Overview:

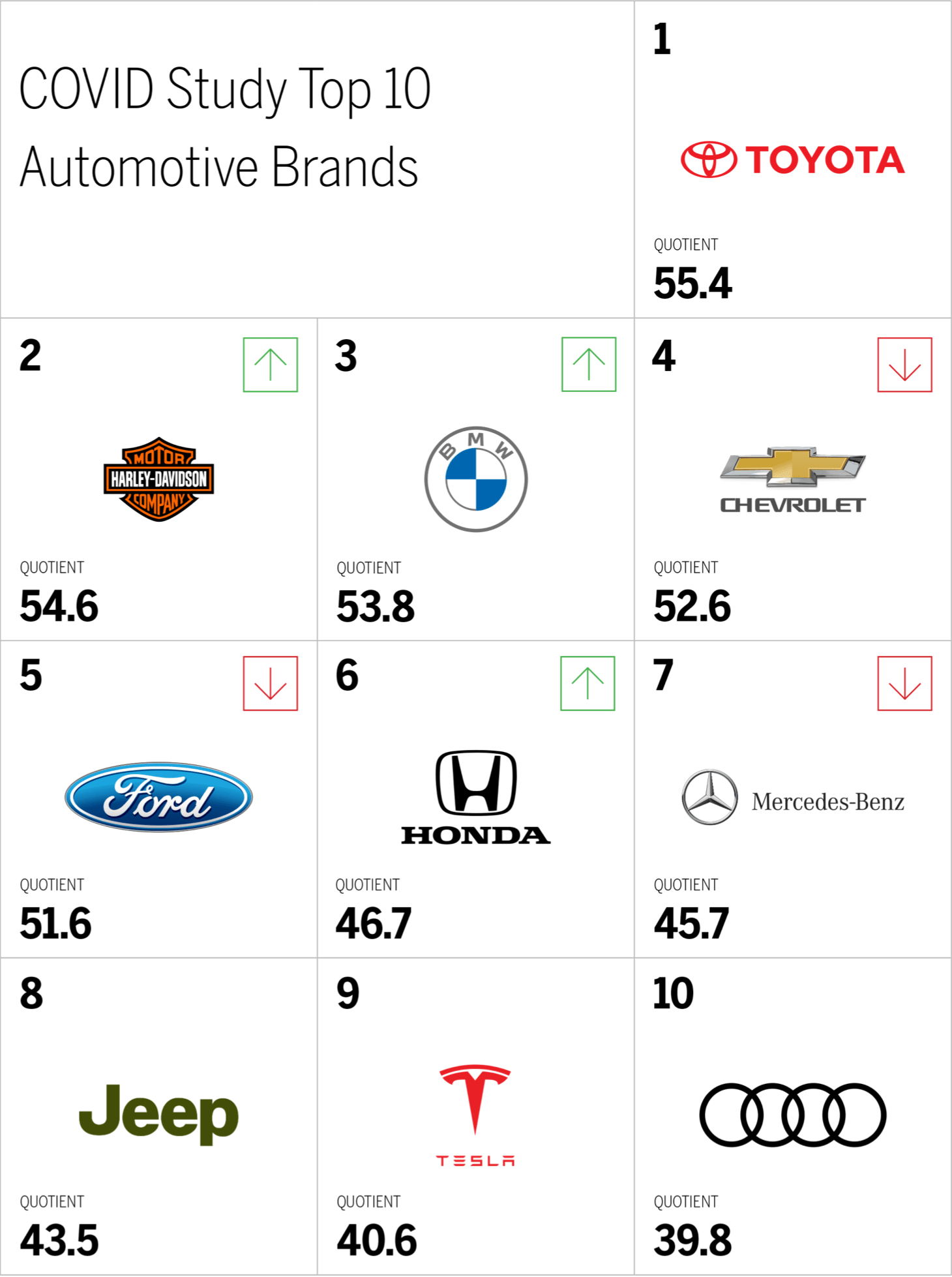

- The automotive industry ranks second in our 2021 Brand Intimacy COVID Study. To view our new study, click here.

- Toyota is the top-ranked automotive brand, and ranks sixth overall in our study. To see Toyota’s brand profile, click here.

- Chevrolet is the top-ranked brand for women. To see Chevrolet’s brand profile, click here.

Introduction

We shared our 2020 Brand Intimacy COVID Study last year as the pandemic was affecting all our lives. We were interested in seeing its impact on the brands we all use and love. We are now sharing a follow-up study, fielded a year later when things were improving and businesses began reopening. Lately, with the rise of the Delta variant, we see the extended presence of COVID in our lives. As the world continues to deal with the pandemic, and businesses and their brands face persistent challenges, we are sharing new insights on how brands can focus, enhance, or optimize for the marketplace that we are all eager to see return to normal.

The findings from our follow-up Brand Intimacy COVID Study, conducted with 3,000 consumers in summer 2021, demonstrate how leading brand and consumer behavior has changed since a year ago.

Brand Intimacy Performance Today

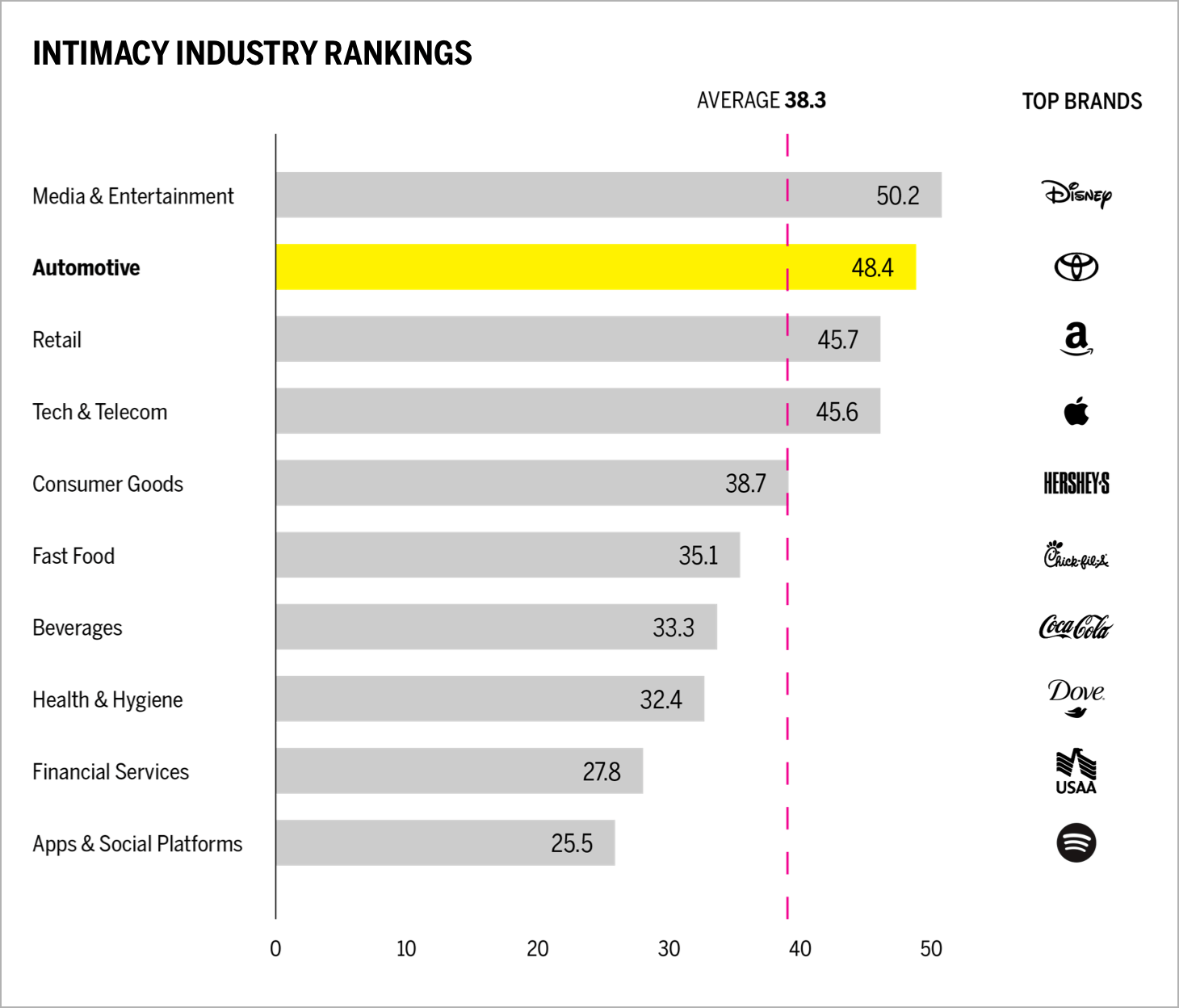

Automotive ranks second this year, behind media & entertainment, with an average Brand Intimacy Quotient of 48.4, well above the cross-industry average of 38.3.

The automotive industry has been greatly affected by the pandemic. Predictions have ranged from factory shutdowns and related labor issues to hastening of electric vehicles, to partnerships like the recent one between Ford and Volkswagen to develop autonomous software.1 The global semiconductor chip shortage is another major challenge and is expected to cost the global automotive industry $110 billion in revenue in 2021.2

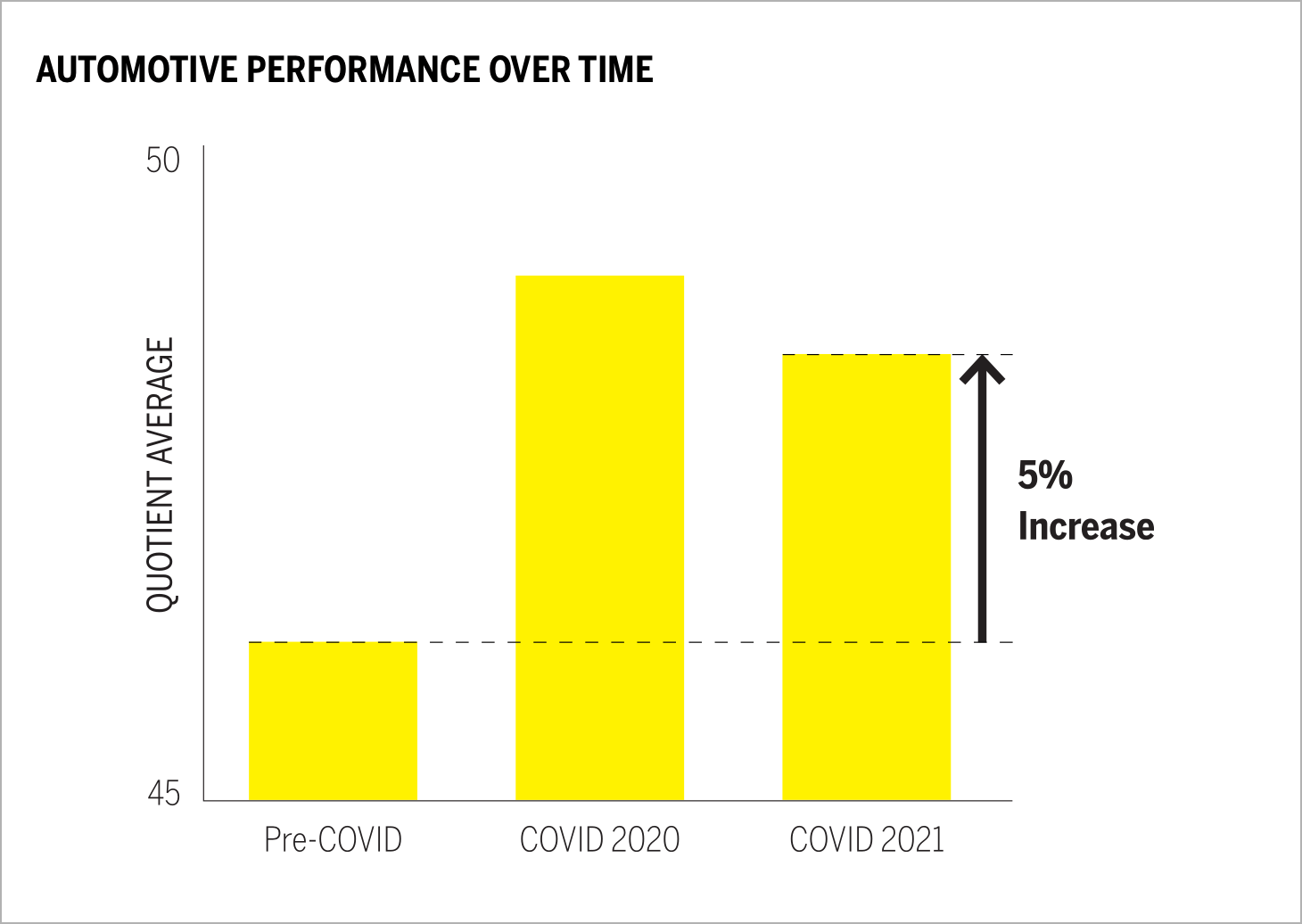

Regardless of these logistical setbacks, the industry’s Brand Intimacy performance has increased by an average of 5 percent since before the pandemic. Despite the hardships imposed by COVID on people and businesses, this period has actually drawn consumers closer to automotive brands and created stronger emotional relationships.

Toyota remains #1 in the industry, up from fifth before the pandemic. Maintaining its top ranking since our 2020 COVID study, Toyota’s performance highlights the more practical aspects of its brand that people are now connecting with. We often see in uncertain and challenging times that value-driven brands tend to rise.

Harley-Davidson, BMW, and Honda all showed improvement, while Chevrolet, Ford, and Mercedes all declined. The industry does better with men than women and with consumers over 35 than under 35.

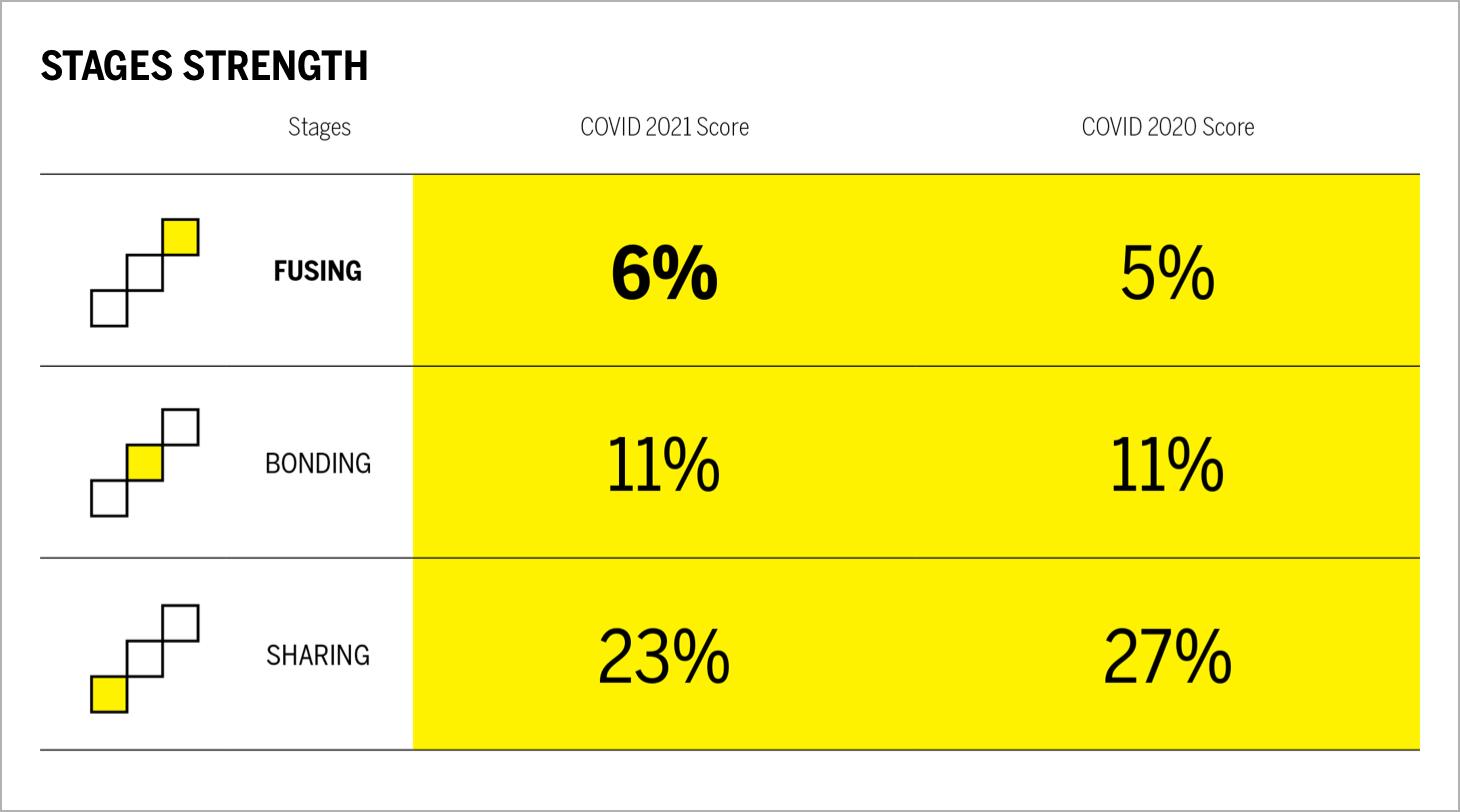

Automotive ranks first among all industries for the highest percentage of users in sharing and bonding, the earliest and middle stages of Brand Intimacy. Sharing, the earliest stage of Brand Intimacy has declined by 15 percent. However, compared to our 2020 COVID Study, the category has improved its performance in fusing, the ultimate stage of Brand Intimacy, by 20 percent.

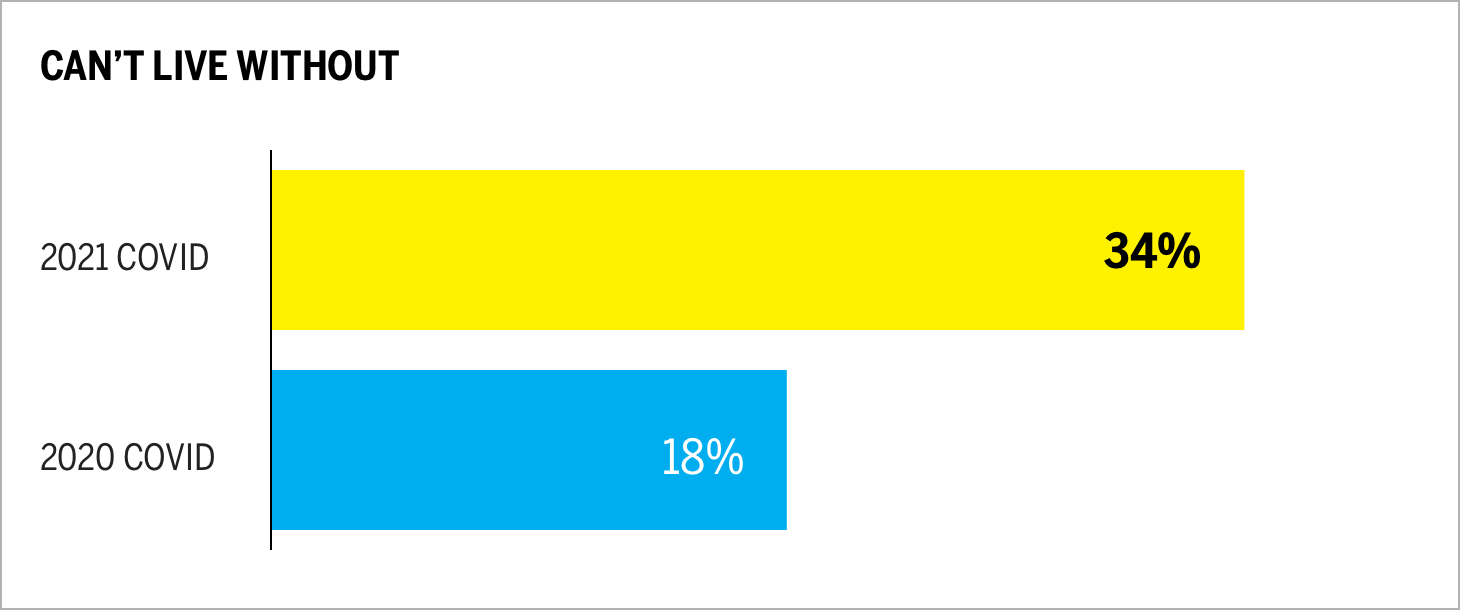

Can’t live without (a measure based on a ten-point scale that determines how essential a brand is to our lives) has risen dramatically by 87 percent since our 2020 study, further highlighting consumers’ continued reliance on automotive brands.

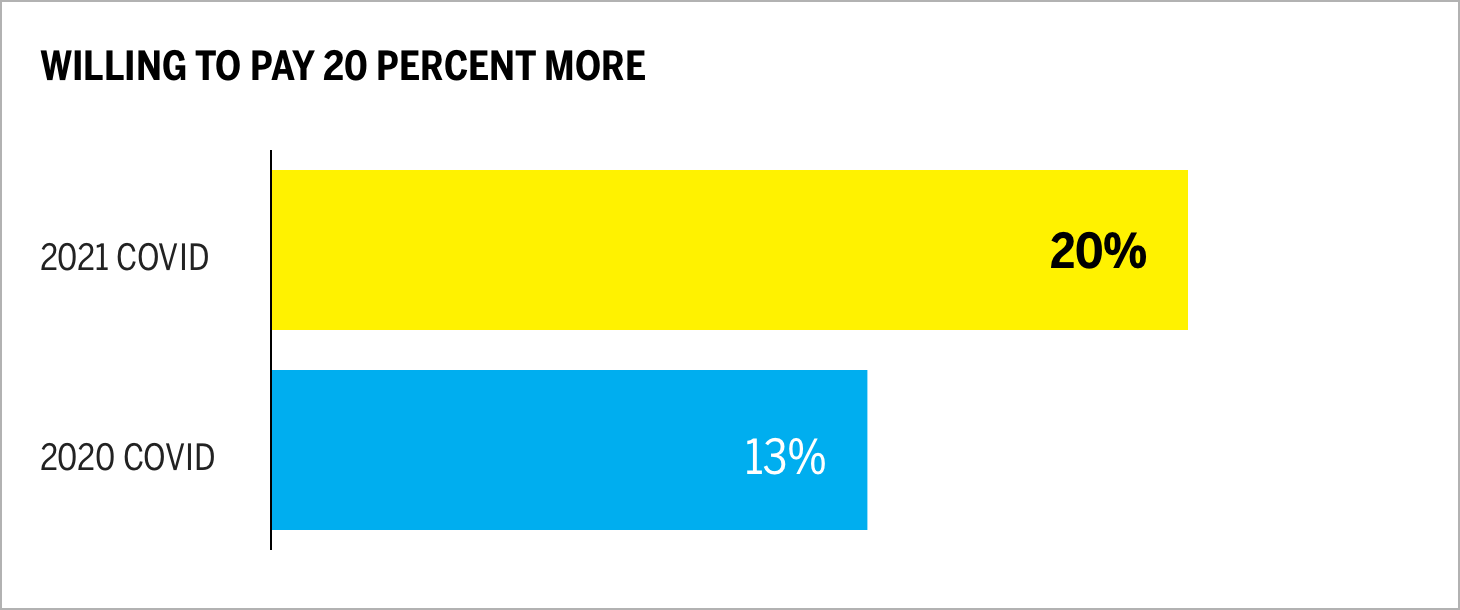

The number of users willing to pay 20 percent or more for automotive products increased by 47 percent. Harley Davidson is the highest-ranked automotive brand that consumers are willing to pay 20 percent more for, with 25 percent of all users willing to pay more. This indicates that when an automotive brand makes the right emotional connection, there is opportunity for price resilience and a willingness among customers to pay more.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how the brands themselves have behaved and communicated since the pandemic started last year. What has changed in their messaging in a year? We have captured a language analysis from company websites and social media, focusing on 5 brands and encompassing 1,065,231 words.

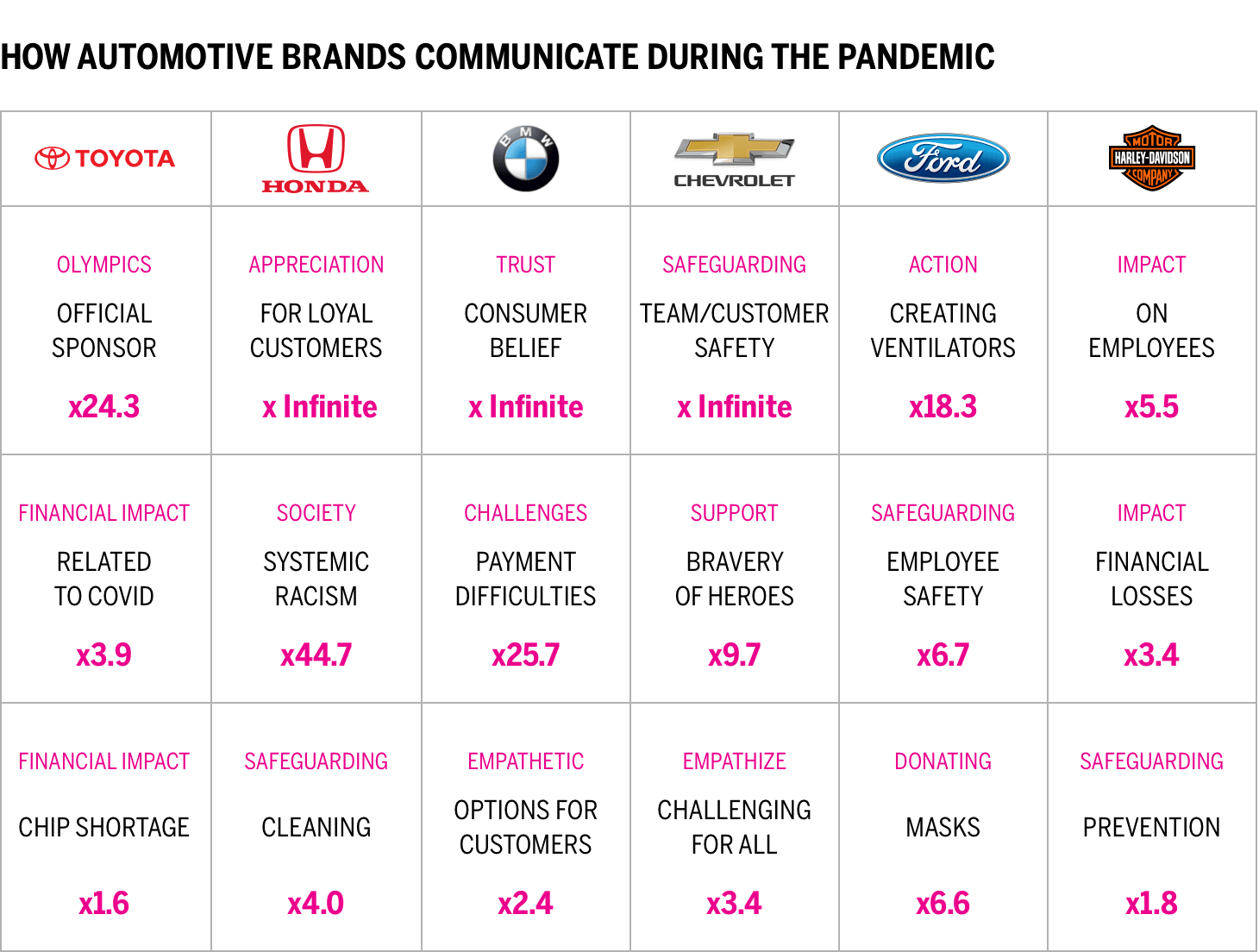

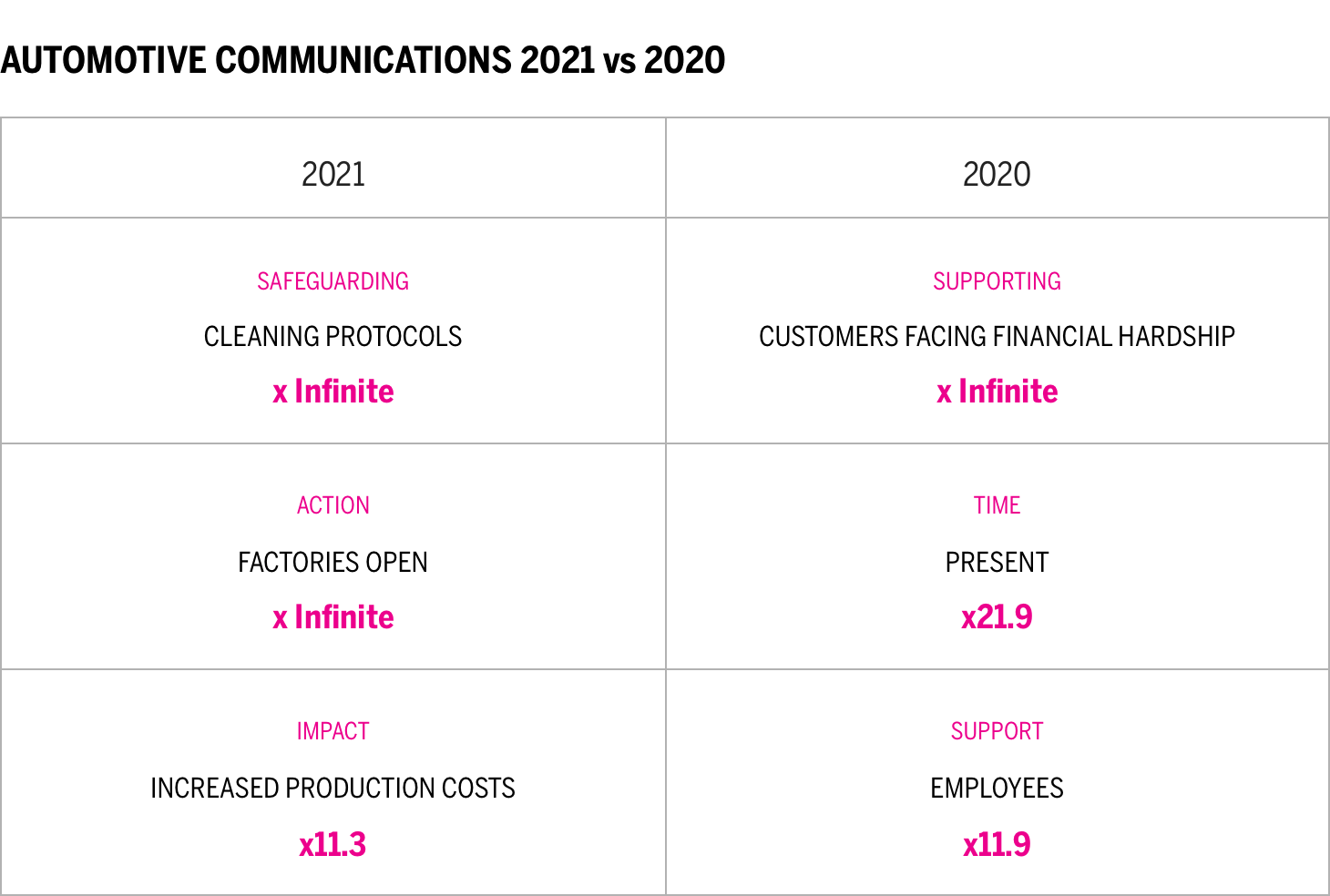

This chart presents a comparison of how leading brands are communicating about COVID on their websites and social. We are able to see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., BMW speaks 25.7 times more about financial difficulties customers may be facing).

Automotive brands have addressed the pandemic in a variety of ways. Some brands are using similar messaging to last year, others have new areas of focus. BMW appears the most sympathetic to customers’ challenges, emphasizing its recent strong performance in an industry survey on trusted brands. BMW also highlights an understanding of payment difficulties many are facing and is working to provide options for customers who may feel uncomfortable coming to dealerships. Toyota, besides their recent sponsorship of the Tokyo Olympics, speaks more about the financial impact of COVID, from factory closings to the chip shortage. Honda uniquely emphasizes combating systemic racism, while Chevrolet still highlights the bravery and dedication of first responders and essential workers. Last year, Ford mentioned the work it is doing to create sustainable personal protection equipment. This year, the emphasis was on creating ventilators during the pandemic’s most trying times. Harley-Davidson, which last year took a more personal tone, now also highlights the financial impact of COVID on their business and employees.

Comparing this year’s communications to last year’s, we see in 2020 that automotive brands paid more attention to supporting customers through financial hardship, living in the present moment, and prioritizing the health and safety of employees. In 2021, communications got more concrete, centering on the impact of COVID and the tangible results brands are achieving. There is greater emphasis on safeguarding employees and customers through enhanced cleaning protocols. The fact that factories and dealerships are open is more evident and there is more communication about increased production costs and more pressure on automotive brands due to the shutdown, supply chain issues, and related shortages.

Automotive brands are not the only ones mentioning shortages and limitations. In 2021, consumers were 7.7 times more likely to mention parts and supplies compared to our study last year. The chip shortage in particular has been a big focus of social posts, and consumers are frustrated.

“@BraselTheGamer and with the new car component shortage because of Covid, used cars are even more expensive right now.”

“@Chevrolet is it true that I can’t get my Blazer because y’all are experiencing a chip shortage and the slowdowns of the pandemic overseas have finally crossed over to the U.S.?!”

“Covid-19 and the ongoing semiconductor shortage are forcing @Honda and @Toyota to stop production at several plants across North America.”

“Dear people of the world: if you go to Tesla asking to buy a car, don’t expect them to give it to you at the price of a geo metro— especially when there’s a global shortage.”

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and a key principle for navigating our challenging times. The continued impact and longevity of the pandemic requires automotive brands to think about maintaining strong emotional connections with current users and attracting new users in more carefully considered ways.

Overall, the automotive industry continues to perform well, ranking second overall and first in sharing and bonding, the first two stages of Brand Intimacy. However, there are some concerns. The automotive industry did not improve its Quotient Scores this year; instead they declined slightly. In addition, we saw the percentage of users in sharing, the earliest stage of Brand Intimacy, shrink by 15 percent. This means fewer new customers are connecting emotionally with automotive brands. We also see significant industry challenges brought on by the pandemic that continue to linger: factory closures, labor issues, supply chain shortages and increases costs. Further, it is unclear what, if any, implications COVID-related lifestyle changes may have; although more people may have chosen remote work, many have moved out of cities and into suburbs and rural areas.

Given the continued top ranking of the automotive industry, we know consumers are very attached to their car and motorcycle brands. Although sales and profits may suffer in the short term for some manufacturers, we anticipate automotive brands will continue to be strong performers, especially if they continue to focus on building relationships and establishing meaningful dialogue with customers.

Review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.