Overview

- LVMH ranks 23rd out of 25 brands in our Brand Family rankings, based on our latest Brand Intimacy Study.

- With an average Quotient Score of 28.5, LVMH’s relatively poor performance as a brand family contrasts with the conglomerate’s global business success.

- To learn more about Brand Family rankings, visit here.

Introduction

In today’s fast-paced and ever-evolving marketplace, brands continuously strive to forge deep connections with their customers and aim to create a sense of emotional attachment that transcends mere transactions. To understand the dynamics of Brand Intimacy, we conduct an annual Brand Intimacy Study that examines hundreds of individual brands across various industries. This year, for the first time, we have added a different focus, and segmented and analyzed leading brand families to understand how these powerful, culture-shaping portfolios win our hearts and minds.

This review encompassed a wide spectrum of conglomerates including luxury, consumer goods, technology, and automotive, to name a few. To be a ranked brand family, conglomerates needed to have at least three of their portfolio brands in our latest Brand Intimacy Study.

One of the most notable findings was the disappointing performance of LVMH, a globally recognized and successful brand conglomerate. Despite its prominence and far-reaching influence, LVMH’s ranking in our Brand Intimacy Family Rankings was underwhelming, placing 23rd out of the 25 companies we assessed. This raises questions about the factors influencing Brand Intimacy within conglomerates and the specific challenges LVMH faces in fostering emotional connections with its consumers. How can such a successful group be so challenged in building strong bonds?

The History of LVMH

To understand LVMH’s journey and the context of its current state, it is essential to explore the brand’s origin. Louis Vuitton, founded in 1854, emerged as an iconic luxury brand renowned for its exquisite luggage and accessories. Over time, the company expanded its offerings, becoming synonymous with elegance, craftsmanship, and exclusivity. This success ultimately paved the way for the establishment of LVMH in 1987, when it transitioned into a multinational conglomerate through strategic acquisitions and partnerships.

Despite its challenges in the realm of Brand Intimacy, LVMH has undeniably achieved exceptional worldwide success. According to Forbes, LVMH Moet Hennessy Louis Vuitton is currently the world’s biggest luxury conglomerate, reaching a historical milestone when it recently became Europe’s most valuable company ever, with its market cap exceeding $500 billion.1 With a collection of over 75 prestigious brands, 79.2 billion euros in revenue in 2022, and 5,600 across the world, LVMH’s global presence is stronger than ever.2 LVMH currently boasts an extensive portfolio of prestigious brands, spanning luxury goods, fashion, spirits, wines, and more. Its influence extends across continents, captivating consumers with its representation of luxury and sophistication. Notably, LVMH recently acquired a majority stake in Platinum Invest group, a French jewelry manufacturing company, after its acquisition of Tiffany & Co. in 2019.3

The Challenge with Luxury and Intimacy

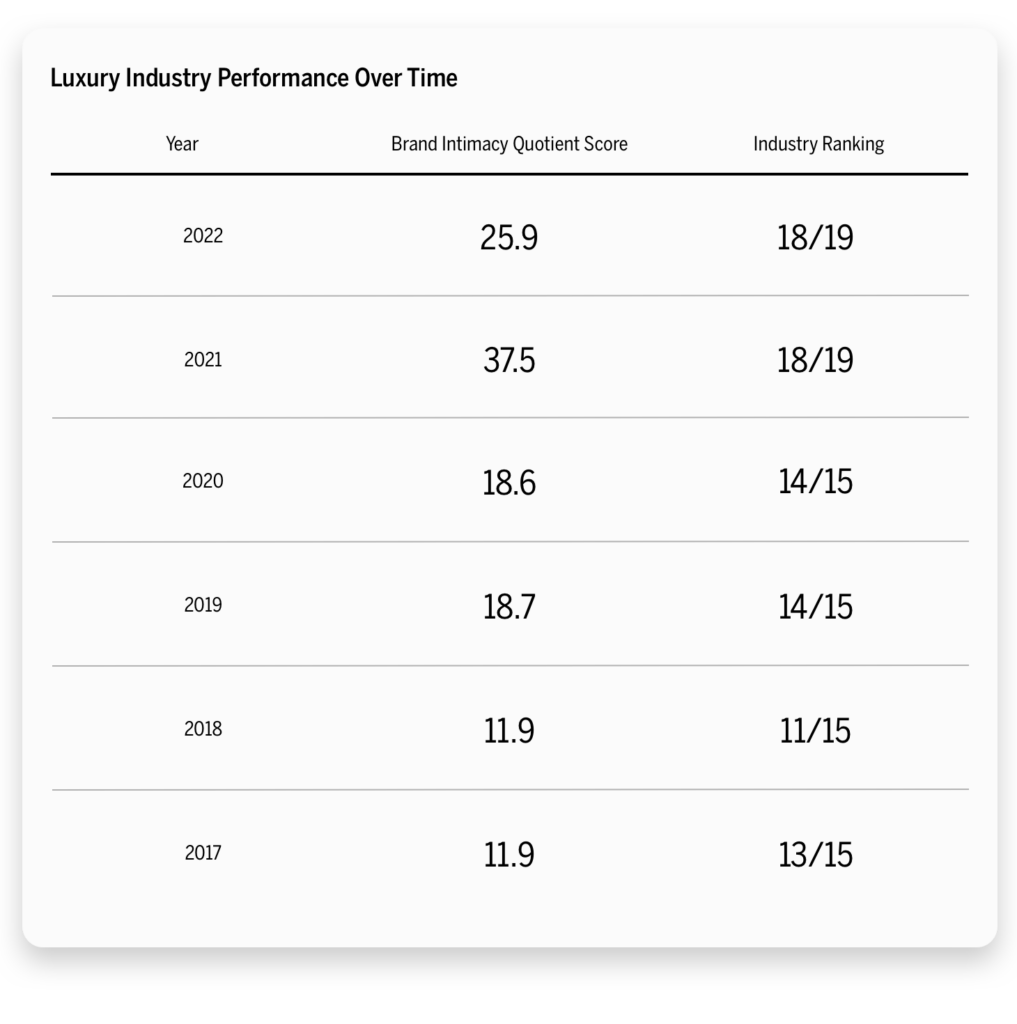

Historically, our studies have observed a recurring pattern among luxury companies in their struggle to reach relatively high levels of Brand Intimacy. By looking deeper into this trend, we can delve into the specific dynamics that hinder building emotional bonds within the luxury industry and gain a better understanding of LVMH’s unique position and challenges. The inherent nature of luxury, characterized by exclusivity, aspiration, and a sense of unattainability, often presents challenges in establishing deep emotional connections with customers.

Luxury brands struggle to create intimate relationships based on the bonds they form with consumers, a phenomenon we detailed in a previous article on the luxury industry.

Overall, luxury products are accessible only to a select, elite group of consumers who are able to afford and indulge in the pricey goods that luxury brands produce. This alone makes the category appear distant and unattainable to the majority of consumers who fall outside the upper class.

However, even within the audience of affluent luxury consumers, the taste for opulent goods has waned in recent years. It is reported that in 2018, only 25% of American affluents were expected to spend more on luxury, as compared with 31% in 2016, a statistically significant difference.4 This trend was presumably amplified by COVID-19’s impact on the US economy and consumer spending. Research shows Americans have begun to spend more cautiously in the wake of the pandemic. In April 2023, consumer spending (as measured by credit card spending) declined by more than 3 percent from a year ago.5 Among retail industries, jewelry retailers saw the largest negative change, -12 percent, in year-over-year spending.6 However, other markers indicate a fierce, post-pandemic comeback; the STOXX Europe Luxury 10 Index has risen by 22.81% as of June 12, 2023, after reaching an all-time high in April.7

Our analysis of luxury brands also shows they often employ covert or hushed marketing strategies, which can be perceived as distant or indifferent, effectively fostering an exclusive aura that further distances them from consumers.

Moreover, there exists a sense of guilt and unease in openly acknowledging an emotional bond with a luxury brand. While mainstream brands focus on seamless, personalized, and digitally-driven experiences, luxury brands tend to shun or selectively embrace such encounters to safeguard their existing status and avoid appealing to the masses.

Brand Performance within the LVMH Family

Although the LVMH family of brands includes over 75 individual companies, our study uses data from the most intimate brands in the LVMH family, as previously ranked individually in our most recent Brand Intimacy Study.

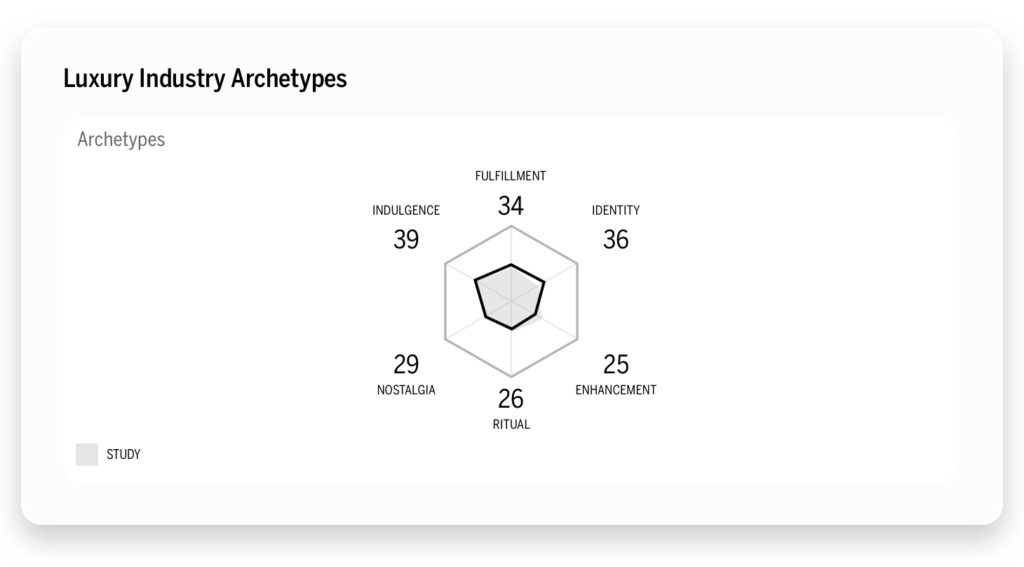

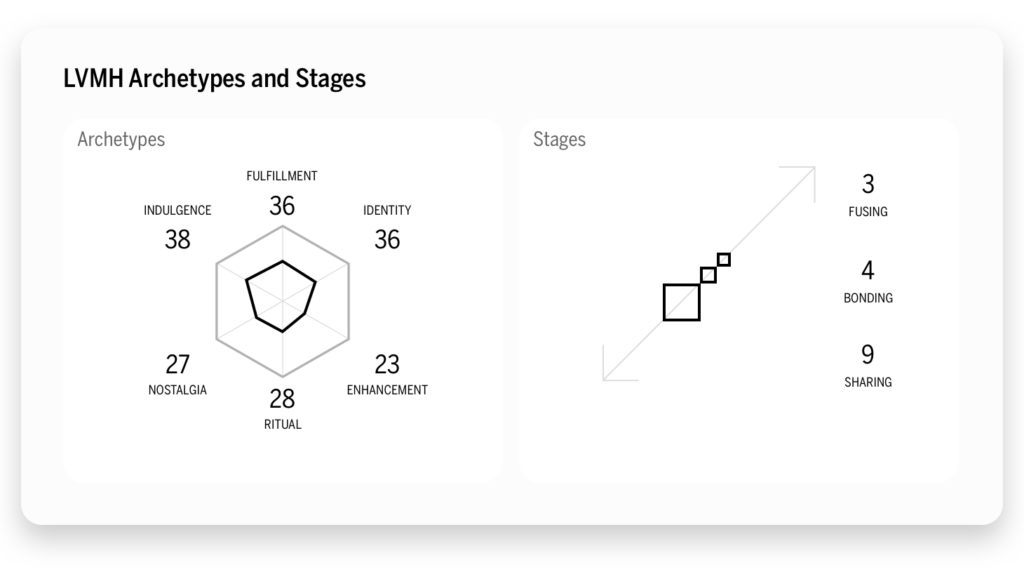

Unsurprisingly, the dominant archetype is indulgence, which describes a brand that creates a close relationship centered around moments of pampering and gratification that can be occasional or frequent.

Looking at stages, we find that an average 8.5% of customers are in the earliest stage of intimacy, sharing; 3.76% are in the bonding stage; and only 2.79% are in fusing, the most intimate stage. When compared to the top performing brand family, Amazon.com, Inc.—which boasts 21.5% of customers in the sharing stage, 8.06% in bonding, and 7.46% in fusing, we see how LVMH fails to measure up, especially in the most preliminary stages of intimacy.

Also of note is the distinction in Brand Intimacy performance between luxury fashion brands and beauty brands that fall under LVMH. Of the 10 LVMH brands in this study, Sephora performs far better than any other LVMH brand, ranking 55th out of 435 brands with a Quotient Score of 48.4. The next best performing LVMH brand, Dior, ranks 212th, with a Quotient Score of 36.3. Fenty Beauty, the other beauty brand in the category, ranks 271st, outperforming every other luxury brand with the exception of Dior.

This split can be further observed by breaking down dominant archetypes. Sephora and Fenty Beauty’s dominant archetype is fulfillment, which describes a brand that exceeds expectations and delivers superior service, quality and efficacy.

A possible explanation is that beauty brands are often perceived as more accessible than luxury brands for several reasons. For one, the price points of beauty products are generally lower compared to luxury goods. This affordability allows a wider range of consumers to engage with and purchase beauty products without a significant financial burden. Additionally, beauty brands often employ effective marketing strategies that target a broader consumer base and leverage social media, influencer collaborations, and diverse advertising campaigns to reach a larger audience. Beauty campaigns, especially in recent years, frequently prioritize inclusivity and diversity by offering a wide range of products tailored to various skin tones, hair textures, and individual preferences. This emphasis on accessibility and inclusivity fosters a sense of connection and relatability among consumers, making beauty brands more approachable and attainable than the exclusivity often associated with luxury brands.

Conclusion

Despite LVMH’s relatively poor performance in our Brand Intimacy Study, the conglomerate remains a formidable global powerhouse in the luxury industry. Although the study highlights the challenges LVMH faces in fostering deep emotional connections with consumers, its overall success can be attributed to a combination of factors. LVMH’s strategic acquisitions and brand autonomy contribute to its ability to capture a significant market share and maintain a strong global presence. The conglomerate’s commitment to excellence and innovation has solidified its position as a leader in luxury goods and experiences.

Luxury brands’ use of secretive marketing tactics to create an exclusive image means many consumers feel isolated or turned off by what the brands offer. In response, some brands are trying to stay relevant by forming partnerships and appealing to younger audiences.

LVMH continues to thrive and shape the industry, showcasing its resilience and adaptability in a volatile marketplace. However, our research shows brands that invest in building stronger emotional connections experience significant financial advantages. Top intimate brands outperform major financial indices across profit, revenue, and stock price. Consumers are willing to pay more for intimate brands and are less willing to live without them. Furthermore, intimate brands are about long-term relationships, which provide stability in times of crisis. As such, although LVMH is far from struggling, it still stands to benefit greatly from building and strengthening connections with its consumers.

Get an overview of Brand Intimacy here.

Read our detailed methodology here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Sources

1 “Ranking The 10 Most Popular Luxury Brands Online In 2023.” By forbes.com https://www.forbes.com/sites/greatspeculations/2023/06/20/ranking-the-10-most-popular-luxury-brands-online-in-2023/?sh=57a75a401632

2 “Financial Indicators.” By LVMH.com https://www.lvmh.com/investors/profile/financial-indicators/#groupe

3 “LVMH Acquires French Jewelry Manufacturing Group To Strengthen Capacities Of Tiffany & Co.” By forbes.com https://www.forbes.com/sites/anthonydemarco/2023/04/13/lvmh-acquires-french-jewelry-manufacturing-group-to-strengthen-capacities-of-tiffany–co/?sh=3649a1f32826

4 “American Affluents Plan To Pull Back On Luxury Spending — Are Luxury Brands Ready For This?” By forbes.com https://www.forbes.com/sites/pamdanziger/2018/05/24/the-thrill-is-gone-american-affluents-plan-to-pull-back-on-luxury-spending/?sh=32475239640d

5 “A monthly update on the state of the US consumer: June 2023.” By mckinsey.com https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/a-monthly-update-on-the-state-of-the-us-consumer

6 Ibid

7 “Ranking The 10 Most Popular Luxury Brands Online In 2023.” By forbes.com https://www.forbes.com/sites/greatspeculations/2023/06/20/ranking-the-10-most-popular-luxury-brands-online-in-2023/?sh=57a75a401632