Overview:

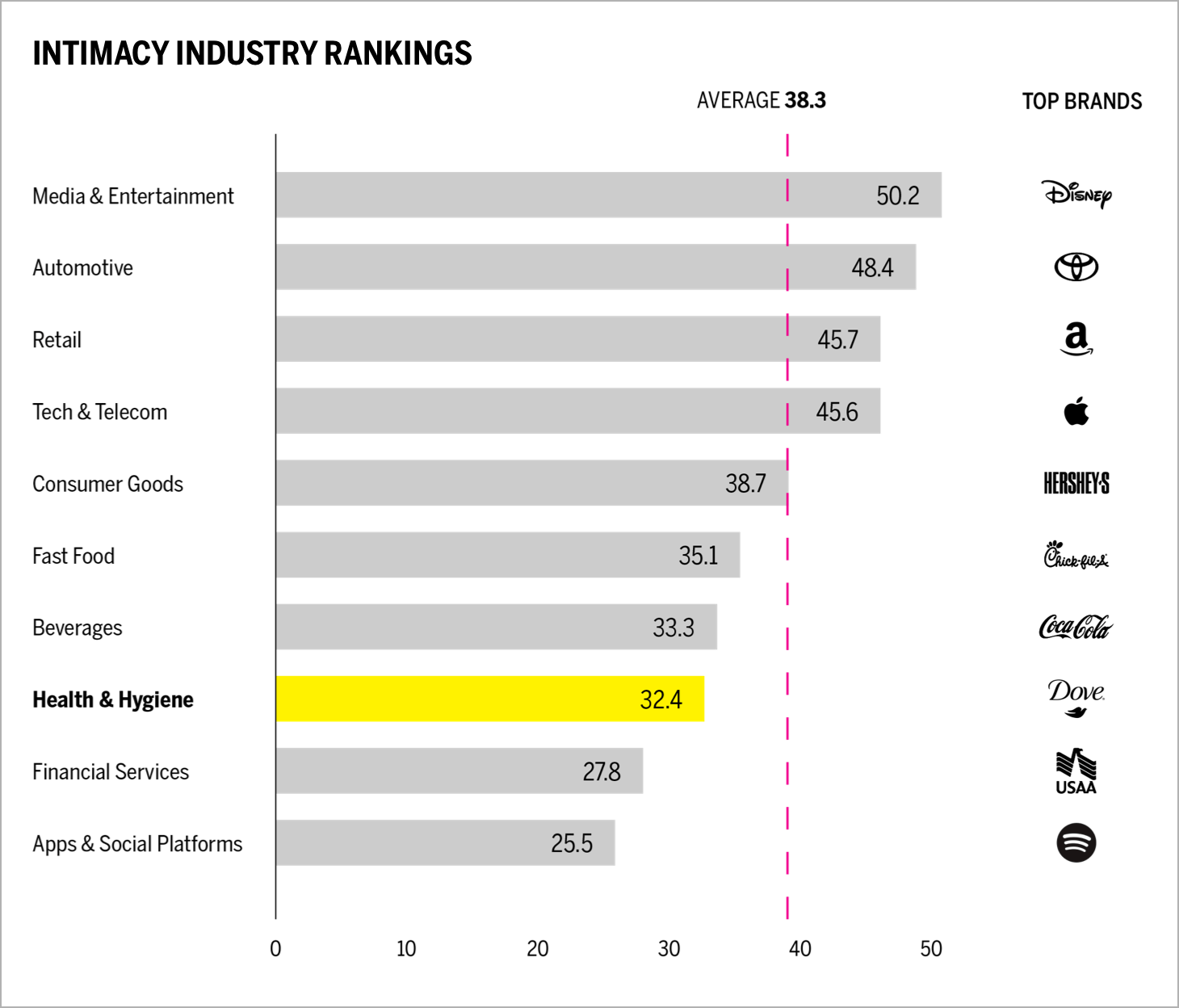

- The health & hygiene industry ranks eighth in our 2021 Brand Intimacy COVID Study. To review our new study click here.

- Dove is the top-ranking brand in the industry. To review its profile, click here.

- The health & hygiene industry has the highest percentage of users willing to pay 20 percent more for brands. To review the industry report, click here.

Introduction

We shared our 2020 Brand Intimacy COVID Study last year as the pandemic was affecting all our lives. We were interested in seeing its impact on the brands we all use and love. We are now sharing a follow-up study, fielded a year later when things were improving and businesses began reopening. Lately, with the rise of the Delta variant, we see the extended presence of COVID in our lives. As the world continues to deal with the pandemic, and businesses and their brands face persistent challenges, we are sharing new insights on how brands can focus, enhance, or optimize for the marketplace that we are all eager to see return to normal.

The findings from our follow-up Brand Intimacy COVID Study, conducted with 3,000 consumers in summer 2021, demonstrate how leading brand and consumer behavior has changed since a year ago.

Brand Intimacy Performance Today

The health & hygiene industry ranks eighth this year, the same position it held in our 2020 COVID study. The industry has an average Brand Intimacy Quotient of 32.4, well below the cross-industry average of 38.3. While still a bottom-ranking intimate industry, the average Quotient Score has risen by 3 percent, indicating that brands in this category have been able to maintain and slightly strengthen their bonds with customers during this period of uncertainty. Mirroring this, our 2021 study reveals that the health & hygiene industry is now first among all industries in users reporting that they would pay 20 percent more for the brands in this category.

Specific hygiene product segments related to combating the spread of the virus, such as soaps and hand sanitizers, continue their upward sales trajectories from the previous year with a projected global market CAGR of 5.8 percent in 2021–20261. Beauty and personal care, by contrast, experienced a 15 percent overall drop in sales in 2020, but it is projected to return to growth in 2022.2

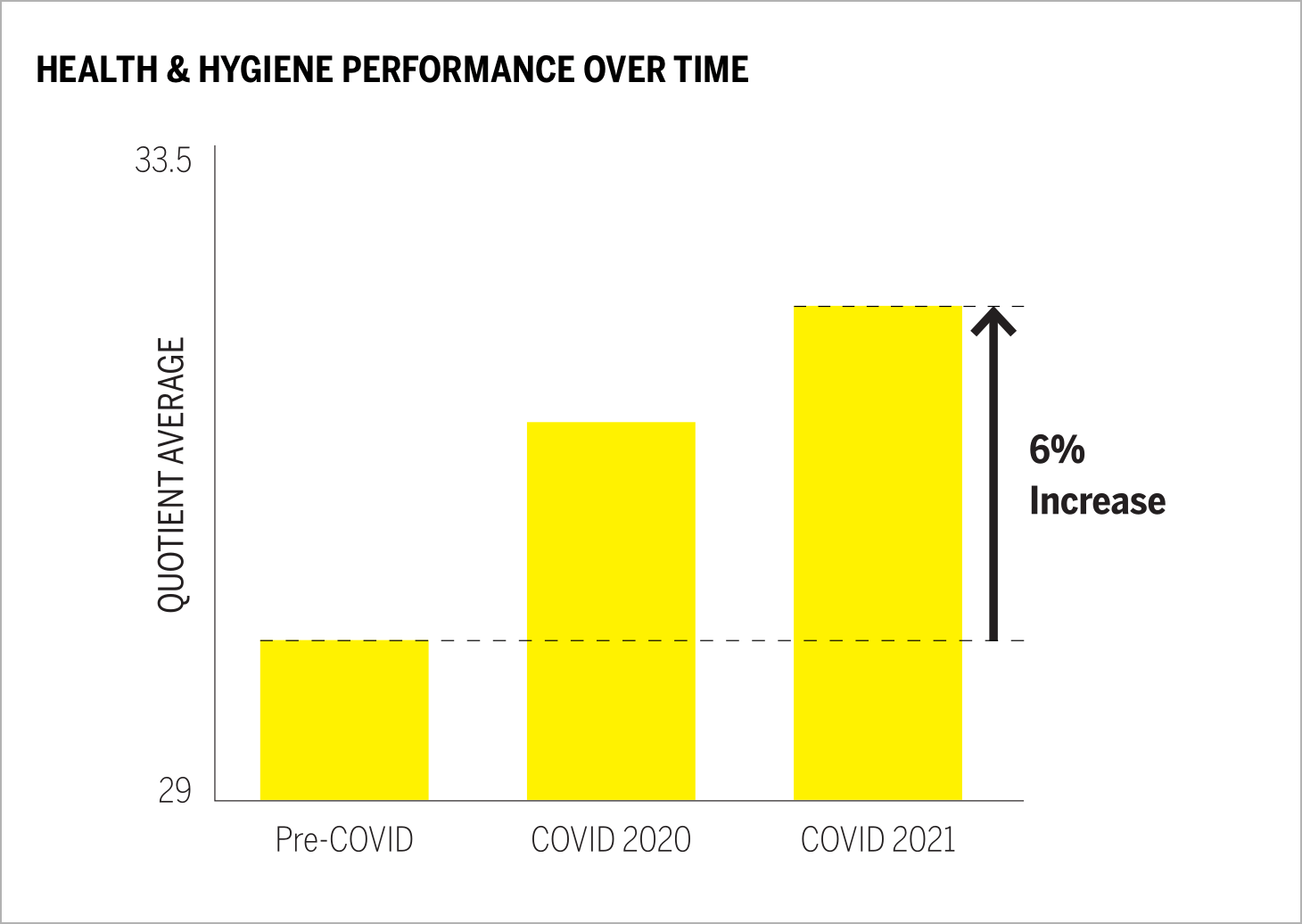

Brand Intimacy performance for the industry has increased by an average of 6 percent since before the pandemic, despite manufacturing and supply chain challenges. Although COVID imposed hardships on people and businesses, this period has actually drawn consumers closer to health & hygiene brands and created stronger emotional relationships.

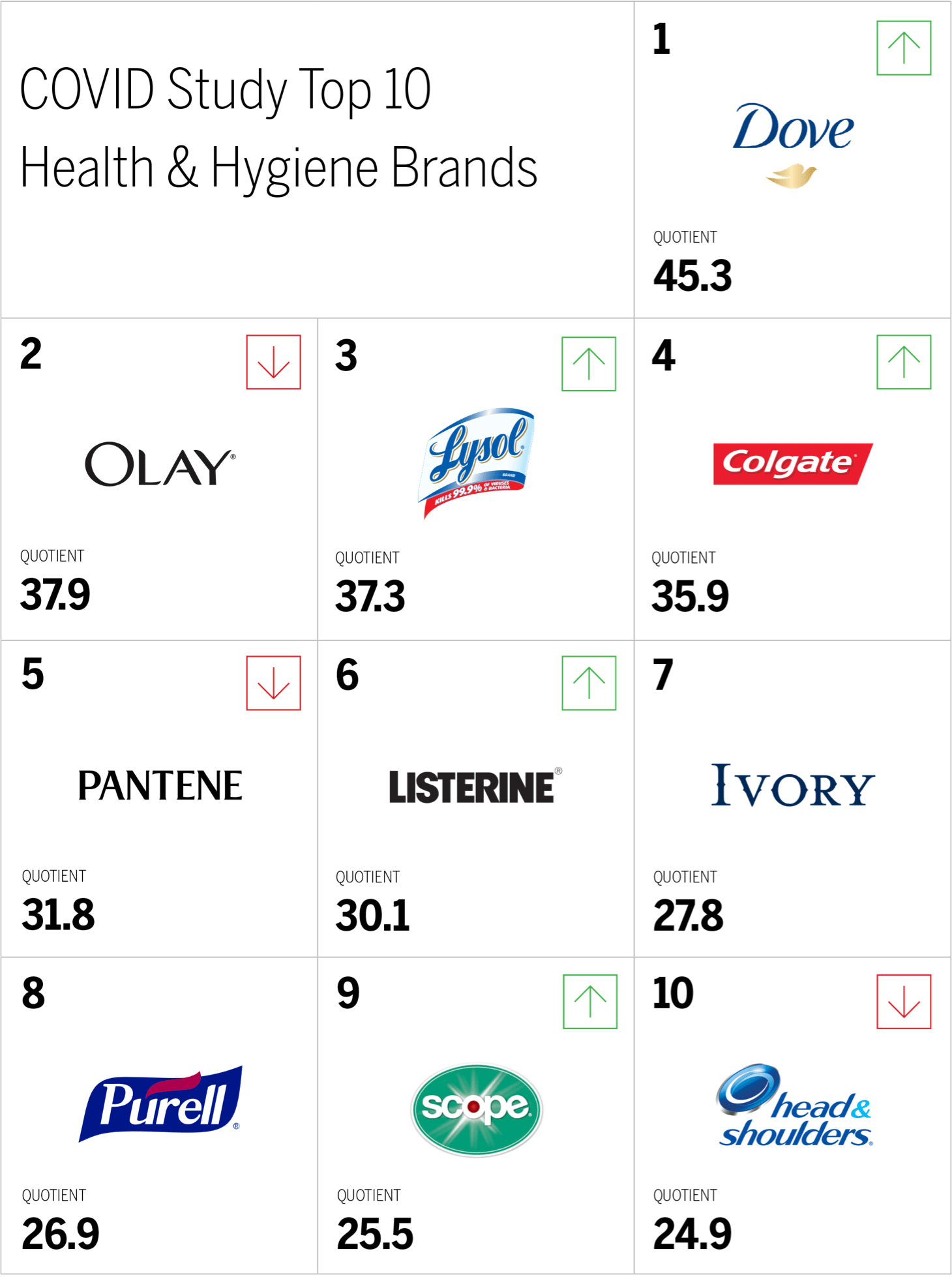

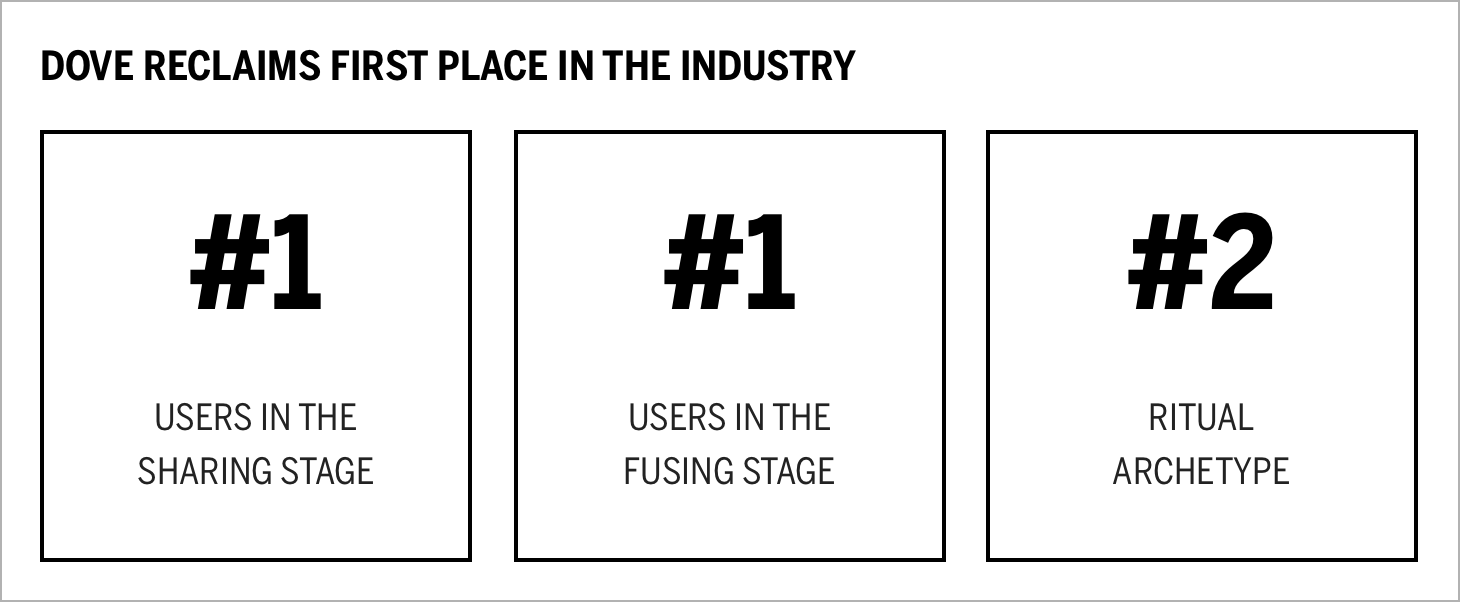

Dove has moved into first place in the industry, increasing its Brand Intimacy Quotient by 18 percent to 45.3, whereas Olay dropped from top ranking to second place. Consumer preference for Lysol and Scope has increased, while preference for Pantene and Head & Shoulders has declined. Health & hygiene brands perform better with women than men and with consumers older than 35 years old versus those under 35.

Dove is also the top-ranking brand across men, women, users under 45, and low- and high-income consumers, ceding to Olay only in the 45-64 year old consumer age range. Indeed, 2020 performance showed that parent company Unilever’s beauty and personal care sales grow 1.2 percent,3 with underlying sales growth at 2.3 percent for Q1 2021.4

Lysol’s performance reflects the overall trend in hygiene product sales trajectories. Lysol is the top-ranking brand in the category for how essential the brand is to consumers’ lives, in the percentage of users willing to pay 20 percent more for the brand, and in the enhancement archetype (becoming smarter, more capable, and more connected through the use of the brand).

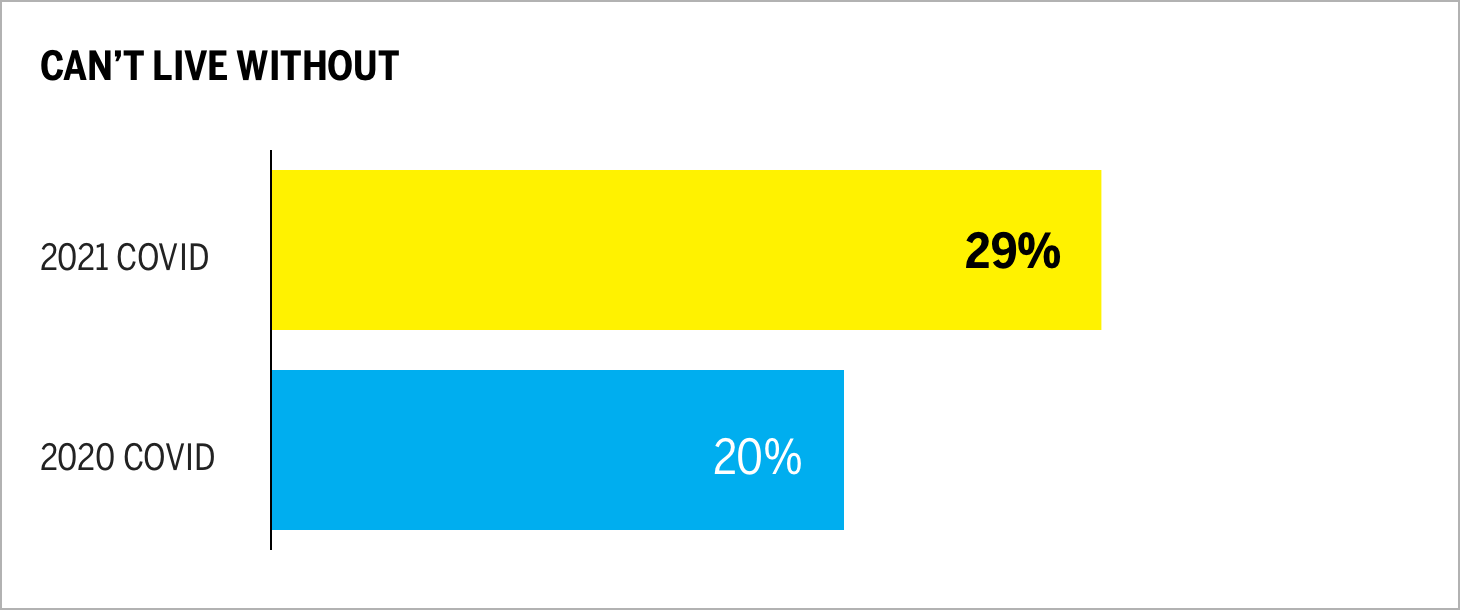

Can’t live without (a measure based on a ten-point scale that determines how essential a brand is to our lives) has increased during the pandemic by 48 percent, further highlighting consumers’ increasing reliance on health & hygiene brands.

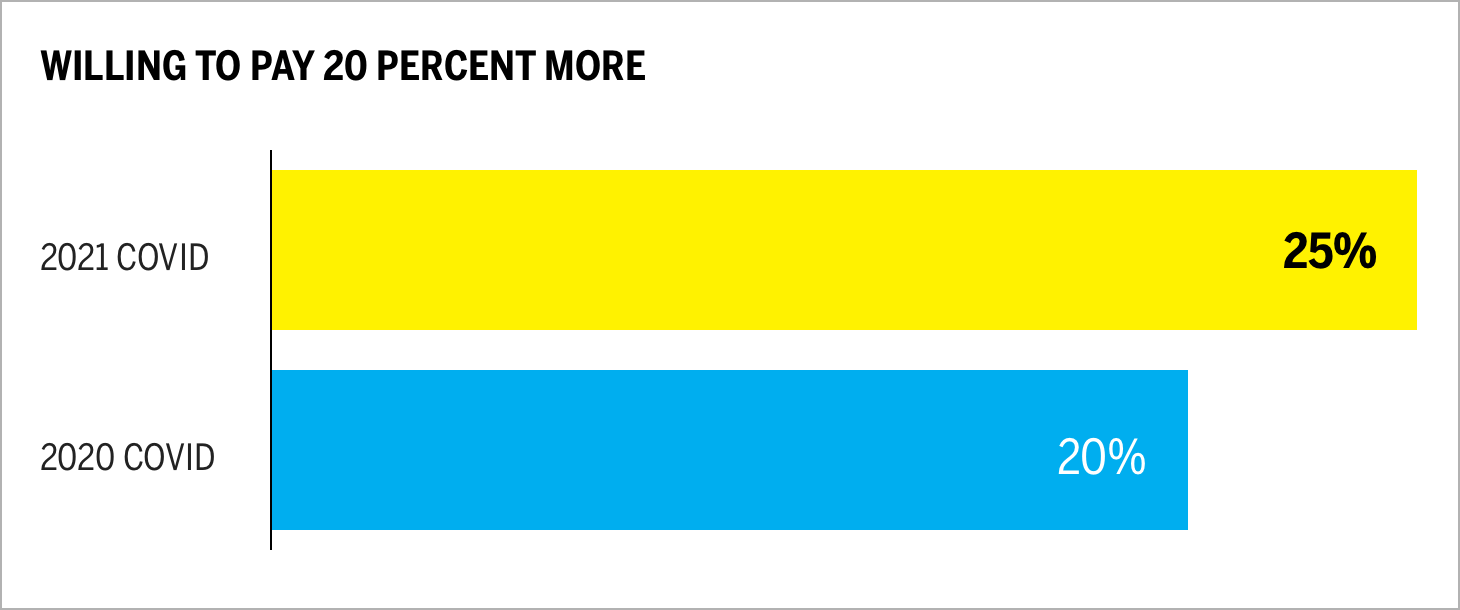

The percentage of health & hygiene consumers who are willing to pay 20 percent or more for brands’ products and services increased by 27 percent. Lysol is also the highest-ranked category brand for this measure at 33 percent.

How Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated since the pandemic started last year. What has changed in their messaging? We’ve captured language analysis from company websites and outbound social media, and also compared this to how brands were communicating last year, focusing on six brands and encompassing over 262,490 words.

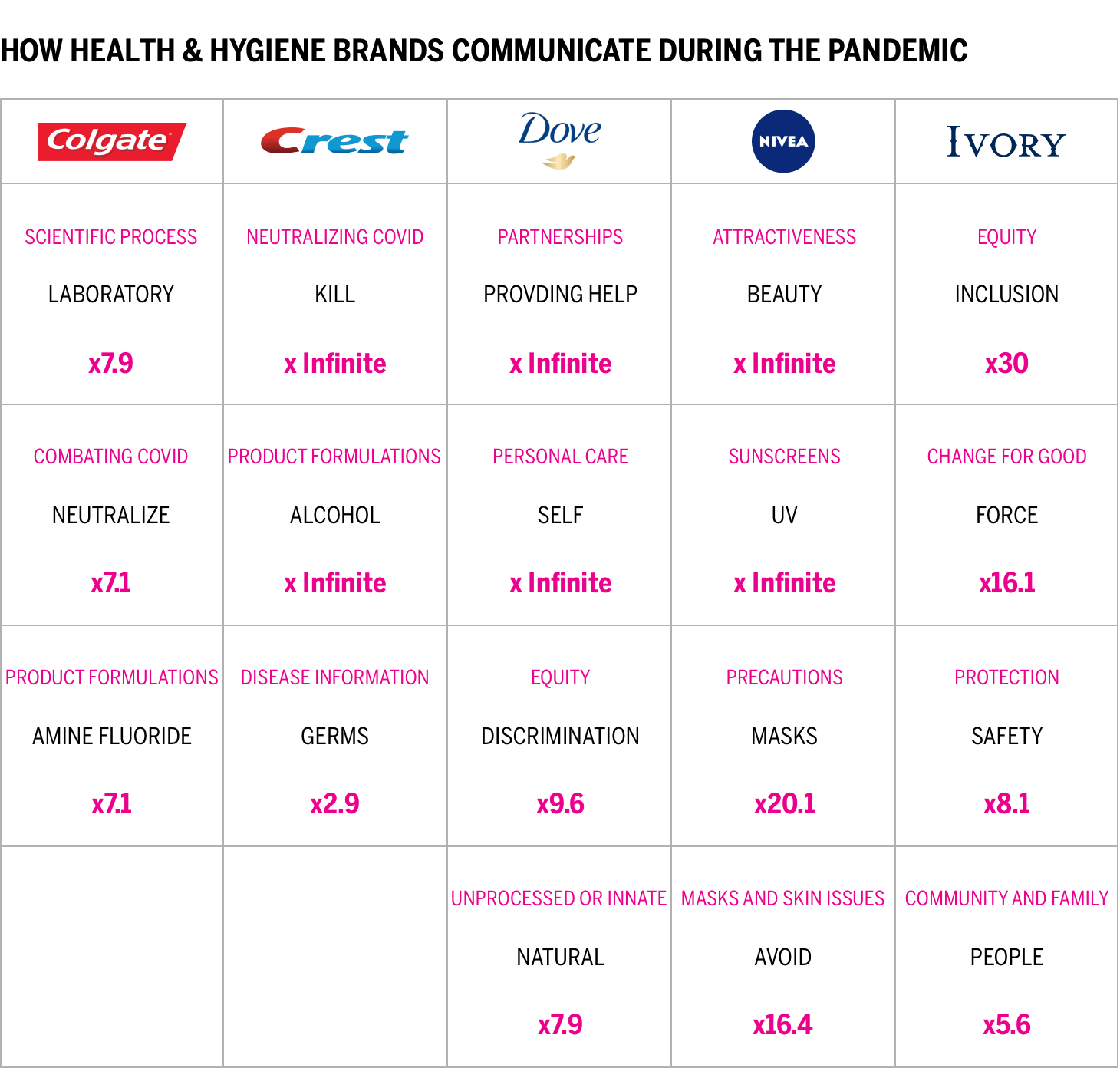

This chart presents a comparison of how these leading brands are communicating about COVID on their websites. We are able to view the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Colgate speaks about their scientific processes using words such as laboratory 7.9 times more than other brands).

Common themes across health and hygiene brand communications include product formulations and their interactions with COVID, such as Colgate’s focus on clearly delineating what effects its products have in neutralizing the virus or Crest’s communications on the effects of alcohol in its mouthwash products. Product-related communications also continue to play a major role, whether they are tactical, such as Crest’s focus on killing germs through toothpaste and Nivea’s focus on sunscreens and UV protection, or more elevated, such as Dove’s spotlight on self-care in challenging times.

Notably, Dove and Ivory (which was reviewed by analyzing parent brand P&G’s messaging) have distinct themes in their web and outbound social communications. Dove continues to promote individual positivity, confidence, and care, with far more mentions of relationships with loved ones, fighting against discrimination in health and hygiene products, and the importance of natural products and natural skin. Ivory (through P&G) places a similar emphasis on inclusion, being a force for good in a challenging times, and helping people in the community.

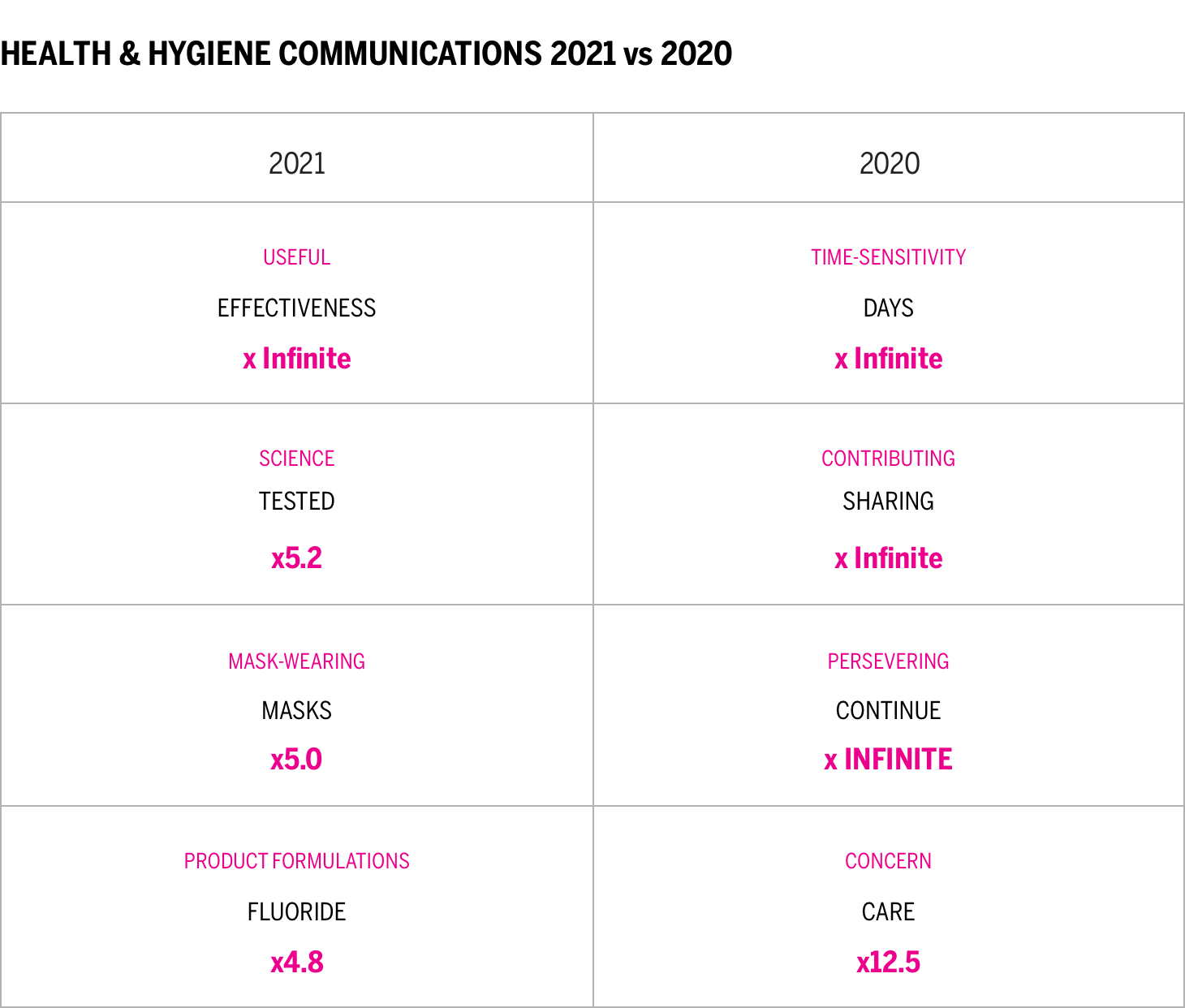

The category as a whole demonstrates how communications have evolved over a year of living through the pandemic, from broader themes of assistance and care to a more detailed focus on product efficacy and scientific testing. Last year, key communications included contributing solutions to ongoing pandemic-induced challenges and persevering through adversity, with frequent sensitivity to timing—what would happen in the coming days, weeks, and months? Since then, messaging has shifted to focus on the effectiveness of products in combating COVID, the rigor behind laboratory testing and product formulations, and the importance of mask wearing.

Conclusion

Though concern around COVID variants grows and nations continue to work through various health mandates, health and hygiene brands cannot rely solely on the necessity of hygiene products to continue to fuel demand and growth. Brands need to build and maintain strong emotional connections with consumers to continue to drive performance. Since our 2020 COVID study, the industry has shown shifts within the rankings and Quotient Scores, but overall trends demonstrate that these brands have largely maintained bonds with consumers and have not significantly grown them.

Though our latest findings demonstrate that these brands are becoming ever more essential to users’ lives, brands in the category need to consider how to deepen the relationships that have been built throughout the pandemic. By further leveraging the industry-leading archetypes of ritual and fulfillment, by reorienting how they speak about topics that have an outsized impact on consumer perceptions such as self-esteem and inclusivity, and by moving users through the stages of intimacy, brands can create better ways to combat sudden swings in purchasing trends and maintain price resiliency in turbulent economic conditions.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.