The financial services industry is on the rise, according to our 2017 Brand Intimacy Study. Since 2015, the category has gone from a below-average brand intimacy quotient of 28 to an above-average quotient score of 31.1, indicating an increase in the ability of brands in this category to create and maintain bonds with consumers. According to our study, another sign of positive growth is that the financial services industry now has more consumers in the stages of intimacy on average, with 25 percent this year compared to 22 percent in 2015. This bump in performance is particularly notable, as personal finance is a common source of stress for US consumers.1 Although these brands provide us with a valuable service, they can easily carry unpleasant associations regarding our financial health as well as challenging responsibilities such as saving, paying bills, and budgeting.

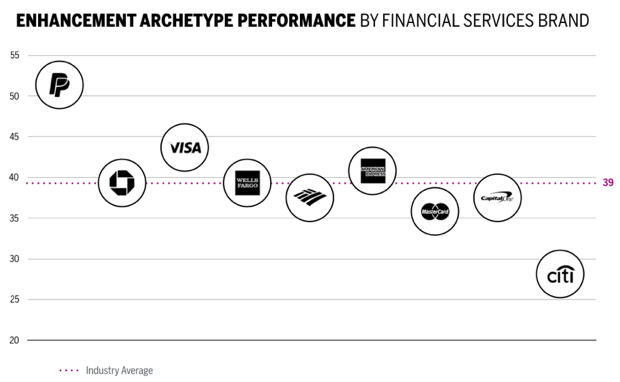

Today especially, we rely on these brands to help us make difficult decisions and simplify our lives. In fact, in our study, the archetype most associated with the category is enhancement, meaning becoming better (smarter, more capable, and more connected) through the use of the brand. The chart above shows how brands in the industry perform in terms of this archetype. This expectation and appreciation for enhancement has presented these brands with a major opportunity to build and maintain intimacy in the digital world by providing seamless services, using thoughtful communications, and building reliance. Taking a hint from the other industry most associated with enhancement (technology and telecommunications), financial services brands have used mobile and digital banking offerings to expand access to their services, inform and empower their users, and deliver more convenient banking experiences. This may be in part why PayPal dominates in terms of its associations with enhancing consumers’ lives.

Banking In The Digital Age

The trend toward digital and online banking is especially true for millennials, as 92 percent said they would choose a bank for its digital services, and 68 percent use online banking to manage their financial life.2 This is a clear indication that younger generations have come to rely on these 2 services to improve their lives, simplify their financial responsibilities, and offer them convenience at no extra cost. Demand for mobile banking is also high for millennials, as 74 percent find it “very important” to them, compared to only 42 percent of baby boomers.3

However, some have speculated that the growing demand for digital and mobile banking could be a problem for commercial banks. Millennials in particular don’t feel tied to their banks, as 73 percent of them are more interested in financial offerings from Google and Amazon than from established nationwide banks, and one-third don’t think they will need a bank at all in five years.4 These sentiments represent a threat for financial services brands, and suggest that they must continue to do more to build greater intimacy with customers to defend against competitive offerings from out-of-category entrants.

This year’s most intimate financial services brands consist of five banks (#2 Chase, #4 Wells Fargo, #5 Bank of America, #8 Capital One, and #9 Citi), three credit card providers (#3 Visa, #3 American Express, and #7 MasterCard), and one electronic payments brand (#1 PayPal).

With digital expansion remaining a large opportunity for the category, it may not be surprising that PayPal leads the industry in brand intimacy. As an electronic payments company, it is the only nontraditional financial services brand in the Top 9, and the most intimate brand in the category with a brand intimacy quotient of 42.7 (up from 38 in 2015). It also has the highest score for the enhancement archetype (52), the ritual archetype (45, tied with Wells Fargo), and the fulfillment archetype (42, tied with American Express), which are the three archetypes most associated with the industry. PayPal has the highest Net Promoter Score compared to any other category brand, with a 52 score. Visa is in a distant second place at 33 and American Express in third place with 30. Additionally, more consumers said they couldn’t live without PayPal than they did for any other financial services brand. Interestingly, it’s not the most used brand in the category. Almost 30 percent of Wells Fargo customers use that brand daily, compared to nearly 14 percent for PayPal. And looking at how often a brand is used weekly, Visa leads with 38.7 percent of customers versus 33.6 percent for PayPal.

As a company, PayPal continued to grow in 2016, adding about five million active customer accounts in the fourth quarter of the year, for a total of 197 million.5 The brand has been signing agreements with Visa, MasterCard, Citi, and Discover Financial Services, allowing PayPal users to pay for goods in stores with their smartphones. These partnerships give PayPal users more power, more freedom, and more opportunities to engage with the brand, which will likely strengthen existing bonds and entice new users to join.

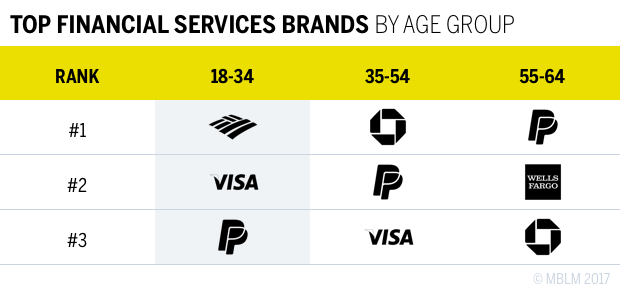

The table above shows the top financial services brands by customer age group. It may come as a surprise that, as an electronic payment brand, PayPal performs better among older consumers, but what’s most notable here is that it is the only brand in the top three for all age groups. This shows that although the brand is relatively young (founded in 1998), it has been successful in forming bonds across all generations.

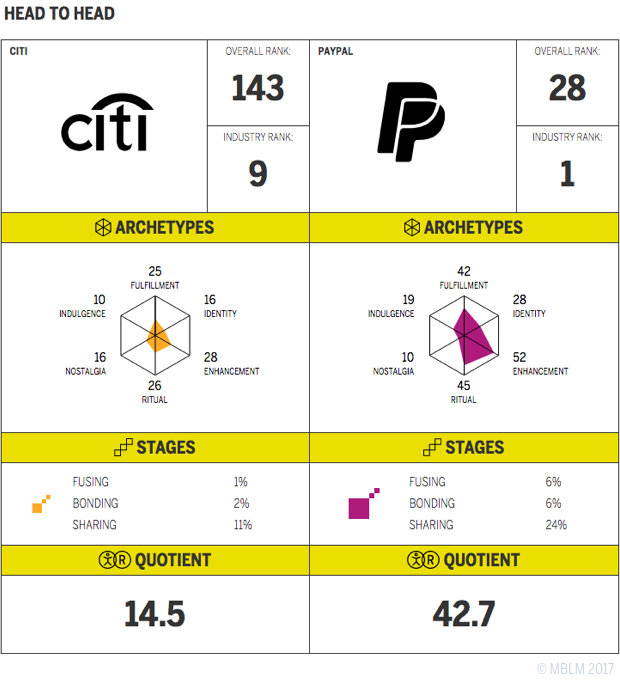

In comparing PayPal to Citi, a global, established financial service provider, you can see how PayPal dominates across the board. This demonstrates that reputation alone won’t build brand intimacy. PayPal ranks first in financial services and 28th overall, whereas Citi ranks 9th in the category and 143rd overall. PayPal has 36 percent of its users engaged in some form of intimacy with the brand compared to 14 percent for Citi. That means PayPal has more than double the intimate customers of Citi. PayPal also leads across almost all archetypes, particularly the ones most relevant to the category. Nostalgia is the only archetype where Citi performs stronger, which is not surprising given the brand’s history relative to newcomer PayPal. PayPal has double the sharing customers of Citi, triple the bonding users, and six times the fusing rates. More people are willing to pay more for Citi services (6 percent), although this may not be a fair comparison because PayPal services are largely free to users.

With PayPal expanding into point-of-sale transactions and more consumers seeking digital banking experiences from traditional financial services brands, it appears the brand will continue to threaten the more traditional players in the category. However, we must remember that financial services brands are improving their intimate performance and that this category has above-average rates of brand intimacy. This is encouraging. Brands here must continue to increase engagement and enhance the lives of their customers by delivering convenience, access, new services, and seamless experiences. They can also improve the way they communicate through all these touchpoints and determine more ways for customers to interact and deepen their relationships. As consumer lives become increasingly connected, they expect more from brands, especially the ones that they depend on. Financial services brands will always play an integral role in our lives, providing them with great potential to engage us through brand intimacy.

To see this year’s study please click here.

Read our detailed methodology here and review the sources cited in this article here.

To learn more about MBLM, click here.