Overview

- Dior ranks #19 overall and #1 in the luxury category

- Luxury has ranked seven out of fifteen industries for the past three years

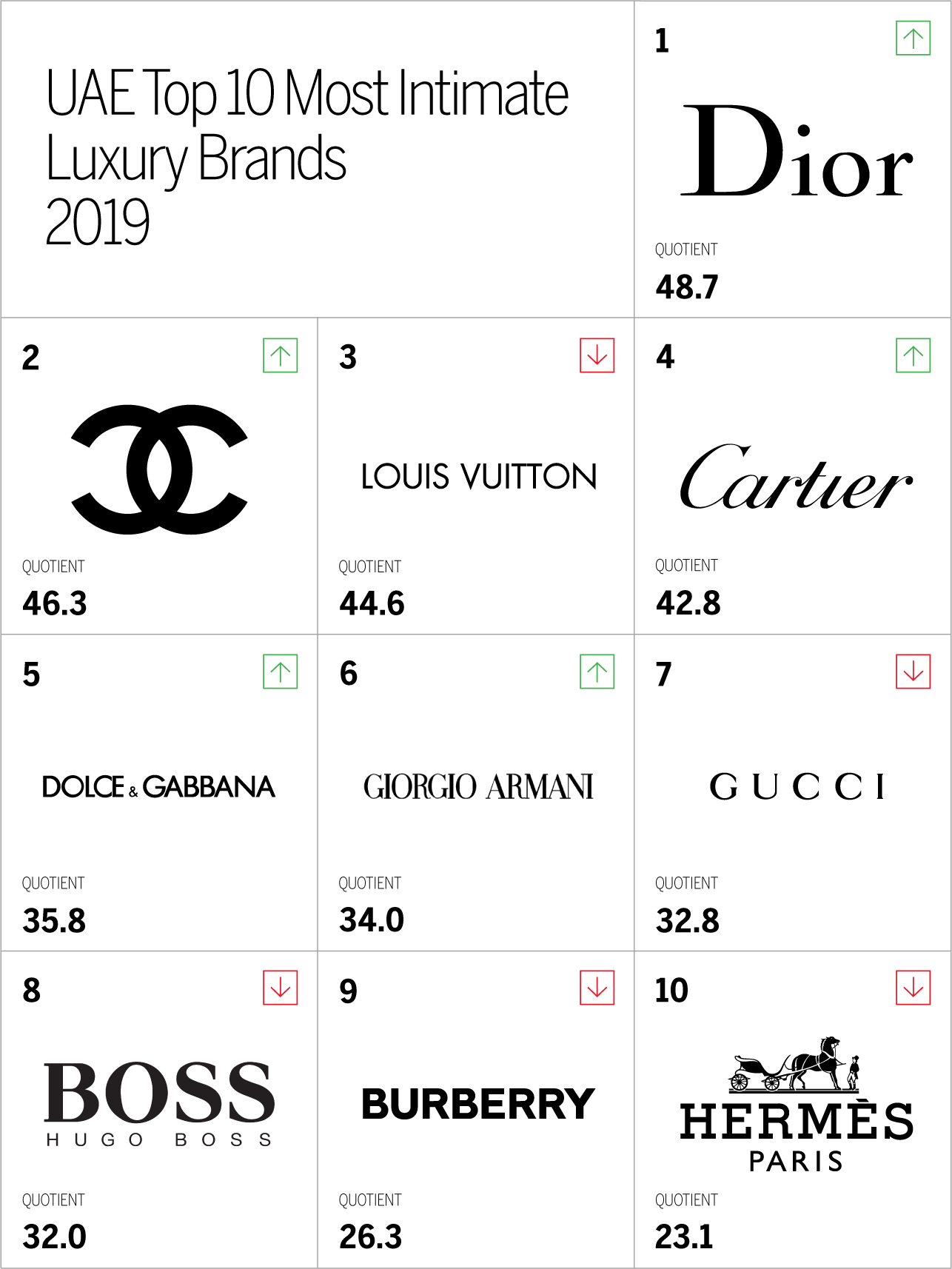

- Two luxury brands rank inside the overall Top 30, Dior and Chanel

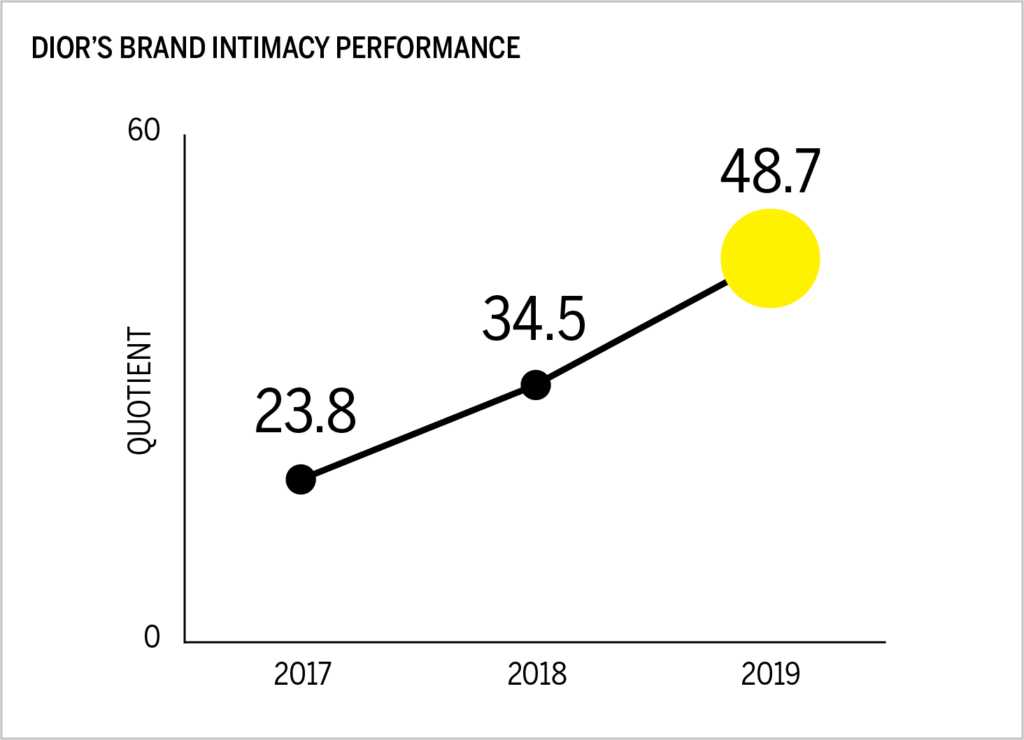

Dior ranks #1 in the luxury industry for the first time. The brand has seen significant growth in the past year, improving its quotient score from 34.5 in 2018 to 48.7 in 2019. This quotient score is higher than the luxury industry average of 36.6.

This improvement is important as intimate brands deliver higher financial performance. Intimate brands outperform the Fortune 500 and S&P 500 annually in terms of revenue and profit. The more intimate consumers are with a brand, the more they are willing to pay and the less they are willing to live without it.

When it comes to Dior, 14.5% of users have stated that they are willing to pay 20% more for the brands’ products, which is higher than the industry average of 10.4%.

Nearly half of all Dior users reported having an immediate emotional connection with the brand. Demographically, Dior ranks as the highest luxury brand for millennials and users with low incomes, and #2 for women, men and users 35 years and above. The brand ranks highest in the identity archetype (reflecting an aspirational image or admired values and beliefs that resonate deeply with its users) across the industry.

Industry performance

The luxury industry has consistently ranked 7th out of 15 categories for the past three years. While the industry’s quotient score has increased gradually, its growth has not kept pace with the rest of the study, ranking #7 across three years. Only two luxury brands comprise the overall Top 30, with five additional brands in the Top 100.

Users in the study strongly associate brands in the luxury industry with the indulgence archetype. Surprisingly, the industry experienced a more than two-fold increase in the enhancement archetype in 2019.

A key destination for luxury goods, brands in the UAE have been able to build strong bonds with consumers over the past few years. So it is not surprising that 30.7% of all users report being in one of the three stages of intimacy.

Head to head

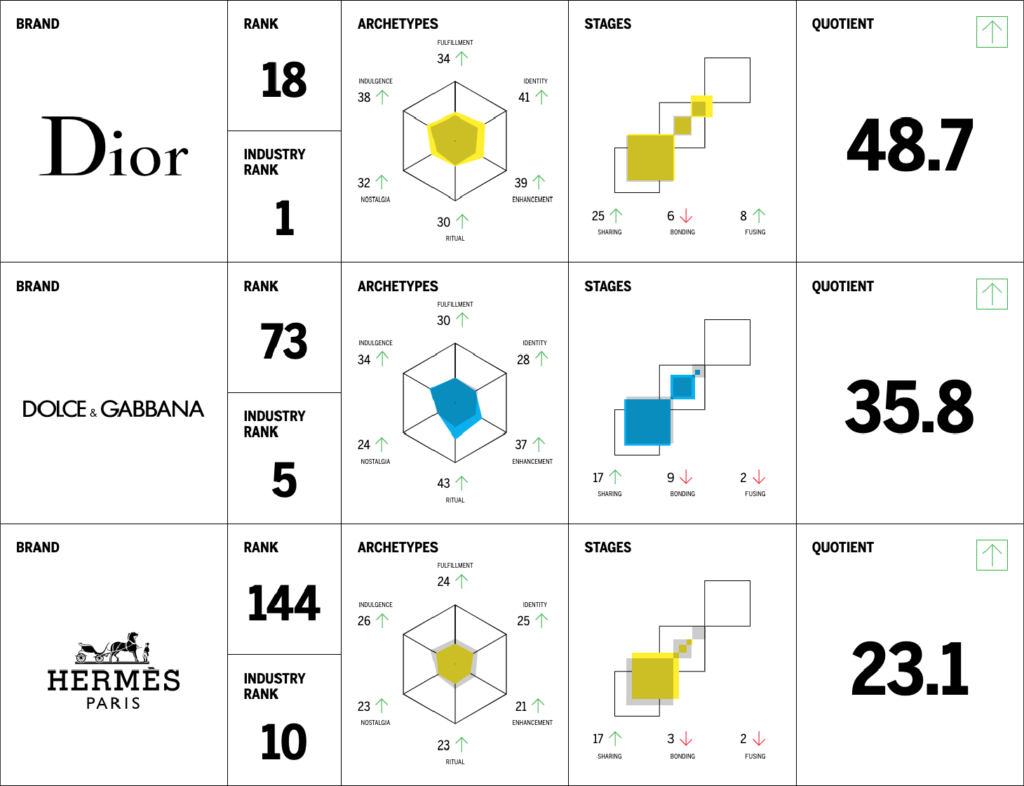

A comparison between Dior, Dolce & Gabbana, and Hermès reveals how brands at either end of the industry build intimate relationships with consumers. We see that Dior performs stronger across most archetypes, in particular across indulgence (close relationships centered around moments of pampering and gratification), fulfillment (brand exceeds expectations by delivering superior service, quality, and efficacy) and identity (reflects an aspirational image or admired values that resonate deeply). These archetypes, or patterns that identify characteristics of the emotional bond, sum up consumers’ associations with the luxury industry.

By examining the stages of intimacy (measuring the intensity and depth of emotional bonds across three stages) we can compare the strength of the bonds that these brands are building with their consumers. Dior has almost twice the number of users in the sharing stage of Brand Intimacy compared to Dolce & Gabanna and Hermès. Sharing occurs when the person and the brand engage and interact: knowledge is being shared, the person is informed on what the brand is all about, and vice versa. At this stage, attraction occurs through reciprocity and assurance.

Most revealing is Dior’s performance in the final and ultimate stage of intimacy—fusing (when a person and a brand are inexorably linked and co-identified). Dior has four times the number of users in the fusing stage compared to both comparative brands. The fusing stage is the most elusive stage of intimacy. Consumers in this stage are more willing to forgive a brand for its indifferences and are willing to pay more for its products.

Dior could improve how consumers move through the stages of intimacy and focus in bonding—the second stage of intimacy where the relationship between a person and a brand becomes more significant and committed.

Conclusion

Dior, like the luxury industry, has grown steadily in the past three years. The brands’ strong bonds with a large percentage of consumers reporting a fusing state have pushed it to the top of the industry. While Dior’s performance indicates a positive outcome in the future, they need to stay ahead in an industry that runs the risk of stagnation or even decline.

Read our detailed methodology here.

Check out our annual study and rankings of intimate brands. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.