Overview:

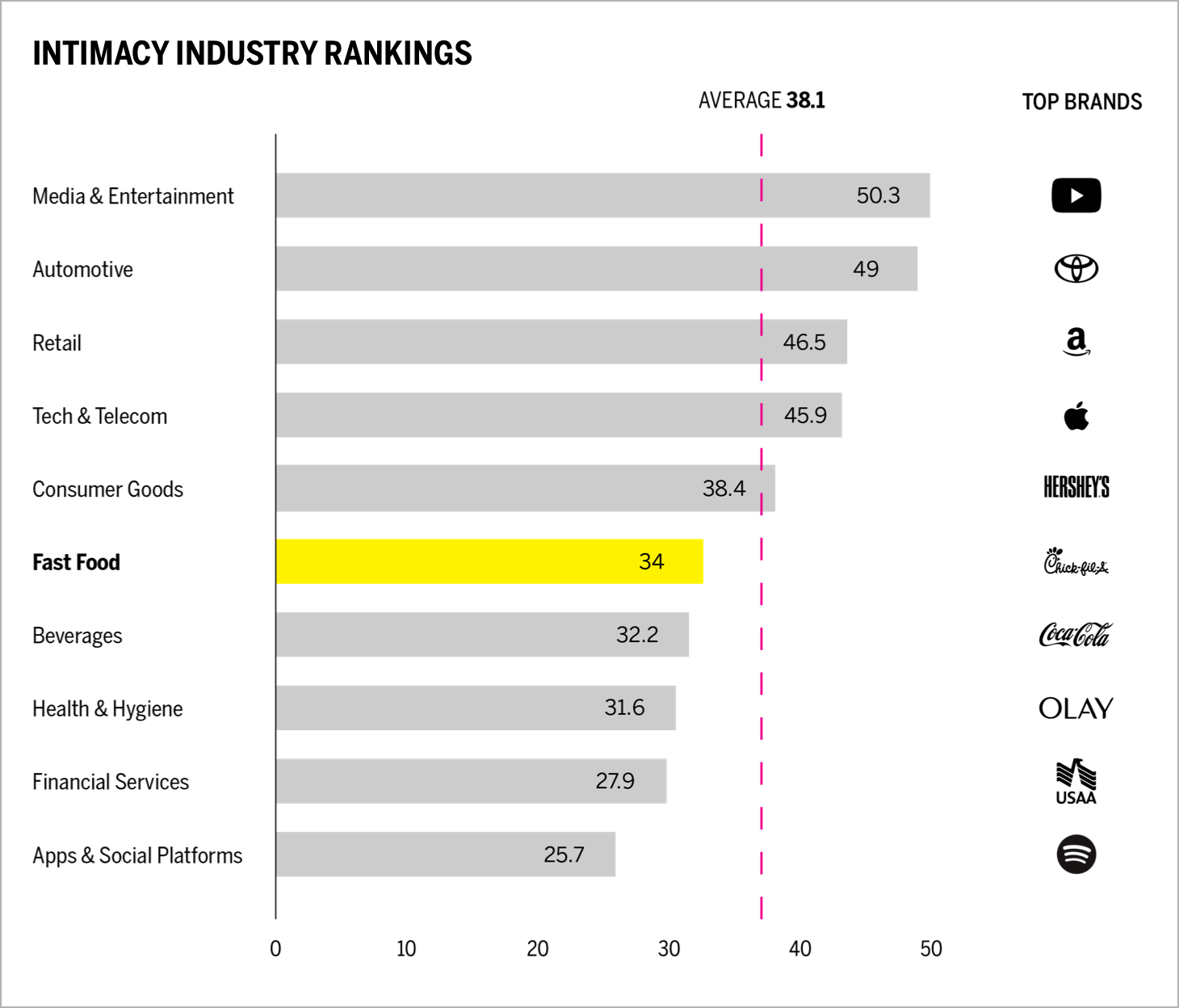

- The fast food industry ranks sixth in our Brand Intimacy COVID Study. To review our new study, click here.

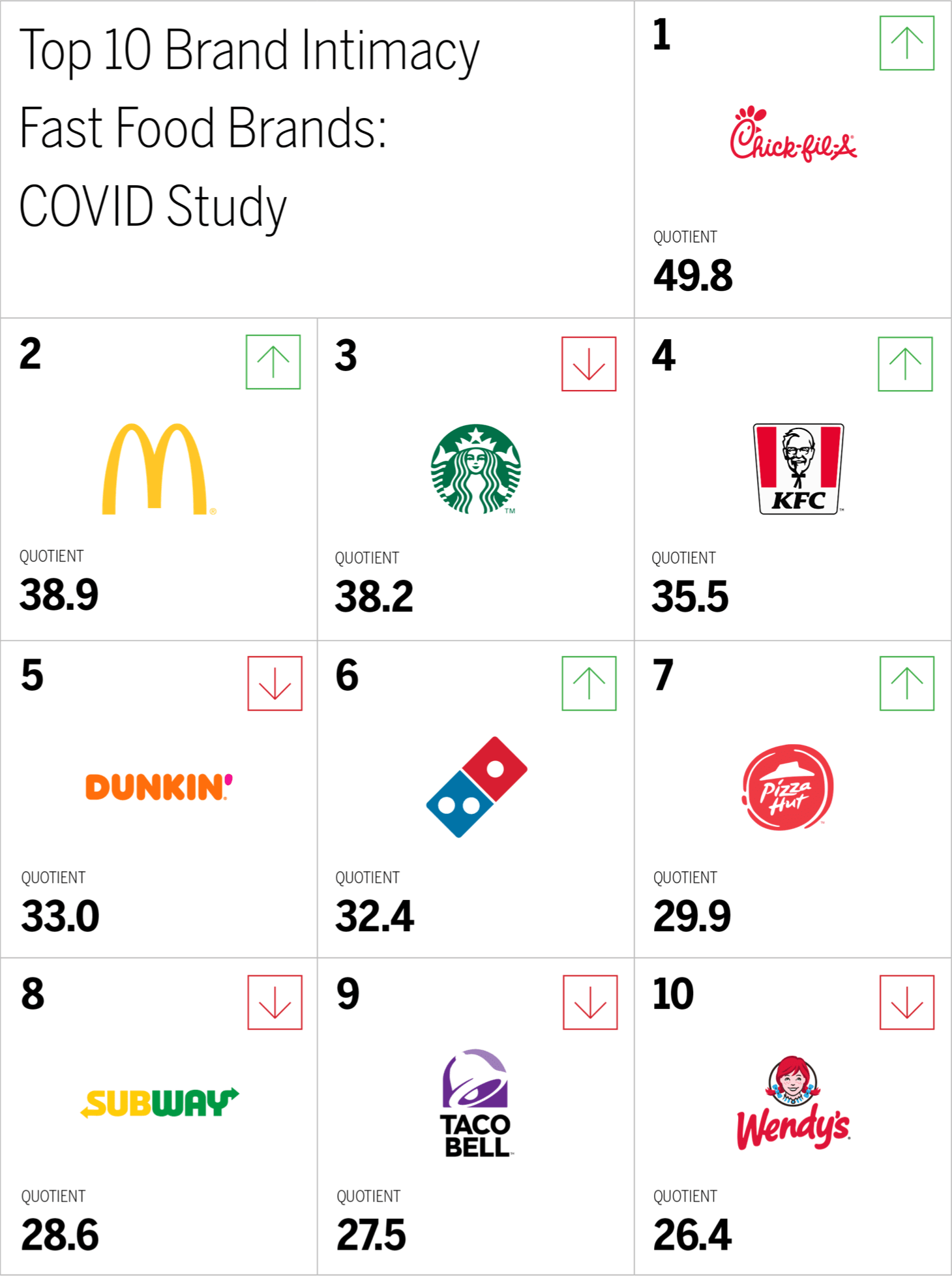

- Chick-fil-A is the top-ranking fast food brand and has an improved Quotient Score. See Chick-fil-A’s brand profile here.

- During COVID, fast food brands have ranked higher than the industry average for the indulgence and nostalgia archetypes. Review the fast food industry page here.

Introduction

As businesses and their brands face unprecedented challenges in the face of the COVID pandemic, we are sharing our new insights on how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

This article is based on data and findings from our new Brand Intimacy COVID Study, conducted with 3,000 consumers in late summer 2020, revealing how leading brands have been affected by the pandemic.

Brand Intimacy Performance Today

The fast food industry has an average Brand Intimacy Quotient of 34, which is below the cross-industry average of 38.1. The industry increased its average Quotient Score by 5.9 percent.

With stay-at-home orders in place for many states over the past few months, we are separated from working, socializing, and the lives we were accustomed to. We have not been able to dine out until recently, although some fast food chains offered takeout and delivery. These brands, long associated with pleasure and convenience, continue to provide relief and are a growing source of comfort. In fact, daily usage of fast food brands increased a significant 37 percent during the pandemic.

The fast food industry has been strongly affected by COVID, with many brands in significant decline due to initial closings and lack of in-store dining. NPC International Inc., the largest franchisee of Pizza Hut restaurants in the United States, filed for bankruptcy after COVID related shutdowns.1 Denny’s sales are down almost 50 percent, and the company announced it is selling stock to raise cash.2 Starbucks expects its current-quarter operating income to plunge by up to $2.2 billion and sales to decline for the rest of the year.3 The company will also close up to 400 company-owned locations over the next 18 months while expanding “convenience-led formats” such as curbside pickup, drive-thru, and mobile-only pickup locations to accommodate changing consumer behaviors due to the coronavirus.4 A few, more takeout-oriented businesses have shown an increase in sales, like Domino’s Pizza, which is up about 26 percent year-to-date.5 Additionally, 6DailyPay has continued to monitor quick-service hiring trends in recent weeks. The data indicates growth in the number of workers hired during the 19-week period from May 11 to September 20 in quick service restaurants (+44 percent).7

Chick-fil-A has regained the first place position it held in 2019. It has also improved its performance by 11 percent compared to our last study. McDonald’s has moved up one spot to second place, whereas 2020’s top brand, Starbucks, has moved to third. Consumer preference for Dominos and KFC has increased, whereas preference for Subway and Wendy’s has decreased.

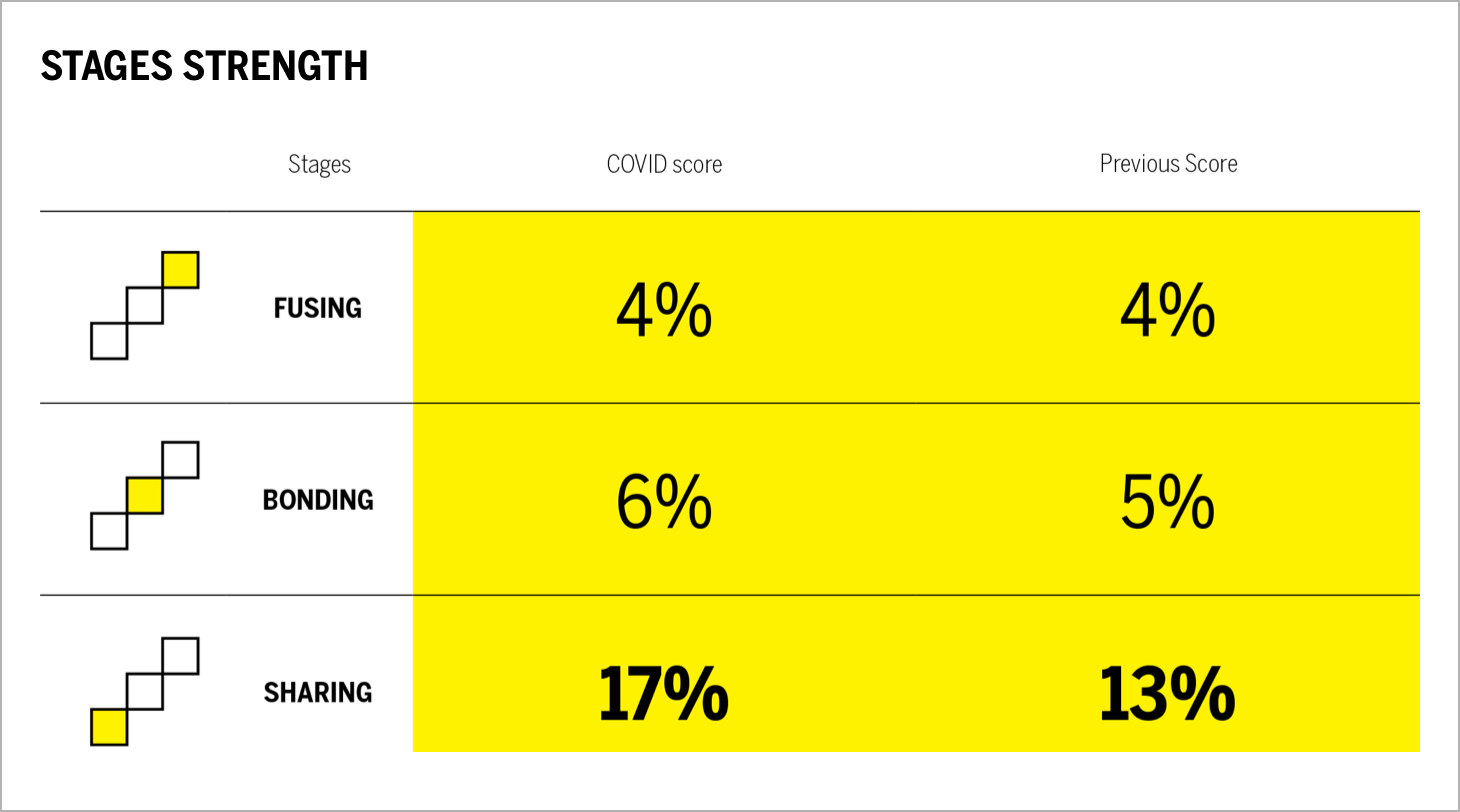

The fast food industry has improved its performance in the earliest stage of Brand Intimacy, sharing, by 31 percent. This suggests that, during the pandemic, more consumers have been emotionally connecting to fast foods brands than in our previous study. In fact, the percentage of customers in some form of intimacy with fast food brands has grown 15 percent. There has also been a small increase in bonding, whereas fusing has remained the same.

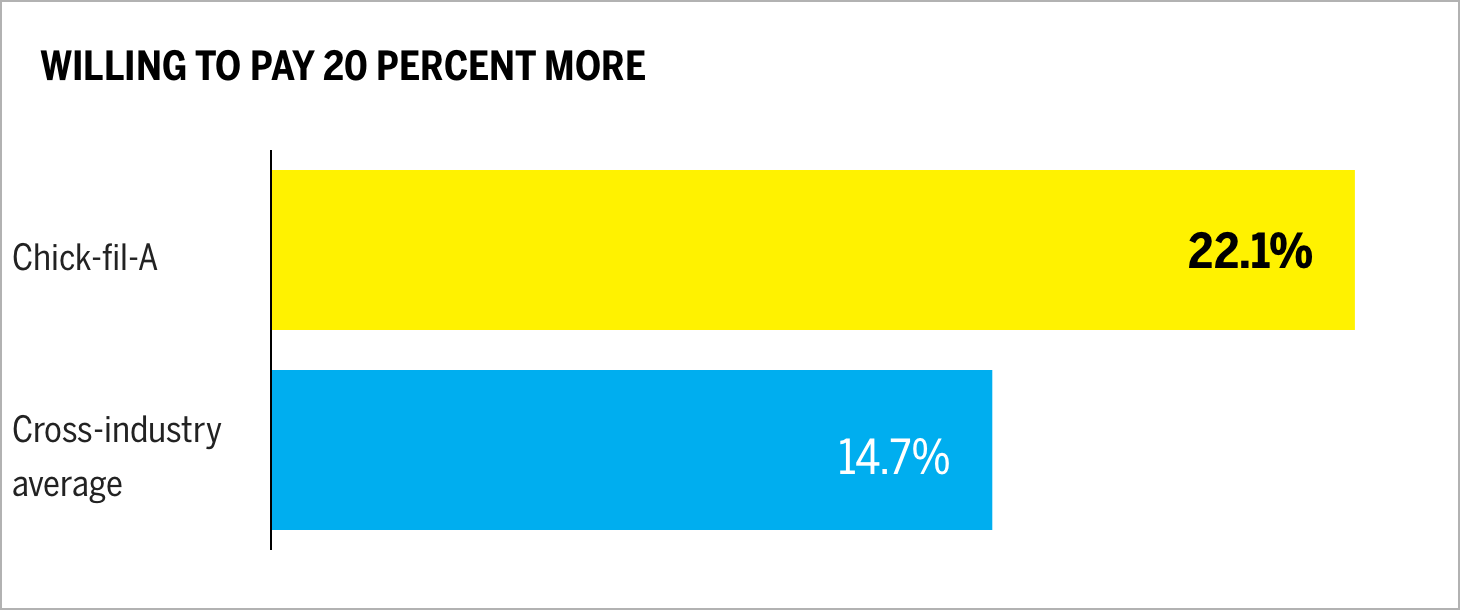

Chick-fil-A, the top intimate fast food brand, has 22.1 percent of customers willing to pay 20 percent more for its products. This is 33 percent higher than the average of all brands in our study, highlighting that the more customers value their brand relationships, the more they are willing to pay for the brands they use and love.

When Brands Speak

In addition to our Brand Intimacy findings, which center on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated during the pandemic. We have captured a language analysis from company websites and outbound social, focusing on five brands and encompassing 561,094 words.

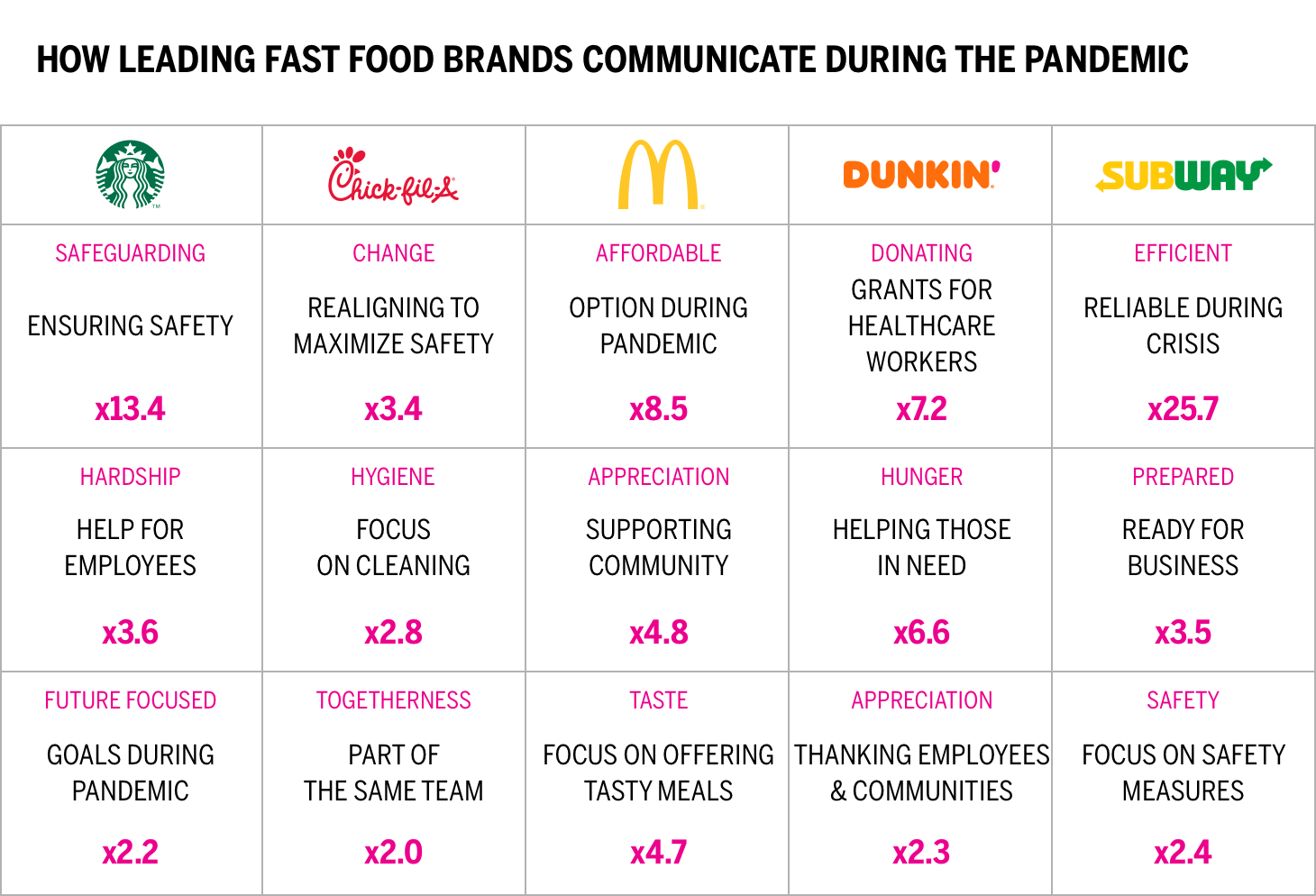

This chart presents a comparison of how leading brands are communicating about COVID on their websites and social. We can see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., McDonald’s speaks 8.5 times more on being affordable compared to competitors).

Each of the five brands reviewed tends to highlight the importance of safety, the focus on safeguarding their employees, and how they are helping during the pandemic. In addition, Starbucks addresses its business goals during the pandemic and the changes it is planning to make. Chick-fil-A also discusses how it has changed operations to ensure safety and what this means in terms of service and operations. Dunkin’ highlights the increasing rates of hunger in the United States and how it plans to help, while Subway emphasizes its readiness to handle the crisis and reliability of its restaurant operations. McDonald’s is the only brand that focuses on the affordable nature of its meals and how it remains a reasonably priced food option during COVID. In terms of tone, Chick-fil-A has a friendlier communication style, whereas Subway, Starbucks, and McDonald’s are more corporate in nature.

There has been some pandemic-related advertising from brands over the past few months, generally highlighting contactless delivery and their readiness to serve.

It is important to keep in mind that a brand’s tactics or communications are just a small signal of a brand’s intent and do not directly indicate how a brand creates greater intimacy.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is also a key principle for navigating our challenging times. The pandemic and its economic aftershocks will require brands to navigate in new and more carefully considered ways. Fast foods have seen mixed results during COVID. Many restaurants were closed for extended periods in multiple states. Many have now reopened in modified form, though, indoor dining is still greatly reduced. Delivery business has increased for some, whereas bankruptcy is looming for others. Consumers have turned to fast food for comfort and calm, for prepared meals, and for providing a sense of normalcy and routine. These brands have become essential to us as we head back to work and need lunch, or return home ready to binge on a meal as we binge-watch our favorite series. For some, picking up dinner for the family harkens back to more normal times; for others, the need for comfort finds relief in a burger and fries.

As we return to “normal” life, it will be interesting to see whether our consumption of, and connection to, fast food brands changes. Intimate brands, those built on a foundation of emotional bonding, should find a way to reference what we have all been through together and how they have reliably comforted us through this crisis.

Additionally, technology will likely continue to play a larger role in how we interact with fast food brands as many consumers prefer to order ahead, flag their arrival via their mobile phone, and track deliveries. We believe brands that can lead with their digital experience and touchless delivery will also advance consumer relationships.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.