandemic. PayPal is straightforward, using its platform during this period to tangibly address the ways it can help. PayPal’s social content takes a lighter tone than its web copy. Capital One is the most pragmatic, mentioning the CARES Act when describing the virus’s impact and highlighting the costs of missed payment fees. Capital One’s social media also features more non-COVID communications, such as interviewing sports professionals. Citi focuses on a corporate story of helping communities and charitable giving. Like PayPal, Chase highlights using its tools and the ways its programs are improving service. Chase also focuses on the ways its rewards programs are being modified in light of COVID. Wells Fargo speaks in the most emotional tone, with a “here to help” message. It acknowledges the difficult time for all and the importance of family and teamwork, and it expresses hope about what’s coming next.

Consumers tend to be frustrated when posting on social media about these brands. They may be asking for help, complaining about long wait times, or suggesting that banks are not on their side. Given the high performance of the enhancement archetype (making you smarter, better connected, and more effective) associated with this industry, consumers expect these brands to help them be more capable, smarter, and more connected. Delays, confusion, or annoying customer service interactions disconnect with expectations.

There has been some pandemic-related advertising from brands over the past few months. Both USAA and JP Morgan Chase focus on online services they offer and saluting customer resilience.

Wells Fargo has a spot that addresses how it is helping feed the hungry by using some of it locations as food banks.

USAA has been leveraging its work with military families to combine our heroes with how the brand is enhancing their lives.

It is important to keep in mind that a brand’s tactics or communications are just a small signal of a brand’s intent and do not directly indicate how a brand creates greater intimacy.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is also a key principle for navigating our challenging times. The pandemic and the economic aftershocks will require brands to navigate in new and more carefully considered ways.

Financial services brands will likely be in for a rocky road over the next few months. Consumers who have no history of financial problems may default or be unable to make payments as a result of COVID. As delayed payments come due, tensions will rise. Some consumers may feel the banks do not care about them. Enhancing communications and establishing real connections between financial service brands and customers will be paramount. Additionally, those that advance their service components, provide status updates, and include tools whereby people can see what they owe and what their payment options are, will help demonstrate tangibly their desire to help, especially since we have seen daily usage increase 19 percent during the pandemic.

At the same time, with every state reopening, maintaining the ability to handle traditional activities like mortgages (given the all-time low rates), personal loans, and business needs requires continuously delivering and collaborating with clients to get people and companies back on their feet.

Before the pandemic, most financial services brands were generally status quo, looking for new niche offerings to expand their portfolios and new technology features to enhance their experiences. Now, with negative financial impact facing most Americans, the role of financial services brands is becoming more significant. Early indications from our COVID Study indicate that the industry is improving on a number of measures and connecting with customers. For those who are less compassionate, more rote, and focused only on transactions, there will likely be an erosion in trust and eventual disengagement. For those that help customers through this crisis, consumers will likely feel a stronger bond and deeper connection. As we return to “normal” life, it will be interesting to see whether our connection to financial services brands changes. Intimate brands, those built on a foundation of emotional bonding, should find a way to reference what we have all been through together and how they have tried to help us through this difficult crisis. That means reflecting our collective consciousness, not going back to the world before COVID.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.