Overview

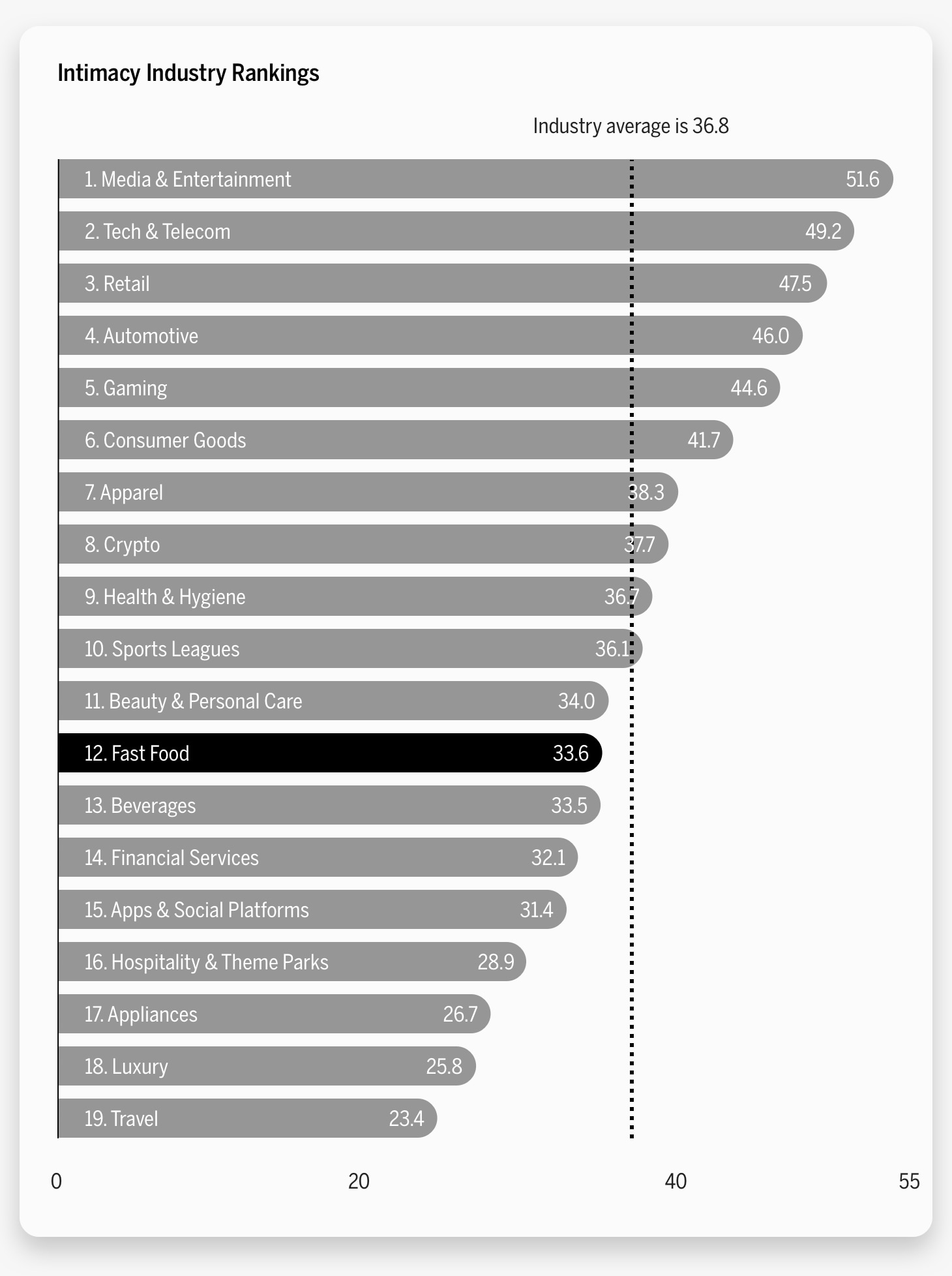

- The fast food industry ranks 12th in our 2022 Brand Intimacy Study.

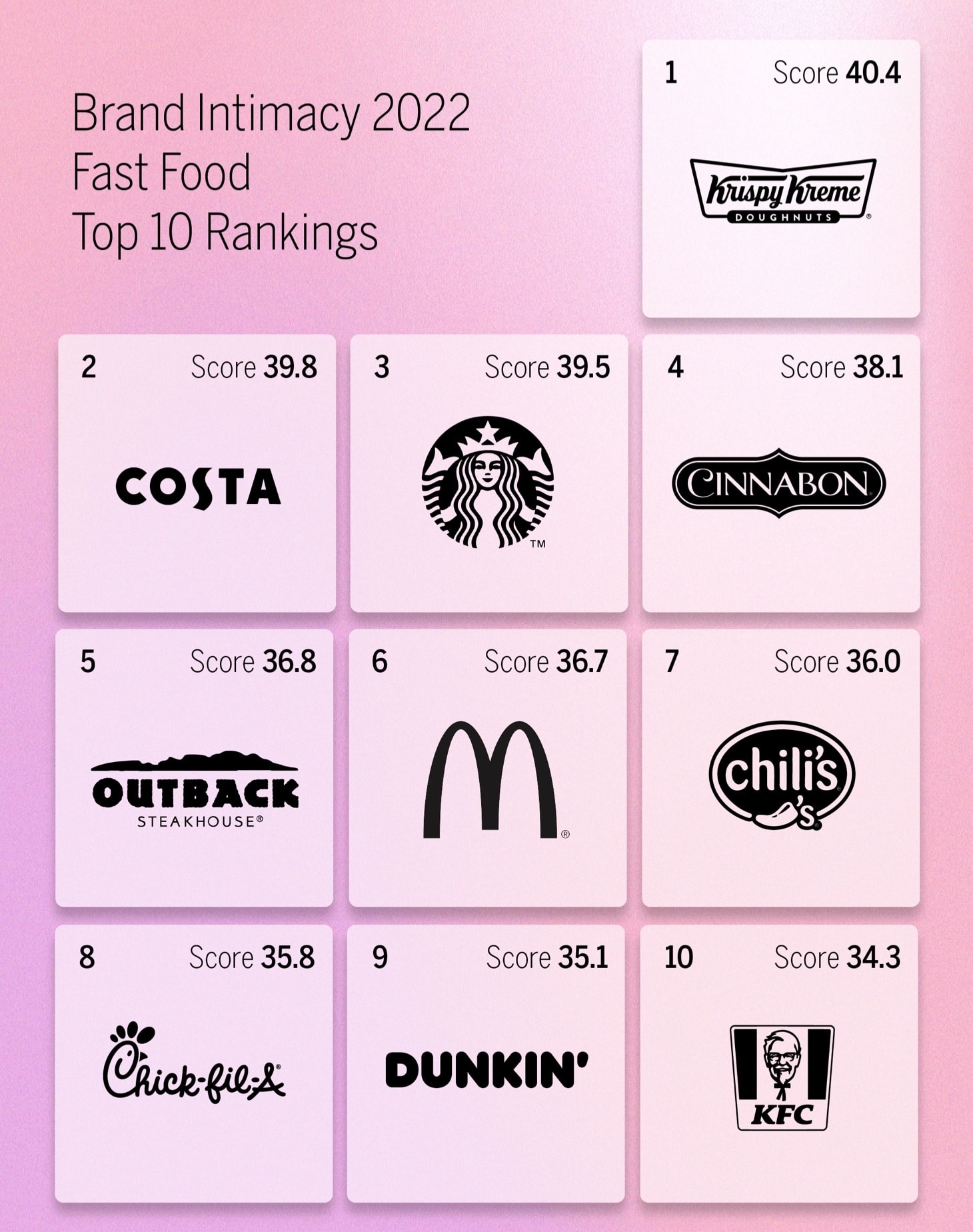

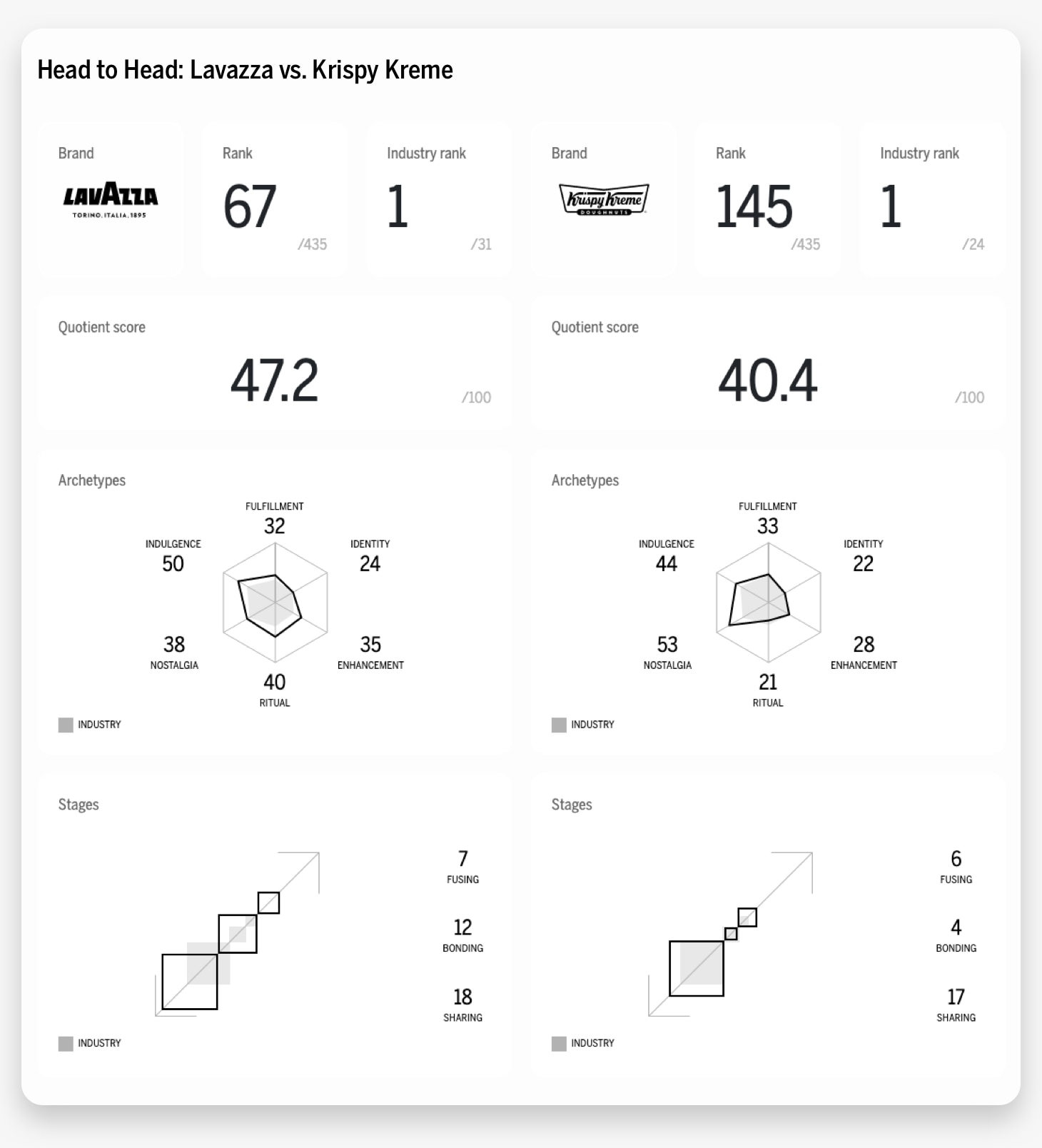

- Krispy Kreme is the top-ranking fast food brand with a Quotient Score of 40.4.

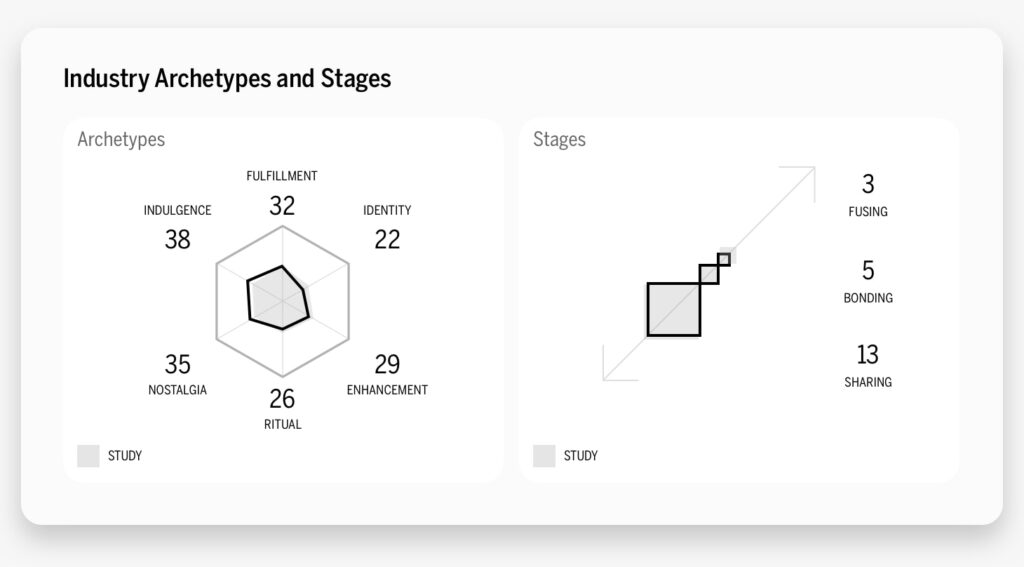

- The fast food industry’s dominant archetype is indulgence.

Introduction

In this year’s Brand Intimacy Study, the fast food industry placed 12th with an average Brand Intimacy Quotient Score of 33.6, falling below the cross-industry average of 36.8.

Chick-fil-A, last year’s top-performing fast food brand, dropped to eighth place whereas Krispy Kreme replaced it as the most intimate fast food brand of 2022. Of the top five fast food brands, four of them (Krispy Kreme, Costa, Starbucks, and Cinnabon), fall into the sweets/coffee chain sub-category as opposed to savory fast food options, such as Outback Steakhouse, McDonald’s, and Chili’s. This may stem from COVID-19, as recent studies have documented notable shifts in our diets and eating habits. The disruption and stress caused by the pandemic resulted in 36% of adults reporting they consumed more unhealthy snacks/desserts.1 Similarly, 47% of respondents in another survey indicated they were eating more sweets now than before the pandemic.2

The prevalence, accessibility, and cost of fast food make it highly attractive to its over 84 million annual American customers.3 Studies show that, on any given day, 36.6% of US adults consume fast food, with almost half of those consumers falling between the ages of 20 and 39.4 Although fast food is relatively cheap, quick service restaurant menu prices in the United States steadily increased from January 2020 to January 2021,5 helping the industry reach over $30 billion in monthly sales in the latter half of 2021.6

The Fast Food Field

With over 192,000 fast food restaurant franchises in the United States7 and domestic sales of over $392 billion last year,8 the fast food industry has remained relatively strong over the past decade. Although full service restaurants saw a consistent decline in performance throughout the pandemic, spending in quick service restaurants briefly suffered before eventually increasing to the point where it even surpassed pre-pandemic levels between December 2020 and February 2021.9 The low-contact, high-speed nature of eating fast food proved particularly attractive to those looking to order food in a low-risk atmosphere. With this dynamic, fast food restaurants faced fewer obstacles from the pandemic than full service restaurants. To read more about the effects of the pandemic on the fast food industry, read The Booming Business of Fast Food.

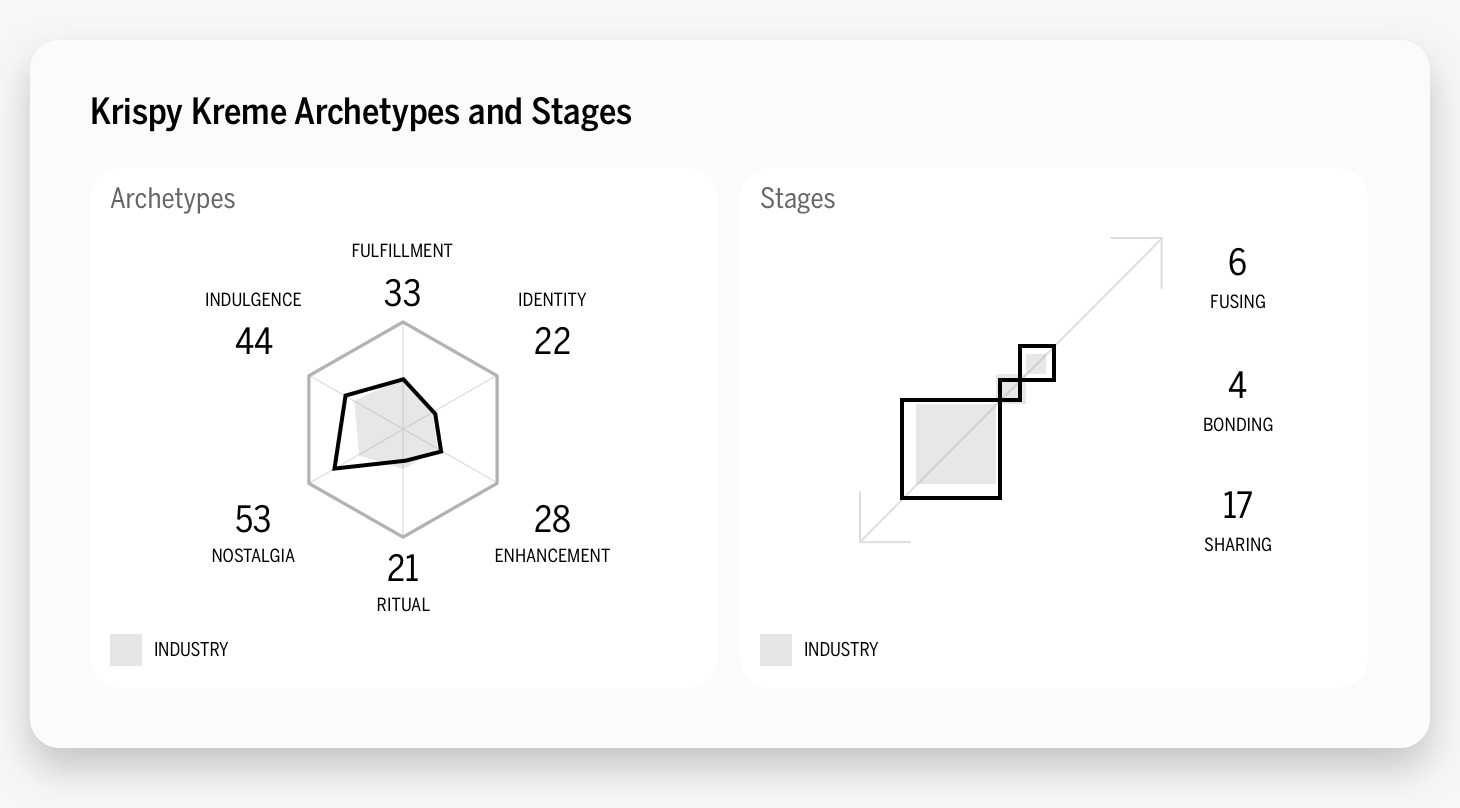

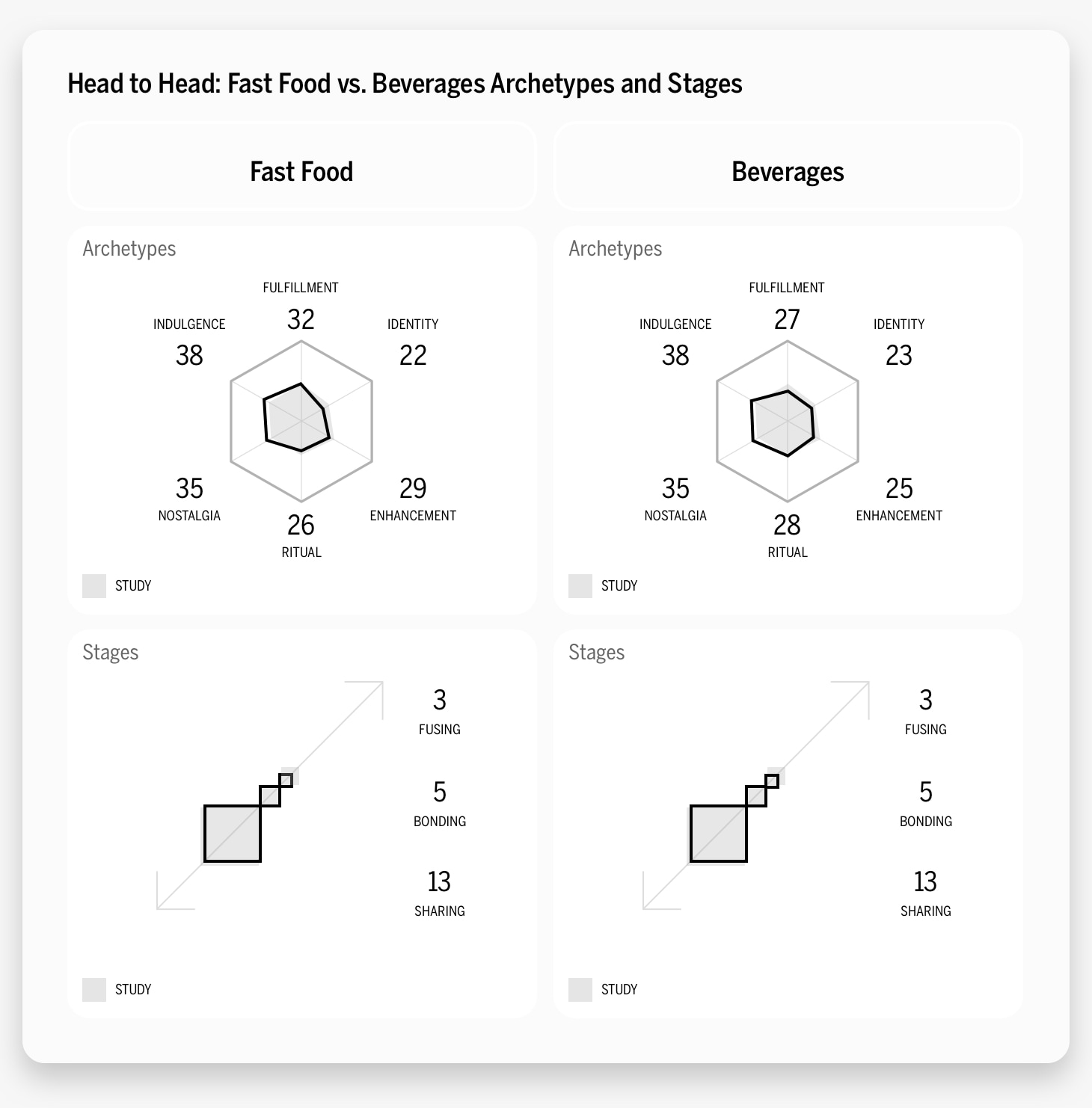

Indulgence, which centers on moments of gratification and pampering, is the industry’s dominant archetype, followed by nostalgia. The industry ranks fourth out of 19 industries for indulgence. Moreover, of the 21% of users in some stage of intimacy with the industry, 13% of users are in the sharing stage, the earliest stage of Brand Intimacy, 5% are in bonding, the middle stage, and 3% are in fusing, the most advanced stage.

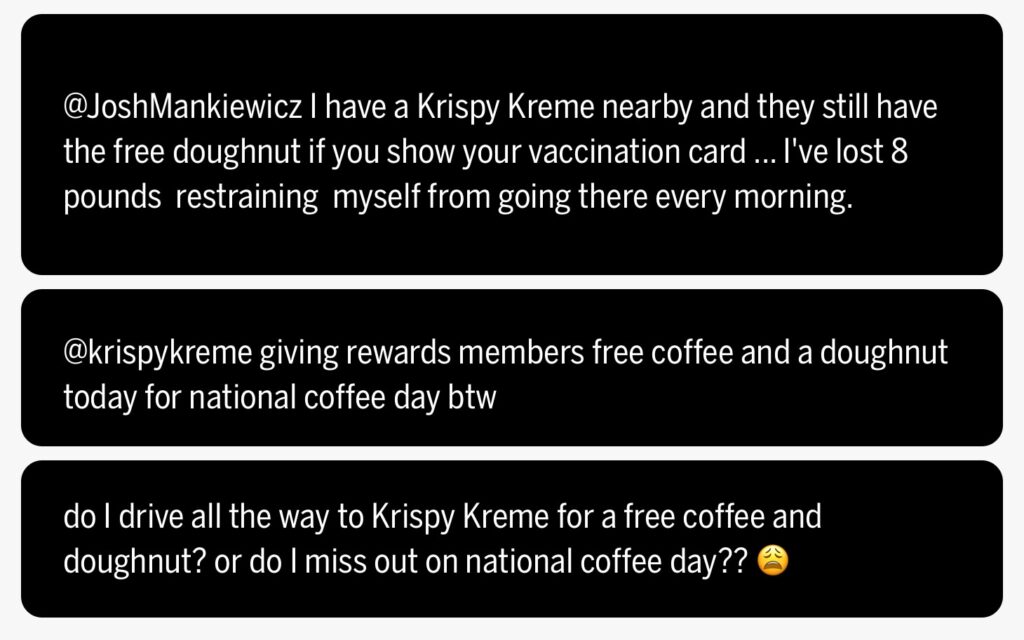

With many of this year’s top fast foods brands leaning more sweet than savory, the industry understandably skews toward indulgence. The sugary, calorically dense treats offered in many of these restaurants do not lend themselves to a “balanced diet.” In fact, when Krispy Kreme announced it would offer one free doughnut everyday to vaccinated individuals, some medical professionals were vocal about the negative health consequences that could result from eating a doughnut every day of the year.10

Krispy Kreme notably just saw its first quarterly profit since going public in 2021,11 and Costa Coffee has experienced a stable rise in profits from 2010 to 2019.12 On the whole, the top-performing fast food brands in our 2022 study have found success, both in revenue and in building emotional connections.

Krispy Kreme

Krispy Kreme opened its first official store in 1937, and has since grown to become closely tied to American identity and culture. Today, there are 373 locations in the United States,13 and over 1,000 locations across the world. In 1997, the doughnut shop, which is particularly popular in the Southern United States, was inducted into the Smithsonian’s National Museum of American History.14

The brand first went public in 2000, where it spent a tumultuous 16 years—including plunging stock value and an accounting scandal, before JAB Holding Company privately acquired it in 2016.15 In 2018, Krispy Kreme acquired Insomnia Cookies, a popular late-night cookie store, and in July 2021 the company once again went public on the NASDAQ.

Unlike the industry overall, Krispy Kreme’s dominant archetype is nostalgia, which focuses on memories of the past and the warm, poignant feelings associated with them. Often, the nostalgia archetype is strong in brands that a customer has grown up with. Customers often post about their fondness for Krispy Kreme’s signature “glazed” doughnut.

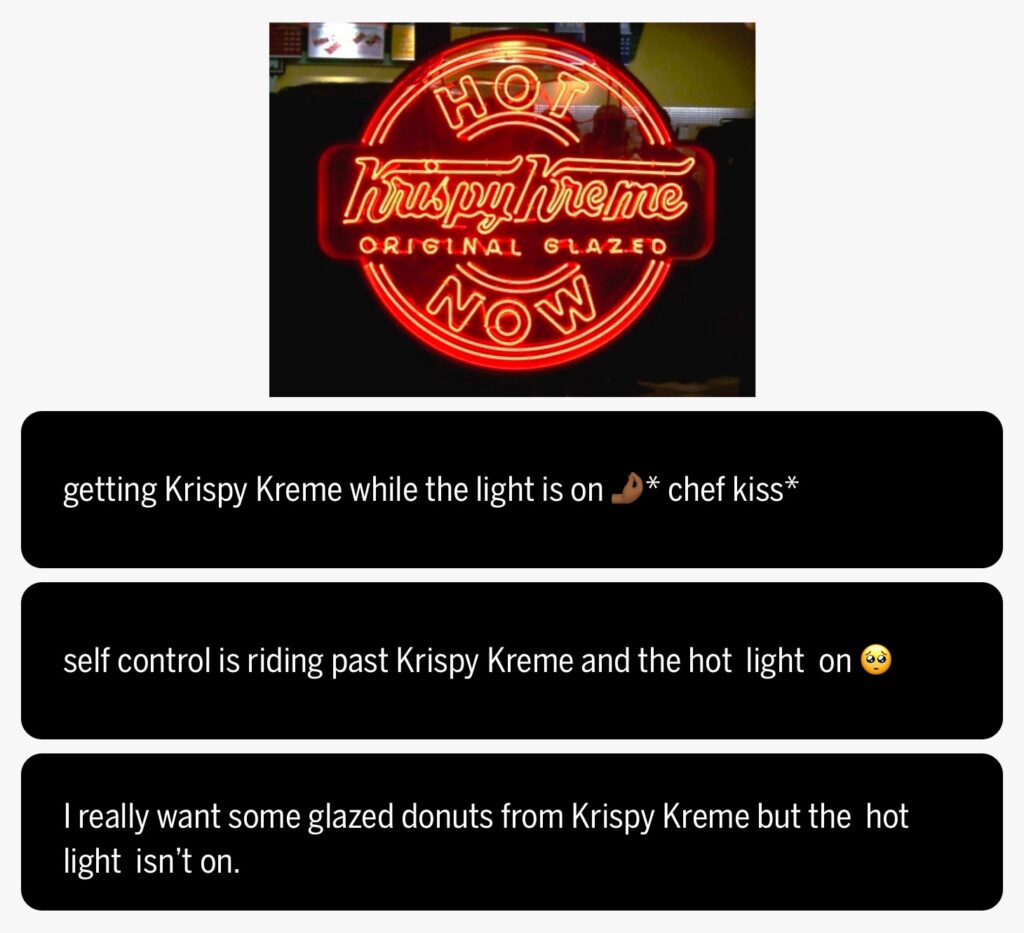

Krispy Kreme is also widely known for its signature “hot light,” where the storefront turns on a red neon light to signal fresh, hot doughnuts have just come out of the oven.

Krispy Kreme’s second strongest archetype is indulgence, which links to brands creating a close relationship centered around moments of pampering and gratification. This archetype connects to the idea of a Krispy Kreme doughnut as a kind of treat or reward, often one that customers can not resist.

Compared to the industry overall, Krispy Kreme performed better in the sharing and fusing Brand Intimacy stages. Almost 30% of Krispy Kreme users are in some form of intimacy with the brand, meaning more than one in four feel a strong emotional connection. Of all the brands ranked in this year’s study, Krispy Kreme ranked 145th.

Chick-fil-A

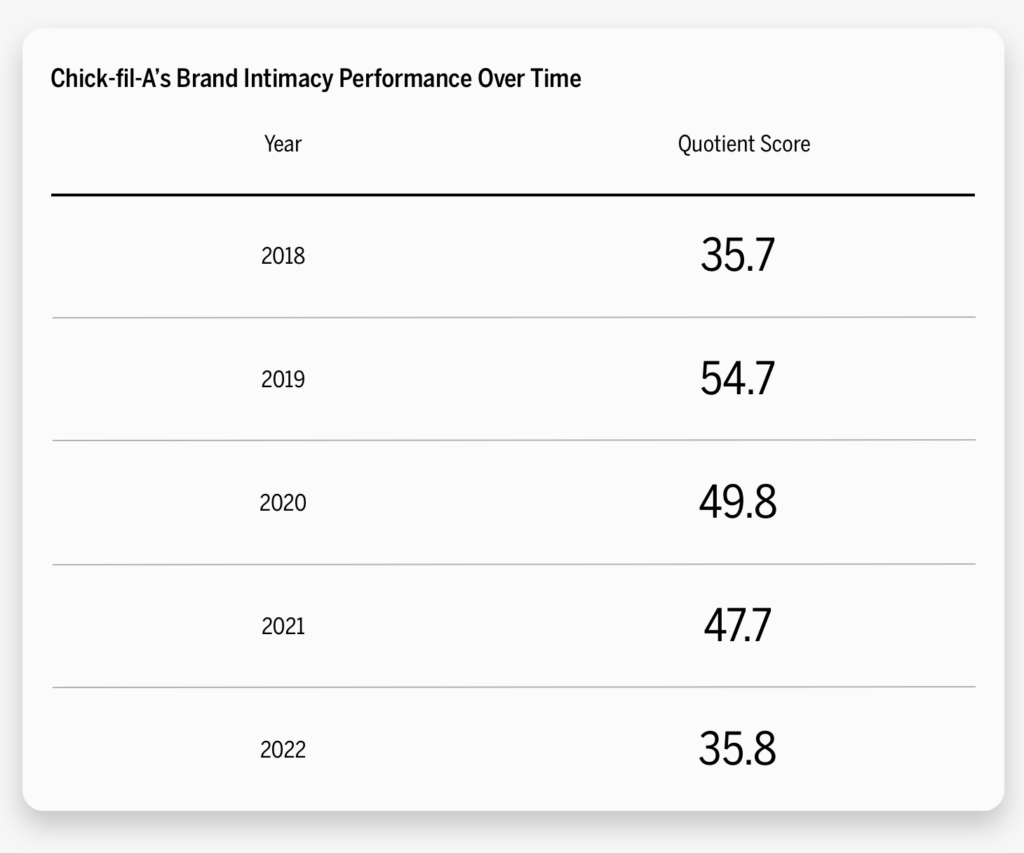

Despite its tumble in this year’s study and its recent political controversies, Chick-fil-A saw record-setting revenue and earnings over the past two years.16 Historically, Chick-fil-A has performed quite well in our Brand Intimacy Study, and previously enjoyed a three-year streak as the best performing fast food brand.

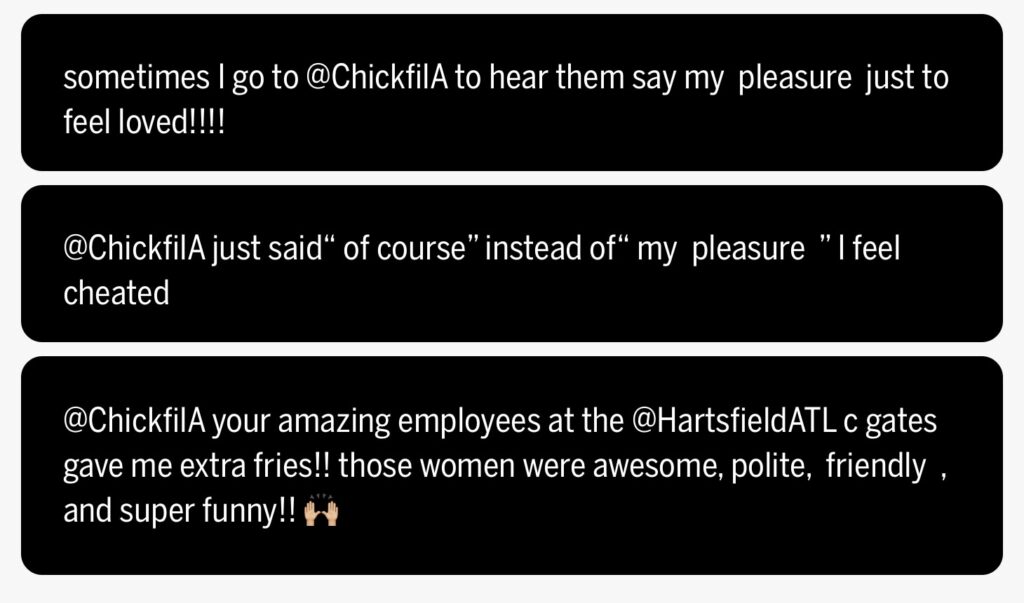

The privately held company prides itself on superior customer satisfaction and hospitality. Chick-fil-A employees are trained to use specific, polite words and phrases to interact with customers, including saying “my pleasure,” instead of “you’re welcome.” Restaurants also try to elevate the fast food dining experience by placing flowers on tables and having employees offer to clear customers’ trash.17

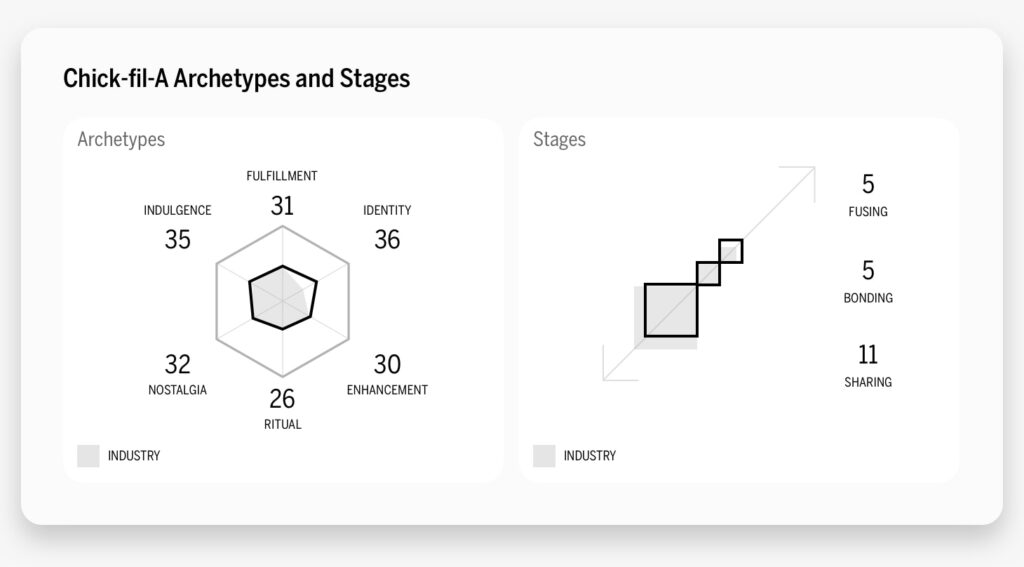

This year, Chick-fil-A had a Brand Intimacy Quotient score of 35.8, coming in eighth in the fast food industry and 221st in the overall study. While indulgence came in a close second, Chick-fil-A also differs from the overall industry with its dominant archetype, identity, which reflects an aspirational image or admired values and beliefs that resonate deeply. Since its first location opened in 1967, Chick-fil-A has consistently cultivated a strong corporate culture. This culture, rooted in founder Truett Cathy’s Southern Baptist religious beliefs, is the reason restaurants are closed on Sundays. As the website explains, “Truett saw the importance of closing on Sundays so that he and his employees could set aside one day to rest and worship if they choose a practice we uphold today.” Other aspects of Chick-fil-A’s corporate culture and value system have thrust the company into many public controversies in recent years. For instance, the company’s open disapproval of same-sex marriage, including their repeated donations to groups that oppose same-sex marriage, has prompted repeated boycotts and movements against the brand.18 This past July, the company landed in further hot water when one location began soliciting “volunteers” to work at the Chick-fil-A drive-thru in exchange for “five free entrees” per shift. Despite these scandals, Chick-fil-A’s sales have not suffered, and the company continues to dominate as one of the largest quick service restaurant chains in the world, with over 2,600 locations.

Of the 20% of Chick-fil-A’s customers in some stage of intimacy, 11% are in the sharing stage, 5% are in bonding, and 5% are in fusing, the highest stage of Brand Intimacy (falling below both the industry and overall study averages). Online, customers praise the restaurant’s tasty food, exceptional customer service, and convenient drive-thrus.

Different Strengths

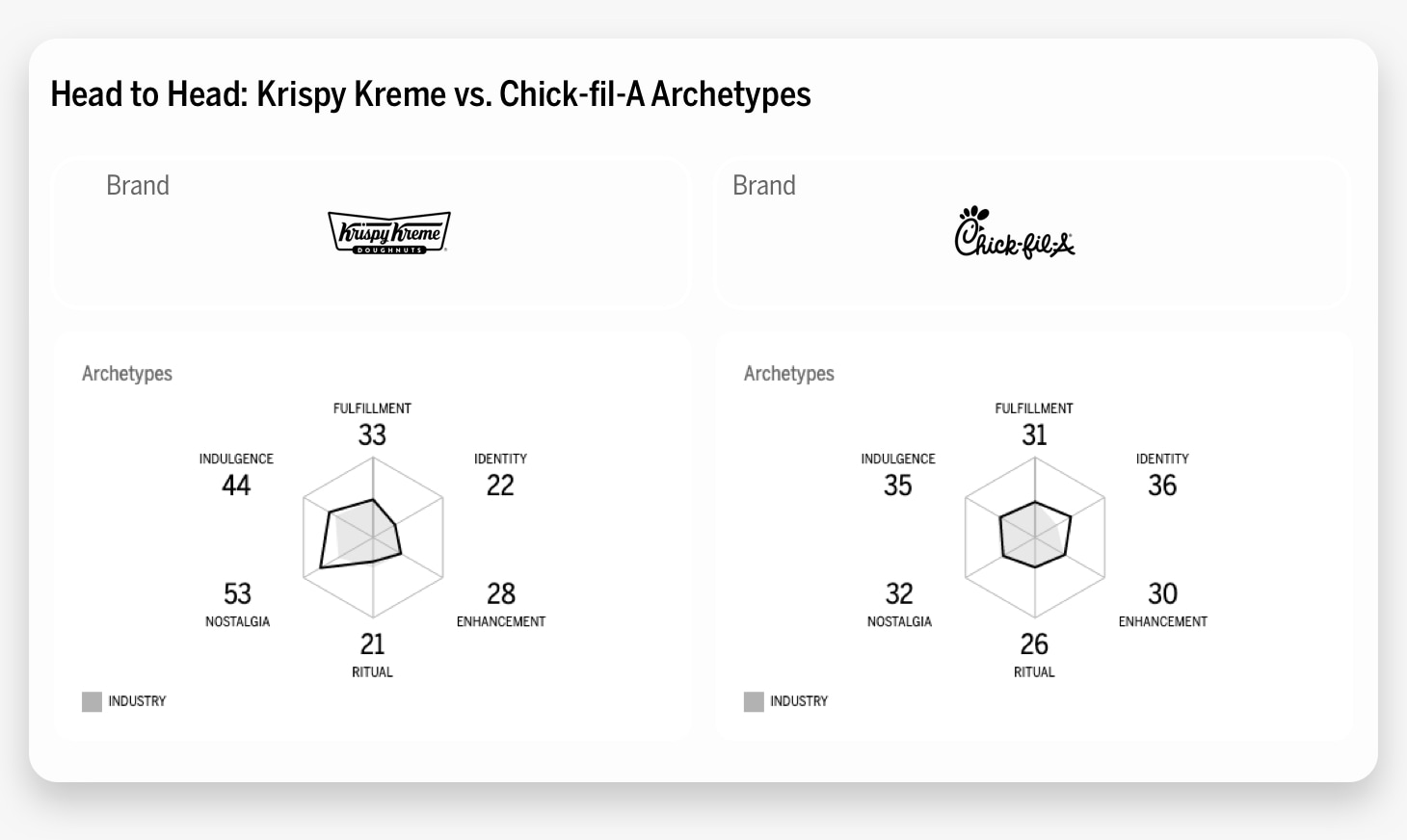

Looking at Chick-fil-A and Krispy Kreme’s archetypes, both brands diverge from the industry’s overall dominant archetype, indulgence, but share it as second place finishers. The gap between Chick-fil-A’s dominant archetype, identity, and indulgence is a difference of only one point, in contrast to Krispy Kreme, whose dominant archetype, nostalgia, leads by nine points. This difference suggests that users associate Krispy Kreme with nostalgia more strongly than they associate Chick-fil-A with identity. Krispy Kreme leans heavily into feelings of nostalgia through its physical store designs, branding, and menu. The iconic, retro design of Krispy Kreme locations and logos have remained largely unchanged throughout their existence. Today, walking into a Krispy Kreme location still evokes feelings of old 50s and 60s diners. The vintage iconography of the brand still plays a part in the brand’s own social discourse and marketing.

Similarly, the brand often introduces and reintroduces old doughnut flavors to conjure feelings of nostalgia. For example, in 2019, the doughnut company launched limited-edition “throwback doughnuts,” centered around a virtual arcade theme and aimed to encourage customers to “take a trip down memory lane.”19 Krispy Kreme’s numbers across the board are much higher than Chick-fil-A’s, indicating the brand performs better in more archetypes overall than Chick-fil-A.

Moreover, the companies present themselves and their values in very different ways. Chick-fil-A’s self-proclaimed corporate purpose is “to glorify God by being a faithful steward of all that is entrusted to us and to have a positive influence on all who come in contact with Chick-fil-A.”20 That message contrasts greatly to Krispy Kreme’s mission, “to make the most awesome doughnuts on the planet every single day.”21 Chick-fil-A emphasizes values that go much deeper than making chicken sandwiches, including upcycling, reducing food waste, and offering parenting friendly menus. Comparably, Krispy Kreme strives to “be sweet” by prioritizing diversity, equity, and workplace health & safety within their company.22 All in all, although Chick-fil-A’s religious identity occupies an important part of its business ideology, it may continue to clash with an increasingly secular American public.23

Food vs. Drink

Ranking in 13th place, directly below fast food, the beverage industry’s performance reveals some interesting parallels. The two industries behaved similarly in almost every way, even sharing an almost identical average Brand Intimacy Quotient Score. Like fast food, the beverage industry’s dominant archetype is indulgence (both at 28), with nostalgia as the second strongest (both at 25). The two even achieved the exact same percentages of users in each stage of intimacy, with 13% in sharing, 5% in bonding, and 3% in fusing.

Although the beverage industry performed ever-so-slightly below fast food, its top performing brand, Lavazza, ranks substantially higher than Krispy Kreme in our overall rankings, with Lavazza coming in at 67th and Krispy Kreme at 145th. Unlike Krispy Kreme, Lavazza’s strongest archetype is indulgence, followed by ritual. Lavazza, a coffee company, benefits from its ability to more easily become a ritual habit in people’s daily lives. While a morning cup of coffee can be both an indulgence and a ritual, a morning doughnut (or a chicken sandwich) is less likely to be a ritual due to health and diet concerns.

Conclusion

This year, the sweets side of the fast food industry prevailed in our Brand Intimacy rankings, aligning with shifts in dietary habits resulting from the recent pandemic.

Although the fast food industry overall performed best in indulgence, Krispy Kreme’s new position as the most intimate fast food brand speaks to its ability to effectively evoke feelings of nostalgia and warm memories of the past with its branding and feel-good messaging. Chick-fil-A, which previously enjoyed a long tenure leading the industry, struggled to even place in the top five this year.

Being able to cultivate a strong, intimate relationship, that spans multiple archetypes is no easy feat. Looking ahead, it will be interesting to see how shifts in public sentiment and post-COVID-19 lifestyle implications affect this booming industry. Changing perspectives on fast food have also contributed to industry-wide adaptations. For instance, recent growth in the number of vegans and vegetarians in the United States has prompted large chains, like Burger King, Starbucks, and KFC to offer meat-alternative options. Similarly, public opinion of fast food as “unhealthy” has influenced brands to come out with more marketable, diet friendly options. It is notable, however, that this year’s leader has succeeded without focusing on shifting trends, rather, it has chosen to focus on simple pleasures. As they say, “Things are better enjoyed together, especially the sweet fluffy clouds of deliciousness we call doughnuts.”

Get an overview of Brand Intimacy here.

Read our detailed methodology here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Sources

1 “Reported Changes in Eating Habits Related to Less Healthy Foods and Beverages during the COVID-19 Pandemic among US Adults.” By The National Library of Medicine

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8838827/

2 “How COVID-19 Has Changed How Americans Eat.” By MDLinx.com

Source no longer available

3 “Here’s how much fast food Americans are eating.” By CNN.com

https://www.cnn.com/2018/10/03/health/fast-food-consumption-cdc-study

4 “Fast Food Consumption Among Adults in the United States, 2013–2016.” By cdc.gov

https://www.cdc.gov/nchs/products/databriefs/db322.htm

5 “Monthly change in quick service restaurant menu prices in the United States from January 2020 to January 2021.” By statista.com

https://www.statista.com/statistics/1247961/change-in-qsr-menu-prices-in-the-us/

6 “Monthly sales of quick service restaurants in the United States in 2019 and 2021.” By statista.com

https://www.statista.com/statistics/1232824/monthly-quick-service-restaurant-sales-us/

7 “Number of quick service restaurant (QSR) franchise establishments in the United States from 2007 to 2021, with a forecast for 2022.” By statista.com

https://www.statista.com/statistics/217561/number-of-quick-service-restaurant-franchise-establishments-in-the-us/

8 “Fast food restaurants in the U.S. – statistics & facts” By statista.com

https://www.statista.com/topics/863/fast-food/#dossierKeyfigures

9 Ibid.

10 “Krispy Kreme faces backlash for free doughnut promotion for vaccinated people.” By today.com

https://www.today.com/food/krispy-kreme-faces-backlash-free-doughnuts-vaccinated-people-t213204

11 “Krispy Kreme reports first quarterly profit since going public, fueled by strong holiday sales.” By cnbc.com

https://www.cnbc.com/2022/02/22/krispy-kreme-reports-first-quarterly-profit-since-going-public-fueled-by-strong-holiday-sales.html

12“Revenue of Costa Coffee worldwide from fiscal year 2010/11 to 2018/19.” By statista.com https://www.statista.com/statistics/579810/costa-coffee-revenue/

13 “Number of Krispy Kreme establishments in the United States from 2001 to 2021.” By statista.com

https://www.statista.com/statistics/297200/number-of-krispy-kreme-doughnuts-stores-us/

14 “America has a sweet celebration: Krispy Kreme doughnuts.” By APNews.com

Source no longer available

15 “Krispy Gets Kremed.” By forbes.com

https://www.forbes.com/2005/08/10/restatement-earnings-kkd-cz_em_0810kkd.html?sh=76d2804e3e01

16 “Revenue and Earnings Blowout for Chick-fil-A in 2021; Systemwide Sales Jump 22 Percent.” By franchisetimes.com

https://www.franchisetimes.com/franchise_news/revenue-and-earnings-blowout-for-Chick-fil-A-in-2021-systemwide-sales-jump-22-percent/article_9534bc9c-b9cb-11ec-8ebd-fb6368c47a3e.html

17 “Chick-fil-A is dominating fast food while teaching workers to say ‘my pleasure’ and putting flowers on tables — here are 6 strategies the chain has used to become the most polite in the industry.” By businessinsider.com

https://www.businessinsider.com/chick-fil-a-most-polite-chain-fast-food-strategies-2019-6

18 “Boycotts haven’t stopped the growth of Chick-fil-A.” By vox.com

https://www.vox.com/the-goods/2018/12/20/18146316/chick-fil-a-growth-controversy

19 “Krispy Kreme Launches its New Retro Doughnut Range with a Nostalgic Campaign Via The Monkeys.” By campaignbrief.com

https://campaignbrief.com/krispy-kreme-launches-its-new-retro-doughnut-range-with-a-nostalgic-campaign-via-the-monkeys/

20 “Who We Are.” By chi-fil-a.com

https://www.Chick-fil-A.com/about/who-we-are

21 “About Krispy Kreme.” By krispykreme.com

https://www.krispykreme.com/about

22 “Sustainability.” By krispykreme.com

https://www.krispykreme.com/sustainability

23 “About Three-in-Ten U.S. Adults Are Now Religiously Unaffiliated.” By pewresearch.org

https://www.pewresearch.org/religion/2021/12/14/about-three-in-ten-u-s-adults-are-now-religiously-unaffiliated/