Overview

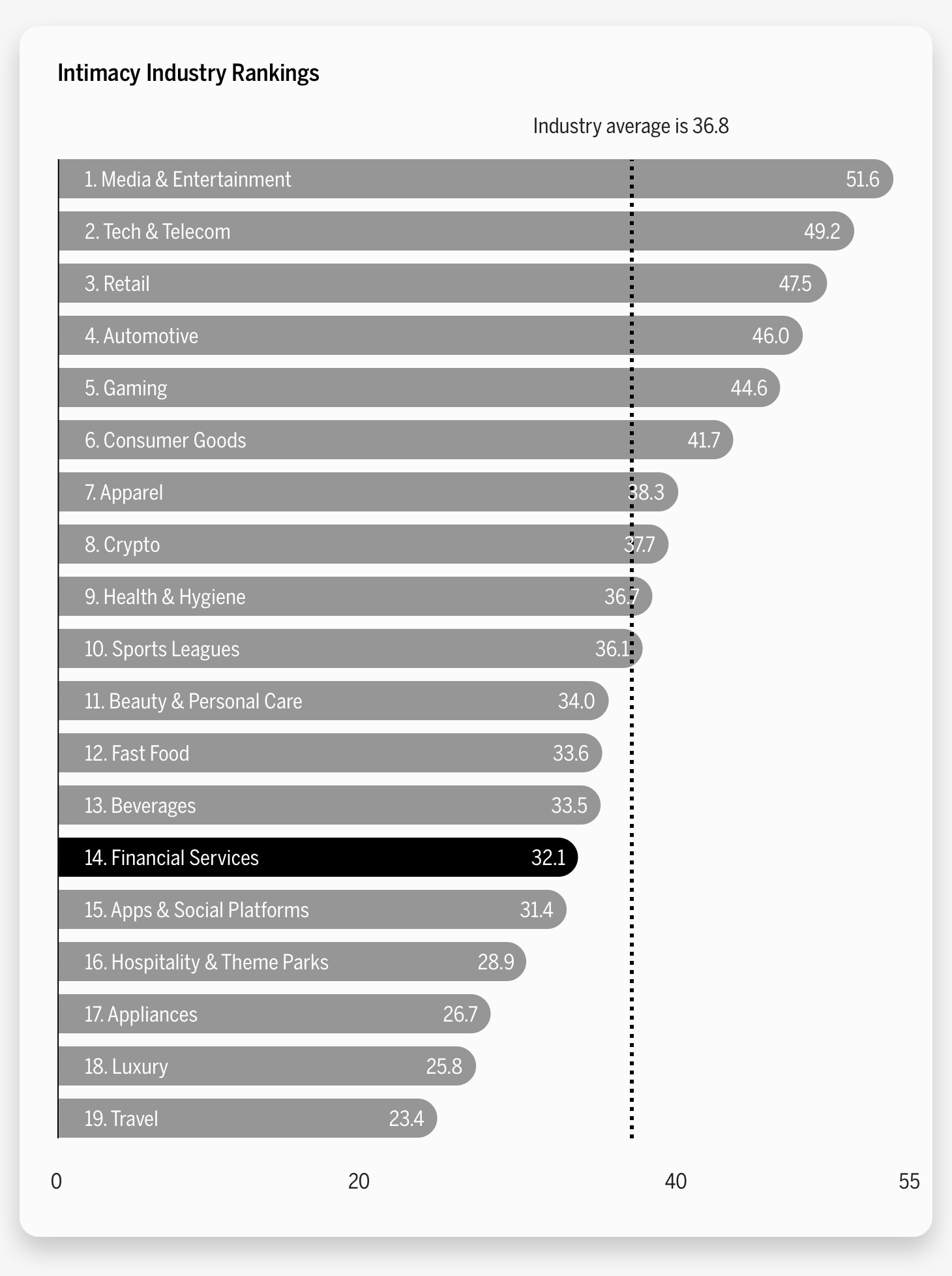

- The financial services industry ranked 14th in this year’s Brand Intimacy Study.

- USAA remained the most intimate financial services brand for the second year in a row.

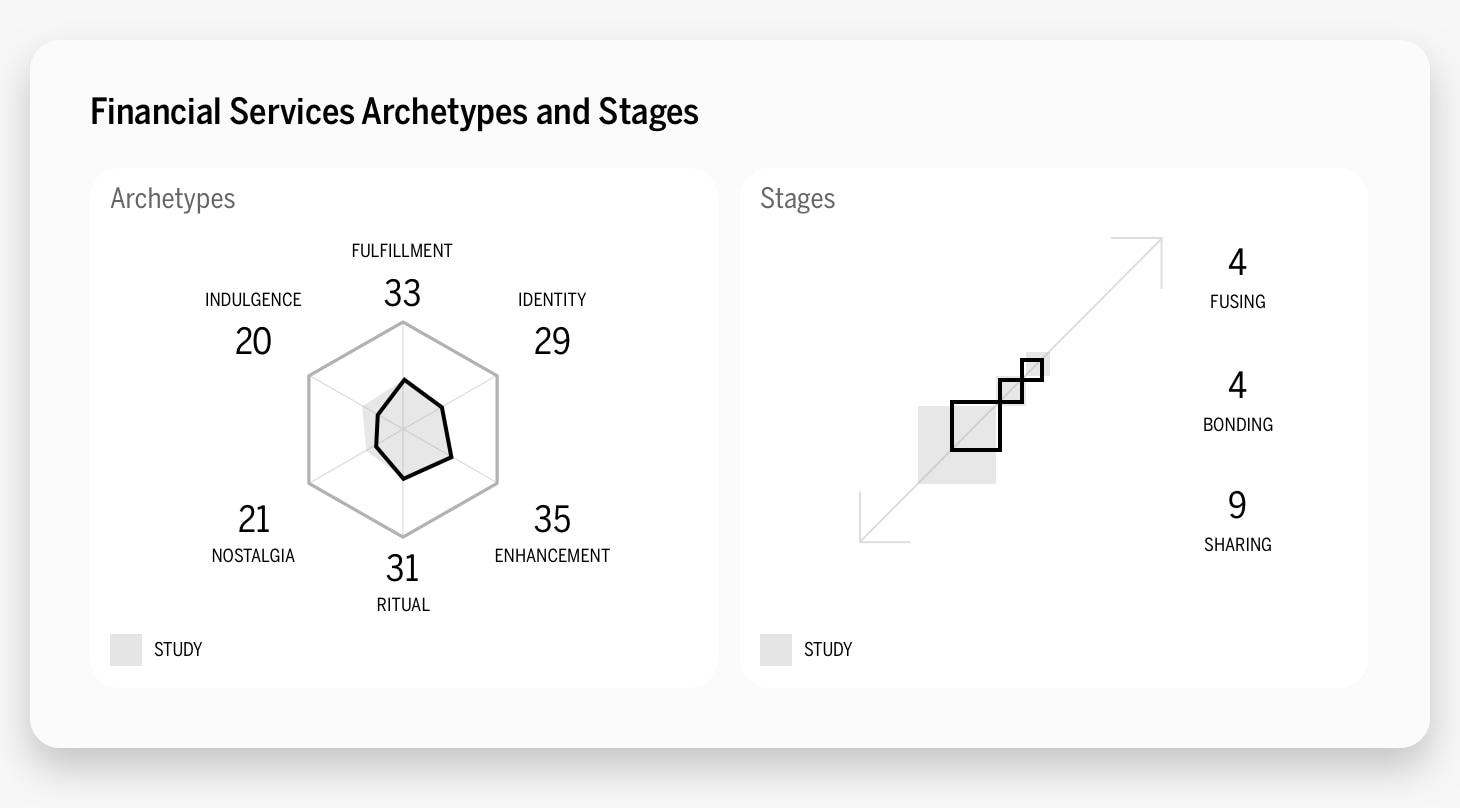

- Enhancement, which is related to becoming smarter, more capable, and more connected through use of the brand, is the top archetype of the industry.

Introduction

The financial services industry placed 14th in this year’s Brand Intimacy Study with an average Brand Intimacy Quotient Score of 32.1, falling below the cross-industry average of 36.8.

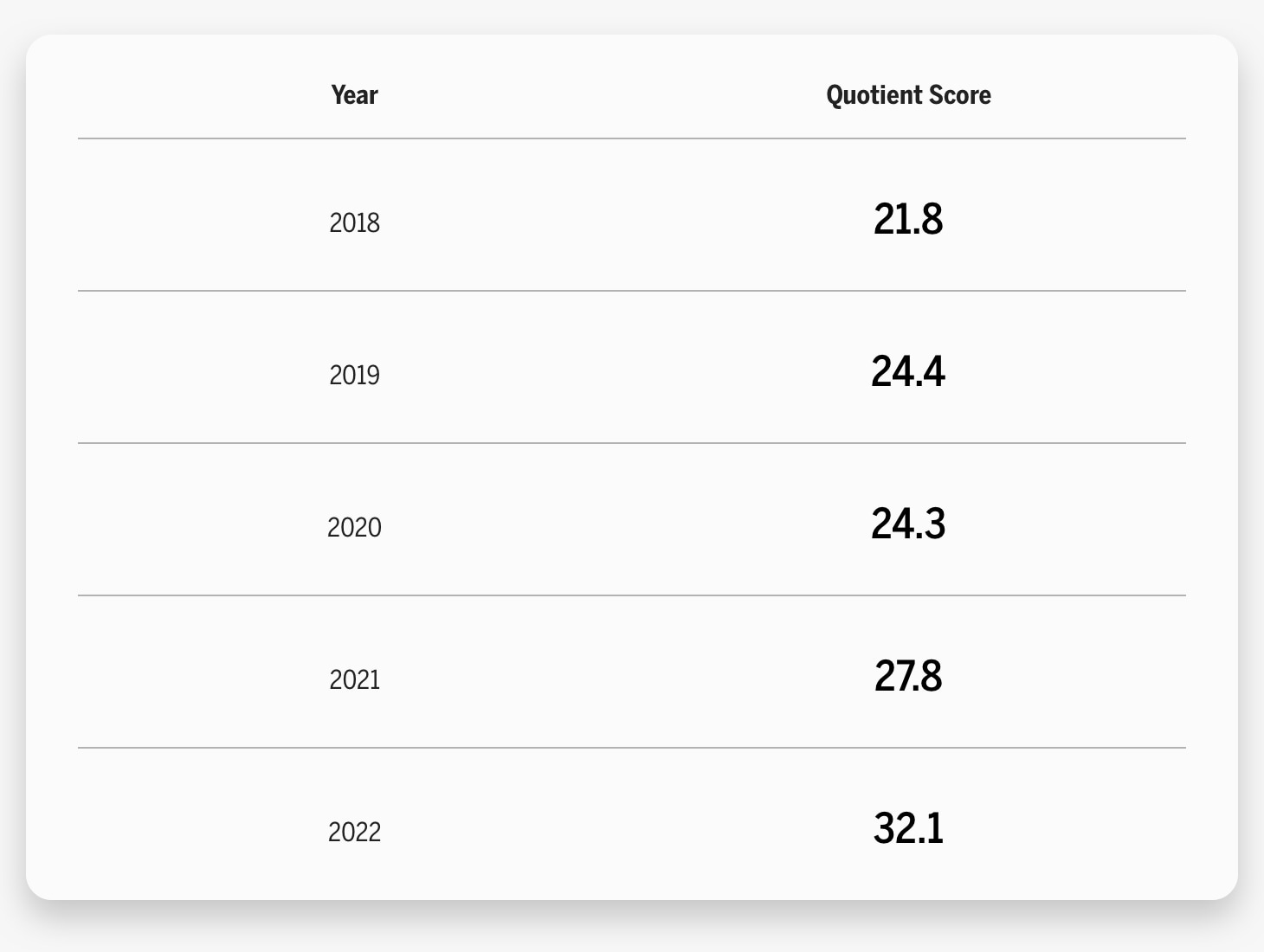

This is not the first time the industry has struggled with its performance. Historical data highlights the category’s challenges to maintain and improve strong emotional connections with consumers. On the positive side, progress is evident over the last five years.

The financial services industry experienced a notable boost in its average Brand Intimacy Quotient Score during the COVID-19 pandemic when many consumers relied on them to allow delayed payments and provide additional funding if needed. (see our previous article, Financial Services Brands & COVID-19). However, this boost seemed to stay stagnant through 2021 (see our more recent article, The Financial Services Standstill). Similarly, the emergence of the crypto industry (see Crypto Comes Out Strong) presents more direct competition to traditional banking institutions and credit cards. Consumers frustrated with the options presented by established financial services brands, especially younger customers, may look toward crypto as a more rewarding investment option. Ultimately, the industry’s poor performance this year shows that more needs to be done to strengthen its relationships with its users.

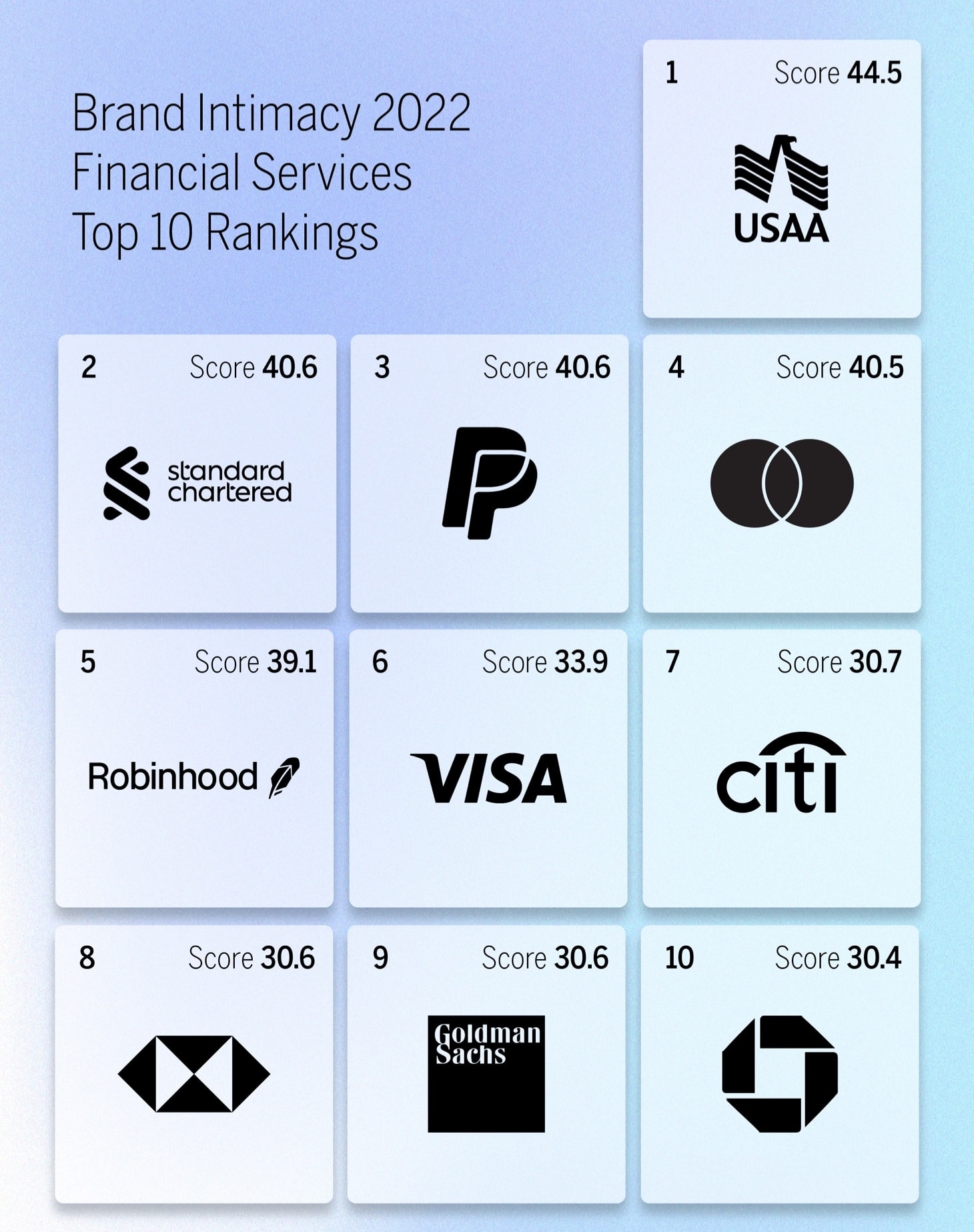

Among the 17 ranked financial services brands, USAA came out on top for the second year in a row with a Quotient Score of 44.5, followed by Standard Chartered with a Quotient Score of 40.6. Of all the brands analyzed in the 2022 Study, USAA and Standard Chartered placed 98th and 138th, respectively. This suggests that even category top performers are not top performers overall.

This article will examine the top-performing bank, credit card, and broader financial services providers to offers insight into how each specific type of company is trying to connect with its consumer, and present implications for the industry at large.

Breaking Down Financial Services

This year and last year, financial services brands’ strongest archetype has been enhancement, which links to customers becoming better or more effective through the use of the brand. This archetype is common with technology brands and financial services and may speak to new apps, services, and digital experiences that consumers are seeking to increase ease and convenience. Fulfillment, which is the second strongest category archetype, is the most dominant archetype across all 19 of our industries. It speaks to exceeding expectations and delivering superior service.

One of the areas in which financial services struggles is limited performance across Brand Intimacy stages. Only 17% of the industry’s users are in some sort of intimate relationship, compared with the Brand Intimacy Study average of 23%. Of the 17%, 9% make up the sharing stage, 4% make it to the bonding stage, and 4% arrive at fusing with brands in the industry. Nickel and diming, frustrating automated systems, and continuing bureaucracy have resulted in consumers feeling a lack of connection and and increasing frustration with brands in this space.

This, coupled with a lack of trust in banks due to frequent scandals, means financial services, in many ways, have greater barriers to overcome when cultivating intimate relationships. In 2021, consumers reported losing over $5.8 million to fraud, representing a 70% increase from 2020.1 According to Edelman’s Trust Barometer, consumer trust in US businesses and the US central bank fell to 49% this year.2 A 2019 study from Ernst & Young estimates that shifting trust dynamics between consumers and financial services will put $11.3 trillion worth of assets into motion over the next few years.3 This growing lack of trust hinders the potential to build strong intimate relationships because emotional connections without trust is nearly impossible.

Top Overall Performer

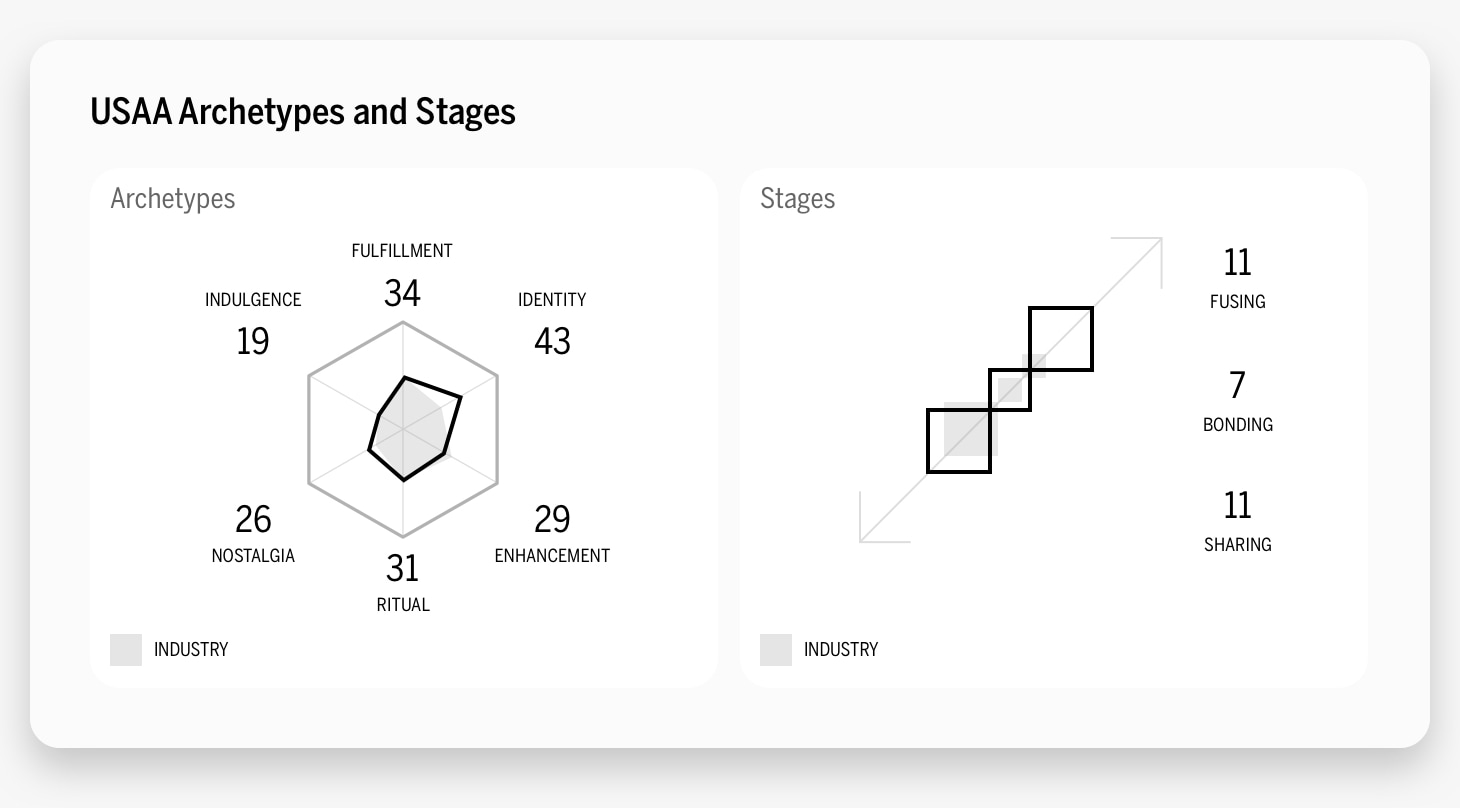

Unlike the overall industry’s dominant archetype of enhancement, USAA’s strongest archetype is skewed heavily toward identity, which is when the brand reflects an aspirational image or admired values and beliefs that resonate deeply. Notably, USAA is the only financial services brand that has identity as its dominant archetype. Of the 29% of users in some stage of intimacy with USAA, 11% are in the sharing stage, 7% are in the bonding stage, and 11% are in the fusing stage, the most advanced stage of Brand Intimacy. Compared with the industry averages, USAA performs better across the board.

USAA, or the United Services Automobile Association, offers insurance, investing, banking, and retirement solutions to individuals who serve or have served in the United States Armed Forces and their families. Because the company itself has such a strong, niche identity, it is easy to understand how it ranks high for shared values. Moreover, because USAA serves a specific kind of customer, those customers are likely to feel more appreciated by, and aligned with, the brand.

This specific insight, its strong performance in identity, gives USAA the edge it needs to lead the financial services industry.

USAA’s messaging is also consistent in the way it emphasizes its role in supporting both military individuals and their families. For instance, the company recently released a series of financial literacy videos intended to teach children and teens good money habits. In 2021, football player Rob Gronkowski became the first non-USAA member to appear in USAA advertisements that reiterate USAA’s exclusive commitment to military members and their families. The advertisements end with the phrase,“It’s still only for the military community.”

USAA’s recent commercial “Member Number” featuring Rob Gronkowski

The Most Intimate Bank

This year’s runner-up in the financial services category and best performing banking service is Standard Chartered. Established in 1969, Standard Chartered came to be after the merger of Standard Bank and Chartered Bank. The company now offers banking services for both individuals and companies.

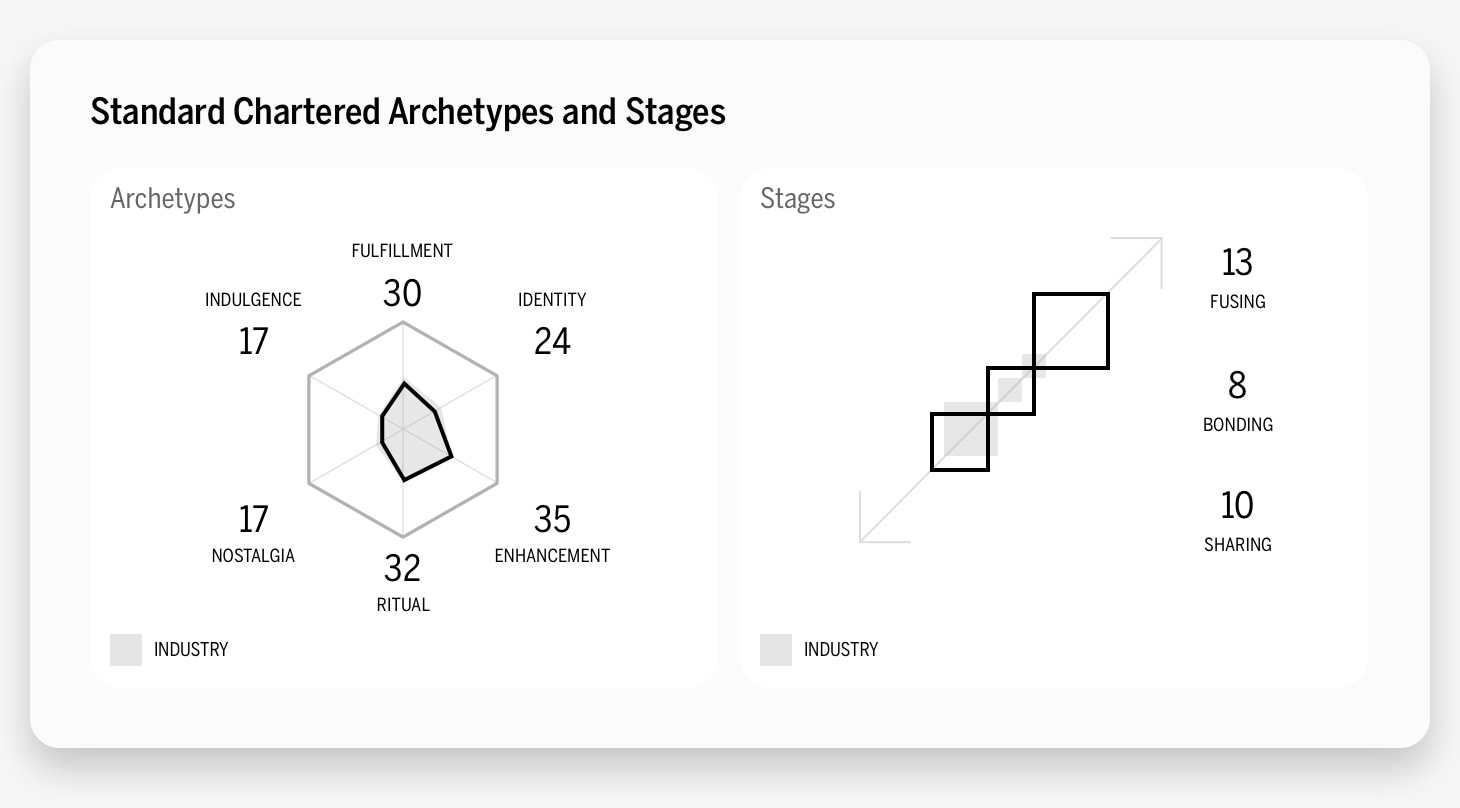

Like the industry overall, Standard Chartered’s strongest archetype is enhancement, followed by ritual. Moreover, Standard Chartered has 10% of users in the sharing stage, 8% in bonding, and 13% in fusing. Altogether, 31% of consumers who write about Standard Chartered are in some form of intimacy with the brand—higher than the cross-industry average of 23%.

However, the brand receives far fewer mentions in social media than USAA. In fact, USAA has more than double the mentions of Standard Chartered. The bank’s recent strong performance and announcement of a $500 million buyback4 show its ability to please many of its customers. Especially in the midst of a slowing global economy, Standard Chartered’s second quarter rise in profit is indicative of the bank’s strength and reliability.5

Sustainability plays a large role in Standard Chartered’s brand messaging. The bank’s “We’re Here for Good” campaign is incredibly future focused and centers on empowering young people to “learn, earn, and grow”.6 To further support this mission, Standard Chartered plans to mobilize $300 billion USD in green and transition financing to help clients reach their net zero target, and aims to reduce absolute financed thermal coal mining emissions by 85% by 2030. The bank organized this playlist of YouTube advertisements detailing all of Standard Chartered’s sustainability efforts. The shift to prioritizing young people in their messaging may give the brand an advantage in maintaining relationships with a younger demographic, many of whom are growing increasingly wary of traditional financial services.

Mastercard Leads Credit Cards

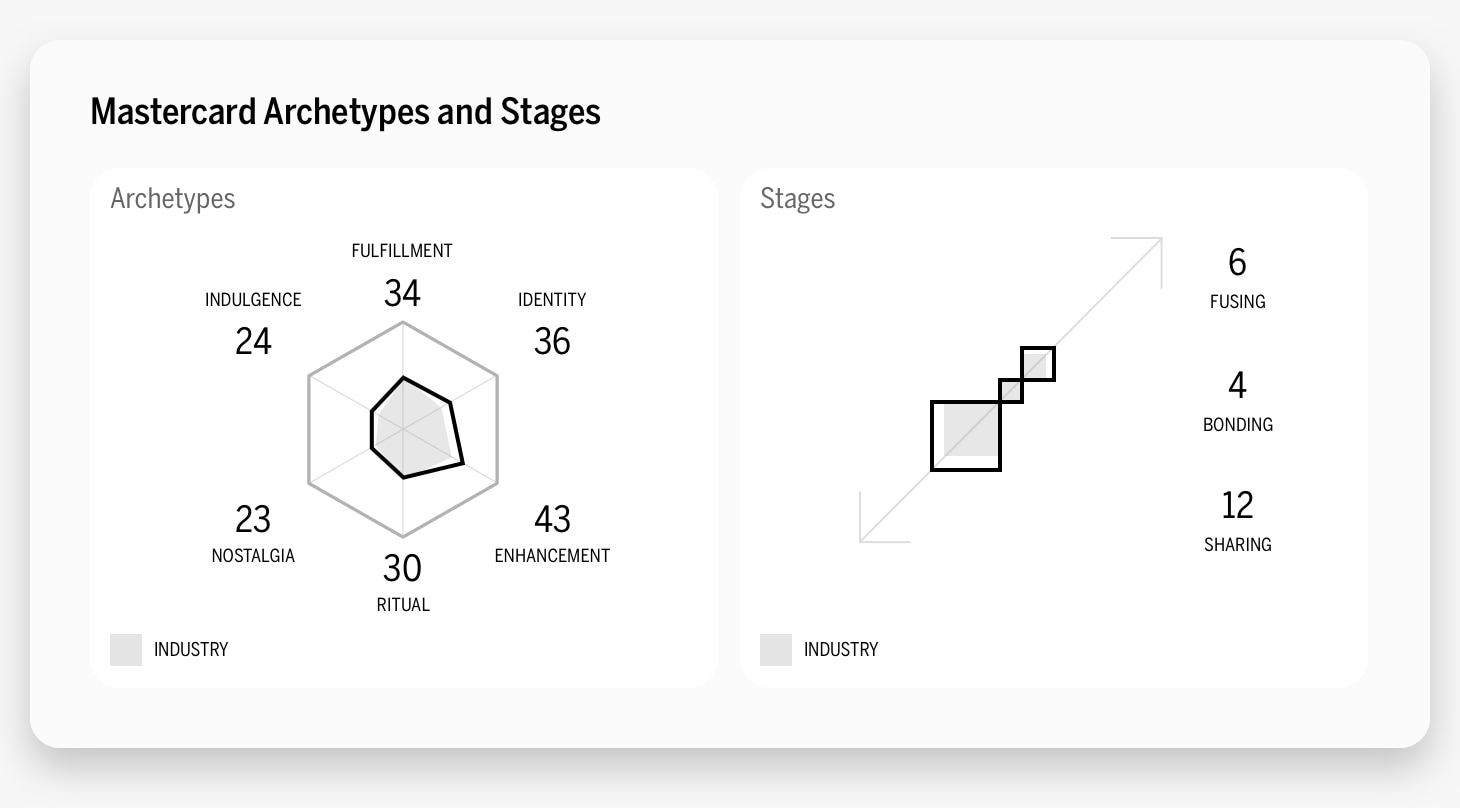

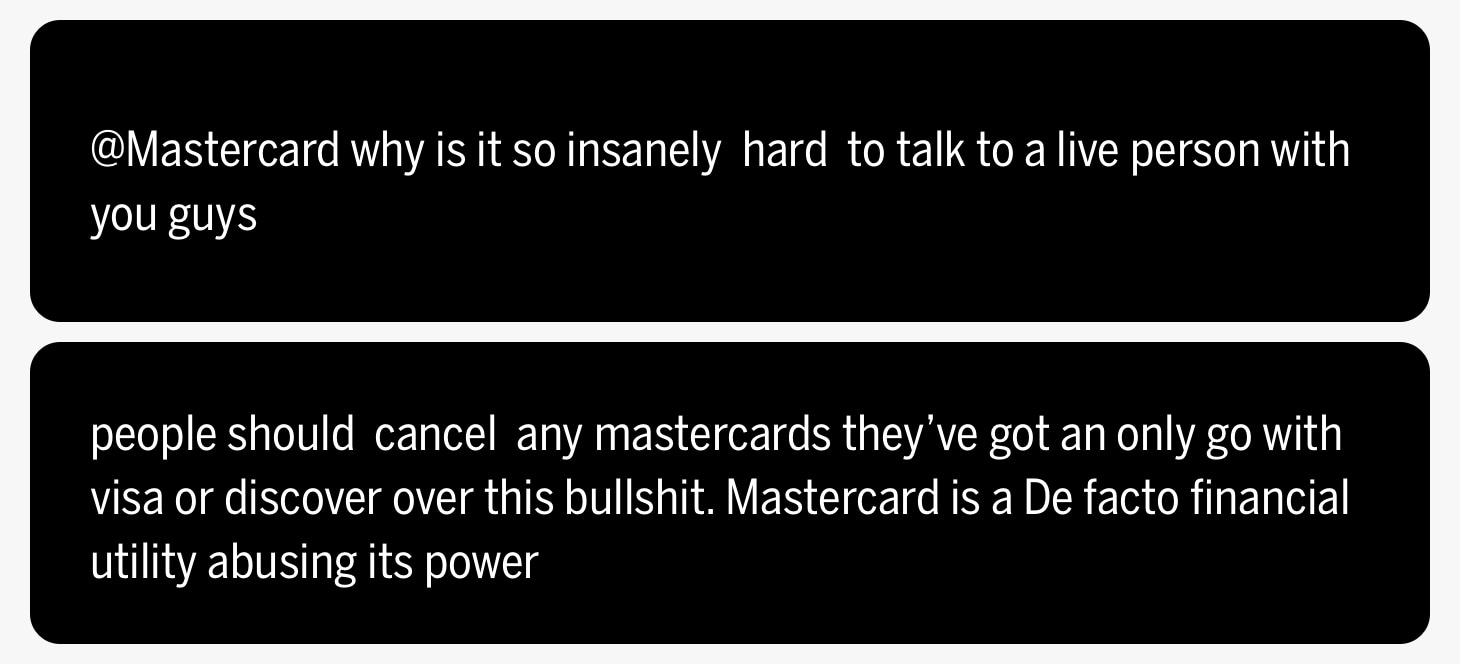

This year’s highest scoring credit card, ranking fourth overall in the industry, is Mastercard, with a Quotient Score of 40.5. Like Standard Chartered, Mastercard’s dominant archetype leans overwhelmingly toward enhancement. Looking at social discourse suggests that Mastercard customers appear to feel particularly pleased with Mastercard’s rewards credit cards, especially ones that offer cash back. This sense of getting something in return for using their product incentivizes card holders to prioritize one card over the other. Despite this, Mastercard struggles to fuse with its customers. Mastercard has 12% of users in the sharing stage, 4% in bonding, and 6% in fusing.

However, Mastercard recently announced a partnership with Binance to launch prepaid “crypto cards” in Argentina.7 This plan will allow users in Argentina to use cryptocurrencies to make purchases and ATM withdrawals wherever Mastercard is accepted. The partnership represents a push to grow crypto’s global adoption and puts MasterCard strategically ahead of many of its financial services competitors. The general acceptance and expansion of crypto signifies its permanence in our financial systems, and MasterCard’s decision to incorporate this shift into their company will likely benefit them in the future.

Like Standard Chartered, Mastercard spotlights sustainability as one of their current core values. In 2021, Mastercard released a corporate sustainability report detailing their initiatives to support prosperity, people, and the planet.8 Beyond environmentally friendly policies, Mastercard has pledged to adopt polices that support gender equity and stand against racism. In 2019, the credit card launched its TrueName feature, which supports transgender people by allowing customers to put their chosen name on their Mastercard without requiring individuals to go through the cumbersome process of legally changing their name.9 Mastercard has evolved its famous “Priceless” campaign to a more inclusive message with “Your True Self is Priceless” and “Because a World Designed for All of Us Is Priceless.”

Mastercard’s new Touch Cards extend the brand’s commitment to inclusivity by expanding accessibility to visually impaired people. The unique notches added to credit, debit, and prepaid cards “will provide a greater sense of security, inclusivity and independence to the 2.2 billion people around the world with visual impairments.”10

“Spotlight” by Mastercard advertises the company’s new Touch Cards

Positive and Negative Social Listening

By examining over 1.4 billion words and phrases from social media, our 2022 Brand Intimacy Study provides us with valuable insights into how consumers feel about brands.

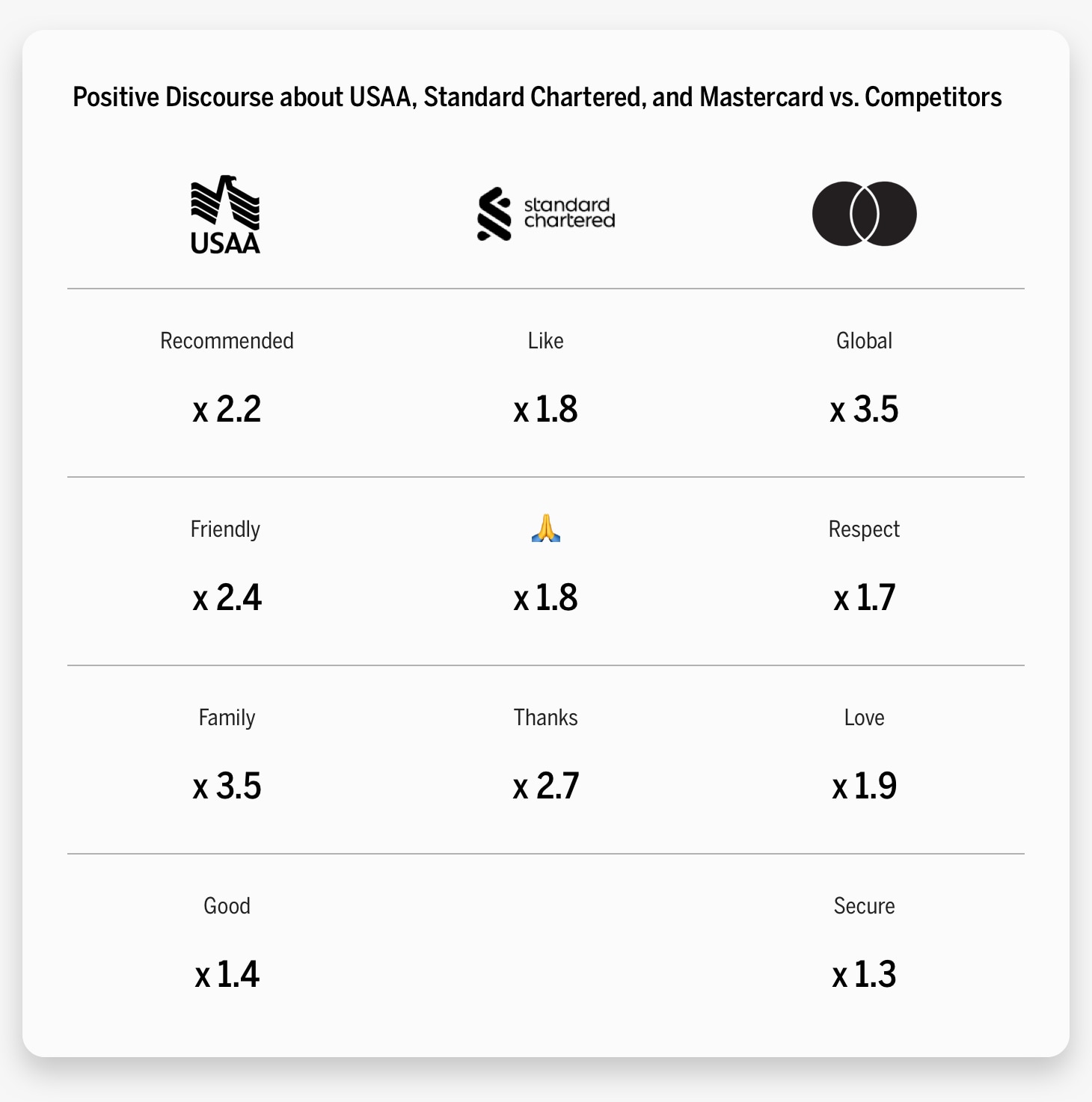

Notably, USAA customers are 2.2 times more likely to recommend the brand, 2.4 times more likely to discuss the brand’s friendliness, and 3.5 times more likely to talk about how the company benefitted their family. On the whole, users seem to view USAA as more family-oriented and family-friendly. Given that the brand covers military members and their families, it is understandable to see this connection.

Mastercard customers lauded the brand’s global presence and security measures. Compared with its competitors, Mastercard holders were also more likely to discuss their love and respect for the company.

Standard Chartered users, conversely, had noticeably fewer positive things to say about their bank than USAA and Mastercard users. However, Standard Chartered customers more frequently expressed their thanks for the company’s help.

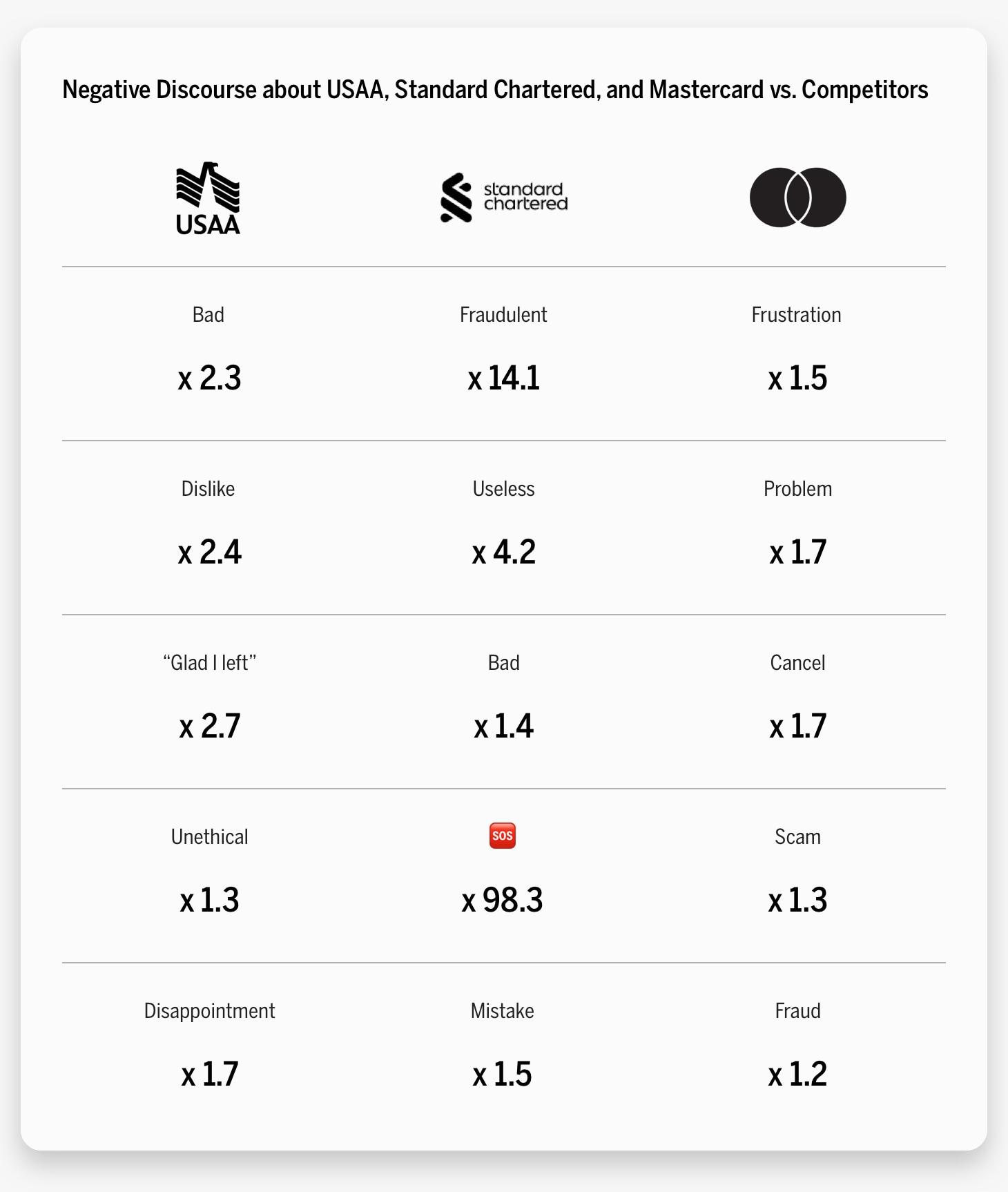

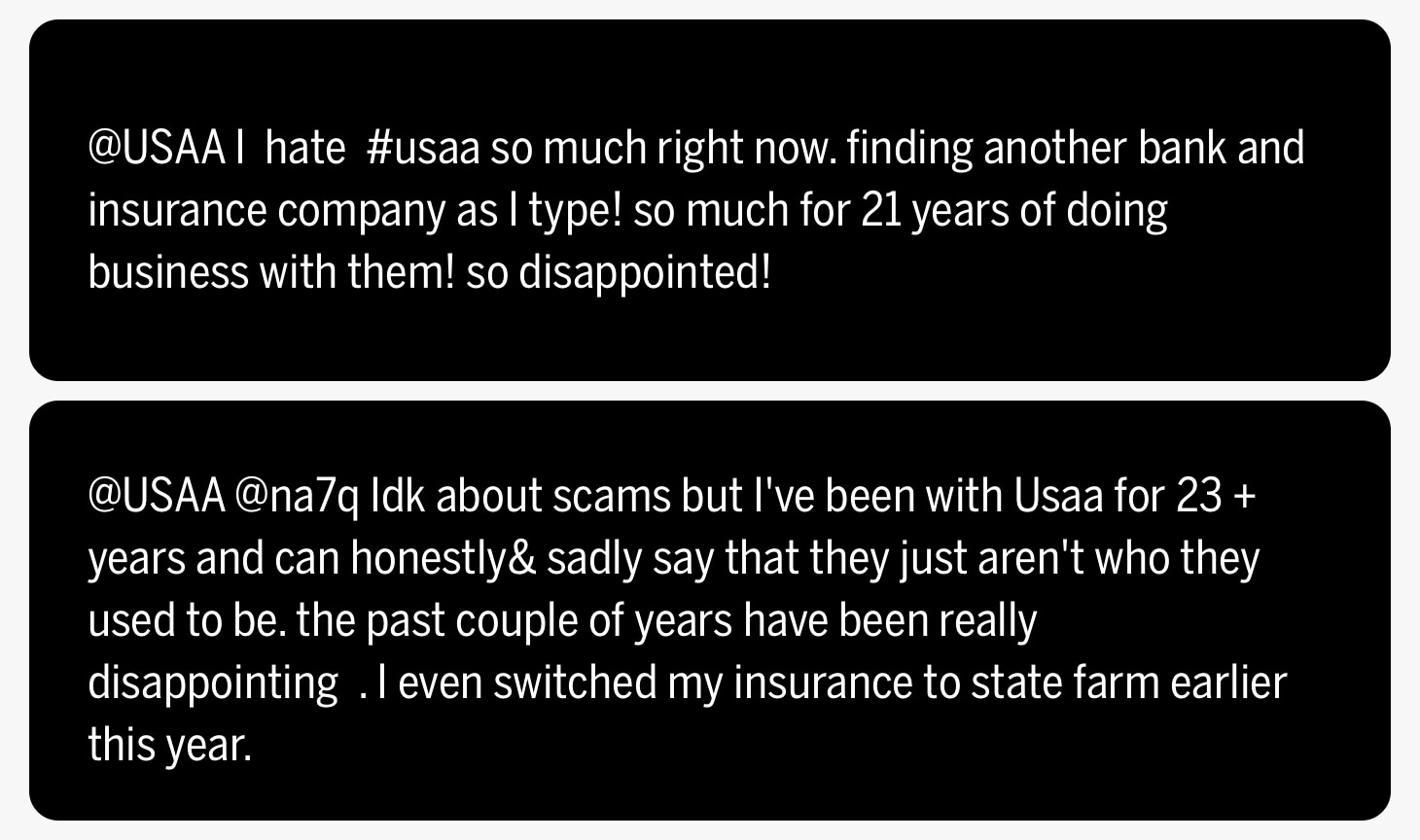

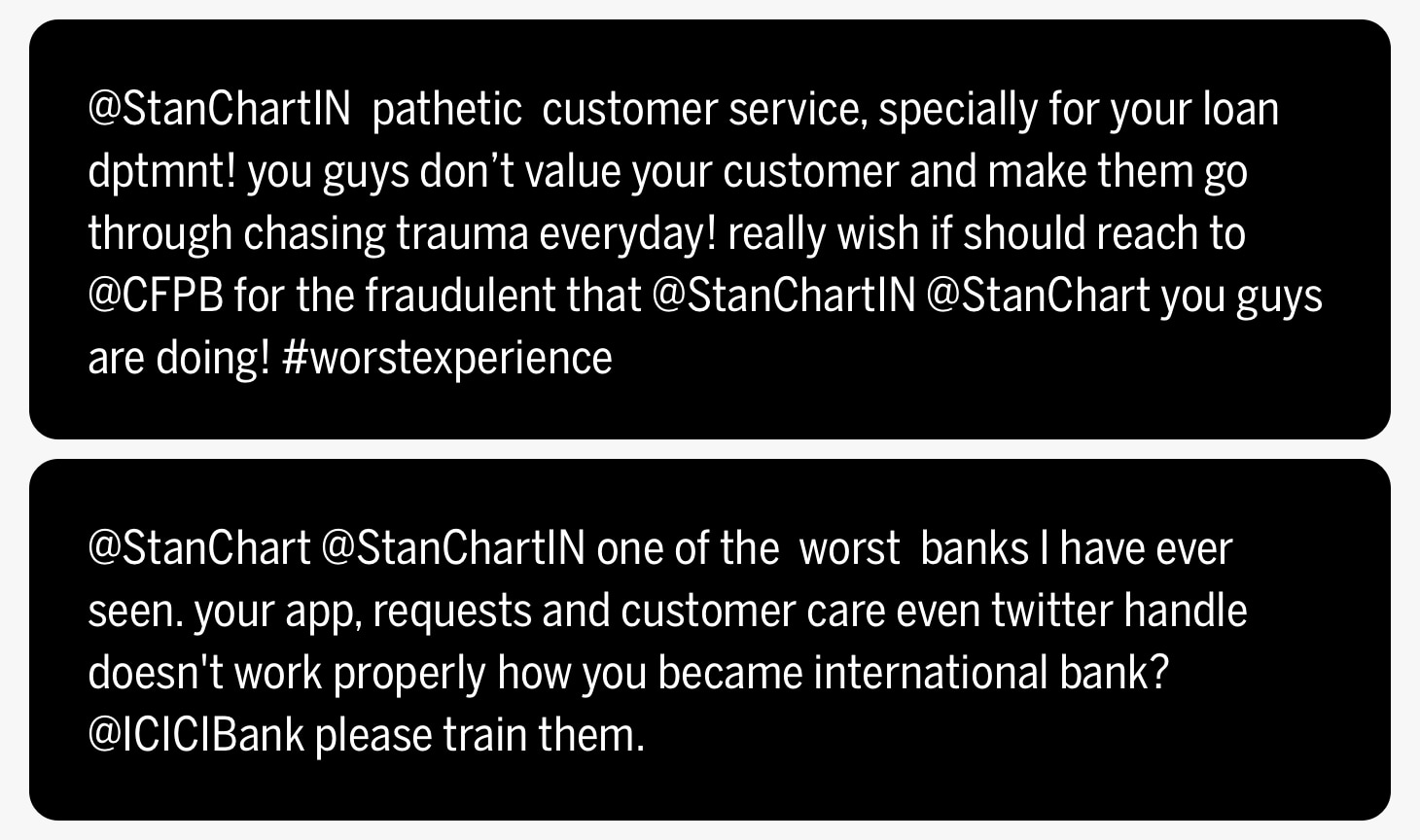

On the flip side, all three brands had a significant amount of negative discourse shared about them. Recurring themes of “frustration,” “fraud,” and “disappointment” were pervasive across the board. Although none of these three brands have experienced any major recent scandals (Standard Chartered was fined $61.5 million in 2021 for repeatedly misreporting a key metric to determine liquidity risk11), they still bear the burden of the bad reputation often carried by financial services companies.

Similarly, consumers often expressed their frustration with category brands’ poor customer service.

The kind of social discourse regarding financial services is different from the way users post about crypto. Crypto enthusiasts view digital assets as a newer, more exciting commodity that may offer a higher, faster return. Posts about cryptocurrencies frequently mention “getting rich quick” and “investing early.” Financial services, on the other hand, have a far less positive reputation. While older and more established, the industry is viewed as bureaucratic, far more predictable, and far less enticing to explore.

Conclusion

Building a relationship rooted in trust and reliability is an essential component of building intimacy between financial services brands and customers. Frequent, and very memorable, scams and scandals have unfortunately bestowed a generally bad reputation upon the industry as a whole. The faceless, nameless service and transactional orientation toward relationships has further alienated consumers. To combat these real issues, financial services must go above and beyond to reassure and support their clients.

Although USAA was the best-performing financial services brand, it was anomalous in its dominant archetype—identity. USAA’s exclusive connection with military members and their families gives it an advantage in fostering more direct relationships.

As the ecosystem of financial services grows and expands, traditional institutions must work to maintain strong customer relationships or risk falling behind. Digital payment technologies like PayPal, Venmo, and Cash App offer consumers an easier, faster banking alternative. Services that once required the involvement of a bank can now be surpassed, providing a more convenient option. To compete with these online payment technologies, seven banks (including Bank of America and Capital One) partnered to launch Zelle, a direct competitor to PayPal and Venmo. Additionally, with the crypto industry competing to dominate the same archetypes, financial services need to evolve to keep up with trends and dispel negative social discourse surrounding their companies.

Foreseeing this change, Mastercard has already made the leap into the crypto space with its Binance partnership. In June, Standard Chartered announced their plans to launch a cryptocurrency trading platform.12 These two moves signal an acknowledgement and acceptance of the new crypto reality as an alternative to traditional brick-and-mortar institutions.

Looking toward the future, Mastercard and Standard Chartered have centered much of their advertising on their sustainability initiatives. Although their messaging focuses less on the topic, USAA also has a page on their website outlining their commitment to the environment.13 Ensuring the well-being of subsequent generations should be a high priority for all companies looking to see long-term growth.

Moving forward, financial services may experience a disconnect from their users. With a shift in how people approach their finances and the growth of digital assets, financial institutions must consider new ways to build trust and support their customers.

Get an overview of Brand Intimacy here.

Read our detailed methodology here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Sources

1 “Consumers lost $5.8 billion to fraud last year–up 70% over 2020.” By CNBC.com

https://www.cnbc.com/2022/02/22/consumers-lost-5point8-billion-to-fraud-last-year-up-70percent-over-2020.html

2 “Edelman Trust Barometer 2022.” By edelman.com

https://www.edelman.com/sites/g/files/aatuss191/files/2022-01/2022%20Edelman%20Trust%20Barometer%20FINAL_Jan25.pdf

3 “NextWave Consumer Financial Services Research.” By ey.com

https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/financial-services/nextwave-cfs-report-190419-digital.pdf

4 “StanChart Announces $500 Million Buyback After Profit Beat.” By bloomberg.com

Source no longer available

https://www.bloomberg.com/news/articles/2022-07-29/standard-chartered-announces-buyback-after-profit-beat

5 Ibid

6 “Here For Good.” By sc.com

7 “Binance and Mastercard will launch prepaid crypto cards in Argentina.” By cointelegraph.com

https://cointelegraph.com/news/binance-and-mastercard-will-launch-prepaid-crypto-cards-in-argentina

8 “Doing Well by Doing Good.” By mastercard.com

https://www.mastercard.com/content/dam/public/mastercardcom/na/global-site/documents/mastercard-sustainability-report-2021.pdf

9 “Truth in Plastic.” By mastercard.com

https://www.mastercard.com/news/perspectives/2020/truth-in-plastic-what-it-means-to-go-shopping-with-no-explanation-necessary/

10 “Mastercard introduces accessible card for blind and partially sighted people.” By mastercard.com

https://www.mastercard.com/news/press/2021/october/mastercard-introduces-accessible-card-for-blind-and-partially-sighted-people/

11 “Standard Chartered fined record $61.5M for liquidity reporting failures.” By complianceweek.com

https://www.complianceweek.com/regulatory-enforcement/standard-chartered-fined-record-615m-for-liquidity-reporting-failures/31188.article

12 “StanChart unit to launch cryptocurrency trading platform.” By CNBC.com

https://www.cnbc.com/2021/06/02/stanchart-unit-to-launch-cryptocurrency-trading-platform.html

13 “Environmental Commitment.” By USAA.com

https://www.usaa.com/inet/wc/about-usaa-environmental-commitment