Overview

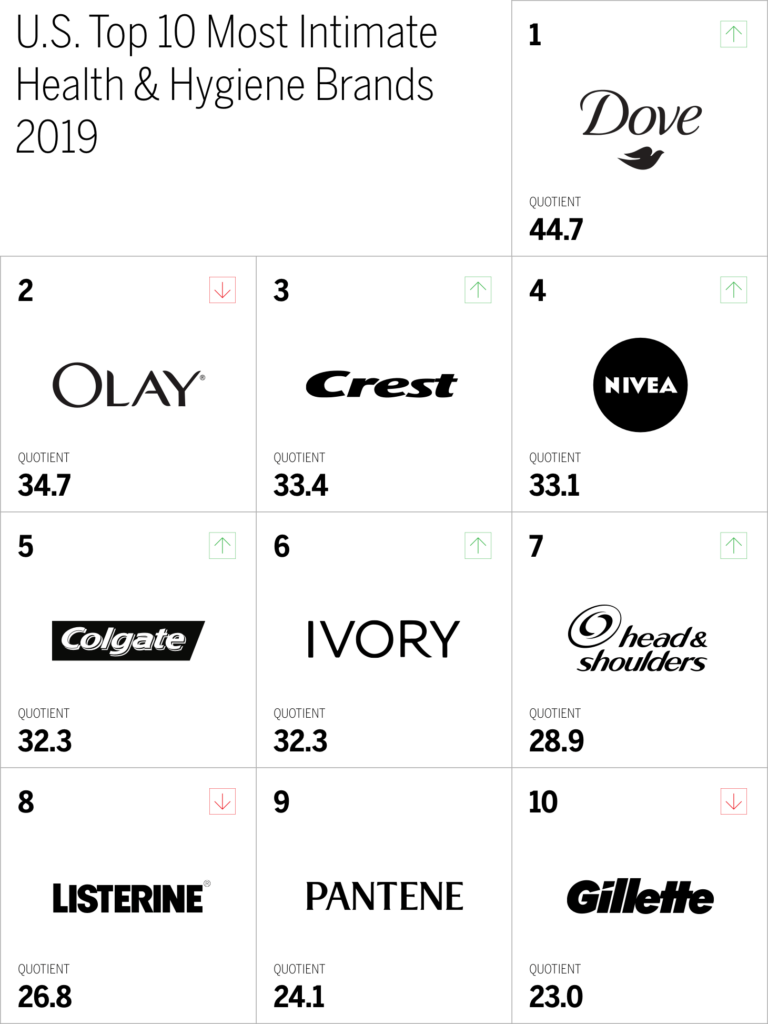

- Dove has risen to the top of the health & hygiene industry, increasing its Brand Intimacy Quotient from 34.7 to 44.7

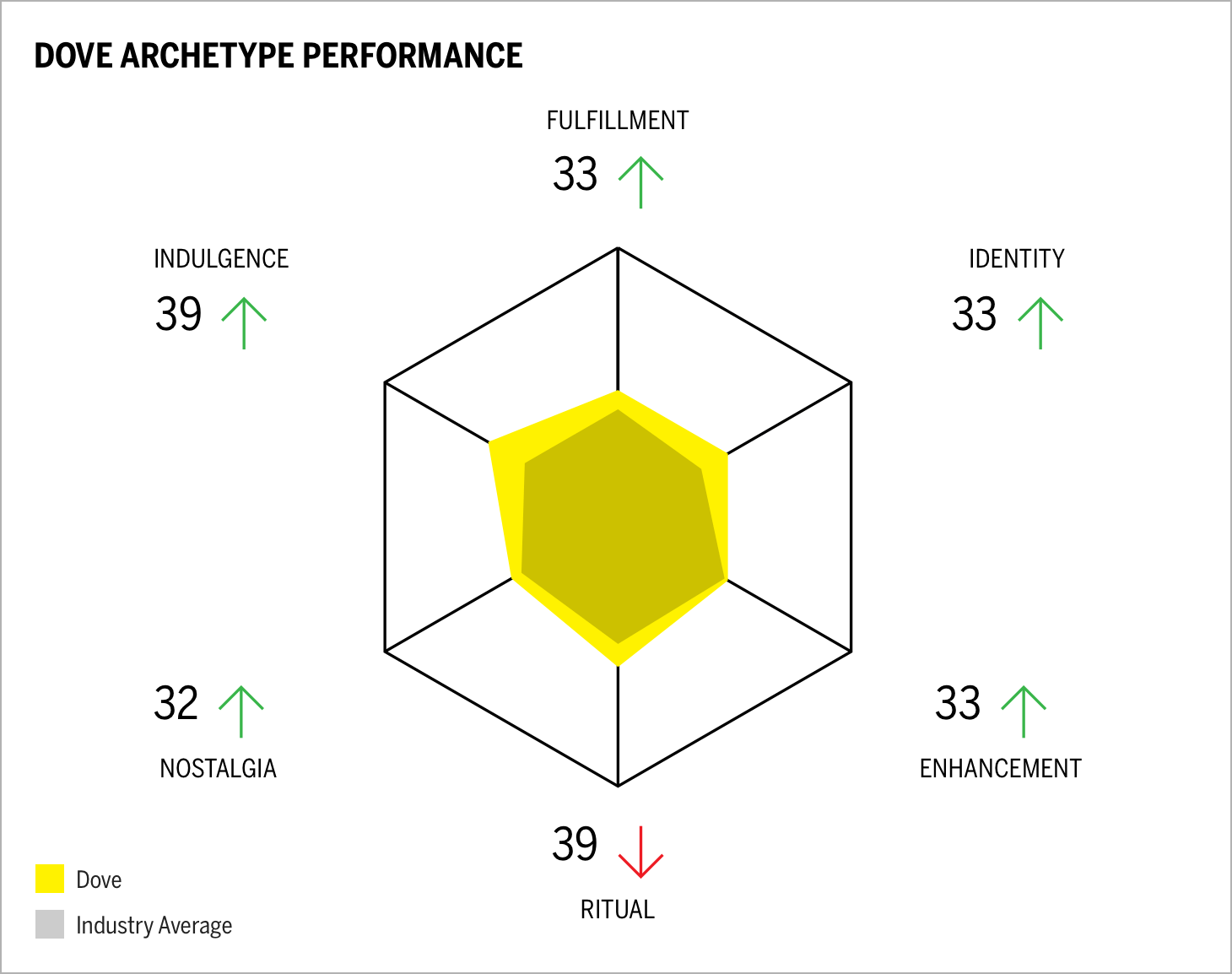

- There has been an overall improvement in Dove’s archetype performance with an average jump of 4 points, particularly among fulfillment and enhancement

- Outside of oral hygiene products, Dove enjoys a high percentage of daily users (60 percent) compared to other skincare products with runner-up Olay having 45 percent and Nivea having 37 percent

- Dove is most popular with women and has a quotient score of 53.7. Dove would rank in the top 10 brands overall if it were measured against only women

Health & hygiene ranked eighth of fifteen industries in the 2019 Brand Intimacy Study, improving its average Brand Intimacy Quotient from 25.3 in 2018 to 29.6 in 2019. In addition, the category improved its overall industry performance across several archetypes, suggesting that brands in this industry are finding more impactful ways to connect and build bonds with consumers.

Dove has jumped from second place to the top brand in the industry, doing particularly well with women and millennials and knocking Olay down to the #2 position. Changing popularity was also observed among the top oral hygiene brands this year. Both Crest and Colgate saw jumps in their respective scores with Crest moving from #10 in 2018 to #3 in 2019 and Colgate rising from #7 in 2018 to #5 this year. It was also a great year for Ivory, which joined the top 10 ranks at #6 after being #12 last year. Ivory’s success mirrors Dove’s as the rankings for both personal care brands have risen this year. The brands that continue to see success in this industry are those inextricably linked with the fulfillment and indulgence archetypes, which suggests a combination of performance and self-care align well with building consumer bonds. Interestingly, skincare brands are seen as more indulgent than non-skincare brands in the category, scoring 34 on the indulgence archetype compared to 24 for non-skincare brands.

Dove gets the gold

In moving to first place in 2019, Dove has improved its Brand Intimacy Quotient score by 10 points. Most telling from this year is that its percentage of users in the fusing stage of Brand Intimacy has seen a significant increase from 5 percent in 2018 to 7 percent in 2019. Fusing is the ultimate stage of intimate brand relationships and occurs when a consumer and a brand become inexorably linked and co-identified. Dove has worked hard to differentiate itself from its competitors, marketing less around its products and more around consumers and emotional stories. Dove’s advertisements have encouraged consumers to find their own inner strength and recognize their own beauty. The company’s strategy to focus on celebrating the diversity and differences of its consumers yielded strong results as seen in its performance this year, and it will be interesting to see if that momentum continues as more brands within the industry attempt to mimic Dove’s storytelling tactics.

Real emotion and real beauty

For more than 15 years Dove has built its brand, as well as its content and marketing strategy, around empowering women. Dove has continued to wrap its brand message and story with a grounded, aspirational sense of self. It has worked hard to differentiate itself in the industry by focusing on a motivational, self-love message. And that effort has led many of its users to connect with Dove because those users align with the brand’s values and aspire to those values. That is reflected in the score for the identity archetype. Dove landed a high score of 33 for identity in 2019. Its competitors fell short with Olay coming in at 30 and Nivea and Ivory at 27 and 26, respectively. Dove is continuing to drive home this message, having recently launched its Project #ShowUs campaign. The new campaign sees Dove partnering with Getty Images to more accurately portray people in media and advertising after 70 percent of respondents to Dove’s survey said they didn’t feel accurately represented. The brand’s success in the last year is a reflection that it is connecting to customers because of bonds formed on an emotional level, and customers, in turn, are more closely identifying with the brand.

Ritualistic behavior

The dominant archetype for this industry overall is ritual in that consumers see these products as part of their routine, and they are ingrained into their everyday lives. Dove performs well in this archetype with 60 percent of consumers saying they use Dove daily. That figure far outpaces the industry average of only 43 percent. Dove’s daily usage score is also much higher than those of its competitors who, on average, have a daily ritual score of 39 percent. The only brand that does better than Dove is (perhaps unsurprisingly) Crest, which has 75 percent of consumers using Crest toothpaste daily. But whilst it is expected that toothpastes are used with more regularity and frequency, Dove’s high score in this area speaks to its ability to assume an important role in consumers’ lives. Dove’s success in this area also shares similarities in terms of how it connect with consumers with Pinterest, which scored top position in its category and also has a strong pairing of ritual with identity.

Changing gender roles

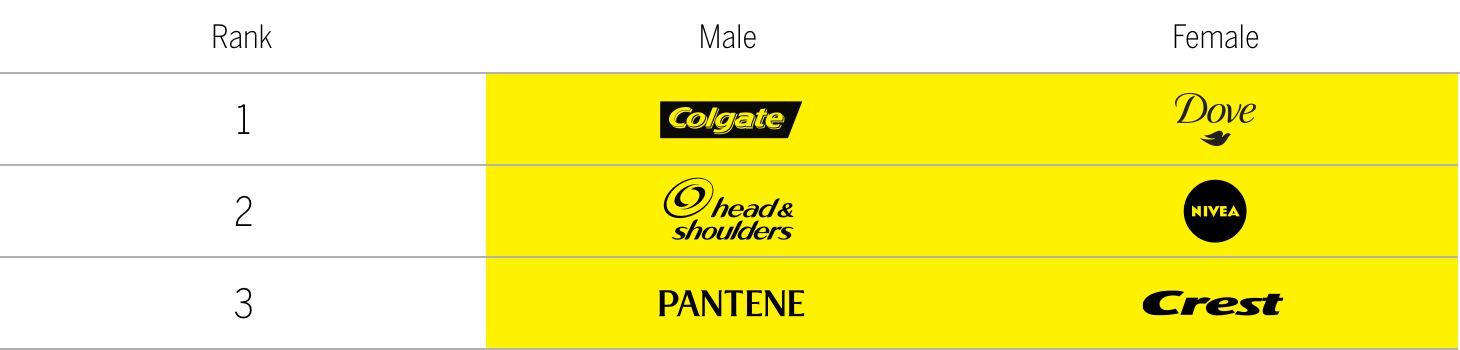

Dove continues to be the most intimately connected brand with women aged 18–34. The brand has tried to expand its audiences to men with its R-E-S-P-E-C-T campaign, but the results have been less successful than those with women. In fact, based on our year-to-year findings, Dove’s popularity continues to decline among men, dropping from second in 2017 to sixth in 2018 and to seventh this year. Instead, Colgate has taken over as the most intimate brand for men.

Top health & hygiene brands by gender

Conclusion

Dove, like the health & hygiene industry overall, has seen continual improvement year over year. Increases in archetype associations and strong performances in the fusing and bonding stages have contributed to its success this year. Perhaps not surprisingly, skincare and skincare brands become more important to women as they age. It will be interesting to see how the key brands consumers are intimate with will change in the years to come as the millennial demographic matures and new consumers enter the market. If Dove can continue to differentiate itself within the industry by leveraging the emotional and positive aspects of beauty through its branding, it is likely that it will continue to maintain its top position and improve upon it. To keep its leadership position, will Dove look to leverage other relevant archetypes to expand its emotional associations or stick to what it is currently focusing on? Will it adjust the brand’s emotional focus across different audiences, and how will it move more of its customers into fusing, the ultimate stage of intimacy?

Read our detailed methodology here, and review the sources cited in this article here.

Check out our annual study and rankings of intimate brands. Visit our most recent rankings of intimate famous figures—BFF. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Register for our webinar to learn patterns, insights and findings from the Health & Hygiene industry here.