Overview

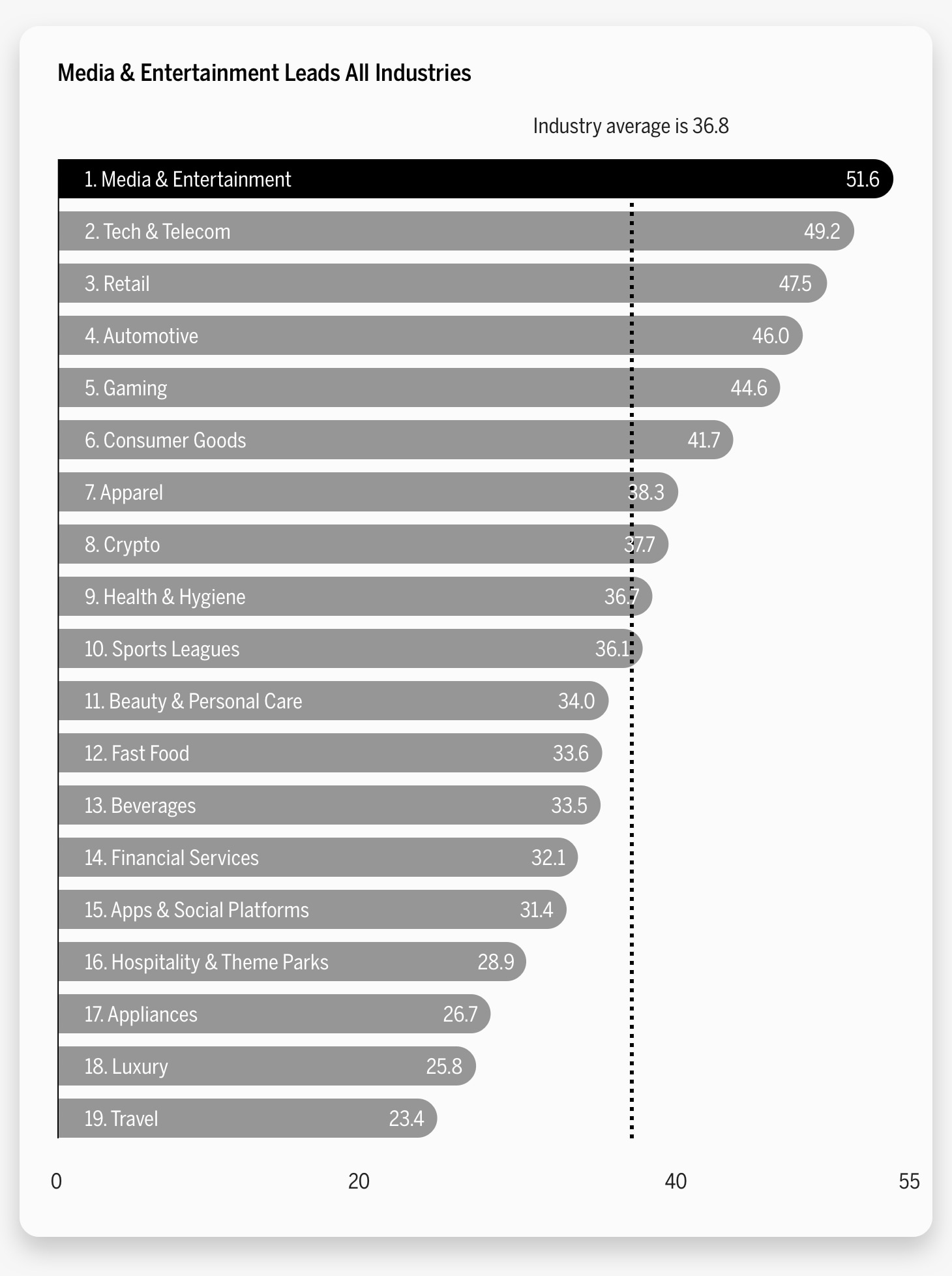

- The media & entertainment industry ranks first in our Brand Intimacy 2022 study. To review our new study, click here.

- Disney is the top-ranking media & entertainment brand, and the number one brand overall. To review Disney’s brand profile page, click here.

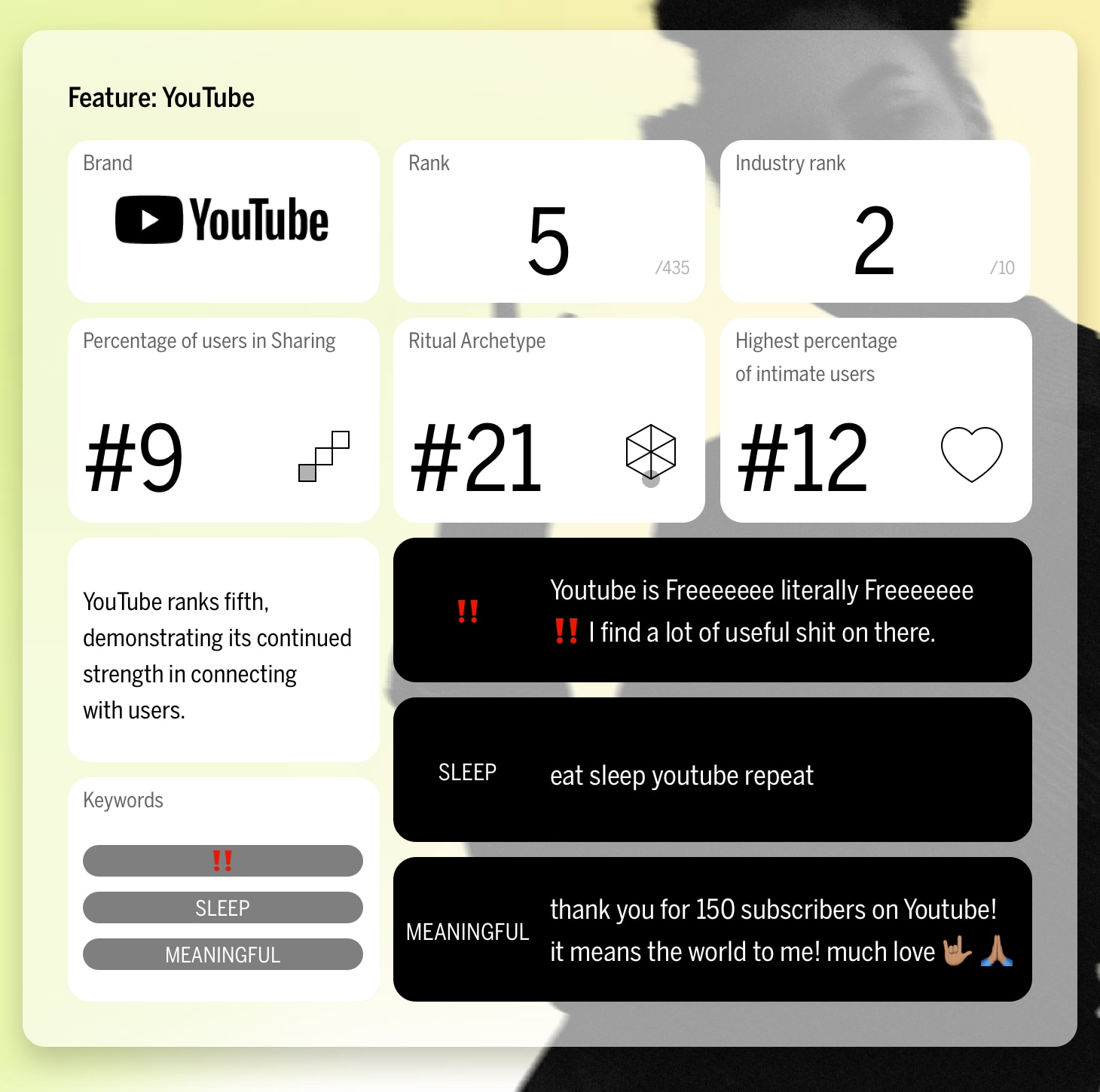

- YouTube ranks fifth overall and second in media & entertainment. Click here to see YouTube’s brand profile page.

Brand Intimacy, the emotional science of how we bond with the brands we use and love, is thriving in its 12th year of existence. In this year’s study, we are excited to share the results of how more than 600 brands performed as we’re emerging from the pandemic and assuming more “normal” routines.

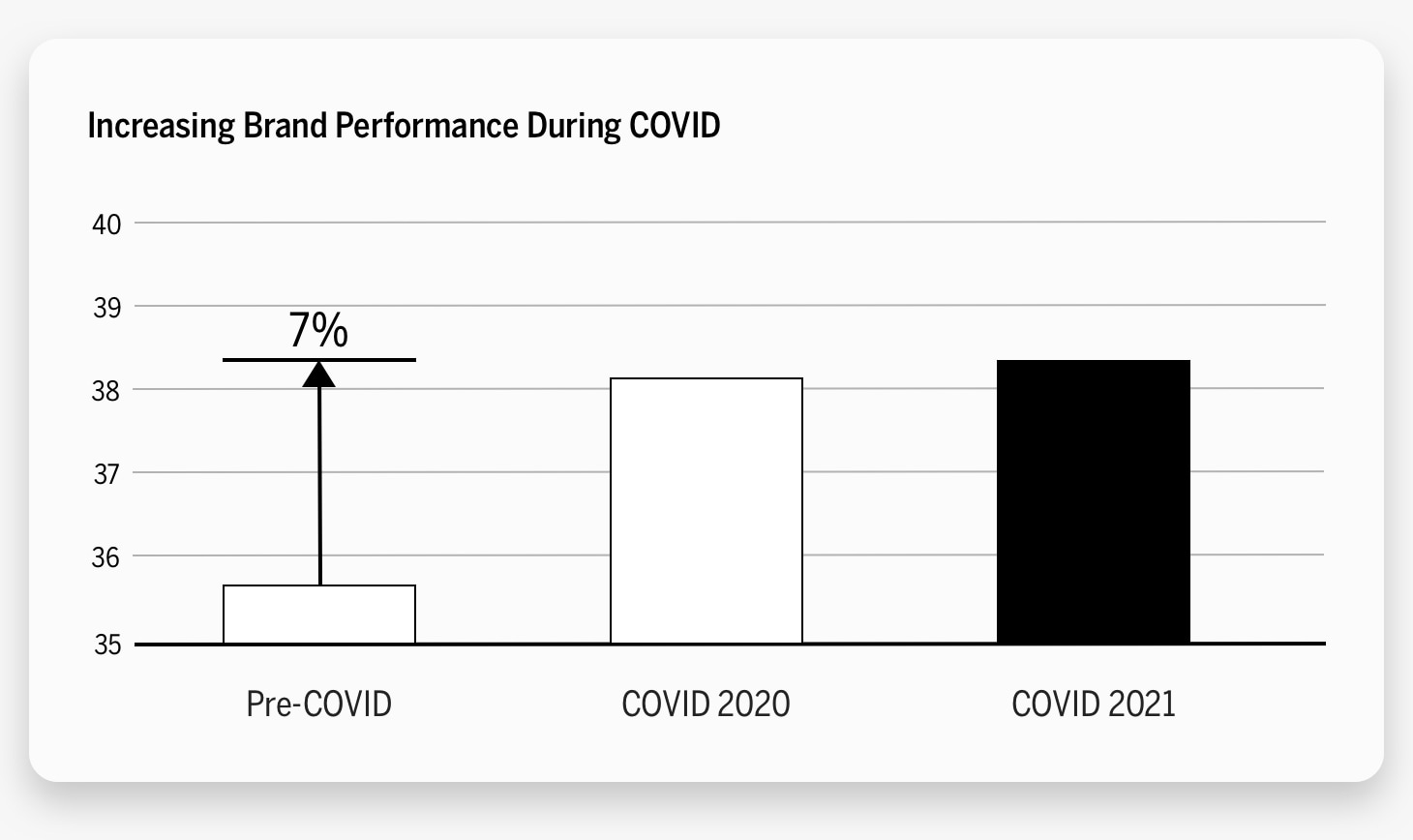

The COVID Brand Bump

For context, our previous two studies confirmed that brand performance increased during COVID for leading brands in most industries and especially for brands in media & entertainment. While there have been clear winners and losers, overall people became more intimate with brands during the pandemic. This means that if your brand hasn’t benefited from a COVID-bump, the gap between your brand and your customers has likely widened and worsened.

Escapism Leads a New Arms Race in the Attention Economy

The past four to five years have certainly been turbulent. As a society in America, we have been on the receiving end of seemingly endless body-blows. From societal turmoil (Black Lives Matter) and political instability (January 6 insurrection) to the global pandemic, it is no wonder we are eager to escape reality.

Delivering relief in these turbulent times, streaming brands were the beneficiaries and clear Brand Intimacy winners, serving the content that viewers were flocking to. Streaming brands (and user-generated content platforms like YouTube) began a new kind of arms race to attract more subscribers with more diversified content on a global scale.

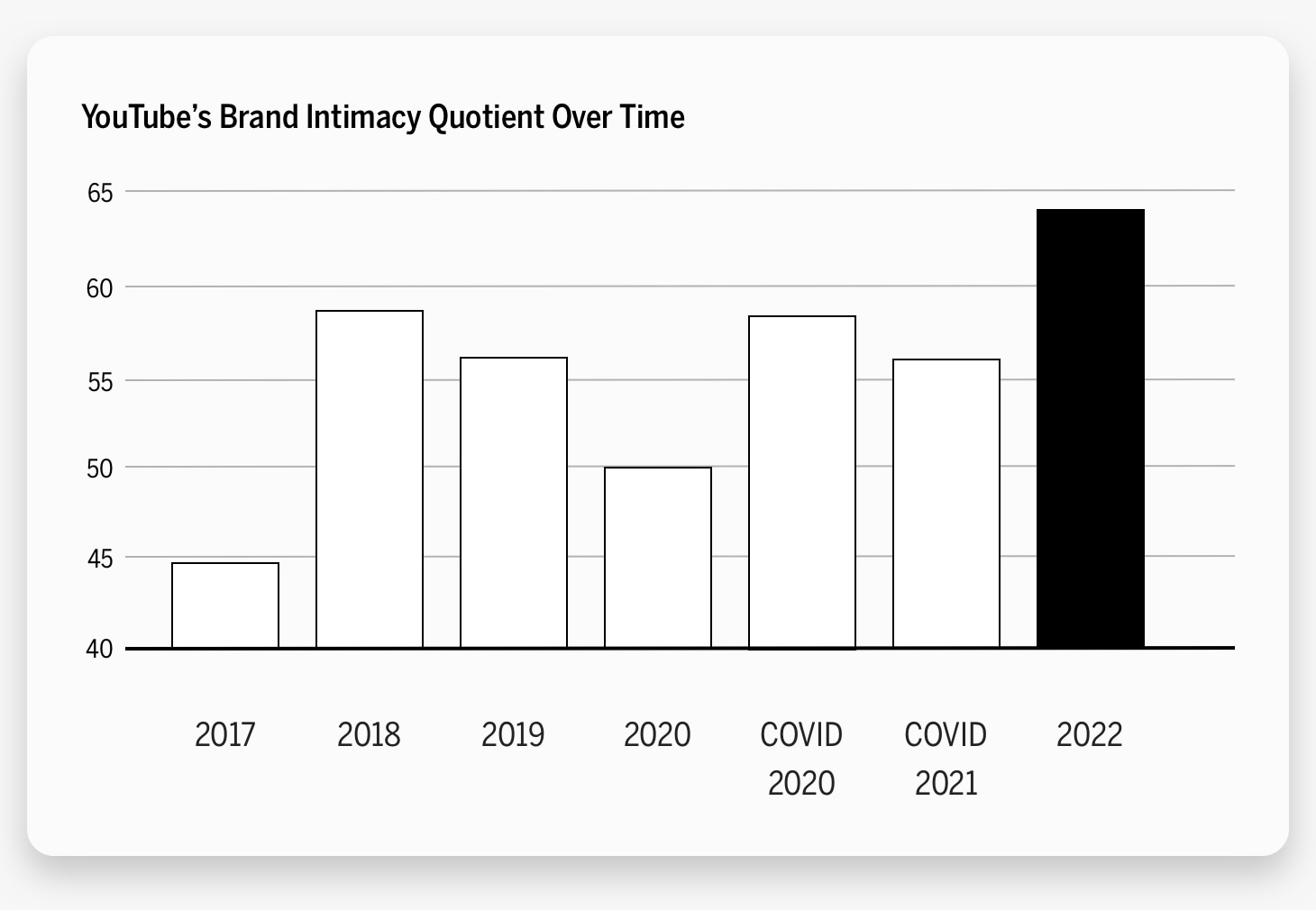

YouTube’s Dominance

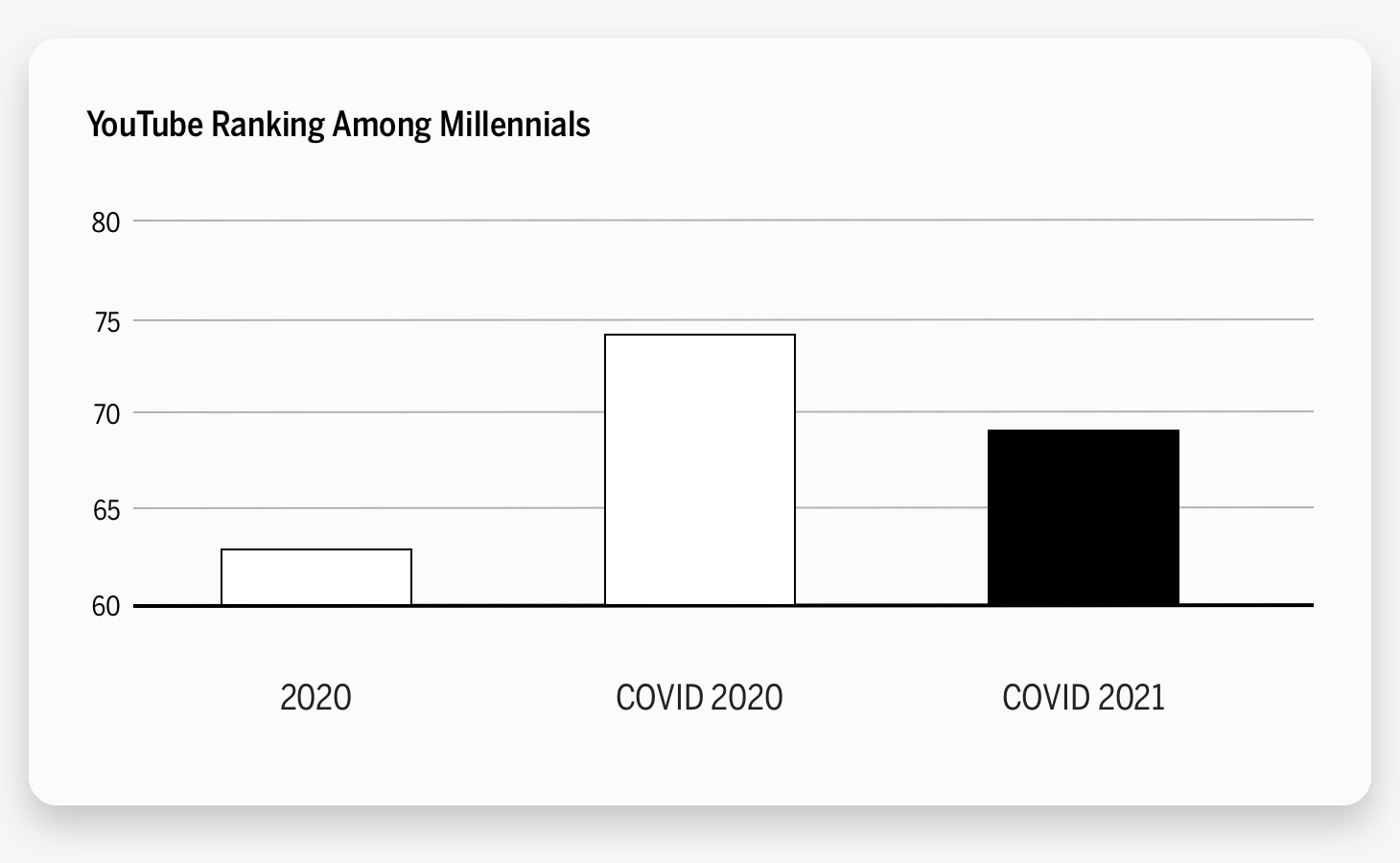

YouTube has improved and risen through our rankings over nearly a decade. From obscurity to a top brand inside of 10 years is no small feat. Even during those early years we saw strong performance, especially with millennials and Generation Z audiences, which portended future successes and remained true as the brand grew. Over the past three years, the brand has become a steady top performer.

As mentioned, YouTube has ranked high among millennials over the past several years. The brand particularly grew in strength with this audience during COVID. It has consistently been among the top three brands overall for millennials.

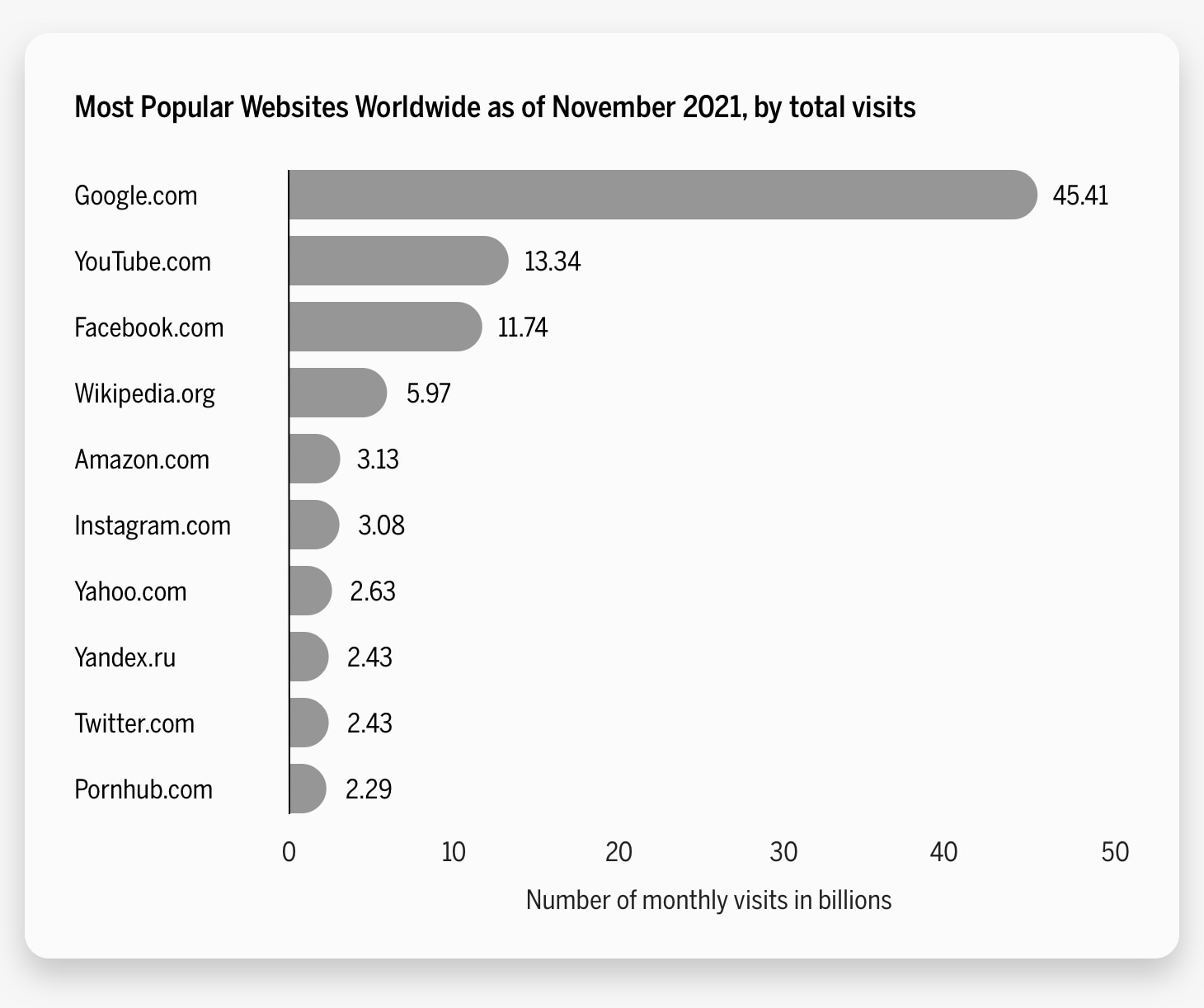

Unlike most of the media & entertainment brands in our rankings that specialize in original content, YouTube is a user-generated experience. On the basis of eyeballs, YouTube ranks only second to another Alphabet brand, Google, compared to popular websites worldwide.

Brand Intimacy Strengths

Beyond the traffic, if you examine the characteristics of the emotional bonds users form with YouTube, you will see enhancement (a brand that makes you smarter, more capable) and ritual (a brand that is part of your daily routine) as far ahead of the category average. These two archetypes, together with indulgence (associated with pampering and gratification), combine for a potent trifecta that underlies the brand’s dominance.

When looking at the Brand Intimacy stages (or the degree of intensity of the bonds formed), we see a brand that is maturing its user base. The brand has migrated its users upwards from sharing, the earliest stage of Brand Intimacy, into bonding, demonstrating a trust with the brand and users committing more to YouTube and less to its competitors. More than 40% of users are in some form of intimacy with the brand.

The 2022 Brand Intimacy rankings leverage AI to analyze over 1.4 million words and phrases that people are expressing about a brand. This has given us more nuanced and personal perspectives. With YouTube, we see users are sharing how the brand is a companion and last trusted source before drifting off to sleep. Others remark on importance and how meaningful the brand is to them and it being a source of education.

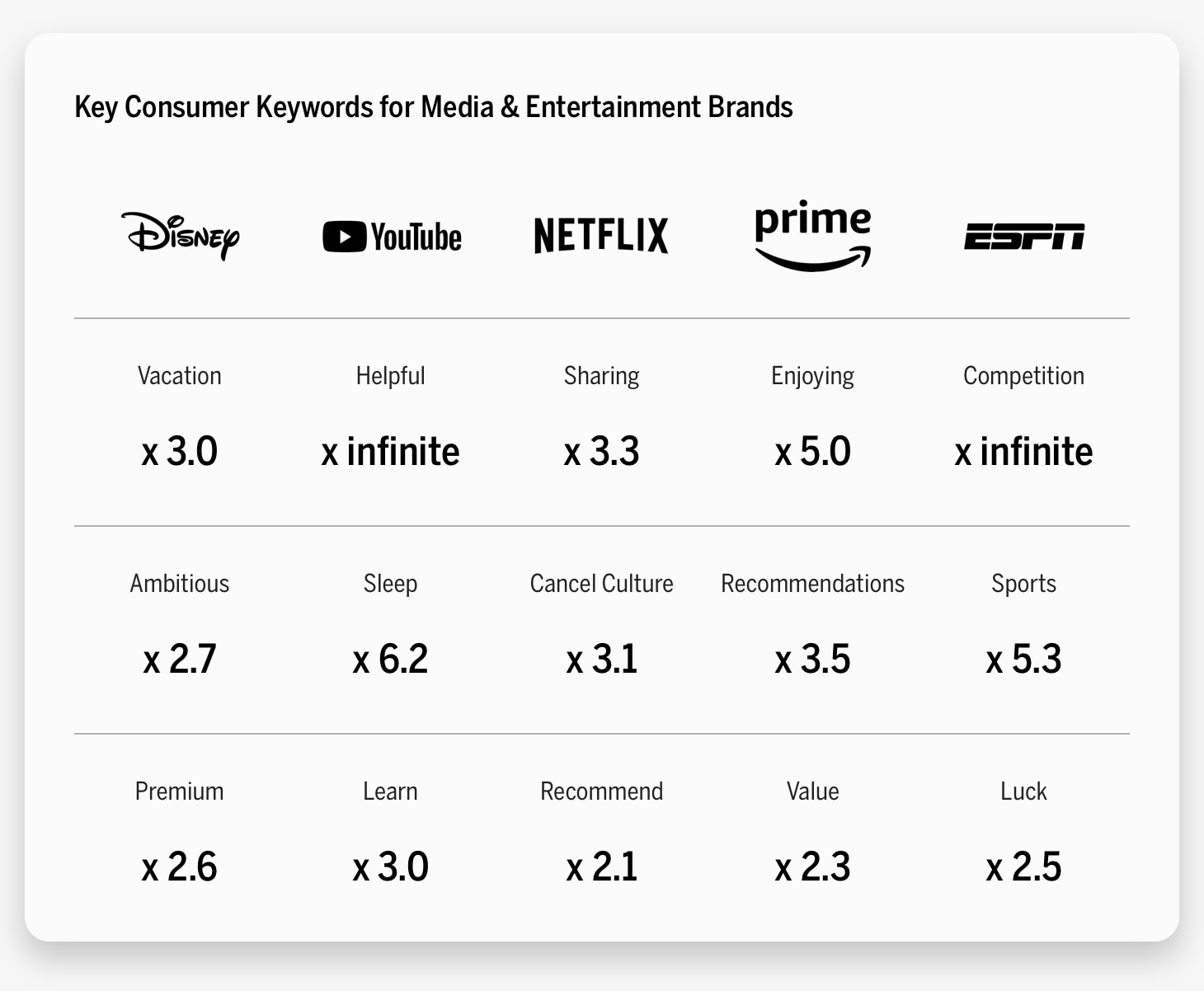

Each of the five brands we reviewed has slightly different consumer associations. Disney is frequently mentioned with regards to its status as a vacation destination, its ambitious experiences, and its premium cost.

YouTube is known for its helpful, educational content and as a calm, trusted source for enhancing sleep.

Netflix is often associated with sharing recommendations and favorite shows. Cancel culture is also frequently mentioned, with people representing both sides of the argument.

Amazon Prime is linked with enjoyable programming and like Netflix, features frequent comments about recommended shows or asking people for recommendations. Prime is also seen as a better value compared to some media & entertainment brands.

Not surprisingly, ESPN is often linked to competition and sports and the luck of certain teams and athletes in pulling out a win.

In comparing YouTube and Netflix, we see YouTube emerging as the stronger intimate brand. It leads across all Brand Intimacy archetypes, notably enhancement and ritual, and all stages, with double the bonding users of Netflix. Keywords for YouTube speak to being meaningful, important, and used for sleep, while Netflix is also associated with sleep, recommending, and anticipating.

Peak TV and How YouTube May Be Poised for Even Greater Brand Intimacy

As the streaming wars have intensified, the proliferation of shows/content is compounded with ever more steaming brands. Perhaps a telling sign of the times is the growing number of apps and services designed to let you reduce the monthly subscriptions you may have forgotten or lost track of. Here’s how a TV executive put it in a recent NPR interview: “There’s just too much competition, so much so that I think the good shows often get in the way of the audience finding the great ones.”1

Despite the competition, Disney+ enjoyed perhaps the most overall success, aligning the clarity of of its brand proposition with major content libraries like Marvel and Star Wars. While Netflix and others are beginning to see cracks and flaws in their business plan as they continue to invest billions to satiate their subscribers’ appetites for new content. YouTube, by contrast, with its focus on promoting its users, seems primed for more growth and sustainable success. Here are three charts that summarize obstacles to Netflix’s success in the future.

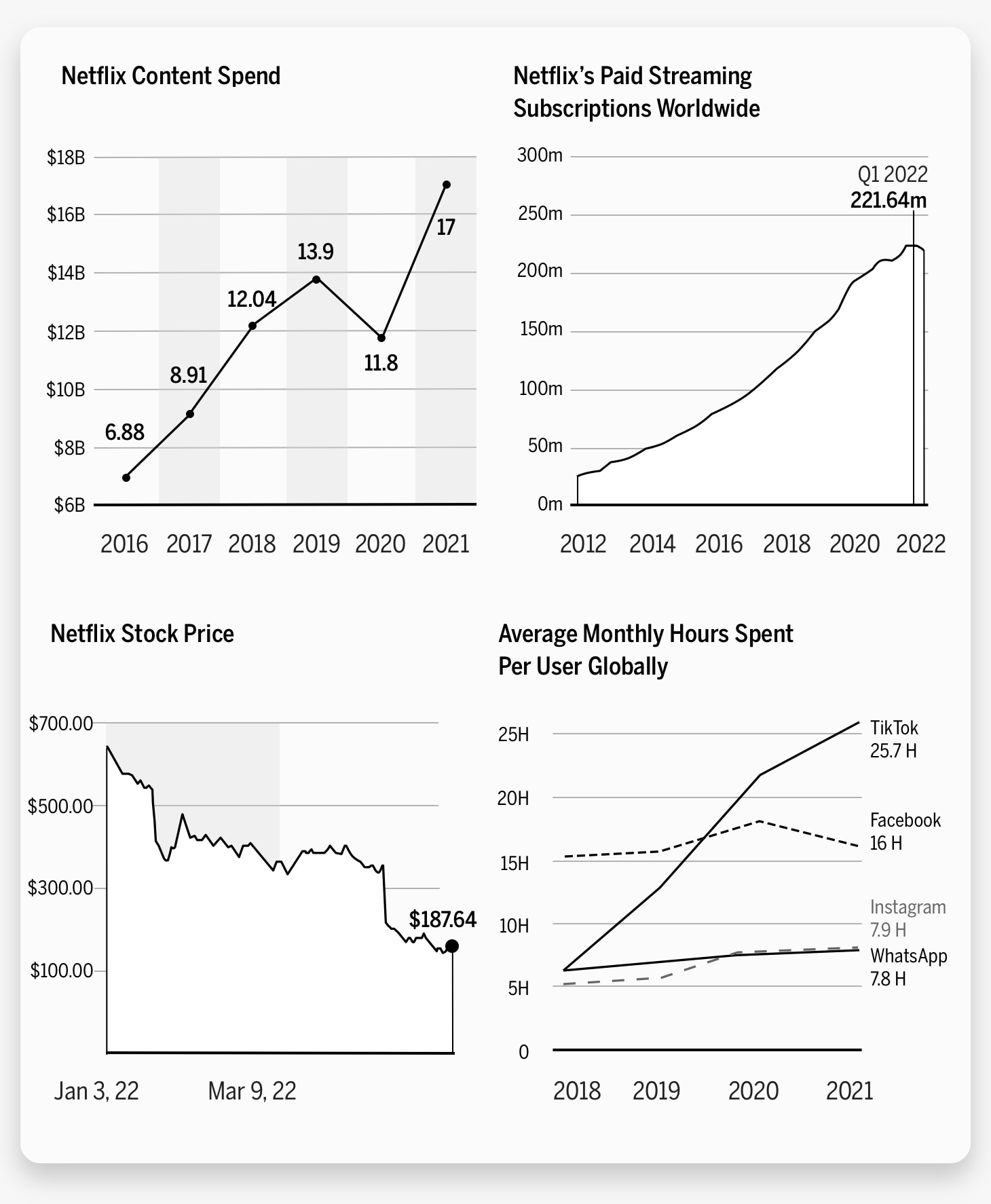

Netflix’s difficult year is perhaps best captured in these three ways. Rising investment and costs in producing content [see Netflix Content Spend], overall subscriber growth stalling for the first time in over a decade [see Netflix Paid Streaming Subscriptions Worldwide] and stock price performance tumbling [see Netflix Stock Price].

In less than six months, Netflix has shed 70% of its value, or over $215 billion.2 Netflix has also started layoffs, reflecting its slowing revenue growth.3 These and other factors are promoting speculation about whether Netflix will add an ad-supported tier and deploy other measures to combat the sharing of accounts. We will be watching the brand’s performance with consumers to see how these changes will affect how users feel.

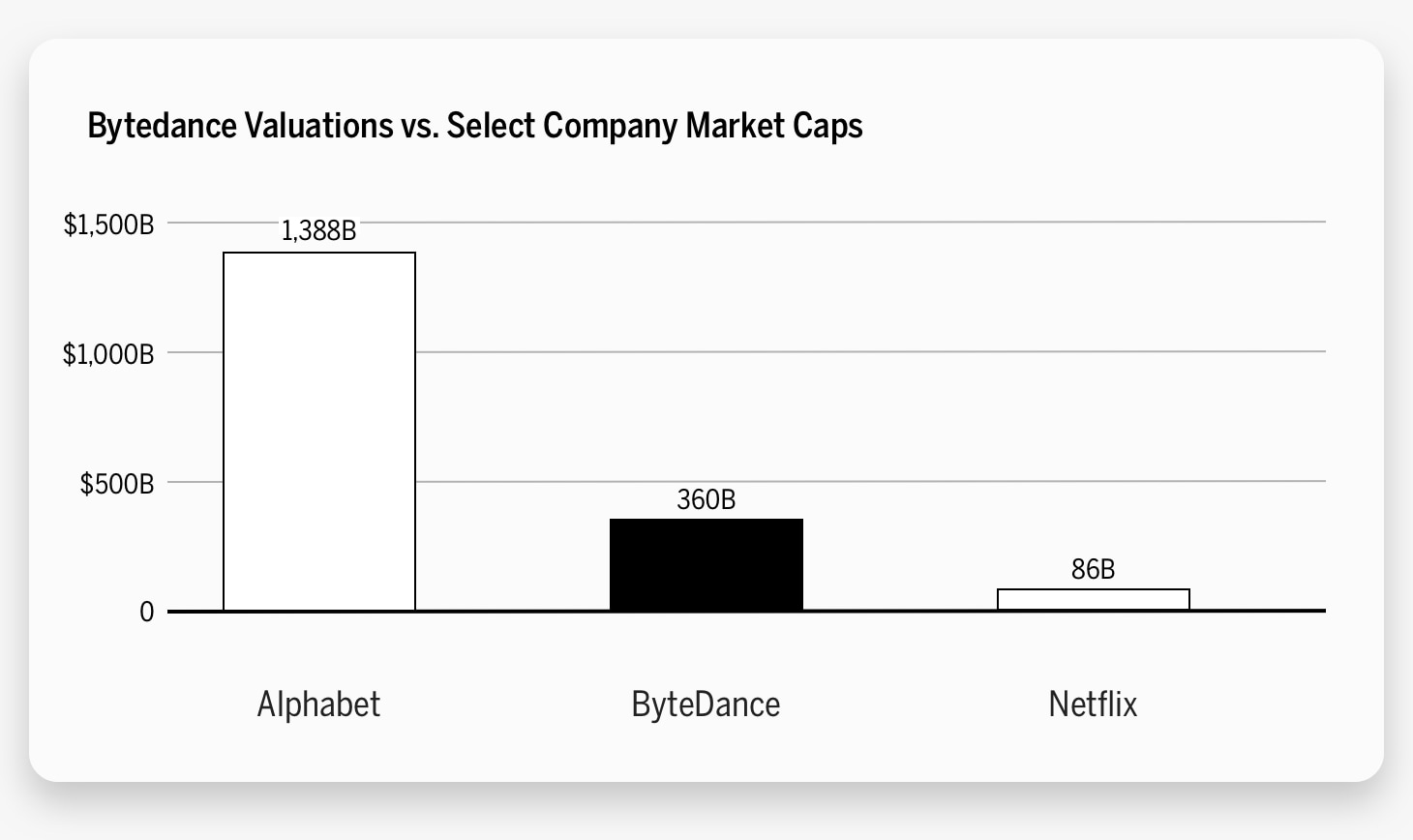

As concerning as this year’s challenges may be for Netflix, the biggest threats are perhaps more fundamental to the offering. Globally, its users, especially Gen Z, are consuming shorter and more user-generated video content [see: Average Monthly Hours Spent Per User Globally]. As Professor Scott Galloway notes, “…Households are canceling their video subscriptions in record numbers. The most sustainable ‘streaming’ platform might be TikTok, which spends $0 on original content (vs. Netflix’s $17 billion) and is free. The platform now commands more attention than Facebook and Instagram combined.”4

To underscore the future potential of brands like TikTok, consider their market cap is over four times that of Netflix. By comparison, YouTube’s parent company, Alphabet, enjoys over a 17 times greater market cap (as of May 2022).

Conclusion

As Gen Z matures, we expect to see their influence follow similar patterns that we observed with millennials, where the brands they have bonded with (on average) continue to grow and excel. YouTube effectively straddles both generations well. YouTube is also well-poised as a business model for future success, given it is based on user-generated content and generally shorter-form content. From a brand perspective, our Brand Intimacy study reveals powerful testimonials that demonstrate the ubiquity, utility, and essence of the brand. A user sums up the dynamic pretty well: “eat sleep youtube repeat.”

Read our detailed methodology here, and get an overview of Brand Intimacy here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Sources

1 There’s too much TV to keep up. Have we hit the limit? By Linda Holmes https://www.npr.org/2022/05/03/1095973458/theres-too-much-tv-to-keep-up-have-we-hit-the-limit

2 High School & CNN+ By Scott Galloway https://www.profgalloway.com/high-school-cnn/

3 Netflix layoffs just the start as streamer stages rebound “It’s time to be a real company,” says media exec By Alexandra Canal https://finance.yahoo.com/news/netflix-layoffs-just-the-start-as-streamer-stages-rebound-its-time-to-be-a-real-company-141926095.html

4 High School & CNN+ By Scott Galloway https://www.profgalloway.com/high-school-cnn/