Overview

- Apple is the #1 brand in all three countries surveyed in the 2018 Brand Intimacy Study (the U.S., UAE, and Mexico)

- The brand’s rich ecosystem of products and services and its ability to build emotional connections with a wide range of audiences are key elements of its success

- The character of the relationships Apple forms with users varies from country to country

- Amazon and Google are seen as possible challengers to Apple’s dominance in the future

Apple is the most dominant brand in the 2018 Brand Intimacy Study by a significant margin. While its popularity and strength as a brand are well known, our study reveals the true nature, depth, and breadth of its ability to connect with consumers on an emotional level.

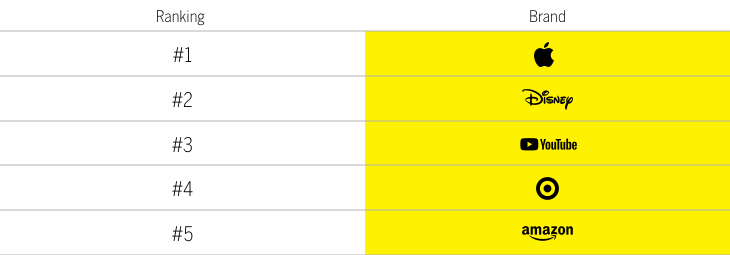

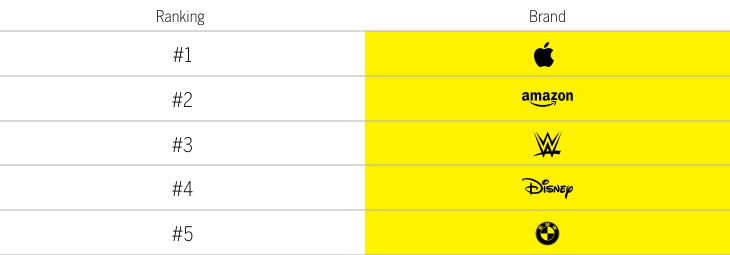

Top 5 most intimate brands per country

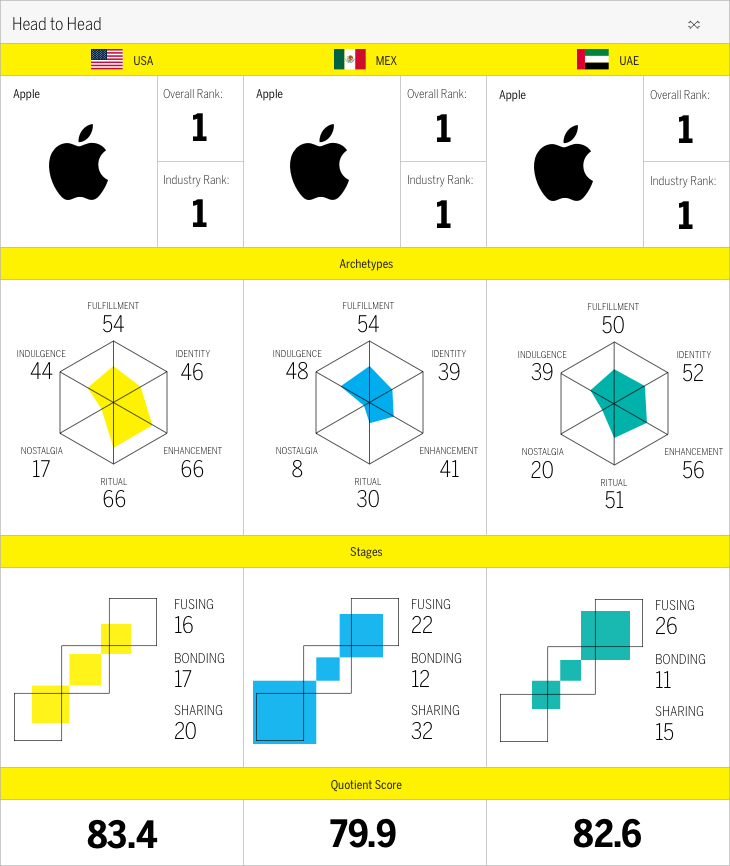

The technology giant is the #1 brand overall in all three of the countries we surveyed (the U.S., UAE, and Mexico), and leads the technology & telecommunications industry in each geographical region by more than twenty points. In the U.S. and UAE, it has been the #1 brand for all three years of our study. Apple is also the #1 brand in all three countries for its percentage of users in the most advanced stage of Brand Intimacy, fusing, which describes a relationship in which a person and a brand are inexorably linked and co-identified. This international success in forming the strongest connections with consumers is unique to Apple and indicates that the brand resonates deeply with a wide range of consumers from different regions.

Apple’s unprecedented performance warrants thorough analysis. So, using data from our study along with observations about the brand and the competitive landscape, we are unpacking the success of Apple, how it’s achieved such high levels of Brand Intimacy so far, and what the future holds for this beloved brand.

A history of intimacy

Apple has shown an impressive performance in the past three years of our study. By looking at its progression, we can gain insight into how its intimacy has grown.

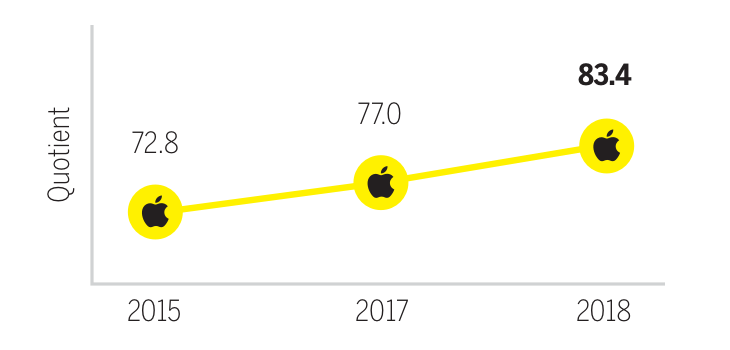

Apple’s 3-year performance

In the U.S., Apple’s Brand Intimacy Quotient has increased each year, from 72.8 in 2015 to 77.0 in 2017 and 83.4 this year. The brand also has increased its lead over the #2 brand, going from a 1.7-point lead over BMW in 2015 to a 3.9-point lead over Disney and, finally, a 16.9-point lead over Amazon today. This increasing lead indicates that Apple continues to build intimate bonds with its users, and the bonds are getting stronger as Apple also has increased its rates of consumers in all three stages of intimacy.

Grown in a walled garden

Apple’s ability to inspire high levels of Brand Intimacy in so many consumers is a result of several factors: it’s known for high-quality products, it has a history of innovation and industry leadership, it develops technology that is easy to use and (generally) accessible, and its marketing has always set the brand apart, both in style and in message. But the loyalty of Apple users is built on more than merit or reputation alone; it comes from the brand’s rich, seamless ecosystem of devices, software, and services.

This “walled garden” that Apple has created makes each of its products a reason to buy the others: if you want to have your phone and laptop in perfect sync, you need to buy a Mac and an iPhone; if you want to listen to music on the HomePod, you need a subscription to Apple Music. This ecosystem makes choosing Apple a commitment for consumers and a statement about who they are. The effects of Apple’s walled garden can be seen in its extremely high rates of customers in the fusing stage as well as in its high scores in the identity archetype (#1 in the UAE overall and #2 in the U.S.).

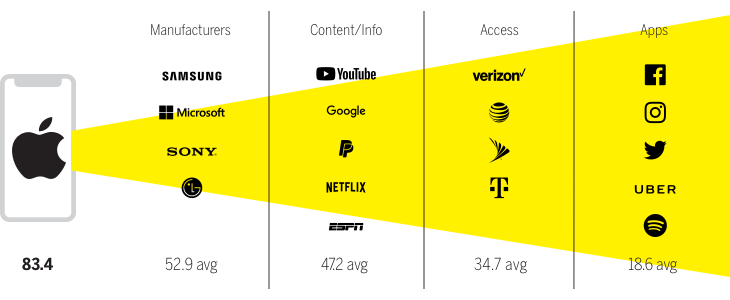

The Smartphone Ecosystem

Apple has not only benefitted from the ecosystem of its own products and services, it has capitalized on what we call the Smartphone Ecosystem, which is made up of device manufacturers like Apple, content services like Netflix, service providers like Verizon, and apps like Facebook. In a recent article we explain that the most intimate brands, on average, in the Smartphone Ecosystem are the device manufacturers. Although apps, service providers, and content/information services all provide value, users have a tendency to see them as utilities they are entitled to or as mere extensions of the device, making device manufacturers like Apple the ultimate heroes.

Apple isn’t the only brand that’s built a robust ecosystem. Amazon has expanded beyond its role as an online retailer to create smart devices, streaming platforms, and original content, and although Amazon’s garden isn’t as insulated as Apple’s, the brand has increased its presence in consumers’ homes, which may give it a unique advantage in years to come. Amazon has slowly been climbing the ranks of the Brand Intimacy Study since 2015 and is now the #2 brand overall in the U.S. (and it may be the biggest challenger to Apple). Google is another technology & telecommunications brand that has been building out its ecosystem, expanding into smart speakers, phones, and more. This year in our study, Google moved from #14 in the U.S. to #10.

Apple’s most intimate demographics

Apple is the most intimate brand overall in the U.S., but certain groups have particularly strong feelings about it. Among millennials, Apple has a Brand Intimacy Quotient of 94.0 (over ten points above its overall average), making it the most popular brand for that age group.

Top 5 most intimate brands for millennials

High-income individuals have an even deeper connection with the brand. For those earning over $100,000 per year, Apple has a Brand Intimacy Quotient of 105.9.

Top 5 most intimate brands for users with incomes greater than $100,000

Apple also does better with men than it does with women with an average Brand Intimacy Quotient of 89.2 for men compared to 78.1 for women. While the brand is successful at building bonds with a range of audiences, it is clearly resonating more with those three groups. This data gives insights into how Apple has created strong relationships with certain demographics, but it also reveals opportunities for the brand to connect more with consumers who have slightly less intimate feelings toward it.

Forming different connections with different countries

Although Apple has achieved high levels of Brand Intimacy across our three geographical regions, the nature of the bonds it has formed varies from country to country.

The Brand Intimacy archetypes are patterns or markers that identify the character of ultimate brand relationships. When comparing Apple’s archetype performances in the three countries, it’s clear that consumers in those regions have different associations with the brand. For example, in the U.S. and UAE, Apple has a stronger association with the ritual archetype, which describes a brand as being ingrained into a user’s daily actions, than it does in Mexico. This is also true for the enhancement archetype, which is characterized by a user becoming smarter, better, and more connected through the use of the brand. Although Apple’s enhancement score is not low in Mexico, it’s significantly higher in the U.S. and UAE.

Another notable difference is Apple’s strong tie to the identity archetype in the UAE. This archetype describes a brand that reflects an aspirational image or admired values and beliefs, and Apple represents a lifestyle and mindset that resonates deeply with many UAE consumers.

There are some similarities in the archetype scores across regions. For all three, Apple leads the technology & telecommunications industry in its score for the indulgence (creating a close relationship centered on moments of pampering and gratification) and fulfillment (exceeding expectations, delivering superior service, quality, and efficacy) archetypes. In general, Apple’s strong performance in a range of archetypes shows how the brand is able to build different associations with its users, giving its Brand Intimacy profile a healthy balance and allowing it to avoid being defined by a single characteristic.

Apple’s performance is the strongest in the U.S., but the Brand Intimacy stages reveal that it has significantly higher percentages of customers in the fusing stage in the other two countries with 16 percent in the U.S., 22 percent in Mexico, and 26 percent in the UAE.

Will Apple ever fall from the tree?

Apple has achieved the highest levels of Brand Intimacy in three significantly different markets, and it seems to be getting better at connecting with consumers every year, but can it continue to maintain its status as the most intimate brand? As mentioned previously, major players in the technology space, like Amazon and Google, are expanding their offerings and building Brand Intimacy. Each brand has unique elements in its ecosystem that could threaten Apple’s dominance: Amazon is a retail powerhouse that is expanding its presence in the modern home and increasingly investing in content creation and acquisitions like Whole Foods, and Google is creating devices that are in direct competition with Apple’s, and it owns YouTube, a preferred brand of millennials and Generation Z and the most popular music streaming service.

Apple has the upper hand at the moment, but its immense success (and likely its intimacy with consumers) has largely been the result of the revolutionary iPhone, a product that debuted over a decade ago. While there isn’t a clear indication that Apple will be eclipsed in the coming years of the Brand Intimacy Study, brands like Amazon and Google hold unique advantages in this space that could afford them new opportunities as the landscapes of technology and entertainment change in the near future.

Apple’s endgame?

As technology brands continue to offer new devices and services to get closer to consumers, it’s unclear how Apple will expand its walled garden to keep competitors at bay. The beloved brand continues to release iterations of its popular devices with new additions like the Apple Watch, HomePod, AirPods, and iPad Pro + Pencil, but none have had the impact or influence of the iPhone. Will the brand maintain its #1 spot in the hearts of consumers while technology trends like artificial intelligence, smart homes, autonomous vehicles, virtual/augmented reality, and original content evolve? Will the future leader in the technology category build on Apple’s successes, or can the world’s most intimate brand find ways to protect its leadership position?

Read our detailed methodology here.

To learn more about MBLM, click here.