We’ve seen some brands target women overtly, whereas other brands attract women as part of their overall strategy. Dove champions beauty in all its forms, and Always shows us that running “like a girl” is something to be proud of, while athletic apparel brands like Nike, Under Armour, and Adidas empower female athletes like never before. This could just be a sign of the times, but it’s more likely that smart brands are taking notice of the immense buying power of women, who are responsible for 70–80 percent of purchasing decisions.1 However, based on our 2017 Brand Intimacy Study, brands still have work to do. When it comes to forming intimate bonds with women, brands have generally fallen a bit short. Although the average brand intimacy quotient for women was only slightly below that of men (29.1 vs. 29.8), it’s clear that certain industries are struggling to reach women. Of the 15 industries we studied, 10 were more successful in creating and maintaining intimacy with men than they were with women.

Statistically, women formed more intimate bonds with brands in retail, consumer goods, health & hygiene, apps & social platforms, and fast food. Intimacy was especially strong for women in retail, where they had an average brand intimacy quotient of 46.5 compared to 37.7 for men. Health & hygiene was another strong category for women (27.7 vs. 20.7), as was consumer goods (37.7 vs. 34.5). While these may not be surprises, as women traditionally shop for the home, they are significant industries. The retail market is enormous, with estimated U.S. sales of $5.126 trillion in 2016.2 As for health & hygiene, the global personal care market is expected to grow 3.5–4.5 percent from 2016 to 2020,3 and consumer goods is in the middle of a major shift toward e-commerce, with online consumer packaged goods sales expected to grow four-and-a-half-fold between 2013 and 2018.4 Women have higher rates of intimacy with Facebook, Instagram, Twitter, and Pinterest than men do, and they have greater intimacy in the apps & social platforms category.5

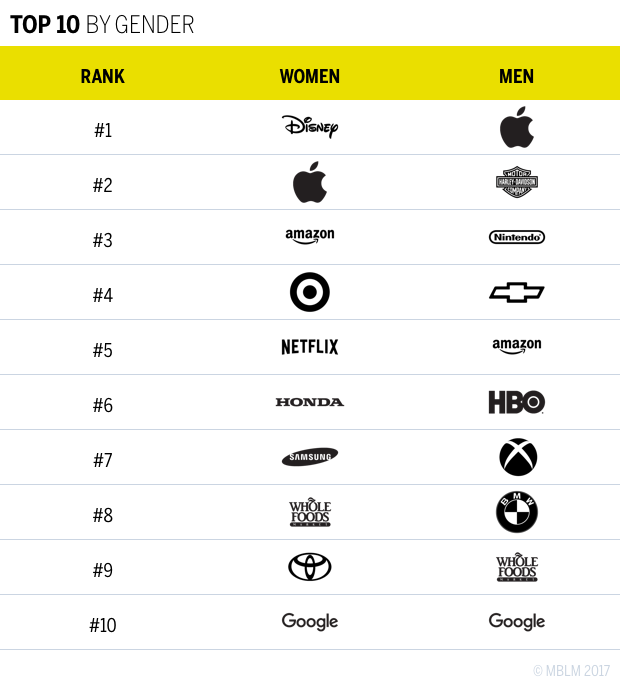

The top three brands for women are Disney, Apple, and Amazon. If we were to extend these lists to the Top 10, we’d see that all 10 brands for both women and men fit into four industries: technology & telecommunications (three for women, two for men), automotive (two for women, three for men), media & entertainment (two for women, three for men; notable that for men, two of the entertainment brands are gaming-oriented, whereas no gaming brand ranks in the women’s top 10), and retail (three for women, two for men). With the exception of retail, these are all industries that men are more intimate with than women, which means that brands in tech & telecommunications, automotive, and media & entertainment all have an opportunity to appeal more strongly to women. Although the averages for each of these industries show that their brands have had more success forming bonds with men, it’s clear that women are also quite willing and able to develop intimacy within these categories.

Another interesting facet of women and brand intimacy is that women appear to be more devoted and dedicated brand users. Women use their top 10 brands daily more then men use their top 10 brands (43 percent vs. 36 percent) Additionally, women said they would find it difficult to live without their top 10 brands more than men (42 percent vs. 37 percent).

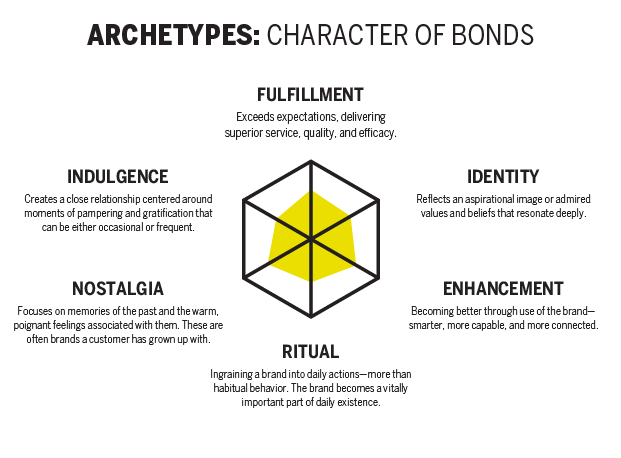

To further dimension intimate relationships, we examine the six archetypes of brand intimacy that characterize the associations and bonds that consumers make with brands. For women, fulfillment (associated with exceeding expectations and delivering superior service, quality, and efficacy) is the most important archetype. This could help explain why women favor retail brands so highly, as the retail industry is most associated with fulfillment. Women outscored men on the indulgence archetype (centered around moments of pampering and gratification), and they had the same score for ritual (ingraining a brand into daily actions, more than habitual behavior). Using these archetypes, we get a clearer picture of how consumers form bonds, and in some cases, we can begin to understand why certain industries have been more successful in cultivating intimacy among women.

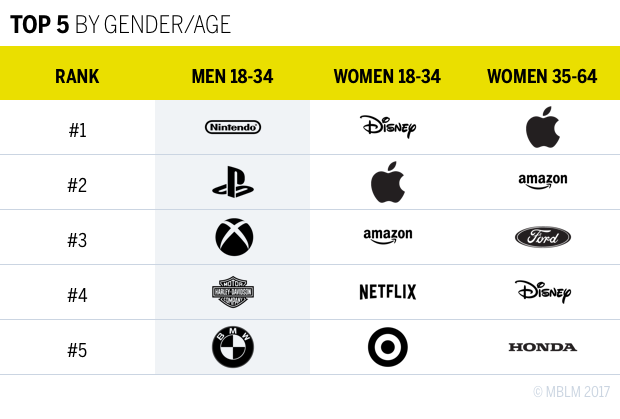

While age is an important consideration in branding, when we break down intimacy by age group, we see that it isn’t as influential as gender. While millennial women have no top 5 brands in common with millennial men, they share three of the same top brands with women ages 35–64 (Disney, Apple, and Amazon). Although there are some key differences, the success of these three brands in forming bonds with women across age groups is worth pointing out. The top 5 most intimate brands for millennial women is rounded out with Netflix (a generally popular brand among millennials) and Target, whereas women ages 35–64 have two automotive brands (#3 Ford and #5 Honda).

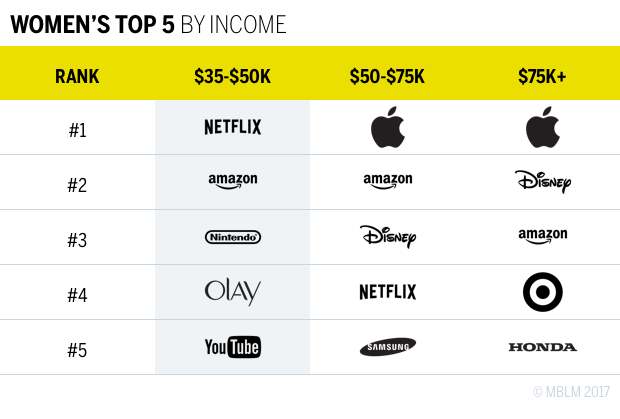

Like age, income is a metric that reveals more similarities among women than it does differences. For example, Amazon is a top 5 brand for every income group, doing especially well with women earning $35,000 to $50,000 and those earning $50,000 to $75,000. Netflix is the top brand for women earning $35,000 to $50,000 and fourth for those earning $50,000 to $75,000. Among the top two income groups, Apple is the top brand, and Disney is in the top 5, but there are some key differences between these groups. For example, it would appear that as income increases, media and entertainment brands become less intimate with women. But what is perhaps most revealing is how much these groups have in common, as four brands appear in at least two of the income groups for women. Much like with our age comparison, we can learn so much by looking at the brands that have achieved intimacy across different demographics of women, which in this case are Amazon, Netflix, Disney, and Apple. It seems that the brands that have successfully achieved intimacy with women are able to do so across multiple ages and incomes.

In a survey, 91 percent of women said that advertisers don’t understand them.6 Analyzing how brands have formed bonds with women can help us understand how to better market to them in ways that connect.

We can look to certain brands as exemplars. Disney, Apple, and Amazon are the top three brands for women overall, and they are top-5 brands for millennial and older women and top-5 brands for women in at least two income groups. These brands aren’t known for specifically catering to women, but they are recognized as strong intimate brands. This gives us an indication that the best way to form brand relationships with women might be to stop focusing on targeting by gender and instead build meaningful brands that anyone can connect with. Other brands we can learn from are Google and Whole Foods, which, along with Apple and Amazon, are among the few brands that made the top 10 for both women and men. Brands like this show that marketing to women doesn’t have to mean sacrificing a male audience and that relying on traditional gender stereotypes can be limiting and less effective. It suggests brand intimacy is similar for men and women, and connecting with brands in an emotional way goes beyond gender. There are specific insights to consider, however. The categories and types of brands women form bonds with is worth understanding, as are the archetypes that are strongly aligned with women. Marketers can learn how to create stronger brands and at the same time align their brand orientation to women more effectively.

Get an overview of Brand Intimacy here.

Read our detailed methodology here and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.