Brands that you wear are, by nature, quite intimate. Historically, how we identify ourselves in part is through our clothes and the brands we purchase. Yet the apparel industry performs slightly below the 15-industry average and comes in 7th out of 15 categories examined. It also held a similar position last year. While the industry ranks better in Mexico (5th place) and in the UAE (4th place), its performance in the U.S. seems puzzling, given its potential for loyal followers, emotional attachment and deeper connections. So why is it solidly in the middle of the pack for U.S. consumers?

The indulgence archetype (centered on moments of pampering or gratification that can be occasional or frequent) is dominant in the category, suggesting emotion is already baked into the experience of buying and wearing clothes.

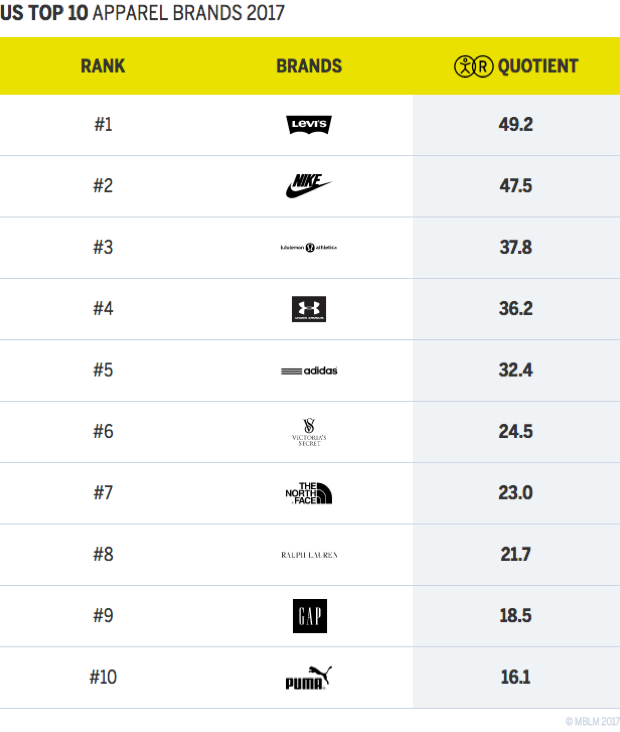

Yet only 24 percent of apparel customers surveyed are intimate with brands in the category. Levi’s is the top apparel ranked brand, coming in 19th overall. Levi’s strongest association is related to nostalgia, and it has the highest percentage of fusing customers, at 9 percent. Interestingly, more than half of the Top 10 Most Intimate Brands in apparel are athletic related, with Nike coming in at #2, lululemon at #3, Under Armour at #4, Adidas at #5, and Puma at #10. This also aligns with the growing “athleisure” movement of wearing more casual/sports clothes in our daily lives, even when we’re not working out.

We have hypothesized four potential reasons why this industry, with its great potential to build intimacy, is currently falling short.

Less Relatable

Iconic apparel brands traditionally had the ability to inspire and motivate. Levi’s has long been associated with Americana, and Nike with instilling the idea that anyone can achieve. While the category is still slightly above the collective 15-industry average (25 versus 22) for the identity archetype (which reflects an inspirational image or admired values and beliefs that resonate deeply), apparel is overall becoming less relatable. Nike’s recent promotion, “Unlimited You,” depicts athletes doing crazy stunts and “going too far.” (https://www.youtube.com/watch?v=VEX7KhIA3bU). The North Face featured a similar campaign, “Question Madness,” (https://www.youtube.com/watch?v=ayv41ZmNWtk) showing people doing incredibly dangerous and daring outdoor activities. Rather than motivating the average person, now the average person seems to be excluded from these superhuman feats. These inspirational ads seem out of touch to most of us, unbelievable more than inspiring and harder to relate to or connect with. Additionally, more line extensions and sub-brands may have limited or stretched the influence of the brand and spread the message too thin.

Pivoting to Celebrities

Aligned with the first point about being less relatable, several brands, particularly sport apparel brands, are partnering with celebrities and pop culture figures, shifting away from a tradition of linking to athletes. We see Karlie Kloss with Adidas, Kylie Jenner for Puma and Gisele Bundchen for Under Armour. These directions signal a targeting of young women and while the celebrity focus is understandable, it may not link strongly with the brands being discussed or establish a clear understanding of the celebrity pairing. Young women may be interested in Karlie Kloss, but does that translate into building a bond with Adidas?

Disintermediation of Shopping Experience

Similar to travel and many other categories, e-commerce makes it easier to shop around for brands at a variety of outlets, reducing the more branded experience of buying products at a company’s own site or store. In fact, apparel & accessories is the largest e-commerce category in the U.S. Many apparel brands are available discounted on Gilt, Rue La La, Amazon, Zappos and other sites that promise upscale brands at better prices. This could result in less intimate shopping experiences. It is easier and more common to shop around for brands, potentially weakening existing bonds, or redirecting fond associations away from, say, Nike, and toward, say, Amazon, which has become the largest online seller of apparel, with an estimated 11 percent share of all U.S. apparel merchandise sales.1

Different Outlooks

We see a shift with millennials today. Not only do they prefer to shop online, they are also drawn to superior service and the elements of web-based stores.2 We’ve seen, in the recent past poor sales from J. Crew, Gap and American Apparel (3Q 2016 revenue for J. Crew was down 7 percent from the same period last year3), and we will soon see mass closings of some major department store chains (108 Kmart locations, 42 Sears locations, and 68 Macy’s locations in 20174), while direct-to-consumer brands like Everlane and Bonobos see consistent growth. These online brands are not limited by traditional infrastructure and manufacturing restrictions and can also reflect a more shared apparel experience, detailing pricing, information about materials, and production. Consider Everlane’s tagline, “Radical Transparency,” which echoes this sentiment.

Another outlook may be part of a broader trend toward more financial caution and conservatism this past year. With this perspective in mind, some people might see clothes as utilitarian and are trying to find the best price and best deal, and making them less focused on the brand.

Why Brand Intimacy?

Why does a stronger Brand Intimacy Quotient matter? Intimate brands create significant business performance. The Top 10 Most Intimate Brands have outperformed established financial indices for both revenue and profit growth over the last 10 years. In addition, these brands command a price premium, enjoying more financial resilience than brands in the same industries that are not intimate.

To explore the Ranking Tool please visit: https://mblm.com/lab/brandintimacy-study/.

To learn more about MBLM, click here.