Overview

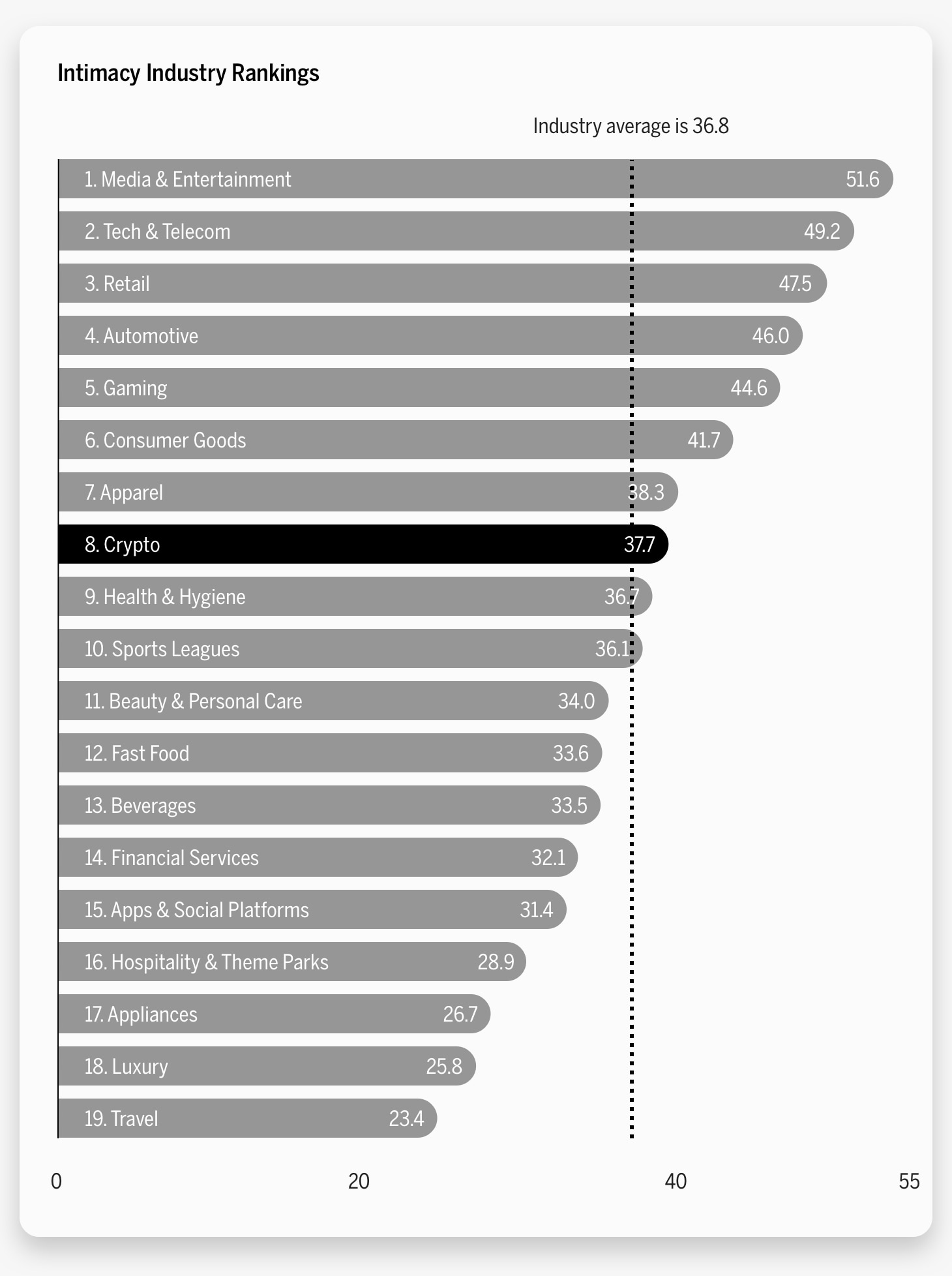

- The crypto industry ranks eighth in our 2022 Brand Intimacy Study.

- Cardano is the top-ranking crypto brand with a Quotient Score of 52.6.

- The crypto industry’s dominant archetype is fulfillment.

Introduction

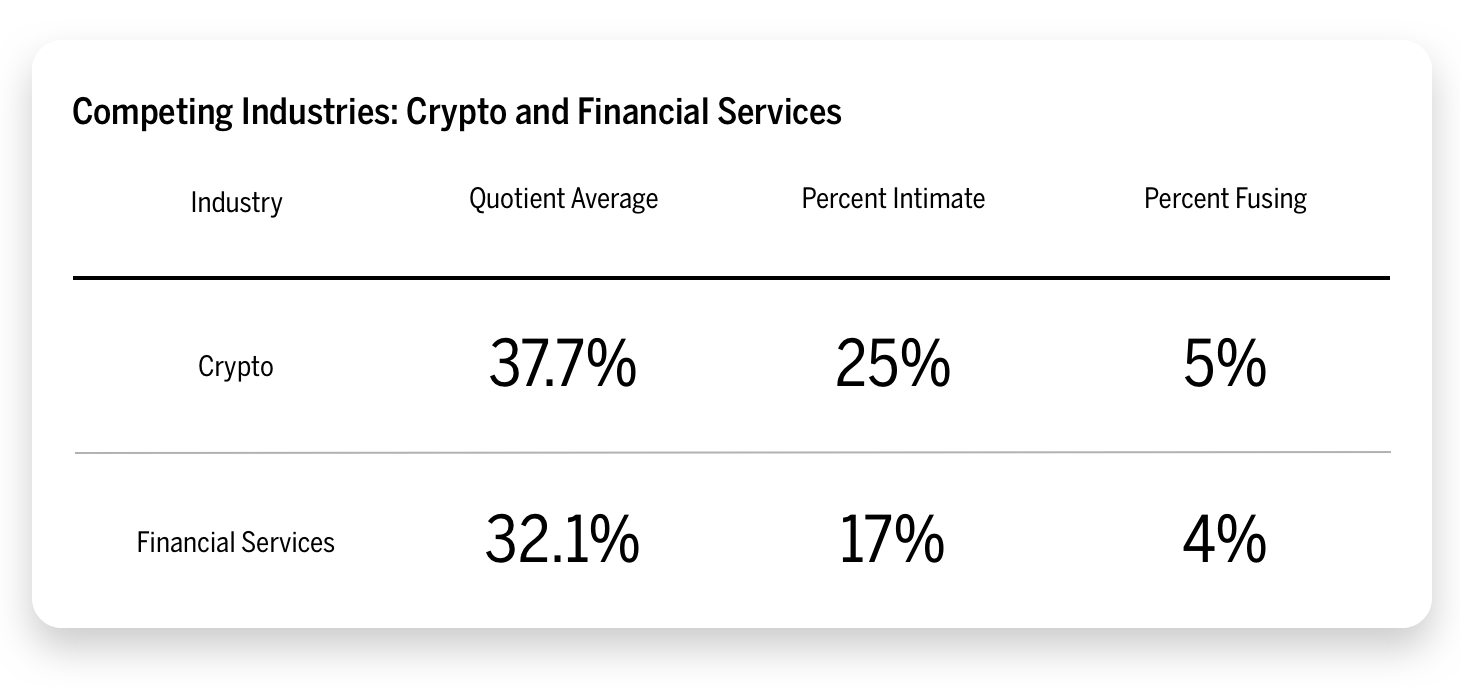

The crypto industry’s performance in this year’s Brand Intimacy Study reveals how users engage with different crypto brands and tests their loyalties in the ebbs and flows of the volatile crypto landscape. In its first year included as an industry, crypto ranked an impressive eighth overall in our 2022 Brand intimacy Study. With an average intimacy Quotient Score of 37.7, crypto scored higher than the cross-industry average of 36.8 and outperformed the financial services industry. This may point toward younger generations shifting away from investing in traditional financial services in favor of crypto.

Within the crypto industry, Cardano (ADA) was the top-ranked brand with a Quotient Score of 52.6, outranking more well-known crypto brands, such as Bitcoin (with a Quotient Score of 51.9) and Ethereum (with a Quotient Score of 42.8). In the study overall, Cardano and Bitcoin came in 26th and 30th place, respectively.

The Crypto Landscape

Global estimates indicate that there are over 295 million crypto users.1 With a current global market cap of $1.01T2, the size of the crypto economy has experienced massive growth since its inception. What began in 2009 with the creation of Bitcoin has led to over 10,000 unique digital coins being traded today. However, this growth has not occurred without significant crashes. Over the past few months, the total market capitalization of all crypto fell from around $3.0T to $900B.3 The price of Bitcoin alone plummeted from an all-time high of $68,990.90 in November 2021 to $17,601.58 this past June.4

Although Bitcoin is the most widely held and traded digital asset, it is not the most intimate. Cardano, a younger and less-established coin, has built stronger emotional connections and come out on top in this year’s study.

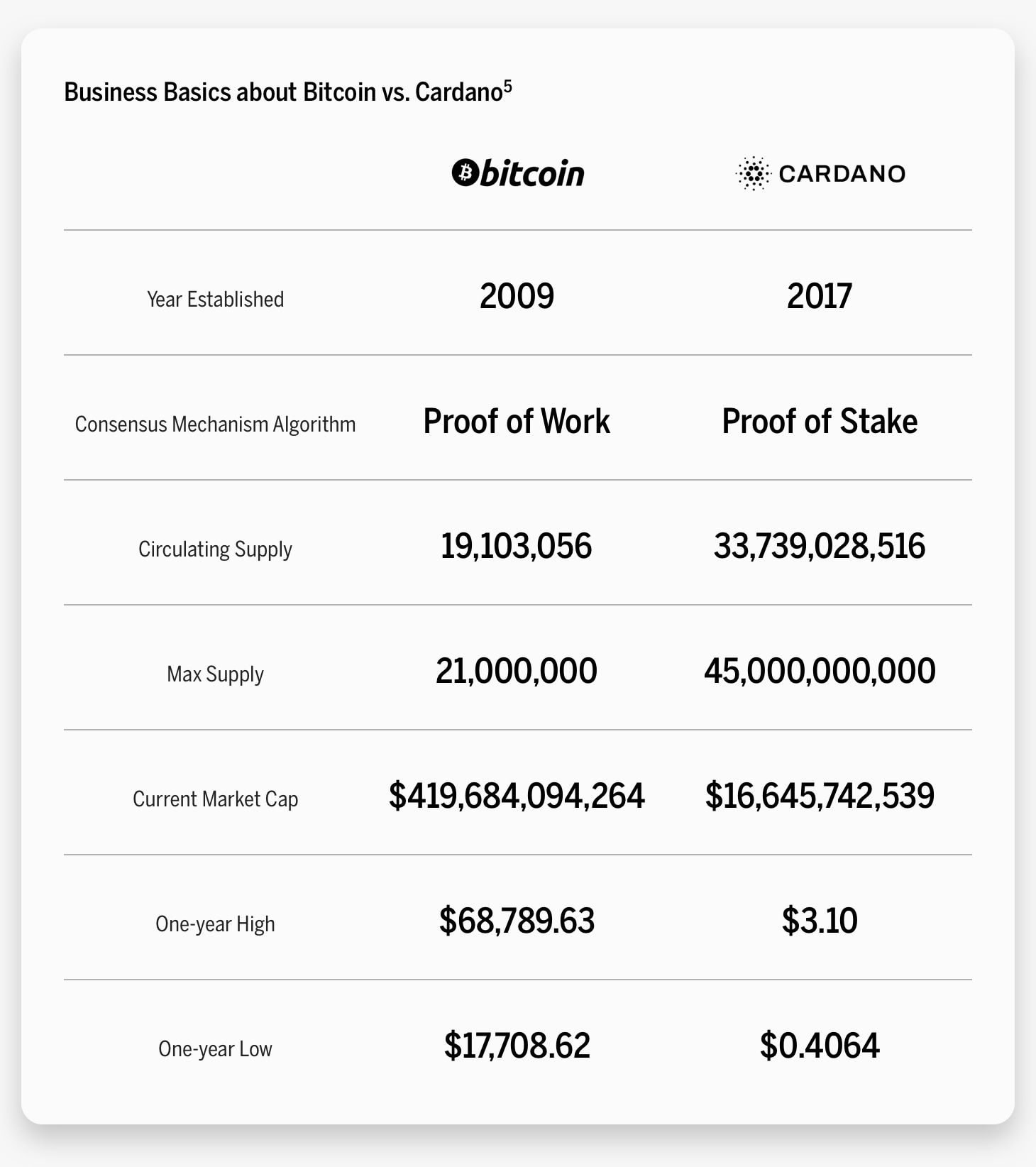

Upon closer review, the quantitative differences between Bitcoin and Cardano are striking. While Cardano’s maximum supply is over 2,100 times greater than Bitcoin’s, Bitcoin’s market cap asserts its position as the most powerful cryptocurrency. Given these numbers, it is even more interesting to dissect Cardano’s success in becoming the most intimate crypto brand of 2022.

Competing Archetypes

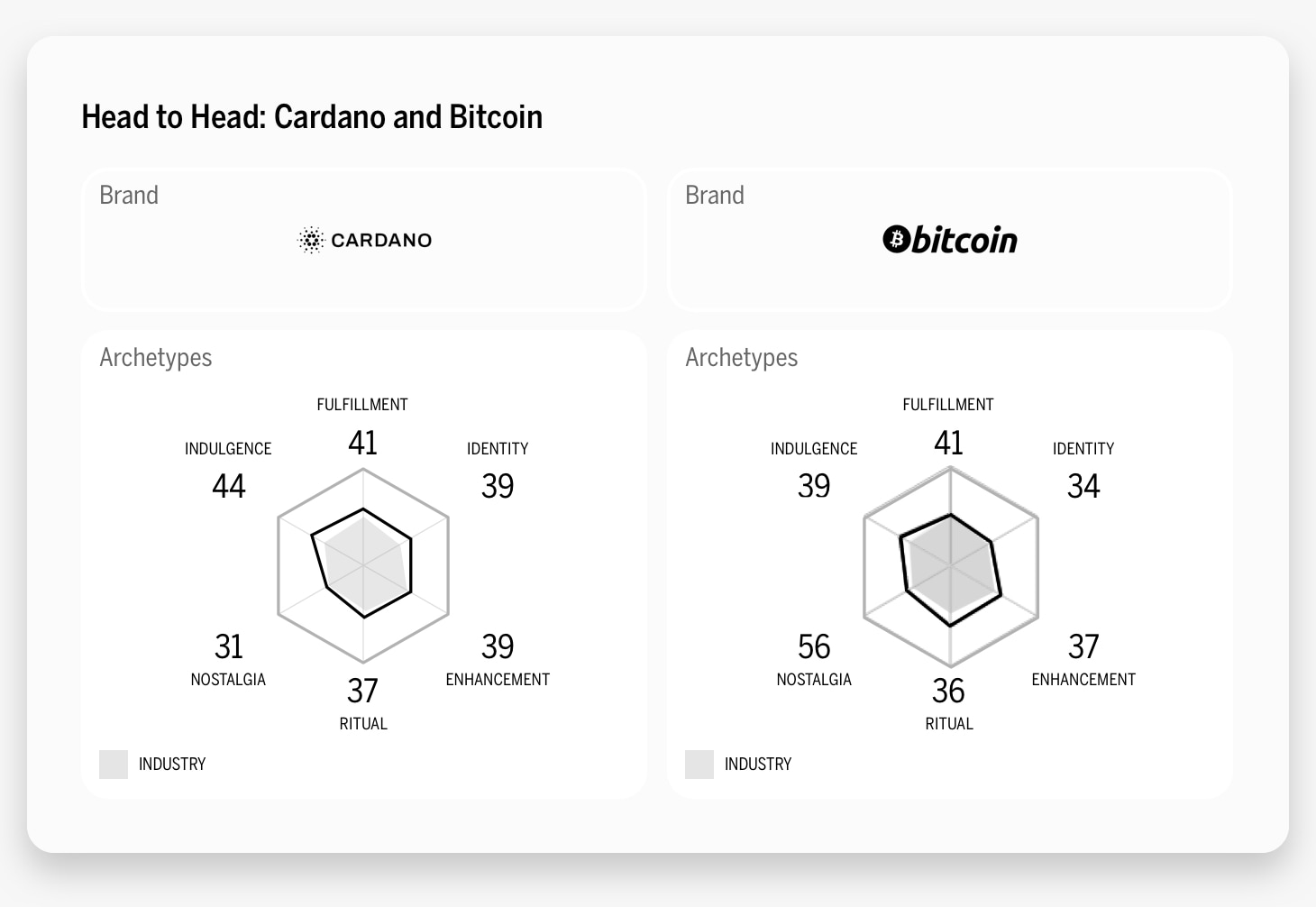

The dominant archetype for the crypto industry is fulfillment, which centers around exceeding expectations and delivering superior, efficient service. Enhancement, which focuses on customers’ lives becoming better through use of the brand, also performs strongly in this category.

When comparing Cardano and Bitcoin, we see some notable differences. Cardano’s dominant archetype leans heavily toward indulgence, which centers around pampering and gratification. Bitcoin, on the other hand, performed the best in the ritual archetype, suggesting the brand has become more ingrained in people’s daily lives and is an important part of their daily existence.

The contrast between the top archetypes of these two brands may be a result of the platforms’ ages. The relatively recent launch of Cardano in 2017 (followed by a stable release in March 2022) means it hasn’t had nearly as much time to become part of people’s daily rituals. Bitcoin’s age (13 years old) and prevalence places it at the forefront of the industry, a familiar brand name even to those not active in the crypto sphere. As Bitcoin becomes increasingly accepted as a dependable form of currency (Goldman Sachs recently offered its first Bitcoin-backed loan6, and El Salvador officially declared Bitcoin its national currency in 20217), its use becomes a normalized habit. Meanwhile, Cardano’s novelty means investing in it feels like an indulgence or special thrill. While individuals may feel more comfortable putting their money behind the more established Bitcoin, investing in a new currency like Cardano may be a bit of a splurge, with the hope that it will offer an impressive return.

Connecting with Users

Another striking difference between Bitcoin and Cardano lies in each brand’s ability to connect with its users. Our Brand Intimacy data reveals around 41% of Cardano users are in some form of intimacy with the brand compared to only 28% of Bitcoin users. Cardano’s percent of users in some stage of intimacy is well above the industry average of 25%. Notably, Cardano has 9% of users in fusing, the highest stage of Brand Intimacy, compared to Bitcoin’s 7%, a 28% difference.

Beyond the crypto industry, Cardano has a higher rate of fusing users than many higher-ranking brands, including YouTube (ranked fifth overall), Netflix (ranked eighth overall), and Android (ranked tenth overall). It is telling that despite its smaller presence, Cardano is still able to more effectively fuse with its users. When it comes to each brand’s communications, Bitcoin focuses on being an innovative payment network: “Bitcoin is a consensus network that enables a new payment system and a completely digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen.”8 Cardano’s message centers around making the world better for all: “Cardano is a blockchain platform for changemakers, innovators, and visionaries, with the tools and technologies required to create possibility for the many, as well as the few, and bring about positive global change.”9 This may explain why Cardano leads in building emotional connections and stronger bonds with users.

Differing Expectations

By examining over 1.4 billion words and phrases from social media, our 2022 Brand Intimacy Study provides us with valuable insights into how consumers feel about brands.

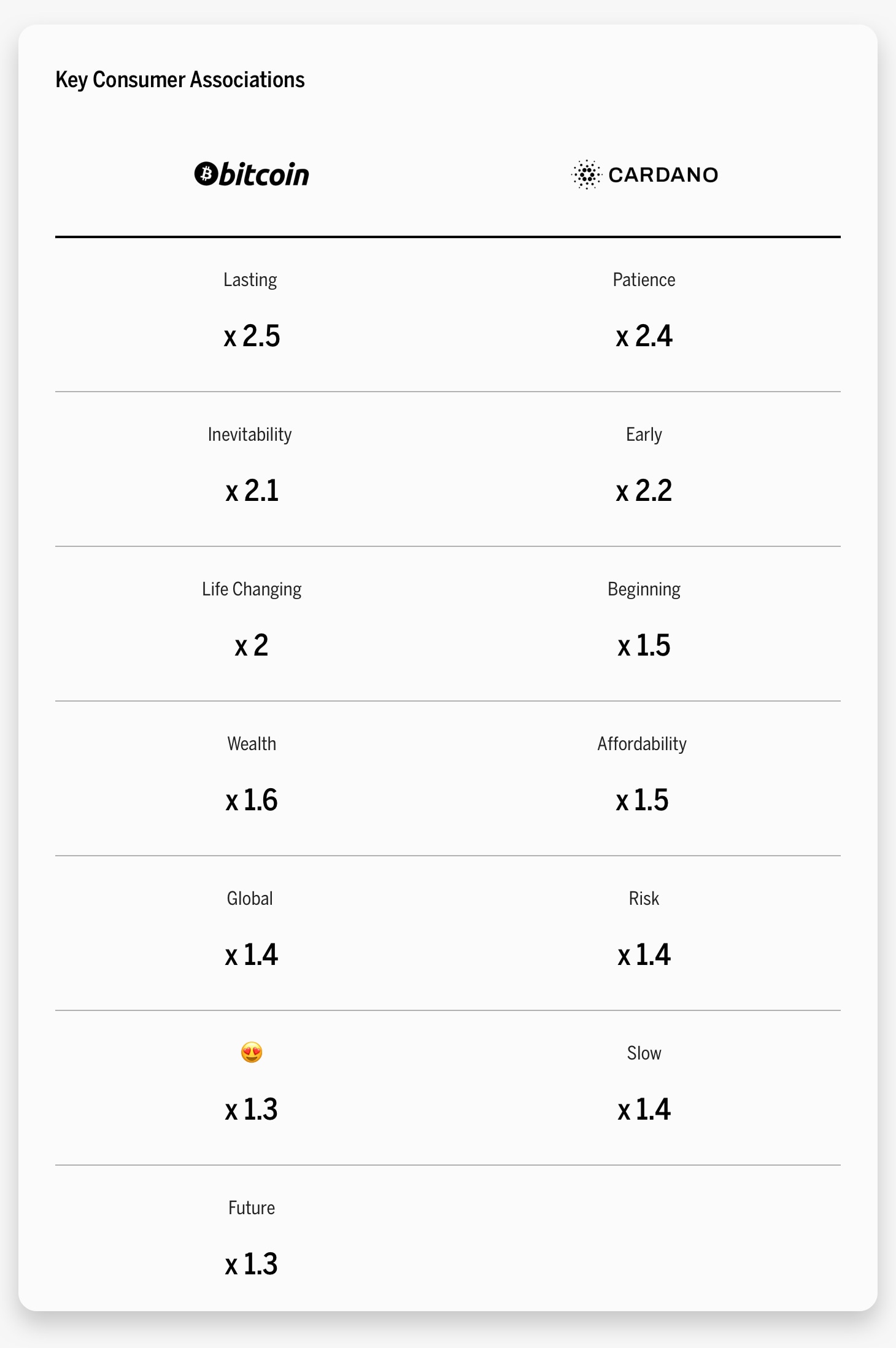

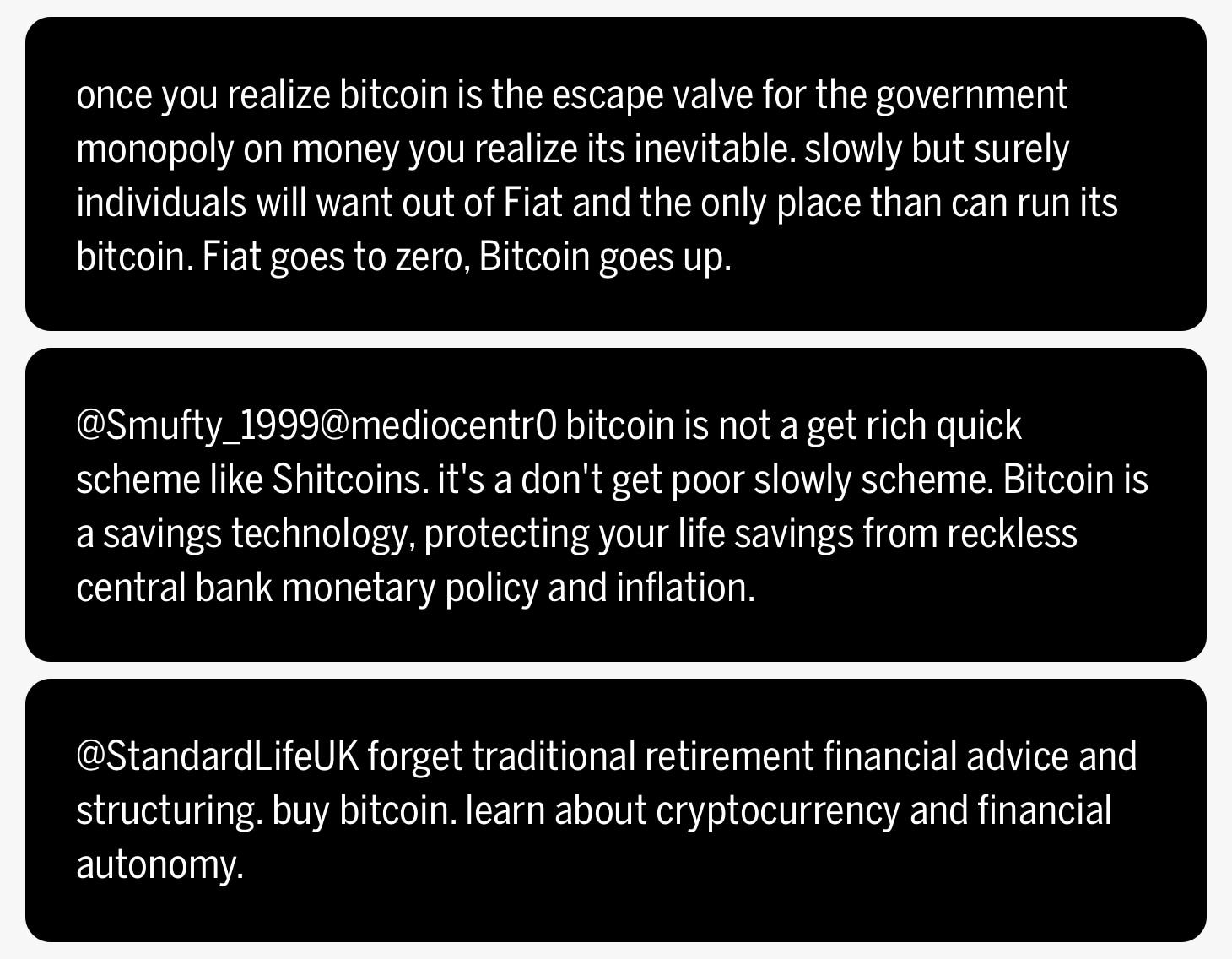

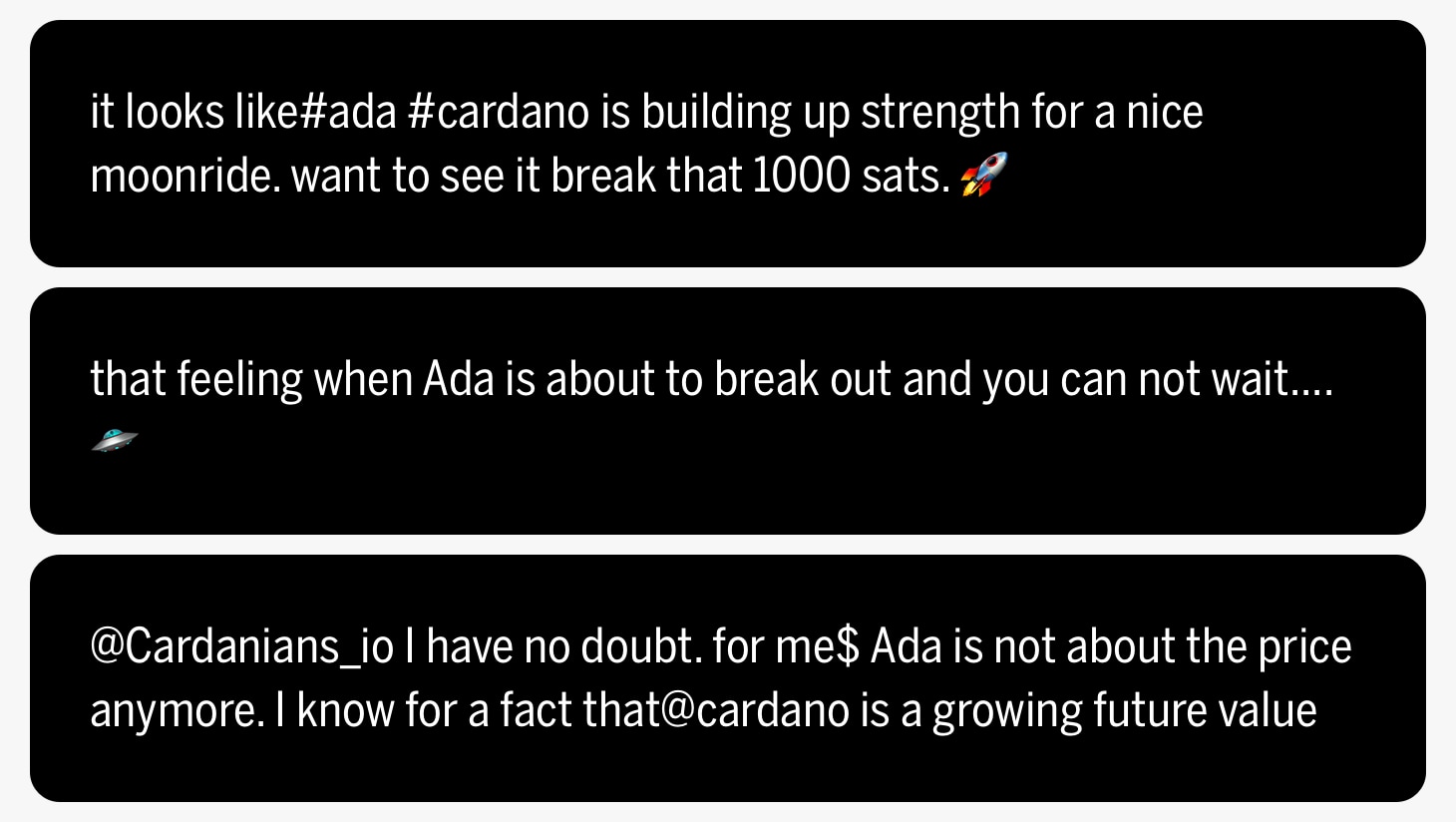

Bitcoin users are adamant that this digital asset is the future of traditional currency. Furthermore, its users appear to believe that Bitcoin has already proven its stability and success and is therefore the most rational investment in the crypto industry. Proponents of Bitcoin further suggest investing in “digital gold” as an alternative to traditional financial planning. Overall, Bitcoin is known for its value, safety, and idea of being a “future asset”.

Cardano, on the other hand, is more often associated with its future potential to skyrocket in value and its current affordability. Users promoting Cardano encourage others to “get in early,” invest, and be patient.

Competing Industries: Crypto and Financial Services

As the crypto economy grows, many users endorse its superiority over traditional financial services. As an industry, financial services ranked fourteenth in our 2022 Brand Intimacy Study, with an average Brand Intimacy Quotient Score of 32.1. With weaker archetypes across the board, financial services failed to measure up to this new competitor. The industry’s dominant archetype, enhancement, still fell short of crypto’s overall performance in the same archetype. Similarly, only 17% of financial services users fell into one of the three stages of intimacy, compared to 25% of crypto users. On the other hand, the top-performing financial services brands, USAA and Standard Chartered, were just as effective in fusing with their users as Bitcoin and Cardano, if not more so.

Category keywords for financial services include reliable, helpful, problem solvers, and efficient. For crypto, we see getting rich, trustworthy, gains, on fire, and future. More specifically, analysis of social discourse about the top financial services brands uncovers differences in frequently used keywords. For instance, USAA users are more likely to talk about the brand’s friendliness and their likelihood to recommend it to other customers. Standard Chartered users deem the brand reliable. However, users of both top financial service brands also share many negative impressions. Standard Chartered users are 1.4 times more likely to mention the brand being the “worst,” and USAA users are 2.4 times more likely to share their “dislike” of the brand.

This is indicative of users’ increasing frustration with traditional financial services. A decline in trust and an increase in disdain toward these institutions may prompt disgruntled users to search for an alternative.

Conclusion

The inclusion of crypto in this year’s Brand Intimacy Study offers telling insights into this new industry. The unprecedented growth of the crypto economy has created opportunity for the creation and trade of thousands of digital coins. Despite Bitcoin’s reputation as the most popular and powerful cryptocurrency, it has been less effective in bonding with its users, resulting in its second-place finish behind Cardano. Bitcoin’s ubiquity and reliability may have made it less exciting or risky to invest in as it once was. Cardano’s lower price and novelty offers its users the opportunity to indulge in taking a risk, without having to invest as much money up front, in the hopes they will see the coin’s price skyrocket. Its messaging is also more inviting, encouraging a relationship and highlighting the currency’s bold aspirations.

Moreover, the sharp growth of cryptocurrency as a legitimate medium of exchange has impacted the way people think about long-term financial planning. Crypto’s dominance over financial services in industry rankings raises questions about the future of both industries and their effects on each other.

The future of crypto assets depends on sufficient regulation to protect investors and users and filter out of toxic players. The lack of local and global regulatory frameworks has impacted the industry causing some crypto brands to lose liquidity or viability and declare bankruptcy.

Get an overview of Brand Intimacy here.

Read our detailed methodology here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Sources

1 “Crypto Market Sizing.” By crypto.com

https://assets.ctfassets.net/hfgyig42jimx/5i8TeN1QYJDjn82pSuZB5S/85c7c9393f3ee67e456ec780f9bf11e3/Cryptodotcom_Crypto_Market_Sizing_Jan2022.pdf

2 “Today’s Cryptocurrency Prices by Market Cap.” By CoinMarketCap (as of July 25, 2022)

https://coinmarketcap.com/

3 “Crypto Crash: Is Now the Time to Buy the Dip?” By Forbes

https://www.forbes.com/advisor/au/investing/cryptocurrency/crypto-crash-is-now-the-time-to-buy-the-dip/

4 “Bitcoin.” By CoinMarketCap (as of July 25, 2022)

https://coinmarketcap.com/currencies/bitcoin/

5 “Today’s Cryptocurrency Prices by Market Cap.” By CoinMarketCap (as of July 25, 2022)

https://coinmarketcap.com/

6 “Goldman Offers its First Bitcoin-Backed Loan in Crypto Push.” By Bloomberg

https://www.bloomberg.com/news/articles/2022-04-28/goldman-offers-its-first-bitcoin-backed-loan-in-crypto-push

7 “In Global First, El Salvador Adopts Bitcoin as Currency.” By New York Times

https://www.nytimes.com/2021/09/07/world/americas/el-salvador-bitcoin.html

8“Bitcoin Frequently Asked Questions.” By Bitcoin

https://bitcoin.org/en/faq

9 “Cardano.” by Cardano

https://cardano.org/