Overview

- It’s estimated that more than a third of the global population will be smartphone users by 2020

- Brands that leverage smartphones performed better than others in the 2017 Brand Intimacy Study

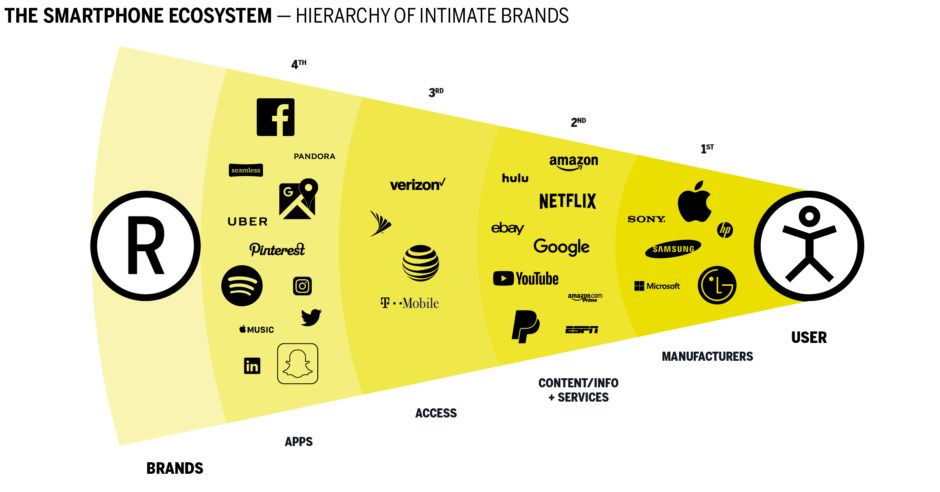

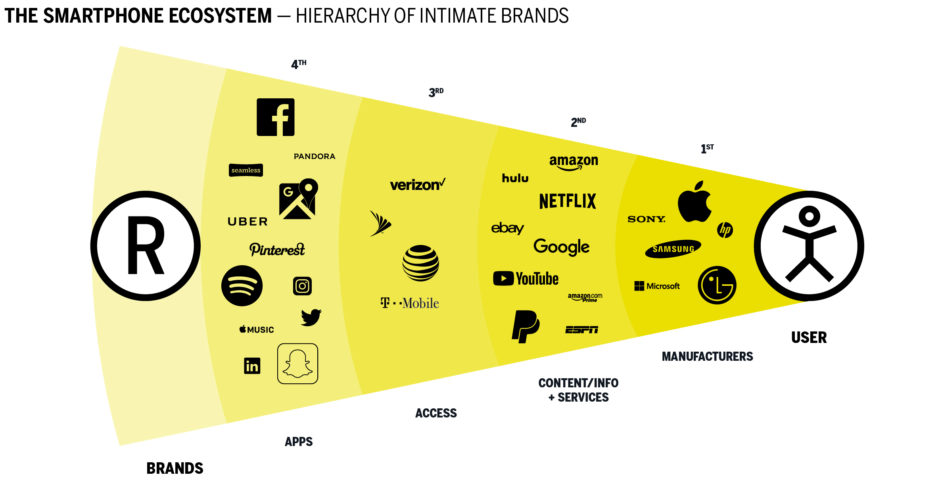

- The “smartphone ecosystem” is made up of manufacturers, content/info and services, access, and apps

- Manufacturers are the most intimate group, followed by content/info and services, access, and apps

The smartphone has become our window to the world. It is the utility knife of our time, fostering our social connections, communications, entertainment, finances, and even our mobility. Can you think of a brand that doesn’t somehow leverage the smartphone today? Examples are becoming fewer all the time. While building the largest study of brands based on emotion, we wondered: how do brands build greater intimacy with a device that knows your preferences, is always near you, and is the very definition of intimate? How do those outside the smartphone ecosystem fare? Is the smartphone the ultimate interface between humans and technology, and can brands still stake a claim, or have the big tech brands already colonized the available opportunities? Who are the biggest brand winners and losers?

An estimated 2.32 billion people are using smartphones in 2017, and that number is expected to be 2.53 billion by 2020, making more than a third of the global population smartphone users.1 Seventy-seven percent of Americans owned a smartphone in 2016, up from only 35 percent in 2011.2 Internet use is becoming increasingly mobile as well. The percentage of global web traffic generated from mobile phones was 35.1 percent in 2015, grew to 43.6 percent in 2016, and is estimated to reach 50.3 percent in 2017.3 As technology advances at an accelerating pace, the future impact our phones will play when they are enhanced by the likes of wearable/implant technologies, Virtual Reality (VR), Augmented Reality (AR), and the Internet of Things (IoT) is staggering.

The adoption of these technologies promises an exciting new ecosystem of devices, content, and experiences that will surely have a profound impact on how brands connect with us in the future. How can marketers navigate this dramatic shift? US consumers look at their devices more than 9 billion times a day (up 13 percent from last year).4 While it’s easy to get excited about the innovations to come, if we want to understand how technological disruption can reinvent the marketing world, it’s worth acknowledging that we already live in a consumer-brand ecosystem that is dramatically different from the one we lived in ten years ago; that is, an ecosystem mitigated by the smartphone.

The current gatekeeper brands in this “smartphone ecosystem” are the device manufacturers followed by content and services, service providers, and apps. They have benefited immensely from consumer adoption and use of smartphones. Using data from the annual Brand Intimacy Study, we measured the brands in the smartphone ecosystem against all brands in the study to compare and better understand their performance. For some context, here’s what we mean by smartphone ecosystem brands:

Brands Linked To The Smartphone Ecosystem Outperform

As we anticipated smartphone ecosystem brands perform better than brands outside the ecosystem—they have an average Brand Intimacy Quotient of 33.9, which is above the study average of 29.5, indicating that brands that are often experienced through smartphones tend to build more emotional bonds with consumers. Clearly the technology of a supercomputer in your pocket enables brands to bond more effectively with consumers.

The Hierarchy Of Brands In The Ecosystem (US)

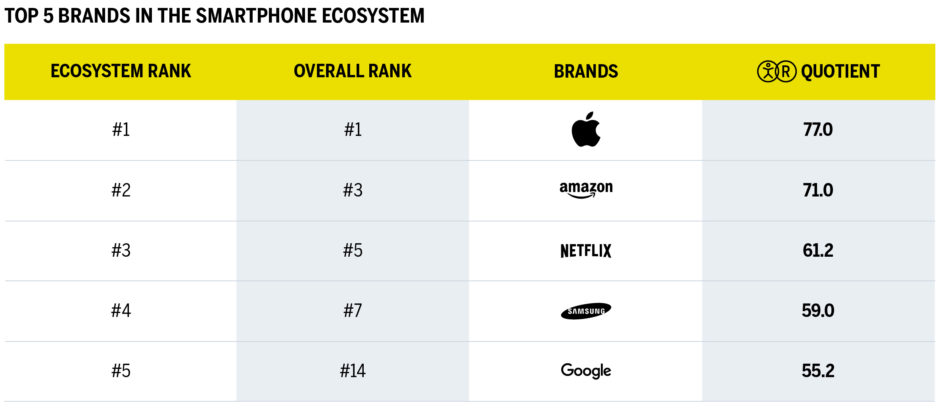

The leading brand in the smartphone ecosystem (and in the study overall) is Apple, which has an impressive Brand Intimacy Quotient of 77.0, followed by Amazon, Netflix, Samsung, and Google.

If we break the ecosystem down into subgroups, we can see that manufacturers, providers of content and services, access, and apps, perform differently when it comes to Brand Intimacy. As a group, the industry’s leading smartphone manufacturers (Apple, Samsung, and LG) have formed the strongest bonds with consumers, showing an average Brand Intimacy Quotient of 58.1. Content/info and services brands (Amazon, Netflix, Google, YouTube, and PayPal) follow closely behind, with an average of 55.0. For consumers, these brands are essential, they are responsible for unique experiences that consumers participate in on a daily basis. Smartphone manufacturers are especially close with consumers because they are seen as the foundation for every interaction within the ecosystem. The device makes it possible to consume content from brands like Amazon or Netflix, and it puts apps like Facebook and Spotify in your pocket for convenient use.

Service providers like Verizon and AT&T are also foundational to smartphone usage, but consumers don’t seem to value them like they do Apple or Samsung because they average a Quotient score of 38.0. This could be because service providers go largely unseen, whereas devices are physical manifestations of the brands they represent. Service providers can also be held to high standards and are quickly blamed for lapses in cell reception and poor customer support, even when they provide uninterrupted connectivity 99 percent of the time. This notion that the manufacturers get more than their fair share of praise when it comes to smartphone usage is something we’ve touched on in a recent article, in which we explain obstacles to Brand Intimacy for social media platforms and theorize that users often credit the manufacturers for many of the benefits that third-party apps bring. It’s likely that a similar phenomenon causes service providers to be under appreciated, resulting in lower levels of Brand Intimacy.

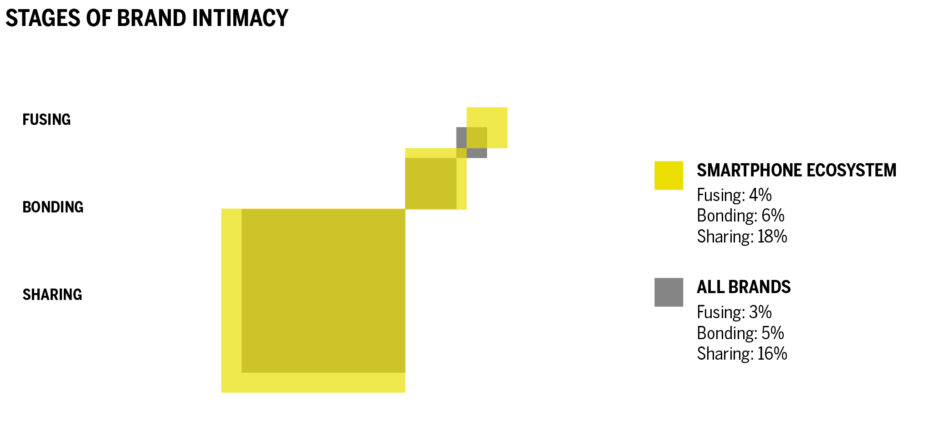

Looking at the stages of Brand Intimacy, which measure the intensity of an intimate brand relationship, we can see that brands in the smartphone ecosystem perform above average in all three stages. In the most intimate stage, fusing, when a person and a brand are inexorably linked and co-identified, the smartphone ecosystem brands have a slight edge. Four percent of consumers experience fusing compared to the 3-percent average. This lead continues and widens in the next two stages: bonding (6 percent vs. 5 percent) and sharing (18 percent vs. 16 percent), indicating that these brands are more successful in all levels of Brand Intimacy. This is critical performance because the higher the degree of intimacy (scores in the sharing, bonding, and fusing stages), the more people are willing to pay for a product or service, and the less they are willing to live without it. In the case of smartphone ecosystem brands, on average, more consumers said they “can’t live without” these brands (33 percent) compared to all brands in the study (24 percent).

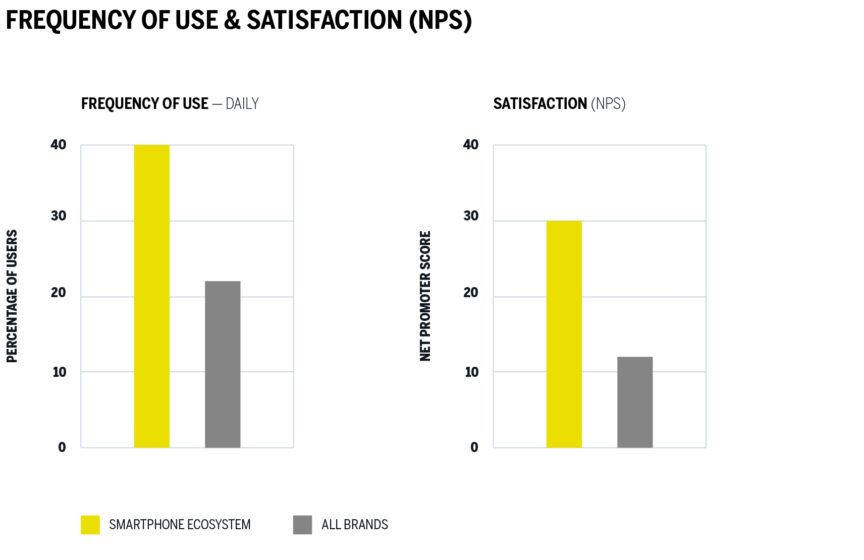

Smartphone ecosystem brands also outperform the average for Net Promoter Score, with an NPS of 30 percent compared to the average, 12 percent. This shows that consumers are generally more satisfied and willing to recommend these brands to others.

More Capable, More Often

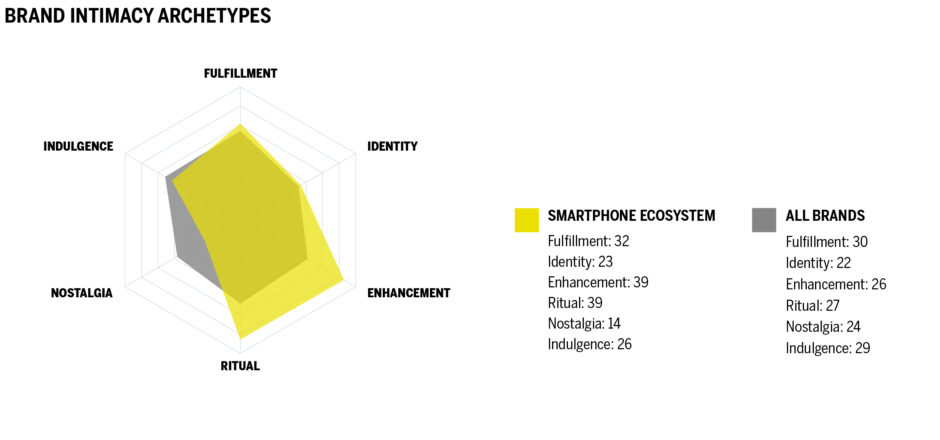

The degree or stage of intimacy is only one dimension in which smartphone ecosystem brands outperform. Brands in the smartphone ecosystem also perform above average in the Brand Intimacy archetypes, which define the character of the bonds they form with consumers. The Brand Intimacy archetypes are patterns or markers among intimate brands that identify the character and nature of consumer-brand relationships. Smartphone ecosystem brands score higher on the enhancement and ritual archetypes.

The enhancement archetype describes a brand relationship in which the user becomes better (smarter, more capable, and more connected) because of the brand. Brands in the smartphone ecosystem make users better every day, giving them new capabilities and ways to connect that they wouldn’t have access to otherwise. This is why these brands average a score of 39 for the enhancement archetype, which is well above the study average of 26.

The ritual archetype characterizes a brand as being ingrained into daily actions and becoming a vitally important part of daily existence. Brands in the smartphone ecosystem averaged a score of 39 for this archetype, compared to the total average of 27. This above-average score can be explained by the fact that smartphones are always with consumers, allowing them to be a click away from their favorite features and apps at all times.

This success in the ritual archetype is echoed in our data explaining how frequently brands are used. Brands within the smartphone ecosystem perform slightly above average in how many consumers use them weekly (20 percent vs. 18 percent), but where they really shine is in daily usage. Forty-six percent of consumers claim to use these brands daily, compared to the study-wide average of only 22 percent. This shows that brands experienced through smartphones are used more often than average, which likely contributes to their tendency to have greater Brand Intimacy.

Conclusion

Based on our findings from the Brand Intimacy Study, it’s clear that the brands that exist within the smartphone ecosystem have more success at building Brand Intimacy with consumers. The companies that have pioneered this category or found ways to integrate themselves into it have benefited from the growth and penetration of the smartphone and its ability to keep consumers in constant contact with their brands. A manufacturer brand like Apple has over 2.5 times the degree of intimacy over the top performing app brands. That is a massive advantage when we consider that the greater the degree of intimacy, the more people are willing to spend, and the less they are willing to live without the brand. Brands that are a part of this ecosystem tend to be seen as enhancing consumers, making them smarter, more capable, and more connected, and an essential part of their daily lives. Whether we examine the level of satisfaction, frequency of use, or, most importantly, the degree of intimacy, the brands that are seen at the center of the smartphone ecosystem do better. Any brand that can become a relevant part of the smartphone ecosystem needs to, especially if that brands hopes to create more emotional connections with its stakeholders.

While the smartphone era seems far from over, new technologies on the horizon show obvious potential for increased Brand Intimacy in the same way that smartphones have. Wearable devices will allow brands to offer new mobile capabilities and ways to connect; VR and AR will let brands create immersive, interactive experiences; IoT will make it possible for new product categories to take advantage of connectivity and “smart” technology; and all three of these mega-trends have the potential to disrupt or enhance the smartphone’s dominance in our lives. One thing we’ve clearly seen from the rise of the smartphone is that the way we connect with brands as well as with each other is forever transformed. As the smartphone ecosystem evolves, be ready to embrace the way brands bond in this new landscape. Brands that adapt with users and that remain technologically relevant will thrive. Leveraging the access and innovating new ways to enhance a consumer’s life will build greater Brand Intimacy and longevity.

Read our detailed methodology here and review the sources cited in this article here.

To learn more about MBLM, click here.