Overview

- Travel is the 10th-ranked out of 15 industries in the 2018 Brand Intimacy Study.

- The archetype most closely associated with the travel sector is fulfillment: embodying the ability to perform at peak upon demand. Emirates scores highest in this archetype.

- Emirates Airlines held its #1 spot in the travel category among UAE consumers, also snagging the #1 spot overall for millennials, men and users with high incomes.

- More notably, Emirates has rocketed this year to the #6 spot on the list of top 10 brands in UAE—a feat for any travel industry brand and especially for one in this market, where automotive and consumer brands are most often in the top ten.

- As we will see, Emirates has succeeded by extending its premium positioning, surprising and delighting customers, and cultivating continued relevance among key audiences.

The travel industry in the Middle East and North Africa (MENA) is climbing out of a slump. With rising labor costs, recent travel bans and regional instability, airlines in the region struggle to remain consistent, and therefore to retain customer devotion. Despite the lift of the U.S. travel ban, regional airlines still face challenges to inspire and nurture customer loyalty, especially when competing for the coveted Millennial demographic. Though the travel industry may rely on the archetype of fulfillment to bond with its customers, from a consumer perspective, many companies in this sector undercut the very premise on which fulfillment is based: consistent, positive performance.

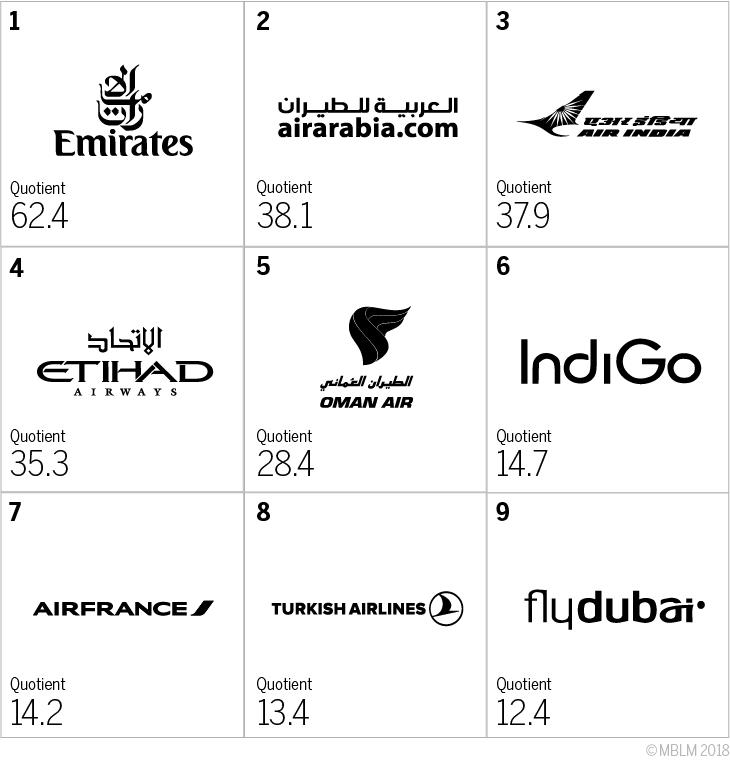

Despite this, the travel industry did gain ground in our 2018 Brand Intimacy Study. Following the lift of the travel ban, airlines in the MENA region experienced positive growth. This year’s #10 ranking for the travel industry, among industries overall in the UAE, was a slight improvement over a #11 ranking in the 2017 study. In ranking #10, travel claimed the spot formerly held by the beverage industry, which dropped to 12th. The landscape of top ten airlines in the UAE travel industry shifted, as well. Incumbent Etihad Airways fell from its #2 spot behind Emirates to land at #4, while AirArabia made a leap the opposite direction from #8 to #2.

In a disappointing sector, Emirates stands apart

Based in Dubai, Emirates Airlines is a brand intertwined with the culture of its homeland, United Arab Emirates (UAE). Yet unlike its MENA counterparts, it manages to inspire devotion not just from native Emiratis, but from a large international consumer base as well. In the year prior to our 2018 Brand Intimacy Study alone, Emirates reported $27.2 billion US in revenue and carried 58.49 million passengers on its 254-aircraft fleet. That stacks up to 3,600 flights weekly from its hub (Dubai International Airport), bound for more than 140 cities in 81 countries across 6 continents.

UAE Top Intimate Travel Brands 2018

Emirates Airlines has held its spot as the #1 most intimate brand in the travel category of our UAE Brand Intimacy Study for multiple years. But for the first time in 2018, Emirates broke the list of top 10 most intimate brands overall in UAE, which was also a first for the travel industry. Splashing onto this elite list at #6, Emirates has a brand intimacy quotient (IQ) of 62.4. And the IQ is no mean shift, either; in 2017 Emirates had boasted a quotient of just 51.1. Perhaps more remarkably, Emirates managed to score #3 overall in the nation among the coveted millennial demographic (ages 18-34), as well as with men and people of high incomes. It also increased its prevalence—the number of people who use the brand—by a slight 0.3 points over last year, and its overall intensity—the strength of its user relationships—by a more impressive 12.3 points.

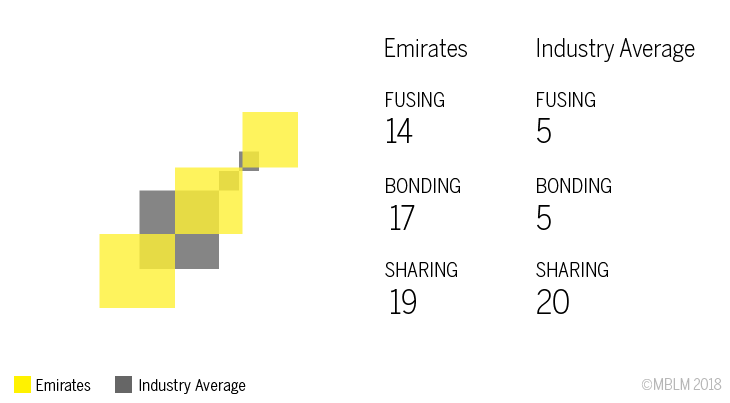

Within the stages of brand intimacy, Emirates ranks first in the travel category for bonding, the stage where consumers deeply trust the brand. It also ranks first in fusing, the final and most critical stage of brand intimacy wherein a brand and individual become co-identified. In the overall top-ten list, Emirates actually doubled its fusing score over last year from 6.9 to 13.7. This is a hard-to-reach but highly-coveted outcome for MENA airlines, because consumers who have fused with a brand are more likely to stick with the brand even in turbulent times, rather than switch to a competitor.

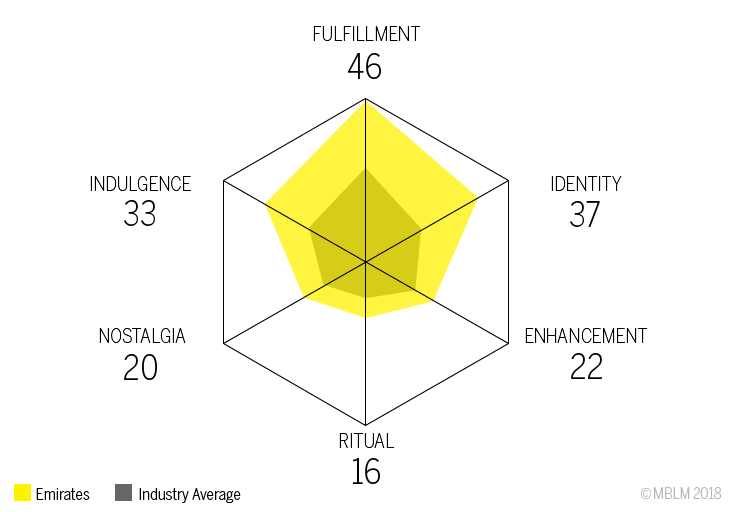

Focusing in on individual archetypes—recognizable patterns and personalities that brands portray—Emirates has traditionally scored best in fulfillment, which as previously mentioned embodies superior performance; indulgence, which embodies luxury; and identity, which embodies one’s essential self. Overall Emirates leads the travel industry in those three archetypes and holds second in two more, enhancement and nostalgia. This means the brand has connected deeply with its customer base in five of the six possible archetypes.

Brand Intimacy archetypes

One might conclude from Emirates’ arrival on the top 10 list that its archetype scores have risen across the board. But the data shows the brand is down overall in every archetype category, over its results last year. In the top 3 alone, fulfillment dropped from 50.5 to 46.1, indulgence from 37.6 to 33.1 and identity from 42.1 to 37.5. How is it possible to decrease in brand personality while increasing in intimacy? A closer data review suggests that while overall scores for archetypes were down, millennial consumers as a demographic rated the brand higher in its top four archetypes. Because this critical demographic used the brand more and increased in intensity, they likely helped contribute to an overall higher brand intimacy score.

Amid the shifting MENA landscape, other airlines struggle to create true human connection and a sense of customer pride in their brand. But despite downward trends in some aspects of data, Emirates has managed to increase its brand intimacy score overall with local Emiratis and with the global flying public alike. Let’s look at memorable moments from the brand’s past year to explore how it has managed to strengthen customer bonds in such a challenging industry.

1. Extending premium positioning for economy customers

For years, Emirates has been known as the go-to airline for luxury and indulgence in the skies. While these benefits do filter down to the average economy-class passenger, the clear focus of Emirates’ past efforts has been higher-income flyers. But that has changed. In 2018, the brand launched a bold new video campaign, “Upgrade Your Airline,” which embodied the indulgence archetype for economy-class passengers. In the advertisements, humorous yet “average” individuals—clearly not luxury-seekers—attempt to charm a bored-looking desk attendant into granting their upgrade requests. No passenger is successful, of course, until heard by a sincere Emirates employee. The final card proclaims, “Don’t upgrade your seat. Upgrade your airline.”

“Upgrade Your Airline” is smart and witty, yet down-to-earth, inviting passengers from all walks of life to smile at least, or more likely chuckle, as they recognize their own frustrations in those presented on-screen. Such attention to requests and ease of upgrading is typically reserved for first- or business-class passengers. Yet in making the bold invitation to “Upgrade Your Airline,” Emirates extends a hand to the beleaguered passengers in all the rows and implies that the most basic promise of the indulgence archetype is now possible for them, too.

The Brand Intimacy Study results support Emirates’ advertising strategy for this campaign. Among low-to moderate-income users (who would presumably be the most interested in a more luxurious economy-class experience), Emirates saw increases that were comparable to those in its more traditional higher-income base. Prevalence increased slightly from 84.9 to 85.4. Intensity of customer relationships increased by an impressive 12 points, from 73 to 85.3. Not surprisingly, these users also more than doubled at the fusing stage of brand intimacy, from 6.6 to 15.7—an even higher leap than the brand’s overall average growth in the fusing stage. As campaigns like “Upgrade Your Airline” demonstrate, Emirates understands its consumer base is evolving and has taken steps to connect emotionally with newer demographics.

2. Enhancing customer experience through thoughtful touches

Attention to detail and customer needs form the core of brands with both the indulgence and fulfillment archetypes. Luxury brands (which typically personify that archetype) know how to anticipate a customer’s desire. And brands high in fulfillment, likewise, cannot provide superior service without forecasting wants. Emirates exudes the attributes of both in its services. For example, the brand’s in-flight entertainment system, ICE (Information, Communication & Entertainment) has led the industry for 14 years with one of the industry’s largest selections of movies, shows, news, sports and education programs—all available in every cabin class.

Emirates has led the industry in digitizing its services as well, for more thoughtful experience. Over 70% of the fleet offer live TV as a part of the ICE system and 99% of aircraft now have Wi-Fi. For the next generation of digital natives, Emirates has unveiled a new line of its “Fly With Me” plush toys that feature augmented reality (A/R) components, helping keep young passengers quiet on long flights. Such technology isn’t just for the little ones, either. In the wake of last year’s travel ban in the U.S., customers were required to surrender their digital devices before boarding. Emirates partnered with local retailers to provide tablets during its long U.S.-bound flights. The brand also created a codeshare agreement with local FlyDubai, allowing loyalists of both airlines to enjoy convenient accrual of points.

Smart gestures like these embody the brand’s recognition that despite its overall decrease in archetype performance, it still has significant leverage in the archetypes of fulfillment and indulgence. Among high-income users in our 2018 Brand Intimacy Study, indulgence was the only archetype to increase, and as we have already seen, among the influential millennial demographic, both fulfillment and indulgence increased. When it comes to making consumers feel loved with amenities that everyone wants but no one thinks to ask for, Emirates knows how to deliver across every class of cabin. And consumers have noticed.

3. Participating meaningfully in customers’ milestone experiences

As mentioned, Emirates scores exceptionally in the Bonding phase of Brand Intimacy (wherein trust has been established between user and brand) and the Fusing phase (wherein a user and a brand become co-identified). One significant way it increases its emotional connection is to participate in customers’ important life moments. A flight might not be everyone’s first choice as a backdrop for a marriage proposal, surprise birthday party or other “milestone moment,” but Emirates wants them to think differently. In 2017, for example, one enterprising woman in first class arranged for champagne, a flower shower and a crew-member choir to help her propose to her beloved. Of course, Emirates shared its involvement on social media.

Sometimes, however, milestone experiences are better left on the ground. Emirates also tries to understand which organizations its loyalists follow at home, so the brand can support them, too. Customers who love sports such as football, tennis, rugby, horse racing, cricket and golf will find Emirates on hand at big events as a sponsor, so their mutual identities as fans and loyalists of the sport further merge. Those more artistically-inclined will find Emirates sponsoring their favourite symphonies, film and literary festivals and shopping festivals.

Brand Intimacy stages

By engaging with consumers in such non-transactional ways, Emirates taps into the identity archetype, establishing itself as a presence during powerful life experiences that reflect users’ deepest values, beliefs and aspirations. And it’s a smart play. Millennial consumers, who are vital to MENA-based airlines, are known to crave experience. They also patronise brands that empower experience. In the 2018 Brand Intimacy Study, Emirates scored almost ten points higher among millennials in the identity archetype. This move from 36 to 45 could suggest that during milestone experiences—moments that most often reflect users’ deeply-held beliefs, values and aspirations—millennials are happy to have Emirates alongside them.

4. Appealing to higher-income consumers’ luxurious appetite

Even while broadening its general and generational appeal, Emirates has not lost sight of its strong high-income customer base. In 2018, the brand launched the world’s first fully-enclosed first-class cabin on its new Boeing 777 aircraft. First-class accommodations in other aircraft now mirror the luxury, detailing and style of high-end Mercedes-Benz vehicles—another brand popular among the wealthy. Meanwhile, Emirates delivers luxury and fulfillment inside those accommodations with other touches, such as luxury vanity kits designed by Bulgari and meal offerings like Iranian caviar and steaks. Plus, Emirates has installed new open bar areas in its first-class & business cabins, providing passengers with a place to mingle and pass the time.

Eyes ever on the details, the brand delivers fulfillment and indulgence on the ground, too. All passengers can book private car transport to the airport, but for its first-class and business passengers, Emirates has unrolled “Chauffeur-drive,” a luxury transport service in partnership with BMW. To arrive even more stylishly, first-class customers can enjoy free Wi-Fi in-car and upgrade to a Mercedes-Benz luxury vehicle. Little else communicates both fulfillment and indulgence as powerfully as such private door-to-door service.

In the 2018 Brand Intimacy Study, Emirates made gains with high-income consumers just as it did with more moderate- and lower-income consumers. But there are some stand-out insights for this category—likely bolstered by Emirates’ continued commitment to satiating their luxury appetite. Brand prevalence and intensity both increased among high-income consumers over last year, from 67.2 to 72.5 and 57.9 to 75.6 respectively. In the second stage of brand intimacy—bonding—high-income users increased by 4.9 points over last year. And in the third stage—fusing—they increased by 5.5. While archetype performance was down overall in this group (except in luxury), these other gains still suggest that Emirates’ continued cultivation of a luxury reputation increases its ability to bond with higher-income consumers.

Conclusion

Emirates Airlines has made a smart—and successful—effort to establish itself as a top brand in UAE. The brand has found new ways to iterate on its core archetypes of luxury, fulfillment and identity, opening doors with new bases of customers who might not have bonded or fused with the brand emotionally otherwise and reinforcing its status with its more traditional consumers. By bringing touches of luxury to the economy-class cabin, finding new ways to surprise and delight customers in all cabins, and forging strategic partnerships with other beloved brands, Emirates has earned itself its brand-new spot as the 6th most intimate brand in UAE.

Read our detailed methodology here.

To learn more about MBLM visit mblm.com.