Overview:

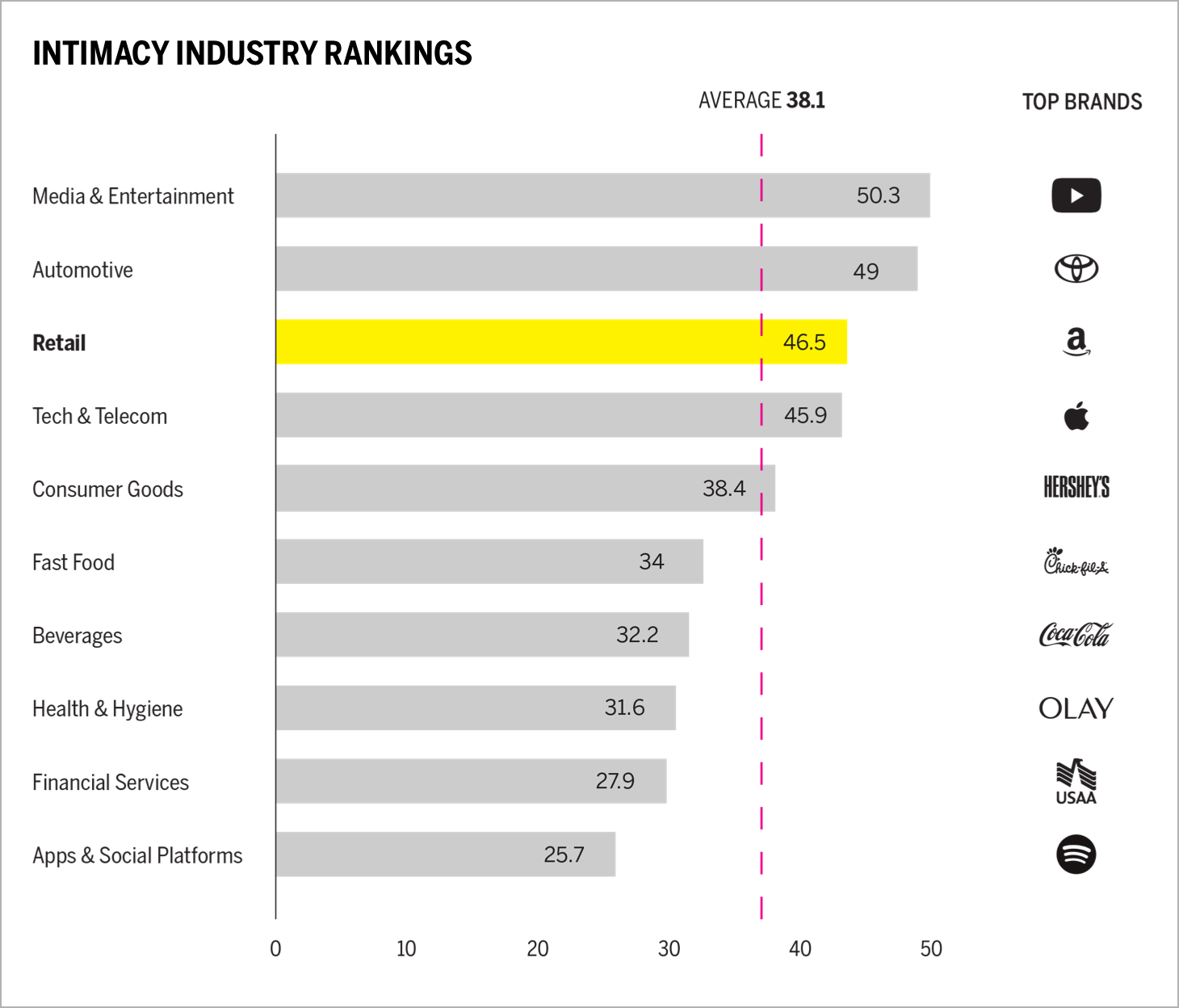

- The retail industry ranks third in our Brand Intimacy COVID Study. To review our new study, click here.

- Amazon is the top-ranking retail brand and has an improved Quotient Score. See Amazon’s brand profile here.

- During COVID, retail brands have ranked higher than the industry average across all archetypes except enhancement and nostalgia. Review the retail industry page here.

Introduction

As businesses and their brands face unprecedented challenges in the face of the COVID pandemic, we are sharing our new insights on how brands can refocus, enhance, or optimize for the marketplace we are eager to see return.

This article is based on data and findings from our new Brand Intimacy COVID Study, conducted with 3,000 consumers in late summer 2020, revealing how leading brands have been affected by the pandemic.

Brand Intimacy Performance Today

The retail industry has an average Brand Intimacy Quotient of 46.35, well above the cross-industry average of 38.1. Performance has improved, and the industry average is up 7.7 percent compared to our previous study. This is not surprising; with concerns about the pandemic, consumers were hoarding specific essential products like water, toilet paper, and disinfectant. With more time at home, there has been also increased spending for personal care products, foods, spirits,1 and home repair products since the virus began.2 It was surprising to see Amazon fall from #1 overall brand in our study, especially with many depending on home delivery more than ever during the pandemic.

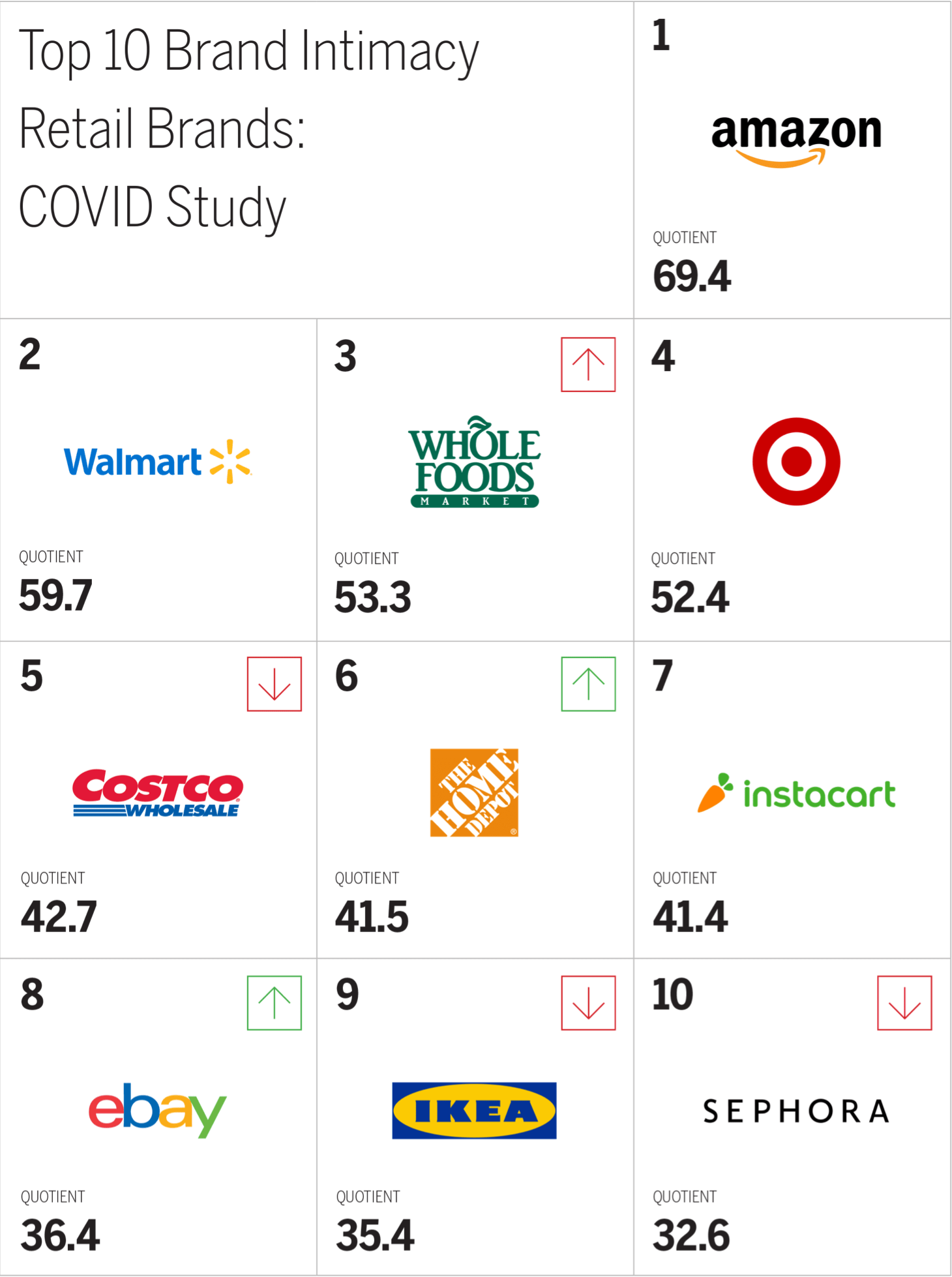

Amazon remains in first place, and Walmart holds steady in second place. Consumer preference for Whole Foods and Home Depot has increased, whereas preference for Sephora and Costco has decreased. Amazon is the top brand for men, women, and millennials, demonstrating its broad appeal during the pandemic. The brand was a lifeline for many during times when consumers did not want to leave home.

What’s more, we see Brand Intimacy rankings aligning with business performance. Amazon and Walmart have experienced increased sales, with Walmart’s online sales up 74 percent3 and consumer spending on Amazon up 60 percent between May and July compared to the same time frame last year.4

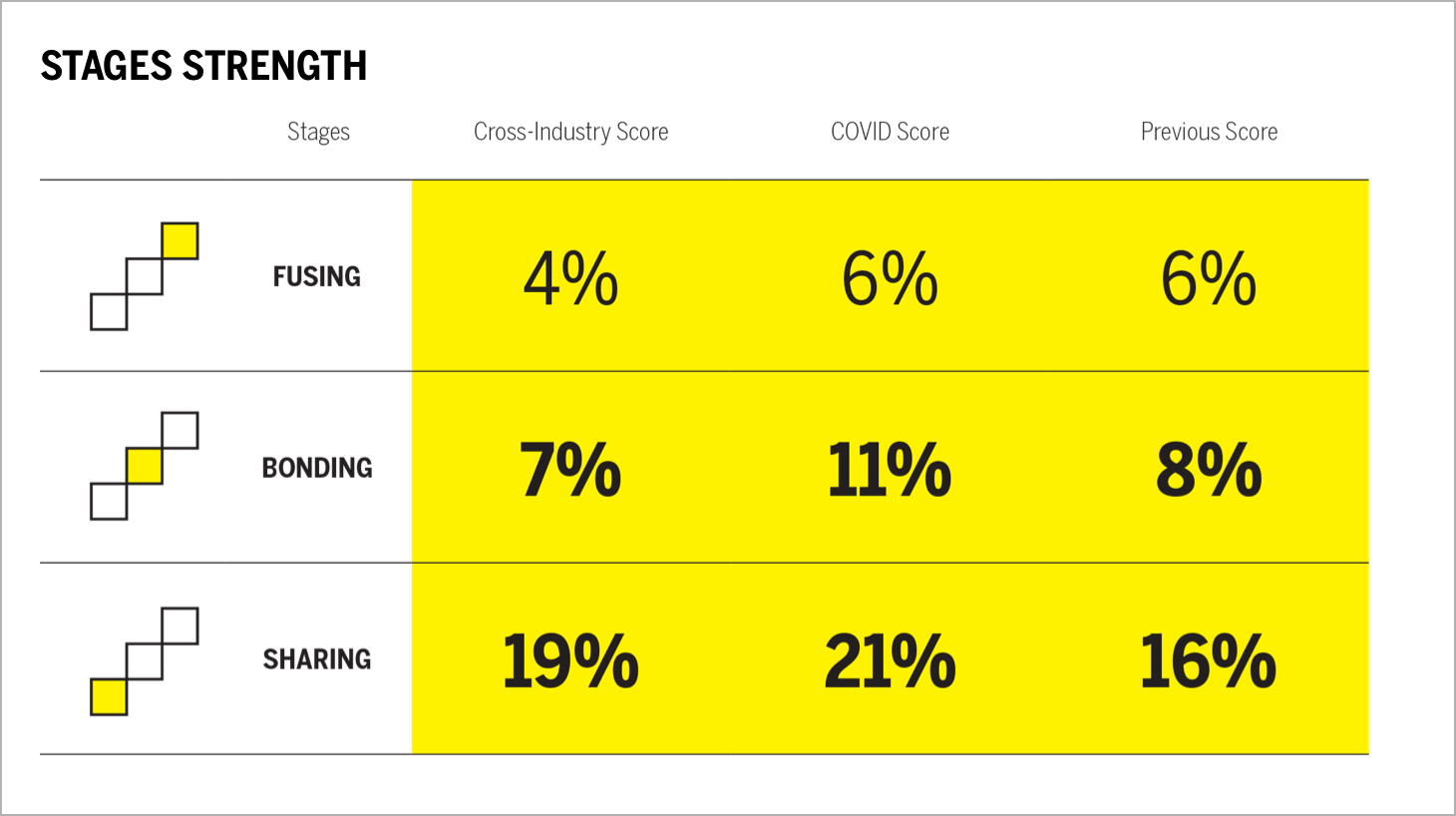

Retail performs better than the cross-industry average for sharing, bonding, and fusing. The industry also has improved its sharing and bonding scores considerably compared to our last study, whereas fusing has stayed the same. This highlights that more consumers had intimate relationships with retail brands and formed emotional connections with the industry during the pandemic.

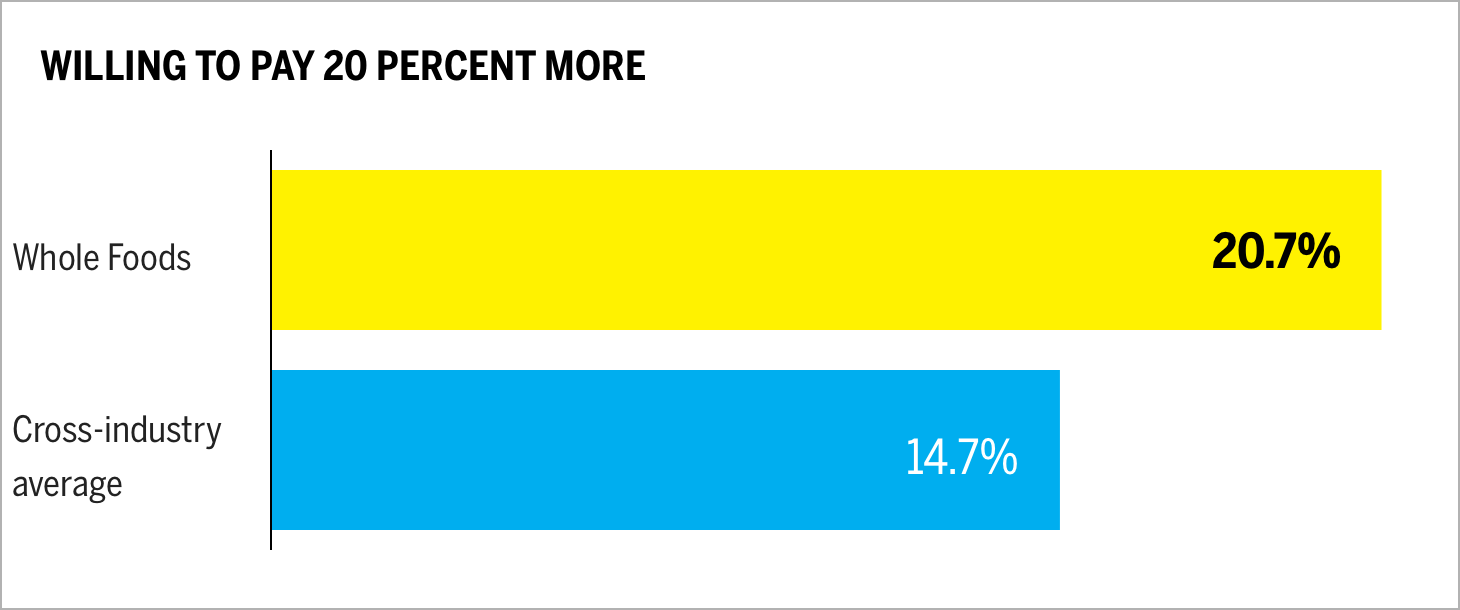

Whole Foods (An Amazon-owned company) is the retail brand for consumers are most willing to pay 20 percent more for. Whole Foods ranks 41 percent higher than the average of all brands in our study for this measure and improved its own performance since our last study by 25 percent. This highlights that when an intimate brand establishes a strong bond with consumers, they are willing to pay more.

When Brands Speak

In addition to our Brand Intimacy findings, which centers on how consumers feel about their brand relationships, we are also looking at how brands themselves have behaved and communicated during the pandemic. We have captured a language analysis from company websites and outbound social, focusing on six brands and encompassing 232,912 words.

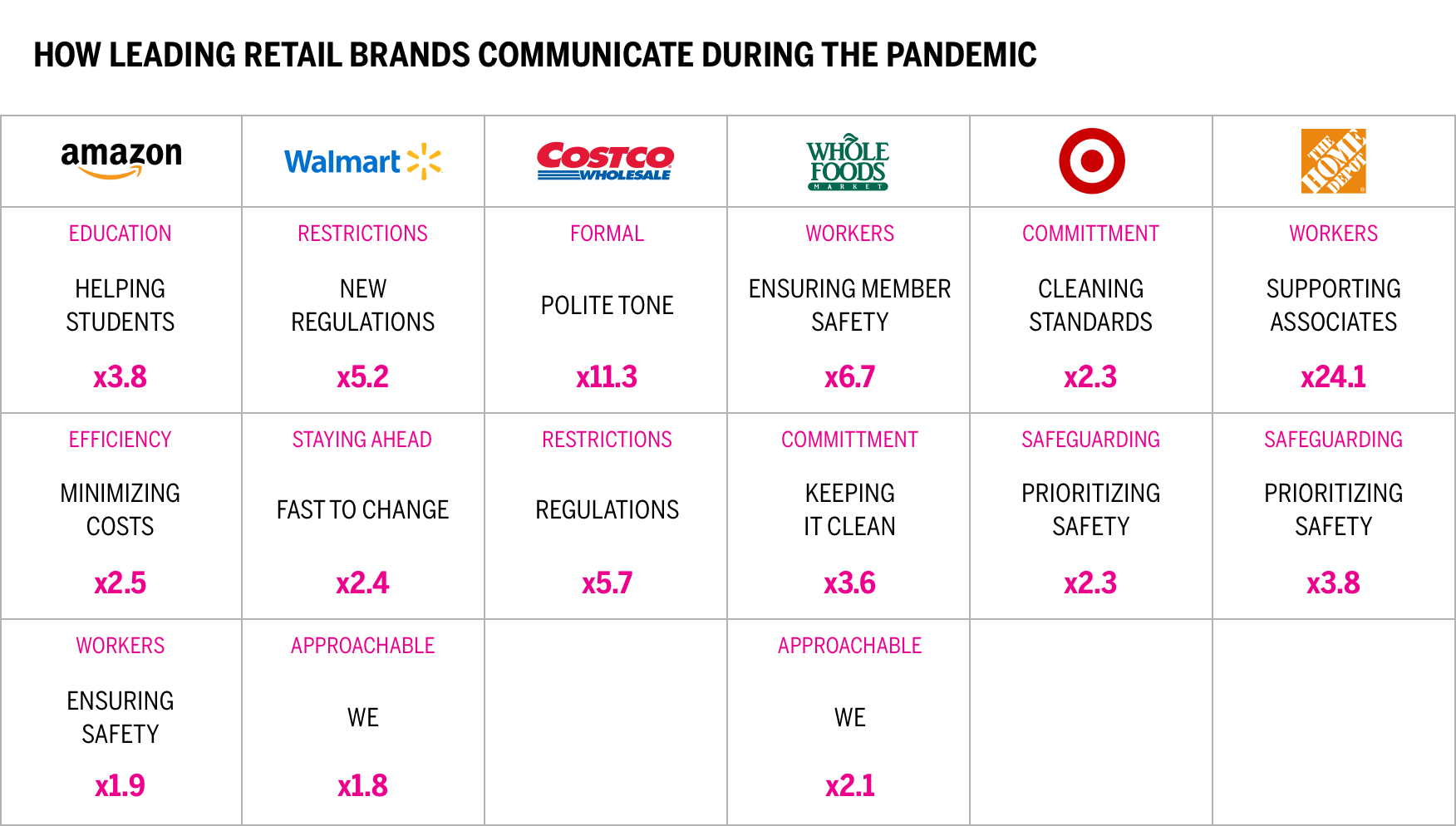

This chart presents a comparison of how six leading brands are communicating about COVID on their websites. We are able to see the number of appearances of key themes for each brand and the relative differences based on the other themes reviewed (e.g., Amazon speaks about helping students 3.8 more times than other brands).

Unlike some other industries we reviewed (media & entertainment, automotive), retail brands have similar areas of focus and key communications. Many focus on ensuring safety in their stores, safeguarding the health of employees, and establishing new regulation to maintain standards. These are expected and important. Some unique communications include Amazon’s focus on helping students and Walmart detailing how it adapted to change quickly. Costco deploys a more formal tone compared to the more-approachable communications of Walmart and Whole Foods.

Conclusion

Building and maintaining strong emotional connections with users is a core tenet of Brand Intimacy and is also a key principle of navigating our challenging times. The pandemic and its economic aftershocks will require brands to navigate in new and more carefully considered ways.

During stay-at-home orders, many chose to order online and limit their time in stores. The impact to many retailers, especially department stores and brick-and-mortar retailers-has been catastrophic.

As we return to normal, retail stores are slowly reopening, with new restrictions and requirements. We expect increased competition, fewer options, and more-discerning buyers. Brands will need to build/maintain their digital presence while they cultivate customer relationships. To compete with the behemoths of Amazon and Walmart, retail brands will need to create new strategies and initiatives to interact with and engage customers with understanding and relevance.

Read our detailed methodology here, and review the sources cited in this article here. Our Amazon best-selling book is available at all your favorite booksellers. Additionally, MBLM offers Custom Dashboards providing extensive data for brands included in its annual Brand Intimacy Study. To learn more about our Agency, Lab, and Platform, visit mblm.com.