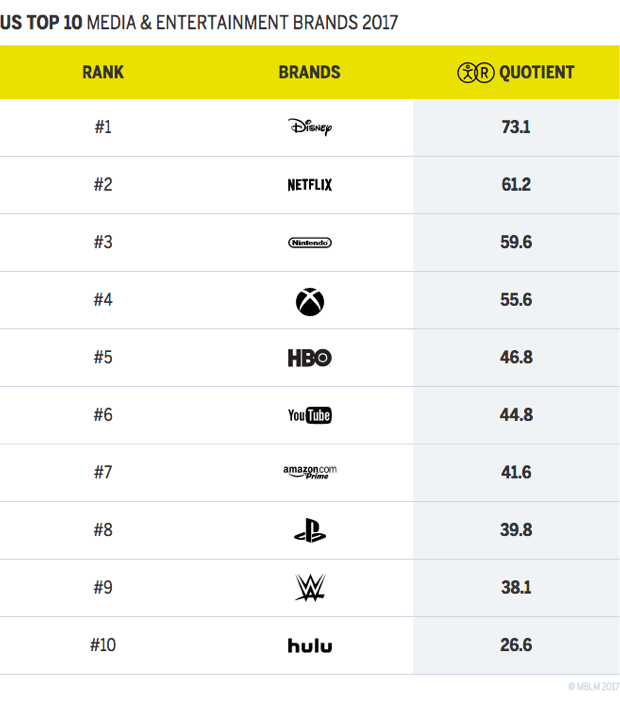

Media & entertainment is the second most intimate industry in the 2017 Brand Intimacy Study, which shouldn’t come as a surprise, as these brands are built around providing emotive content (movies, TV, video games, etc.), and they tend to ask little of their consumers. But because the industry has jumped from #5 in 2015 to #2 this year, it’s worth considering why there has been such improvement and which brands have done the most to capitalize on them. For half of our Top 10 Most Intimate Brands in media & entertainment, their primary or secondary focus is video streaming (#2 Netflix, #5 HBO, #6 YouTube, #7 Amazon Prime, #10 Hulu).

Why Media & Entertainment, and Why Now?

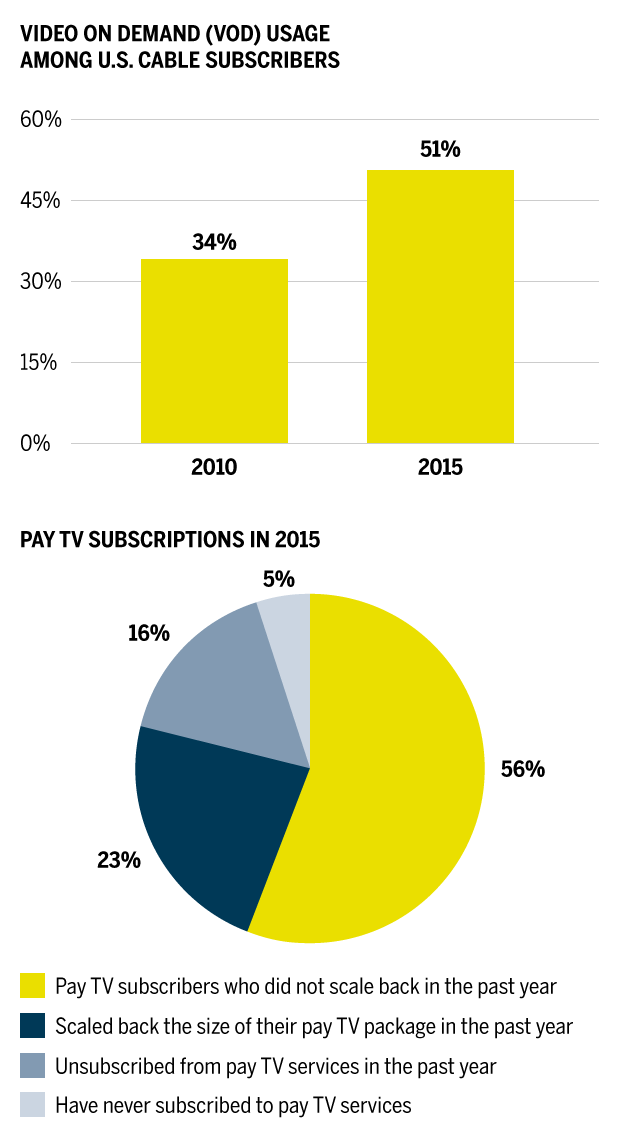

More consumers are realizing the convenience and flexibility of streaming and video on demand (VOD), and opting for these services over traditional pay TV subscriptions. In 2015, 16 percent of U.S. viewers unsubscribed from their pay TV subscriptions and 23 percent scaled theirs back.1 VOD is growing in popularity among U.S. cable subscribers, as 51 percent used VOD in 2015, compared to just 34 percent in 2010.2 Consumers are becoming more attached to internet-based video services, and one of the reasons is the rising popularity of binge-watching.

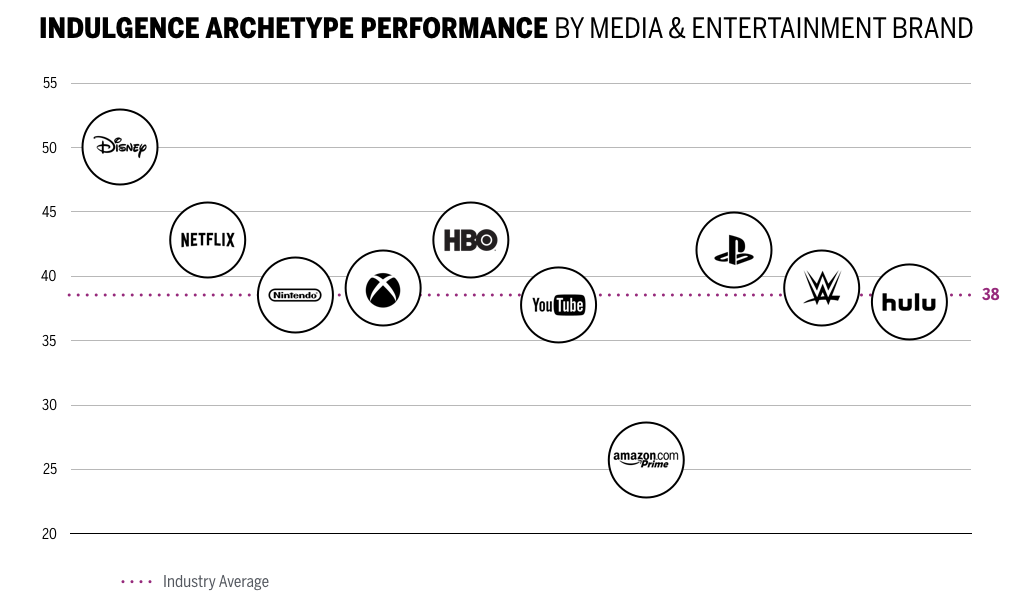

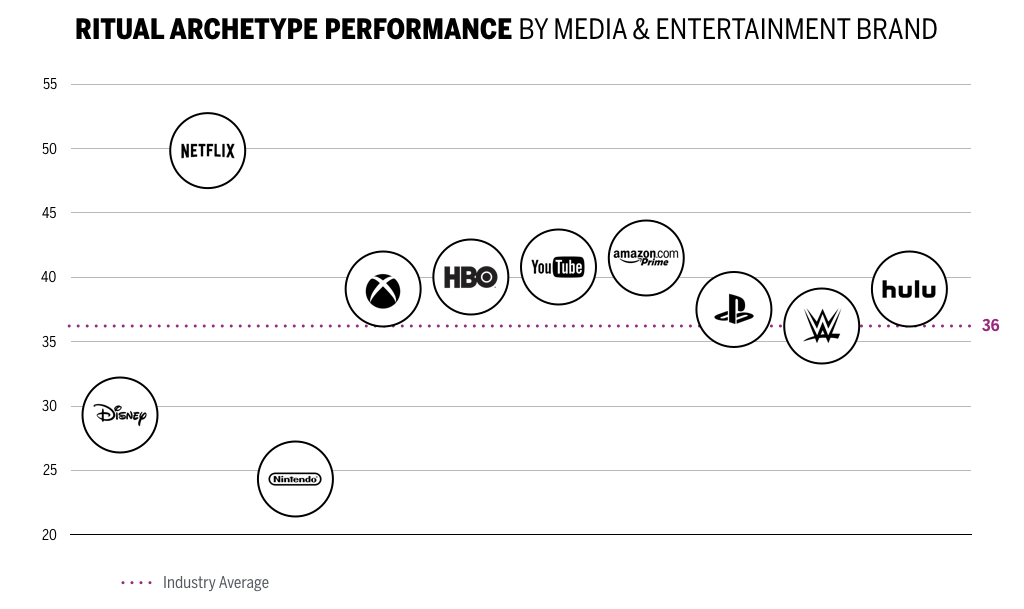

Approximately 42 percent of viewers binge-watch a show at least one to two times per month,3 and that number is likely to rise, especially for Netflix, which saw an astounding 30 percent increase in binge-watching activity among its users between March and May 2016.4 In the context of Brand Intimacy, this binge-watching trend could help explain the rise in intimacy between video streaming brands and their consumers. In our study, the archetype most associated with the media & entertainment industry is indulgence, which characterizes a brand relationship as being centered around moments of pampering and gratification, followed closely by the ritual archetype (ingraining a brand into daily actions, more than habitual behavior). Fulfillment (exceeding expectations; delivering superior service, quality and efficacy) is also an important archetype for the category, especially for streaming services (#1 Amazon Prime, #2 Netflix). Increased frequency of use helps build stronger bonds and aligns specifically to becoming an ingrained habit, providing escape, and being a reliable indulgence.

Streaming trends aren’t the only thing boosting Brand Intimacy in the media & entertainment industry. An overriding theme we’ve theorized from the Brand Intimacy findings this year is the increase in escapism. Possibly due to stress from rising uncertainty due to a tense economic and political climate, U.S. consumers aren’t as happy as they have been in recent years. About 78 percent of Americans are dissatisfied or angry with the way the federal government has been working.5 Also, the 2016 presidential campaign made Americans more uneasy, as roughly one-third of both Democrats and Republicans were disappointed or upset with their party’s candidate,6 and 61 percent of voters weren’t satisfied with having to choose between the two.7

Whatever tensions U.S. consumers have taken on, it seems they’ve been able to find comfort in entertainment. This helps explain this category’s rise in our study, along with the improved performance of the consumer goods industry (from #7 in 2015 to #5), which we also consider to be an industry of escape or comfort. In general, unhappiness is correlated with a higher daily consumption of TV,8 and based on the recent content trends, it appears that consumers have been taking an escapist attitude toward their viewing choices. In 2016, six of the 10 most popular TV shows were either sci-fi or fantasy (#1 “Game of Thrones,” #2 “The Walking Dead,” #4 “Westworld,” #5 “The Flash,” #7 “The OA,” #8 “Stranger Things”),9 which indicates that viewers may be trying to take refuge from real-world anxieties.

This trend in consumer escapism has also drawn some viewers to more nostalgic content, which has worked out exceptionally well for Disney. The industry leader and #1 in the study for the nostalgia archetype, Disney is the #2 most intimate brand overall, up from #6 in 2015. It has a natural link to nostalgia for many consumers who are familiar with Disney’s iconic children’s movies (especially among millennials), but based on its recent acquisitions, the brand seems to want to strengthen this association even more. Disney’s acquisitions of Marvel Entertainment in 2009, and of Lucasfilm in 2012,10 are investments in iconic and familiar franchises, allowing the brand to cash in on nostalgic moments and intertextual references that are inherently exciting to viewers. This year, Disney became the first movie studio to top $7 billion in ticket sales,11 with four out of the top 5 grossing movies, three of which were based on existing franchises (#1 “Captain America: Civil War,” #2 “Finding Dory,” #4 “The Jungle Book”).12 And its empire of nostalgia is expanding physically as well, with the upcoming openings of two new theme parks: Pandora — World of Avatar in 2017, and Star Wars Land in 2019. (Universal currently owns the rights to Marvel theme parks).13

Why Netflix Is Winning

Clearly, Netflix has been the beneficiary of the recent streaming and binge-watching trends, with a 12 percent month-over-month increase in binge-watching among its U.S. users in 2016,14 and a jump from approximately 75 million subscribers in 2015 to nearly 94 million in 2016.15 Each year we highlight a particularly powerful intimate brand and this year it’s Netflix. Before jumping from #25 to #5 in our Brand Intimacy Study, its stock had gone up 500 percent between 2010 and 2015,16 and when traditional TV audiences dropped three percent in 2015, about half of it was because of Netflix.17 In January 2016, Netflix launched in 130 countries around the world, extending its reach to every major market except for China,18 and by the end of 2016, it had released an estimated 128 original series/films (more than any other single network or cable channel in the U.S.).19

There’s no doubt that the brand’s expanded audience and explosion of original content have improved Netflix’s ability to form more intimate bonds with consumers. Its rate of customers in the fusing stage of intimacy is roughly the same as it was in our previous study, but its bonding rate has shot up from seven percent to 17 percent, and its sharing rate has gone from 26 percent to 30 percent. The brand has also seen a dramatic improvement in its scores for the industry’s two most associated archetypes. From our previous study, Netflix has moved from #10 in the category for indulgence to #2, and for ritual, has gone from #5 to #1. The two charts below show how media & entertainment brands perform in the indulgence and ritual archetypes.

Apart from a few favorable trends, Netflix’s business success and rise in Brand Intimacy stem from its complete commitment to understanding and satisfying its users. Using a global algorithm that looks past demographics like geography, gender, and age, Netflix organizes its users by what they like, and makes recommendations based on viewers with similar tastes from all over the world.20 This creates a sense of being anticipatory and understanding its customers, gaining traction in building relationships. Netflix has also rolled out new features that give its users more freedom, like an offline viewing option21 and in-app subscriptions for their iOS app (which quickly made it the top-grossing app in the U.S. App Store).22 Netflix hasn’t been blind to the consumer escapism and nostalgia trends, either. Of its top 5 most popular shows of 2016, three were sci-fi/fantasy (#2 “Stranger Things,” #4 “Luke Cage,” and #5 “Daredevil”), and #3 was the nostalgia-heavy “Full House” revival, “Fuller House.”23

With more content, more options, and a better understanding of its users, Netflix has been able to establish itself as a staple in people’s lives, something they rely on to make life easier and more enjoyable.

Consumer and technology trends are working in favor of the top media & entertainment brands, and many are making smart moves to capitalize even further. In general, it appears that the top brands are listening to consumers, creating content and experiences that they know customers will want to indulge in, and finding ways to fit themselves into existing consumer behaviors so that they can become a part of their daily rituals. We expect this industry to continue to grow in intimacy, as media & entertainment becomes more accessible, more targeted, and more immersive, allowing brands to form stronger bonds with consumers.

Why Brand Intimacy?

Why does a stronger Brand Intimacy Quotient matter? Intimate brands create significant business performance. The Top 10 Most Intimate Brands have outperformed established financial indices for both revenue and profit growth over the last 10 years. In addition, these brands command a price premium, enjoying more financial resilience than brands in the same industries that are not intimate.

Get an overview of Brand Intimacy here.

Read our detailed methodology here and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. To learn more about our Agency, Lab, and Platform, visit mblm.com.