Overview

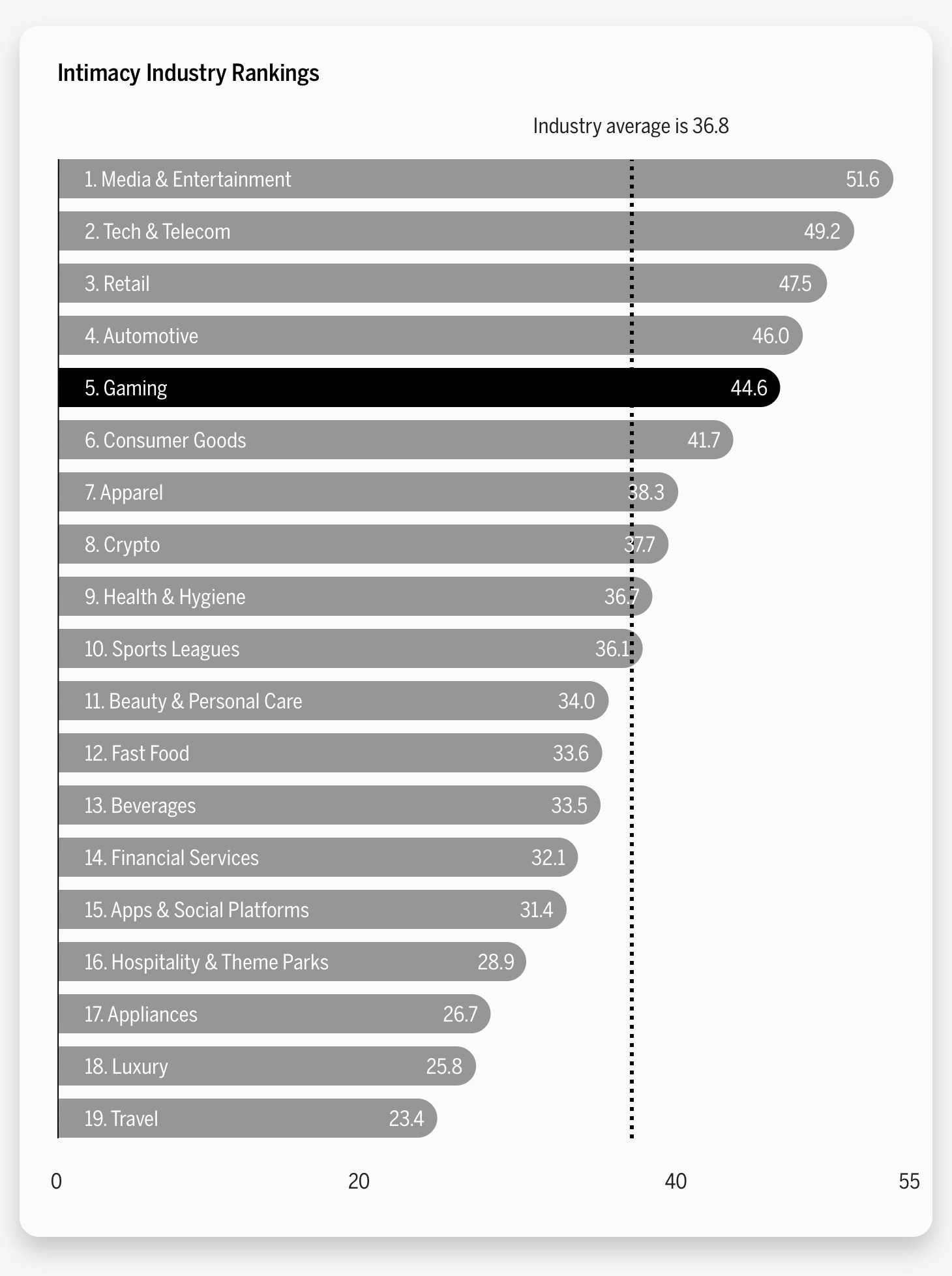

- The hospitality & theme parks industry ranks 13th in our 2022 Brand Intimacy Study. To view our new study, click here.

- Disney Parks is the top-ranking hospitality & theme parks brand. To see its brand profile, click here.

- The industry encompasses hotel brands, theme parks, and cruise brands. To see the industry’s performance, see here

Introduction

Brand Intimacy, the emotional science behind how we bond with the brands we use and love, is thriving in its 12th year of existence. In this year’s study, we are excited to share how more than 600 brands performed as we’re emerging from the pandemic and assuming more “normal” routines.

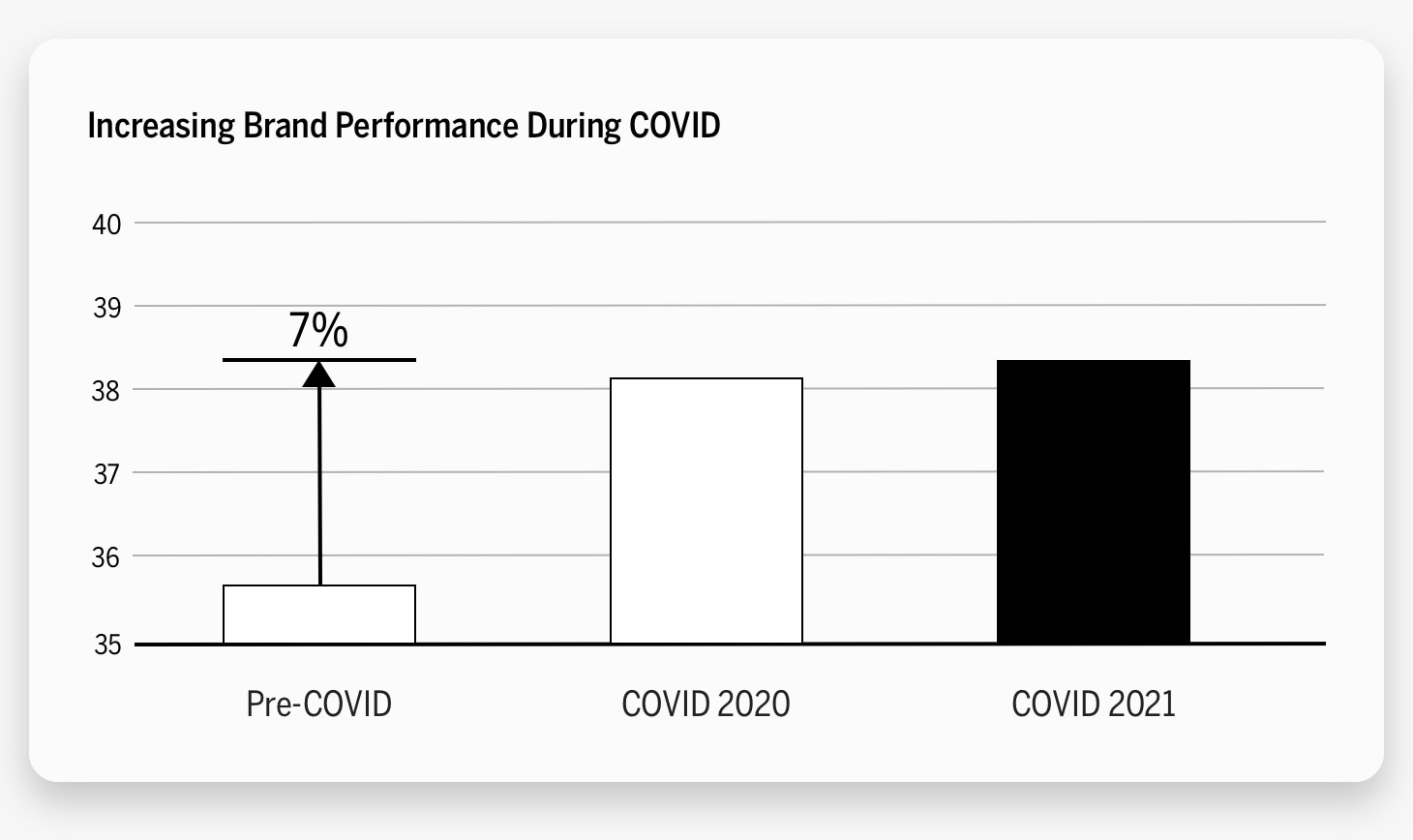

The COVID Brand Bump

For context, our previous two studies confirmed that brand performance increased during COVID for leading brands in most industries. Although there have been clear winners and losers, overall, people became more intimate with brands during the pandemic. This means that if your brand hasn’t benefited from a COVID-bump, the gap between your brand and your customers has likely widened and worsened. Given the limitations on travel and hospitality this category has not been featured in our studies since 2020.

Pandemic impact on hospitality & theme parks

The hospitality industry was one of the sectors hit hardest by the pandemic. Government restrictions and consumer fear caused the industry to almost shut down, and two years later, many businesses are not back to capacity. Between theme parks, hotels, and cruises, the cruise industry was perhaps most affected by the pandemic, with cruising suspended in 2020. It was estimated that each day of suspension would lead to a loss of approximately 2,500 jobs worldwide1. Norwegian reported a revenue loss of 80% in 2020 compared to 2019, with a further 10% decrease in 2021, resulting in a 90% loss over the past two years.2

Theme parks were also impacted by COVID. Estimates suggest the pandemic resulted in $23 billion in economic losses in 2020 due to closures. In North America, attendance at the top 20 theme parks, including Disney’s theme parks in California and Florida, Universal Studios, Six Flags, Cedar Fair, and others, dropped 72% from 159.3 million in 2019 to 44.1 million in 2020.3 In 2019, the hotel and resort sector’s worldwide market size reached $1.52 trillion. In 2020 and 2021, the market size dropped below $1 trillion.4

However, forecasts for the industry are more positive. Global hotel revenue is expected to show an annual growth rate (CAGR 2022-2026) of 11.34%, resulting in a projected market volume of US$479.90 billion by 2026.5 By the last quarter of 2023, global cruise passenger volume is predicted to recover and surpass 2019 levels.6 Additionally, the theme parks market is expected to reach $89.17 billion in 2025 at a CAGR of 9%.7

Given all the restrictions and upheaval in the hospitality & theme park industry, it may not be surprising that it ranks 16th out of 19 industries, and has an average Brand Intimacy Quotient of 28.9, below the cross-industry average of 36.8. Only 15% of all hospitality & theme park customers are in an emotional relationship with these brands today. The dominant Brand Intimacy archetype for the category is fulfillment, which means to exceed expectations, deliver superior service, quality and efficacy. Encouragingly, hospitality & theme parks also outperforms the cross-industry average for three Brand Intimacy archetypes: fulfillment, identity, and indulgence. Keywords associated with the industry include fun, anticipation, delicious food, and vacation.

Our top 10 features five hotels, three theme parks, and two cruise lines. Notably, our top two brands (by a considerable margin) are Disney Parks and Warner Bros, suggesting that theme parks currently have the strongest emotional connection with consumers in the hospitality space. In fact, intimacy rates (meaning the percent of users in an emotional relationship) for the two top theme parks are at 35%, more than double the industry average of 15%.

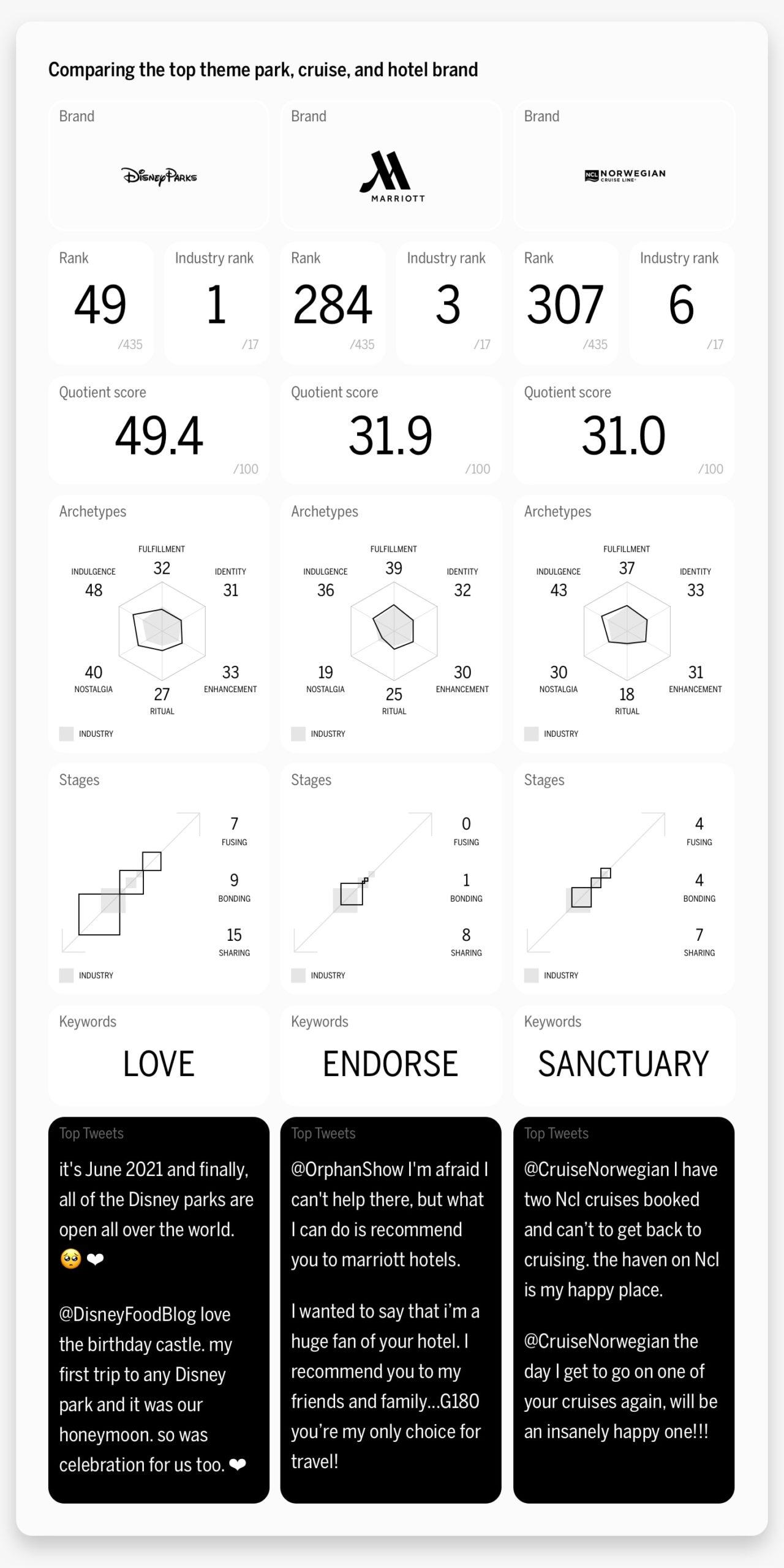

We thought it would be interesting to look at the top-performing theme park (Disney Parks), hotel (Marriott), and cruise (Norwegian) brands across our Brand Intimacy measures to provide additional insight into how each category within hospitality is building bonds and reconnecting with consumers.

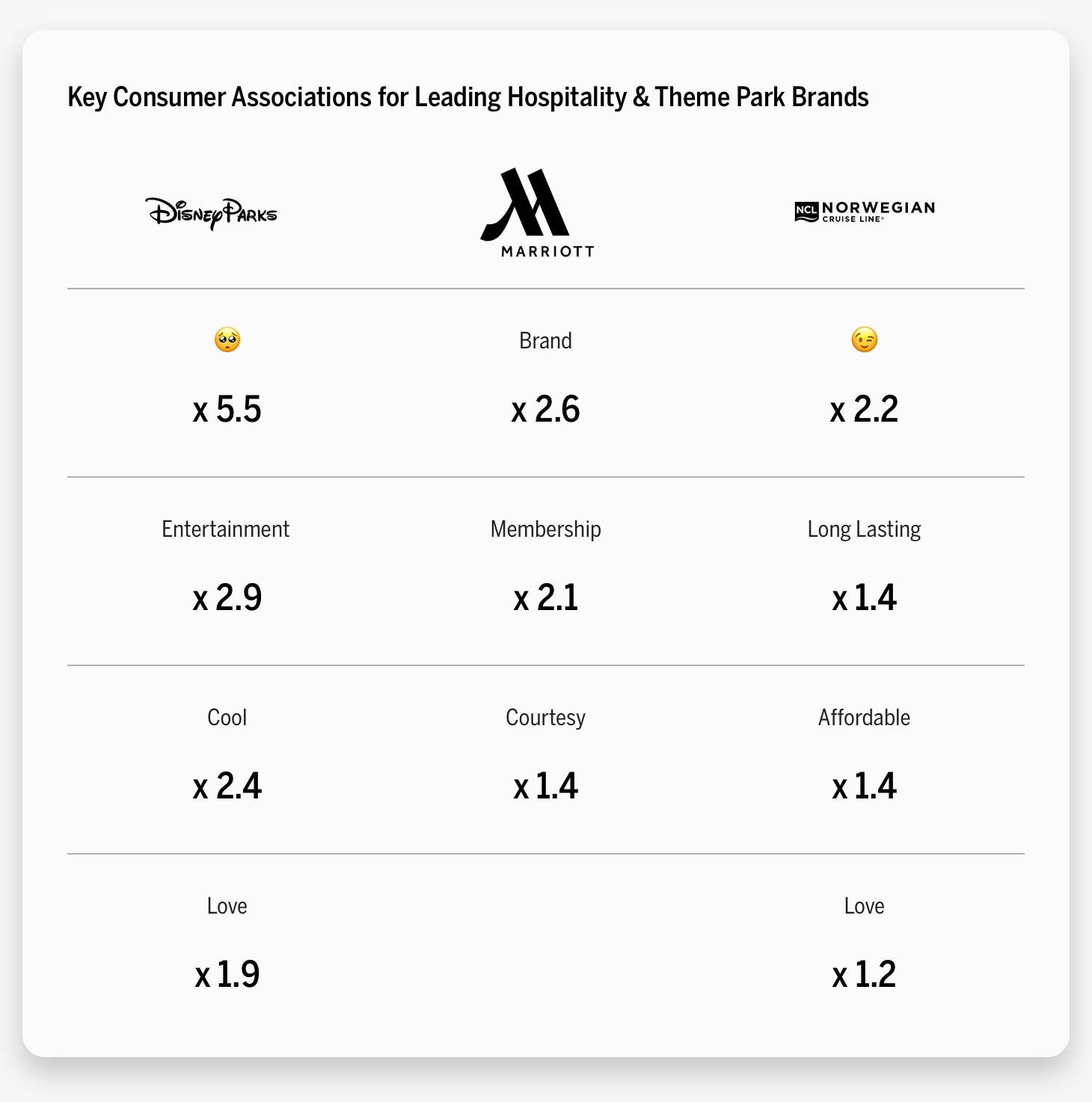

In comparing Disney Parks, Marriott, and Norwegian, we see that Disney Parks and Norwegian both lead with indulgence (associated with pampering and gratification), whereas Marriott’s strongest archetype is fulfillment (meaning to exceed expectations, deliver superior service, quality and efficacy). Disney Parks is also strongly linked with nostalgia whereas Marriott is linked with identity (reflecting an aspirational image or admired values).

Our research demonstrates that keywords vary for each brand as well. Consumers express love and anticipation for Disney Parks, satisfaction for Marriott, and they associate Norwegian Cruises with a sanctuary experience.

In terms of stages, the depth and intensity of intimate relationships, we see Disney Parks is far ahead. It has nearly double the percentage of sharing customers and an even greater percentage lead with fusing users, the most advanced stage of intimacy. It is also notable that despite Disney Parks, Marriott, and Norwegian each representing the top theme park, hotel, and cruise line, both Marriott and Norwegian rank significantly lower than the the theme park giant. Indeed, Disney Parks ranks 49th in our overall Brand Intimacy rankings, whereas Marriott ranks 284th and Norwegian 307th.

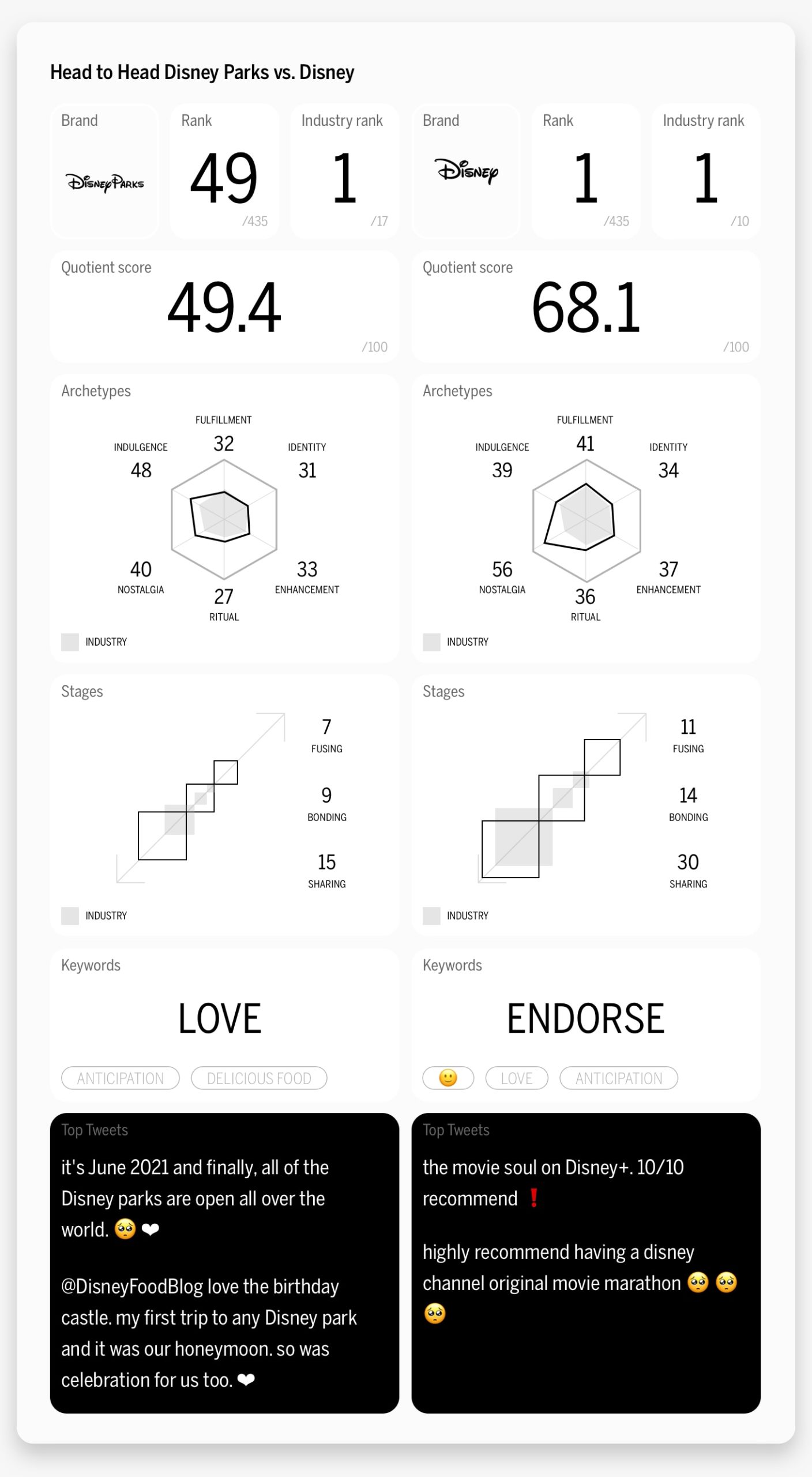

Disney Parks has an obvious association with the Disney brand, the number one ranked brand in our 2022 study. This link’s importance cannot be overstated. When you look at Disney and Disney Parks’ brand profiles, you see overall Disney is the more intimate brand, however, Disney Parks is stronger and more associated with indulgence than the Disney brand. Both brands are heavily linked to nostalgia and perform well across a broad range of archetypes. Disney and Disney Parks are both superior in the intensity of the relationships they have with customers. Disney’s rate for fusing, the ultimate stage of intimacy is 11%, compared to the industry average of 3.5%. Similarly, Disney Parks has 7% fusing users, compared to industry average 2.4%. Interestingly, Disney’s keywords include endorse, love and anticipate. Disney Parks is also associated with love, as well as entertainment and being cool.

Looking at over 1.4 million words and phrases, our 2022 Brand Intimacy study provides us with valuable insights into how consumers feel about brands. We see that these brands build bonds in different ways, Disney Parks brings its iconic entertainment characters to life, Marriott provides quality service and reliability across all their hotels, and Norwegian, assures a vacation of escape and entertainment for the whole family.

Disney is frequently mentioned in regard to its status as a vacation destination, its ambitious experiences, and its premium cost.

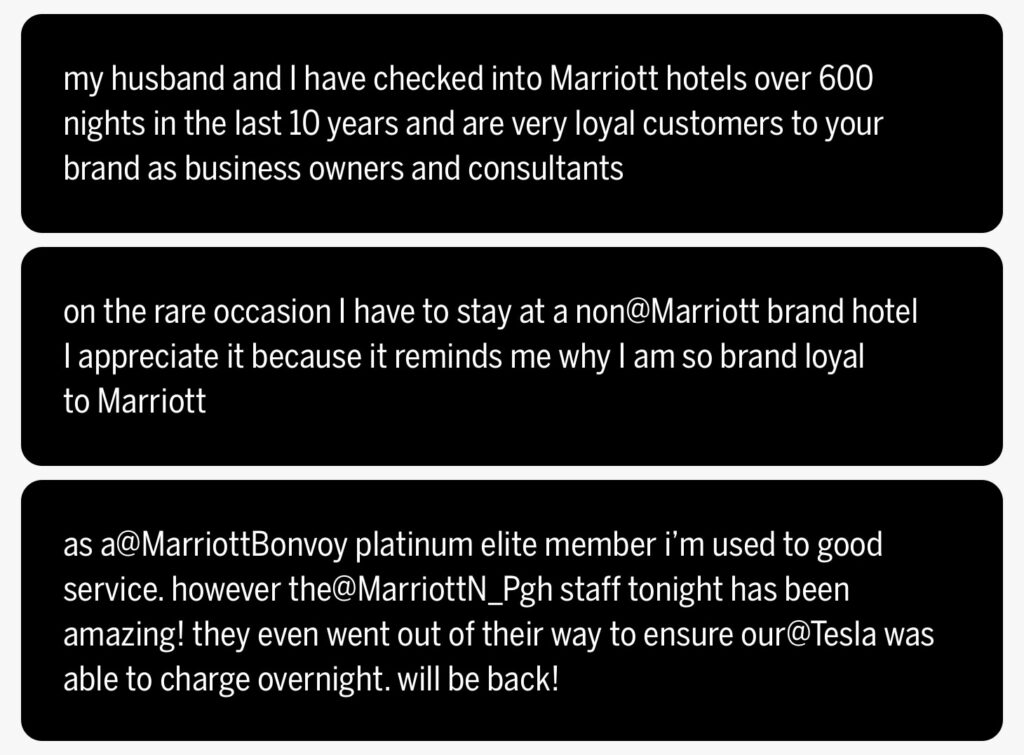

Marriott is known for its reliability, quality service across their chain, and membership program.

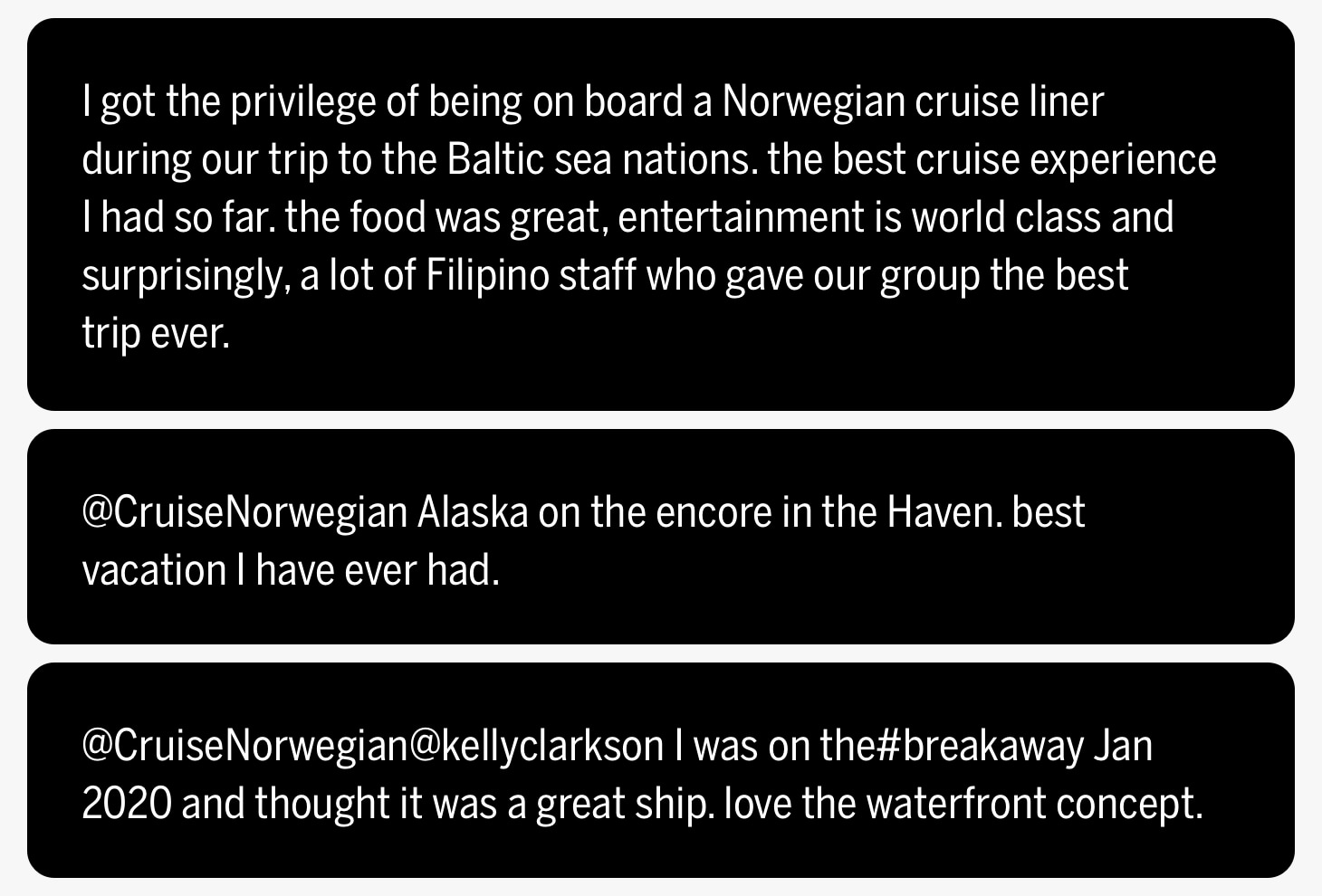

Norwegian is often associated with entertainment, desirability, vacation, and love. Customers share cherished moments and adventures with family and friends while on board.

When looking at the top theme park, top hotel brand, and top cruise line we see that consumers associate Disney with vacations, good experiences, and cost. When thinking about Marriott, customers consider its strong brand identity and membership benefits, whereas Norwegian is combined with entertainment and desirability.

Conclusion

As we see COVID-related mandates being lifted, hotels, theme parks, and cruises seem poised for a strong year. Despite the makings of a strongly emotional industry (remember the industry keywords— fun, anticipation, delicious food, and vacation), hospitality & theme parks ranks among the lowest categories in our study. Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and a key principle for navigating challenging times. Brands in this space must do a better job at focusing on relationship building and establishing a dialogue with customers. Hospitality brands must find new ways to leverage consumers’ emotional attachments to travel and vacations in ways that strengthen their bonds and build stronger connections.

Read our detailed methodology here, and get an overview of Brand Intimacy here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Sources

1 “Estimated daily number of jobs lost in the cruise industry due to the coronavirus (COVID-19) pandemic worldwide as of June 2020, by region.” By Statista https://www.statista.com/statistics/1170473/covid-19-impact-on-employment-in-the-cruise-industry/

2 “30 Cruise Industry Statistics and Facts For 2022.” By Cruise Mummy https://www.cruisemummy.co.uk/cruise-industry-statistics-facts/

3 “New report shows pandemic’s impact on attendance at Disneyland, Universal Studios, other theme parks.” By Joseph Pimentel

https://spectrumnews1.com/ca/orange-county/attractions/2021/09/23/new-report-shows-coronavirus-pandemic-s-impact-on-attendance-at-disneyland–universal-studios-and-other-theme-parks

4 “Market size of the hotel and resort industry worldwide from 2011 to 2021, with a forecast for 2022.” By S. Lock https://www.statista.com/statistics/1186201/hotel-and-resort-industry-market-size-global/

5 “Hotels WorldWide” -Statista Market Forecast. By Statista https://www.statista.com/outlook/mmo/travel-tourism/hotels/worldwide

6 “Global Cruise Passenger Volume to Exceed 2019 Levels by 2023, Says CLIA.” By GTP

https://news.gtp.gr/2022/01/28/global-cruise-passenger-volume-to-exceed-2019-levels-by-2023-says-clia/

7 “Amusement Parks Global Market Report 2021: COVID-19 Impact and Recovery to 2030”

https://www.researchandmarkets.com/reports/5238071/amusement-parks-global-market-report-2021-covid