Overview:

- The retail industry ranks third in our 2021 Brand Intimacy COVID Study. To review our new study, click here.

- Amazon is the top-ranking retail brand. To review its profile, click here.

- This year there are four retail brands in the Top 10 Intimate Brands rankings. To review the industry report, click here.

Introduction

We shared our 2020 Brand Intimacy COVID Study last year as the pandemic was affecting all our lives. We were interested in seeing its impact on the brands we all use and love. We are now sharing a follow-up study, fielded a year later when things were improving and businesses began reopening. Lately, with the rise of the Delta variant, we see the extended presence of COVID in our lives. As the world continues to deal with the pandemic, and businesses and their brands face persistent challenges, we are sharing new insights on how brands can focus, enhance, or optimize for the marketplace that we are all eager to see return to normal.

The findings from our follow-up Brand Intimacy COVID Study, conducted with 3,000 consumers in summer 2021, demonstrate how leading brand and consumer behavior has changed since a year ago.

Brand Intimacy Performance Today

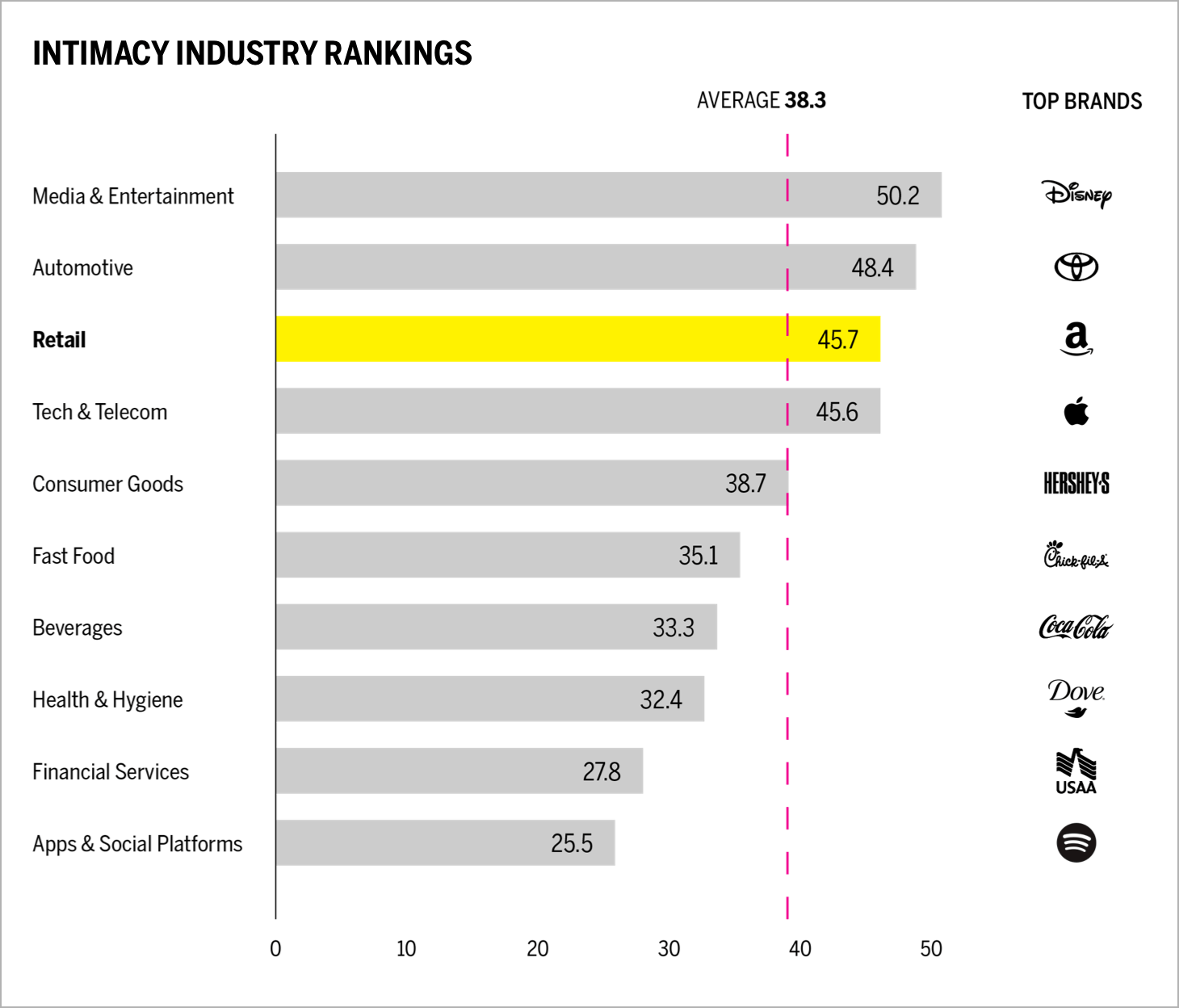

The retail industry has an average Brand Intimacy Quotient of 45.7 well above the cross-industry average of 38.3. Brand performance has slightly declined since a year ago, which is not surprising because last year consumers were hyper-concerned with hoarding essential products like water, toilet paper, and disinfectant.

The industry is now bouncing back, with sales expected to grow between 10.5 percent and 13.5 percent to an estimated total of $4.44-$4.56 trillion in 2021, as the economy rebounds from the pandemic.1

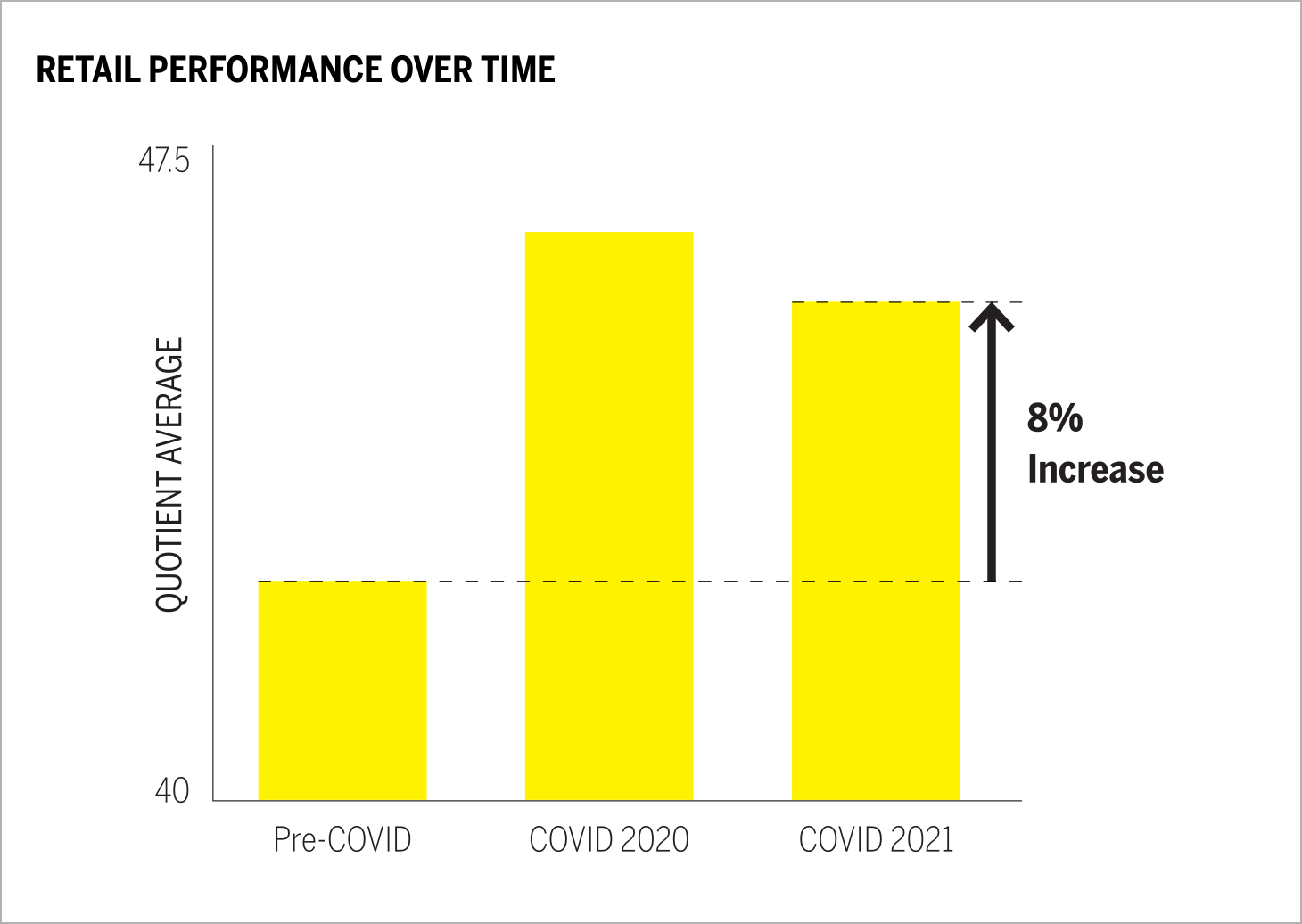

Although there have been drastic fluctutations in demand, Brand Intimacy performance for the industry has increased by an average of 8 percent on average since before the pandemic. Despite the hardships imposed by COVID on people and businesses, this period has actually drawn consumers closer to brands and created stronger emotional relationships.

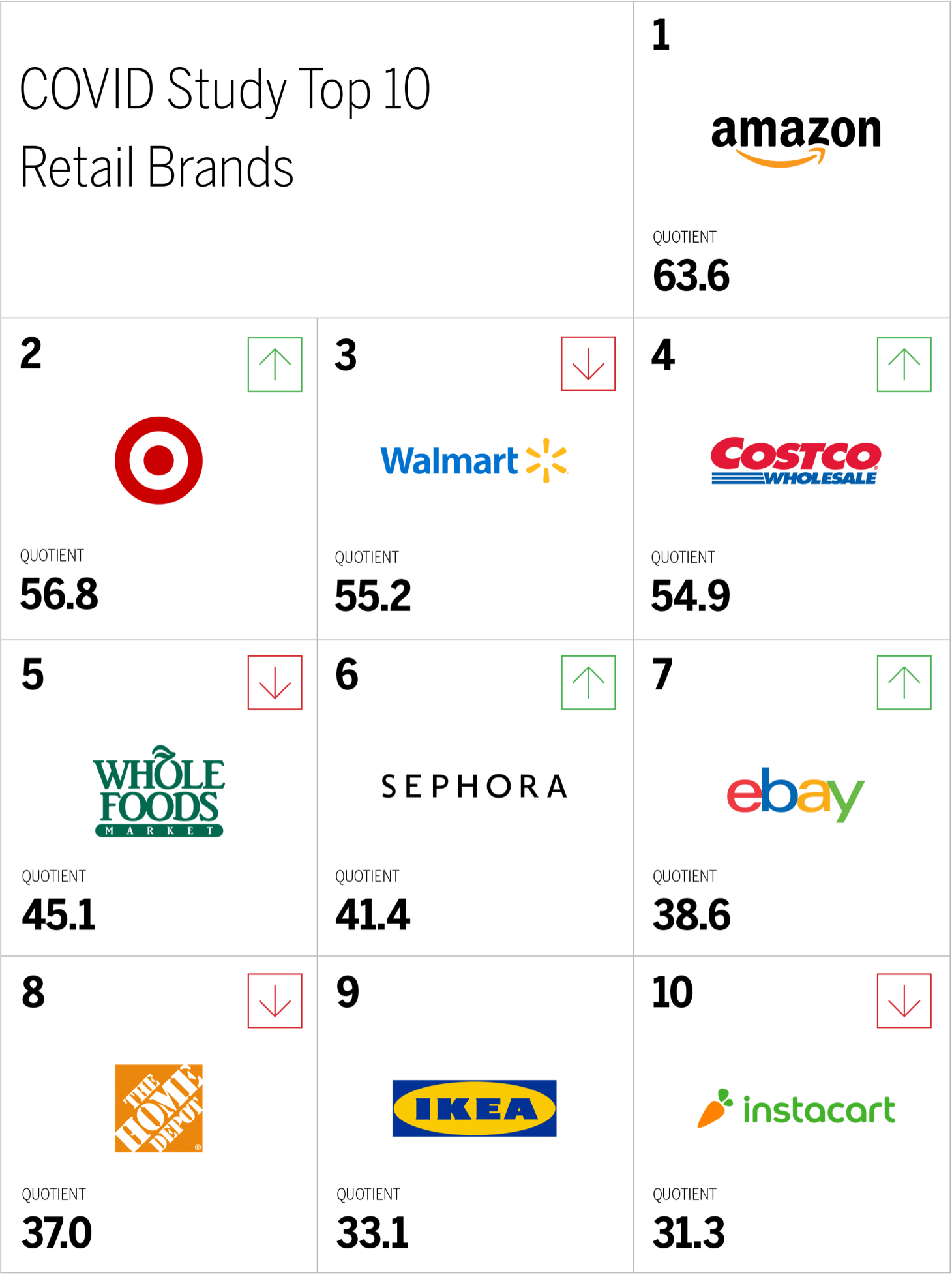

There has been considerable movement among the top 10 retail brands. Amazon remains in first place, with Target rising to second place. Whole Foods dropped from third position to fifth, and Instacart fell three places. Amazon is the #1 brand for women and across all ages groups, demonstrating its broad appeal during the pandemic.

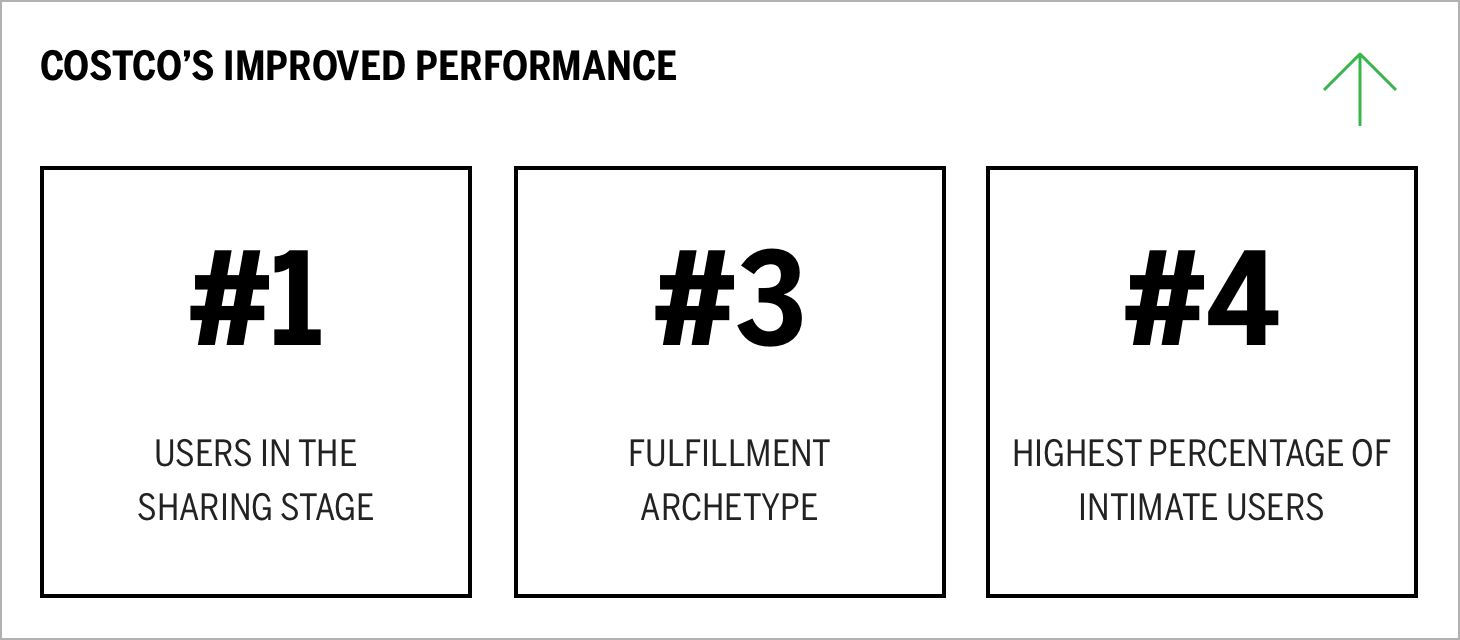

Costco’s rise is also notable in our 2021 study. The brand rose 24 positions to rank eighth overall and fourth in retail. This aligns with its soaring business performance, as sales in the third quarter were ahead of expectations, with net sales increasing +21.7% to $44.4 billion from $36.5 billion last year.2

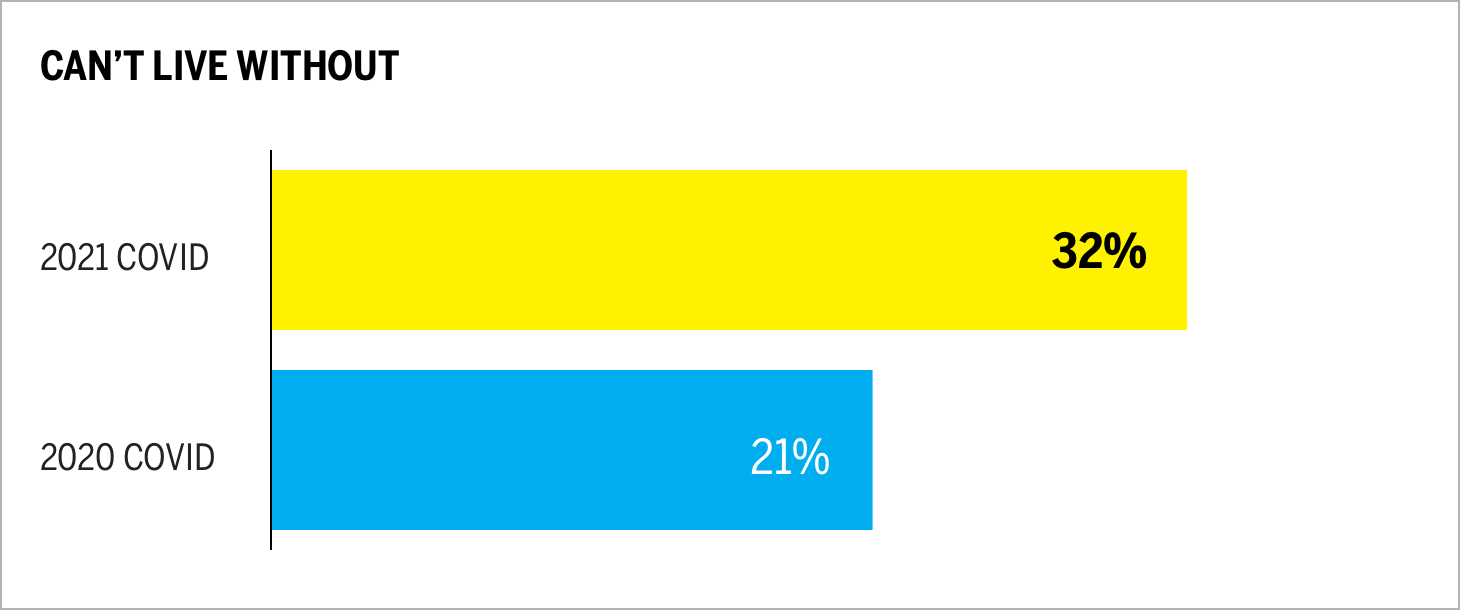

Can’t live without (a measure based on a ten-point scale that determines how essential a brand is to our lives) has increased during the pandemic by 55 percent, further highlighting consumers are increasing reliance on retail brands.

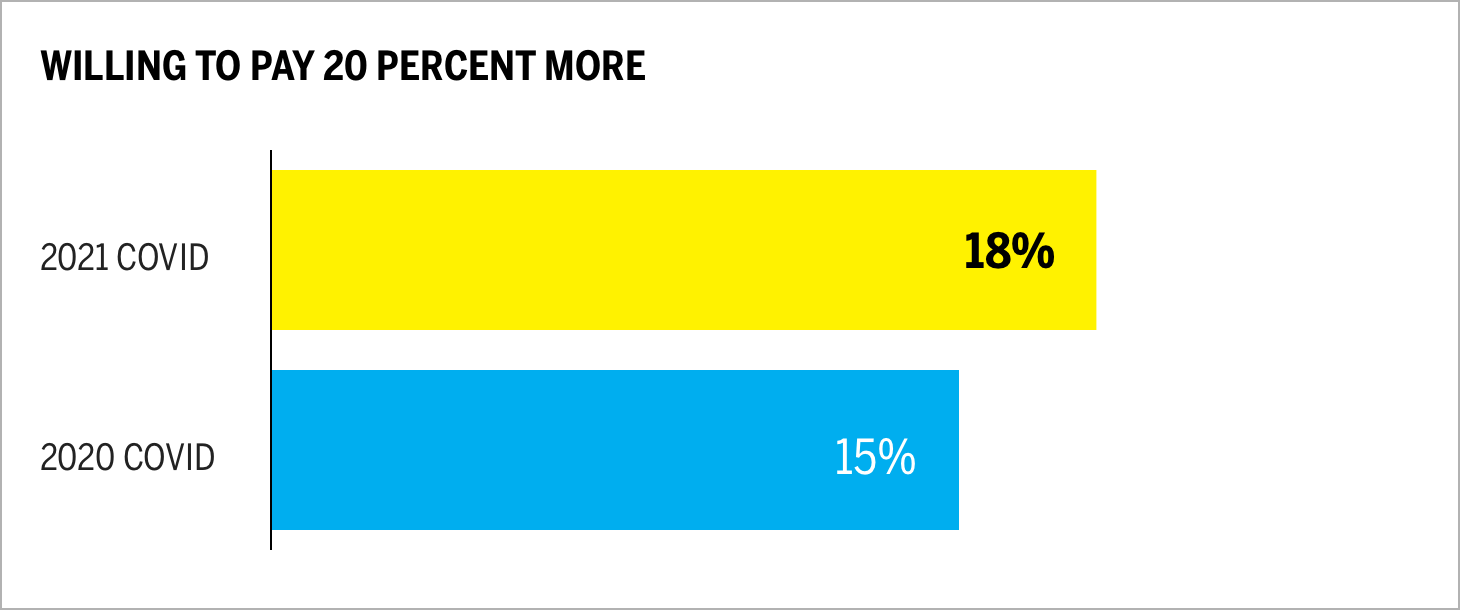

The percentage of consumers willing to pay 20% or more for products and services increased by 17 percent. Walmart is the highest-ranked retail brand for this measure, at 27 percent.

How Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we also looked at how brands themselves have behaved and communicated since the pandemic started last year. What has changed in their messaging? One notable finding is there is more talk about COVID now vs. a year ago: the use of language related to COVID has more than doubled since 2020.

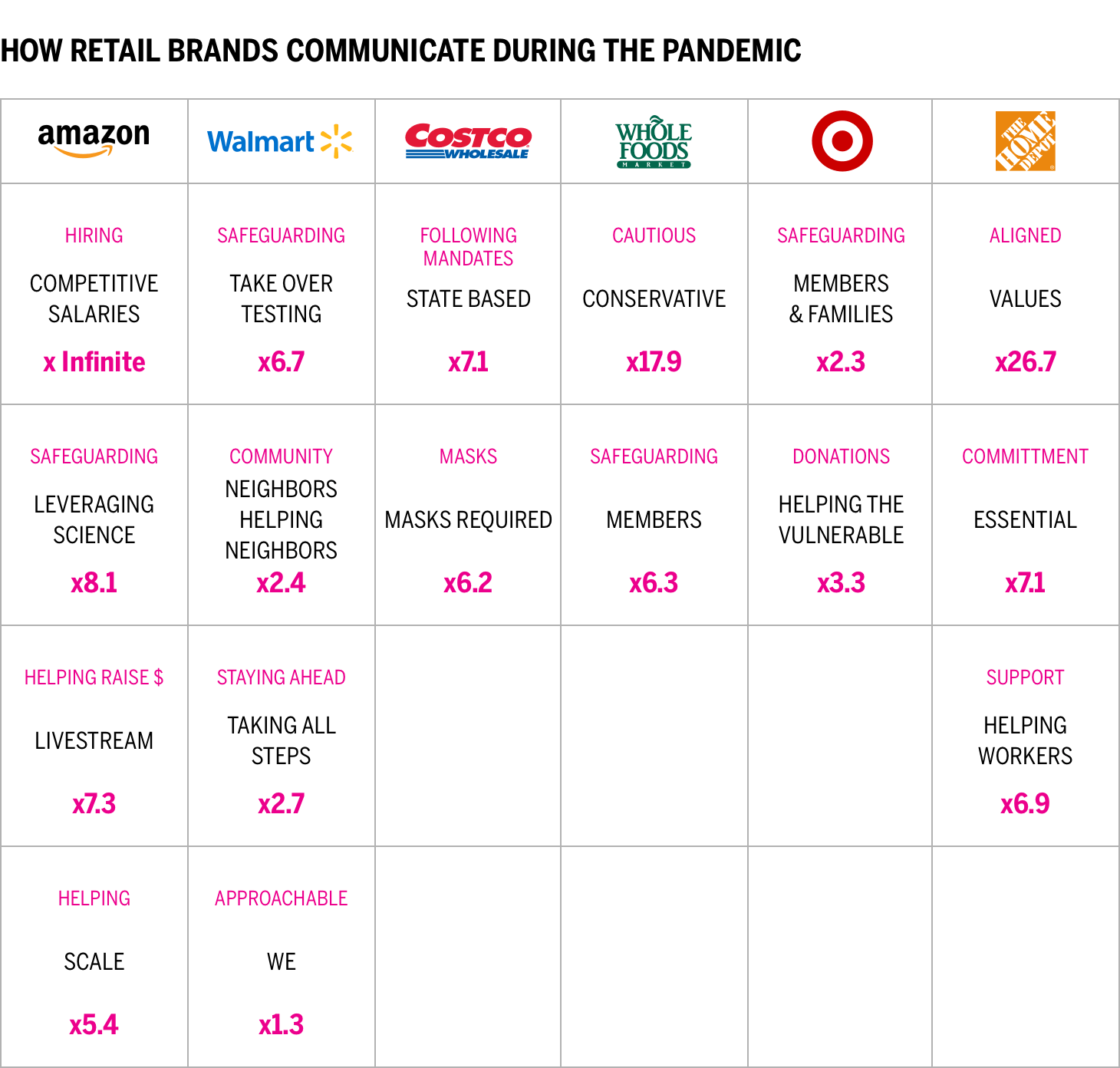

This chart presents a comparison of how six leading brands are currently communicating about COVID on their websites. The analysis covers 1,228,950 words. We can see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Amazon speaks about leveraging science 8.1 more times than other brands).

Retail brands have some similar areas of focus and key communications. Many detail how they are safeguarding the health of employees and the safety of customers in their stores: these communications are expected and important. More unique communications include Amazon’s focuses on hiring and leveraging science. Both Target and Amazon highlight raising money for those in need, while Home Depot stresses how their values align with helping others, and their role as an essential retailer.

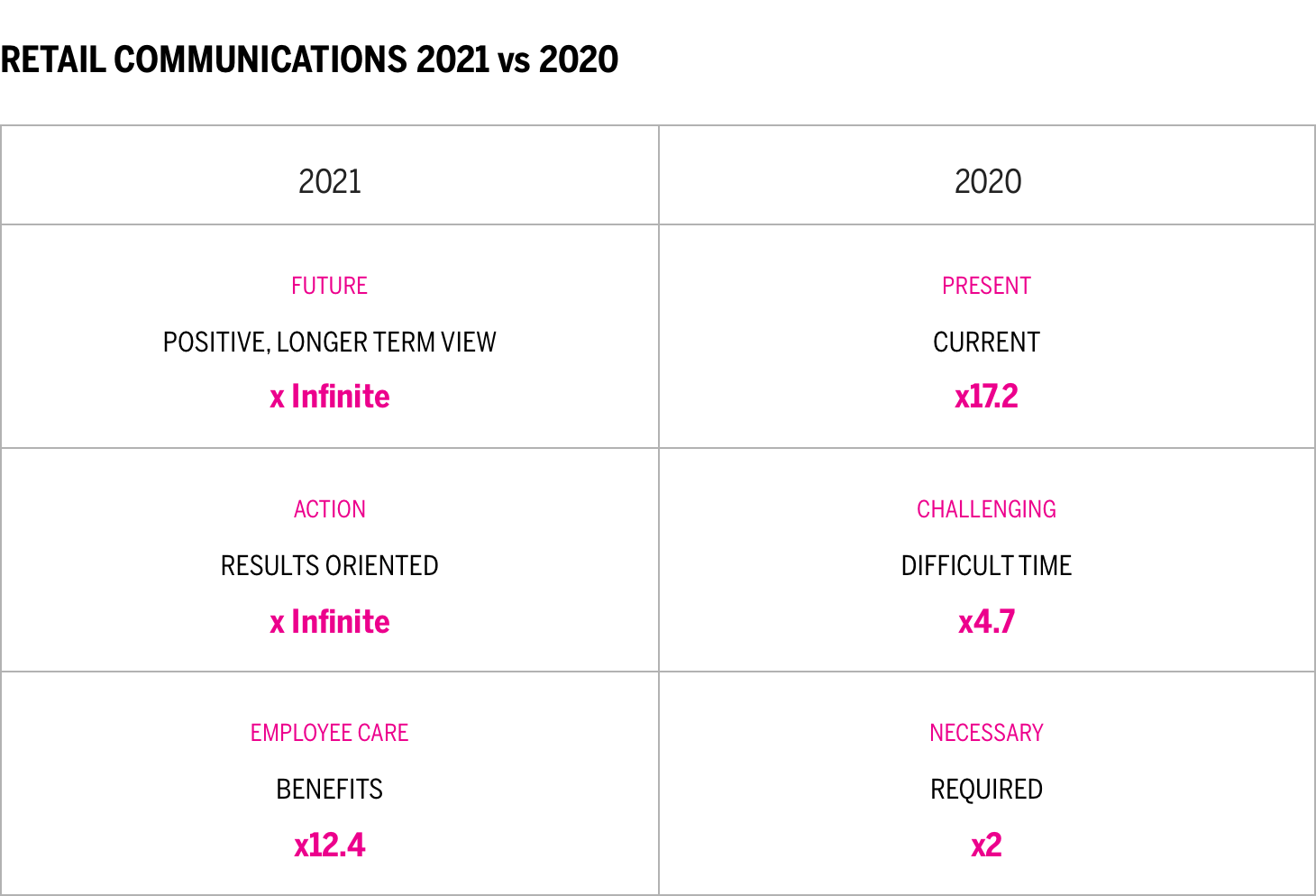

One year ago, retailer messaging highlighted the current challenging times and requirements, whereas today it focuses more on looking to the future by demonstrating decisive action and tangible ways these brands are caring for employees (bonuses, wages, and time off). In addition, we see more messaging currently than one year ago. In 2021, 88,873 words on the brands’ websites are related to COVID versus 34,498 words on the same topic in 2020.

Conclusion

Our relationships with retail brands remains strong, and our newest findings demonstrate the category has become more essential to the consumer, with four out of the top 10 brands overall in our study being retail brands. Because Quotient Scores remain largely the same, it appears most users have maintained their brand relationships versus deepening them. The fact that these relationships remain steady after a turbulent year is also demonstrates how most retailers have been able to maintain the bonds they built with consumers.

As recent concerns over COVID variants have once again elevated safety issues, there may be some continued shifts in protocols and behaviors. However, we expect competition to increase as people return to more of their “normal” ways of living. Retail brands should be considering how to deepen the relationships they built or established during the pandemic and start engaging customers in more personal ways. Communications should be focused on understanding customer priorities. In terms of fulfillment, which centers on service, performance and meeting expectations the dominant industry archetype, highlighting those characteristics and the ways retailers are dedicated to optimizing their offerings and retail experience can further help establish stronger emotional connections with consumers.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.