Overview

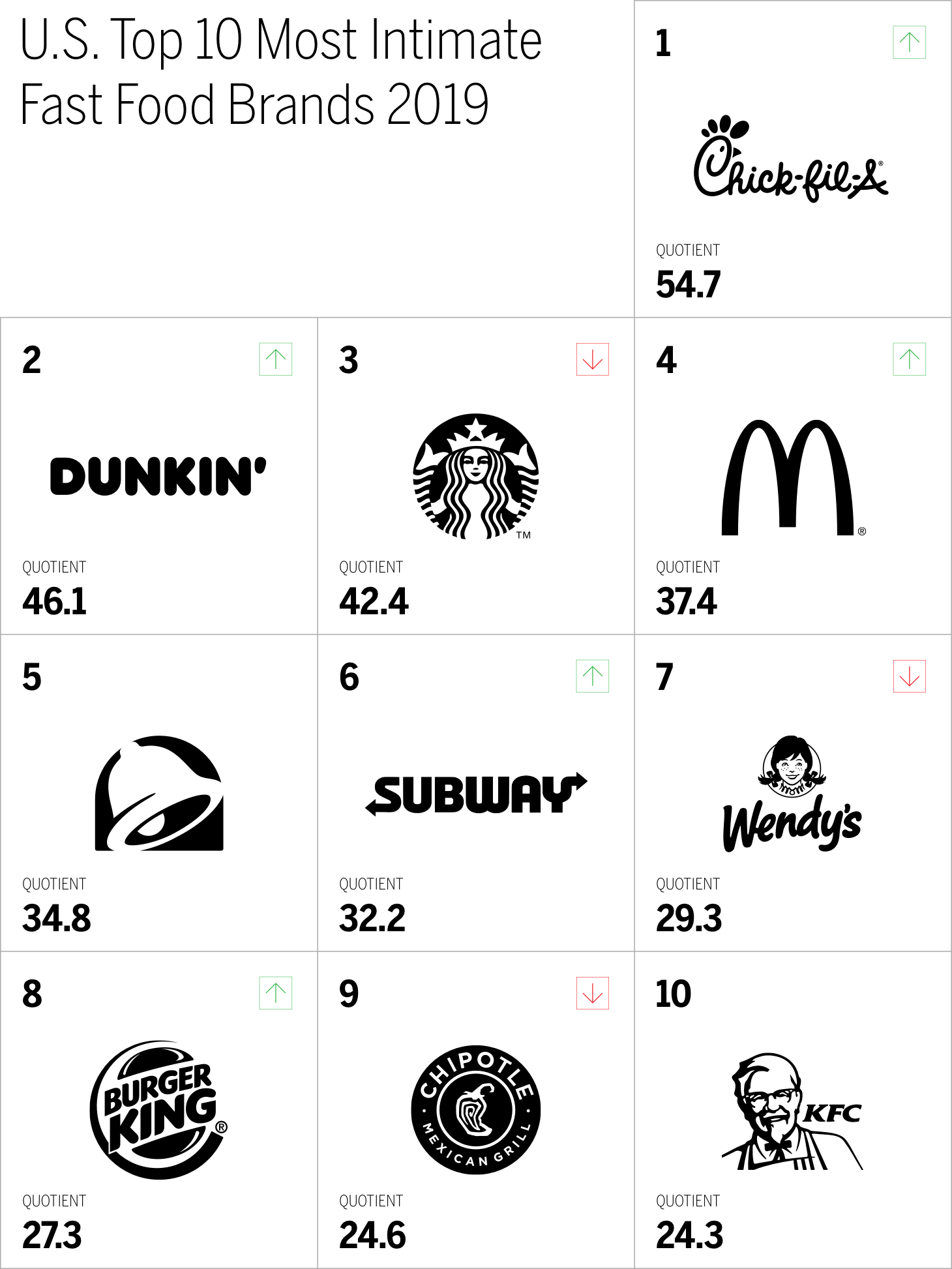

- Chick-fil-A has shown strong improvement in its Brand Intimacy performance in 2019. It ranks #1 in the fast food category and #10 overall.

- Chick-fil-A is particularly strong with women and millennials.

- The Fast Food category ranks 6th out of 15 industries surveyed.

- Dunkin’ Donuts also showed strong improvement, coming in 2nd in the industry and 28th overall, compared to its ranking of 9th in 2018 and 98th overall.

A strong showing

Chick-fil-A is the top intimate fast food brand in 2019. It also ranks 10th overall, the highest position of any food or beverage brand. It is aggressively growing, rapidly adding locations, and delivering quality and convenience at reasonable prices. Chick-fil-A grew its domestic systemwide sales by 16.7 percent in its latest fiscal year to reach nearly $10.5 billion, putting it behind only McDonald’s and Starbucks.1 The brand has weathered some controversy, most notably for its support of groups like the Marriage & Family Foundation that promote traditional marriage and oppose gay marriage; but this does not seem to have hurt the business or the brand. It is said to be the most profitable fast food chains in the country on a per-location basis and has been the number one fast food restaurant on the American Customer Satisfaction Index for three years in a row.2

This year, Chick-fil-A has topped Dunkin’ Donuts, Starbucks, McDonald’s, and Taco Bell to name just a few competitors in the fast food industry. It improved its performance last year and continues to build strong emotional bonds.

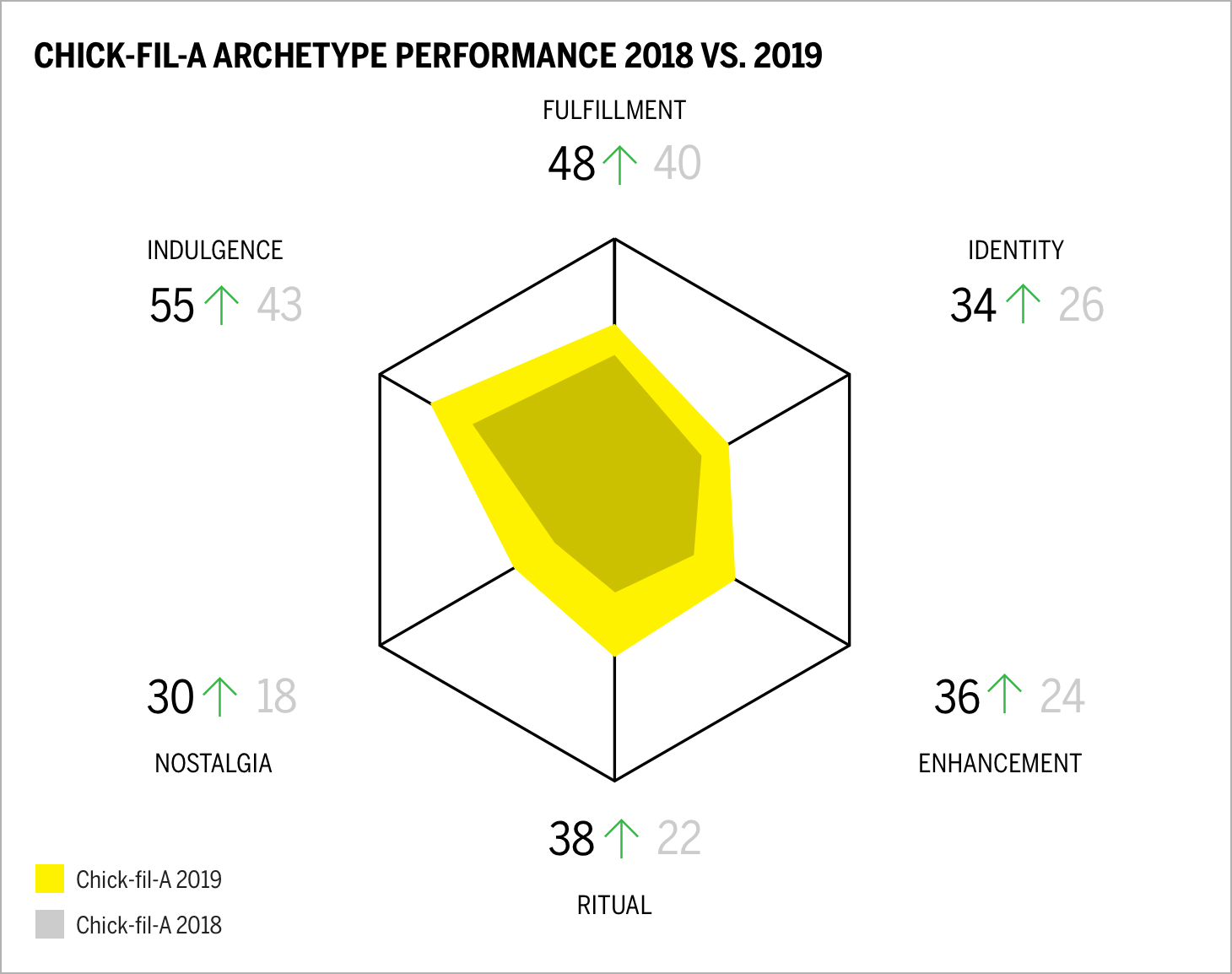

Archetype improvement across the board

Brand intimacy archetypes are six patterns that are consistently present, in part or in whole, among brands identified and validated as intimate through research. They help showcase the character of intimate brand relationships. Indulgence, the archetype that centers around moments of pampering and gratification, which can be occasional or frequent, is the fast food industry’s dominant archetype. Chick-fil-A leads the industry in the association with indulgence; it also improved on this measure by 13 points since 2018. The brand improved across all six Brand Intimacy archetypes, an impressive feat, showing the breadth and range of its ability to build emotional bonds with users in a variety of compelling ways. The brand also showed double-digit improvements related to ritual (that is, a brand that is part of a customer’s daily routine), enhancement (a brand that makes the customer smarter and more connected), and nostalgia (a brand that a customer associates with warm memories of the past). Its strong enhancement showing, second only to that of Starbucks, may be due to its revamped mobile app and recent focus on accessibility through select locations offering delivery and food to go.3

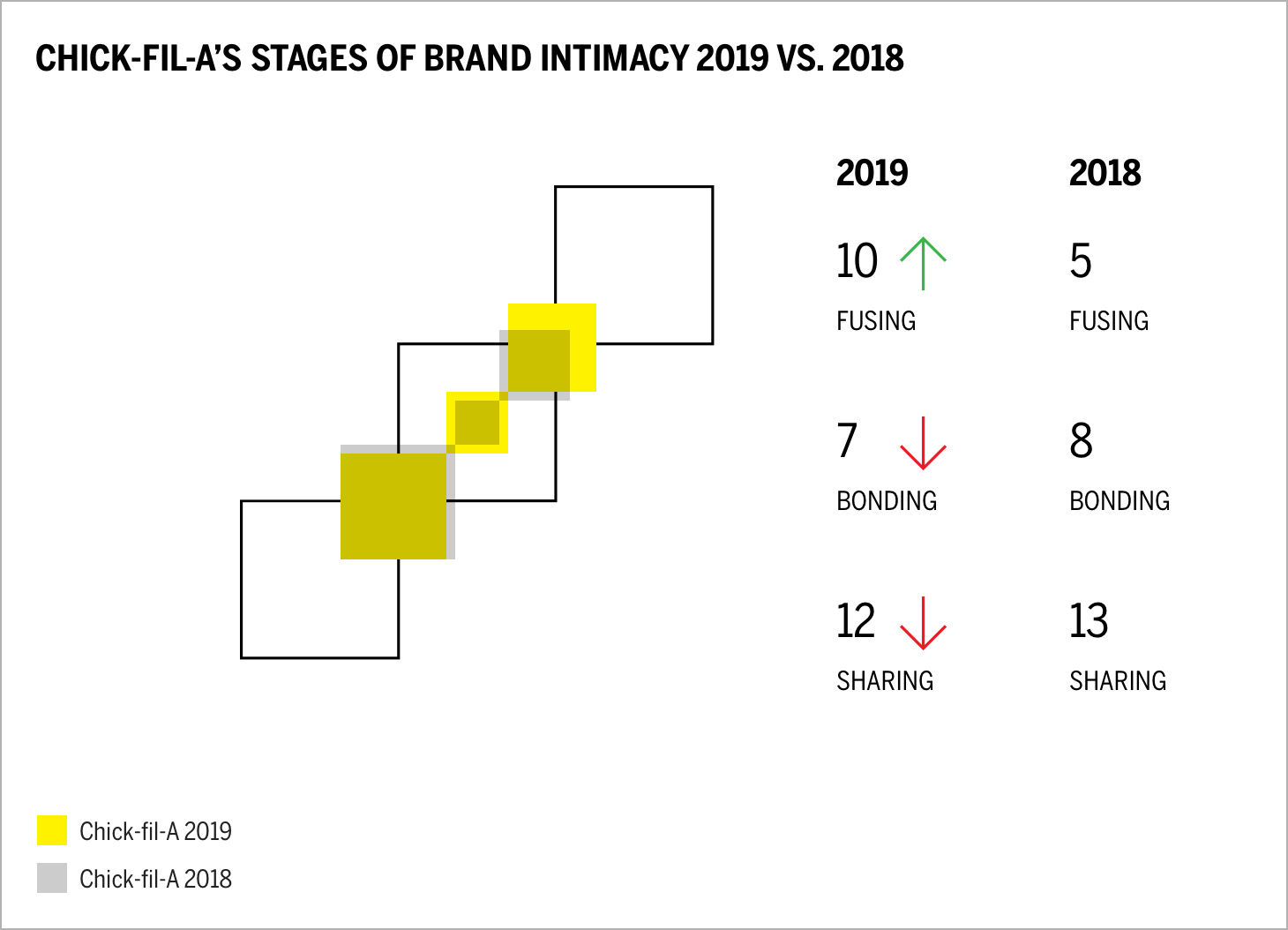

Fusing powerhouse, but more intimate customers needed

Chick-fil-A also improved its performance in the fusing stage of Brand Intimacy. This is the most advanced stage of intimacy and occurs when a person and a brand are inexorably linked and co-identified. The brand doubled its percent of fusing customers, from 5 percent in 2018 to 10.1 percent in 2019. This is the seventh-highest percentage of fusing users in our study, with only Disney, Amazon, PlayStation, Apple, Ford, and YouTube faring better. Though the brand’s strong performance in fusing is notable, Chick-fil-A’s performance across sharing and bonding, the two other Brand Intimacy stages, worsened. In 2018, 26 percent of users were intimate with Chick-fil-A; in 2019, it was 28 percent, a relatively small improvement given the brand’s other achievements. Both Dunkin’ Donuts and McDonald’s had larger numbers of intimate users than did Chick-fil-A. This suggests that, though Chick-fil-A’s current users have strong emotional connections, more users need to come into the Chick-fil-A ecosystem and start experiencing the brand. It is a bit of a mystery why the percentage of intimate users is not higher, especially given that 65 percent of current users said they formed an emotional connection with the brand immediately.

Looking at the brand’s stakeholders, we see a large range of audiences. Women and those aged 54 years old rank the brand highest, while, whereas men, millennials, those aged 55-64, and people earning between $35,000 and $100,000 annually rate the brand as #1. Those with incomes over $100,000 are the only group in our study for whom the brand did not rank among the top performers. Notably, this income group also ranked the category lower than others, with an average Quotient Score of 26.9, whereas the average among all respondents was 33.2.

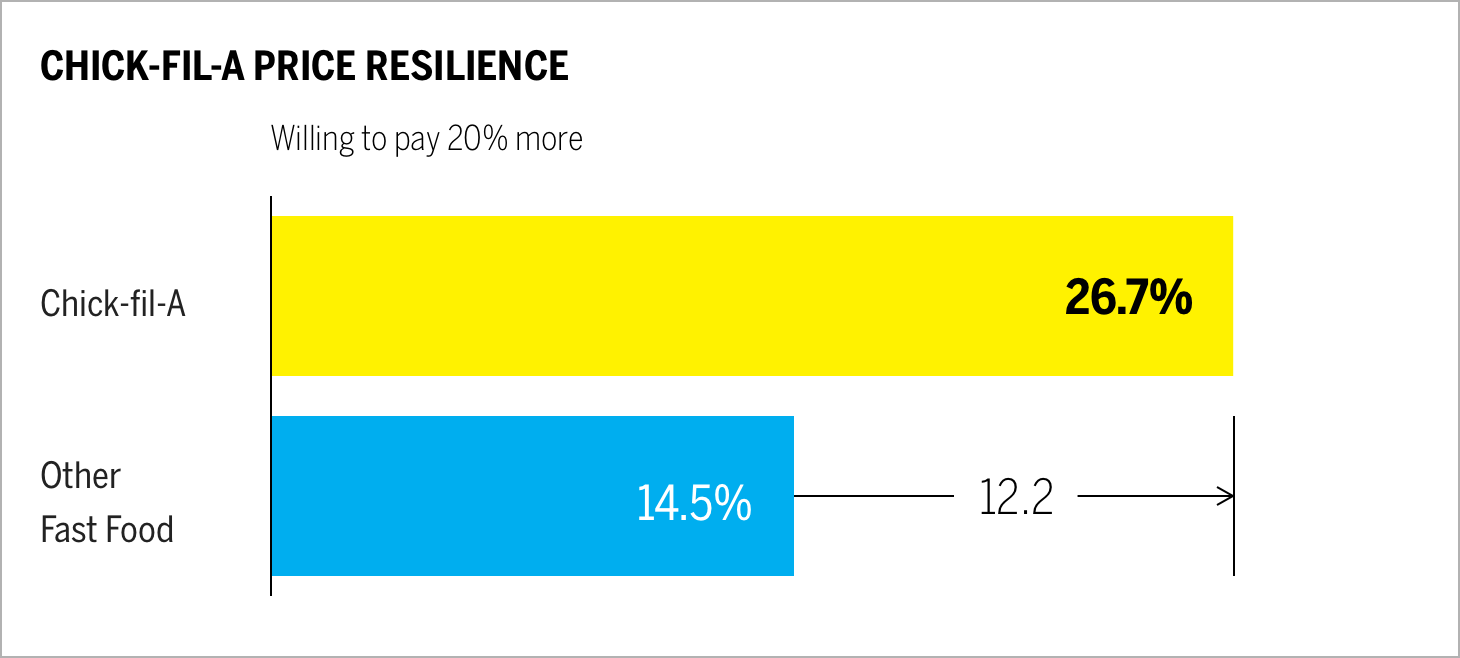

What this suggests is that the brand has wide appeal and should continue to increase its funnel of users who can become intimate with the brand. This is important, as we have proven that brand intimacy and business performance correlate. Furthermore, we can see that, among intimate users, the brand has greatly improved its price resilience metrics. This means that 26.7 percent of Chick-fil-A users said they would be willing to pay 20 percent more for the brand’s products. This is the third-highest price resilience score in the 2019 Brand Intimacy Study.

It’s a wrap

Chick-fil-A is clearly an intimate brand to watch. It has climbed into the Top 10 Most Intimate Brands for the first time and is building a strong profile among a broad range of consumers: women, men, millennials, boomers, and people with a variety of incomes. It has extremely high rates of fusing and price resilience, which demonstrates the attachment users have to the brand.

While the brand has attracted some controversy for its stance on certain issues, Chick-fil-A appears to continue to grow and connect with consumers. As presidential candidate Pete Buttigieg noted, “I do not approve of Chick-fil-A’s politics, but I kind of approve of their chicken.” Notwithstanding the divisive nature of some of the brand’s associations, it is clearly becoming a major player in its ability to build emotional bonds. If the brand is able to increase its base of intimate customers, we expect it will continue to be a top 10 ranking brand and category leader.

Get an overview of Brand Intimacy here.

Read our detailed methodology here and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.