Overview

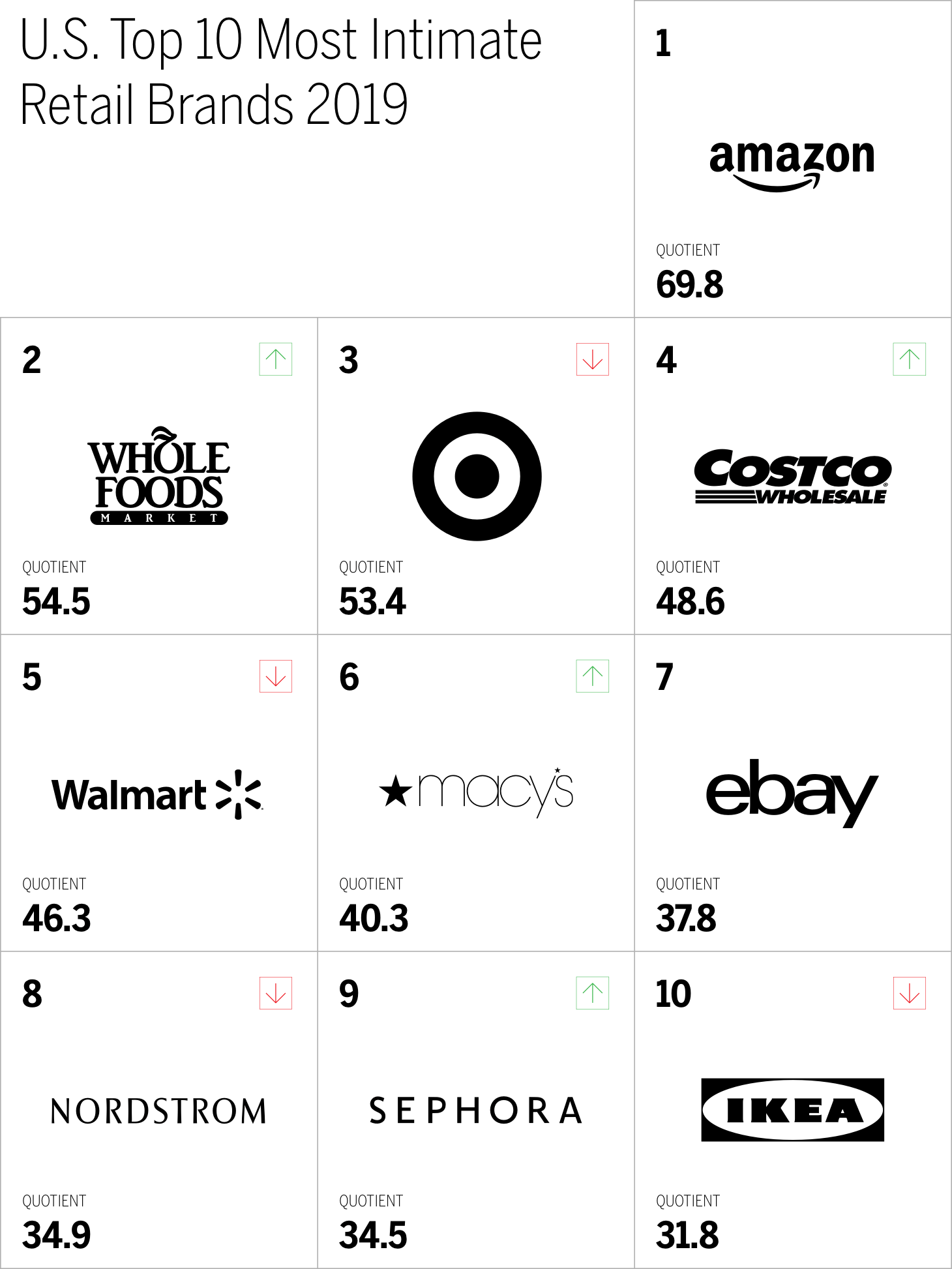

- Amazon has maintained its top position in this year’s Brand Intimacy Study, coming in #1 for the third year in a row

- Amazon is the top brand with females and those who make between $35-40k per year

- Whole Foods is the dominant brand among males and among those who earn over $100k per year

- Enhancement, the archetype most strongly associated with becoming better, smarter, and more capable through the use of the brand, is the dominant archetype for the category

Retail ranks fourth out of fifteen industries, with an average Brand Intimacy Quotient of 41.8, which is well above the cross-industry average of 31.0.

Since the inception of the annual Brand Intimacy Study, Amazon has consistently been a strong performer. As the company has grown in scale and breadth, its brand‘s ability to form more intimate bonds with its customers has also improved. We have proven that intimacy and good business performance correlate, so it stands to reason that Amazon’s dominance is a result of its ability to form powerful, enduring consumer bonds. This year, 50 percent of Amazon users said they formed an immediate emotional connection with the brand. This article will discuss the reasons for this emotional connection and how Amazon outperforms all other retail brands and most brands in general.

A surprising factor in Amazon’s performance has been its ability to insulate itself from bad press or negative feedback related to its aggressive business practices. The brand has faced criticism from local and federal governments around topics such as how little it pays in taxes while it extracts subsidies for its facilities. Additionally, some brands that are selling on the platform complain of unfair practices by Amazon, which seems to overexert its leverage.

Despite the challenges Amazon faces, it is the third-most intimate brand in the U.S. and we anticipate that in future rankings, the brand will overtake perennial strong performers like Disney (#1 this year) and Apple (#2). This article will go deeper into its performance and reveal the extreme gap between Amazon and many of its peer brands. To demonstrate Amazon’s grip on the market, it is the eve of Prime Day, which last year generated $4.19 billion in sales on over 100 million products, yielding a 43 percent increase over the previous year for this 48-hour event1.

Leading the pack

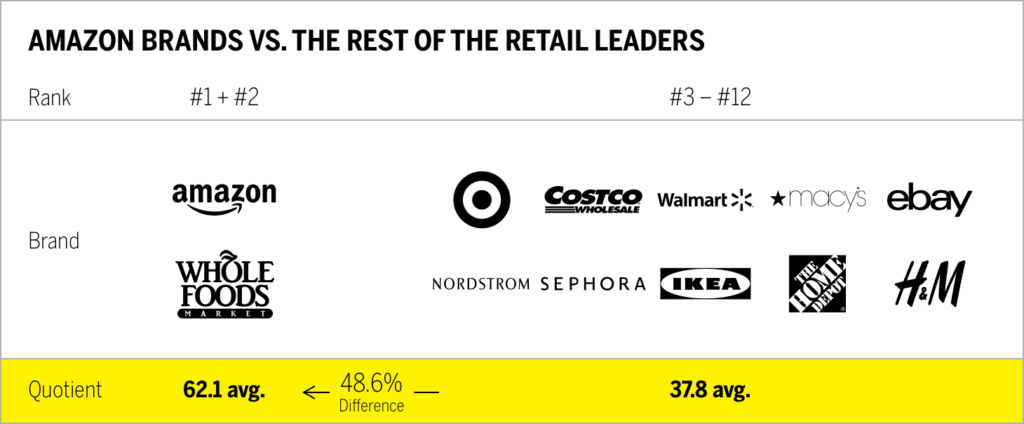

The delta between Amazon and other retail brands gets more dramatic when you realize Amazon also owns the #2 ranking brand (Whole Foods). Averaging these two brands against the rest of the retail category reveals that the Amazon pair of brands scores an average Brand Intimacy Quotient score of 62.1, versus 37.8 for the rest of the category—a nearly 40 percent difference.

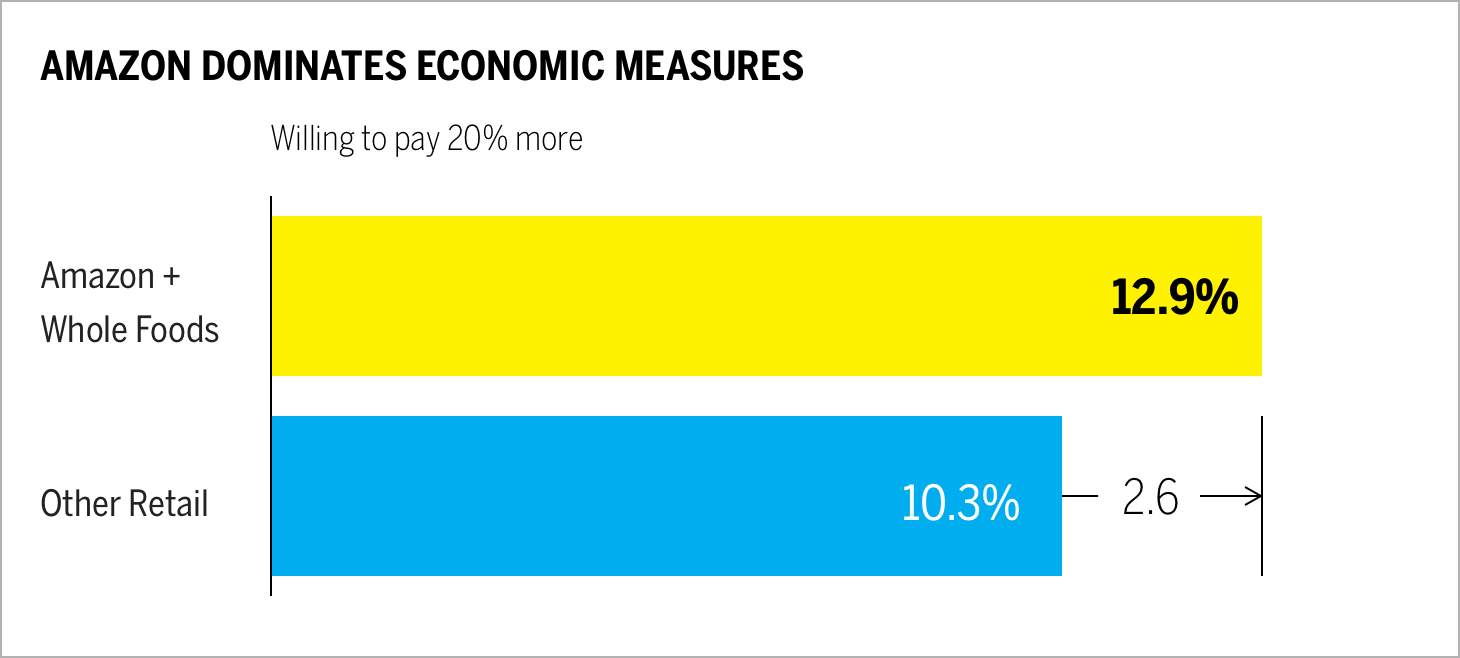

Even more surprising for a brand built on convenience and offering value through lower prices, consumers of Amazon and Whole Foods on average are 20 percent more likely to be willing to pay more for a product. That willingness is a powerful economic measure of the bonds the brand has formed with its users. Interestingly, Amazon more than doubled its economic equity since 2018 (was 6 percent, now 14 percent).

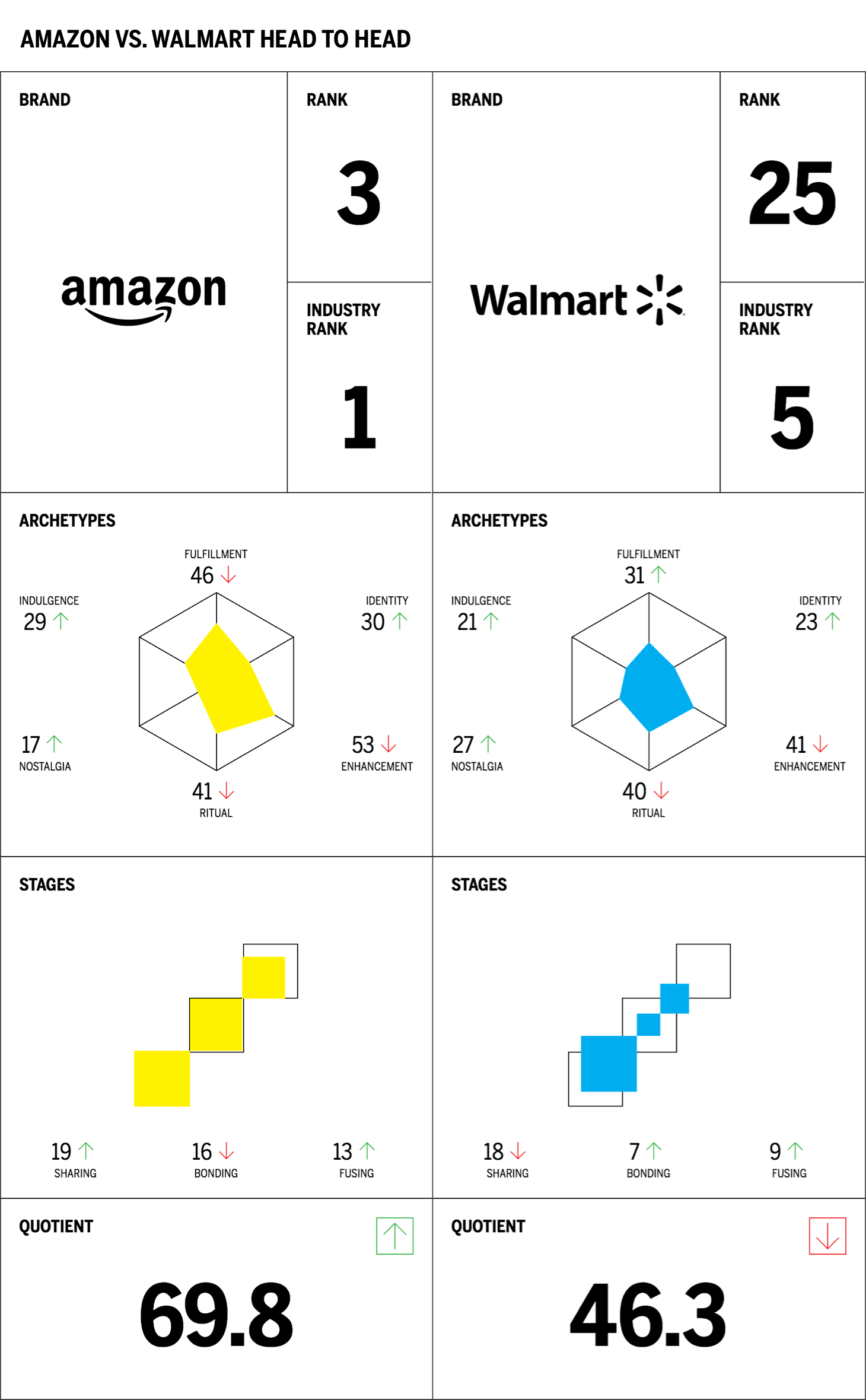

Examining head-to-head performance with Walmart reveals the extent of Amazon’s strength in building consumer bonds. Amazon features strong archetype performance, along with a trifecta of fulfillment (superior service), ritual (a brand that is part of a daily routine), and enhancement (a brand that makes me smarter, more capable). By comparison, Walmart has more subdued characteristics and performs much worse in measures of fulfillment and enhancement.

Even more dramatic is the comparison of stages. Amazon does a far superior job in converting users into more intense degrees of bonding and fusing stages of intimacy. Each level of improvement, from sharing to bonding and eventually to fusing, creates consumers who are more engaged, willing to pay more, and less willing to live without the brand.

When you consider that intimate brands outperform the F500 and S&P, it is easy to see why Amazon outperforms Walmart by 34 percent in Brand Intimacy and in the marketplace.

The ecosystem

Much has been written about the breadth and diversity of the Amazon business, which includes web services, data centers, retail, electronics, and content. Looking at the consumer brands Amazon is nurturing reveals a powerful mix of sub-brands and services that surround the customer in a comprehensive and holistic way.

If there is one area of weakness we’ve found, it relates to user demographics. The brand performs well with women (it is actually the number one brand in our study according to female respondents) and with older consumers. However, the brand is less compelling to millennials and Gen Z consumers. Generally speaking, the brand is stronger with older, female, and lower-income consumers, which reflects the “value seeker” demographic in the US. Finding ways to broaden the brand’s demographic appeal is likely a key priority, and the Whole Foods acquisition is clearly a response to this challenge.

Notwithstanding the relatively minor performance gaps, the brand is truly dominant in building intimate consumer relationships. We anticipate that this trend will accelerate over time. Given its breadth of industry strengths and its ability to leverage its resources, scale, data, and content, we believe it is only a matter of time before Amazon ranks #1 in our annual study.

Read our detailed methodology here, and review the sources cited in this article here.

Check out our annual study and rankings of intimate brands. Visit our most recent rankings of intimate famous figures—BFF. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.

Register for our webinar to learn patterns, insights, and findings from the Retail industry here.