As the Brand Intimacy Agency, MBLM is dedicated to building ultimate brand relationships. We seek to help develop strong bonds and emotional connections between users and brands, largely through technology. For nearly a year, we have been conducting ethnographic research with Apple Watch users, to understand their perspective on using the device. We have been examining every aspect of their experiences by having them complete daily and weekly diaries, requiring them to try specific features and functions, forcing them not to wear the watch for periods of time, and noting their reactions and videotaping them periodically.

As we’ve learned more about the Apple Watch experience and how it started strong yet began to ebb, we wanted to understand how the watch measured up to other significant Apple product launches. Here’s an overview of what we learned:

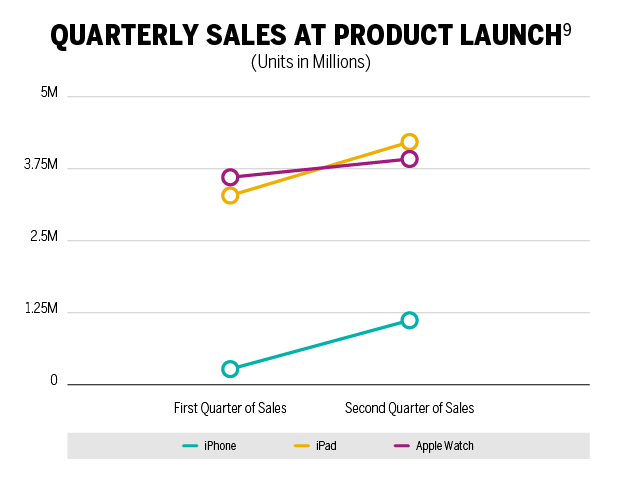

- Apple Watch initial sales equalled or exceeded sales of the first iPhone or iPad.

- Apple products typically go through a cycle of peaks and declines with every new. model release. It is too soon to tell if Apple Watch follows a similar pattern.

- Initial user satisfaction levels for the Watch, iPhone and iPad were all very high and similar.

- Studies on Apple Watch users are few and far between. They differ on the continued satisfaction and usage over this first year with the Watch, with MBLM’s year-long ethnographic research suggesting users are losing interest.

Apple Watch Sales

There have been conflicting reports on Apple Watch sales in the first year of its release. However, it is clear that sales are significant and the category is growing exponentially. A recent report notes that Apple Watch sales have been on the rise, with estimates of 5.1 million units sold in the fourth quarter of 2015, making up 63 percent of the smart watch market (8.1 million total).1 Apple grew its watch distribution and leveraged holiday promotions during that fourth quarter. However, the International Data Corporation (IDC) notes that volumes for the fourth quarter grew only slightly from the previous quarter, and total revenues have yet to counterbalance the slowing growth and decline in the company’s other product categories.2 Others have estimated that Apple shipped 15.4 million Apple Watches in 2015, bumping Samsung to No. 2.3,4

Importantly, from 2014 to 2015, the total shipment of wearables grew an incredible 171.6 percent.5 This high level of anticipated growth suggests there is still plenty of opportunity in terms of greater distribution, new designs/forms, usage/application development and expansion of the user base. Are we just at the beginning of the watch’s potential or has it failed, as many pundits hypothesize?6

Looking at the sales of other Apple products over their two original launch quarters, the watch’s initial sales are comparable to those of the original iPad at launch and significantly higher than the first iPhone.7,8,9 Apple itself noted this, when CFO Luca Maestri stated that “sales in its [Apple Watch] first nine weeks exceeded those of the iPhone and iPad in their first nine weeks of availability.”10 Are expectations simply higher for the watch as Apple’s reputation and brand have increased?

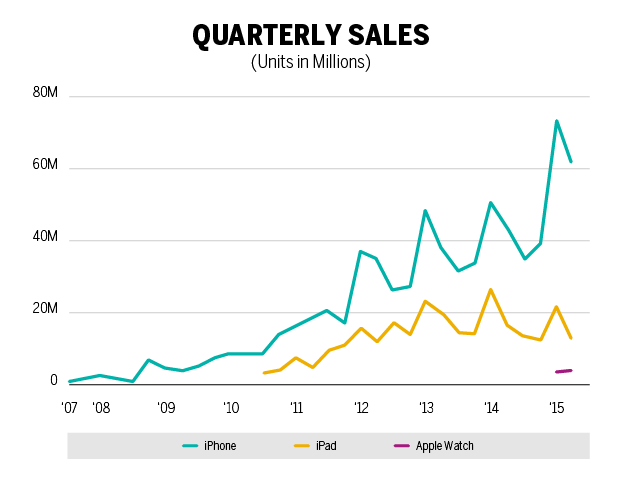

As with other technology and innovation-oriented products, there is a life cycle process that emerges with new products. It begins with a new offering entering the market (e.g., Apple Watch), where early adopters or loyalists often become the first to engage.

Next comes the bigger, broader adoption, where the product becomes more mainstream and popular. As quickly as the product rises, it begins to fall, with the expectation of the next version or a new product. This pace of demand necessitates companies to have a strong and organized pipeline of updates for survival. In reviewing historic Apple sales data above, one sees the spikes and falls with each new product generation.11,12,13 It is too soon to see how Apple Watch aligns (or doesn’t) with this pattern. However, it’s clear that watch users are already eagerly anticipating enhancements and improvements to the watch, and many others are waiting to see what is in store for Apple Watch 2 has in store. We know from our ethnographic data that some in our panel recommend the watch to others, while more suggest waiting for the kinks to be worked out.

Satisfaction Levels

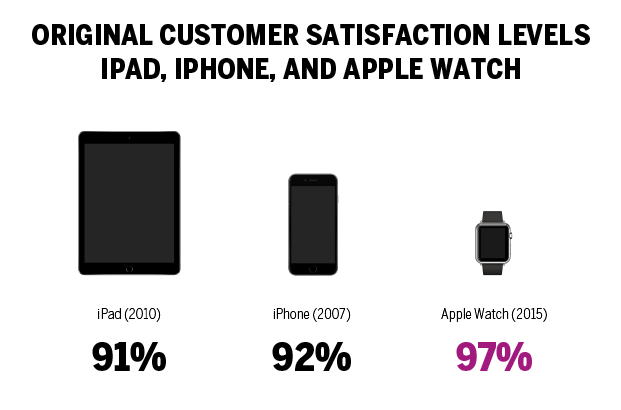

There is limited published customer data on how users feel about their Apple Watches. Wristly released a study three months after the watch launched and noted a 97 percent satisfaction rate, with 66 percent being “very satisfied” and 31 percent being “somewhat satisfied.”14 This also matches the findings of MBLM’s initial ethnographic watch findings, conducted after using the watch for one week, where it averaged an 8 out of 10 in terms of satisfaction.15 451 Research also conducted research a few months after the launch, resulting in similar findings, with 54 percent of users “very satisfied” and 33 percent “somewhat satisfied.” While these early findings are generally aligned, there appears to be more divergence as users continued to wear the Apple Watch over the next several months.

MBLM’s ethnographic Apple Watch study found that by six months, satisfaction decreased significantly, with users (particularly millennials) wearing the watch less and finding it more limited in terms of their needs. We segmented the watch’s use into three main functions: notifications, the activity monitor, and answering texts and calls.16 By six months, Wristly also published insights among unsatisfied Apple Watch owners, although their panel still gave the watch a 96 percent approval rating.17 Key reasons for those falling out of love with the Watch include its limited features and functions, its reliance on the iPhone, difficulty of use, slowness and battery issues.18,19

For more context, the chart above shows initial levels of satisfaction with the iPad, iPhone and Apple Watch when they first launched. There appears to be a similar high level of performance across all of them.20

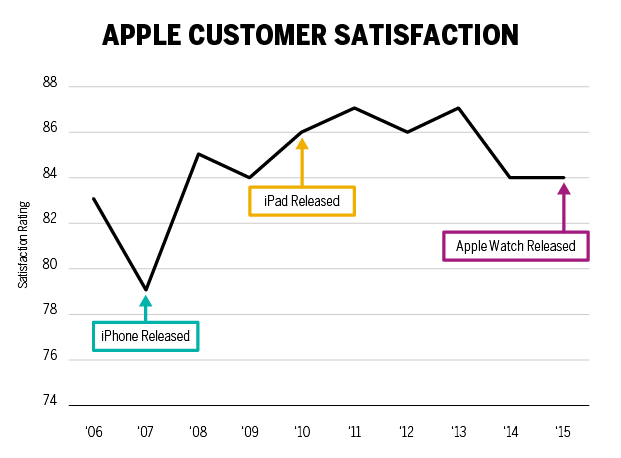

When reviewing Apple’s overall customer satisfaction scores over time, however, we see some different findings. There is a significant spike in satisfaction after the iPhone’s release and a small uptick following the launch of the iPad. However, the Apple Watch’s introduction comes at a slight dip in the company’s overall satisfaction levels.21 It will be intriguing to see what subsequent quarters demonstrate.

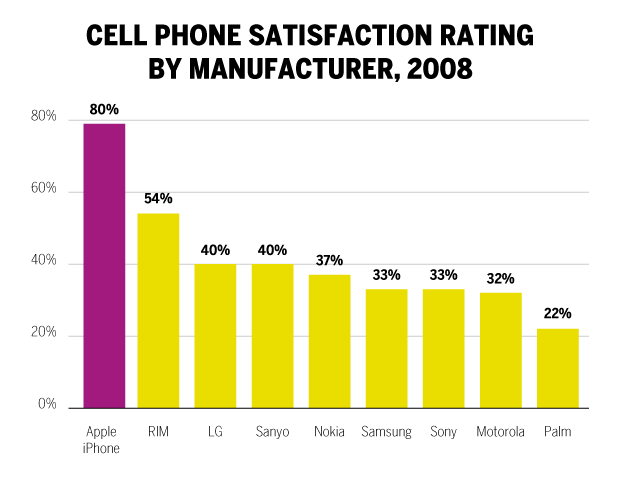

Historical data shows Apple users were consistent regarding their satisfaction levels with the iPhone.22 However, MBLM’s ethnographic study on the Apple Watch does suggest the watch may follow a different pattern, as we indicated that, for a significant percentage of our panel, satisfaction has decreased over time.

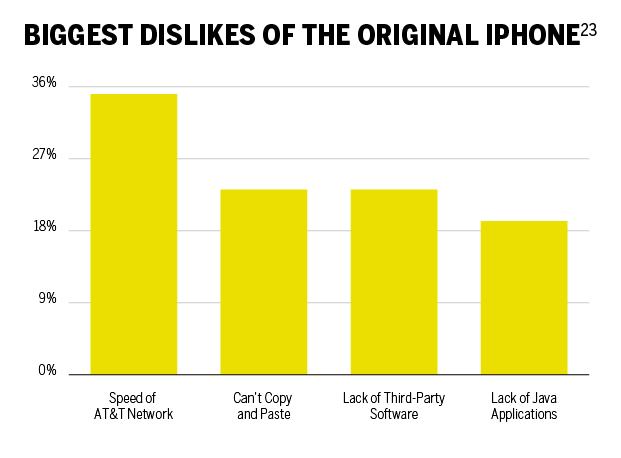

It is interesting to note that we do see similar issues that original iPhone users had with their phones, compared with Apple Watch users today (speed, limited number of third-party apps).23 This is not surprising, given the inevitable growing pains that Apple goes through with the invention of any new device.

Expectations

There are considerable expectations for the next generation of the Apple Watch, which is anticipated to launch in Fall 2016, along with iPhone 7. Our panel’s wish list includes a camera, better location-awareness, an improved Siri, device independence, increased app options and speed, as well as being waterproof. As the wearables categories grow exponentially, we must wait to see how Apple releases new editions and fosters user relationships, while watching the competitive landscape become cluttered. Even among those users who are dissatisfied with the watch’s current capabilities, there is tremendous goodwill toward Apple and the continued hope the watch will improve and become a more vital part of their lives. How the watch continues to compare and contrast with previous Apple launches will also provide an interesting study into adoption of new technology devices.

Review the sources cited in this article here. To learn more about our Agency, Lab, and Platform, visit mblm.com.