Overview:

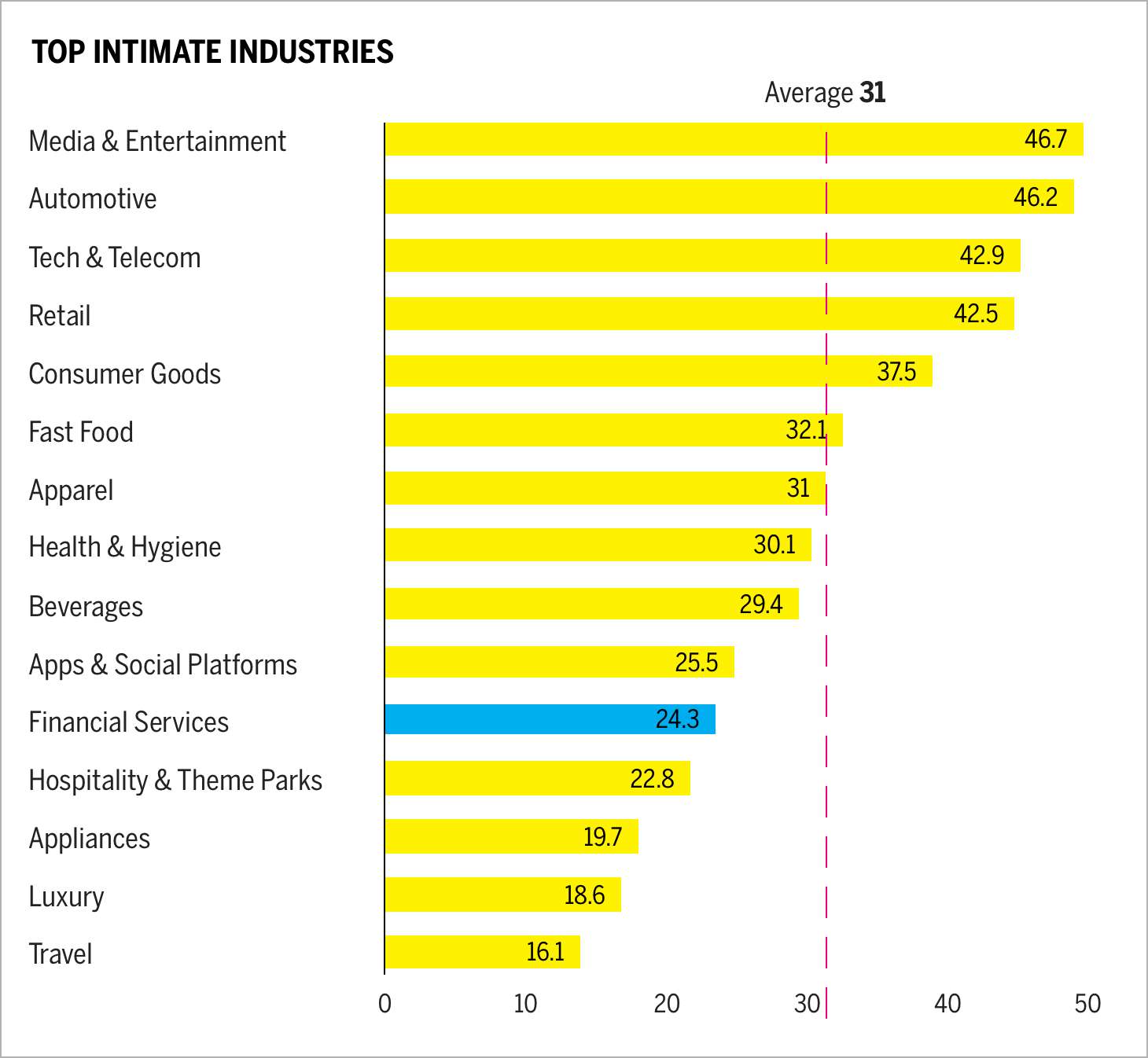

- The financial services industry ranks 11th out of 15 industries in building Brand Intimacy.

- Enhancement, which is related to becoming smarter, more capable, and more connected through use of the brand, is the top archetype in the industry.

- The financial services industry ranks 3rd out of 15 industries in enhancement.

- COVID-19 is affecting the needs of consumers and the roles banks are playing in meeting those needs.

As the world continues to adapt in the face of the COVID-19 pandemic, and businesses and their brands face unprecedented challenges, we are sharing our insights into how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

For context, our annual study of intimate brands, the largest of its kind, launched on Valentine’s Day 2020 with research fielded in fall 2019. Because we are all facing the new reality that COVID-19 has created, we are offering highlights of brand performance from both before and after the pandemic onset.

Before the crisis, financial services brands were showing signs of eroding Brand Intimacy, appearing to focus more on transactional relationships than on establishing customer bonds. Our Brand Intimacy research shows that 30.3 percent of financial services users felt an immediate emotional connection to these brands, compared with 32.5 percent of users who said they have never connected emotionally with them. Additionally, 16 percent of users of financial brands say they cannot live without them compared with the cross-industry average of 21 percent.

Category Performance

The financial services industry ranks 3rd out of 15 industries.

Enhancement is the dominant archetype for the financial services industry. This means becoming smarter, capable, and connected through use of the brand. The category also ranks 3rd out of 15 industries for this archetype. The fact that financial services brands are so strongly linked to helping people become better and more effective in managing finances may also help explain why people have reached out for help and information during the pandemic.

The financial services industry ranked 3rd for enhancement.

Pandemic Impact

With COVID-19 present in the United States for several months, the finances of most Americans have been affected. With fraud and identity theft major customer concerns before the pandemic, now banks are flooded with calls about not being able to make mortgage payments or pay bills and how to apply for government loans.

Brands in the financial services category are clearly looming large. The pandemic has increased the role technology has played in forcing banks to be “all in” as it related to technology, because fewer consumers are going to branches. Additionally, banks have become a gateway for government help, increasing the significance of their roles. They have been the front line for small businesses seeking to participate in payment protection programs as well as for consumers receiving government stimulus payments through direct deposit or debit cards. Banks have also been associated with granting dubious fund approvals for large store chains and Ivy League universities while minority businesses have been underrepresented and fared poorly through the process.

COVID-19 is affecting business for financial services. Credit cards such as American Express are limiting new customers, because it is currently difficult to get an accurate picture of someone’s financial health or job security.1 Visa has noted a shift from credit card use to debit card use, citing a more pragmatic consumer psyche. Volume on Visa credit cards was down .88 percent in May, while debit card values were up 12 percent.2 With travel spending down and more focus on entertainment and groceries, many are adjusting their reward perks to better meet evolving consumer needs.3 Chase Sapphire Reserve and Chase Sapphire Preferred cardholders can now redeem points for statement credits to offset purchases at grocery stores and home improvement stores, previously these points applied to travel.4 Similarly, some American Express cardholders are now eligible for cash back if they pay for certain streaming entertainment services like Hulu or wireless phone service.5

Some banks, like Citi, Chase and Wells Fargo, are trying to provide ways to lessen financial burdens. They have offered delays of 2-3 personal loan or mortgage payments and have removed payment fees where possible. Others, like CapitalOne, have invited customers to call them and discuss their specific situation. Chase and Bank of America have also deployed millions in new philanthropic investments to help with supporting vulnerable, hard-hit individuals who have lost their jobs or experienced reduced income.6 Wells Fargo is supporting national nonprofits in expanding virtual, cost-free coaching services to help the public adapt in these challenging times.7

Capital One, notably, has received negative press for aggressively garnishing wages during COVID-19 from those who owed the bank money.8 When COVID-19 hit, New York, like many other states, took several steps to protect vulnerable people, such as halting evictions or new garnishment orders. However, the state let existing wage garnishments continue, so this is also expected to remain a continued challenge post-pandemic.

The Current Voice of Financial Services Brands

We’ve augmented our Brand Intimacy research (fielded in November 2019) with social listening research (captured the week of May 25). We studied a sample of our Top 10 financial services brands, focusing primarily on banks (PayPal, CapitalOne, Chase, Citi, and Wells Fargo) regarding communications on their websites related to COVID-19 and outbound social conversations on Twitter. The analysis encompassed 640,119 words.

It is important to note that social listening data aren’t directly related to Brand Intimacy measures, although we hypothesize that the sentiment measured through the Internet and social media will affect future Brand Intimacy quotient scores and rankings.

Different areas of focus among a range of top-ranked financial services brands.

This chart presents a comparison of 5 of the most intimate financial services brands on the web and in social media.9 It shows how these 5 leading brands are communicating and how they are being talked about during the pandemic. We are able to see the number of appearances of key themes for each brand and the relative differences based on the other brands reviewed (e.g., Citi speaks 18 times more about uplifting women during this time).

Our topline findings:

Financial services has assumed a more significant role during the pandemic, influencing the way these brands communicate and the way we relate to them. Each brand has elected to take a slightly different approach to dealing with the pandemic. PayPal is straightforward, emphasizing using its platform during this period and tangibly addressing ways it can help. PayPal’s social content takes a lighter tone than its web copy. CapitalOne is the most pragmatic, mentioning the CARES Act when describing the virus’s impact and highlighting the costs of missed payment fees. CapitalOne’s social media also features more non-COVID-19 communications such as interviewing sports professionals. Citi focuses on a corporate story of helping communities and charitable giving. Like PayPal, Chase highlights using its tools and ways the programs are improving service. It also focusses on its rewards programs and ways it is being modified in light of COVID-19. Wells Fargo speaks in the most emotional tone, with a “Here to help” message. It acknowledges the difficult time for all and the importance of family and teamwork, and expresses hope about what’s coming next.

Consumers tend to be frustrated when posting on social media about these brands. They may be asking for help, complaining about long wait times, or suggesting that banks are not on their side. Given the high performance of enhancement associated with this industry, consumers expect these brands to help them be more capable, more smarter and more connected. Delays, confusion, or annoying customer service interactions disconnect with expectations.

Advertising Today

Financial services brands seem slow in determining how to adjust their advertising and communications. However, both Wells Fargo and J.P. Morgan Chase released ads that align to the communications emphasized on their websites. Wells Fargo highlighted teamwork and appreciating the challenging time we’re in, and Chase focused on optimizing service and collaboration.

J.P. Morgan produced a commercial quickly. The company reduced many of the usual steps, cutting a process that usually takes months down to about 10 days from idea to execution.10

Conclusion: Where Will Financial Services Go?

Financial services brands will likely be in for a rocky road over the next few months. Consumers who never had a history of financial problems may default or be unable to make payments as a result of COVID-19. As delayed payments come due, tensions will rise. Some consumers may feel the banks don’t care about them and, conversely, that banks have a business to maintain and employees to support. Communications and establishing real connections between the banks and their customers will be paramount. Additionally, banks that advance their service components, ability to provide status updates, and tools where people can see what’s owned and their payment options, will help demonstrate tangibly their desire to help.

At the same time, with every state reopening, maintaining the ability to handle traditional activities like mortgages (given the all-time low rates), personals loans, and business needs requires continuously delivering and collaborating with clients to get people and companies back on their feet.

Before the pandemic, most banking brands were generally status quo, looking for new niche offerings to expand their portfolios and new technology features to enhance their experiences. Now, with financial impact facing most Americans, the role of financial services brands are becoming more significant. How will our feelings about these brands evolve? For those who are less compassionate and more rote, and who are focused only on transactions, there will likely be an erosion in trust and eventual disengagement. For those that help us through this crisis, consumers will likely feel a stronger bond and deeper connection.

Read our detailed methodology here, and review the sources cited in this article here.

Check out our annual study and rankings of intimate brands. Visit our most recent rankings of intimate famous figures, BFF. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards, which provides extensive data for brands included in our annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.