Overview

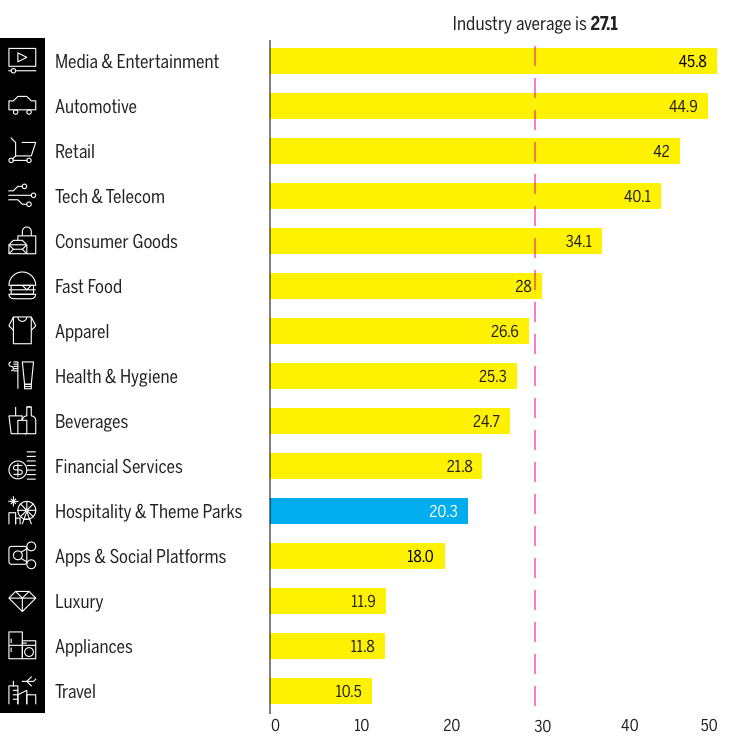

- Hospitality & theme parks is ranked #11 out of the 15 industries in our 2018 Brand Intimacy Study

- By comparing a popular hotel brand (Marriott) to a related brand from a different industry (Airbnb), we can gain valuable insights into the category

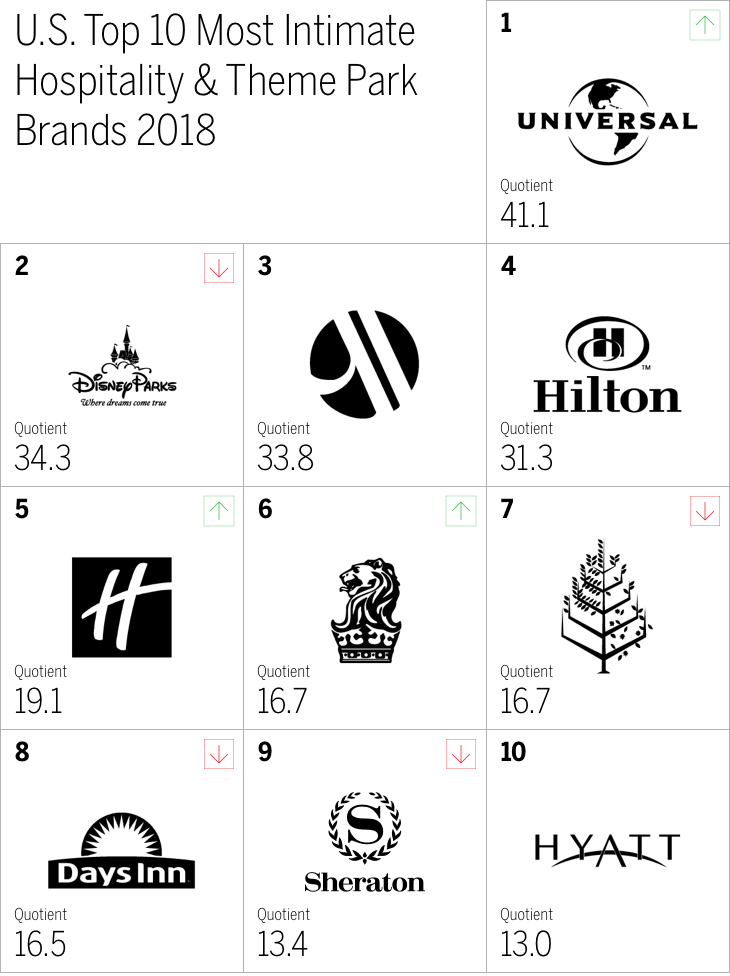

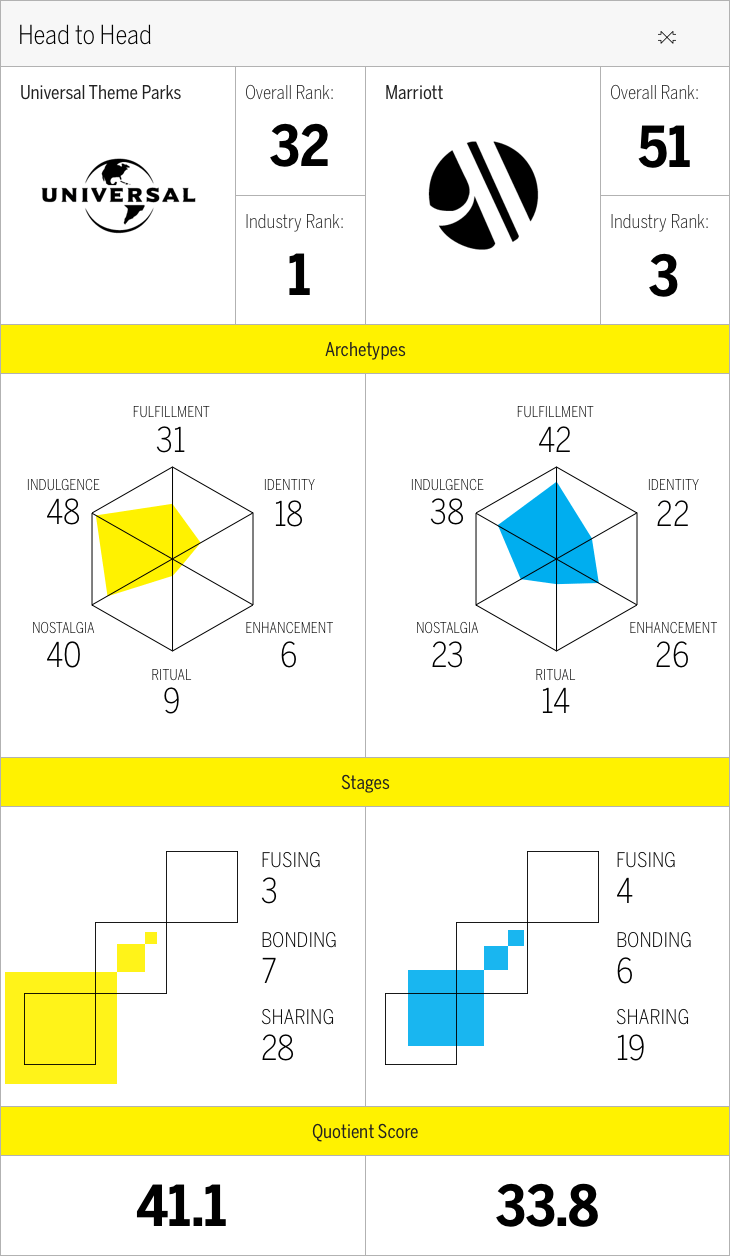

- Universal Theme Parks is the most intimate brand in the industry, ranking #32 overall

- Trends affecting the industry include the increased use of technology, a focus on experience, and the decreasing popularity of loyalty programs

When it comes to building Brand Intimacy with customers, hotels have consistently performed poorly. This is ironic given that this category offers the benefits of exploration, adventure, luxury, and pampering.

Brand Intimacy industry averages

Similar to what we see in the airline industry (the lowest-ranked industry in our 2018 Brand Intimacy Study), as hotels fight commoditization and consolidation forces, travelers are feeling increasingly less emotionally connected to these brands. These trends help explain why the industry is led by two theme park brands (Universal Theme Parks and Disney Parks), since theme parks are more easily differentiated and imbued with emotion compared to hotels.

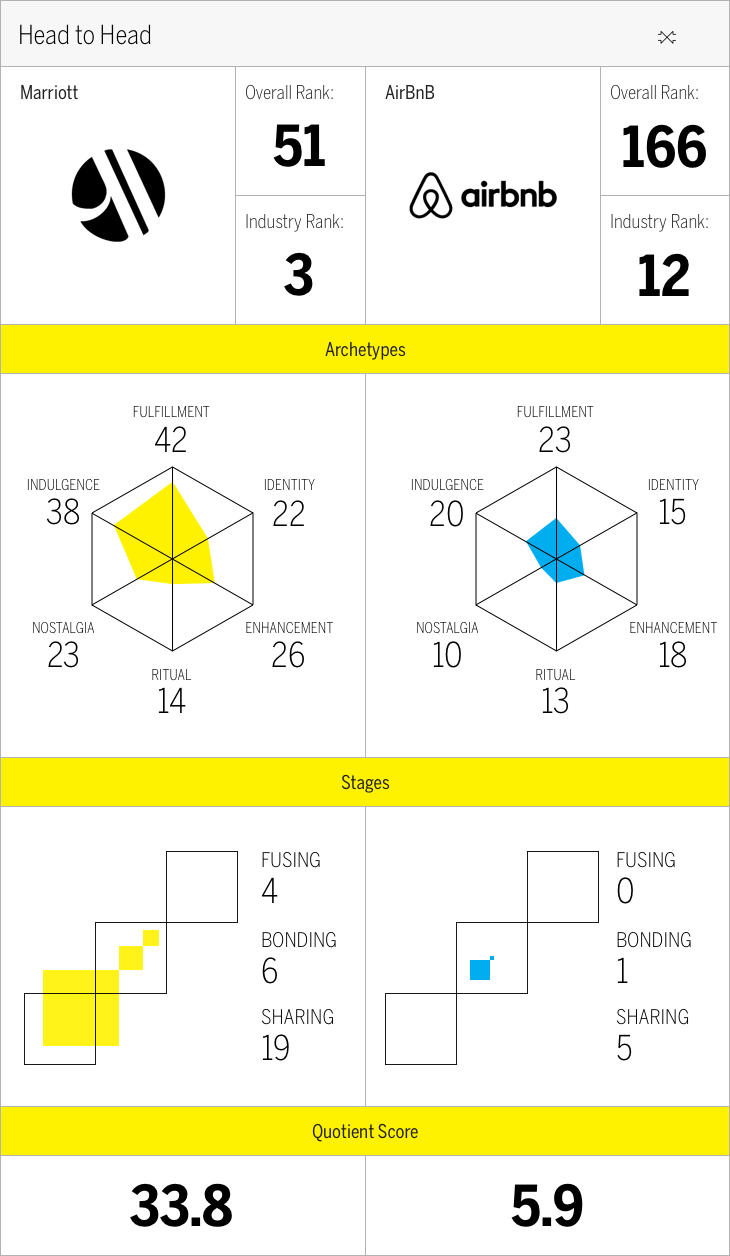

As part of our annual research and ranking of the world’s most intimate brands, we’ve taken a deeper dive into the hospitality industry. We’ve chosen to contrast two very different and opposite brands: Marriott and Airbnb. Marriott is over ninety years old and is a $23 billion enterprise synonymous with accommodations that span virtually every price point across its 1.3 million rooms in 127 countries. Airbnb is a nine-year-old, $2.6 billion business with over four million lodging listings in 65,000 cities and 191 countries.

Marriott vs. Airbnb

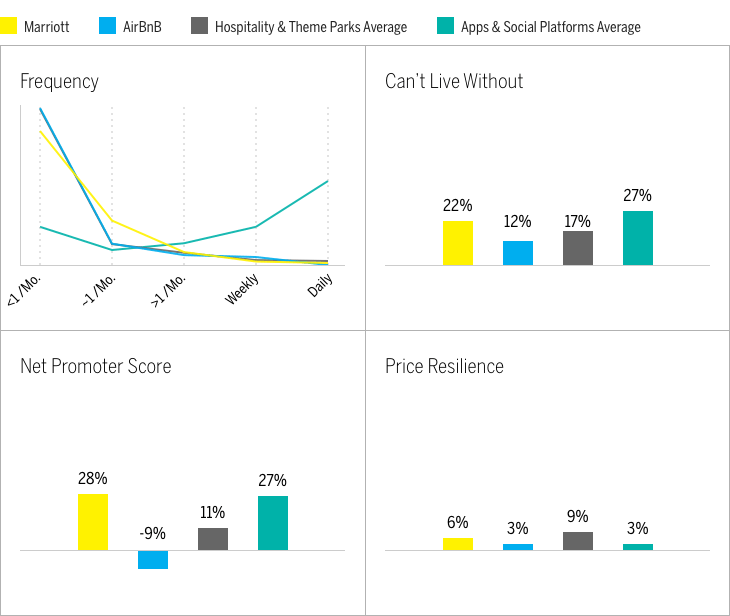

Although comparing Marriott and Airbnb may seem like a comparison between an industry stalwart and the darling disruptor, diving into our Brand Intimacy data reveals some surprising insights. The Marriott brand outperforms Airbnb in virtually every dimension of emotional connection with its customers and even outperforms it in other measures, such as Net Promoter Score (NPS) and price resilience. This performance reveals a level of maturity and depth to the Marriott brand. For Airbnb, it reflects what we see with other app brands like Uber (technically, Airbnb is ranked within the apps & social platforms industry) that are falling short of effectively connecting with customers.

Our research shows that 29 percent of Marriott’s customers are in an intimate relationship with the brand compared to only 6 percent for Airbnb. In addition, for the industry, Marriott has above-average rates of users in all three stages of intimacy, from sharing, the earliest phase, to fusing, the ultimate stage. The vast majority of Airbnb’s intimate customers are in the sharing stage. We also see Marriott offering a richer set of intimate characteristics and associations than Airbnb. Looking at the Brand Intimacy archetypes, which are patterns or markers that identify the character and nature of ultimate brand relationships, we see that Marriott is strongest in fulfillment (exceeding expectations and delivering superior service), followed by indulgence (creating a relationship centered on moments of gratification and pampering), both of which are extremely relevant for hospitality brands. Interestingly, these are also the best-performing archetypes for Airbnb, although at much lower rates than Marriott. It is notable that the brands are very close in score for the archetype of ritual (when the brand is a vitally important part of daily life), with Airbnb only one point behind Marriott. This may speak to an opportunity that Airbnb can better leverage to build bonds with customers. Some other curious findings include the fact that Airbnb performs better with women, while men favor Marriott. Additionally, Airbnb is stronger with consumers 18–44 years old, whereas Marriott has an older audience profile, doing best with those 45–64 years old.

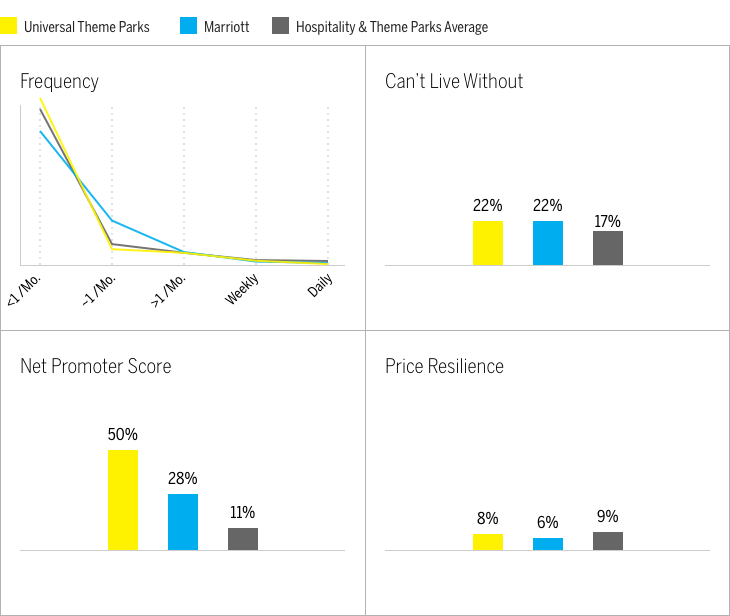

Today, Marriott also outperforms Airbnb across related measures of Brand Intimacy, including NPS score, where Marriott has more than double the industry average score and Airbnb is significantly below the average. Airbnb is seen as a brand consumers can live without, while Marriott is seen as more essential. More customers are willing to pay extra for Marriott rooms than Airbnb customers are for their brand’s service. Airbnb’s frequency/usage data follow the patterns of hospitality brands more than other brands in the app space.

While Marriott towers over Airbnb across a breadth of brand measures, when we compare its performance to the industry winner, Universal Theme Parks, we see some shifts. Most obviously, 38 percent of Universal Theme Parks customers we surveyed are in an intimate relationship with the brand, compared to 29 percent for Marriott. Interestingly, the brands are similar in their percentages of customers in the bonding and fusing stages, with Universal having significantly more customers in the sharing stage. We also see much stronger indulgence and nostalgia scores with Universal Theme Parks, whereas Marriott has the advantage related to fulfillment and ritual. The brands are similar with respect to frequency and customers being unable to live without them; however, Universal Theme Parks is much stronger in NPS and economic equity, with its customers willing to pay 20 percent more for its goods and services.

Each of these brands teaches a different lesson: Marriott has clear, broad strength and offers a relationship to its customers; Airbnb has opportunity, but it is currently not creating emotional connections with users; and Universal Theme Parks is highly recommended and valued, with a large sample of intimate customers, although it needs to continuously move them up the funnel into the bonding and fusing stages.

Impacting the category

Looking outside the performance of specific brands, we see a number of considerations affecting how consumers bond with hospitality and theme parks.

More than technology for technology’s sake

Hotels are scrambling to invest and leverage technology to enhance the consumer’s experience. From smart rooms and mobile integration for booking, keys, and messaging to using AI to service guest requests, hotels of the future are dramatically affecting the travel journey today. We wonder how exactly these advancements will build stronger bonds with consumers. Our Brand Intimacy research demonstrates that technology can indeed help foster greater intimacy by creating experiences that are more intuitive and customer-centric; however, it is often a double-edged sword that, if executed poorly, can create the opposite result—indifference.

The experiential factor

Millennial and Generation Z audiences tend to value experiences over material goods. This shift is affecting retail in profound ways and is a positive trend of which the hotel category can take advantage. These younger audiences rank hospitality brands substantially higher in the Brand Intimacy archetype of indulgence (catering to moments of gratification and pampering). This provides more clues for hotels to embed components that deepen unique experiences, engaging and entertaining guests in the customer journey, environments, and marketing. Many of the hotel giants have developed brands targeting younger audiences in an attempt to provide curated experiences (Tru, Canopy, Curio, Freehand, Aloft, 25hours, AC Hotels, ASAI, 1 Hotels, Cordis, Tryp, EVEN, The Edition, Graduate, Jen, Hyatt Centric, Moxy, OE Collection, Proper, Qurorvus, Radisson Red, Vib), but whether or not these “new” brands will succeed or evolve has yet to be seen.

Brands that endure

Apps & social platforms, especially those that are more like utilities, perform poorly in building intimate bonds with their consumers. One aspect that affects this performance is the age of the brands. Generally, younger brands need more time to build nuanced relationships with consumers in one of the three stages of Brand Intimacy (sharing, bonding, and fusing). Airbnb suffers from this reality as do many of the new brands that the hotel industry has proliferated (listed in the section above) to attract new audience segments. While connecting with the younger generations is important, brand building requires long-term commitment, and the consolidation in the industry—the creation of new brands and the new industry disruptors like Airbnb—means that brands will have to take the long view in creating lasting connections with consumers.

Loyalty is dead

According to a 2016 study, the typical American household holds memberships in 29 loyalty programs but is only active in 12.1 Furthermore, as far back as 2012, there was evidence that companies that spend more resources on loyalty perform slightly worse than those that don’t.2 A McKinsey & Company study suggests that having a rewards program isn’t a surefire way to build loyalty and drive sales. With Starwoods and Marriott loyal programs merging, consumers are seeing the last gasp of a fading construct that is creating less and less incentive for consumers. Brands looking for success would be better off investing in efforts to funnel more customers into the fusing stage than expecting repeat business from loyalty programs. Real brand loyalty isn’t created through money-saving programs; it is built on emotional connections. Intimate consumers are willing to pay more for and are less willing to live without the brands they love.

Conclusion

Hospitality brands are trying to evolve and better reflect the needs of a changing demographic and the impact of technology. In terms of building more intimate brands, their progress to date is weak, save for select theme park brands. Though industry disruptors are building compelling business models with explosive growth, they too are failing to win the hearts of their consumers. The opportunity for brands to leverage Brand Intimacy as a way to enhance the consumer journey to and through the hotel experience is immense—probably bigger than for any other industry. The need to technologically advance the experience can be a great agent of change for brands looking to thrive, as can rethinking new ways to build loyalty among intimate customers.

While there is enormous opportunity, it requires new thinking, new approaches, and new investments. Hospitality companies must be open to rethinking their industry in ways that can imbue experiences with real emotion, giving customers a reason to commit to their brand that goes beyond price point, amenities, or a membership program.

Read our detailed methodology here and review the sources cited in this article here.

To learn more about MBLM, click here.