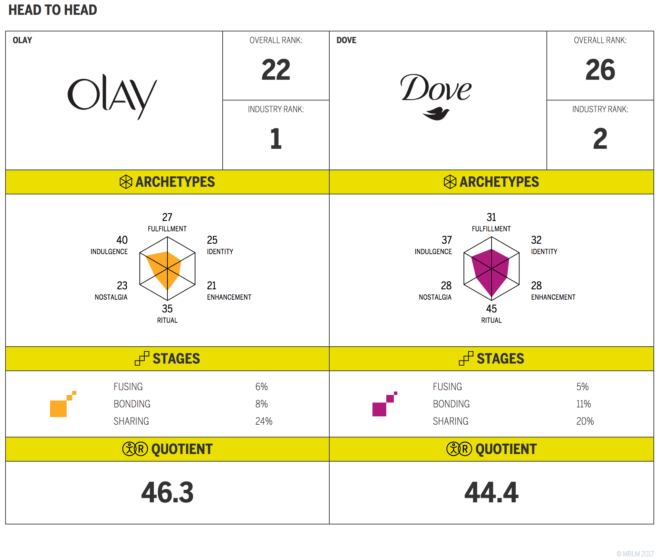

In our 2017 Brand Intimacy Study, the health & hygiene industry is led by two global brands: Olay and Dove. Both brands are ranked in the Top 30 of our study and have strong Brand Intimacy Quotients, with 46.3 for Olay and 44.4 for Dove. Both brands scored substantially higher than the category’s number three brand, Crest, which has a quotient of 28.1. Although these two industry leaders are both widely popular and sell many of the same kinds of products (lotions and moisturizers, soaps and body wash, etc.), they approach Brand Intimacy from different perspectives.

The health & hygiene industry seems inherently intimate because its products are generally used directly on skin and in hair and mouths, and yet it ranks 9th out of the 15 industries in our study. This is likely because the category is complex and multifaceted. It is simultaneously associated with health and beauty, maintenance and appearance, cleanliness and youthfulness, and self-improvement and vanity. For some, this is why brands in this category can be so special. The right product can make you feel cleaner, healthier, more attractive, and more confident. But health & hygiene brands must ultimately choose between being seen as a beauty brand, highlighting the benefits related to physical appearance, or as a personal care brand, emphasizing health and comfort.

When we look at Olay and Dove, we see two brands with different approaches to Brand Intimacy. Both brands highlight the quality and efficacy of their products, but they promote distinct purposes (or benefits) of those products. Olay is dedicated to creating “ageless beauty,” helping consumers get younger, more beautiful skin, whereas Dove promotes “real beauty,” encouraging consumers to nourish both their skin and their self-confidence. These are two very different messages.

To better understand this difference from a Brand Intimacy perspective, we can examine each brand’s association with the Brand Intimacy archetypes, which are patterns or markers that identify the character and nature of brand relationships. As seen in the diagram above, Olay’s strongest archetype is indulgence, which describes a relationship centered on moments of pampering and gratification, a type of association one would expect with a beauty brand rather than a personal care brand. “Ageless beauty” could also connote benefits related to identity (which describes a brand reflecting an aspirational image or admired values that resonate deeply with consumers). However, the fact that Olay isn’t highly associated with this archetype may suggest that many believe ageless beauty is out of reach or a self-indulgent want. Compared to Olay and Dove, the rest of the health & hygiene industry has weak associations to indulgence. The category average for the archetype is 22, and its third-most indulgent brand, Pantene, scores a 28, which is far below Olay and Dove’s scores of 40 and 37, respectively. This suggests that both Olay and Dove bring an element of gratification and excitement to the category that other brands don’t.

Dove outperforms Olay in all the other archetypes. It has a much higher association with the identity archetype, which can be explained by Dove’s strong message of celebrating all types of beauty and feeling positive about the way you look. Like most brands in the category (and the category on average), Dove’s strongest association is with the ritual archetype. Brands associated with the ritual archetype are ingrained into daily actions to become a vital part of daily existence. In terms of the ritual archetype, Dove ranks 7th-highest among all brands in our study. Dove’s ranking aligns with the idea of health & hygiene products as part of a daily personal maintenance routine, rather than an occasional indulgence. Interestingly, even though Dove outperforms Olay in the ritual archetype (45 vs. 35), consumers still rely heavily on Olay. 35 percent of consumers said they can’t live without the brand, compared to only 30 percent who said the same for Dove. Dove however has a higher net promoter score (46 percent vs. 32 percent), indicating that its customers may have higher levels of overall satisfaction than Olay’s customers.

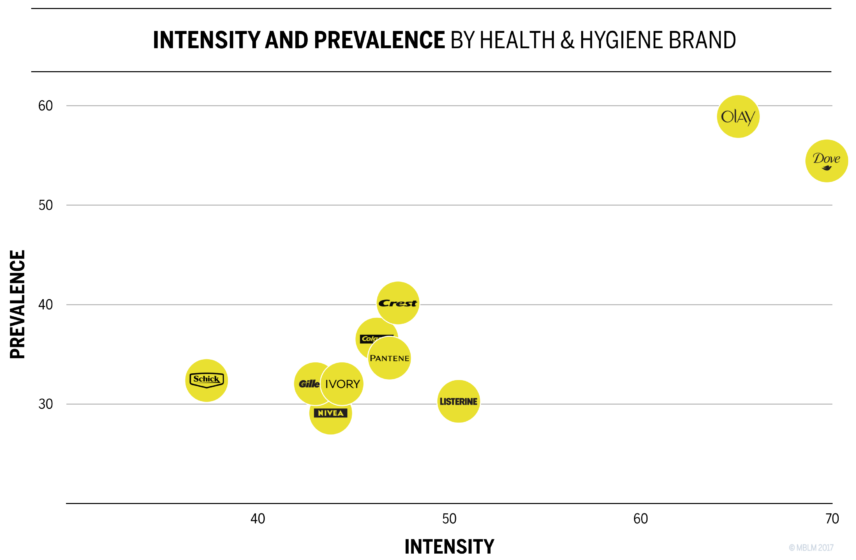

Dove has stronger associations with archetypes compared to Olay. However, Olay has more customers in some form of intimacy with the brand. To help understand each brand in more detail, we can look at the chart above, which plots each health & hygiene brand by the intensity and prevalence of its intimate relationships with consumers. Dove manages to form more intense bonds with its customers (meaning more of its customers are in the advanced stages of intimacy), but intimacy is more prevalent for Olay because it has a broader audience.

The stages of Brand Intimacy, which measure the depth of an intimate relationship, are detailed in the “Head-to-Head” diagram. Overall, the brands perform similarly, but Olay edges Dove out in the most intense stage of intimacy (fusing) and in the earliest stage (sharing). However, Dove has a significant advantage in the middle stage (bonding). Olay has more customers in stages of intimacy overall, with 38 percent compared to Dove’s 36 percent. This could be a reflection of each brand’s approach to health & hygiene. Olay may appeal more broadly to the idea of looking beautiful and young, whereas Dove connects more deeply to a narrower audience by challenging the established conventions of beauty.

Another way the brands’ differing approaches have impacted their Brand Intimacy performance is in age demographics. Although Olay and Dove perform relatively similarly across incomes, the age groups have more polarized preferences. For both age groups shown above, Olay and Dove are the top two brands, but millennials strongly prefer Dove (46.0 vs. 32.5), and older consumers tend to choose Olay (55.3 vs. 43.6). Olay’s “ageless” message may be more relevant to and connect best with an older audience. This may also suggest some attitudinal differences between generations. Older generations seem to value the more “traditional” ideals of beauty associated with Olay, whereas millennials are more likely to choose a brand with a more body-positive, empowering message.

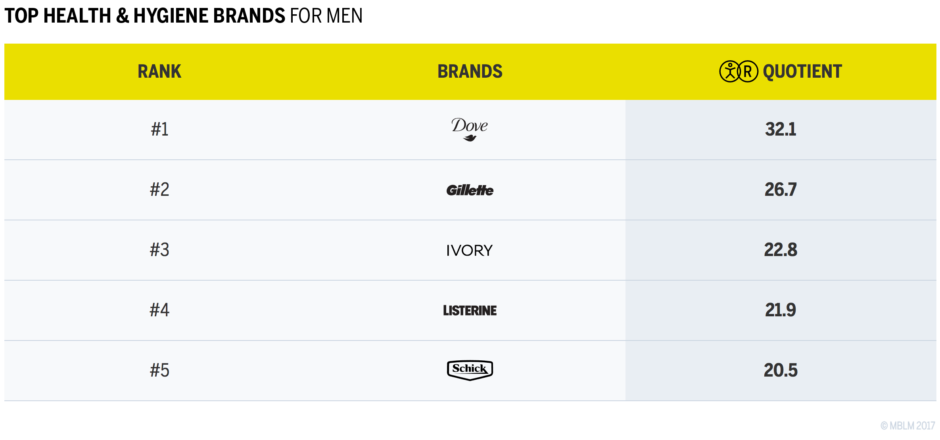

Perhaps Dove’s biggest advantage over Olay is its performance among men. With a Brand Intimacy Quotient of 32.1 among men, Dove outranks traditionally masculine health & hygiene brands, like Gillette, Schick, and Head & Shoulders, whereas Olay isn’t even ranked in the Top 10 for men, probably because it doesn’t sell any products that are specifically marketed to them. Dove’s high intimacy with men can be attributed to its reinvention of its men’s brand in 2010, when it successfully launched a new men’s line, Dove Men+Care, despite Dove’s general image as a feminine brand. Dove Men+Care remains popular; Dove’s parent company, Unilever, pointed to Dove Men+Care as an area of strong growth for the brand in 2016. This puts Dove in a particularly good position, given that the global male grooming market is expected to grow from $17.5 billion in 2015 to $60.7 billion by 2020.

Currently, Dove’s approach to building Brand Intimacy is to appeal to millennial values, emphasize an empowered and confident message, and capitalize on the growing men’s market. However, Olay appears to have big plans for deepening its Brand Intimacy as well. As a brand that’s dedicated to understanding skin to create “ageless beauty,” Olay puts a strong emphasis on the role of science and technology in the creation and application of its products. In 2016, Olay launched Skin Advisor, a service that uses artificial intelligence to recommend skincare regimens to users based on their pictures and information about their current routine. Products and services like Skin Advisor could be a tremendous opportunity for the brand, allowing Olay to further broaden its influence. More importantly, innovations like this leverage Olay’s focus on using science to give more credibility to its dedication to ageless beauty and could strengthen the brand’s association with the enhancement and identity archetypes. Going forward, it will be interesting to see if Olay begins to shift the focus of its brand to align more with these archetypes, or if it will continue to tie itself to indulgence as it has in the past.

Compared to the rest of the health & hygiene industry, both Olay and Dove have had enormous success in forming intimate relationships with consumers. Their successes may be due in part to how differently they have marketed themselves over the years, allowing consumers to distinguish each brand as an individual: one that innovates “ageless beauty” and one that empowers “real beauty.” Although consumers will always value certain characteristics inherent to health & hygiene brands, Olay and Dove show us that, as in other industries, there’s more than one way to build a successful intimate brand.

To download the full Brand Intimacy 2017 Report or explore the Ranking Tool, please visit: mblm.com/lab/brandintimacy-study/.

Read our detailed methodology here and review the sources cited in this article here.

To learn more about MBLM, click here.