Overview

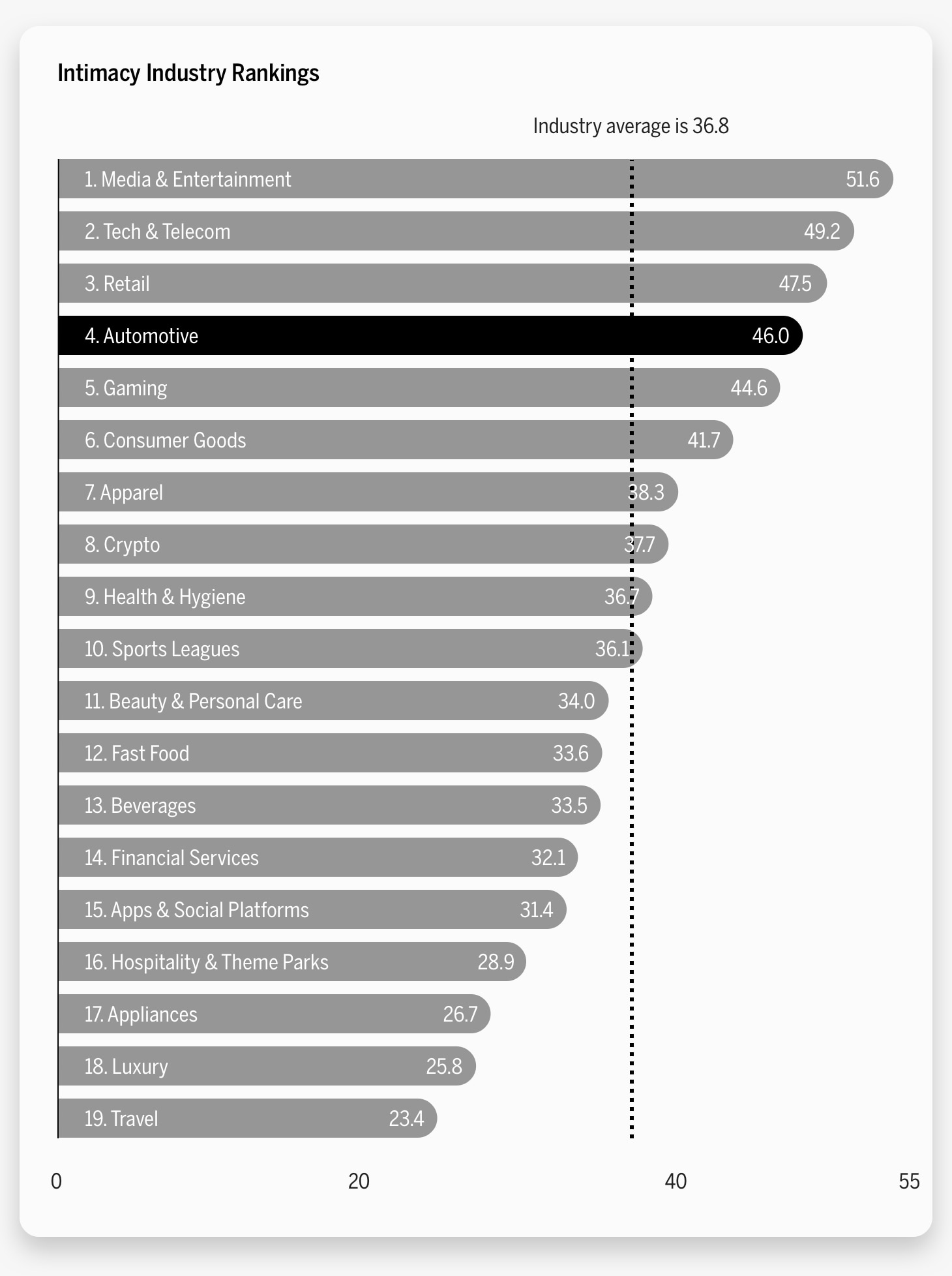

- The automotive industry ranks fourth in our 2022 Brand Intimacy Study.

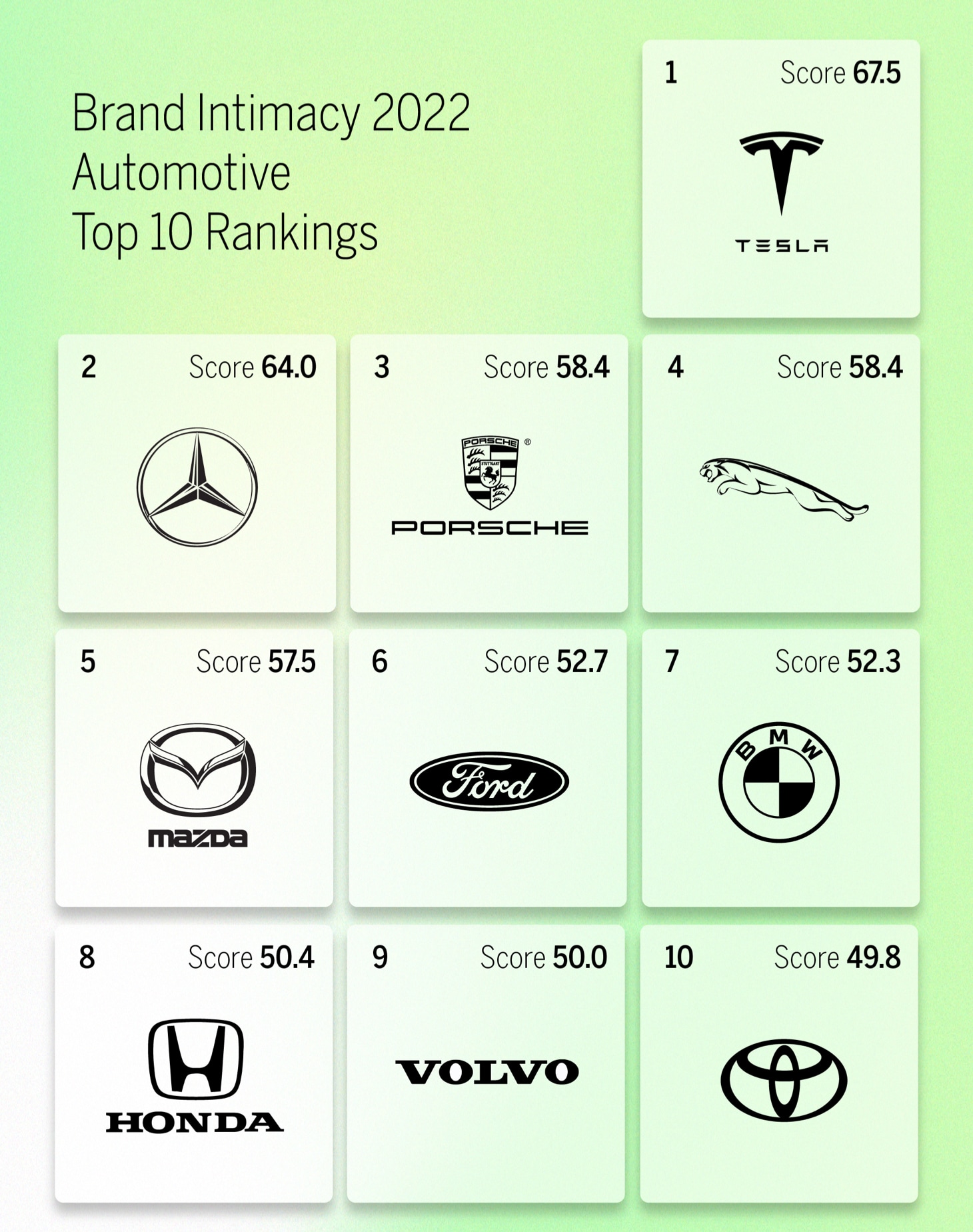

- Tesla is the top-ranking automotive brand with a Quotient Score of 67.5.

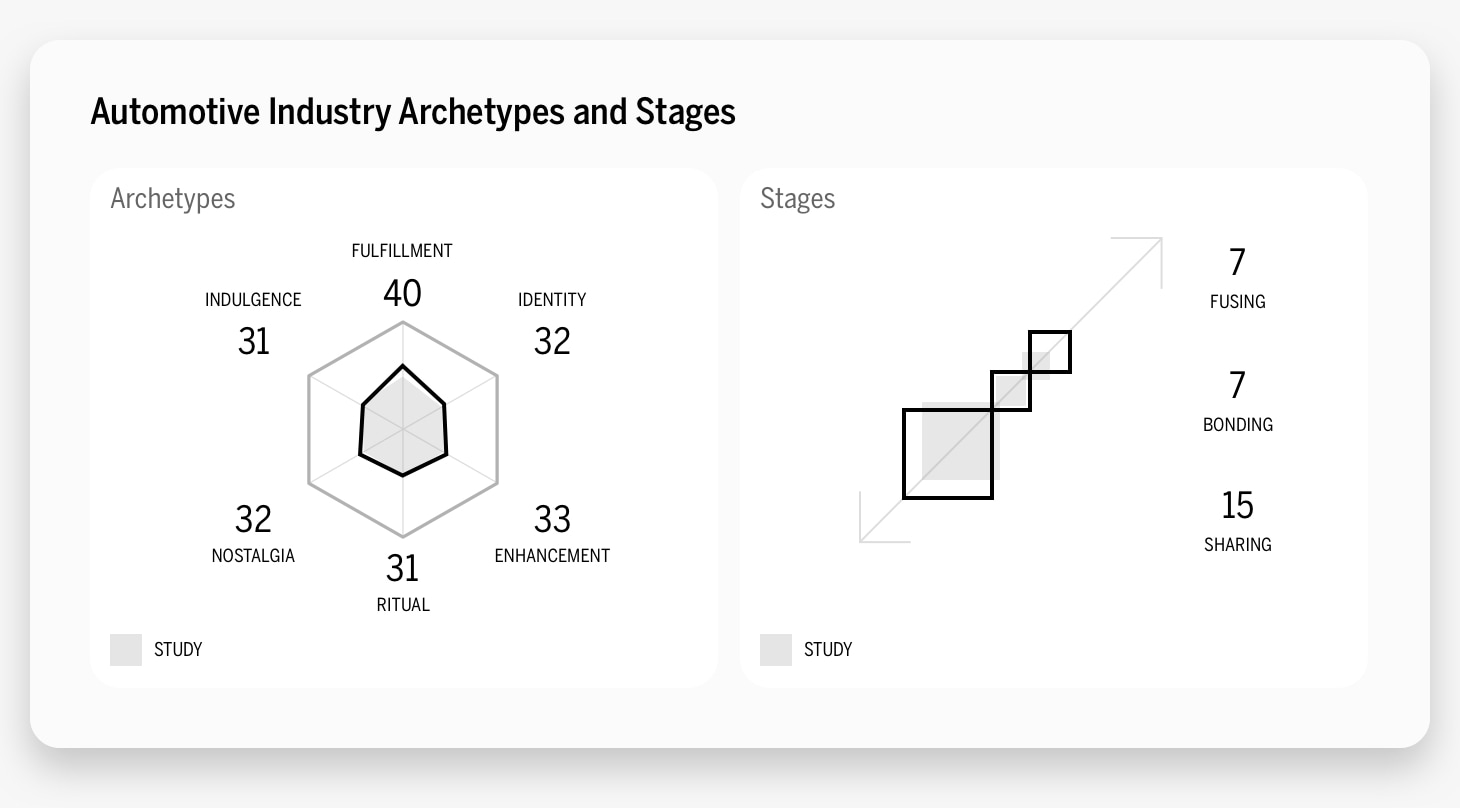

- The automotive industry’s dominant archetype is fulfillment.

Introduction

In this year’s Brand Intimacy Study, the automotive industry placed fourth with an average Brand Intimacy Quotient Score of 46.1, which is well above the cross-industry average of 36.8. The automotive industry continues to perform well in our annual study, although it saw a drop from its second place finish in last year’s Covid Study.

There’s been considerable movement in the industry since last year as well as the addition of many new entrants, including Tesla as the top automotive brand. Toyota, last year’s top-performing brand, dropped to 10th place this year, whereas Harley Davidson, the the second-most intimate automotive brand in 2021, dropped to 14th place. Although some industries and brands faced devastating consequences as a result of the pandemic, the past two years saw more consumers becoming closer to automotive brands and creating stronger emotional relationships. (To learn more about the effects of the pandemic on the automotive industry, read our article Driving Ultimate Brand Relationship). Tesla, in addition to ranking #1 in automotive, ranks #2 in our study overall. The brand has a devoted following, and redefined the future of the industry, more specifically, electric vehicles.

Industry Overall

In 2021, the global automotive manufacturing market was worth about 2.86 trillion US dollars, with the market projected to grow to around 2.95 trillion dollars in 2022.1 Although these numbers seem impressive, the market is still slowly recovering from the pandemic and has yet to surpass its 2019 high. Also in 2021, Toyota topped the industry as the world’s largest car brand with a market share of around 10.5%. Japan’s Toyota Motor Corporation is the world’s largest motor vehicle manufacturer.2 Despite its dominance in our 2022 BIS Study, Tesla commands a market share of roughly between 2% and 3% and delivered around 930,000 vehicles in 2021.3 This highlights how scale and size do not necessarily equal having the strongest emotional connections.

Although relatively tame in terms of scandal and controversy compared to other industries, the automotive industry has not gone without its moments in the limelight. Most recently, the push for greater adoption of electric or hybrid vehicles has sparked important change and dialogue within the industry and its consumers.

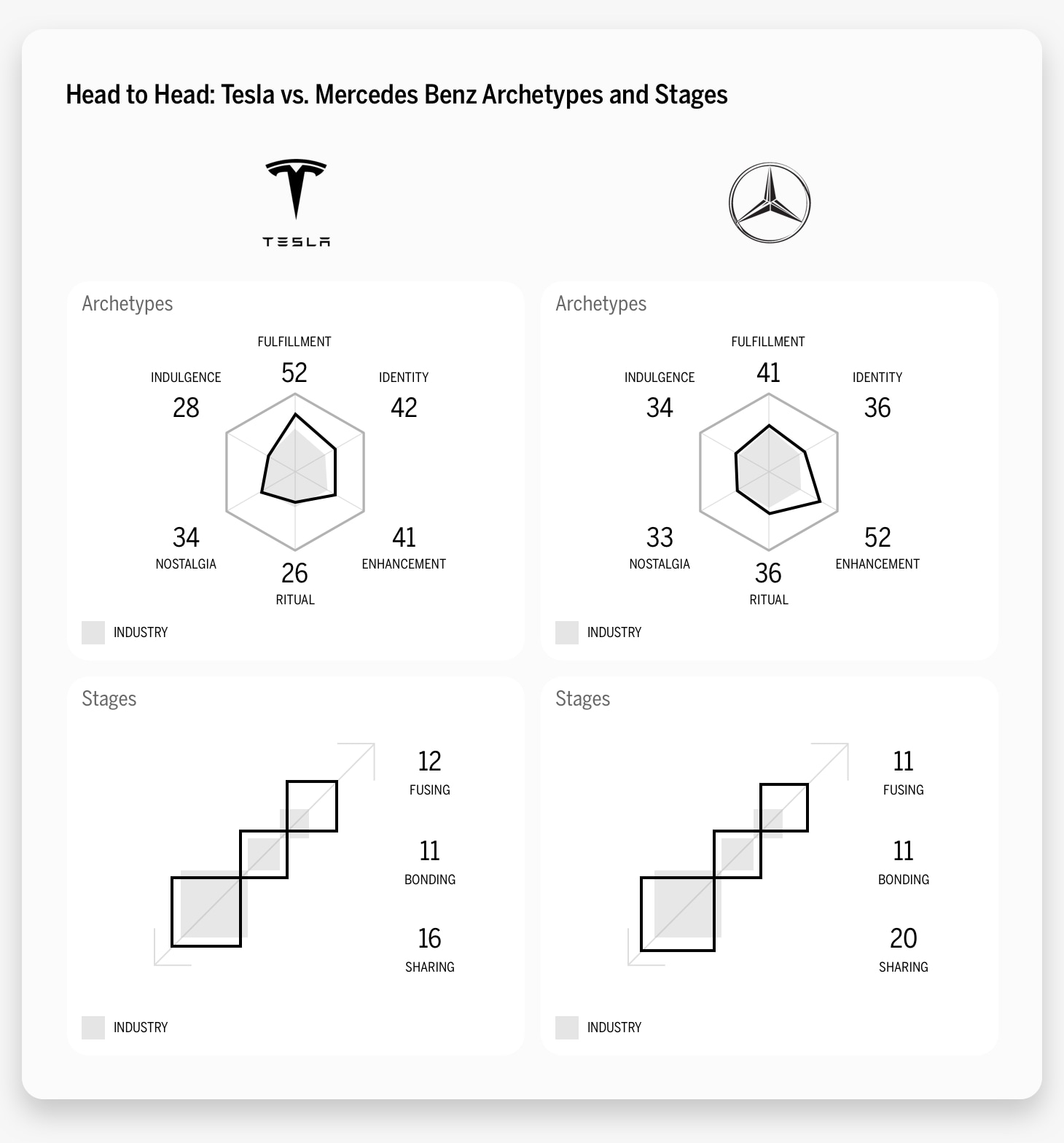

Fulfillment, which refers to a brand exceeding expectations, delivering superior service, quality and efficacy, remains the industry’s dominant archetype. Moreover, several Brand Intimacy archetypes have improved, notably nostalgia and indulgence. Overall, the industry did well in each stage of Brand Intimacy, with 15% of users in the sharing stage, 7% in the bonding stage, and 15% in the fusing stage, the most advanced stage of Brand Intimacy. Here the automotive category ranks second highest out of 19 industries. On average, nearly 30% of industry consumers are in some stage of intimacy with an automotive brand, as compared to 23% of consumers across the entire study.

Mercedes Benz, the second-most intimate automotive brand, is equally as strong in enhancement as Tesla is in fulfillment, and vice versa. Enhancement, which refers to customers becoming better through the use of the brand—smarter, more capable, and more connected, is the dominant archetype only for Mercedes among the top 10 automotive brands. Tesla also leads in identity and fusing, whereas Mercedes-Benz is stronger in ritual, indulgence, and the sharing stage.

Tesla on Top

Although widely associated with its current, enigmatic CEO, Elon Musk, Tesla was originally incorporated in 2003 by two engineers, Martin Eberhard and Marc Tarpenning.4 In 2004, Musk became Tesla’s chairman after investing $6.5 million into the company’s Series A funding round.5 The company’s first car, the Roadster, began regular production in March 2008, shortly before Musk was named CEO in October of that same year. Under Musk’s leadership, the company has grown exponentially from narrowly avoiding bankruptcy as a result of the 2008 recession. In 2009, Tesla received a $465 million loan from the Department of Energy, and in 2010 the company went public with a $2.2 billion value. Tesla’s next cars, the Model S and Model X, catapulted the brand into the spotlight. More recently, Tesla has ventured into solar power, including a solar roof, and has introduced two more car models, the Model Y and the Model 3. This past June, Tesla celebrated its 12th anniversary as a public company.

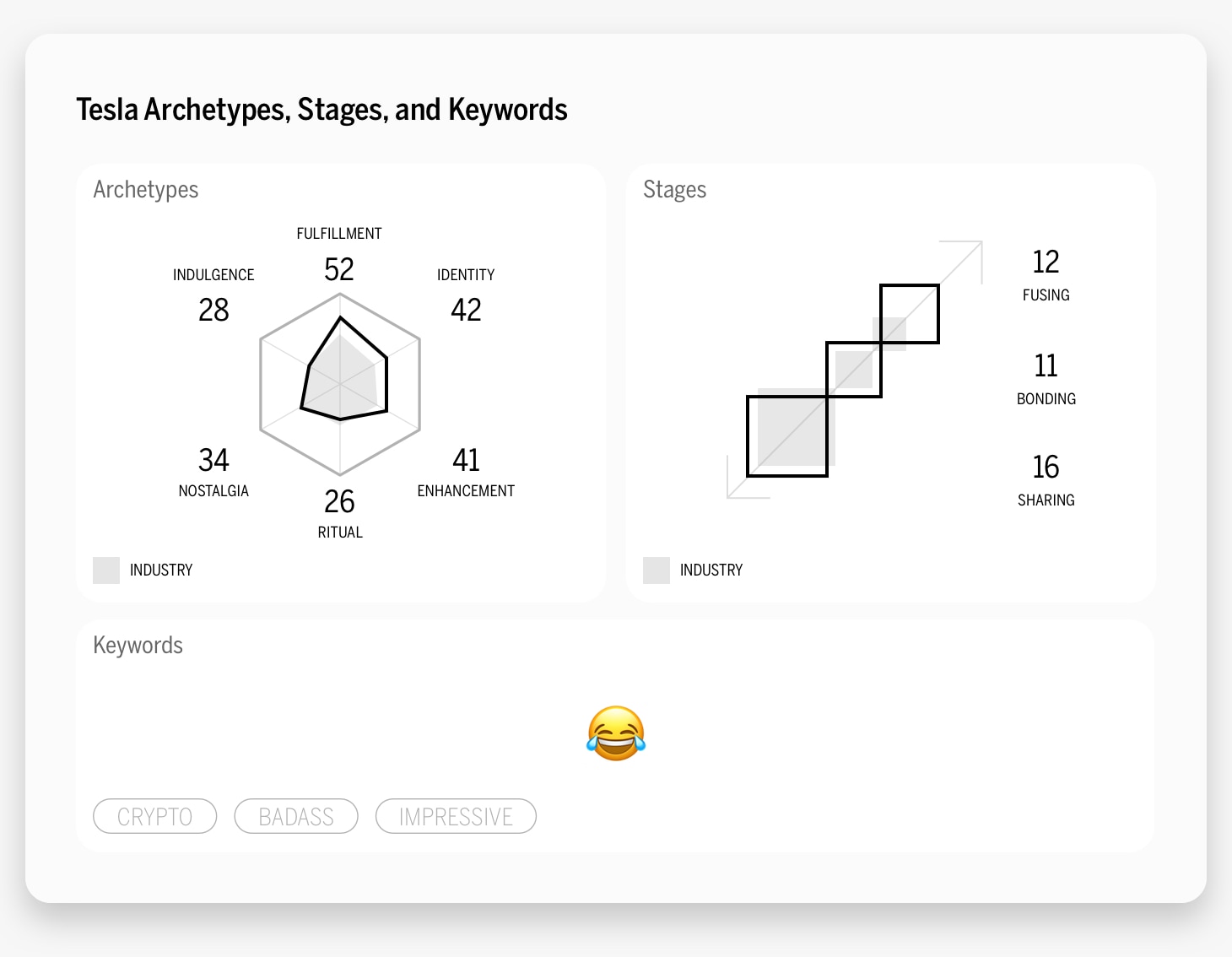

Tesla ranks first in the automotive industry and second in our overall study, falling behind Disney. Tesla’s Brand Quotient Score of 67.5 further outperforms the industry average Quotient Score of 46.1 by more than 20 points. Like the overall industry, Tesla’s dominant archetype is fulfillment, which is when brands exceed expectations, deliver superior service, quality and efficacy. The brand also ranks within the top two automotive brands for the fulfillment, enhancement, and identity archetypes, showing it has a variety of ways it is connecting with consumers. It performs well, its technological advances are well-known and it’s hip and cool, aligned with sustainability and sleek design. Moreover, 16% of Tesla consumers are in the sharing stage, the earliest stage of brand intimacy; 11% are in bonding, the middle stage; and 12% are in fusing, the most advanced stage of intimacy. In each of these stages, Tesla outperforms the industry average. Of the consumers who write about Tesla, 40.0% are in some form of intimacy with the brand.

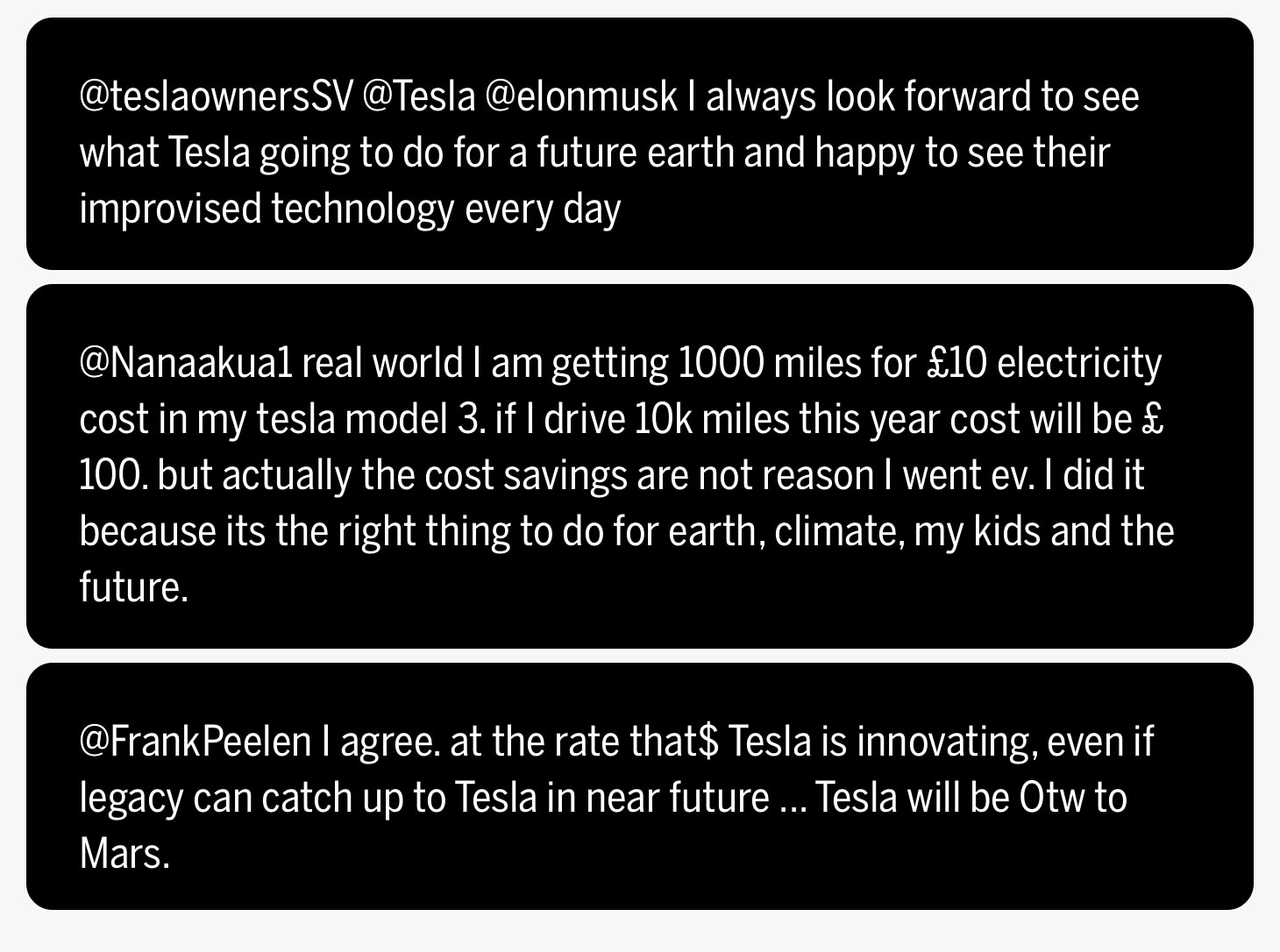

These data align with the idea that Tesla owners are deeply bonded and connected to the brand. By examining over 1.4 billion words and phrases from social media, our 2022 Brand Intimacy Study provides valuable insights into how consumers feel about brands.

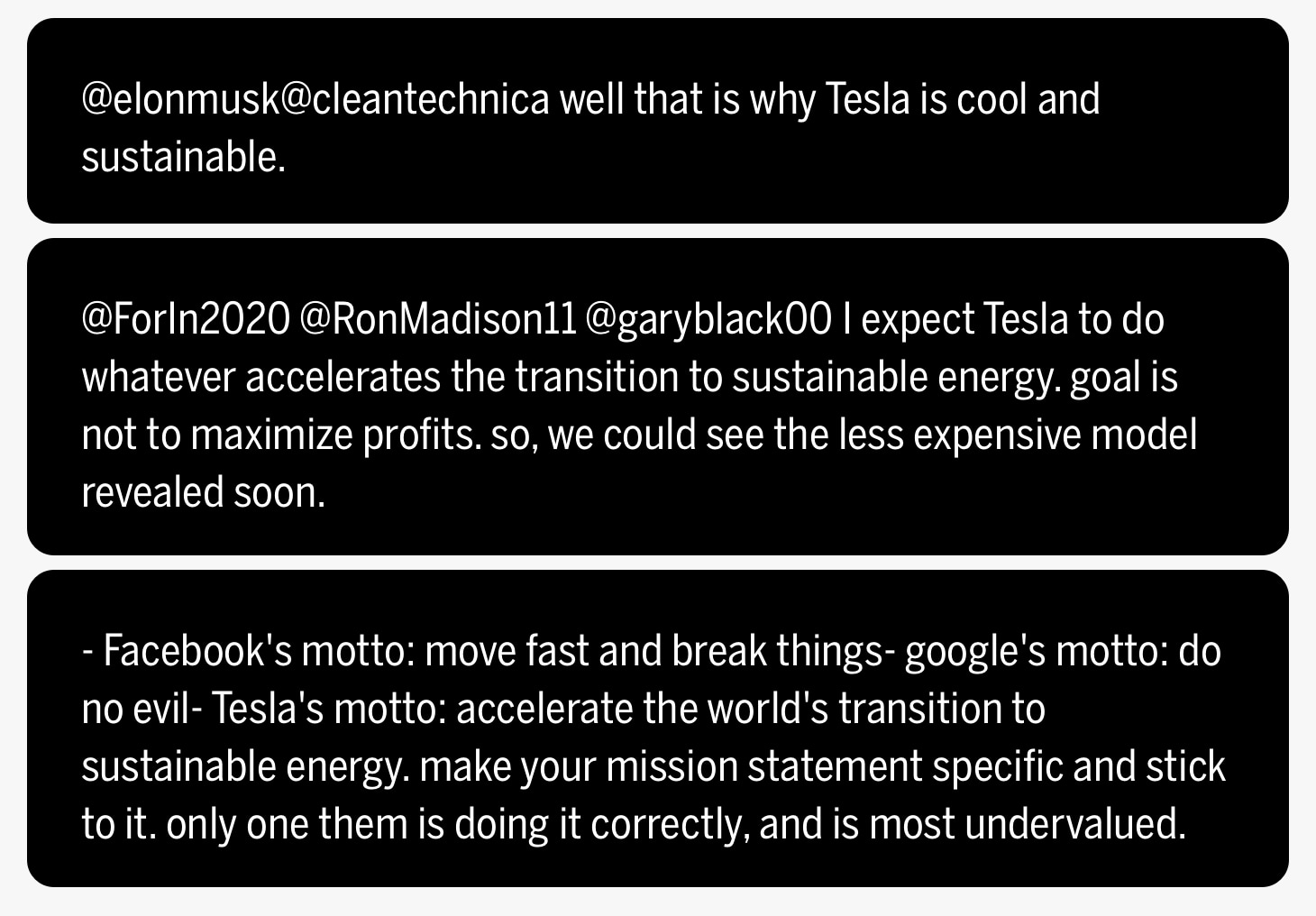

Compared to other top-performing automotive brands, people are 2.8x more likely to talk about Tesla’s environmentalism and sustainability.

Often accredited with putting electric cars on the map, Tesla’s pioneering of sustainable energy initiatives is a selling point for many consumers and investors, who often appear as evangelists for the brand.

Online, individuals also praised the company’s future-focused thinking 1.6x more often.

Tesla users also frequently associate the brand with crypto because Musk himself has been a huge proponent of and investor in digital assets.

As a matter of fact, Tesla still holds about $218 million in Bitcoin after selling about 75% of its Bitcoin holdings (around $936 million at the time) in July 2022.6 Musk has been a vocal supporter of Dogecoin, which has contributed to the coin’s drastic fluctuation in value over the past few years. In 2021, Dogecoin spiked in value after Musk announced it would begin to accept the cryptocurrency as a means of payment for Tesla products.7

Perhaps most notably, today the car brand is inexorably linked to Musk. Not surprisingly, Tesla owners are more than 60x more likely to mention Musk in communications.

Musk’s association with Tesla has traditionally been largely positive; however, it has also caused some issues for the CEO himself. In August of 2018, Musk tweeted that he was planning on taking Tesla private at $420 a share, contingent on a shareholder vote. As a result of said tweet, Tesla’s stock price jumped by over 6% and led to significant market disruption.8 As a result, the SEC launched an investigation that resulted in Musk being forced to step down as Tesla’s chairman and pay a $40 million penalty ($20 million from Tesla and $20 million from Musk).9

As Musk’s beliefs, antics, and behaviors become more widely known, it is unclear what impact, if any, this may have on the car brand.

The Future of Electric Cars

The past few years have seen significant growth in the electric and hybrid vehicle market. In 2020, for instance, there were more than 10 million electric cars on the road across the world.10 The push for greener, more sustainable energy has led to more manufacturers developing electric or hybrid vehicle models.

In the long term, companies project that mainstream electric vehicles will both transform the automotive industry and decarbonize the planet.11 A recent study from McKinsey projects that by 2035, the largest automotive markets will go electric.12 These forecasts may force automotive manufacturers to either adapt or suffer the consequences of being left behind in an increasingly green industry. Chevrolet, Hyundai, Kia, Audi, Jeep, Nissan, and Cadillac already have or are currently developing electric vehicles, heating up the once barren EV market share dominated by Tesla. Although it has a head start, soon Tesla will be facing more competition and will need to up its game.

In a recent auto-reliability survey, Tesla came in second to last overall, with respondents citing frequent issues with the cars sensors, heat pumps, air conditioning, and body panels.13 Moreover, in this year’s Bloomberg Electric Car Ratings, Tesla came in second to Lucid Air, signaling a slip in Tesla’s firm grasp on the industry. These performance slips are indicative of a greater shift in the future of electric vehicles. If Tesla continues to be bested by better options, its impressive position at the top of the industry may finally be challenged.

Conclusion

Tesla continues to show promise. It debuted with an extremely strong Brand Intimacy performance, demonstrating the brand is connecting with a wide variety of stakeholders. The company is focused on moving forward and has hinted at new innovations it plans to roll out, namely, a new vehicle dubbed the “robotaxi” as well as a humanoid robot called Optimus. We have also witnessed Tesla’s improved operating efficiencies this year, enabling the company to produce more than 300,000 vehicles in Q1. Tesla’s choice to double down on factory automation and heavy research and development during its early years appears to be paying off. The brand has broad appeal and, by doing things its own way, is able to create more unique brand associations.

However, we see the brand slipping in some performance-related surveys. Tesla also recently missed its Q3 production numbers. This, along with growing competition, global market concerns, and Elon Musk’s increasingly polarizing presence (weighing in not only on US politics but also on the war in Ukraine and other significant geopolitical issues) raises questions about whether the hype-driven brand will be able to overcome these significant headwinds.

Tesla is poised for continued success, and its brand, by not following traditional automotive marketing rules, has gained tremendous appeal. However, the channels it does tend to focus on, namely social, continue to cause some headaches and missteps. We can imagine Tesla trying to expand into new direct consumer channels and continuing to deepen the bonds it has with existing and prospective customers, while outside factors may result in many missing the signal for the noise.

Get an overview of Brand Intimacy here.

Read our detailed methodology here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Sources

1 “Global automotive manufacturing industry revenue between 2019 and 2022.” By statista.com

https://www.statista.com/statistics/574151/global-automotive-industry-revenue/

2 “Global automotive market share in 2021, by brand.” By statista.com

https://www.statista.com/statistics/316786/global-market-share-of-the-leading-automakers/

3 Ibid.

4 “Tesla just celebrated its 12th year as a public company. Here are the most important moments in its history.” By BusinessInsider.com

https://www.businessinsider.com/most-important-moments-tesla-history-2017-2

5 Ibid

6 “Elon Musk’s Tesla Still HODLing $218M in Bitcoin.” By decrypt.co

https://decrypt.co/112443/tesla-still-hodling-218m-in-bitcoin-in-q3

7 “Support.” By tesla.com

https://www.tesla.com/support/dogecoin

8 “Elon Musk Settles SEC Fraud Charges; Tesla Charged With and Resolves Securities Law Charge.” By sec.gov

https://www.sec.gov/news/press-release/2018-226

9 Ibid

10 “Trends and developments in electric vehicle markets.” By iea.org

https://www.iea.org/reports/global-ev-outlook-2021/trends-and-developments-in-electric-vehicle-markets

11 “Why the automotive future is electric.” By McKinsey.com

https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/why-the-automotive-future-is-electric

12 Ibid

13 “Here’s where Tesla and other EVs ranked in this year’s Consumer Reports reliability survey.” By cnbc.com

https://www.cnbc.com/2021/11/18/consumer-reports-2021-auto-reliability-survey-how-tesla-evs-fared.html