Overview:

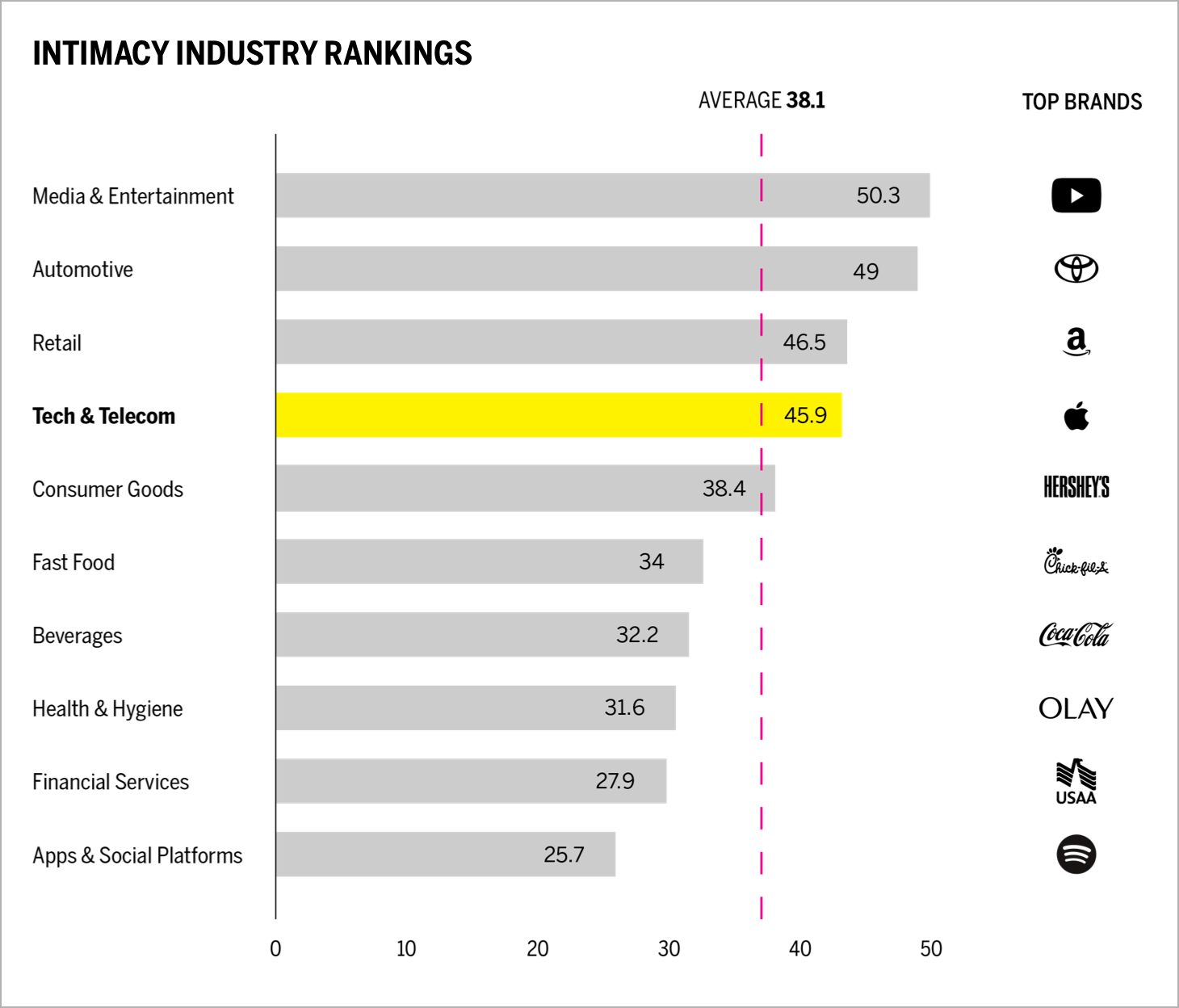

- The technology & telecommunications industry ranks fourth in our Brand Intimacy COVID Study.

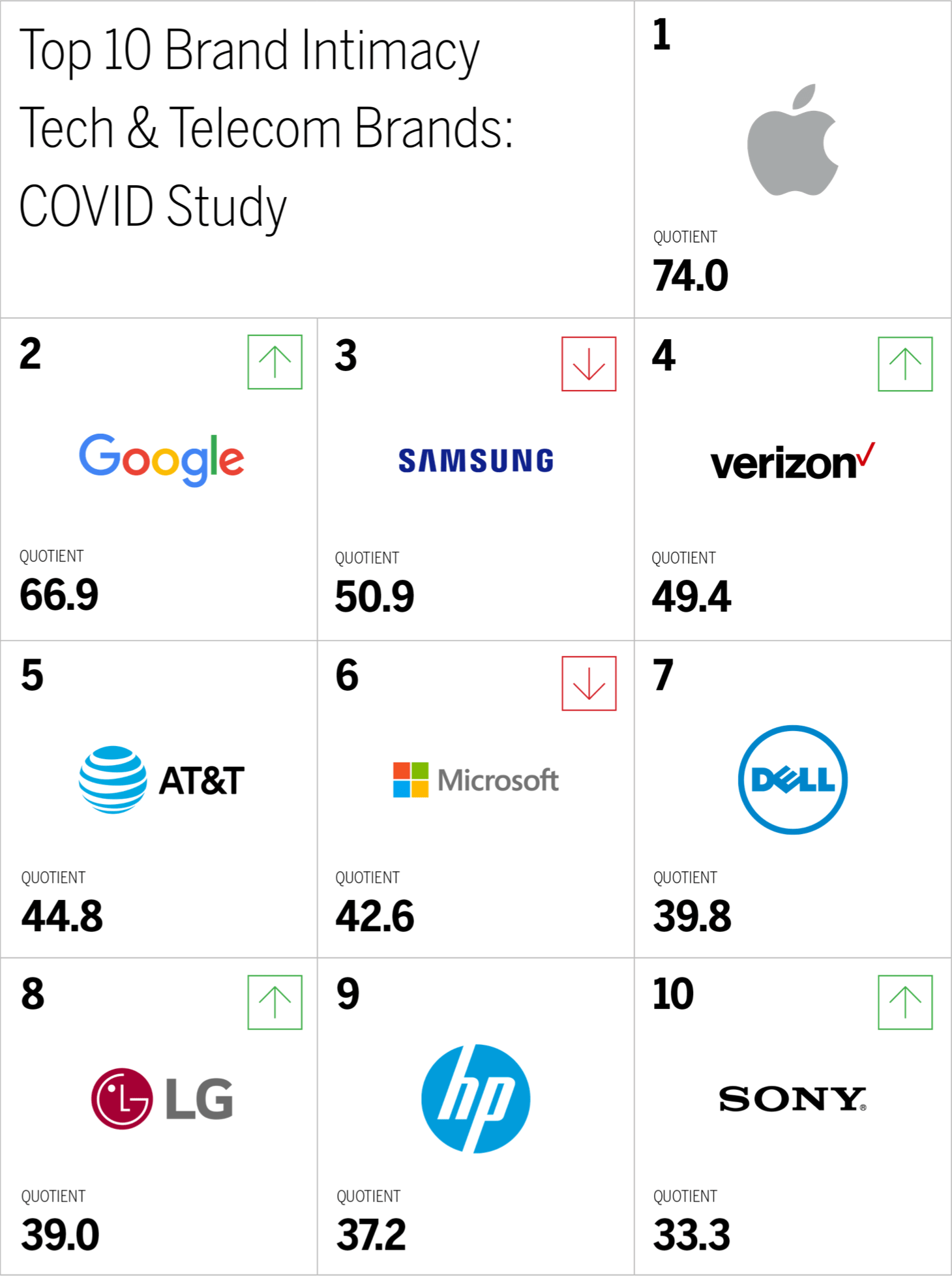

- Apple is the top-ranking technology & telecommunications brand and top brand overall in our study.

- During COVID, technology & telecommunications brands rank higher than the cross-industry average for all archetypes.

Introduction

As businesses and their brands face unprecedented challenges in the face of the COVID pandemic, we are sharing our new insights on how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

This article is based on data and findings from our new Brand Intimacy COVID Study, conducted with 3,000 consumers in late summer 2020, revealing how leading brands have been affected by the pandemic.

Brand Intimacy Performance Today

The technology & telecommunications industry has an average Brand Intimacy Quotient of 45.9, well above the cross-industry average of 38.1. The industry increased its average Quotient Score by 7 percent.

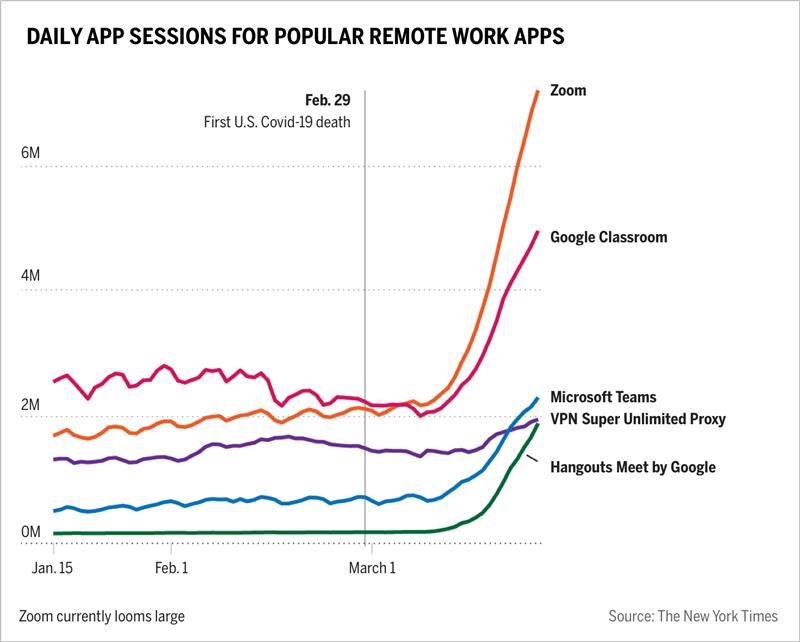

Like virtually all industries, technology & telecommunications has been affected by the pandemic. Supply chain delays, especially from manufacturing centers in China, have impacted production and delivery times. However, our reliance on technology has increased exponentially. Microsoft CEO Satya Nadella noted in April that “we’ve seen two years’ worth of digital transformation in two months”.1 As we have suddenly become reliant on services that allow us to work and learn from home, tools that allow us to gather, share, and collaborate have taken off. Our data find that since COVID, there are considerably more new technology customers (customers less than 1 year) in the industry, up 43 percent from our last study. Zoom, Microsoft Teams, Google Meet/Hangout and others platforms like Slack have seen daily sessions more than triple in number.2 As security and privacy concerns have grown, so has the desire of tech giants like Facebook, Google, and Microsoft to somehow maintain pace with Zoom’s leading growth.

Apple remains in top position, and Google moves up to second place. Consumer preference for Verizon has increased, while preference for Samsung has decreased. The number of customers having some form of intimate connection with technology & telecommunications has also risen to 34.6 percent from 30.3 percent, a 14 percent increase.

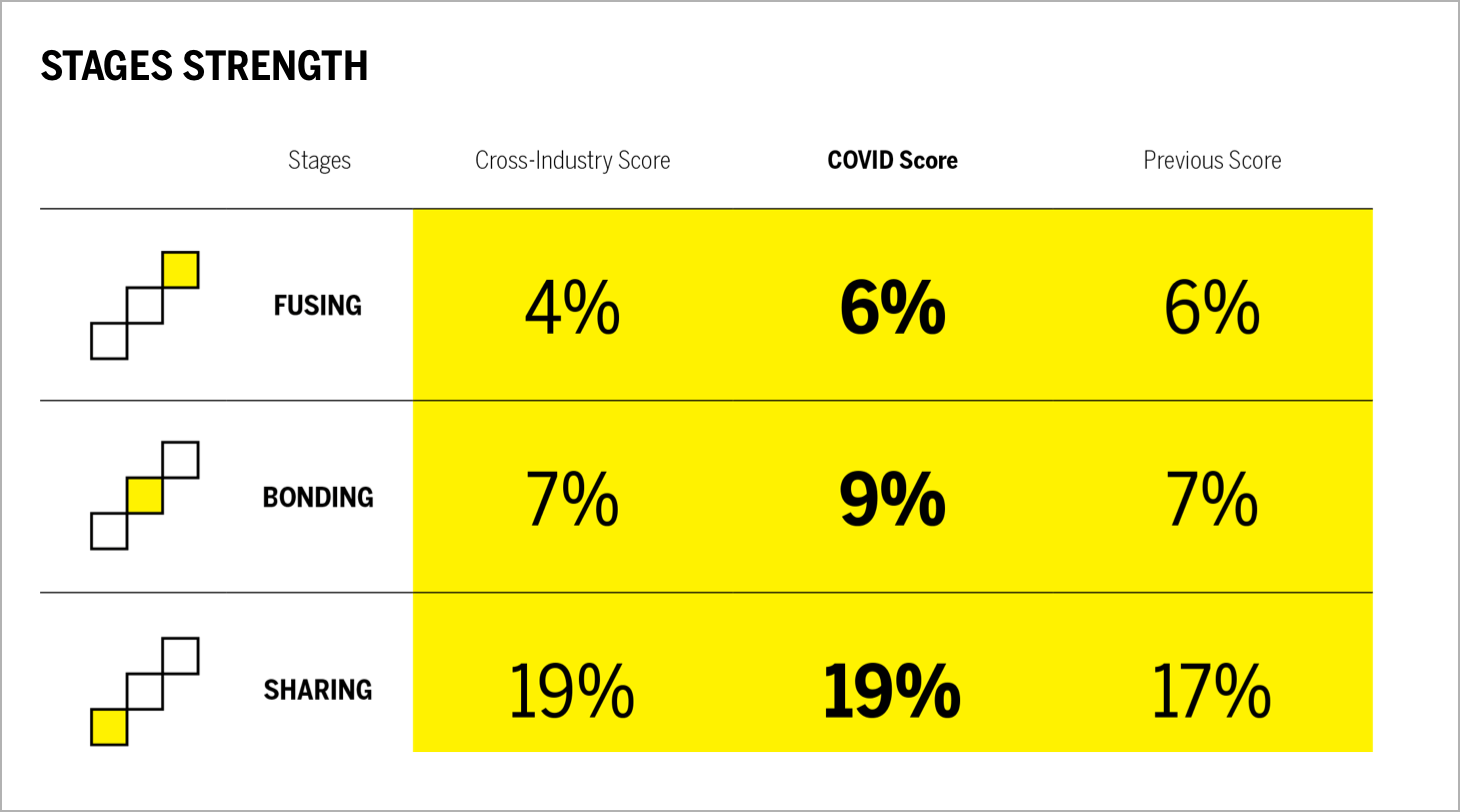

Technology & telecommunications performs better than the cross-industry average for bonding and fusing, the middle and advanced stages of intimacy. The industry also has improved its sharing and bonding scores considerably since our last study. This suggests that during the pandemic, consumers were emotionally connecting to technology & telecommunications brands more than in our previous study. Fusing scores have stayed the same.

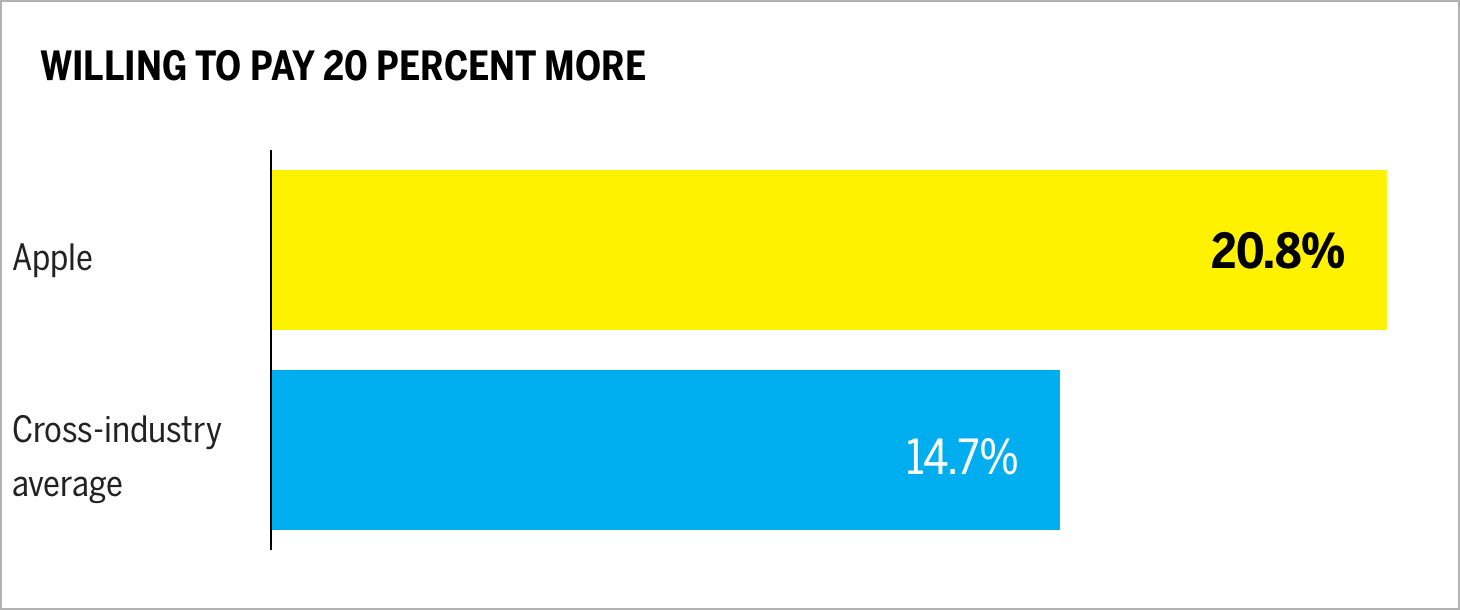

Apple 20.8%

Cross-industry average: 14.7%

Apple has 20.8 percent of customers willing to pay 20 percent more for its products. This is 41 percent higher than the average of all brands in our study, highlighting the more customers value their brand relationships, the more they are willing to pay for the brands they use and love. Apple is also the top-ranked brand in technology & telecommunications for this measure.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are looking at how brands themselves have behaved and communicated during the pandemic. We’ve captured a language analysis from company websites and outbound social, focusing on four brands and encompassing 3,873,522 words.

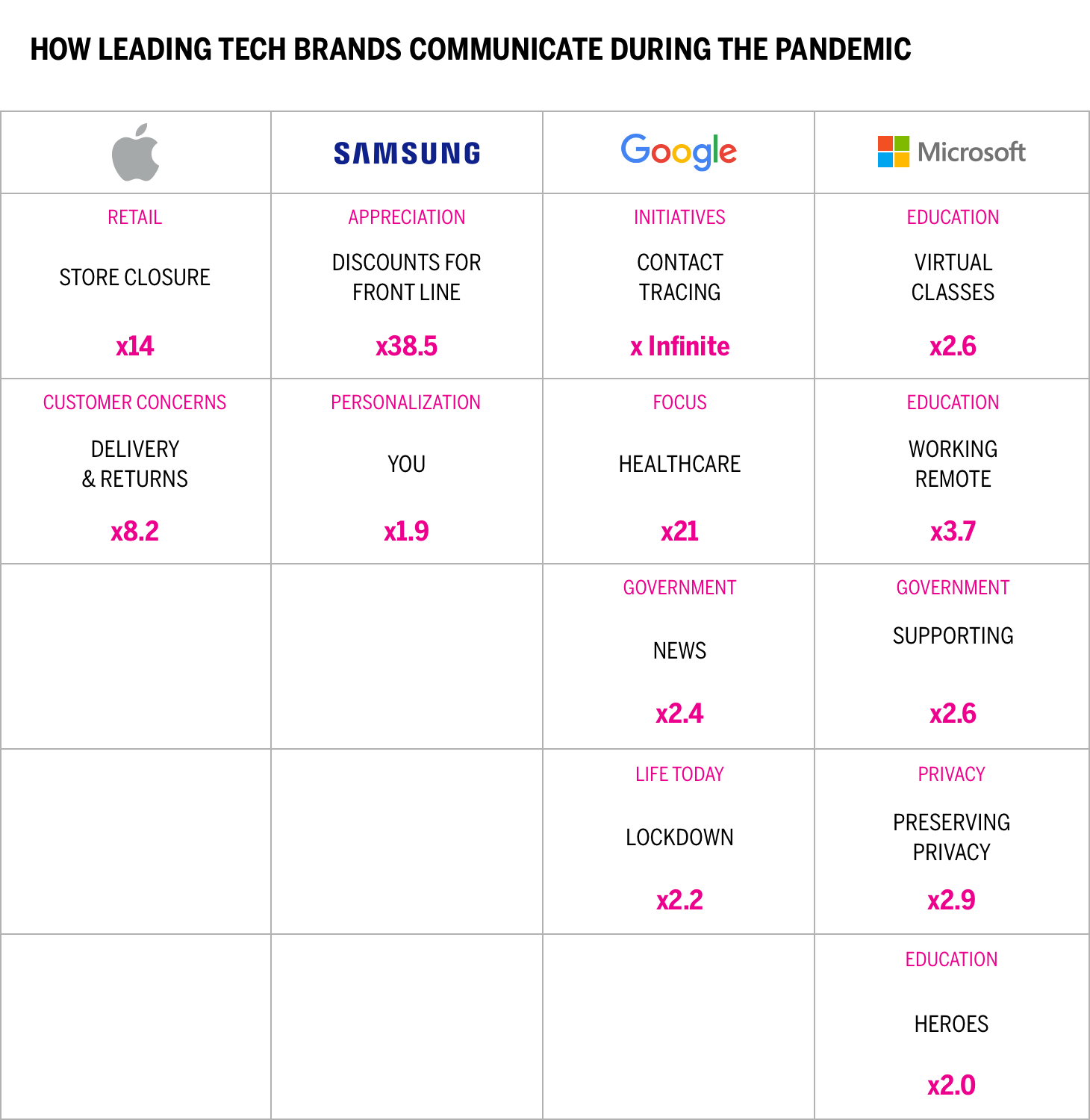

This chart presents a comparison of how leading brands are communicating about COVID on their websites and social. We see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Apple speaks 14 times more on store closures than its competition).

It is interesting to note Microsoft’s more clearly human-centric and emotionally centered content. Microsoft talks about the crisis in compelling ways and makes the pandemic the focus of its social and website communications. Marry that fact with how brands like Apple and Samsung are generally doing very little proactive social media related to the pandemic, and the delta between these brands gets even larger.

One clear way some of these brands are approaching COVID challenges is through practical assistance. It is noteworthy to see Apple and Google’s partnership for contact tracing, as wells as Google’s and Microsoft’s attempts to streamline or accelerate distance learning features and technologies on their platforms; improve facial recognition while wearing masks; and provide data related to store closures, product returns, and shipping. Each brand has assumed an increasingly critical role in our lives during the pandemic and is fixing problems, which is what good engineering-led companies should do.

Microsoft seems to be reaching higher and going deeper in response to COVID challenges by making efforts to privacy, focus on education, and provide supportive messaging. Although Bill Gates no longer runs Microsoft, he and his foundation have been prominent in the media during the pandemic for both his foresight in predicting the pandemic and his perspective on how we will get through it. Gates and his efforts are also clearly giving Microsoft a greater halo of heroic proportions.

Conclusion

The process of building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and a key principle for navigating these challenging times. The pandemic and the economic aftershocks will require brands to navigate in new and more carefully considered ways. The roles these private enterprises have played during the pandemic have become important case studies. Their immense cash reserves and ubiquity of devices and services render their impact greater than that of most countries. We are witnessing private company collaboration at a governmental scale. Billionaire founder of Salesforce, Mark Benioff connected FedEx, Walmart, Uber, and Alibaba to procure $25 million in protective medical supplies to ship to hospitals in need to circumvent a tied-up supply chain and bureaucracy.3

Get an overview of Brand Intimacy here.

Read our detailed methodology here and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.